Home

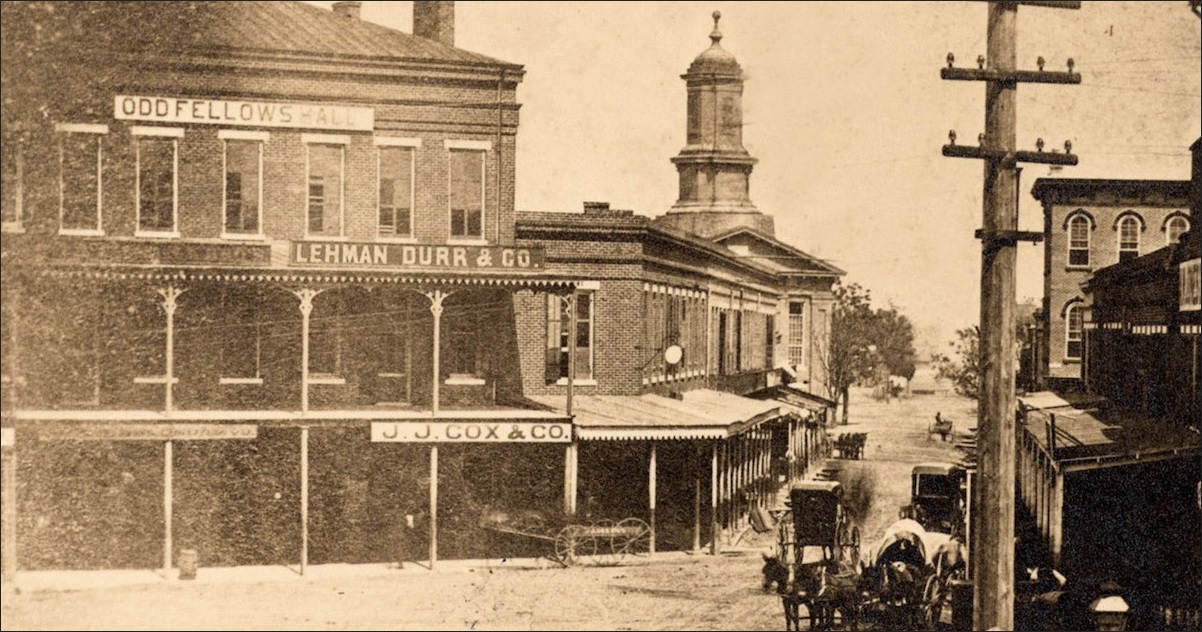

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

CNNMoney.com Market Report - Jun. 26, 2008https://money.cnn.com/2008/06/26/markets/markets_newyork/index.htmJun 26, 2008 · Dow in 350-point tumble Blue-chip indicator ends at a 21-month low as crude hits record high above $140 a barrel. Goldman Sachs' downgrades of investment banks, GM drag on markets.

Laissez Faire Economic Policies and Financial Criseswww.bearishnews.com/post/1666Sep 16, 2009 · But no argument that regulation couldn’t have prevented the spill. The best examples I know of for this are the two notorious nuclear accidents at Three Mile Island and Chernobyl. It seems the best explanation of why the first was less serious was that the American nuclear industry was regulated while the Soviet one wasn’t, or barely.

THE GOVERNMENT RAID ON YOUR BANK ACCOUNT – PART 2 ...https://lexingtonlibertarian.wordpress.com/2014/12/03/the-government-raid-on-your-bank...Dec 03, 2014 · THE GOVERNMENT RAID ON YOUR BANK ACCOUNT – PART 2. ... by virtue of holding client assets Liabilities arising with an original maturity of less than 7 days owed by the banks to a credit institution or investment firm Liabilities arising from participation in designated settlement systems ... This is the new policy as agreed by the G20 on ...

Pan-African News Wire: Nationalize? Hey, Not So Fast: New ...https://panafricannews.blogspot.com/2009/03/nationalize-hey-not-so-fast-new-york.htmlMarch 8, 2009 Economic View Nationalize? Hey, Not So Fast By ALAN S. BLINDER New York Times THE financial crisis grows weirder by the day. When philosophical conservatives like Alan Greenspan start talking about nationalizing banks, you know you’ve passed into some kind of parallel universe.[PDF]

Wall Street Pay in the Cross Hairs - The New York Timeshttps://dealbook.nytimes.com/2009/02/05/wall-street-pay-in-the-crosshairsFeb 05, 2009 · In announcing executive pay limits on Wednesday, President Obama is trying to hold the financial industry accountable to taxpayers while aiming to change an entrenched corporate culture that endorses outsize bonuses and perks that often bear little relationship to corporate performance.. As with bonuses, Wall Street perks — like private jets, country club dues and gym memberships — are ...

Lawyers finding new ways to settle cross-border ...https://www.ft.com/content/66619f4c-5ac4-11e5-9846-de406ccb37f2Oct 01, 2015 · A wave of financial scandals involving global banks has kept London’s civil courts busy with cases of complex cross-border litigation. But it is notable that the global nature of business is ...

Stad in de Maak – From crisis to a shared ownership model ...https://cooperativecity.org/2017/11/16/stad-in-de-maakNov 16, 2017 · Stad in de Maak is an association set up to take on the redevelopment of vacant properties in Central Rotterdam, together with the local community. The association renovated six buildings, investing upfront the amount of loss the buildings were projected to generate for their owner, a housing corporation, in the coming 10 years.

Kuala Lumpur: 'The Next Big Thing' in Asia-Pacific ...https://cfi.co/asia-pacific/2012/08/kuala-lumpur-the-next-big-thing-in-asia-pacific...The first woman to lead a major global financial services provider, Ana Botín remains one of. ... you have a stable political system. This is of course, for investors, an element that will drive the decisions. And we have proficiency in English, which is quite important to us, because communication is everything. ... but it has absolutely ...

Geithner said to consider leaving Treasury after debt ...https://business.financialpost.com/news/economy/geithner-said-to-consider-leaving...Jun 30, 2011 · Geithner said to consider leaving Treasury after debt debate Treasury Secretary Timothy F. Geithner has signaled to White House officials that he’s considering leaving the administration after ...

Marginal Revolution - Saratoga Film Forumhttps://www.saratogafilmforum.org/2012/film-forum-news/whats-new-at-saratoga-film...There has been no shortage of documentaries about the 2008 financial meltdown and related issues. Inside Job, which the Saratoga Film Forum screened last year, was perhaps the highest-profile of these. 2009’s Collapse was another, and the Enron-collapse doc The Smartest Guys in the Room dates from 2003. But “financial dramas”—let alone financial thrillers—have tended …

Disrupting Disruption | ORIGINhttps://www.originmarkets.com/disrupting-disruptionAnd, despite some outliers, for the majority, as good as it gets for disruptors in finance. They have made headway but they haven’t reached the heights hoped for. Of course, there is potential for future development but, for now, disruption in fintech hasn’t removed or …

Timing the rise of the Phoenix (and market) - Bloggerhttps://humblestudentofthemarkets.blogspot.com/2008/06/timing-rise-of-phoenix-and...Jun 13, 2008 · Timing the rise of the Phoenix (and market) ... One of my other favorite rules of thumb in looking for a bottom is the valuation of the investment banks. The investment banks tend to bottom out at a price to book ratio of 1 during periods of economic stress. ... The first step to recovery is recognition that there is a problem. This June 16, ...

CISCO SYSTEMS DL-,001 (CIS.DE) Stock Price, Quote, History ...https://ca.finance.yahoo.com/quote/CIS.DEThis is partly because when we’re in a particular economic environment, especially one that has lasted a long time, we tend to forget that there was ever a time when it was different.But it’s also because, more often than not, the thing that changes everything usually comes out of the blue — it’s a long tail event, or a black swan or ...

Gartmore Investment Management · The Hedge Fund Journalhttps://thehedgefundjournal.com/gartmore-investment-managementIn the back of the worst year ever for hedge funds, the timing may be less than auspicious for Gartmore Investment Management’s absolute return manager stars Roger Guy and Guillaume Rambourg to celebrate their 10th anniversary running the AlphaGen Capella Fund. But a closer look shows that Guy and Rambourg delivered in spades for investors […]

2 Much Cents: 08/01/2012 - 09/01/2012www.2muchcents.com/2012/08Feel free to contact me by posting on this site, emailing me, calling me, Facebook messaging me, sending me a telegraph, or any other means of communication you can think of. This was a suggestion from one of my readers, and I think it could be a really good opportunity for me to learn what financial topics you would like to know more about.

Ermotti shifts UBS’s investment vision | Financial Timeshttps://www.ft.com/content/d2d7c4ca-2512-11e2-a6aa-00144feabdc0Nov 04, 2012 · It then transformed itself into UBS Warburg Dillon Read by merging with Union Bank of Switzerland in 1998, setting a target of becoming one of the …

Glenn Stevens: Economic conditions and prospectshttps://www.bis.org/review/r120319f.pdfGlenn Stevens: Economic conditions and prospects Address by Mr Glenn Stevens, Governor of the Reserve Bank of Australia, to the Credit Suisse 15th Asian Investment Conference 2012, Hong Kong, 19 March 2012. * * * Thank you for the invitation to join this conference here in Hong Kong.

Change is Good: The Future of Innovation in Capital ...https://originmarkets.com/lorem-ipsum-is-simply-dummy-text-of-the-printing-2May 05, 2017 · Change is Good: The Future of Innovation in Capital Markets. Innovation used to be something that just happened in financial services. Now it’s a corporate department, a …

Will the ECB cut rates? | Financial Posthttps://business.financialpost.com/news/economy/will-the-ecb-cut-ratesSep 26, 2011 · Will the ECB cut rates? Speculation of a sharp cut in euro zone interest rates next month is “wild,” European Central Bank policymaker Yves Mersch said …

Online Bond Trading: The Future Is Now: Online Trading ...https://www.bondbuyer.com/news/online-bond-trading-the-future-is-now-online-trading...Nov 27, 2000 · Online trading of municipal bonds is finally coming into its own. There are currently several dozen sites where individuals can buy or sell these …

Obama Administration Offers Regulatory Reform Proposal ...https://financialreform.wolterskluwerlb.com/2009/06/obama-administration-offers...By Richard Roth, J.D., Editor, the CCH Federal Banking Law Reporter, CCH Bank Compliance Guideand Bank Digest, June 17, 2009. A white paper issued by the Obama administration on June 17, 2009, outlines the President's plan to restructure the regulation of the U.S. financial services system. The proposal sets out...

“Financial Fordism,” or Why the Automobile Industry ...https://www.cairn-int.info/article-E_REI_134_0085--financial-fordism-or-why-the.htmyou're reading "Financial Fordism," or Why the Automobile Industry Has Suffered So Much From the Financial Crisis

The Future Is Now: Online Trading Takes Off | Bond Buyerhttps://www.bondbuyer.com/news/the-future-is-now-online-trading-takes-off-bb130586Nov 21, 2000 · The Future Is Now: Online Trading Takes Off ... these Web sites offer retail customers more than just inventories of bonds and a trading ... "That's why I think the first place ...

You're doing it wrong: 4 mistakes that make everyone a bad ...https://www.fool.com.au/2013/07/13/youre-doing-it-wrong-4-mistakes-that-make-everyone...Jul 13, 2013 · For a limited time, The Motley Fool Australia is giving away an urgent new investment report outlining our 5 favourite stocks for investors over 50. ... 4 mistakes that make everyone a bad ...

Barclays: A fork in the road - Board Agendahttps://boardagenda.com/2017/01/03/barclays-fork-roadOne of the City’s so-called “rock stars”, with a remuneration package to match, Diamond was on a mission to grow Barclays into a global investment bank that could take on Goldman Sachs on Wall Street. He was described as “inspirational” and a “true leader” by colleagues.

CISCO SYSTEMS DL-,001 (CIS.F) stock price, quote, history ...https://uk.finance.yahoo.com/quote/CIS.F?p=CIS.FThis is partly because when we’re in a particular economic environment, especially one that has lasted a long time, we tend to forget that there was ever a time when it was different.But it’s also because, more often than not, the thing that changes everything usually comes out of the blue — it’s a long tail event, or a black swan or ...

Some early morning Bean on NGDP | FT Alphavillehttps://ftalphaville.ft.com/2013/02/27/1401842/some-early-morning-bean-on-ngdpSome early morning Bean on NGDP. Twitter; ... usually taken to mean returning nominal income to a continuation of its pre-crisis trend line. ... But it is also apt to breed suspicion of a ...

Much Ado About Facebook | Everything Financehttps://kelloggfinance.wordpress.com/2012/05/26/much-ado-about-facebookMay 26, 2012 · Coverage in the press of the Facebook IPO has been sensational, with headlines about Facebook's "stumble" at the IPO. In this post I'll suggest a way to think about what happened, who won, who lost, and whether we should care about the decline in Facebook's share price at the IPO. My answer: No, we shouldn't…

An Open Letter to Finance - CAPITAL INSTITUTEhttps://capitalinstitute.org/blog/open-letter-financeThis is the implication of a contingent socialist financial system. Lesson 2: The global response to the financial crisis was wrongly focused on saving finance to save the economy. It is true that a financial collapse would destroy the economy, but it does not follow that …

Keynote Address By CFTC Commissioner J. Christopher ...www.mondovisione.com/...and...cftc-commissioner-j-christopher-giancarlo-commodity-marketsKeynote Address By CFTC Commissioner J. Christopher Giancarlo, Commodity Markets Council, State Of The Industry Conference, Miami, Florida, End-Users Were Not the Source Of The Financial Crisis: Stop Treating Them Like They Were

General Life Issues (Tips)https://life-issues.blogspot.comHealth insurance is a big ball of wax — so big, in fact, that many of us put it on the back burner rather than deal with it. But it's one of the most important decisions we have to make as consumers. Not only does it determine the care that we receive should our health take a wrong turn, but it can be the wild card in your financial plan.

Laborers National Pension Fund vs American National Bank ...www.ipsn.org/court_cases/laborers_national_pension_fund.htmThe Laborers National Pension Fund (Fund) filed suit against American National Bank and Trust Company of Chicago (ANB) for damages because of breach of fiduciary duties as the Fund's investment manager under the Employment Retirement Income Security Act of 1974 (ERISA), 29 U.S.C. §§ 1001 et seq. After a bench trial, the district court ...

Lawyers’ Perspective on a “Time of ... - Harvard Magazinehttps://harvardmagazine.com/breaking-news/lawyers-perspective-on-a-time-of-turmoilLawyers’ Perspective on a “Time of Turmoil” ... The first was the "systematic short-sightedness that we have all shown in the last three or four years." From 2003 on, he said, it was clear that a credit crisis was building: stocks were trading at "crazy multiples" (of earnings), there was "no due diligence" (presumably of loan conditions ...

The 86 Biggest Lies on Wall Street by John R. Talbotthttps://www.goodreads.com/book/show/6486498-the-86-biggest-lies-on-wall-streetThe 86 Biggest Lies on Wall Street - John Talbott (Scribner) February 3, 2010 Oh, we should have listened to John Talbott... Talbott was the one, who in 2003 foretold the coming economic collapse in the real estate market with his book "The Coming Crash in the Housing Market: 10 Things You Can Do Now to Protect Your Most Valuable Investment."3.4/5(3)

Research Report: International Microfinance 2009www.myphilanthropedia.org/research-report/international/microfinance/2009Research Report: International Microfinance 2009 Next Steps Meet the experts. View nonprofit rankings. Sign up for our newsletter! One day our grandchildren will go to museums to see what poverty was like. -Muhammad Yunus

IFLR - International Financial Law Reviewwww.iflr.com/stub.aspx?stubid=33135Prior to joining CITIC Capital, he worked as the Associate General Counsel for APG Asset Management Asia, one of the world’s largest institutional investors with an AUM over EUR300billion under management. Prior to that, he has worked in various reputable international law firms in the U.S., London, Hong Kong and Singapore.

173 F3d 313 Laborers National Pension Fund v. Northern ...https://openjurist.org/173/f3d/313/laborers-national-pension-fund-v-northern-trust...1. The Laborers National Pension Fund (Fund) filed suit against American National Bank and Trust Company of Chicago (ANB) for damages because of breach of fiduciary duties as the Fund's investment manager under the Employment Retirement Income Security Act of …

WikiZero - Abdul Wahid Omarhttps://www.wikizero.com/en/Abdul_Wahid_OmarTan Sri Abdul Wahid bin Omar (Jawi: ????????? ?? ???; born 1964) is the chairman of the board of directors of Universiti Kebangsaan Malaysia (UKM), one of Malaysia top universities, since 1 November 2018.. He was the former Group Chairman of Permodalan Nasional Berhad (PNB), a Malaysia's government-linked investment company and one of the country's largest fund management company ...

Everything old is new again: lessons from the past can ...https://www.thefreelibrary.com/Everything+old+is+new+again:+lessons+from+the+past+can...Free Online Library: Everything old is new again: lessons from the past can help lenders survive in today's much leaner market.(Cover Report: Wholesale / Correspondent Lending) by "Mortgage Banking"; Banking, finance and accounting Business Real estate industry Economic development Forecasts and trends United States Inflation (Economics) Evaluation Inflation (Finance) Recessions Unemployment ...

Big Strategy/Small Strategy - Richard Whittington, 2012https://journals.sagepub.com/doi/10.1177/1476127012452828We increasingly recognize that firms’ strategies are prone to fashion and bandwagon effects (Xia et al., 2008): in CEO Chuck Prince’s notorious phrase, it was the mimetic desire to keep dancing while the music still played that drove Citigroup to pour more money into private equity even as the crisis swelled (New York Times, 10

Kunal Dogra - Professionals - Proskauer Rose LLPhttps://www.proskauer.com/professionals/kunal-dograKunal Dogra is an associate in the Corporate Department and a member of the Private Equity and Mergers & Acquisitions Groups. He focuses on all aspects of mergers and acquisitions, including public and private transactions, joint ventures, private equity and venture capital investments, board and committee engagements, and financial advisory matters.

Sample text for Library of Congress control number 2009289789catdir.loc.gov/catdir/enhancements/fy0916/2009289789-s.htmlAs horrible as the first day after Lehman was, the bigger fear was that nobody knew where the collapse might end. Bernanke, Geithner, and Paulson confronted the biggest threat to American capitalism since the 1930s, and their responses were commensurately big. Within one week, they:

Economic Crisis and Rule Reconstructionhttps://www.worldscientific.com/worldscibooks/10.1142/9916Since 1997, he has served as Mayor and CPC Committee Secretary of Suzhou City, Governor of Shaanxi Province, and Deputy Director of the National Development and Reform Commission (Ministerial level) successively. He was appointed as the Minister of Commerce from December 2007 to March 2013.

SCOR wins “Catastrophe Risk Transaction of the Year” award ...https://www.scor.com/en/media/news-press-releases/scor-wins-catastrophe-risk...Environmental Finance magazine has named SCOR as the winner of this year’s “Catastrophe Risk Transaction of the Year” award for its “Atlas V” transaction carried out in February 2009. Environmental Finance is a leading monthly industry magazine covering the ever-increasing impact of environmental issues on the lending, insurance, investment and trading decisions affecting industry ...

Board of Directors | BrandHaiti: Jou-a Rive Pou Nou Chanjehttps://brandhaiti.wordpress.com/about/bodBrandHaiti’s Board of Directors serves as a governing body of financial and strategic advisers for the organization. The board’s members work in various sectors, providing our students - the driving force of the organization - with diverse perspectives on business and financial issues. This exchange amongst students, recent graduates, and professionals creates the multidisciplinary ...

Speaker Biographieshttps://www.credit-suisse.com/microsites/hightech/en/forum/speakers/cv-speaker.htmlRichard is Co-Head of the Global Technology Team at Permira, and a member of the firm’s Investment Committee. He joined Permira in 1999 and became a Partner in 2006. He spent the first nine years at Permira based in London before locating to the United States in 2008 to establish the firm’s Silicon Valley office in Menlo Park, CA.

M&A Media Grouphttps://mamediagroup.com/executive_experience.htmlSrinath Narayanan Senior Board Member. Mr. Narayanan serves as a Principal at Canaccord Adams Investment Banking group focused on leading the firm's effort to provide West Coast-based clients with a broad range of investment banking services, including public offerings, private placements, and mergers and acquisitions advisory work.

Speakers Loan Pricinghttps://www.loanpricing.com/lpc-events/7th-annual-lpc-middle-market-loans-conference/...Nate Allen Senior Client Advisor WMS Partners. WMS Partners was founded in 1993 as a family office and an alternative for wealthy families to traditional financial-services firms.

IFLR - International Financial Law Reviewwww.iflr.com/stub.aspx?stubid=34305In 1996, Mr. Lee founded Hendale Asia, one of the first Asian-based multi-strategy alternative funds, after being a Principal at the Bass family office in Texas for 6 years. Hendale now specializes in direct private investments in globally.

iGlobal Forum's 8th Independent Sponsor Summit - Speaker ...https://iscp.iglobalforum.com/8th-independent-summit-speaker-profilesDan is one of the leaders of Merit’s efforts to develop and expand its relationships with independent sponsors, and has completed several transactions with these groups. Dan began his career at the First National Bank of Omaha, and later worked at LaSalle Bank, NA in Chicago where he focused on leveraged and commercial loan transactions.[PDF]Response to crises: plus çà change…https://www.mikeconomics.net/downloads/pdf/how_the_system_responds_to_crises.pdfmortgage crisis, one of the first consequences of the turmoil was the merger of Banque Populaire with Caisse d’Epargne. This was a bit surprising as these not much involved in financial sector risky bets.6 The benefits of this consolidation for shareholders, customers, and other stakeholders are not obvious.

Abdul Wahid Omar — Wikipedia Republished // WIKI 2https://wiki2.org/en/Abdul_Wahid_OmarAug 01, 2016 · Being appointed (non-elected) as one of the Minister in the Prime Minister's Department is a humbling experience for Abdul Wahid Omar. He pledge that he will do everything in his power to help Malaysia in achieving the vision 2020 mission. He states that he will use his vast banking experience to help Malaysia by applying it in his department.[PDF]Protectionism During Recession-Why are Trade Barriers no ...https://core.ac.uk/download/pdf/82208538.pdfcaused world output and trade to contract sharply between the last quarter of 2008 and the first quarter of 2009. The latter was aggravated by reduced trade financing. One of the consequences of what has become known as the biggest global financial crises since the Great Depression was a large decline in the world trade flows.

Marketing Strategy of Colonial Properties Trust ...www.managementparadise.com/forums/marketing-management/210776-marketing-strategy...Jun 17, 2017 · Marketing Strategy of Colonial Properties Trust. Discuss Marketing Strategy of Colonial Properties Trust within the Marketing Management forums, part of the PUBLISH / UPLOAD PROJECT OR DOWNLOAD REFERENCE PROJECT category; Colonial Properties Trust (NYSE: CLP), headquartered in Birmingham, Alabama, is a diversified Real Estate Investment Trust (REIT) company.

Grading Bernanke's Fed - AOL Financehttps://www.aol.com/article/finance/2013/06/15/how-will-history-remember-ben-bernanke/...Jun 15, 2013 · Washington Post columnist Neil Irwin stopped by to discuss his book, The Alchemists: Three Central Bankers and a World on Fire. It's a great read on the history of central banks, including[PDF]The Financial Crisis, Contested Legitimacy, and the ...https://www.jstor.org/stable/24526396Yet as The Economist wrote at the time, the largest emerging markets were "recovering fast and starting to think the recession may mark another milestone in a worldwide shift of economic power away from the West."3 As the BRIC finance ministers stated, "We recognized that the crisis has to some extent affected all of our countries.

Has John Paulson lost his magic touch? - Telegraphhttps://www.telegraph.co.uk/finance/newsbysector/banksandfinance/8598452/Has-John...Jun 25, 2011 · Has John Paulson lost his magic touch? John Paulson, the hedge fund manager who made billions betting on a collapse in US house prices, has suffered heavy losses at Sino-Forest, a Chinese timber ...[PDF]Ruling for Starr International Companies Digital Music Trialhttps://www.bsfllp.com/images/content/1/5/v2/1511/Boies-Schiller-Flexner-Report-July...brings that effort to a successful conclusion,” Managing Partner Jonathan Schiller told the Wall Street Journal. Lehman’s bankruptcy trustee had claimed that the brokerage business purchased by Barclays did not include more than $4 billion in margin assets and a further $1.9 billion in other so-called clearance box assets. The U.S.

Ionian Capitalhttps://www.ionian-capital.comNicholas Georgiadis is an external senior financial analyst at Ionian Capital and a certified financial analyst by the Hellenic Capital Markets Commission with over 20 years of professional experience in the valuation of companies in the banking, industrial and IT sectors.

Speaker Bios - NYU Sternhttps://www.stern.nyu.edu/experience-stern/about/departments-centers-initiatives/...Prior to founding Dream Forward, Easterbrook was one of the first fintech analyst and has been tracking fintech (with a particular focus on robo advice) since 2011. He has been cited on the topic of fintech in the media over 100 times, including in leading outlets like the Wall Street Journal, the …

Machine Learning Institute Certificate in Finance (MLI)https://mlinstitute.orgHe was the recipient of one the first Engineering and Physical Sciences Research Council (EPSRC) funded RSE Fellowships in the UK and is additionally a Fellow of the Software Sustainability Institute. He was co-investigator on the EPSRC RSE-Network grant that helped bootstrap the UK national Research Software Engineering society.

ASEAN Regulatory Summit - Speakersinfo.risk.thomsonreuters.com/asean-regulatory-summit-2016-speakersPreviously, Janos was the first hire at a prospective UK challenger bank, Lintel, helping it to secure a banking license from the PRA & FCA. This role followed a specialist interest developed over 7 years, in financial systems and their stability.

Our Team – Continental Grain Companyhttps://www.continentalgrain.com/teamHe has held senior financial executive roles at a variety of companies including Capital Access Network, Inc., Independence Community Bank, and ContiFinancial Corporation. He was also a consultant for Meridian Capital Group, LLC, one of the country’s largest commercial mortgage brokerage firms, and a partner at Columbia Financial Partners. Mr.

Fed Modifies Crisis Liquidity Facilities | Committee for a ...https://www.crfb.org/blogs/fed-modifies-crisis-liquidity-facilitiesJun 25, 2009 · June 25 - The Fed announced today that it would extend and modify many of its liquidity programs. These changes followed upon the two day meeting of the Federal Open Market Committee (FOMC). The changes reflect improvements in some markets, redesign of specific facilities, but on the whole continuing fragility in most parts of the financial system.

Obama vows better control of $350 billion bailout cash ...https://uk.reuters.com/article/usPoliticsNews/idUKTRE50C72520090113Jan 13, 2009 · U.S. President-elect Barack Obama promised on Tuesday stricter control over a financial rescue package, winning over some skeptical lawmakers who …

Dubai remains a vital hub for region - The Nationalhttps://www.thenationalnews.com/business/dubai...Dubai may have taken a harder knock from the global economic crisis than many expected, but it remains a vital hub for a region whose infrastructure and spirit of innovation will lead the Gulf forward into recovery, executives and officials attending the World Economic Forum on the Middle East said.

Hood River Weather: They Knew...https://hoodriverweather.blogspot.com/2008/11/they-knew.htmlNov 12, 2008 · Titled "The End", it is authored by Michael Lewis, who worked for a while in Wall Street, and earlier wrote the book "Liars Poker". When Bear Sterns and Lehman collapsed, putting thousands of investment analysts out of work, the photos I saw of them leaving their workplace for the last time seemed rather odd.

Section 50 of the ASIC Act – KPMG v Commonwealthhttps://lamppostblog.blogspot.com/2010/06/section-50-of-asic-act-kpmg-v.htmlJun 01, 2010 · On Tuesday, Hayne J referred to the Full Court a Constitutional challenge to the validity of s 50 of the Australian Securities and Investment Commission Act 2001 (Cth). Section 50 says: Section 50 - ASIC may cause civil proceeding to be begun Where, as a result of an investigation or from a record of an examination (being an investigation or examination conducted under this Part), it appears ...

30 shocking economic collapse statistics the mainstream ...economiccollapsenews.com/2013/02/09/30-shocking-economic-collapse-statistics-the...Perhaps the culprit of the rise of alternative media. ... Here are 30 shocking economic collapse statistics the mainstream media will not report on. ... These interest payments are the ...[PDF]

Not Necessarily the High Life - The English Magazinehttps://english-magazine.org/english-reading/english-news-round-up/33-english-articles/...The last half of 2008, and now into 2009 has not proven very inspiring on the business, economic, and financial front. With a recession in full swing in numerous countries, government, corporate, and private concerns are looking for a way out of the downturn. A return to economic health will not occur overnight. The problem is too deep and ...

Whispers and Waiting In Bond Market - WSJhttps://www.wsj.com/articles/SB108066015371869069Whispers and Waiting In Bond Market ... the 10-year yield fell to a new trading range of between 3.65% and 3.92%. ... Throw in unknowns such as the effect of hiring overseas and greater ...

Finance: The Great Depression of 2009 - KuchBhiwww.kuchbhi.com/finance/finance-the-great-depression-of-2009.htmlMar 24, 2009 · The future looks prospect less. The fact that all these come immediately after the market was on a boom makes things look even grimmer than they actually are. The Gross Domestic Product (GDP), which measures the national income for a country’s income, of …

Is Turkey Ready for Incubators? - An Answer ...https://grandstandingtraction.blogspot.com/2007/05/is-turkey-ready-for-incubators...But in the end, if the governmental systems show any sign of not working, all of for naught, and the investment climate may indeed get a little cold, and very quickly. The Exit: Again, with a good network of individuals, VC's, Angels, and pertinant industry contacts, an exit is not impossible, given the current climate. Series A, B or C ...[PDF]Assessing risk when determining the appropriate rate of ...https://www.aer.gov.au/system/files/Frontier Economics - Assessing risk when...Assessing risk when determining the appropriate rate of return for regulated energy networks in Australia Executive summary 1 1 Introduction 7 2 Risks that may be relevant to regulated networks in Australia 9 2.1 Identification of potential risks 9 2.2 Features of a firm that may amplify or mitigate risks 26

Systemic risk after the global crisis | VOX, CEPR Policy ...https://voxeu.org/article/systemic-risk-after-global-crisisMar 10, 2011 · The global financial crisis has undergone various phases. The build-up of the financial crisis from July 2007 was followed by a systemic, and largely generalised, outbreak at the time of the Lehman collapse in September 2008.[PDF]

What to Do During a Market "Adjustment" - EzineArticleshttps://ezinearticles.com/?What-to-Do-During-a-Market-Adjustment&id=1501788Sep 04, 2008 · "I know Americans are concerned about the adjustments that are taking place in our financial markets." - President Bush. Adjustment!?! What on earth is a financial market "adjustment?" Despite the sugar-coating, President Bush did get one thing …

Prajna Capital - An Investment Guidehttps://prajnacapital.blogspot.com/2016/04You cannot claim a tax deduction on your investments in any fixed deposits with a five-year tenure. You will have to invest in tax saving / saver fixed deposits that come with a five-year tenure to claim a tax deduction under Section 80C of the Income Tax Act.Tax-saving fixed deposits have a lock-in period of five years and they qualify for a tax deduction of up toR1.5 lakh under Section 80C.[PDF]

Financial Sector Stress and Asset Prices: Evidence from ...https://www.ou.edu/content/dam/price/Finance/energyfinanceconference/Financial Sector...increase in the TED spread (VIX) leads to a decrease in contract prices of 1.79% (1.45%) on average. In sum, contracts are typically priced near their actuarially fair value, but during periods of nancial sector stress, they are lower than this value. This is consistent with nancial institutions decreasing[PDF]

www.federalreserve.govhttps://www.federalreserve.gov/SECRS/2018/September/20180918/OP-1614/OP-1614_091418...subordinated could argue against it. As the Board noted without refutation, "commenters [to the proposed QFC stay rule] argued that parties cannot by contract alter the U.S. Bankruptcy Code's provisions, such as the administrative priority of a claim in bankruptcy." 7 If parties could do so[PDF]

'Disruption' of private debt markets creates opportunities ...https://www.fsprivatewealth.com.au/blogs/view/disruption-of-private-debt-markets...Jan 17, 2020 · With the traditional dominance of banks in the private debt and credit markets declining, combined with an ongoing lower interest rate environment, we are seeing new opportunities arise for investors from a centuries-old, but previously inaccessible investment sector.

Claims against financial services providers in USA - Lexologyhttps://www.lexology.com/library/detail.aspx?g=3ca15f0f-260c-489c-913d-35e44e4d836aAug 23, 2019 · An overview of essential considerations when bringing claims against financial services providers in USA, including common causes of action and contractual and non-contractual duties.[PDF]Investment in Productivity and the Long-Run Effect of ...https://www.finance.group.cam.ac.uk/beststudentpaperaward/MdR_InvProdFinancialCrisis_V...(0.92 correlation in overlapping sample). TFP is measured as the part of labor productivity not explained by capital deepening. Intangible capital investments are the sum of investments in computerized information, innovative property and economic competencies. Trends extrapolate average growth between 2000 and 2007.[PDF]By Tobias Adrian and Hyun Song Shin (American Economic ...homepage.ntu.edu.tw/~nankuang/MB2010II/Money Liquidity and Monetary Policy/Lecture note...security today for a price below the current market price on the understanding that it will buy it back in the future at an agreed price. The difference between the security’s market price and the price at which it is sold is called the “haircut.” The fluctuations in the haircut determine the degree of funding available to a

Lobby Alliances Shifting - POLITICOhttps://www.politico.com/story/2007/01/lobby-alliances-shifting-002394Lobby Alliances Shifting. ... The union calls for a universal health care system that "must ensure a choice of doctors and health care plans without gaps in coverage or access" and at the same ...[PDF]Marty Whitman: The Outlook for Distressed Securitieshttps://www.advisorperspectives.com/newsletters09/pdfs/Marty_Whitman-The_Outlook_for...Marty Whitman: The Outlook for Distressed Securities By Robert Huebscher July 7, 2009 Martin J. Whitman is the founder, Co-Chief Investment Officer, and Portfolio Manager of the Third Avenue Value Fund. He is a veteran value investor with a long, distinguished history as a control investor.

Accrued Interest: Countrywide: Surely he must be dead by now.https://accruedint.blogspot.com/2008/01/countrywide-surely-he-must-be-dead-by.htmlI oversee taxable bond trading for a small investment management firm. Opinions expressed on this website may not reflect the opinions of my employers. Strategies described here should not be taken as advice, and may not be the strategies being used for my clients. Take this website as the egotistical ramblings of a bond geek and nothing more.

Is Janet Yellen Smarter Than Me? | Zero Hedge | Zero Hedgehttps://www.zerohedge.com/contributed/2013-11-30/janet-yellen-smarter-meThis is the scenario where losses exacerbated by out of this world leverage, cause that 85 Billion to be nothing but a mere entry point for more shorting, as the Market Crash takes hold, and stocks freefall dropping chunks of losses along the way that has fund managers selling without Algos – just get this stuff out the door at any price ...[PDF]External Shocks, Banks and Optimal Monetary Policy: A ...https://www.norges-bank.no/contentassets/9db3bdc2a73f4f27b4ccbc2930c1179e/external...External Shocks, Banks and Optimal Monetary Policy: A Recipe for Emerging Market Central Banks1 Yasin Mimir2 Enes Sunel3 September 28, 2017 Abstract We document that the 2007-09 Global Financial Crisis exposed emerging market economies

Eleanor Duckwall's Spotlight: Prediction: Dow expected to ...https://sixthcolumn.typepad.com/duckwalls/2008/02/prediction-dow.htmlA repurchase agreement, as defined by the Fed, is a government security offered by the federal government to a small list of specified primary government securities dealers, for a limited period of time, usually 28 days or less, with overnight return being the most common.[PDF]External Shocks, Banks and Optimal Monetary Policy: A ...https://www.norges-bank.no/contentassets/9db3bdc2a73f4f27b4ccbc2930c1179e/external...External Shocks, Banks and Optimal Monetary Policy: A Recipe for Emerging Market Central Banks1 Yasin Mimir2 Enes Sunel3 September 28, 2017 Abstract We document that the 2007-09 Global Financial Crisis exposed emerging market economies

Has TPMA had its day? - Mortgage Finance Gazettehttps://www.mortgagefinancegazette.com/.../has-tpma-had-its-day-05-10-2007Has TPMA had its day? By admin in Market news, ... What are the current and future drivers for the industry and what needs to occur for a step change in the volume and scale of TPMA deals? ... As the deals above illustrate, a number of players have had their fingers burned by third party mortgage administration and as a result we have probably ...

Fixed Income Management at Ardeahttps://www.ardea.com.au/wp-content/uploads/Ardea_Strategy_Paper_20042015.pdf2 Ardea Fixed Income Management at Ardea Using derivatives to protect portfolios and capture opportunities Fixed income investment managers Ardea Investment Management is a specialist fixed income investment boutique with a focus on delivering consistent alpha to clients.

Accrued Interest: Time for Tips - Bloggerhttps://accruedint.blogspot.com/2009/01/time-for-tips.htmlI oversee taxable bond trading for a small investment management firm. Opinions expressed on this website may not reflect the opinions of my employers. Strategies described here should not be taken as advice, and may not be the strategies being used for my clients. Take this website as the egotistical ramblings of a bond geek and nothing more.

Money, Liquidity, and Monetary Policyhttps://www.jstor.org/stable/25592465led to a drying up of this particular metaphor. Understanding the nature of liquidity in this sense leads us to the importance of financial intermediaries in a financial system built around capital markets, and the critical role played by monetary policy in regulating credit …

IMF Archives - Buy Gold And Silver - ITM Trading Inchttps://www.itmtrading.com/blog/category/blog/imfThe EU Monetary Union And The Road To A Greek Debt Reset. Who Really Got Bailed Out? 8-29-17 Greece, by Lynette Zang After years of preparation, in 2001 Greece was accepted into the EU Monetary Union. The main benefit was the ability to borrow at the same rate as …

FinanceDublin.com - Deal of the year 2003: Madison ...www.financedublin.com/article.php?i=2549&p=115The acquisition of JSG was a landmark deal and was the biggest ever deal involving an Irish company, surpassing recent large deals such as the €3.6 billion acquisition of eircell by Vodafone in 2002 and the €3 billion leveraged buy-out of eircom in 2001.

Boom/Gloom Index slips as financial markets jump ...https://www.icis.com/chemicals-and-the-economy/2013/02/boomgloom-index-slips-as-finanThe blog will look at the US GDP news in more detail on Monday. But as the chart shows, the Boom/Gloom Index (blue column) fell back into neutral territory during January, with a reading of 4.2. This is its lowest level since October, before the presidential election. For the moment, at least, it remains range-bound.

Market direction a Macro view - Dow industrials average ...https://www.intertrader.com/en/blog/market-direction-a-macro-view-dow-industrials-averageMar 09, 2010 · I would like to offer a view on the direct of the stock market. I will be using the Dow industrials average (^DJI) for this as most indices follow it’s lead. I tried to use the Elliot wave theory and apply it to the beginning of the 2008 crisis. In my view this was the […][PDF]Recent Economic and Financial Developments and the …https://www.boj.or.jp/en/announcements/press/koen_2009/data/ko0910b.pdfbe expressed as the acute pain caused by the recent financial crisis -- led to a sharp contraction in the volume of world trade; this significantly reduced Japan's exports, and the country's economy underwent a sharp downturn at an unprecedentedly fast pace. However, positive momentum has been observed in Japan since this spring as overseas

Quantitative Portfolio Strategy — Including US MBS in ...https://link.springer.com/chapter/10.1057/9780230251298_13The emergence of the European Central Bank led to a re-evaluation of investment objectives for national central banks within the Eurozone, and the growing role of sovereign wealth funds as managers of national wealth has led to the inclusion of more aggressive assets and strategies within these portfolios.

Stress Test: Reflections on Financial Crises - free PDF ...https://ifarus.com/stress-test-reflections-timothy-geithnerStress Test: Reflections on Financial Crises by Timothy F. Geithner in CHM, FB2, FB3 download e-book. ... This is the inside story of how a small group of policy makers—in a thick fog of uncertainty, with unimaginably high stakes—helped avoid a second depression but lost the American people doing it. ... TIMOTHY F. GEITHNER was the seventy ...

The last financial crisis 2007-2009 Research Paperhttps://studentshare.org/finance-accounting/1498086-the-last-financial-crisisFinancial Crisis of 2007-2009 After the growth, expansion, innovation, and modernization intechnology and science in the last few decenniums, the nastiest cataclysm that the world encountered during the later half of the 2000s was the financial crises that happened in 2007.The disaster left no economies and financial systems unaffected with its drastic and harsh effect.

Stress Test by Timothy F. Geithner · OverDrive (Rakuten ...https://www.overdrive.com/media/1581570/stress-testThis is the inside story of how a small group of policy makers—in a thick fog of uncertainty, with unimaginably high stakes—helped avoid a second depression but lost the American people doing it. Stress Test is also a valuable guide to how governments can better manage financial crises, because this one won't be the last.[PDF]This PDF is a selection from an out-of-print volume from ...www.nber.org/chapters/c0944.pdfment as the age of conscious social change—a time when we take into account what we as humans have done and are doing to our planet earth and what we must do if we are to continue to improve our condi-tions and not return to a less abundant existence. The Charles Carter Newman Symposium on Natural Resources Engineering provided the

No easy fixes for India's nonbanks - Nikkei Asian Reviewhttps://asia.nikkei.com/Business/Business-Insight/No-easy-fixes-for-India-s-nonbanksNov 20, 2018 · At first glance, the default of a unit of IL&FS, an Indian infrastructure finance company, should not have been a major financial shock. After all, this was the subsidiary of a nonbank with a far ...

Aftermath of the Dubai debacle - The Financial Expresshttps://www.financialexpress.com/archive/aftermath-of-the-dubai-debacle/549637Dec 05, 2009 · On Wednesday, last week, a press release issued by the government of Dubai and the Dubai Financial Support Fund took global markets by total surprise when it …

Someone Else's Eye: "Bank of Evil"?https://someoneelseseye.blogspot.com/2010/07/bank-of-evil.htmlYes I know, I know - Wall Street has a reputation problem every five or six years. This is probably the third such cycle I've lived through since I started working in financial services in the late '80s. Back then, the punchline was a survey on trustworthiness.[PDF]PDF - Steamshiphttps://www.steamshipmutual.com/pdf.htm?id=577882&pdf=trueto be manutactured by A to a's order, B wrongfully repudiates the contract, and accepted by A, A is entitled to terminate the contract; and, it ne does so, two things follow: A need no longer manufacture the goods, and he can claim damages trom B. 9.

(PDF) The Euro Crisis: Institutional Structure, the ...https://www.researchgate.net/publication/279061727_The_Euro_Crisis_Institutional...The last phase to date in the unfolding of the crisis was the outburst of a sovereign debt crisis in the euro area, first in Greece, in May 2010, then in Ireland at the end of November 2010 and ...[PDF]U.S. Exporters Want Expanded Role for Ex-Im Bankhttps://larouchepub.com/.../eirv03n35-19760831_040-us_exporters_want_expanded_role.pdfu.s. Exporters Want Expanded Role For Ex-1m Bank Aug. 21· (NSIPS) - High-level spokesmen for trade-related Midwestern banking and industrial interests this week admitted that there is a battle underway for control over the U.S. Export Import bank. The battle is between these pro-Ford interests and

McCain Blasts Wall Street For Financial Woes : NPRhttps://www.npr.org/templates/story/story.php?storyId=94680771Sep 16, 2008 · McCain Blasts Wall Street For Financial Woes Republican John McCain berated Wall Street, a day after he said the fundamentals of the economy were …

Anboundwww.anbound.com/Section/ReadMore.php?Rnumber=6427&...In reality, only a theoretical value and changes were done based on geopolitical influence and the authoritarian rule. This had led to a serious currency crisis. After that, many countries gave up the seemingly unrealistic gold standard; first, it was the British pound, then followed by the U.S. dollar.

InterWeave Smart Solutions: The Most Comprehensive, SaaS ...https://interweavesmartsolutions.wordpress.com/2017/12/15/interweave-smart-solutions...Dec 15, 2017 · “This result was the ... As the team at InterWeave became more dependent on Salesforce as their Sales tool, the aspect of integrating CRM to Financial Applications and Databases spoke loudly. ... InterWeave’s team of experts spent three years re-tooling InterWeave from an on-site Enterprise Engine to a SaaS, Hosted Solution running at ...

Bonfire of Illusions : Alex Callinicos : 9780745648767https://www.bookdepository.com/Bonfire-Illusions-Alex-Callinicos/9780745648767Already badly damaged by the Iraq debacle, this consensus has now suffered potentially fatal blows.In Bonfire of Illusions Alex Callinicos explores these twin crises. He traces the credit crunch that developed in 2007-8 to a much more protracted crisis of overaccumulation and profitability that has gripped global capitalism since the late 1960s.

lismanalysis of the financial marketshttps://lismanalysis.blogspot.comNov 22, 2008 · American Hilco, the reorganization experts are looking into buying the company straight out and assuming its debt. If a deal is not reached soon, 30,000 jobs are on the line. This is a time of caution and damage control for Woolworths seeking to survive in the present financial crisis.

BLOG 1 | dcasst2002https://dcasst2002.wordpress.com/2014/05/12/blog-1May 12, 2014 · BLOG 1: What Caused the Great Recession in the United States? Possible Answer: Housing Bubble Burst causing Subprime Mortgage Crisis Summary of the Concept of Subprime Loans and the Risks They Pose to the Lender and Borrower During the years leading up to the Global Financial Crisis of 2008, housing prices were continually increasing. At the same time,…

S&P/ASX 200 surge to 6000 points puts GFC to resthttps://www.theaustralian.com.au/business/markets/citi-tips-asx-to-hit-6400-next-year/...After trading sideways for the past 2½ years, the benchmark S&P/ASX 200 finally broke above its 2015 high yesterday, rising 1 per cent to 6014.3 points, its highest daily close in almost 10 years.

BBC NEWS | Business | America's urgent banker dilemmanews.bbc.co.uk/2/hi/business/7967389.stmMar 27, 2009 · America's urgent banker dilemma By John Mervin Business reporter, BBC News, New York ... But balancing all the prevailing sense across America, if not the world, that the economic crisis was "made on Wall Street". ... AIG, appeared before Congress for his inevitable scolding about bonus payments, he revealed to a largely unsympathetic ...

The Bond Market Is Warning of Huge Trouble Aheadhttps://finance.yahoo.com/news/bond-market-warning-huge-trouble-182900170.htmlJan 15, 2015 · And down from the post-recession high of 4.85 percent set in 2010 and a recent high of nearly 4 percent set in late 2013. ... as the bond market is warning, I …

Berkshire Hathaway: The Next Ten Years | The Rational Walkhttps://www.rationalwalk.com/berkshire-hathaway-the-next-ten-yearsThis is not always easy to do given the fact that reports are naturally backward looking. What will Berkshire Hathaway look like in ten years? If all earnings continue to be retained and deployed well, we will be looking at a company with $600-700 billion in shareholders’ equity and a market value that could be approaching $1 trillion.[PDF]2014 1 28 PIMCO Personnel Change - El-Erian Finalwww2.co.fresno.ca.us/9200/attachments/agendas/2014/020514/Item 16.d. 020514 PIMCO...Given that Mr. El-Erian was widely seen as the heir apparent to PIMCO’s co-founder and co-CIO Mr. Bill Gross, a material event ... Mr. El-Erian’s announcement. If sustained, these asset redemptions could lead to a ... years of investment experience and holds a bachelor's degree from Oxford and a master's degree from Harvard ...

Re to rise more, to fuel hedginghttps://www.financialexpress.com/archive/re-to-rise-more-to-fuel-hedging/502808Aug 17, 2009 · The rupee is expected to touch 44 to a US dollar by March 2010, a rise of over 8% from the current 48, says a research report from Axis Bank. The report makes the conclusion based on the ...

No Job Growth Under 'Regime Uncertainty' | HuffPosthttps://www.huffpost.com/entry/regime-uncertainty_b_1828457Oct 27, 2012 · As we near the end of August and prepare for Labor Day weekend, the latest in depressing unemployment news indicates that jobless rates rose in 44 U.S. states in July -- "the most states to show a monthly increase in more than three years and a reflection of weak hiring nationwide" -- and rose by 4,000 to a seasonally adjusted 372,000 in August, the second straight increase and the …[PDF]Link to OMFIF website - Francesco Papadiamoneymatters-monetarypolicy.eu/wp-content/uploads/2014/05/OMFIF-Intervention.pdfLink to OMFIF website ... the Bank of England, the Swiss National Bank and, to a more limited extent, the Bank of Japan have shown both characteristics in quite remarkable amounts. One way to visualize that, traditionally, central banks provide liquidity: ... in his penultimate press conference, but of course the problem could come up ...[PDF]1 Editors’ introductory chapter and overviewassets.cambridge.org/97811070/44555/excerpt/9781107044555_excerpt.pdf1 Editors’ introductory chapter and overview J. S. Chadha, A. C. J. Durré, M. A. S. Joyce andL.Sarno The on-going ?nancial crisis continues to expose the limits of our collective knowledge and thereby motivate new avenues of research for

The Treasury: Learning from managing the Crown Retail ...https://www.oag.govt.nz/2014/treasury-progressIntroduction. 1.1 In October 2011, we published our report of our performance audit of the Treasury’s management of the Crown Retail Deposit Guarantee Scheme (the Scheme). The Scheme was put in place in October 2008 as part of the Government’s response to the global financial crisis.

Goldman's Blankfein 'feeling great' after cancer treatmenthttps://www.afr.com/companies/financial-services/goldmans-blankfein-feeling-great...Feb 04, 2016 · Lloyd Blankfein, chief executive and chairman of Goldman Sachs, says he is "feeling great" after his cancer treatment. In his first interview after revealing in …

The true financial cockroaches survivedhttps://www.smh.com.au/national/the-true-financial-cockroaches-survived-20081011...Oct 11, 2008 · Fuld, 62, informed that his role was to play the "villain" of Wall Street, did his best during his televised grilling in Washington. "I don't expect you to feel sorry for me," he told the committee.[PDF]INCUS CAPITAL ANNOUNCES CLOSING OF FLAGSHIP …https://bebeez.it/files/2018/09/Incus-Capital-European-Credit-Fund-III.pdfa Managing Director and Country Head of France. In his various roles, he has been involved in a number of complex and strategic credit restructuring and deleveraging transactions for French and Benelux institutions. Sebastien holds a BA and a Master Degree in Financial Markets (DESS 203) from University Paris Dauphine (France).

12 Reasons to Hate Bank Stocks | Fox Businesshttps://www.foxbusiness.com/markets/12-reasons-to-hate-bank-stocksJul 27, 2016 · This is a good place to pause for a moment and reflect. ... My first three reasons to hate bank stocks are all about how hard it is to make sense of their financial statements. ... but it may be ...

Raghuram Rajan says developed markets will crack if ...https://www.cnbctv18.com/finance/raghuram-rajan-says-developed-markets-will-crack-if...Former Reserve Bank of India (RBI) governor Raghuram Rajan on Monday said that monetary policy cannot be the answer to all the problems, adding that developed markets will crack if emerging markets slow down.Get latest Business online at cnbctv18.com

Master in Finance: IE vs LSE vs Cambridgehttps://www.wallstreetoasis.com/forums/master-in-finance-ie-vs-lse-vs-cambridgeJun 29, 2010 · Hi all, I recently got accepted at IE in their Master in Finance program. I also applied to the Mphil Finance at Judge B-School (Cambridge) and await a reply in March 2010. I would like to work in London for some time after graduation or Asia. I also know LSE have a good Finance program. I wonder

U.S. short sale curb came from the heart, not head - Reutershttps://www.reuters.com/article/us-exchanges-summit-shortselling/u-s-short-sale-curb...Apr 01, 2010 · The new U.S. rule restricting short selling was an emotional, rather than logical, response to the financial crisis, but it will help restore confidence in the markets, according to industry ...

5 Dangerous Investment Ideas - AOL Financehttps://www.aol.com/article/finance/2013/06/26/5-dangerous-investment-ideas/20640476Jun 26, 2013 · "This is the stock in which I have the most confidence. I'm going to buy some as soon as the price drops a little." Many investment mistakes we make are things we didn't do …

News - Football Finance Thread | The Fighting Cock ...https://www.thefightingcock.co.uk/forum/threads/football-finance-thread.29215Jan 04, 2019 · Hello my fellow cocks, It can no doubt be said that finances have been frustrating us recently. We have built a huge stadium which has been delayed to infinity and have had to sit through a summer of almost no activity. We watch as stingy wages …

Can the RBI’s open market operations help the rupee? – IDEAshttps://www.networkideas.org/featured-articles/2018/10/can-the-rbis-open-market...This is famously referred to as the “taper tantrum” that afflicted all emerging markets when Ben Bernanke, then Governor of the US Federal Reserve, noted that the Fed might soon start tapering off the extraordinary liquidity creation measures (Quantitative Easing) that had marked the recovery strategy after the global crisis.

financial planning Archives - The Meridian Blogwww.meridianwealth.com/tag/financial-planningWhat is the value that people get when they work with an objective, client-focused financial planner? Most planning firms are reluctant to toot their own horns—partly out of modesty, and partly out of a conviction that you probably have better things to do than read about how they help you with your financial life.

Here’s the Difference Between FDIC and SIPC Insurance ...https://globalfinancetips.com/heres-the-difference-between-fdic-and-sipc-insurance-and...And even once you could read, it’s possible that “FDIC insurance” is one of those terms you’ve seen countless times without ever really knowing what it meant. You’ve possibly just been passively aware of it all along, never totally understanding what it means or how exactly it works. Honestly, fair.

Why it pays you to be a bear right now – Capital & Conflicthttps://www.capitalandconflict.com/why-it-pays-you-to-be-a-bear-right-now-21100If there’s one thing you need as an investor, it’s an advantage. The biggest advantage you can have is superior insight. Our mission here at Capital & Conflict is simple: To arm you with the insights and ideas you need to help make better, investment decisions. Every day, our team of experts around the world reveal their insights, analysis and opinions on the world of finance, investment ...

Ire Directed at Germany Is Not Just Nitpicking | Cato ...https://www.cato.org/publications/commentary/ire-directed-germany-not-just-nitpickingNov 29, 2013 · Ire Directed at Germany Is Not Just Nitpicking . ... As the accompanying chart shows, credit to the private sector in the Eurozone is actually lower now than it was when Lehman collapsed in ...

Dow 30 Earnings: American Express Third Quarter 2017https://www.valueline.com/Stocks/Highlights/Dow_30_Earnings__American_Express_Third...Oct 19, 2017 · American Express, (AXP) a Dow-30 component and one of the world' s largest issuers of credit cards, has reported September-period financial results. For the quarter, revenues of $8.4 billion were nicely ahead of the year-earlier figure ($7.8 billion) and beat our estimate of $8.3 billion. Share net came in at $1.50, which was a nickel better than our expectation and compared favorably with the ...

(PDF) Bringing down the Great Wall? Global implications of ...https://www.researchgate.net/publication/262522812_Bringing_down_the_Great_Wall_Global...Capital account liberalisation in China and internationalisation of the renminbi would have a large impact on the global financial system. ... This is all the more true for China, which is larger ...

Europe's Debt Crisis. How Does it Affect America? - Global ...https://www.globalresearch.ca/europe-s-debt-crisis-how-does-it-affect-america/26621Sep 17, 2011 · Indeed, one of the world’s top experts on fraud says that we’ve had the greatest financial crime in the history of the world, and that none of the main players have been prosecuted. As such, the European crisis continues to worsen, just as the U.S. economy is worsening because no amount of band-aids will cure a cancer that is not removed.

Can the RBI’s open market operations help the rupee? – IDEAswww.networkideas.org/featured-articles/2018/10/can-the-rbis-open-market-operations...This is famously referred to as the “taper tantrum” that afflicted all emerging markets when Ben Bernanke, then Governor of the US Federal Reserve, noted that the Fed might soon start tapering off the extraordinary liquidity creation measures (Quantitative Easing) that had marked the recovery strategy after the global crisis.

Jeremy Warner: Britain's long road back to prosperity ...https://www.telegraph.co.uk/finance/comment/jeremy-warner/9400110/Jeremy-Warner-Brita...Jul 14, 2012 · Jeremy Warner: Britain's long road back to prosperity Britain, and much of the rest of the developed world, is stuck in an economic rut from which it appears powerless to escape.

Sold: Montpelier Re (MRH) | Can Turtles Fly?https://can-turtles-fly.blogspot.com/2012/03/sold-montpelier-re-mrh.htmlMar 03, 2012 · In any case, I just sold off one of my very first investments—one I made before I started this blog—for a small gain. That investment is a small reinsurance company called Montpelier Re (MRH). I bought it in February 2007 and sold it today (March 2012). Purchase price (approx): US$ 17.96 Sale price: US$ 19.49

In Search of Investment Opportunities in Challenging ...https://www.miga.org/story/search-investment-opportunities-challenging-countriesMIGA’s Executive Vice President Izumi Kobayashi welcomed this finding, especially as the global economy is still in flux. "Undoubtedly important for all of us around the globe—but it is even more so for underserved markets—especially those economies that have been struggling under the very heavy burden of conflict and instability."

If You Think Risky Strategies Are Just For the JPMorgans ...https://www.yahoo.com/news/think-risky-strategies-just-jpmorgans-think-again-194721322...Jun 11, 2012 · One of the most common risks imperiling portfolios is being over-invested in a single company. ... If you think disloyal and you work for a public ... But it…

The Bitcoin Bubble Explained in 4 Charts :: The Market ...www.marketoracle.co.uk/Article60751.htmlSo as the financial community takes sides, I decided to dig into Bitcoin’s tremendous run using nothing but hard data to see whether it’s in bubble territory or not.

29/03/2016 ‹ World Business Reporthttps://subsaga.com/bbc/news/world-business-report/2016/03/29.htmlThe latest business news with informed analysis from the world's financial centres. Similar Content. Browse content similar to 29/03/2016.Check below for episodes and …

London house prices fall for the first time in EIGHT YEARS ...https://www.standard.co.uk/news/london/london-house-prices-fall-for-the-first-time-in...London home owners face a painful double whammy as property prices fall for the first time since the financial crisis ahead of a near certain interest rate hike. The average price of a home in the ...

Riccardo Ravasini, Author at Rava Realty - Page 60 of 60https://newyork.ravarealty.com/author/riccardo/page/60As we know, the industry that drives New York City (and the rest of the economy I should say). The forecasts were bleaker than reality, the unemployment rate in the financial industry stopped rising and inverted its course before most analysts expected. Mansion Tax This infamous tax, equal to one ... Continue Reading ?

INNOVATIONS IN INVESTING / Industry / #4 / The ...https://compassmag.3ds.com/4/Industry/INNOVATIONS-IN-INVESTINGAmin Rajan, chief executive of CREATE-Research, a research boutique based in London, UK, orks with financial institutions in general and asset managers in particular to improve their innovation processes. Rajan’s latest study focuses on innovation challenges for asset managers who invest US$65 trillion in assets worldwide, yet lag in innovation.

Addressing emerging poverty in Italy - Alliance magazinehttps://www.alliancemagazine.org/feature/addressing-emerging-poverty-in-italyJun 01, 2013 · The social problems that are now so dramatically emerging, and the alarmingly widening gap, in terms of income and wealth, between the rich and the middle class and the poor, have earlier and deeper roots, which were disguised in the first years of the millennium by economic growth fuelled by the bubble of the financial and real estate markets.[PDF]MINUTES Louisiana Deferred Compensation Commission …https://wwwcfprd.doa.louisiana.gov/boardsAndCommissions/MeetingMinutes/236_Minutes...MINUTES . Louisiana Deferred Compensation Commission Meeting . March 20, 2012 . The Monthly Meeting of the Louisiana Deferred Compensation Commissionwas held on Tuesday, March 20, 2012, in the offices of the Plan Administrator, 223South Acadian 7 Thruway, Suite 702, …

"Hugely in-vogue stocks rarely do well as an investment ...https://www.investmentnews.com/hugely-in-vogue..."Hugely in-vogue stocks rarely do well as an investment" Most small mutual fund managers count themselves lucky to follow several hundred stocks each month.

Lloyds Bank sale marks an encouraging milestone - Telegraphhttps://www.telegraph.co.uk/.../Lloyds-Bank-sale-marks-an-encouraging-milestone.htmlSep 17, 2013 · Lloyds Bank sale marks an encouraging milestone The economic crisis won’t be over until our debt starts to fall – which is why we must not turn on the spending taps yet

Audit is cool!!!: New Audit Order: Take 2. Remodeling ...https://audit-is-cool.blogspot.com/2011/03/audit-profession-is-very-conservative.htmlMar 03, 2011 · The first one would be concerned with internal controls and financial statements. ... dissatisfaction by work of auditors whether they failed to predict bankruptcy of Lehman brothers or failed to reveal fraud in Enron is caused by bad quality of audit work; non-compliance with audit standards or weak audit standards itself. ... They do not have ...WARNING?Site might be dangerousWe suggest you choose another result. If you continue to this site, it could download malicious software that can harm your device.Learn more or see the Bing Site Safety Report for details.

Dodd-Frank | Notice & Commenthttps://www.yalejreg.com/nc/tag/dodd-frankAs my colleague Paul Rose and I have explored elsewhere, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank) has raised the stakes for financial regulation by requiring more than twenty federal agencies to promulgate hundreds of new rules and regulations. Not only has it kept the financial regulators busy, but it

11 Common Misconceptions Around Digital IRAs | BitIRA®https://www.bitira.com/common-misconceptions-digital-iraThis is a testament to the financial value of BTC compared to USD. But it’s important to note that investors can buy small fractions of 1 BTC and other cryptocurrencies. Some newer coins do cost less than $1 USD each, but you can also buy 1 cent’s worth of BTC if so desired. ... The First Exclusive Crypto Bank to Soon Launch in the United ...

Party leaders of the United States Senate | Financial ...https://debtcrisis.wordpress.com/tag/party-leaders-of-the-united-states-senateJul 31, 2011 · But it does not ask the wealthiest people in this country and the largest corporations to make any sacrifice. The Reid plan is bad. The constantly shifting plan by House Speaker John Boehner is much worse. His $1.2 trillion plan calls for no cuts in the wars in Afghanistan and Iraq, and it requires a congressional committee to come up with ...

BBC - London - TV - Inside Out: 03/10/07www.bbc.co.uk/london/content/articles/2007/10/02/insideout_031007_feature.shtmlOct 02, 2007 · The Pink Plateau. Investment banking is big business. It is common for traders to earn upwards of a million pounds a year. It is a very competitive …

Whitbread News Headlines. WTB Share News. Financial News ...https://www.lse.co.uk/news/WTB/sunday-share-tips-whitbread-petra-diamonds-empiric...Whitbread News Headlines. WTB Share News. Financial News Articles for Whitbread Plc Ord 76 122/153P updated throughout the day.

Buying shares - Angkor Resources Corp - Cambodia Expats ...https://cambodiaexpatsonline.com/business-and-finance/buying-shares-angkor-resources...This will be fun - i am just about to try and buy some mining shares for the first time since high school days. Angkor Resources Corp. Canadian listed, TSX V Venture exchange, small caps Only want 1-200 bucks worth, not sure if i can do that yet. I m..

Global economic growth engine 'starting up': IMF chiefhttps://www.smh.com.au/world/global-economic-growth-engine-starting-up-imf-chief...International Monetary Fund chief Dominique Strauss-Kahn on Wednesday said the global economy appears to be recovering from recession but the crisis was not yet over.

A Concise Dictionary of Markets and Investing eBook Previewhttps://www.rosettabooks.com/TheStreet/preview.phpThis is a dictionary of key market and investing terms to help individuals and organizations grow their wealth.A comprehensive financial dictionary with more than 180 terms in such fields as mutual funds, banking, stocks, bonds, tax laws, and transactions in the various financial markets investment classic.[PDF]FLAHERTY & CRUMRINE PREFERRED INCOME FUNDwww.preferredincome.com/PDF_Files/PFD053108.pdfThis is a staggering amount of new supply to come in a relatively short period of time, and as a ... the Fund does own a disproportionately large percentage of non-financials, but it would not be possible to avoid financials and still maintain a diversified portfolio of quality holdings. ... Flaherty & Crumrine Preferred Income Fund Incorporated

Market Correcting Itself - Politics and Critical Thinkinghttps://politicsandcriticalthinking.blogspot.com/2008/09/market-correcting-itself.htmlSep 09, 2008 · This is an expansion of commercial banking into the world of financial investment, a rather bold move by Bank of America and JPMorgan-Chase. Although, intuitive, this move was done out of neccessity, but, it is a great example of a potential market correction.

The Dodd-Frank Act Explained | Nasdaqhttps://www.nasdaq.com/articles/dodd-frank-act-explained-2017-02-03Feb 03, 2017 · The too big to fail problem. The Dodd-Frank was designed to ensure that a financial crisis like that in 2008 won't happen again. As such, it sought to attack the principal problem that ...

Fox Finds The Villain Of JPMorgan Chase's $2 Billion Loss ...https://www.mediamatters.org/fox-friends/fox-finds-villain-jpmorgan-chases-2-billion...In the wake of a $2 billion trading loss sustained by the bank JPMorgan Chase, many economists have advocated for the strengthening of financial reform to prevent against reckless behavior. Not ...

The Financial Reform Law: “Never have the corrupt done so ...https://mcauleysworld.wordpress.com/2010/06/29/the-financial-reform-law-never-have-the...Jun 29, 2010 · The Financial Reform Law: Never have the corrupt done so little for so many while shielding the guilty from “true change”. False claims and exaggerations about the “proposed changes” to a small segment of America’s financial markets.

Update on the New Normal 2 - SlideSharehttps://www.slideshare.net/DanHassey/update-on-the-new-normal-2Oct 07, 2015 · 1. Update on the New Normal 2 This economic cycle has seen subpar growth with little wage growth, and fewer high paying jobs. Is this the “new normal”? Before the global financial crisis of 2008, Dr. Mohamed El-Eraian (former CEO, and co-CIO of Pimco, one of the world’s largest bond money managers), wrote a book, When Markets Collide.

Too Big to Fail - Audiobook | Listen Instantly!https://audiobookstore.com/audiobooks/too-big-to-fail-unabridged.aspxToo Big to Fail audiobook, by Andrew Ross Sorkin... Andrew Ross Sorkin's websiteAndrew Ross Sorkin's interview on Charlie RoseWatch a VideoAndrew Ross Sorkin delivers the first true behind-the-scenes, moment-by-moment account of how the greatest financial crisis since the Great Depression developed into a global tsunami. From inside the corner...

Liquidity crisis, relationship lending ... - ScienceDirect.comhttps://www.sciencedirect.com/science/article/pii/S0378426613004159Large banks are the heaviest user of non-core funding, relying on this capital for over 30% of their total assets. ... This is in line with Chan et al. ... The first and third loans involve both lenders A and B and the second loan only involves lender A. We compute REL_DUM, as a dummy variable, as 1 since company C has repeated loans with at ...

CNN.com - Transcriptsarchives.cnn.com/TRANSCRIPTS/1001/22/qmb.01.htmlAnd how the markets are trading in New York -- a third day of losses, with the Dow Jones up 102 points, nearly 1 percent. The market -- I mean, in any other market or in any other time, I'd -- I wouldn't be too concerned. But it is the third day -- consecutive day of serious losses.

- Democratic Undergroundhttps://www.democraticunderground.com/discuss/du...The fund's line is that there is no gain without pain. That was the message delivered to Jim Callaghan's Labour government when it sought help during the sterling crisis in 1976 and, as the Greek prime minister George Papandreou has found out, the message remains the same today.

Investor induced contagion during the banking and European ...https://www.sciencedirect.com/science/article/pii/S0261560614001119This study investigates the way a crisis spreads within a country and across borders by testing the investor induced contagion hypothesis through the liquidity channel on stock-bond relationships of the US and five European countries before and during the global banking and …

The more things change | CBC Newshttps://www.cbc.ca/news/canada/the-more-things-change-1.788658What we won't know, probably until it's too late, is if The Next New Thing — the same sort of transformational crisis that ushered out whaling, the fur trade and the Age of Steam — and ...

Houlihan Lokey - WikiVisuallyhttps://wikivisually.com/wiki/Houlihan_LokeyHoulihan Lokey, Inc., is American multinational independent investment bank and financial services company. Houlihan Lokey was founded in 1972 and is headquartered at Constellation Place in Century City, Los Angeles, California; the firm advises large public and closely held companies as well as institutions and governments. Its main service lines include mergers and acquisitions, capital ...

Capitalisn’t: Regulating financial weapons of mass ...https://review.chicagobooth.edu/public-policy/2018/article/capitalisn-t-regulating...Mar 29, 2018 · Speaker 9: Who knows where going to end up? This is volatility we haven’t seen of course, since way before you and I were born. Speaker 10: By what Warren Buffet once called financial weapons of mass destruction. Luigi: Sharon, when was the first time in that ominous fall that you got a sense that this was really big and this was ...

Financial contagion explainedhttps://everything.explained.today/Financial_contagionAt the time, it did not seem excessive, but it appeared so in the aftermath. Bad loans were made, risks were taken due to misunderstandings, and the level of debt continued to grow. "After the start of the crisis, national equity betas increased and average returns fell substantially". The first currency that faced problems was the Thai baht.

The Big Short (Book) | South San Francisco Public Library ...https://ssf.bibliocommons.com/item/show/2398873076_the_big_shortThe Big Short Inside the Doomsday Machine (Book) : Lewis, Michael : Presents an analysis of the economic crisis of 2009, citing such factors as expanded home ownership and risky derivative elections in the face of increasing shareholder demands and discussing the role of responsible parties in the government, financial, and private sectors.

Financial Meltdown And The Madness Of Imperialism By ...https://www.countercurrents.org/lotta260908.htmFinancial Meltdown And The Madness Of Imperialism. ... But it proved to be no more than the patching up of a pothole during an earthquake. ... One of the most significant features of world growth ...

48 Best I ? NY images | United nations headquarters ...https://www.pinterest.com/houtnany/i-nyFeb 26, 2013 - The city of New York is the most populous city in the US and the center of the New York Metropolitan Area. A global power city, New York exerts a significant impact upon commerce, finance, media, art, fashion, research, technology, education, and entertainment. The home of the United Nations Headquarters,New York is an important center for international diplomacy and has been ...

The global financial crisis: six charts that tell the ...https://www.cazenovecapital.com/uk/charities/insights/market-news/the-global-financial...The energy sector is an interesting case. One of the drawbacks of using trailing price-to-earnings (P/E) is that it focuses on the last 12 months earnings. Energy stocks had a stellar 2016, compared to the last 10 years, as the oil price recovered from historic lows, which is the reason the trailing P/E is so high and its average is so low.

The World’s Most Dangerous Systemic Risks for the Week ...themillenniumreport.com/2016/10/the-worlds-most-dangerous-systemic-risks-for-the-week...There are presently two paramount foreground dangers and a third that is moving closer to the foreground. We are currently experiencing the biggest, global-scale, financial bubble in history (the “mother of all bubbles” or MOB) and not a one-dimensional bubble like the “Crash of 1929”, the 2000 dot com bubble or the 2008 housing bubble: the MOB is simultaneously present in all ...[DOC]blogs.baruch.cuny.eduhttps://blogs.baruch.cuny.edu/authenticityand... · Web viewOntology answers the questions: what, when, where; epistemology answers the questions: why and how. Once we uncover and discover reality, we can then find and further all that we know about various essences, things, etc.[DOC]M E M O R A N D U Mfcic-static.law.stanford.edu/NARA.FCIC.2016-03-11... · Web viewOne of the things that CDS gets a bad rap for is that to be sure, AIG was selling protection through CDS, and the risks that they took were enormous, but they could have done the same thing through insurance contracts. You can’t blame the instrument in this case. To say that CDS are the cause of AIG is wrong.

Neanderthal Supremacy - AnthroScapehttps://www.tapatalk.com/groups/anthroscape/neanderthal-supremacy-t25819.htmlJan 14, 2013 · One such individual is Richard Severin Fuld, Jr, head of Lehman brothers at the time of it's collapse. Fuld has an exceptionally large supraorbital torus, a long mid-face and a pair of anti-mongoloid eyes. His nickname within the financial industry was "the Gorilla"[24] and he publicly stated (jokingly) that he wanted to cannibalize people.[25]

Live Economics: What is Systemic Risk in Finance?https://bkmiba.blogspot.com/2017/01/what-is-systemic-risk-in-finance.htmlJan 28, 2017 · In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to risk associated with any one individual entity, group or component of a system, that can be contained therein without harming the entire system. It can be defined as "financial system instability, potentially catastrophic, caused or exacerbated by idiosyncratic events or conditions ...

Catastrophe averted?https://www.newstatesman.com/economy/2008/11/world-financial-china-economicVincent Cable Shadow chancellor, Liberal Democrats By the low standards of economic summitry, the G20 meeting rated quite high. There was a predictable, no doubt pre-written, communiqué, full of the usual banalities. And the meeting suffered from the absence of the world's most important politician, who hasn't yet taken up office. But, these necessary caveats aside, there were important ...

Crash of the Titans: Greed, Hubris, the Fall of Merrill ...https://www.amazon.co.uk/Crash-Titans-Merrill-Near-Collapse-America/dp/0307751163This is a deeply researched and briskly written account of the demise of Merrill Lynch amidst the general market turmoil of 2008//9. It does a good job of setting context - both in terms of the culture and history of the two firms as well as the personal motivations and incentives the key players brought to the table.Reviews: 65Format: Audio CDAuthor: Greg Farrell