Home

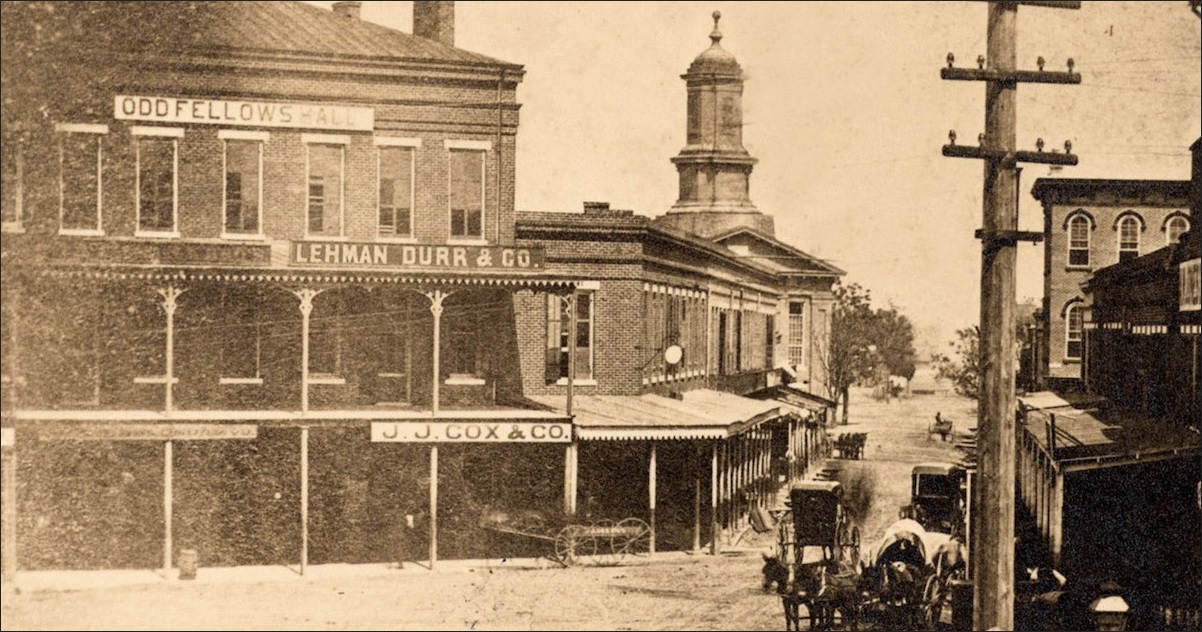

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Settlement: Lehman brothers to take over Moonlight | News ...https://www.bozemandailychronicle.com/news/...Manhattan investment bank Lehman Brothers will take ownership of Moonlight Basin under a plan the bank and the resort submitted Friday to U.S. bankruptcy court.

Counterparty credit exposure won't spark the next Lehman ...https://www.risk.net/our-take/5921751/counterparty...The tenth anniversary of Lehman Brothers’ demise has brought with it speculation on the potential source of the next crisis. Evidence from recent risk disclosures suggests a future panic is unlikely to be triggered by the failure of a bulge-bracket dealer as in 2008.

case study slide.pptx - LEHMAN BROTHERS CRISIS IN ...https://www.coursehero.com/file/41485609/case-study-slidepptx•The financial position of Lehman Brothers as of September 14th facing bankruptcy-Firm had $1.4billion in liquidity but faced projected cash shortfall of $4.5 billion the next day • The liquidity of the firm’s is frustrating • Barclays would buy the operating subsidiaries of the corporation for $3 billion and Lehman shareholders would retain all ...

2007 subprime financial crisis: Latest News & Videos ...https://economictimes.indiatimes.com/topic/2007-subprime-financial-crisis/9Mar 11, 2020 · Lehman, Wachovia CEOs coming before panel. An inquiry panel is hearing from former CEOs of two big banks that succumbed to the financial crisis, Lehman Brothers and Wachovia Corp, as it delves into the ``too big too fail'' predicament and potential system wide risk from financial institutions.

Paulson, Calpers object to Lehman bankruptcy plan | Reutershttps://www.reuters.com/article/us-lehman-creditors-idUSTRE65S5PH20100629Jun 29, 2010 · A group of Lehman Brothers Holdings Inc's <LEHMQ.PK> creditors, including the largest U.S. pension fund and a prominent hedge fund, said they object to …[PDF]NEW EVIDENCE ON THE AFTERMATH OF FINANCIAL CRISES …https://eml.berkeley.edu/~dromer/papers/RomerandRomerFinancialCrises.pdfEven before the collapse of Lehman Brothers set off a worldwide financial meltdown, economists had shown renewed interest in financial crises. The experiences of Japan and the Nordic countries in the early 1990s and the East Asian crisis of the late 1990s had demonstrated that financial crises were not just a topic of historical interest.

There may not be enough demand for a flood of new ...https://money.cnn.com/2009/05/28/markets/thebuzzMay 28, 2009 · Long-term Treasury yields are now around the level they were at in early September before Lehman Brothers filed for bankruptcy. And much of …

How to spot and prepare for a bear market - USA TODAYhttps://www.usatoday.com/story/money/markets/2017/...Mar 08, 2017 · Lehman Brothers' bankruptcy, bailouts of well-known banks and fears that local branches would run out of cash caused a panic. There are no signs of a similar crisis today, Golub says.

Wall Street Interns Take Financial Crisis in Stride - CNBChttps://www.cnbc.com/id/25739660Jul 29, 2008 · "Days when there’s bad news, it’s scary in the office. Everyone’s in panic mode," said one summer intern at Lehman Brothers, who chose to remain anonymous because he …

COVID-19 impact: RBI may opt for loan recast for select ...https://www.tribuneindia.com/news/business/covid...In 2008 also, when the world was hit by the global financial crisis following Lehman Brothers going insolvent, the RBI had announced a one-time loan restructuring for several sectors to help them ...

Time for Bank Creditors to Share the Pain? - The New York ...https://www.nytimes.com/2009/04/29/business/economy/29leonhardt.htmlApr 29, 2009 · The case against haircuts starts with Lehman Brothers. When Lehman collapsed into bankruptcy on the night of Sept. 14, its creditors were left with billions of dollars in loans to Lehman they ...

Recent Case on Safe Harbor Provisions in Swap Agreements ...https://www.jdsupra.com/legalnews/recent-case-on...Lehman Brothers Derivative Products Inc., et al., Adversary No. 09-1728 (JMP) in the U.S. Bankruptcy Court for the Southern District of New York, is the latest decision considering the scope of ...

Credit default swaps are insurance products. It’s time we ...https://www.washingtonpost.com/business/credit...While the radical deregulation wrought by the CFMA led to AIG’s self-directed collapse, it also helped steer two of the largest securitizers of mortgages — Bear Stearns and Lehman Brothers ...

A Few Things....How To Deal With Uncertainty - Ahmed’s ...https://afewthings.substack.com/p/a-few-thingshow-to-deal-with-uncertaintyJan 18, 2020 · To name a few: 9/11, Lehman Brothers’ inability to find a buyer, Iraq invading Kuwait, the 1973 OPEC embargo, Pearl Harbor, and a small Austrian bank called Creditanstalt whose 1931 bankruptcy set off a chain reaction of global bank failures that …

Japan Inc Shakes off Initial COVID-19 Gloom but Resurgence ...https://money.usnews.com/investing/news/articles/...Dec 13, 2020 · Companies also plan to slash new graduate hiring by 6.1% in the year beginning in April, the survey showed, which would be the most cautious hiring plan since the collapse of Lehman Brothers …[PDF]DEMAND FOR CRASH INSURANCE, INTERMEDIARY …https://www.nber.org/system/files/working_papers/w25573/w25573.pdfputs to buyers (e.g., in the months following the Lehman Brothers bankruptcy in 2008), it is likely that the tightening of constraints are forcing the intermediaries to aggressively hedge their tail risk exposures, rather than the intermediaries accommodating an increase in …

BLF TempCash | BLMXX | Cash Managementhttps://www.blackrock.com/cash/en-us/products/282754The Fund invests in a broad range of U.S. dollar-denominated money market instruments, including government, U.S. and foreign bank, and commercial obligations and repurchase agreements. Under normal market conditions, at least 25% and normally a substantial portion of the Fund’s total assets will be invested in obligations of issuers in the financial services industry and repurchase ...[PDF]DEMAND FOR CRASH INSURANCE, INTERMEDIARY …https://www.nber.org/system/files/working_papers/w25573/w25573.pdfputs to buyers (e.g., in the months following the Lehman Brothers bankruptcy in 2008), it is likely that the tightening of constraints are forcing the intermediaries to aggressively hedge their tail risk exposures, rather than the intermediaries accommodating an increase in …

JPMorgan sees liquidity wild card in gauging depth of next ...https://www.crainsnewyork.com/finance/jpmorgan...Sep 13, 2018 · A decade after the collapse of Lehman Brothers sparked a plunge in markets and a raft of emergency measures, strategists at the bank have created a …

Improved Outlook Pushes U.S. Economic Confidence Back Uphttps://news.gallup.com/poll/164426/improved...Sep 17, 2013 · Bottom Line. While Americans remain more negative than positive about the U.S. economy overall, Gallup's Economic Confidence Index is significantly better than it was five years ago, in the days immediately before and after Lehman Brothers collapsed and a global economic meltdown ensued.. Although Americans' economic confidence has slightly improved over the past two weeks, …[PDF]DeeP rOOts. BrOaD reach.files.brattle.com/assets/principals-announcement...Unsecured Creditors of Lehman Brothers Holdings Inc. v. JPMorgan Chase Bank N.A. In both litigation and non-litigation matters, she has also worked on behalf of Barnes & Noble, tD Bank Group, ravelport, t allianz se, and a number of private companies. Ms. austin smith has written a number of articles on valuation and credit analysis for a

How To Get Ready For The Economic Recession Coming In 2017 ...https://www.huffpost.com/entry/how-to-get-ready-for-the_b_13913688Dec 31, 2016 · It could be a sudden trigger like the collapse of Lehman Brothers in late 2008 or just a general loss of confidence. Economic theories, such as works by economist Hyman Minsky , explain that the longer an expansion continues, the more likely a recession becomes.

Where Howard Marks Looks for Signs of Market Troublehttps://www.bloombergquint.com/bq-blue-exclusive/...Oct 23, 2019 · We bought more than a half a billion dollars of securities every week in the last 15 weeks of 2008, following the Lehman Brothers bankruptcy. And that was a great thing to do. If you waited until 2009, it was too late.

What Economists May Have Gotten Wrong About Refugees and ...https://www.bloomberg.com/news/articles/2017-05-23/...May 23, 2017 · Analyzing newspaper articles from 1987 to present, economists find that economic policy uncertainty in Japan peaked during the Asian Financial Crisis and in reaction to Lehman Brothers…

are we headed for a deflationary recession? | Yahoo Answershttps://answers.yahoo.com/question/index?qid=20081009141700AAwSu2EOct 09, 2008 · But if 60%-80% came to the bank and do the same thing, how can the bank still alive without help from the Government and the other Banks. Imagine that the banking system collapse (like Lehman Brothers), millions of People would lose their money, less people come to the store.

Board of directors | Cramhttps://www.cram.com/subjects/board-of-directorsThe adoption of poor corporate governance is clearly noticeable in most famous corporate collapse like: HIH Insurance, One Tel, Washington Mutual, Lehman Brothers, etc. These collapses have thrown a light on the importance of implementation of proper corporate governance into practice.

How to get ready for the economic recession coming in 2017 ...https://www.lifeandnews.com/articles/how-to-get...How much longer can it continue? No one knows why economic expansions end.It could be a sudden trigger like the collapse of Lehman Brothers in late 2008 or just a general loss of confidence.. Economic theories, such as works by economist Hyman Minsky, explain that the longer an expansion continues, the more likely a recession becomes.. The length of an expansion matters because banks lower ...

Financial crisis: central banks do not take this kind of ...https://www.telegraph.co.uk/finance/financial...Sep 15, 2011 · Three years to the day since Lehman Brothers went under, taking the global economy with it, the Bank of England and its counterparts in America, …

Judge: Purdue workers should get bonuses, but maybe not CEOhttps://www.baynews9.com/fl/tampa/ap-top-news/2019/...Dec 04, 2019 · In 2009, a judge ruled that Lehman Brothers, the investment bank, could pay 230 traders bonuses totaling $50 million to keep working through that company’s bankruptcy.

Oaktree Capital’s Howard Marks on How the Market Cycle ...https://www.bloomberg.com/news/articles/2019-10-23/...Oct 23, 2019 · We bought more than a half a billion dollars of securities every week in the last 15 weeks of 2008, following the Lehman Brothers bankruptcy. And that was a …

how old is a nonagenarian - Brainly.comhttps://brainly.com/question/1864540Sep 28, 2016 · Bear Stearns and Lehman Brothers in 2008 more closely resembled normal corporations with solid, Middle American values than did any Wall Street firm c... On a hot summer day is Jane rents inner tubes by the river that runs through her town... On hot, sunny, summer days, Jane rents inner tubes by the river that runs through her town.…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

"What's the Problem, Mr. President? Bush's Shifting ...https://www.questia.com/library/journal/1G1-279722811/what-s-the-problem-mr-president...Introduction . On September 15, 2008, the 150-year-old global financial services firm, Lehman Brothers Holdings, Inc., declared bankruptcy after the Federal Reserve and Treasury Department denied its pleas for a federal bailout.

People Are Not Your Greatest Asset – Irustima's webhttps://www.irustima.com/people-are-not-your-greatest-assetThe reason is – People are the greatest asset in most organization only in Word and not in Spirit. Even brilliant hardworking diligent employee is not the greatest asset. In fact, great workers are the greatest liability. Consider Lehman Brothers.…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Exclusive: The Brits who won't Brexithttps://ca.news.yahoo.com/exclusive-brits-wont-brexit-105351347.htmlDec 19, 2019 · They include billionaire Alan Howard, one of Britain's best-known hedge fund managers, and Jeremy Isaacs, the former head of Lehman Brothers for Europe, the Middle East and Asia. Cyprus' interior ministry recommended that both men's applications be …[PDF]The QuanTum Theory of InvesTmenThttps://www.quantumamc.com/downloads/pdfs/qt.pdffriend of mine who works for one of these large “global financial companies” in New York told me: the closer you get to the money, the more it stinks. And there was a global stink in 2008. The collapse of some of the largest financial companies in the world after the bankruptcy of Lehman Brothers in September 2008 is only another example of

Lehman Brothers - Case - Faculty & Research - Harvard ...https://www.hbs.edu/faculty/Pages/item.aspx?num=38465In 2008, the U.S. financial system was in a state of crisis and Lehman Brothers went from a major Wall Street investment bank to an insolvent institution. It was a swift end for a …

Lehman Brothers` partner, for a while - 1 answer ...https://www.crosswordclues.com/clue/lehman-brothers`-partner,-for-a-whileWe found one answer for the crossword clue Lehman Brothers` partner, for a while. Are you looking for more answers, or do you have a question for other crossword enthusiasts? Use the “Crossword Q & A” community to ask for help. If you haven't solved the crossword clue Lehman Brothers` partner, for a while yet try to search our Crossword Dictionary by entering the letters you already know!…lehman brothers stock chart 2008lehman brothers bankruptcy websitelehman brothers share pricelehman brothers stock 2019lehman brothers stock graphbankruptcy of lehman brothersfemale lehman brothers related peoplelehman brothers history

Lehman Brothers: Crisis in Corporate Governance | The Case ...https://www.thecasecentre.org/main/products/view?id=123967Lehman Brothers, heavily exposed to the US subprime and commercial real estate markets, began to experience increasing levels of distress. Looking for a merger to save the company, Chairman of the Board and Chief Executive Officer Richard 'Dick' Fuld began to actively seek a buyer for the company.

Lehman Bros. Trustee Seeks $1.9B Creditor Payout - Law360https://www.law360.com/articles/678478/lehman-bros...The liquidating trustee for Lehman Brothers Inc. on Monday requested permission from a New York bankruptcy court to distribute approximately $1.89 billion to unsecured general creditors who have ...

SoftBank CEO Masayoshi Son preparing for 'worst case scenario'https://www.cnbc.com/2020/11/17/softbank-ceo...Nov 17, 2020 · While Son didn't offer specifics on what "disaster" could be likely in the coming months, he alluded to Lehman Brothers' 2008 collapse for how one event could be a catalyst for a …

Lehman Brothers | Harvard Business Publishing Educationhttps://hbsp.harvard.edu/product/810106-PDF-ENGFeb 16, 2010 · In 2008, the U.S. financial system was in a state of crisis and Lehman Brothers went from a major Wall Street investment bank to an insolvent institution. It was a swift end for a firm that had its beginnings over 150 years prior. What would be the firm's legacy? And how, if at all, had its activities changed the course of American history?

The Daily Docket: Lehman Seeks To Lower Banks' Loss Claimshttps://www.wsj.com/articles/BL-BANKB-17818Jan 17, 2012 · Lehman Brothers wants to slash at least $35 billion from what some of banks claim they are still owed. Delaware's chief bankruptcy judge has made a company-friendly reading of a U.S. Supreme Court ...

Regulators: JPMorgan illegally let Lehman Bros. count ...https://www.washingtonpost.com/business/economy/...Apr 04, 2012 · JPMorgan Chase illegally allowed Lehman Brothers, the investment bank whose 2008 bankruptcy brought the financial system to the brink of collapse, …

Report says Lehman executives subpoenaed - Reutershttps://uk.reuters.com/article/uk-lehmanbrothers-idUKTRE49G3A820081017Oct 17, 2008 · Richard Fuld, Chairman and CEO of Lehman Brothers Holdings, pauses during testimony at a House Oversight and Government Reform Committee hearing on the causes and effects of the Lehman Brothers ...

The Biden post-election market surge is the best for a new ...https://kvia.com/news/business-technology/2021/01/...Jan 19, 2021 · The Biden post-election market surge is the best for a new president in 60 years ... Investors were still extremely nervous about the collapse of Lehman Brothers …

Lehman Brothers Case Solution and Analysis, HBS Case Study ...https://caseism.com/lehman-brothers-48598In 2008, the U.S. financial system was in a state of crisis and Lehman Brothers went from a large investment bank on Wall Street to an insolvent institution. It was fast for a company that got its start more than 150 years before the end. What would be the legacy of the company?

Lehman Brothers: Crisis in Corporate Governance | Harvard ...https://hbsp.harvard.edu/product/NA0176-HCB-ENGNov 01, 2012 · Lehman Brothers, heavily exposed to the U.S. subprime and commercial real estate markets, began to experience increasing levels of distress. Looking for a merger to save the company, Chairman of the Board and Chief Executive Officer Richard "Dick" …

Lehman Brothers | Page 11 of 26 | Business | The Guardianhttps://www.theguardian.com/business/lehmanbrothers?page=11Lehman Brothers bosses could face court over accounting 'gimmicks' Contentious techniques temporarily boosted bank's balance sheet by up to $50bn, reveals 2,200-page report into its collapse ...

Lehman Bankruptcy Takes Big Step Toward an End - The New ...https://dealbook.nytimes.com/2011/08/30/lehman...Aug 30, 2011 · 8:39 p.m. | Updated . A federal bankruptcy judge on Tuesday blessed a plan by Lehman Brothers’ bankruptcy estate to pay out about $65 billionto creditors, about one-fifth of what they are owed, a major step toward winding down the investment bank.. The approval by Judge James M. Peck of the federal bankruptcy court in Manhattan, who has overseen Lehman’s case, paves the way for a …

Lehman Brothers - schemes of arrangement offer a viable ...https://www.lexology.com/library/detail.aspx?g=bed...Oct 18, 2013 · Lehman Brothers Australia Limited (in liquidation) (LBA) was an Australian subsidiary of Lehman Brothers Holdings Inc, which had filed for Chapter 11 bankruptcy protection in …

Lehman Brothers | Public Relationswww.bu.edu/news/tag/lehman-brothersSeptember 15th marks the 2nd anniverary of Lehman Brothers’ collapse. Mark Williams, a former Federal Reserve Bank examiner, is the author of “Uncontrolled Risk.” He is Executive-in-Residence/Master Lecturer in the School of Management. “It has been two years since Lehman Brothers fell and almost brought down the entire financial system.

Lehman Brothers - New York Essayshttps://newyorkessays.com/essay-lehman-brothers-13370Get a verified expert to help you with Lehman Brothers. Hire verified writer. $35.80 for a 2-page paper. They hide the truth with no care about others feelings.All their unethical behaviors and irresponsibility lead Lineman’s company to bankruptcy. Question 5 The reason why all these things happen in accompany is simply the greed of money.

Kenneth Heuer - Greater New York City Area | Professional ...https://www.linkedin.com/in/kenneth-heuer-6b16b3Oct 08, 2019 · Liked by Kenneth Heuer Yesterday, we hosted a virtual event with 10 Axial members, including former Lehman Brothers CEO Dick Fuld, for a …500+ connectionsLocation: Greater New York City

Lehman Brothers | BU Nowblogs.bu.edu/bunow/tag/lehman-brothersSep 14, 2010 · September 15th marks the 2nd anniverary of Lehman Brothers’ collapse. Mark Williams, a former Federal Reserve Bank examiner, is the author of “Uncontrolled Risk.” He is Executive-in-Residence/Master Lecturer in the School of Management. “It has been two years since Lehman Brothers fell and almost brought down the entire financial system.

Lehman Brothers Case Solution and Analysis, HBS Case Study ...https://casegurus.com/lehman-brothers-5146In 2008, the U.S. financial system was in a state of crisis and Lehman Brothers went from a major Wall Street investment bank to an insolvent institution. It was a swift end for a company that had its beginnings more than 150 years ago.[PDF]Lehman Brothers Inc. Trustee Offers Opportunity for ...portal-redirect.epiq11.com/LBI/document/GetDocument.aspx?DocumentId=3407530(2) sell the claim to the Sponsor for a distribution equal to 2.23% of the allowed general unsecured claim (the 0.75% plus an additional payment of 1.48%). The Deadline to participate in the Accelerated Final Distribution Election is August 16, 2018. NEW YORK, July 11, 2018-- James W. Giddens, trustee for the liquidation of Lehman Brothers

UPDATE 1-Boston Properties creates reserve for Lehman rent ...https://uk.reuters.com/article/idUKN1631816220080916Sep 16, 2008 · Lehman Brothers Inc, a unit of Lehman Brothers Holdings Inc LEH.N, which filed for Chapter 11 bankruptcy protection on Monday, leases 436,723 square feet of office space at 399 Park.Lehman's ...

Lehman Brothers | Business Insiderhttps://www.businessinsider.com.au/category/lehman-brothersStories in Lehman Brothers include: Thomas Cook's failure has left half a million people stranded abroad. Here are 9 of the worst company collapses in history. | The US Treasury Secretary's hectic ...

Inside Lehman Brothers - Movie Reviewshttps://www.rottentomatoes.com/m/inside_lehman_brothers/reviewsInside Lehman Brothers is highly relevant for a world still awakening to #MeToo. It also walks viewers through the invisible machinations that led to the subprime mortgage crisis...

The Biden post-election market surge is the best for a new ...https://yalibnan.com/2021/01/20/the-biden-post...Jan 20, 2021 · The Biden post-election market surge is the best for a new president in modern history ... Investors were still extremely nervous about the collapse of Lehman Brothers …

Five Years After Lehman’s Collapse, Bankers Still Haven’t ...https://hbr.org/2013/09/five-years-after-lehmans-collapse-bankers-still-havent...Sep 16, 2013 · In 2005, four dozen senior executives at Lehman Brothers took a decision-making course. They holed up at the Palace Hotel on Madison Avenue and heard from top business school researchers and ...

Find a Legal Entity Identifier | Office of Financial Researchhttps://www.financialresearch.gov/data/financial-company-reference-databaseDuring the financial crisis of 2007-09, the financial industry, regulators, and policymakers struggled to trace quickly the exposures and connections of Lehman Brothers and others across the financial system. This problem highlighted the need for a globally recognized identifier for legal entities.

Lehman Brothers files for bankruptcy. Is AIG next?https://www.rediff.com/money/2008/sep/15leh.htmSep 15, 2008 · Lehman Brothers, fourth largest investment firm, filed for bankruptcy, after Barclays pulled out of an 11th-hour rescue, becoming the largest financial firm to fail in the global credit crisis ...

Citigroup to Settle 10-Year Old Dispute With Lehman Brothershttps://www.zacks.com/stock/news/277421/citigroup...Citigroup Inc. (C Quick Quote C - Free Report) has agreed to pay $1.74 billion to the estate of Lehman Brothers Holdings Inc. for a case that was filed during 2008 financial crisis.The settlement ...

Lehman Brothers: Top and Latest News, Videos and Photos ...https://www.livemint.com/Search/Link/Keyword/Lehman-BrothersLehman Brothers: Get all the Latest News, Pictures, Videos and Special Report about Lehman Brothers by mint.[PDF]What the Libor-OIS Spread Sayshttps://files.stlouisfed.org/files/htdocs/publications/es/09/ES0924.pdfthe announcement that Lehman Brothers had filed for Chapter 11 bankruptcy. The spreads increased to very high levels—about 350 basis points—for a period after the Lehman announcement, but have subsequently narrowed. Indeed, the 31-month 3Libor-OIS 3spread on April 6, 2009, was about 28 basis points, only about 15 basis points

Alexander B. Simkin | Ropes & Gray LLPhttps://www.ropesgray.com/en/biographies/s/alexander-simkinRepresented Lehman Brothers’ Officers in a variety of securities litigations arising from the company’s collapse. Represented AIG in in a dispute with a Fortune 100 company concerning coverage for a high profile defamation settlement under multiple professional liability policies.*

Ten years on, the revolution in investment banking is on ...https://www.fnlondon.com/articles/ten-years-on-the...Aug 30, 2018 · Ten years on from the collapse of Lehman Brothers the world of investment banking has been transformed. The banks behind the boom and bust have changed beyond recognition, most of the bankers who made out like bandits have lost their jobs and some are behind bars.[PDF]Lehman Brothers Inc. Trustee Plans Additional $228 Million ...portal-redirect.epiq11.com/LBI/document/GetDocument.aspx?DocumentId=3119375Lehman Brothers Inc. Trustee Plans Additional $228 Million Distribution to Unsecured General Creditors 5th Interim Distribution to be Made in April, Total Unsecured Recovery 39% with $9 billion distributed New York, NY, February 24, 2017 – James W. Giddens, Trustee for the liquidation of Lehman Brothers[PDF]UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT …www.nysb.uscourts.gov/sites/default/files/opinions/171257_44782_opinion.pdfmanagement fees is a direct cause of Lehman Brothers Inc. (“LBI”), as prime broker to the funds, having failed to comply with instructions to transfer securities in September 2008. In its

Lehman Brothers: Crisis in Corporate Governance Case ...https://caseism.com/lehman-brothers-crisis-in-corporate-governance-45068Lehman Brothers: Crisis in Corporate Governance Case Solution, This case describes in detail the desperate negotiations in September 2008 to prevent the failure of investment bank Lehman Brothers in New York. After the

Lehman Brothers: Too Big to Fail? | The Case Centre, for ...www.thecasecentre.org/educators/products/view?id=140033After months of battling the crisis, they were confronted with the largest problem they had encountered yet - Lehman Brothers, the global investment bank, was teetering on the edge of failure. This case asks students to consider what the appropriate response from …

Reed Introduces Legislation to Hold ... - Senator Jack Reedhttps://www.reed.senate.gov/news/releases/reed-introduces-legislation-to-hold...“For example, the Financial Crisis Inquiry Commission concluded ‘the financial crisis reached cataclysmic proportions with the collapse of Lehman Brothers,’ and yet, according to the Congressional Research Service, not a single senior executive officer at Lehman Brothers at the federal level was charged, went to jail, or personally paid a ...

Lehman bonuses reward for merely doing job, U.S. says ...https://prev.dailyherald.com/story/?id=343584Dec 12, 2009 · Lehman Brothers Holdings Inc.'s plan to pay $50 million in bonuses to employees handling derivatives contracts appears to be a reward for merely doing their job, the U.S. Trustee said in a court filing. Lehman, which is liquidating in bankruptcy, asked a judge last month for permission to pay incentives to about 230 full- time employees ...

SAGE Business Cases - Lehman Brothers: The Fall from Gracehttps://sk.sagepub.com/cases/lehman-brothers-the-fall-from-graceOn 15 September 2008, Lehman Brothers Holdings Inc. filed for bankruptcy protection at the United States Bankruptcy Court in Manhattan, New York. The news of Lehman's bankruptcy filing sent shockwaves through the United States (US) financial markets, the impact of which was later felt across the world, contributing to the global financial ...

"Fuld Rejected Koreans' Offer to Rescue Lehman; Blunder ...https://www.questia.com/newspaper/1G1-185264422/...Newspaper article The Evening Standard (London, England) Fuld Rejected Koreans' Offer to Rescue Lehman; Blunder: Lehman Brothers Chief Executive Dick Fuld Has Been Castigated for Turning Down a $5.3 Billion Offer from Korea Development Bank Which Would Have Saved the Failed American Investment Bank. the Talks Collapsed after Fuld Demanded a Higher Offer, Thus Sealing the Fate of Lehman Brothers

How the 2008 financial crisis is impacting us now - ABC7 ...https://abc7news.com/great-recession-lehman...SAN FRANCISCO (KGO) -- It's hard to believe it's been a decade since the great recession began. 7 On Your Side's Michael Finney talks to Washington Post reporter Renae Merle about the lessons learned.

Company Bankruptcy Information for Lehman Brothers U.K ...https://businessbankruptcies.com/cases/lehman...Debtor. Lehman Brothers U.K. Holdings (Delaware) Inc. 277 Park Avenue 46th Floor New York, NY 10172 NEW YORK-NY Tax ID / EIN: xx-xxx5453 Represented By

PwC Basically Says That the Lehman Brothers Bankruptcy is ...https://www.goingconcern.com/pwc-basically-says...If you find yourself out of work but are willing to endure several sleepless nights across the pond, PwC in the UK may need some help with the administration of Lehman Brothers. More, after the jump Reuters, via NYT: PriceWaterhouseCoopers, which is working with over 100 companies, mostly in the UK but also in continental Europe, said on Sunday: "We're dealing with a large number of entities ...

What is P&L attribution | Capital.comhttps://capital.com/p-l-attribution-definitionIn the news. The Fundamental Review of the Trading Book, conducted by the Basel Committee on Banking Supervision, set out new rules to prevent another financial crisis, including stringent P&L attribution to explain catastrophic losses like those that caused Lehman Brothers to collapse. What you need to know about P&L Attribution.

Before the Fall: Lehman Brothers 2008 Case Solution and ...https://casegurus.com/before-the-fall-lehman-brothers-2008-6262In particular, the case allows for a study of the effects of changes in a company and are able to communicate to key external stakeholders in a … Read more » This case examines Lehman Brothers in the months before its collapse.

LEHMAN BROTHERS QUARTO ATTO | Page 335 | Forum di ...https://www.investireoggi.it/forums/threads/lehman...Jun 03, 2020 · Honorable Shelley C. Chapman Tuesday, June 09, 2020 10:00 AM 08-13555-scc Lehman Brothers Holdings Inc. Ch. 11 Adversary proceeding: 16-01312-scc Lehman Brothers Holdings Inc. v. Aurora Financial ...[PDF]Time, not timing, is the best way to capitalize on stock ...https://www.putnam.com/literature/pdf/II508.pdfThe collapse of Lehman Brothers in September 2008 triggered a severe market downturn and recession. Within a year, stocks had recovered significantly. In June 2016, U.S. stock prices plummeted more than 5% in the two days a†er the Brexit referendum, followed by a dramatic three-day recovery. n r e. 12/31/19 $36,418 The market declined sharply

"Tale in Two Cities: Shock, Anger and Pleas for a Job; (1 ...https://www.questia.com/.../tale-in-two-cities-shock-anger-and-pleas-for-a-jobNewspaper article The Evening Standard (London, England) Tale in Two Cities: Shock, Anger and Pleas for a Job; (1) the Lights Are on but & Empty Desks at Lehman Brothers' HQ in Canary Wharf Ahead of the London Markets Opening This Morning. before the Collapse the Building Would Have Been Bustling at This Time (2) London Falling: A Canary Wharf Worker Clears His Desk

Recession Quotes - Page 5 - BrainyQuotehttps://www.brainyquote.com/topics/recession-quotes_5Created by Congress as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the CFPB was a direct response to the financial crisis and ensuing Great Recession that began with the subprime mortgage debacle and the unraveling of Lehman Brothers investment bank.

Lehman Brothers Bankruptcy Case | Doral Financialurelawfirm.com/lehman-brothers-bankruptcy-case-continuesJul 07, 2015 · Lehman Brothers & Doral Financial. On September 15, 2008, Lehman Brothers filed for Chapter 11 bankruptcy protection following the withdrawal of most of its clients and heavy devaluation of its assets. Lehman’s Chapter 11 bankruptcy is the largest in US history, and thought to be a major contributor to the global financial crisis in the late 2000’s.

Lehman Brothers: A deluded banker's tale of Lehman's last ...https://economictimes.indiatimes.com/markets/...Sep 15, 2018 · by Shuli Ren On a Sunday night 10 years ago, I was sitting alone in my midtown Manhattan apartment on 46th Street, preparing to dial into a conference call to discuss the impending demise of my employer: Lehman Brothers Holdings Inc. That morning, Sept. 14, it had become widely accepted that Lehman would go into bankruptcy.

Top 10 John McCain Campaign Donors | Human Eventshttps://humanevents.com/2008/06/19/top-10-john-mccain-campaign-donorsJun 19, 2008 · Top 10 John McCain Campaign Donors. See who is giving it up for the Republican presidential nominee. By. Human Events. on. June 19, 2008. Facebook Twitter Email Print. Here are the top 10 contributors to Sen. John McCain during the 2008 presidential election, according to data released by the Federal Election Commission. ... Lehman Brothers ...…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

The green-shoots index – Anderson Cooper 360 - CNN.com Blogshttps://ac360.blogs.cnn.com/2009/04/20/the-green-shoots-indexApr 20, 2009 · The earth was barren in the six months or so after the collapse of Lehman Brothers, but newspapers have, with the onset of northern hemisphere spring, started to find the confidence to discuss recovery. In the past, mentions of the word recession (as mapped in an “R-word” index) have been a useful indicator of the likelihood of the real thing.[PDF]SFC, HKMA and Citibank reach agreement on Lehman …https://webb-site.com/codocs/SFC110708.pdf2. MLNs and ELNs were issued by Lehman Brothers Treasury Co. B.V. and guaranteed by Lehman Brothers Holdings Inc. They were distributed by Citibank HK on a private placement basis with a minimum subscription amount of HK$500,000. 3. MLNs were structured notes offered in USD/HKD/AUD/NZD with a tenor from 2.5 to 4.75 years.

Alternative Sources of Recovery: Lehman Brothers ...www.creditorsresource.com/...of-recover/...of-recovery-lehman-brothers-directors-officersOct 05, 2008 · A couple of articles in the Wall Street Journal here and here are the basis for my bet that we are going see claims against Lehman's directors and officers insurance coverage. Perhaps even a fight over who is entitled to make claims against any policies. See Kimberly Melvin's article for background on D&O Policy Proceeds as Bankruptcy Estate ...

Bankruptcy under Chapter 11: Frequently Asked Questions ...https://www.avvo.com/legal-guides/ugc/bankruptcy-under-chapter-11-frequently-asked...Mar 23, 2017 · Think of K-Mart, Marvel Studios, Chrysler (or, for that matter, the infamous Lehman Brothers). They all filed for bankruptcy under Chapter 11 at some point, without ceasing operations. The answer, then, is yes: Chapter 11 is specially tailored for running a …

Discussion Questions From Class ... - Read this and hack!https://bizgovsoc6.wordpress.com/2013/02/14/discussion-questions-from-class-leadership...Feb 14, 2013 · As promised, here are the discussion questions we addressed at the end of my teaching session. 1.What would you have done differently in the shoes of Dick Fuld? 2.Do you think Lehman Brothers should have been bailed out? Why or why not? 3.Who is really to blame for the economic troubles following Lehman’s collapse? 4.Are…

FRONTLINE: Inside the Meltdown | KPBShttps://www.kpbs.org/news/2009/may/15/frontline-inside-the-meltdownFRONTLINE investigates the causes of the worst economic crisis in 70 years and how the government responded. The film chronicles the inside stories of the Bear Stearns deal, the Lehman Brothers ...

Thought Archives - Money Bull and Thinking Bearhttps://moneybullandthinkingbear.com/category/thought10 years after the collapse of Lehman Brothers Just last week, 15th Sep 2018 marks the 10 year anniversary of the collapse of Lehman Brothers. The incident is still fresh in the minds of many people. The internet gets flooded with articles of lessons learned from 10 years ago. All the articles focused on learnings Read More …

development aid Archives - The Globalisthttps://www.theglobalist.com/tag/development-aidFirst Lehman Brothers, Next Liberia? By Donald Steinberg , January 26, 2009 in Globalist Analysis Why is continued funding for fragile states still crucial, even in the midst of the financial crisis?

All-Stars Are Shorting Shipping Companies | The Motley Foolhttps://www.fool.com/.../general/2011/03/03/all-stars-are-shorting-shipping-companies.aspxDavid Einhorn shorting Lehman Brothers in 2007. Steve Eisman's dead-on call on the subprime mortgage collapse.. When someone with a proven track record goes against popular opinion, it's usually ...

Government planning a new bailout - Sep. 18, 2008https://money.cnn.com/2008/09/18/news/economy/rtc_speculation/index.htmSep 18, 2008 · A widening banking crisis has toppled two major firms - Lehman Brothers and Merrill Lynch - and prompted an $85 billion government loan to stem the sudden collapse of …

Soros Sees No Bottom For World Financial 'Collapse' - The ...https://dealbook.nytimes.com/2009/02/23/soros-sees-no-bottom-for-world-financial-collapseFeb 23, 2009 · Soros Sees No Bottom For World Financial ‘Collapse’ ... He said the bankruptcy of Lehman Brothers in September marked a turning point in the functioning of the market system. ... a former Federal Reserve chairman who is now a top adviser to President Barack Obama.

America's fiscal crisis Archives - The Globalisthttps://www.theglobalist.com/tag/americas-fiscal-crisisHow much did public debt increase in US and EU due to the decision not to bail out Lehman Brothers? ... What are the potential consequences of increasing income inequality in the world’s largest economy? ... Who Is a Globalist? Speaking and interview topics/Expertise TV appearances Radio interviews

Explainers - The Sunhttps://www.thesun.co.uk/topic/explainers/page/723Explainers. We’ve got all the explanations you could possible need ... Why did Lehman Brothers collapse and what caused the financial crisis in 2008? ... Who are the Strictly Come Dancing 2018 ...

Who is to blame for the banking crisis - Economics ...www.citethisforme.com/topic-ideas/economics/Who is to blame for the banking crisis...Aug 07, 2015 · Who is to blame for the banking crisis - Economics bibliographies - in Harvard style . Change style powered by CSL. Popular AMA APA ... These are the sources and citations used to research Who is to blame for the banking crisis. ... Lehman Brothers' former CEO blames bad regulations for bank's collapse. [online] the Guardian. ...

Lehman Brothers Holdings, Jenner & Block Llp, Anton ...https://www.jdjournal.com/2010/03/12/lehman...Mar 12, 2010 · After a year of arduous investigation, Anton Valukas and his Chicago based law firm, Jenner & Block, LLP, have produced a 2,200 page report regarding the bankruptcy of Lehman Brothers …

Financial crisis fashion: the boom in Lehman Brothers ...https://www.ft.com/content/fe4b7b3d-ee7e-4185-992d-a3b6d2151c70“Especially for the firms that no longer exist — Lehman, Merrill [Merrill Lynch agreed to a takeover by Bank of America in late 2008, the same weekend Lehman Brothers fell, and was rebranded ...

Nightmare on Wall Street continues - CNN Businesshttps://money.cnn.com/2008/12/03/news/companies/goldman_morgan/index.htmDec 03, 2008 · The collapse of Lehman Brothers and a drought in short-term funding sources, considered crucial for investment banks, prompted both Goldman Sachs and Morgan Stanley to convert into bank holding ...

Q&A: Chad Mackay of Mackay Restaurants on the recession ...https://www.bizjournals.com/portland/blog/real...Feb 04, 2013 · Mackay: The bottom fell out in September 2008 after the collapse of Bear Stearns and Lehman Brothers. El Gaucho caters to diners celebrating special events and business people.

Post-Lehman, the push for global financial protections ...https://www.washingtonpost.com/business/economy/...Jan 29, 2013 · Five years after the collapse of Lehman Brothers, a global push to tighten financial regulation around the world has slowed in the face of a tepid recovery and a …[PDF]Indian Point Nuclear Power Plants: History of Failure ...https://www.nrc.gov/docs/ML0131/ML013100203.pdfApril, 1994 Lehman Brothers ranks IP3 one of 8 US nuclear plants as "poor performers" in a report on nuclear investments. May, 1994 After an NRC directive forces the utility to inspect its spent fuel pool at IP1, Con Ed admits that water has been leaking the site for[PDF]JUDGMENT AND ORDER APPROVING SETTLEMENT BETWEEN …www.lehmansecuritieslitigationsettlement.com/lbe/...(3) Purchased or acquired Lehman common stock, call options, and/or sold put options between June 12, 2007 and September 15, 2008, through and

Philip Turner's research works | Bank for International ...https://www.researchgate.net/scientific-contributions/Philip-Turner-12564536In mid-September 2008, following the bankruptcy of Lehman Brothers, international interbank markets froze and interbank lending beyond very short maturities virtually evaporated.

Richard G. Murphy, Jr. Lawyer Profile on Martindale.comhttps://www.martindale.com/attorney/richard-g-murphy-jr-869303Lehman Brothers Ruling Calls into Question Enforceability of Cross-Affiliate Netting in Bankruptcy; LEGAL ALERTS/ARTICLES; May 28, 2010 | Author: Warren N. Davis , Richard G. Murphy , Beverly J. Rudy and Paul B. Turner ; Law Firm: Sutherland Asbill & Brennan LLP - Washington Office and Sutherland Asbill & Brennan LLP - Houston Office The U.S. Bankruptcy Court for the Southern District …

Central banks move to stabilize world financial system ...https://www.nj.com/business/2011/11/central_banks_move_to_stabiliz.htmlThat fall, fear gripped the financial system after the collapse of Lehman Brothers, a storied American investment house. Banks around the world severely restricted lending to each other. Investors ...[PDF]IF YOU ONLY KNEW THE POWER OF THE DARK SIDE: AN …https://news.law.fordham.edu/jcfl/wp-content/...market cap over the prior year; Lehman Brothers filed for Chapter 11 bankruptcy protection in September 2008; and Bank of America purchased Merrill Lynch & Co. in September 2008, also at a deep discount.4 As financial institutions rapidly collapsed, banks grew more and more hesitant to lend to one another, the London Interbank Offered

“The Red Book,” by Deborah Copaken Kogan - Washington Posthttps://www.washingtonpost.com/entertainment/books/...Mar 29, 2012 · They are amalgams of traits — a commune child who grew up to be a managing director at Lehman Brothers, an aspiring actress turned wealthy stay-at-home mother — more than fully realized ...[PDF]Committee on Bankruptcy Corporate Reorganization Nwww.nycbar.org/pdf/report/uploads/20072001-Non...Lehman Brothers to see how the pressure of the restructuring process can drive parties to a relatively quick sale of assets. While the inability to access credit markets can make the restructuring environment difficult, it is not the only reason why lawyers should consider whether a …

Japanese Bank Gets Chunk Of Morgan Stanley - CBS Newshttps://www.cbsnews.com/news/japanese-bank-gets-chunk-of-morgan-stanleySep 22, 2008 · Over the past week, as fellow investment banks Lehman Brothers Holdings Inc. filed for bankruptcy protection and Merrill Lynch & Co. sold itself to Bank of America Corp., reports centered on ...

Ending ‘Too Big to Fail’ Could Rest on Obscure Contract ...https://www.bloomberg.com/news/articles/2014-07-29/...Jul 29, 2014 · The change is designed to prevent a recurrence of one of the most vexing problems revealed by the 2008 financial crisis: When Lehman Brothers …[PDF]OMB Meeting Materialshttps://obamawhitehouse.archives.gov/sites/default/files/omb/assets/omb/oira/1900/...(Citigroup, Credit Suisse, Goldman Sachs, Lehman Brothers, and Morgan Stanley) on the Title XVII loan guarantee program authorized by the Energy Policy Act of 2005. We believe loan guarantees are essential to support the financing in the credit markets of new

Uncategorized | The Anonymous Accountanthttps://audit.wordpress.com/category/uncategorizedDec 29, 2010 · By now, many of you have heard quite a bit about the E&Y lawsuit (if you haven’t the Cliff Notes version is that Andrew Cuomo, the outgoing NY Attorney General, has filed a civil suit against E&Y for its role in the collapse of Lehman Brothers).

Donovan, Christine - Global Custodian – The Leading ...https://www.globalcustodian.com/gc-legends/donovan-christineIn fact, Chris Donovan had less cause for anxiety than most agent lenders in the weeks after Lehman Brothers collapsed, for she has preached the virtues of cutting counterparty and collateral reinvestment risk through intrinsic value lending for a decade and a half.

Most People Cannot Even Imagine That An Economic Collapse ...https://goldreference.com/most-people-cannot-even...Nov 07, 2014 · And a lot of people might not like to hear this, but without those banks we essentially do not have an economy. When Lehman Brothers collapsed in 2008, it almost resulted in the meltdown of our entire system. The stock market collapsed and we experienced an absolutely wicked credit crunch. Unfortunately, that was just a small preview of what is ...

Media company tailors print, broadcast, apps to Indian ...https://www.indiaabroad.com/business/media-company...Jul 21, 2017 · But that trend changed after the downturn in the U.S. economy following the collapse of the Lehman Brothers in 2008. A 2016 Pew Research Center report noted that eight years after the great recession sent the U.S. newspaper industry into a tailspin, the pressures facing America’s newsrooms have intensified to nothing less than a ...[PDF]BIT RATE AND BUSINESS MODEL - Akamaihttps://www.akamai.com/.../documents/white-paper/bit-rate-and-business-model.pdfthe same video at a lower resolution and a re-buffering event occurring during a key scene. In addition, each subject was primed to associate their own viewing experience with one of the three major OTT business models: Subscription Video on Demand (SVOD), Ad-Supported Video on Demand (AVOD), or Transaction Video on Demand (TVOD).

On the Market: Commercial - The Real Deal New Yorkhttps://therealdeal.com/issues_articles/on-the-market-commercial-29Midtown East building could sell for more than $500M The 600,000-square-foot Philip Morris Building at 120 Park Avenue and 42nd Street is drawing bids of more than $500 million from…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Sell Short to Save the Market! | The Motley Foolhttps://www.fool.com/investing/dividends-income/2008/10/09/sell-short-to-save-the...Sell Short to Save the Market! ... AIG), and let Lehman Brothers fail. Funny, but that act alone may now be pushing governments worldwide to the brink of bankruptcy. ... These are the people we ...

10 years on from the collapse of Lehman Brothershttps://www.blacktowerfm.com/news/615-10-years-on-from-the-collapse-of-lehman-brothersThe 10-year gilt yield fell from 4.5% before the collapse of Lehman to around 3% in the aftermath, then fell back to below 2% during the eurozone debt crisis, then to a little over 0.5% after the Brexit vote. Pension liabilities, which are the long-term costs faced by a retirement plan, rise as gilt yields fall.

What happened in the 1973 oil crisis - Answershttps://www.answers.com/Q/What_happened_in_the_1973_oil_crisisSep 13, 2011 · Most definitely. The crisis occurred when, in response to US support of Israel in the Yom Kippur war, Arab oil producers cut back supply of oil to the US, and increased oil ……lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

subprime mortgage crisis News and Updates from The ...https://economictimes.indiatimes.com/topic/subprime-mortgage-crisis/news/2Lehman Brothers, a 150-year-old investment bank collapsed in September 2008, prompting the worst global economic crisis since the 1930s. ... Notional amount of CDS rose to a high of more than $60 trillion by 2007 from about a trillion at the turn of the century. Unlike in 2007, there’s caution ... The shadow lenders are the reason why the ...

For Fintech Career Switchers, the Hardest Skills to Master ...https://www.cfainstitute.org/en/research/cfa-magazine/2018/for-fintech-career...Before career switchers can adapt to a new work culture, they first need to adapt successfully to a different job market and get a position, moves that require new approaches. ... Putnam spent three years at Lehman Brothers pursuing a dream career in investment banking. Tossed back into the job hunt when Lehman collapsed in 2008, he had a brief ...

The Bernanke file - The Washington Posthttps://www.washingtonpost.com/opinions/the-bernanke-file/2015/10/11/74e52770-6e95-11e...Oct 11, 2015 · What makes this claim more believable now are the results of Lehman’s bankruptcy, which Bernanke cites. Losses were estimated near $200 billion, and ……lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Robert Samuelson: Bernanke theory not quite complete ...https://www.telegram.com/article/20151011/NEWS/151019940Oct 11, 2015 · For starters, it gives new credibility to his claim that the Fed couldn't have prevented Lehman Brothers' bankruptcy in September 2008. Recall that …

The next financial crisis: Why it looks like history may ...https://www.cnbc.com/amp/2018/09/14/the-next-financial-crisis-why-it-looks-like...Sep 14, 2018 · Sept. 15, 2018, will be the 10th anniversary of the collapse of Lehman Brothers, the fourth-largest investment bank in the United States. It was the …

CPA - The Guardian - #1804https://www.cpa.org.au/guardian/2017/1804/10-the-asian-financial-crisis.htmlIn 2008, the global financial crisis erupted, with the United States as its epicentre. The tip of the iceberg was the collapse of Lehman Brothers and the massive loans given out to house-buyers that were not credit-worthy, thus the term “sub-prime crisis”.

The Bernanke File | RealClearPoliticshttps://www.realclearpolitics.com/articles/2015/10/12/the_bernanke_file_128364.htmlOct 12, 2015 · The Bernanke File. By Robert ... it gives new credibility to his claim that the Fed couldn't have prevented Lehman Brothers' bankruptcy in September 2008. ... It was the …

Robert J. Samuelson commentary: Bernanke's book doesn't ...https://www.dispatch.com/article/20151012/OPINION/310129690Oct 12, 2015 · What makes this claim more believable now are the results of Lehman’s bankruptcy, which Bernanke cites. Losses were estimated near $200 billion and ……lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

(Solved) - Discuss the role of the investment bank as ...https://www.transtutors.com/questions/discuss-the-role-of-the-investment-bank-as...1 Answer to Given what you know about the Lehman Brothers bankruptcy, including but notlimited to the attached case, discuss the pros and cons of a) liquidationbankruptcy, b) governmental bailout and c) private sector acquisition. Be specificand consider both short and long term ramifications. 2.Discuss the...

The case against Lehman Brothers - YouTubehttps://www.youtube.com/watch?v=t3eMVgWTDxEClick to view13:34Aug 19, 2012 · Steve Kroft investigates the collapse of Lehman Brothers, which triggered a chain reaction that produced the worst financial crisis and economic downturn in 70 years.Author: CBS NewsViews: 14K

Why did Lehman Brothers fail? - YouTubehttps://www.youtube.com/watch?v=pBRyZz8PLl8Click to view3:21Sep 18, 2018 · Few thought it would happen. They said Lehman Brothers was too big to fail. But in 2008 the investment bank filed for bankruptcy. The largest in US history. And as Lehman fell, the world's economy ...Author: The NewsmakersViews: 3K

Lehman Brothers - Wilmington Trusthttps://www3.wilmingtontrust.com/lehman-bondholdersOn September 15, 2008 and thereafter, LBHI and certain of its affiliates (collectively, "Lehman Brothers" or the "Debtors") filed for relief under chapter 11 of title 11 of the United States Code (the "Bankruptcy Code") in the United States Bankruptcy Court for the Southern District of New York. The Debtors cases have been assigned to Judge ...

Lehman Brothers Sues Intel Over $1 Billion in Seized ...https://www.cnbc.com/id/100699012May 02, 2013 · Under the swap agreement, executed days before Lehman filed for bankruptcy in 2008, Intel gave $1 billion to a derivatives unit of Lehman Brothers in exchange for 50.5 million Intel shares, to …

"Representations of power: A critical multimodal analysis ...https://digitalcommons.unl.edu/teachlearnfacpub/236In September 2008, the collapse of the bank Lehman Brothers led to a financial crisis and the worst recession since the Great Depression of the 1930s, threatening the entire global financial system. Some of the effects of the crisis included evictions, foreclosures and high and prolonged unemployment. Despite the fact that bankers and corporate executives are widely known to bear much of the ...

The Lehman Trilogy Showtimes - IMDbhttps://www.imdb.com/showtimes/title/tt10127546The story of Lehman Brothers, from their beginnings as cotton brokers before the Civil War to the company's involvement in the financial crisis of 2008.

Bank behaviour and risks in CHAPS following the collapse ...https://www.bankofengland.co.uk/working-paper/2012/...The ratio of payments made to liquidity used was 30% lower in the period from 15 September 2008 to 30 September 2009 than in the period preceding the default of Lehman Brothers. This was due initially to payment delay, but later was due to banks making more payments with their own liquidity, probably because quantitative easing increased the ...

Lehman Excel snafu could cost Barclays dear • The Registerhttps://www.theregister.com/2008/10/15/lehman_buyout_excel_confusionOct 15, 2008 · Lehman Brothers sought bankruptcy protection on 15 September, a move that set off a chain of events that have shaken confidence in global financial institutions and the collapse of stock markets across the globe that has only been partially reversed by unprecedented government bail-outs to the banking sector.

Lehman Brothers Gets a Pass From SEC: Report - TheStreethttps://www.thestreet.com/investing/stocks/lehman...May 24, 2012 · Lehman Brothers. or any of its top executives in relation to the firm's spectacular 2008 collapse, according to a report from Bloomberg . An internal SEC …

AMC (AMC) Sees More Red After Guiding Below Expectationshttps://www.investopedia.com/amc-amc-sees-more-red...Oct 20, 2020 · The Collapse of Lehman Brothers: A Case Study. Company Profiles. ... Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective ...

15 notable bankruptcies in 2008 - Boston.comarchive.boston.com/business/gallery/2008bankruptcy?pg=10Lehman Brothers. The 158-year-old investment bank roiled Wall Street on Sept. 15, when it became the biggest US company to ever file for bankruptcy. Lehman Brothers Holdings Inc. crumbled under the weight of mounting losses from bad investments in mortgage-related securities. Lehman's filing, coupled with Merrill Lynch & Co.'s sale to Bank of ...

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT …www.nysb.uscourts.gov/sites/default/files/opinions/171257_34720_opinion.pdfLehman Brothers Holdings Inc. and Its Affiliated Debtors, ECF No. 22972. 4 The Court notes that the Bankruptcy Code allows for payment of “reasonable compensation for professional services rendered” by an attorney or accountant employed by an indenture trustee if such indenture trustee has an

Why Stock Investors Play the Risky 'Momentum' Gamehttps://www.investopedia.com/news/why-stock...Jun 25, 2019 · Soon thereafter, the collapse of Lehman Brothers set off a full-fledged financial crisis. Another sign of froth in U.S. equities today is the 14-day relative strength index (RSI) , a measure of ...

How the Financial Crisis Still Affects Investors | Barron'shttps://www.barrons.com/articles/how-the-financial-crisisstill-affects-investors...Sep 20, 2018 · The implosion of Lehman Brothers 10 years ago next weekend poured gasoline on a smoldering fire. Over the next six months, the S&P 500 fell 46%. Retirees lost decades worth of accumulated wealth.

CiteSeerX — Causes and Effects of the Lehman Brothers ...citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.494.6343CiteSeerX - Document Details (Isaac Councill, Lee Giles, Pradeep Teregowda): I argue that the demise of Lehman Brothers is the result of its very aggressive leverage policy in the context of a major financial crisis. The roots of this crisis have to be found in bad regulation, lack of transparency, and market complacency brought about by several years of positive returns.

Lehman Bros. collapse 10 years ago hit Long Island and the ...https://www.newsday.com/business/lehman-brothers...The collapse of investment bank Lehman Brothers on Sept. 15, 2008, catalyzed the most severe financial crisis and economic downturn since the Great Depression. For Lenny Messina, a …

Bank raided over $400M Lehman transfer - CNN.comedition.cnn.com/2008/BUSINESS/10/22/germany.bank.raid/index.htmlOct 22, 2008 · The government-owned KFW bank group transferred €319 million ($412 million) to Lehman Brothers on September 15, after the U.S. bank filed for bankruptcy, the state prosecutor's office in ...

Compass Lexecon Client, Lehman Brothers Holdings, Prevails ...https://www.compasslexecon.com/cases/compass...Mar 14, 2018 · After Lehman Brothers Holdings Inc., (“Lehman”) filed for bankruptcy, Trustees for 244 RMBS Trusts filed claims arising out of alleged breaches of representations and warranties on mortgages conveyed to the Trusts. In 2012, the parties agreed to a $5 billion reserve for the RMBS Trusts’ claims.

Chapter 10 - ‘No More Boom and Bust’: The Subprime Bubblehttps://www.cambridge.org/core/books/boom-and-bust/...House prices in many parts of these countries more than doubled in the years leading up to 2007. They then crashed with terrible consequences for the global financial system, which imploded in September 2008 when Lehman Brothers entered bankruptcy. The chapter then discusses how the bubble triangle explains this episode.

When Does Narcissistic Leadership Become Problematic? Dick ...https://journals.sagepub.com/doi/full/10.1177/1056492613478664I draw on concepts from psychoanalysis in this formulation. I also argue that a downturn in the environment is the key factor that may lever a constructive narcissistic leader to become reactive. I use the example of Dick Fuld—whose leadership at Lehman Brothers was at the eye of the 2008 credit crisis storm—to illustrate this.

How to Energize Your Portfolio | Barron'shttps://www.barrons.com/articles/SB122369274272225483Oct 13, 2008 · In addition, Lehman Brothers, which filed for bankruptcy in mid-September, was a lender and adviser to a handful of MLPs. As Lehman and others shed assets, lowering their …

Solved: Which Of These Was NOT A Response By The Governmen ...https://www.chegg.com/homework-help/questions-and...Question: Which Of These Was NOT A Response By The Government To Mitigate The Effects Of The Financial Crisis?: A) It Made Large Loans To The U.S. Automobile Industry. B) It Lent Over $100 Billion To Lehman Brothers To Keep It From Bankruptcy. C) It Passed A Very Large Stimulus Package To Boost Aggregate Demand.

When Does Narcissistic Leadership Become Problematic? Dick ...https://journals.sagepub.com/doi/10.1177/1056492613478664I use the example of Dick Fuld—whose leadership at Lehman Brothers was at the eye of the 2008 credit crisis storm—to illustrate this. A key implication is that constructive narcissistic leaders may be incubating problems that only become manifest at a later stage.

Solved: In The Fall Of 2008 An Investment Bank ... - Chegg.comhttps://www.chegg.com/homework-help/questions-and...In the Fall of 2008 an investment bank, Lehman Brothers, declared bankruptcy. This bankruptcy touched off a financial crisis that led to a dramatic reduction in credit available to …

Bank Behaviour and Risks in Chaps Following the Collapse ...https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2092668Jun 21, 2012 · The ratio of payments made to liquidity used was 30% lower in the period from 15 September 2008 to 30 September 2009 than in the period preceding the default of Lehman Brothers. This was due initially to payment delay, but later was due to banks making more payments with their own liquidity, probably because quantitative easing increased the ...

Lehman Brothers crisis News and Updates from The Economic ...https://economictimes.indiatimes.com/topic/Lehman-Brothers-crisis/news/310 years after Lehman Brothers, four big risks 04 Jul, 2018, 07.24 AM IST There are four main areas of worry that, taken together, suggest the global economy may be in a more fragile place than it was even at the eve of Lehman’s demise a decade ago.

Lehman Brothers files bankruptcy plan – The Denver Posthttps://www.denverpost.com/2010/03/15/lehman-brothers-files-bankruptcy-planMar 15, 2010 · NEW YORK — Lehman Brothers Holdings Inc. and 22 affiliates filed a bankruptcy plan Monday to repay creditors of the failed brokerage firm. “The proposed plan represents a fair economic ...

Information dissipation as an early-warning signal for the ...https://ui.adsabs.harvard.edu/abs/2013NatSR...3E1898Q/abstractIn financial markets, participants locally optimize their profit which can result in a globally unstable state leading to a catastrophic change. The largest crash in the past decades is the bankruptcy of Lehman Brothers which was followed by a trust-based crisis between banks due to high-risk trading in complex products. We introduce information dissipation length (IDL) as a leading indicator ...

Joseph T. Moldovan | Morrison Cohen LLPhttps://www.morrisoncohen.com/jmoldovanMediator, Mediation Panel For Indemnification Claims of Lehman Brothers Holdings Inc. and Affiliated Debtors against Mortgage Loan Sellers, appointed pursuant to Court order in Lehman Brothers Holdings Inc., et. al. Chapter 11 Case No. 08-13555 (SCC) United States Bankruptcy Court for the Southern District of New York.

StreetInsider.com - Lehman Brothers - News, Researchwww.streetinsider.com/entities/Lehman+BrothersDec 27, 2018 04:31PM Form 8-K LEHMAN BROTHERS HOLDINGS For: Dec 27 Dec 27, 2018 02:02AM Japan's Nomura aims for increased deal-related business in U.S. push: CEO[PDF]SOUTHERN DISTRICT OF NEW YORK - Epiq 11https://document.epiq11.com/document/getdocumentby...the Southern District of New York (the “Bankruptcy Court”) on the dates indicated below. On December 6, 2011, the Bankruptcy Court confirmed the Modified Third Amended Joint Chapter 11 Plan of Lehman Brothers Holdings Inc. and its Affiliated Debtors (the “Plan”). On March 6, 2012, the “Effective Date” (as defined in the Plan) occurred.

The Collapse of "Lehman brothers"https://www.slideshare.net/pallavgrover96/lehman-brothers-48232419About collapse of Lehman Brothers. A global financial services firm which filed bankruptcy in 2008, thereby, leading to worldwide crisis of economic downturn e…

Firm Obtains Series of Victories for Lehman Brothers in ...https://www.willkie.com/news/2015/01/firm-obtains-series-of-victories-for-lehmanJan 23, 2015 · Willkie has scored a series of significant victories on behalf of client Lehman Brothers Holdings Inc. In a series of rulings, the United States District Bankruptcy Court for the Southern District of New York denied RMBS Trustees’ request to increase the potential liability of Lehman Brothers …

How the Subprime Crisis went global: Evidence from bank ...https://www.sciencedirect.com/science/article/abs/pii/S0261560612000435Following the failure of Lehman Brothers, the interdependencies briefly increased to a new high, before they fell back to the pre-Lehman elevated levels – but now they more clearly reflected heightened funding and counterparty risk. After Lehman's failure, the prospect of global recession became imminent, auguring the further deterioration of ...

"Reframing International Financial Regulation After the ...https://repository.law.umich.edu/mjil/vol36/iss1/2The British bank Northern Rock failed on September 14, 2007; U.S. investment bank Bear Stearns collapsed on March 17, 2008 and was subject to a government-engineered takeover by J.P. Morgan Chase; and, on the night of September 15, 2008, U.S. investment bank Lehman Brothers filed for bankruptcy and sent global financial markets into disarray the following Monday morning. These …

The Last Days of Lehman Brothers (2009) — The Movie ...https://www.themoviedb.org/movie/59027-the-last-days-of-lehman-brothersThe heads of Wall Street's biggest investment banks were summoned to an evening meeting by the US Treasury Secretary, Hank Paulson, to discuss the plight of another - Lehman Brothers. After six months' turmoil in the world's financial markets, Lehman Brothers was on life support and the government was about to pull the plug. Lehman CEO, Dick Fuld, recently sidelined in a boardroom coup, spends ...

Subprime crisis – News, Research and Analysis – The ...https://theconversation.com/us/topics/subprime-crisis-13708Jul 18, 2019 · The collapse of Lehman Brothers was a pivotal moment in the most recent financial crisis. The next crash may feature another bank failure. Reuters December 1, 2014

Inside Lehman Brothers Movie Poster - Chargefield Key Arthttps://chargefield.com/portfolio/inside-lehman-brothersMessy mortgages taken out by Lehman Brothers caused a real estate crisis in America ten years ago. This led to a global financial crisis. Ten years later, the French journalist Jennifer Deschamps looks back on the bankruptcy of Lehman Brothers.

Inside Lehman Brothers (2018) | MUBIhttps://mubi.com/films/inside-lehman-brothersMessy mortgages taken out by Lehman Brothers caused a real estate crisis in America ten years ago. This led to a global financial crisis. Ten years later, the French journalist Jennifer Deschamps looks back on the bankruptcy of Lehman Brothers.

BBC NEWS | Business | 'Decade' to wind up Lehman Europenews.bbc.co.uk/2/hi/business/8255782.stmSep 14, 2009 · The total includes the $8bn that was "swept back" to New York two days before Lehman Brothers went into Chapter 11 bankruptcy. Cash from the European operation was regularly transferred between London and New York, but many felt that Lehman's London employees had lost out due to …

BBC News - Lehman administrators PwC repay $11bn to creditorsnews.bbc.co.uk/2/hi/business/8434178.stmDec 29, 2009 · Administrators of the collapsed investment bank Lehman Brothers have agreed a plan to return $11bn (£6.9bn) to former investors. PricewaterhouseCoopers (PwC) said more than 90% of affected investors - with assets still locked in Lehmans - had agreed to the deal.

LEHMAN BROTHERS HOLDINGS INC. : Stock Market News and ...https://www.marketscreener.com/quote/stock/LEHMAN...The case is In re Lehman Brothers Equity/Debt Securities Litigation, U.S. District Court, Southern District of New York, No. 08-cv-05523. Lehman's bankruptcy is In re Lehman Brothers Holdings Inc, U.S. Bankruptcy Court, Southern District of New York, No. 08-13555. (Editing by Bob Burgdorfer and Lisa Shumaker) By Nick Brown

Short seller is collateral damage in Lehman collapse - Oct ...https://archive.fortune.com/2008/10/10/news/...Oct 10, 2008 · The recent problems for Copper River began in the middle of last month as Lehman Brothers began to totter. According to Copper River investor and another person close to the fund, Copper River had put on a series of derivative trades with Lehman as its counter-party.

"Discretion to Act: How the Federal Reserve's Decisions ...https://digitalcommons.pepperdine.edu/jbel/vol10/iss2/7The housing market crash of 2007–2008 threatened to cause the collapse of the United States and global economies. By early 2008, Bear Stearns, Lehman Brothers, and American International Group all faced the strong possibility of bankruptcy absent government intervention. The Federal Reserve Board of Governors activated its emergency lending powers pursuant to Section 13(3) of the Federal ...

Part 3 of 3. Of course, all three... - Camilo Velasco ...https://www.facebook.com/camilovelasco01/posts/3804892729571898When CEO of Lehman Brothers, Richard Fuld was driven from his home to a heliport, then helicoptered into Manhattan, driven in another limo… m-heffernan.medium.com THREE PROBLEMS OF POWER: Distance and Dehumanization

Spreadsheet Error Horror Storieshttps://incisive.com/spreadsheet-error-horror-storiesBarclays – During the banking crisis in 2008, Barclays agreed to purchase Lehman Brothers, except spreadsheet errors led them to eat losses on contracts they did not intend to buy. The detailed spreadsheet of Lehman assets contained approximately 1,000 …

Credit rating migration risk and interconnectedness in a ...https://www.sciencedirect.com/science/article/abs/pii/S0275531919310487Further, the study undertakes a stress test using a historical economic scenario pertaining to a credit rating migration matrix shortly after the Lehman Brothers’ bankruptcy. The test finds a much sparser network structure due to a large number of firm defaults.

[PDF] Derivatives, financial fragility and systemic risk ...https://www.semanticscholar.org/paper/Derivatives,-financial-fragility-and-systemic...This paper aims at analysing the relationship among derivatives, financial fragility and systemic risk by discussing the role played by these financial instruments in the collapse or near-collapse of Barings Bank, Long-Term Capital Management (LTCM), Lehman Brothers and AIG. We investigate in which ways derivatives contributed to the build-up of systemic risks in these experiences according to ...

CiteSeerX — Causes and Effects of the Lehman Brothers ...citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.684.8926CiteSeerX - Document Details (Isaac Councill, Lee Giles, Pradeep Teregowda): I argue that the demise of Lehman Brothers is the result of its very aggressive leverage policy in the context of a major financial crisis. The roots of this crisis have to be found in bad regulation, lack of transparency, and market complacency brought about by several years of positive returns.

Fuld - Wikipediahttps://en.wikipedia.org/wiki/FuldFuld may refer to: . A former English name for Fulda, a city in Hesse, Germany; Bracha Fuld, German-born Jewish resistance fighter; Dick Fuld, banker and executive; former CEO of Lehman Brothers; Leo Fuld, Dutch singer; Sam Fuld, American major league …

Bank v. Lehman Brothers Holdings Inc. | VOLOhttps://volo.abi.org/cco/bank-v-lehman-brothers-holdings-incJul 18, 2018 · Mediafare Entm’t Corp., 777 F.2d 78 (2d Cir. 1985), the Court determined that the parties intended to be bound to a settlement, absent a signed document Procedural context: Appeal from district court order affirming bankruptcy court decision enforcing putative settlement agreement between appellant and respondent.

Inside Lehman Brothers (TV Movie 2018) - Photo Gallery - IMDbhttps://www.imdb.com/title/tt9021104/mediaindexMessy mortgages taken out by Lehman Brothers caused a real estate crisis in America ten years ago. This led to a global financial crisis. Ten years later, the French journalist Jennifer Deschamps looks back on the bankruptcy of Lehman Brothers ...

Jeb Bush Wasn't Maybe Entirely Useless As A Paid Hand For ...https://dealbreaker.com/2015/07/jeb-bush-wasnt...Jan 14, 2019 · Bush bought $77,000 in Lehman Brothers stock in July 2008. The firm filed for bankruptcy in September 2008 and Bush sold the shares for $54 on Dec. 26, 2008. Ouch.

Lehman Brothers to pay $2.4 bn to settle mortgage claims ...https://www.business-standard.com/article/...Read more about Lehman Brothers to pay $2.4 bn to settle mortgage claims from pre-2008 era on Business Standard. Following Lehman's 2008 bankruptcy, trustees representing hedge funds and institutional investors brought a claim, saying Lehman breached its contract

Lehman Brothers whiskey stirs up troublehttps://www.thespiritsbusiness.com/2014/12/lehman...Dec 18, 2014 · The Lehman Brothers whiskey website states: “If a whiskey could be called a New Yorker, Lehman Brothers would be the quintessential New Yorker. It …[PDF]A L E R Thttps://www.ropesgray.com/~/media/Files/alerts/...A bar date of September 22, 2009 at 5:00 p.m. (prevailing Eastern Time) has been set for filing claims in the bankruptcy proceedings of Lehman Brothers Holdings Inc. (LBHI) and the LBHI subsidiaries listed below (collectively, “Lehman”).

CBA and Westpac reveal Lehman exposure - NewsComAuhttps://www.news.com.au/news/banks-reveal-lehman...Oct 21, 2009 · The 158-year-old Lehman Brothers announced yesterday it intended to file for bankruptcy after emergency talks in New York over the weekend failed. CBA shares were trading down $1.08 at $40.90 at ...[PDF]Shai Y. Waisman Mindy J. Spector Kevin F. Meade WEIL ...https://www.creditslips.org/files/lehman_brothers_holdings_inc._1.pdfCorporation v. Lehman Brothers Inc. , No. 08-CIV-8119 (GEL) (S.D.N.Y. Sept. 19, 2008). The LBI Liquidation Order, inter alia , appointed James W. Giddens as SIPA Trustee and removed the proceeding to this Court. 9. Upon information and belief, Defendant is a New Jersey corporation that did or

Avoid These Red Flag Terms in Office Emailhttps://lifehacker.com/avoid-these-red-flag-terms-in-office-email-5562878Bloomberg News points out that investigators looking into the momentous collapse of Lehman Brothers at the brink of the recent financial meltdown managed to cut their way through 34 million pages ...

EconPapers: Bank lending during the financial crisis of 2008https://econpapers.repec.org/RePEc:eee:jfinec:v:97:y:2010:i:3:p:319-338After the failure of Lehman Brothers in September 2008, there was a run by short-term bank creditors, making it difficult for banks to roll over their short term debt. We find that there was a simultaneous run by borrowers who drew down their credit lines, leading to a spike in commercial and industrial loans reported on bank balance sheets.

How Lehman Brothers Continues To Echo Todayhttps://www.realclearmarkets.com/2018/09/05/how...Sep 05, 2018 · The standard story about the September 2008 collapse of Lehman Brothers is that it led to a deeper understanding of the risks of financial complexity and free-wheeling capitalism.[PDF]PUBLISH UNITED STATES COURT OF APPEALS TENTH CIRCUIT ...https://www.ca10.uscourts.gov/opinions/95/95-1357.pdfsubject to a private cause of action under § 10(b). Although subjecting municipalities to civil liability for securities fraud under § 10(b) may have "grave political and constitutional consequences" and could "fundamentally alter the relationship between elected officials and the electorate," see In re New York Municipal Securities Litigation ,

Lehman Brothers (OTC:LEHMQ) and JP Morgan Chase (NYSE: JPM ...https://www.americanbankingnews.com/2010/02/25/...Lehman Brothers Holdings Inc (OTC:LEHMQ) will pay JP Morgan Chase & Co (NYSE: JPM) $557 million in cash and allow the bank to keep $7.7 billion in collateral to settle many of the bank’s claims in Lehman Brothers bankruptcy case. JP Morgan, which is currently the second largest bank in the United States in terms […]

The rise of Nio; Goldman Sachs' future; Lehman Brothers ...https://www.wktv.com/content/national/493227861.htmlSep 14, 2018 · Lehman anniversary: Saturday marks the 10th anniversary of the collapse of Lehman Brothers. The investment bank's demise set off a chain reaction of bank failures that required unprecedented US federal action, and led to a global financial meltdown.

The rise of Nio; Goldman Sachs' future; Lehman Brothers ...https://www.kezi.com/content/national/493227861.html3. Lehman anniversary: Saturday marks the 10th anniversary of the collapse of Lehman Brothers. The investment bank's demise set off a chain reaction of bank failures that required unprecedented US federal action, and led to a global financial meltdown. On paper, the global economy has mostly healed.[PDF]Lehman Brothers Financial Services Conference Jeffrey M ...ir.cit.com/File/Index?KeyFile=1500045080Lehman Brothers Financial Services Conference Jeffrey M. Peek Chairman & Chief Executive Officer New York, NY September 8, 2008 2 Notices Forward Looking Statements Certain statements made in these presentations that are not historical facts may constitute “forward-

Lehman Brothers Collapse: Henry Paulson, Ben Bernanke And ...https://www.bloombergquint.com/lehman-financial...Sep 12, 2018 · As Lehman Brothers filed for bankruptcy protection on Sept. 15, 2008, it fell to three policymakers to undertake a number of unprecedented measures.10 years later, Former Federal Reserve Chairman Ben Bernanke and former U.S. Treasury Secretaries Henry Paulson and Tim Geithner reveal why they did what they did.

Resolution of Claims in Lehman Brothers International ...https://www.cravath.com/Resolution-of-Claims-in...Cravath represented a major financial institution in connection with a matter relating to a significant amount of post-petition interest on claims arising from terminated ISDA swaps in the Lehman Brothers U.S. bankruptcy case and the related U.K. insolvency administration of Lehman Brothers …