Home

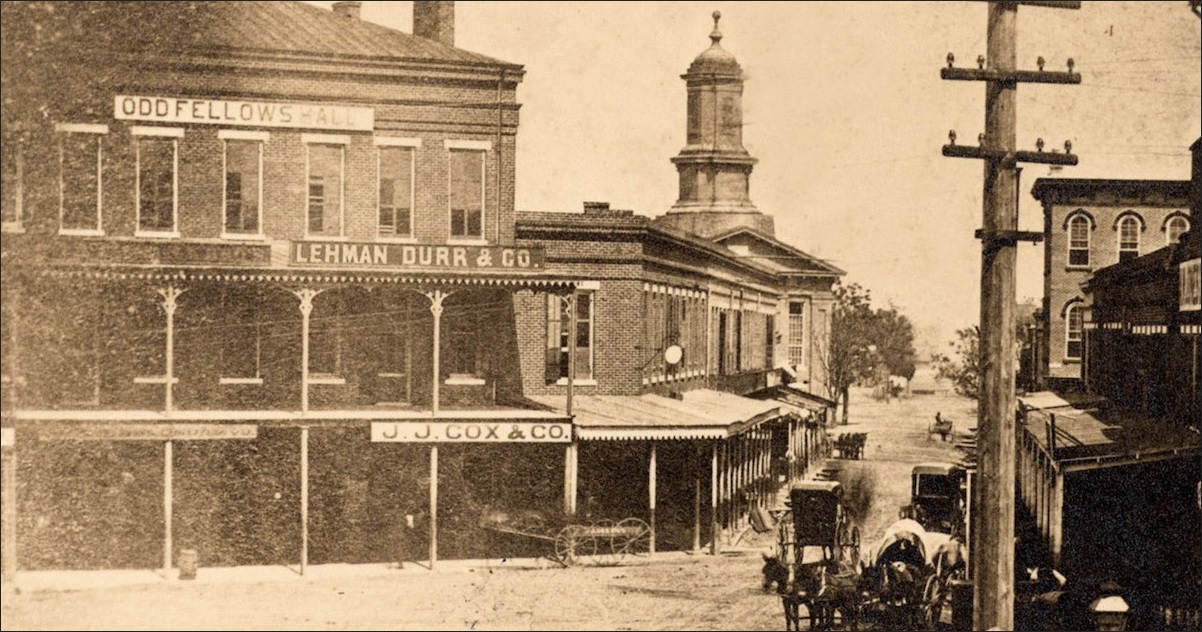

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Bill Gross lawsuit claims "improper, dishonest and ...https://www.afr.com/world/north-america/bill-gross-lawsuit-claims-improper-dishonest...Oct 11, 2015 · This is what Mr Gross had to say about some of Pimco's "cabal" of key executives, which according to the complaint, plotted to oust him from the firm. ... such as the collapse of Lehman Brothers ...

Credit rating agencies and the subprime crisis explainedeverything.explained.today/Credit_rating_agencies_and_the_subprime_crisisHundreds of billions of dollars' worth of these triple-A securities were downgraded to "junk" status by 2010, and the writedowns and losses came to over half a trillion dollars.This led "to the collapse or disappearance" in 2008–09 of three major investment banks (Bear Stearns, Lehman Brothers, and Merrill Lynch), and the federal governments ...

Erdogan a Hero or Villain? - blogspot.comhttps://thepoliticalhawk.blogspot.com/2017/08/erdogan-hero-or-villain.htmlWhen the Lehman Brothers got bankrupt in 2008, it initiated a shock wave through out the planet and dragged the world into a turmoil know as the 2008 financial crisis. The crisis exposed the dark side of the banks to the whole world. Without any doubt the banks were responsible for the disaster but instead of being held responsible they were saved.

Downturn Deals Help Companies Outperform the Market ...https://insurancenewsnet.com/oarticle/Downturn-Deals-Help-Companies-Outperform-the...Jul 06, 2009 · Downturn Deals Help Companies Outperform the Market Overall Downturn Deals Help Companies Outperform the Market Overall Companies Completing Deals After Lehman Collapse Outperform Peers by 6.3% ...[PDF]AFR FDIC Liquidation 5-23-11https://www.fdic.gov/regulations/laws/federal/2011/11c17ad73.pdfThe immediate cause of the financial crisis was the collapse of Bear Stearns and Lehman Brothers, which then revealed that other key financial ... As the non-partisan Financial Crisis Inquiry Commission stated in its conclusions ... Following are the partners of Americans for Financial Reform.

The Role of Religion in the Global Financial Crisis Rev ...ijptnet.com/journals/ijpt/Vol_2_No_3_September_2014/14.pdfThis is so, because religion still offers answers to questions of suffering and pain in the world, as well as the question on the purpose of human life. For instance, African Traditional Religion uses proverbs, folktales, stories, myths etc, to promote human flourishing. In Christianity, the sacred scripture and…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

2019 Trading Thread - Page 29 - Business, Finances and ...https://forumserver.twoplustwo.com/30/business-finance-investing/2019-trading-thread...Jun 27, 2019 · The number of outstanding shares in the SPDR S&P 500 rose by 63% from Sept. 15, 2008, the day Lehman Brothers filed for Chapter 11 bankruptcy protection, through the end of that year, according to data from State Street Global Advisors. That’s despite the …[PDF]AFR FDIC Liquidation 5-23-11https://www.fdic.gov/regulations/laws/federal/2011/11c17ad73.pdfThe immediate cause of the financial crisis was the collapse of Bear Stearns and Lehman Brothers, which then revealed that other key financial ... As the non-partisan Financial Crisis Inquiry Commission stated in its conclusions ... Following are the partners of Americans for Financial Reform.[PDF]Analysis of Banking System Performance of Select Global ...https://core.ac.uk/download/pdf/81941497.pdfbanks were leveraged to a far greater extent than US banks. However, it was the multiple regulatory environment that created regulatory complications in USA resulting in financial crisis of 2008 [6]. 4. Global Financial Crisis and Experience of Some Select Economies The Global Financial crisis impacted banking systems worldwide.[PDF]Ethnography Meets Econometricshttps://anthrosource.onlinelibrary.wiley.com/doi/pdf/10.1111/j.1556-3502.2009.50707.xkey factor was the social silence and the fact that although credit markets were overheating, they did not meet the usual defini-tion of a journalistic “story,” since the subject matter seemed too complex, technical and dull, dressed up in a jargon that only bankers appeared able to under-stand.

Spain enters the eye of the Eurozone storm – Chemicals and ...https://www.icis.com/chemicals-and-the-economy/2012/10/spain-enters-the-eye-of-the-euContact Client Success on clientsuccess@icis.com . Contact sales. TAKE A FREE TRIAL…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

What Best Describes the United States in the 21st Century ...https://ca.answers.yahoo.com/question/index?qid=20080920104505AA94KwwSep 20, 2008 · During the last five years of his tenure as CEO of now-bankrupt Lehman Brothers, Richard Fuld’s total take was $354 million. John Thain, the current chairman of Merrill Lynch, taken over this week by Bank of America, has been on the job for just nine months. He pocketed a $15 million signing bonus. His predecessor, Stan O’Neal, retired with a package valued at $161 million, after the ...

Revenge of the Wall St. Nerds | Harvard Political Reviewharvardpolitics.com/books-arts/revenge-of-the-wall-st-nerdsMay 25, 2010 · An exposé of the math guys who broke the economy. The quants: how a new breed of math whizzes conquered Wall Street and nearly destroyed it, by Scott Patterson, Crown Business, 2010. $27.00, 337 pp. Wall Street titans like Lehman Brothers CEO Dick Fuld, AIG CEO Hank Greenberg, and scam artist Bernie Madoff have emerged as the central villains of the financial crisis.

Putin’s Endgame • The Berkeley Bloghttps://blogs.berkeley.edu/2014/09/02/putins-endgame/comment-page-1If the West tightens the screw of sanctions, the economic consequences for Russia will be dire: inflation, deep recession, low income, high unemployment, a banking system in shatters. If the collapse of Lehman Brothers nearly brought down the U.S. economy, one can only imagine how bad it can turn for Russia if the banking system stops ...

Qatar may make $1 billion selling Barclays shares after ...https://banksdaily.com/news/banks/Qatar-may-make-billion-selling-Barclays-shares"This is to prepare the war chest for Sainsbury." Barclays turned to Qatar Holding and Abu Dhabi's royal family for funding last October rather than accept a U.K. government bailout after the collapse of Lehman Brothers Holdings Inc. Qatar also invested in Barclays in June 2008 as the bank sought to bolster capital and expand abroad.…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Need an Out of This World Location? Shoot ... - Studio Dailyhttps://www.studiodaily.com/2012/06/need-an-out-of-this-world-location-shoot-in...Then came the country's banking collapse. As a result of the financial crisis here in the U.S., Iceland tumbled into a deep financial morass of its own. The value of its banks had ballooned to ten times the size of its economy, and when Lehman Brothers went down, so did the entire Icelandic banking system.

Pensions on the mend as rates rise | The Starhttps://www.thestar.com/business/personal_finance/...Aug 04, 2011 · In 2008, that figure had plunged to 41.5 per cent in the wake of the financial crisis which included the collapse of Lehman Brothers. Some of the giants of …

Hong Kong's corporate rescue marathon – Are we approaching ...csj.hkics.org.hk/site/2013/08/05/hong-kongs...Aug 05, 2013 · In 2008/ 2009, company failures fell to about 550 cases after the collapse of Lehman Brothers. Winding-up orders made in 2012 dropped to around 300 cases. One key factor which contributed to the rising number of corporate collapses after the financial crisis was the lack of a corporate rescue regime in Hong Kong.

Stock lending isn't worth the money for now, some mutual ...https://www.investmentnews.com/article/20080928/REG/309299966Sep 28, 2008 · The collapse of Lehman Brothers Holdings Inc. of New York highlighted the counterparty risk that comes with securities lending, said Andrew Gogerty, a mutual fund analyst with Morningstar Inc. …

How the recession deepened financial exclusion | Brunel ...https://www.brunel.ac.uk/news-and-events/news/...How the recession deepened financial exclusion ... was in the grip of a major financial and economic crisis that saw huge financial institutions such as Northern Rock and Lehman Brothers collapse. ... These groups’ vulnerability resulted from factors completely outside their control. It was the combination of firm-related factors – like ...

Coronavirus - do you trust the UK Government to make the ...https://www.avforums.com/threads/coronavirus-do...Mar 07, 2020 · Against that, I vividly remember Obama holding court for 30-60 mins in the aftermath of Lehman Brothers and the Financial Crisis in early 09, explaining in detail the nuances of the bailout of the big US car manufacturers and how their pension entitlements would be dealt with.

Crash landing | Feature | Law Gazettehttps://www.lawgazette.co.uk/features/crash-landing/5102987.articleSince the collapse of Lehman Brothers in 2008, regulators around the world have sharpened their focus on corporate culture in financial services by switching attention from firms to individuals.

Keiser Report: China + Yuppies = Chuppies (E115) | Keiser ...https://www.keiserreport.com/2011/01/keiser-report-china-yuppies-chuppies-e115One of the main reasons why entities such as Lehman Brothers collapsed, after all, was that investors fled from repo deals, because they became frightened about counterparty risk. They also feared that the collateral backing these deals was losing value, particularly in relation to mortgage bonds, which represented 37% of collateral.

Polar Capital Technology Trust (PCT) - Shares Comment ...https://www.sharesmagazine.co.uk/shares/share/PCT/news/sharesOnly 2011 had a worse showing. A decade ago makes for a notable point of comparison given that on 15 September 2008 investment bank Lehman Brothers collapsed. With more than $639bn worth of its assets it was the largest bankruptcy in US corporate history and arguably represented the ...

Interviewing Ann Coulter Tomorrow! - Turning the Tide...https://candacesalima.blogspot.com/2011/07/interviewing-ann-coulter-tomorrow.htmlI'll admit it, I am a big fan of Ann Coulter. I've followed her career for many years, and read many of her books. So you can imagine how pleased I am that she is joining us on air tomorrow, 7 July 2011, to be interviewed by Tim and me at 10:20 a.m. (MDT) for 30 minutes.[PDF]Capital adequacy, ETS and investment uncertainty in the ...https://research-repository.griffith.edu.au/bitstream/handle/10072/32214/61464_1.pdf;...to plunge. But only part of the story. The drivers of investment uncertainty in Australia can be summarized as: • The Financial Crisis: following the collapse of the CDO market and Lehman Brothers, the availability and tenor of debt has reduced and been materially re-priced. Corporate

Oil market slides out of control | Financial Timeshttps://www.ft.com/content/83885558-71a2-11e5-9b9e-690fdae72044Nov 01, 2015 · Oil market slides out of control. ... The downfall of Lehman Brothers in 2008 and the subsequent financial crisis toppled crude prices from a higher peak than in 2014 to its lowest trough ...

Text: FOMC Minutes - CNBChttps://www.cnbc.com/id/27070742Oct 07, 2008 · However, the bankruptcy of Lehman Brothers and market concerns about other financial institutions were causing a wide variety of financial firms to experience increasing difficulty in obtaining ...

Red Shift - Eterna Partnershttps://eternapartners.com/red-shiftMoving in-house, Serra then spent 12 years in communications roles in financial services. She was a senior member of the Lehman Brothers global communications team during the collapse of the bank in 2008. Most recently, she was Group Head of Communications at ICAP plc, renamed NEX Group plc, before co-founding Eterna Partners.

Financial reform, Wall Streethttps://www.attorneypaladin.com/Financial_reform.htmlA year in the making and 22 months after the collapse of Lehman Brothers triggered a worldwide panic in credit and other markets, the bill cleared its final hurdle with a 60-39 Senate vote (very close to a party line vote) and goes to the White House for President Barack Obama's signature.

Buy 09/08/2018 - The Economisthttps://www.zinio.com/the-economist/09-08-2018-i393116The first was the terrorist attacks of September 11th 2001, the second the global financial crisis, which boiled over ten years ago this month with the collapse of Lehman Brothers. September 11th led to wars, Lehman’s bankruptcy to an economic and political reckoning. Just as the fighting continues, so the reckoning is far from over.

Dollar Carving out its Smallest Range in 15 Months Before Fedhttps://finance.yahoo.com/news/dollar-carving-smallest-range-15-041000847.htmlAug 01, 2012 · Since late 2008, in the wake of the Lehman Brothers collapse, the Federal Reserve has injected an incredible amount of support into the capital markets to …

Boulder County venture capital: Funds, companies hope for ...https://www.dailycamera.com/2011/02/11/boulder-county-venture-capital-funds-companies...A month-and-a-half into 2011, optimism for a turnaround seems prevalent in some circles of the Boulder region’s VC community, but others caution that a bigger crisis looms: that Colorado’s VC ...[PDF]Capital Flow Policies, Monetary Policy and Coordinationhttps://rba.gov.au/publications/confs/2014/pdf/fratzscher.pdfCapital Flow Policies, Monetary Policy and Coordination Marcel Fratzscher* 1. Introduction The past six years have seen a controversial debate between advanced and emerging markets about the role and determinants of global capital flows, including in the G20 agenda under several presidencies. After the collapse of Lehman Brothers in September ...

The Harvard Law School Forum on Corporate Governance ...https://corpgov.law.harvard.edu/2015/03Mar 31, 2015 · Within a few weeks, on September 15, 2008, Lehman Brothers filed for bankruptcy. To give you a sense of its rapid decline, within 15 days, its share price went from $17.50 per share to virtually worthless. The demise of Lehman Brothers is often seen as the first in a rapid succession of events that led to an unimaginable market and liquidity ...

Gold, Silver and Oil Trading Outlook | Nasdaqhttps://www.nasdaq.com/articles/gold-silver-and-oil-trading-outlook-2011-08-15Aug 15, 2011 · Many people also compare the current economic situation with Y 2008 when Lehman Brothers collapsed, the current pattern of Gold price is more similar to the period from Q-3 …

China risk score hits 10-year low amid liquidity crisis ...https://www.euromoney.com/.../china-risk-score-hits-10-year-low-amid-liquidity-crisisJun 25, 2013 · China’s ECR score has plummeted to a 10-year low as fears grow that policymakers’ steps to reduce credit growth from mid-tier lenders and leverage in the shadow banking system will exact a heavy macroeconomic toll at a time of softer growth. China’s ECR score fell by 0.4 points in June to 59.4, indicating mounting concerns of a blow-up in the country’s banking sector.[PDF]Capital Markets Handbook 2011 lation Clearing OTC ...https://www.sidley.com/-/media/files/publications/2011/01/clearing-otc-derivatives-the...The European Commission’s proposal for a new EU regulation (ti-tled the European Market Infrastructure Regulation) on OTC de-rivatives, central counterparties and trade repositories (EU Regu-lation) was published on 15 September 2010, precisely two years after the commencement of the Lehman Brothers bankruptcy. The EU Regulation is designed ...

The Political Origins of the Greek Crisis: Domestic ...https://www.insightturkey.com/articles/the-political-origins-of-the-greek-crisis...The 2008 financial crisis led to a rapid downturn of global output. The collapse of Lehman Brothers set in motion dormant forces in the lightly regulated financial sector and led to a series of bank mergers, nationalizations and takeovers in the US, the UK and elsewhere.

Policy solutions to India's balance of payment crisis ...https://www.financialexpress.com/opinion/policy-solutions-to-indias-balance-of-payment...Sep 18, 2018 · The point to be borne in mind is that there is no panic in the current situation, unlike the case of the 1991 crisis when foreign exchange reserves were sufficient for only for a few weeks’ imports.[PDF]BUSINESS NOVEMBER 22, 2009 Lehman, Bear Executives …www.law.harvard.edu/programs/corp_gov/MediaMentions/11-22-09-WSJ.pdfNov 22, 2009 · BUSINESS NOVEMBER 22, 2009 Lehman, Bear Executives Cashed Out Big By AARON LUCCHETTI Bear Stearns Cos. and Lehman Brothers Holdings Inc. executives cashed out nearly $2.5 billion from their firms between 2000 and 2008 even though the financial crisis hammered the shares they held, according to a study set to be released Monday.

Robin Parker - Consultant - AMP Capital | LinkedInhttps://au.linkedin.com/in/robin-parker-b1962a9My experience encompasses a wide variety of product exposure which has been gained as CFO for a Family Office, fixed income Securities House, Head of Finance for the Investment Management Division at Lehman Brothers, COO for the Investments Division at the Government Employees Superannuation Board as well as the Senior Finance Business Partner ...Title: Financial services executive with …Location: Sydney, Australia500+ connections[PDF]Investment Management Regulatory Updatehttps://www.davispolk.com/files/2019-08-27_investment_management_regulatory_update...Aug 27, 2019 · exempt from registration pursuant to a 1998 exemptive order (the “1998 Order”). As described in the Incoming Letter, following Lehman’s Chapter 11 filing for bankruptcy protection on September 15, 2008, the advisory relationships for a majority of funds in the Lehman Brothers Private Equity Division, including[PDF]The Loan Covenant Channel - Harvard Universityhttps://scholar.harvard.edu/files/chodorow-reich/files/covenant_channel.pdfthe covenant channel accounts for a large share of the total cross-sectional variation in lender credit supply. We conclude that the transmission of bank health to non nancial rms in 2008-09 occurred largely through the loan covenant channel. We discuss related literature next.Section 2provides institutional background on covenants.

Cheer up, it might not happen | Features | IPEhttps://www.ipe.com/cheer-up-it-might-not-happen/10021330.articleYet there are concerns that pension funds, with their current levels or risk, are vulnerable to downside shocks. As the credit crunch and the subsequent Lehman Brothers collapse fade into history, it will be important to remember the value of investment beliefs and nimble behaviour when the time comes to switch in or out of asset classes.

European shares hit record even as coronavirus shows no ...https://business.financialpost.com/pmn/business-pmn/european-shares-hit-record-even-as...Wall Street futures pointed to a slightly higher open. ... shares outside Japan rose 0.1% for a weekly gain of almost 2%. ... the 800th cut by global central banks since the collapse of Lehman ...[PDF]The bullwhip effect and the Great Trade Collapsehttps://www.ebrd.com/downloads/research/economics/workingpapers/wp0148.pdfmost of the drop, as well as the overreaction of trade to GDP, can be explained by an unusually large demand shock, coupled with a strong compositional effect. After Lehman Brothers ?led for bankruptcy in September 2008, a wave of extreme uncertainty spread across the world. The

Nigeria: Financial Crisis - Morgan Stanley, Goldman Sachs ...https://allafrica.com/stories/200810130591.htmlAs the global financial ... and following the collapse of 158 year old banking giant-Lehman Brothers, there have been growing concern over the health of Morgan Stanley and Goldman Sachs, leading ...

Market Insights Bubble, Bubble, Toil and Trouble - Cambridgehttps://www.cambridgefx.com/blog/bubble-bubble-toil-and-troubleStability leads to instability. The more stable things become and the longer things are stable, the more unstable they will be when the crisis hits. – Hyman Minsky Eight years on from the collapse of Lehman Brothers and the wholesale devastation of the global financial crisis, financial markets have never had it as good. Even against a […]

Award FINRA Office of Dispute Resolutionhttps://www.finra.org/sites/default/files/aao_documents/18-01230.pdfin investment vehicles such as the Citigroup Fund. After the collapse of Lehman Brothers on September 15, 2008, the Citigroup Fund lost almost all of its invested capital and was liquidated by Respondent in November 2008. On November 18, 2008, Mr. S sent an email to Claimant alleging that his investment was inconsistent with his desired criteria.[PDF]

London’s West End overtakes Tokyo as the world’s most ...https://www.knightfrank.com/news/london’s-west...The West End had dropped to second place in the rental rankings in the 2009 and 2010 surveys, as a result of falling rents in the aftermath of the Lehman Brothers collapse, but this year's report sees it regain top position on the back of a revival in occupier demand which has fuelled strong rental growth.

Brazil Brimming Economic Collapse– What can we do?https://sites.psu.edu/global/2016/10/17/brazil-brimming-economic-collapse-what-can-we-doBrazil Brimming Economic Collapse– What can we do? ... and U.S. factory orders has now fallen for 15 months in a row with the corporate default rate in the U.S. higher than Lehman Brothers during their collapse. ... insights and knowledge; The Pennsylvania State University (n.d) also defines high cultural synergy as the embodiment of highly ...

London’s West End overtakes Tokyo as the world’s most ...https://www.knightfrank.com/news/london’s-west...The West End had dropped to second place in the rental rankings in the 2009 and 2010 surveys, as a result of falling rents in the aftermath of the Lehman Brothers collapse, but this year's report sees it regain top position on the back of a revival in occupier demand which has fuelled strong rental growth.

corporate fraud | Risk Management Monitorwww.riskmanagementmonitor.com/tag/corporate-fraudMar 07, 2017 · “As the phenomena of ‘fake news’ and ‘alternative facts’ permeate the U.S. landscape, it is interesting to see how disconnected many executives are from the true prevalence of fraud and corruption in their organizations,” said Dan Zitting, chief product officer at ACL, a risk management software provider.…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Leading Emirates health care, education investor eyes ...https://www.arabnews.com/node/1418226Abhishek Sharma worked as a financial analyst at Bank of America, Merrill Lynch and Lehman Brothers before launching Foundation Holdings in 2016.[PDF]The Non-Bank Credit Crunch in Mexico: Rise and Fall of an ...daac.itam.mx/sites/default/files/nonbank_credit_crunch_mexico_dec2012.pdfThe Non-Bank Credit Crunch in Mexico: Rise and Fall of an Industry ... mostly as the result of spillover effects from the subprime mortgage crisis in the U.S., heightened risk aversion affected financial intermediaries’ funding in Mexico and ... and a sudden stop in the loan securitization market.[PDF]News Bulletin March 24, 2009 - Morrison & Foersterhttps://media2.mofo.com/documents/090324finstab.pdfof Lehman Brothers, sudden sale of Merrill Lynch and continued worsening of the financial sector led Treasury to request authority to address the troubled assets continuing to plague financial institutions. Signed into law on October 3, 2008, the Emergency Economic Stabilization Act (Stabilization Act) authorizes Treasury to spend $700[PDF]08-06-07 Picking a Skipperhttps://webreprints.djreprints.com/2504850321157.pdfHe shares his recommendations for a model “growth” portfolio, targeted for individuals who want market-beating returns over a 10- year period. The ideal investor for this portfolio, he says, is at least 10 years away from retirement. The portfolio currently is about 90% stocks, and a …

Bulletin – March Quarter 2010 The Australian Government ...https://www.rba.gov.au/publications/bulletin/2010/mar/4.htmlBulletin – March Quarter 2010 The Australian Government Guarantee Scheme ... the collapse of Lehman Brothers triggered high uncertainty about the stability of the global financial system, and a virtual closure of parts of global capital markets. ... Separately, under the Guarantee Scheme, eligible ADIs have been able, for a fee, to offer ...[PDF]Iceland's Financial Crisis - Digital Libraryhttps://digital.library.unt.edu/ark:/67531/metacrs10825/m1/1/high_res_d/RS22988_2008...Iceland’s Financial Crisis James K. Jackson Specialist in International Trade and Finance Foreign Affairs, Defense, and Trade Division Summary On November 19, 2008, Iceland and the International Monetary Fund (IMF) finalized an agreement on a $6 billion economic stabilization program supported by a $2.1 billion loan from the IMF.[PDF]Credit Risk and the Macroeconomy: Evidence from an ...https://albertoortiznet.files.wordpress.com/2017/08/artc3adculo-gilchrist_ortiz...credit markets led to a widespread loss of con?dence in the ?nancial sector, and in the early ... Lehman Brothers Holdings ?led for bankruptcy; and the insurance company American International Group Inc. (AIG) came under severe pressure, necessitating the Federal ... and restart certain securitization markets. For a history and a full ...

Reaching New Heights with 3D - Airforce Technologyhttps://www.airforce-technology.com/features/feature91192Eighteen months after the high-profile collapse of Lehman Brothers, the repercussions of the credit crisis are still being felt around the world. In spite of some encouraging revitalisation in emerging markets, the global aerospace sector faces two key challenges: Western governments with tight control of military purse strings and a more ...

Free Parking - Page 2231 - Political Graffiti - SurfTalkhttps://www.stripersonline.com/surftalk/topic/649721-free-parking/?page=2231Apr 17, 2016 · Lehman Brothers started tanking in 2007, finally declaring bankruptcy in September of 2008, two months before Obama was elected. Obama had nothing to do with IBM. IBM downsized because they didn't adapt to the IT market. It's called "capitalism". IBM was about mainframe computers. The market pushed towards cloud computing and mobile devices.

Don’t panic! What superannuation is teaching the post-GFC ...https://www.superratings.com.au/2018/09/20/dont-panic-what-superannuation-is-teaching...Sep 20, 2018 · Ten years since the collapse of US investment bank Lehman Brothers, Australia’s superannuation funds have accumulated over $1 trillion in retirement savings, providing a windfall for members prepared to take a long-term view. According to data from leading superannuation research house SuperRatings, members with a balance of $100,000 at the end of August 2008, just...

Valuation of Guaranteed Unitized Participating Life ...https://www.hindawi.com/journals/ddns/2019/9439786Crisis events such as the collapse of Lehman Brothers have radically changed the view that extreme events in financial markets have negligible probability. Over the last decade, the life insurance industry’s situation has deteriorated due to substantial changes in both …

Bailouts, markets and Lehman Brothers | Vancouver Sunhttps://vancouversun.com/news/staff-blogs/bailouts-markets-and-lehman-brothersNov 23, 2010 · Bailouts, markets and Lehman Brothers. ... for a family of 2-4 people has to be down-sized; i reside in china and i see how people live with less expectations and wants– and i …[PDF]Are Any Creditors 'Particularly Deserving'?: On the ...https://digitalcommons.law.yale.edu/cgi/viewcontent.cgi?article=6277&context=fss_papersAcademics and policy-makers often argue for a harmonized international system to resolve the failures of large international financial institutions in order to reduce both systemic risk and the probability that an insolvency of a major bank will lead to a global economic collapse.' Despite the perceived

Gold Mining, Inflation and Deflation | Gold Newshttps://www.bullionvault.com/gold-news/gold-mining-inflation-deflation-110820122The Gold Report is a unique, free site featuring summaries of articles from major publications, specific recommendations from top worldwide analysts and portfolio managers covering gold stocks, and a directory, with samples, of precious metals newsletters. To subscribe, simply complete the online form.. See the full archive of Gold Report articles.[PDF]The ‘Celtic Crisis’: Guarantees, Transparency and Systemic ...https://www.bankofcanada.ca/wp-content/uploads/2013/09/wp2013-31.pdfthree-fold following the collapse of Lehman Brothers in September 2008. Figure 1(b) shows the changes in the spreads for banking sector and sovereign credit default swaps (CDSs), between January 2007 and late September 2008 (shortly after the default of Lehman Brothers). Viewed as proxies for the probabilities of bank default, we note a

Fiscal space, government spending, and tax rate ...https://voxeu.org/article/fiscal-space-government-spending-and-tax-rate-cyclicality...Sep 28, 2018 · The upward trajectory of policy interest rates in OECD countries will impose growing fiscal challenges, testing their fiscal capacity for countercyclical policy and thus their resilience. This column compares fiscal cyclicality across countries and identifies measures of fiscal space. The results reveal a mixed fiscal scenery, where more than half of countries are[PDF]EU BANKING STRUCTURES SEPTEMBER 2010https://www.ecb.europa.eu/pub/pdf/other/eubankingstructures201009en.pdfEU banking structures September 2010 1 OVERVIEW OF DEVELOPMENTS IN EU BANKING STRUCTURES This chapter analyses major structural and regulatory developments in the EU banking sector in the period from 2008 to 2009. 1 The bankruptcy of Lehman Brothers in autumn 2008 triggered a general loss of con? dence in ? nancial markets and institutions

Is Shopify (TSX:SHOP) an Acquisition Target?https://ca.finance.yahoo.com/news/shopify-tsx-shop-acquisition-target-170050475.htmlAug 29, 2019 · (Bloomberg) -- The biggest volatility crisis since Lehman Brothers is rocking markets, and the return of real-money investors is the only thing that’s going to stop it. Luckily, now is the perfect time for them to step in.So says JPMorgan Chase & Co. …

investors | Search Engine Newshttps://thatsmyfooname.wordpress.com/tag/investorscompanies and investors nationwide. As the Dow Jones Industrial Average chalked up its largest one-day point drop in its history, parts of the credit markets regressed to where they were in the days following Lehman Brothers Holdings Inc.’s collapse this month. Corporate bonds slumped, the cost of credit

Innovation and Development around the World, 1960-2000https://openknowledge.worldbank.org/handle/10986/8576Over a decade has passed since the collapse of the U.S. investment bank Lehman Brothers marked the onset of the largest global economic crisis since the Great Depression. The crisis revealed major shortcomings in market discipline, regulation, and supervision, and reopened important policy debates on financial regulation.

FN Weekend: The Very Best of Financial Newshttps://www.fnlondon.com/articles/fn-weekend-the-very-best-of-financial-news-19-20180629Jun 29, 2018 · FN Weekend is edited by Financial News's online editor Fareed Sahloul Please send any feedback — good or bad — and story tips to fsahloul@efinancialnews.com or news@efinancialnews.com Bob the builder Bob Diamond is betting on Mifid II with his latest investment in a financial firm. The former Barclays CEO has taken almost 20% of the French broker Kepler Cheuvreux in the hope that its ...[PDF]Dynamics of Inductive Inference in a Uni ed Framework1 2 3 4www.tau.ac.il/~igilboa/pdf/GSS_Dynamics_of_Inductive_Inference_in_a_Unified_Model.pdfSimilarly, following the collapse of Lehman Brothers in September 2008, the head of a major investment rm confronted clients anxious to sell their assets, even assets that had already lost 90% of their value. Again, the ana-lyst did not apply Bayes rule to a prior that had taken into account a possible failure of Lehman Brothers.

HIGHLIGHTShttps://www.phil.frb.org/-/media/research-and-data/publications/banking-legislation...2008, the day after Lehman Brothers Holdings Inc. announced its bankruptcy, the Reserve Fund announced that its Primary Fund would break the buck and price its securities at $0.97 per share instead of $1.00 per share. Even though the Reserve Primary Fund held only 1.2 percent of its assets in Lehman Brothers commercial paper, when

BofA-SEC Settlement Axed Amid Obama Address ...https://www.institutionalinvestor.com/.../bofa-sec-settlement-axed-amid-obama-addressSep 15, 2009 · BofA-SEC Settlement Axed Amid Obama Address. ... U.S. District Judge Jed Rakoff's decision comes as the largest U.S. bank faces a Monday deadline to offer more information about the merger to New ...[PDF]In The United States District Courthttps://cftc.gov/sites/default/files/idc/groups/public/@cpcasestatusreports/documents/...(formerly Fimat International Banque SA), and Lehman Brothers International Europe that are held for the benefit of Lake Shore clients, for the purpose of marshaling, preserving, accounting for, and liquidating the assets that are subject to this Order for the sole purpose of making a[PDF]Bank Capital Structure Reponses to the Post-Crisis ...web.econ.ku.dk/eprn_epru/Forskningsprojekt/Bank Capital Structure Reponses to the Post.pdfBank Capital Structure Reponses to the Post-Crisis European Bank Levies Niels Johannesen ... Lehman Brothers in August 2008 triggered a global financial crisis. ... it is our aim that the research project results in a paper that is suitable for submission to a top journal such as the Journal of Finance or a top-field journal such as the Journal ...[PDF]Discussion of “Did the Crisis A?ect In?ation Expectations?”www.ijcb.org/journal/ijcb11q1a9.pdfthe failure of Lehman Brothers in September 2008, ?gure 1 plots yields on nominal and in?ation-indexed government bonds as well as break-even in?ation rates in Japan. After the failure of Lehman Brothers, yields on nominal and in?ation-indexed government bonds decoupled and became exceptionally volatile.1,2 The yields on[PDF]QUANTITATIVE FINANCE RESEARCH CENTREhttps://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2165656_code355571.pdf?abstractid=...peak 79 on October 2008, soon after Lehman Brothers collapses. This value is more than 4 times of its value in October 2007. It is further observed from the ?gure that, the price and volatility tend to move together (in the opposite direction) with di?erent market conditions corresponding to …[PDF]Retirement Plan Quarterly Investment Reviewcommunity.pepperdine.edu/hr/content/benefits/fulltime/december2009review.pdffor a job start searching again. Moreover, history suggests it could take up to five years of expansion to push the unemployment rate back down to a “fullemployment”level of 5% using current statistics. Inflation (CPI) Core 1.8% Headline 2.7% Despite rising energy prices over the course of 2009, measure of core inflation remain subdued. With

Liquidity key to carry trade; FX not as liquid as you ...https://www.euromoney.com/article/b12kjk3sk1f1ym/liquidity-key-to-carry-trade-fx-not...It found that, contrary to common perceptions, FX – as the world’s largest financial market – is highly liquid at all times, and all exchange rates experienced a substantial decline in liquidity during the financial crisis, especially after the bankruptcy of Lehman Brothers.

Financial mismanagement - lse.ac.ukwww.lse.ac.uk/News/Research-Highlights/Economy/Managing-banksFeb 17, 2020 · Drawing on multiple examples such as the rise and fall of the Rothschild family business, the collapse of Barings bank in 1995, and the Lehman Brothers bankruptcy in 2008, Dinesen builds a case for how absent rather than poor management has caused crises and recessions.

What are "tail risks", and why should you care?https://www.allianz.com/en/press/extra/knowledge/finance/150629-what-are-tail-risks...Jun 29, 2015 · Tail risks can have a completely different impact depending on the individual situation: Those who were fully invested in equities in 2008 will recall the collapse of Lehman Brothers as a nightmare. In contrast, for investors in Bunds, the year was one of the best ever.

To reduce dependence on IPPs, Suzlon to focus on captive ...https://www.thehindubusinessline.com/companies/to-reduce-dependence-on-ipps-suzlon-to...Jan 17, 2018 · What if something happens elsewhere in the world, like the collapse of Lehman Brothers, and funds-starved IPPs exit the market even if for a few …

LEHMAN BROTHERS QUARTO ATTO | Pagina 66 | Forum di ...https://www.investireoggi.it/forums/threads/lehman-brothers-quarto-atto.88789/page-66Lehman Attys Tout Progress As 9th Ch. 11 Anniversary Nears August 17, 2017-- As the ninth anniversary of Lehman Brothers’ historic collapse approaches, attorneys overseeing the wind-down of …

A decade of success in the container shipping industry ...https://blog.greencarrier.com/a-decade-of-success-in-the-container-shipping-industry...Oct 17, 2018 · Let us start from the beginning. The success of Greencarrier Liner Agency in Latvia goes all the way back to 2008 when the financial collapse and bankruptcy of Lehman Brothers was a fact. The company started at the very bottom and slowly but steadily grew as the shipping market recovered.

Lehman Brothers Next Wall Street Bank to Go Bust? :: The ...www.marketoracle.co.uk/Article4048.htmlLehman Brothers Next Wall Street Bank to Go Bust? Companies / Credit Crisis 2008 Mar 18, 2008 - 01:05 AM GMT. By: Nadeem_Walayat In the wake of Bear Stearns Firesale to JP Morgan, which itself is ...

BlackRock Says Insurers May Be New Loan Capitalhttps://www.fa-mag.com/news/blackrock-says-insurers-may-be-new-loan-capital-8483.htmlBlackRock, based in New York, is seeking capital for a market that shrank by about 13 percent since the 2008 collapse of Lehman Brothers Holdings Inc. caused investors to shun riskier assets such ...

Garrett Fail - Weil, Gotshal & Manges LLPhttps://www.weil.com/people/garrett-failGarrett Fail is a partner in Weil’s Business Finance & Restructuring Department. Mr. ... Lehman Brothers Holdings Inc. and its affiliates, ... Electric Company filed for bankruptcy in March 2017 and emerged in August 2018 with a concurrent sale to Brookfield for a transaction value of $3.8 billion, or $4.6 billion including the assumption of ...

Not a far-fetched idea: How one man built a $1.5bn fashion ...https://www.bbc.com/news/business-37629627Nov 07, 2016 · Trouble soon arrived, however, in the form of the global financial crisis, with US banking group Lehman Brothers collapsing just two weeks after Farfetch's launch.

A Debt Default Is Serious, But Not the End of the World ...cepr.net/publications/op-eds-columns/debt-default-is-serious-but-not-the-end-of-the-worldOct 15, 2013 · If the benign debt default story is silly, so is the apocalypse story. When the collapse of Lehman Brothers caused a tsunami in the financial sector, this was because trillions of dollars in assets, specifically mortgages and mortgage backed securities, were suddenly recognized as being worth much less than their face value.

EWA KARWOWSKI | PhD in Economics | University of ...https://www.researchgate.net/profile/Ewa_KarwowskiThe latest economic crisis shook the previously firm belief in the prosperity-bringing financial sector around the globe. For many months after the catalytic bankruptcy of Lehman Brothers, the ...

Paulson, Goldman CEO spoke often in heat of crisishttps://www.ibtimes.com/paulson-goldman-ceo-spoke-often-heat-crisis-307525The New York Times on Saturday reported records of two dozen conversations between Paulson and Goldman chief executive Lloyd Blankfein the same week last September that rival bank Lehman Brothers ...[PDF]New Twists on an Old Plot: Investors Look to Avoid the ...openscholarship.wustl.edu/cgi/viewcontent.cgi?article=1028&context=law_lawreview229 . NEW TWISTS ON AN OLD PLOT: INVESTORS LOOK TO AVOID THE WASH SALE RULE BY HARVESTING TAX LOSSES WITH EXCHANGE-TRADED FUNDS . On October 7, 2007, all seemed well on Wall Street as the Dow Jones

The 2008 Global Financial Crisis and are we close to ...https://www.chan-naylor.com.au/2008-global-financial-crisisTen years ago on 15 September 2008, a 158-year-old global financial services firm, Lehman Brothers, declared bankruptcy which led to the worst global economic disaster since America’s Great Depression of 1929. In Australia, it was known as the 2018 Global Financial Crisis. So what factors unleashed the global financial crisis?

Economy – The Political Hawkhttps://thepoliticalhawkblog.wordpress.com/tag/economyWhen the Lehman Brothers got bankrupt in 2008, it initiated a shock wave through out the planet and dragged the world into a turmoil know as the 2008 financial crisis. The crisis exposed the dark side of the banks to the whole world. Without any doubt the banks were responsible for the disaster but instead … Continue reading Not Too Big To ...

Chris Harman: The trillion dollar crash (Winter 2009)https://www.marxists.org/archive/harman/2009/xx/trillion.htmlThe manner in which Lehman Brothers failed disrupted the trust that underpins the smooth functioning of market economies. ... General Motors said it needed $4 billion immediately to avoid bankruptcy and Ford joined them in asking for a $34 billion government handout. ... Iceland and the Netherlands as well as the US, and bringing the whole ...[PDF]Number 959 16 November 2009 - Latham & Watkinshttps://www.lw.com/thoughtLeadership/coeur-défense-decision-confirms-efficacy-of...Another Lehman Brothers entity, Lehman Brothers UK, provided a hedging agreement, in the form of interest-rate caps, in favor of Hold with respect to the loans which provided for a floating interest rate. The collapse of the Lehman Brothers entities on 15 September 2008 resulted in the downgrading of the Lehman entity providing the hedging and thus

Discount Window Data Shows Global Impact Of Crisis | New ...www.newworldorderinfo.com/money/528/discount-window-data-shows-global-impact-of-crisisApr 27, 2011 · Financial institutions started to beg the Fed to help them out as the financial system froze and economy started to dive downward after the Lehman Brothers collapsed in September 2008. The real damage was found when the discount window details sheets were released.

Not a far-fetched idea: How one man built a $1.5bn fashion ...https://www.bbc.co.uk/news/business-37629627Nov 07, 2016 · Trouble soon arrived, however, in the form of the global financial crisis, with US banking group Lehman Brothers collapsing just two weeks after Farfetch's launch.

Economic/Financial Crisis - blogspot.comhttps://sergenehme.blogspot.comLehman Brothers , one of the primary banks in the world, has experienced many difficulties and problems which led to its bankruptcy. On the 15th of November , the economic crisis hits the world with striking news : Lehman Brothers Bankruptcy . This was due to financing too many assests with too little capital which was a very risky move.

Essay on Brief History of Fed & Public Management Issue | Cramhttps://www.cram.com/essay/Brief-History-Of-Fed-Public/FK5Q5TK5CEssay on Brief History of Fed & Public Management Issue. 2047 Words Feb 6th, ... Woodrow Wilson, as the winner of 1912 presidential elections, eventually started to shape the conversation towards a formal conclusion and proposed a combination of private and public representation in a central bank. ... After the Lehman Brothers’ collapse and ...

MFA s Gaine: Alternative strategies to make strong ...https://www.pionline.com/article/20081017/ONLINE/810179995/mfa-s-gaine-alternative...Oct 17, 2008 · Chicago-based Citadel is one of the world’s largest hedge funds, with $18 billion in assets under management. ... % and stem in part from its exposure to Lehman Brothers Holdings Inc., which ...

EuroZone Profiteers: Who Owes Whom? | corpwatchhttps://corpwatch.org/article/eurozone-profiteers-who-owes-whomNov 13, 2013 · When Lehman Brothers, the New York investment bank, collapsed in September 2008, the global economy went into shock. The stock market plunged. U.S. and European banks froze lending to each other, afraid that they might be next. The New York Times called October the "wildest month in the history of Wall Street."

Millionaire Mom Creates .COM Sensation in Dorm Roomhttps://news.yahoo.com/blogs/driven/millionaire-mom-creates-com-sensation-dorm-room...Apr 26, 2012 · One guy went so far as to tell me that his wife handles that," recalls Genevieve. Adding insult to injury, Genevieve was about to face one of the most difficult times in her life. The collapse of Lehman Brothers spawned a domino effect with investors retracting across the board.[PDF]Case: 14-15220 Date Filed: 11/16/2015 Page: 1 of 6media.ca11.uscourts.gov/opinions/unpub/files/201415220.pdfServices, Inc. (“MERS”), Lehman Brothers Bank FSB, and Florida Title Company ... Mr. Marin defaulted on his mortgage loan for a condominium by failing to make his January 1, 2007 payment and has not made a payment on the loan for ... district court suit was for the same thing as the foreclosure suit, namely, title to the condominium.

U.S. Among Most Depressed Countries in the World : collapsehttps://www.reddit.com/r/collapse/comments/9n5pcj/...It's amazing how many financial institutions like Lehman Brothers, Merrill Lynch, Washington Mutual and more were consolidated into the "too big to fail" banks. Now those even bigger banks have another financial crisis looming and this looks to be worse than 2008. Hold on to your hat folks.

Examining the Designation and Regulation of Bank Holding ...https://financialservices.house.gov/uploadedfiles/07.08.2015_paul_h._kupiec_testimony.pdfJul 08, 2015 · 1 When Lehman Brothers failed without a government rescue in September 2008—the failure did not directly drag down any other significant financial firm, even though Lehman was one of the largest nonbank financial institutions in the US. The chaos following Lehman’s bankruptcy reflected the government reversal on its policy of rescuing[PDF]

GM files for bankruptcy – San Bernardino Sunhttps://www.sbsun.com/2009/06/01/gm-files-for-bankruptcyJun 01, 2009 · Lehman Brothers Holdings Inc.’s September 2008 bankruptcy filing is the nation’s largest with $691 billion in assets, and likely served as a catalyst for GM – and Chrysler’s – downfall ...

Monopoly Capitalismhttps://www.marxist.com/monopoly-capitalism.htmThe world economic crisis has claimed a few victims, especially in the dodgy financial sector, such as the Lehman Brothers, but the process of monopolisation is continuing unabated. T-Mobile have just announced they’re to merge with Orange to create the UK’s largest mobile phone service provider, cornering 37% of the market.

Data Governance | Content in Contexthttps://contentincontext.me/category/data-governanceOct 17, 2017 · At the height of the GFC, banks, governments, regulators, investors and corporations were all struggling to assess the amount of credit risk that Lehman Brothers represented to global capital markets and financial systems.One of the key lessons learnt from the Lehman collapse was the need to take a very different approach to identifying, understanding and managing counterparty risk – a ...

# Dont Tread On Me Flag Mean - (2019) Dont Tread On Me ...survivalskills-usa.com/financial-crisis-lehman-brothers/dont.tread.on.me.flag.mean=p15739aIn this busy and stress-filled society eating right can as being a quick and way to help you through your busy schedule. Dont Tread On Me Flag Mean A knife means a great deal to a rv. Knives are one of the critical tools to survive in the woods or any camping or hiking site that you desire to be or learn.

Stockman: Now It Begins—America’s State Wreck Gathers ...https://www.cobdencentre.org/2018/03/stockman-now-it-begins-americas-state-wreck...Within weeks of the Lehman Brothers bankruptcy in September 2008, Washington, with Wall Street’s gun to its head, propped up the remnants of this financial mess in a panic-stricken melee of bailouts and money-printing that is the single most shameful chapter in American financial history.

Investors expect Fed to tap brakes - POLITICOhttps://www.politico.com/tipsheets/morning-money/2013/09/investors-expect-fed-to-tap...LEHMAN DEMISE GENERATED BILLIONS IN FEES — FT’s Tracy Alloway in New York: “When Lehman Brothers failed almost five years ago, it set off a global financial crisis — and a …

Weekend reading: Download a free e-version of Ray Dalio’s ...https://monevator.com/weekend-reading-download-a-free-e-version-of-ray-dalios-new-big...Sep 14, 2018 · What caught my eye this week. I can’t believe it’s 10 years since those crazy weeks of 2008, when the fall of the US bank Lehman Brothers took the global financial system to the edge.. But I guess I have my own additional reasons to feel this way. At the height of the financial crisis, my father was unconscious in intensive care. He’d had a massive heart attack, but somehow survived it.

You'll Be Jealous of Your Local Prepper Chick When the ...https://jezebel.com/youll-be-jealous-of-your-local-prepper-chick-when-the-s-5989534MY OWN ATTEMPTS at prepping started at a point between the fall of Lehman Brothers and the corresponding rise of quantitative easing, when it occurred to me — as, of course, it did to many ...[PDF]A Study on Enterprise Risk Management and Business …https://file.scirp.org/pdf/JFRM_2018032914544736.pdfThe US subprime mortgage fiasco came to a spectacular head in 2008 with the collapse of well known institutions like Bear Sterns in March 2008 and Lehman Brothers later in September. The open economy of Singapore did not come out unscathed in the ensuing global …

Senate - The US Politics discussion | Page 667 | Jedi ...https://boards.theforce.net/threads/the-us-politics-discussion.50007263/page-667Jan 12, 2017 · This is one of those times. ... or “hanging chads” or 9/11 or “Mission Accomplished” or the inundation of the Lower Ninth Ward or the collapse of Lehman Brothers or the absurd birther movement that undermined the Age of Great Expectations. It was the way all these events together exposed those expectations as radically suspect."

The state of cleantech venture capital, part 1 ... - Gigaomhttps://gigaom.com/2011/11/28/the-state-of-cleantech-venture-capital-part-1-the-moneyNov 28, 2011 · In September 2008, Lehman Brothers filed for bankruptcy and the stock market went into free-fall, losing 30 percent of its value by year-end. This spooked investors of all types, venture capitalists included, and cleantech start-up investment dropped by a third in 2009.

Germany: the miraculous machinehttps://www.theaustralian.com.au/business/business-spectator/news-story/germany-the...When the failure of Lehman Brothers at the end of 2008 led to a collapse in demand for the country’s goods – and the economy contracted faster than most other industrialised countries ...

Astrology of Today’s News – Page 270 – Astroinform with ...https://star4cast.com/astrology-of-todays-news/page/270The Lehman Brothers/sub-prime/banking collapse happened in 2007/08, sending countries globally into a downward spiral for a few years. But the banksters didn’t end up in prison, power-hosed out of the Augean stables. They kept their bonuses, prospered and the taxpayers took the pain.

Huge Trouble Is Percolating Just Under The Surface Of The ...www.thesleuthjournal.com/huge-trouble-is-percolating-just-under-the-surface-of-the...Apr 21, 2015 · All of this reminds me of the months leading up to the implosion of Lehman Brothers. Most people were feeling really good about things, but huge trouble was brewing just underneath the surface. Finally, one day we learned that Lehman Brothers had …[PDF]Chasing Stars - Project MUSEhttps://muse.jhu.edu/chapter/1439809In 1994, Josie Esquivel was in her seventh year at Lehman Brothers.1 Though barely forty, Esquivel was a legend on Wall Street: having arrived at Leh-man in 1987 with almost no experience, she had been voted one of the best equity analysts in her industry a mere eighteen months later. And a few[PDF]Financial Interconnectedness, Amplification, and Cross ...https://www.boj.or.jp/en/research/wps_rev/wps_2019/data/wp19e11.pdfThis is because it is such interconnectedness that invoked investors' uncertainty and fears about financial institutions, which drove their disruptive reactions (i.e., runs) and contagions in response to negative events such as the collapse of Lehman Brothers, making these events a trigger for the full-blown financial crisis. 2[PDF]JUNE 2009 The Reform Agenda - World Banksiteresources.worldbank.org/...Reform_Agenda.pdfThis is the second in a series of policy briefs on the crisis—assessing the policy responses, shedding light on financial reforms currently under debate, and providing insights for emerging-market policy makers. JUNE 2009 NOTE NUMBER 2 The Reform Agenda[PDF]Measuring Financial Market Liquidity and Risk Aversion ...https://www.ecb.europa.eu/pub/pdf/fsr/art/ecb.fsrart200712_04.en.pdfstates can persist for a considerable period, they seem to be followed by periods of higher risk aversion and reduced market liquidity as has been the case from July 2007 onwards. INTRODUCTION When strains start to emerge in ? nancial markets, as was the case from late July 2007 onwards, the risk appetite of investors is usually

Lessons from the European meltdown | The Courier-Mailhttps://www.couriermail.com.au/ipad/lessons-from-the-european-meltdown/news-story/653c...THE Great Depression did not begin with the Wall Street crash of 1929. That event did lead to a prolonged recession in the same way the collapse of investment banking giant Lehman Brothers in 2008 ...

The Silicon Graybeard: IMF Warns of Financial Instabilityhttps://thesilicongraybeard.blogspot.com/2015/11/imf-warns-of-financial-instability.htmlNov 09, 2015 · As the Guardian puts it: Massive monetary policy stimulus has rekindled growth in developed economies since the deep recession that followed the collapse of Lehman Brothers in 2008; but what the IMF calls the “handover” to a more sustainable recovery – without the extra prop of ultra-low borrowing costs – has so far failed to materialise.

Q&A with VTB CEO Andrey Kostin | Euromoneyhttps://www.euromoney.com/article/b12kjzg4whfm9w/qampa-with-vtb-ceo-andrey-kostinOn the other hand we helped to rescue the fifth-largest bank in Russia. Actually, we prevented a Lehman Brothers-like negative effect on the domestic banking sector as a whole. Of course we find it very regrettable that the UK authorities gave political asylum to a person who committed a huge criminal offence in Russia.[PDF]arXiv:1602.05998v2 [q-fin.PR] 11 Jun 2017https://arxiv.org/pdf/1602.05998.pdfwere Fannie Mae, Freddie Mac, Lehman Brothers, Washington Mutual, Landsbanki, Glitnir and Kaupthing, to which we could also add Merrill Lynch). One of the explosive manifestations of this crisis was the sudden divergence between the rate of overnight indexed swaps (OISs) and the LIBOR rate, pointing to the credit and liquidity risk existing

Profile: Alistair Darling - BBC Newshttps://www.bbc.com/news/uk-politics-14779262Sep 04, 2011 · But Mr Darling gradually appeared to grow into the job and staked out his independence when, in the summer of 2008 - and not long before the collapse of Lehman Brothers - …

When Raghuram Rajan proved giant Alan Greenspan wrong ...https://www.businesstelegraph.co.uk/when-raghuram...Sep 15, 2018 · Ten years ago, on this day, Lehman Brothers filed for bankruptcy and triggered a global financial crisis that destroyed thousands of jobs and brought down several big financial institutions. So strong was the belief in the infallibility of the market that few could see the crisis coming. One of those few was Raghuram Rajan, who […]

Recon, rebuild, recover: Alvarez & Marsal’s three-step ...https://www.thenational.ae/business/recon-rebuild-recover-alvarez-marsal-s-three-step...By the time of the global financial crisis in 2008, it had established itself as the go-to firm for restructuring advice, and earned itself the challenge of getting to grips with Lehman Brothers ...

CEE architects of transition: Andreas Treichl | Euromoneyhttps://www.euromoney.com/article/b1fbrkktfb1334/cee-architects-of-transition-andreas...May 14, 2019 · It is more than 10 years since the collapse of Lehman Brothers, but Andreas Treichl still hasn’t forgiven himself for what he sees as the biggest mistake he made in the run-up to the financial crisis. “I had always been vehemently opposed to currency-mismatched lending to individuals,” says the veteran chief executive of Erste Group.

Profile: Alistair Darling - BBC Newshttps://www.bbc.co.uk/news/uk-politics-14779262Sep 04, 2011 · But Mr Darling gradually appeared to grow into the job and staked out his independence when, in the summer of 2008 - and not long before the collapse of Lehman Brothers - …

Bernanke Admits Fed Made Mistakes Combating Crisis 10 ...https://au.investing.com/news/economy-news/...Bernanke, the Fed chief from 2006 until 2014, is now a distinguished fellow at the Brookings Institution in Washington. He singled out the panic that engulfed the financial system with the 2008 collapse of Lehman Brothers Holdings Inc. as the key reason for the depth of the recession back then.

Black Swan Definition - MBA Skool-Study.Learn.Share.https://www.mbaskool.com/business-concepts/finance-accounting-economics-terms/11807...Example: The collapse of Lehman Brothers can be suitably termed as a Black Swan event. It came as a big surprise to the whole world; it brought down the whole world economy with it and the major reason attributed to it was the lack of proper regulatory controls in the American banking industry.[PDF]SAPAN GUPTA - Lex Mundiwww.lexmundi.com/Document.asp?DocID=8011Before joining the Firm, Sapan was working as the Chief Legal Officer at Bajaj Finance, one of the largest non-banking finance company in the country with asset under management of USD 6 billion. Prior to the current assignment, Sapan was the Head of Legal …

Translate reprising in Russian with contextual exampleshttps://mymemory.translated.net/en/English/Russian/reprisingTranslate this pageThe second is that the ECB knows that the financial system lacks transparency – and knows that investors know that they cannot gauge the impact of an involuntary default, which could cause credit markets to freeze, reprising the aftermath of Lehman Brothers’ collapse in September 2008.

Polish banks haunted by Swiss franc mortgages in European ...https://www.thepeninsulaqatar.com/article/29/09/2019/Polish-banks-haunted-by-Swiss...Since the collapse of Lehman Brothers in 2008 the Swiss franc has risen 85% from 2.18 zloty to 4.04 zloty, while this year alone it appreciated by 6% against the Polish currency. ... "This is the ...

Keyword: carbontradinghttps://www.freerepublic.com/tag/carbontrading/indexRemember Enron, the corrupt firm whose failure should have disproved the myth "too big to fail", but didn't? At the time it was the seventh largest corporation. It's bankruptcy was the largest in history until Lehman Brothers failed. Incidentally, Lehman Brothers was also involved in carbon trading.[PDF]The New Crisis for the New Century: Some Observations on ...https://scholarship.law.cornell.edu/cgi/viewcontent.cgi?article=2492&context=facpub6. Perhaps, the most vivid illustration of this complex dynamics was the infamous conflict between the United Kingdom and Iceland over the U.K. ... new scheme will be in practice and whether or not it will serve as the first step toward a more comprehensive system of global ... such as Lehman Brothers or American International Group (AIG), but ...[PDF]Japan's Economy in 2009: Review of the Year and Challenges ...https://www.boj.or.jp/en/announcements/press/koen_2009/data/ko0912d.pdfJapan's Economy in 2009: Review of the Year and Challenges Ahead ... financial crisis caused by the failure of Lehman Brothers in the autumn of 2008. While ... balance-sheet adjustment, which I mentioned as the first factor, remains in the U.S. and European economies. Therefore, there is an increasingly stark contrast between the slow

Maintaining price stability with unconventional monetary ...https://www.ecb.europa.eu/press/key/date/2018/html/ecb.sp180129.en.htmlThe first phase was the immediate liquidity crisis triggered by the turning of the global financial cycle and the subsequent collapse of Lehman Brothers. Market funding came to a sudden stop for many financial institutions. The ECB’s response was to lower its main refinancing rate to the then record low of 1% in May 2009, to expand the range ...

Extending CalPERS V. ANZ Securities To Exchange Act Cases ...https://www.law360.com/articles/966452/extending-calpers-v-anz-securities-to-exchange...Sep 21, 2017 · At issue in CalPERS was the timeliness of an individual opt-out suit brought by CalPERS under Section 11 of the Securities Act arising out of Lehman Brothers’ collapse. The pension fund filed ...[PDF]Jose Manuel Gonzalez-Paramo: The response of the ...https://www.bis.org/review/r091113d.pdfJosé Manuel González-Páramo: The response of the Eurosystem to the financial crisis Keynote speech by Mr José Manuel González-Páramo, Member of the Executive Board of the European Central Bank, at the European Parliament’s Special Committee on the Financial, Economic and Social Crisis (CRIS), Brussels, 10 November 2009. * * *

The risk of high capital flow - chinadaily.com.cnwww.chinadaily.com.cn/business/2011-04/20/content_12364697.htmBut the credit and asset bubbles under way expose them to a risk of a sharp asset correction and economic downturn, even more so than seen during the Lehman Brothers' collapse - only this time ...[PDF]final approved isda Lehmanshttps://www.oeclaw.co.uk/images/uploads/documents/HFS Lehman Judgment.pdf1. This is an application by the Joint Administrators of Lehman Brothers International Europe (“LBIE”) for directions as to the true construction and effect of five interest rate swap agreements (“the Swaps”) pursuant to which LBIE was, when it went into administration on 15th September 2008, the floating rate payer. Each Swap

Peter Praet: Maintaining price stability with ...https://thefinancialanalyst.net/2018/01/29/peter-praet-maintaining-price-stability...Jan 29, 2018 · The first phase was the immediate liquidity crisis triggered by the turning of the global financial cycle and the subsequent collapse of Lehman Brothers. Market funding came to a sudden stop for many financial institutions. The ECB’s response was to lower its main refinancing rate to the then record low of 1% in May 2009, to expand the range ...[PDF]Scanned with CamScannerhttps://learningandunlearning.weebly.com/uploads/5/1/4/4/51442353/bad_money_phillips.pdfAs the mortgage markets seized up in mid-2007, shrewd players un- derstood the virginity of the terrain. Jack Malvey, the chief Aoba] fixed- income strategist for Lehman Brothers, explained: "This is what we Would characterize as the first correction of the neo-credit market. We've

House prices in five UK cities still struggling to recover ...https://propertyindustryeye.com/house-prices-in-five-uk-cities-still-struggling-to...Aug 28, 2018 · Ten years ago, in September 2008, investment bank Lehman Brothers collapsed – a global event which followed the run on Northern Rock the previous year, when it became the first British bank to fail for 150 years. ... “While 2008 was the year when house prices fell at their fastest rate, they continued to fall for a further three to four ...

1.2 Conjugacy? Chapter 1 Week 1- Bayesian inference.https://maths.lancs.ac.uk/grabows1/web/accessible/math331/lectures.tex/Ch1.S2.htmlLehman Brothers filed for bankruptcy on 15 September 2008, prompting a fall in the FTSE 100 of 4%. It was the beginning of a slump that by Christmas of that year had resulted in 23.4% being wiped off the value of Britain’s top 100 companies.

2Q Review | Salt Creek Investorshttps://saltcreekinvestors.com/sci-2nd-quarter-reviewRebalancing is performed as soon as the data is available at the end of each calendar quarter. Quick Facts. In the eight years since the collapse of Lehman Brothers, the world’s top 50 central bankers have, on average, cut rates once every three trading days. 10 cuts occurred in June (Alex Dryden).

The Arc of Optimism - Open The Magazinehttps://openthemagazine.com/lounge/books/the-arc-of-optimismJun 14, 2017 · The S&P index lost close to 50 per cent of its value between late 2007 and 2009. In this period, a number of American financial institutions either collapsed, for example Lehman Brothers, or had to be bailed out by the government, as in the case of insurance giant AIG. The effects of that crisis continue to linger.

Essay about The Impact of the Financial Crisis on ...https://www.studymode.com/essays/The-Impact-Of-The-Financial-Crisis-1302485.htmlDec 10, 2012 · The bankruptcy of a US investment bank, Lehman Brothers, in 2008 turned a severe credit crunch into the worst financial crisis since the Great Depression, resulting in an unprecedented dislocation in financial markets and damaging stability and confidence in many advanced financial systems. The unprecedented pouring of financial support[PDF]Board of Directorshttps://www.hdfcsec.com/Admin/CmsApp/MediaGalary/hsl.docs/HDFC Securities Annual Report...as the most significant area of concern. WPI remained above 9% till Nov 2011 (peaking at 10% in Sept 2011) before falling to 6.95% in Feb 2012. This compelled RBI to adopt a tight liquidity regime, by raising repo rates 13 times in a row by a total of 375 bps till Oct 2011. Coupled with domestic factors, which led to a …

Trump Trump - Teller Reporthttps://www.tellerreport.com/life/2019-08-01---trump-trump-.SJgQh7qeQH.htmlThe endless and uncontrolled sale and resale of unsecured mortgage debt led to a giant financial market bubble, corporate bankruptcies like Lehman Brothers and the rescue of state agencies Fannie Mae and Freddie Mac with US taxpayers money ($ 187 billion, for a second), many of whom lost their houses.[PDF]The Consequences of the Great Financial Crisis: Five Years Onhttps://www.boj.or.jp/en/announcements/press/koen_2012/data/ko121012d.pdfglobal growth remained at an elevated level for a long time, averaging around 5 percent annually from 2004 until the failure of Lehman Brothers in 2008. While this number was inflated by the unprecedented credit bubble, it was significantly higher than the 3 percent level …[PDF]3Q07 - Tesshttps://www.rswinvestments.com/wp-content/uploads/3q07.pdf***Lehman Brothers Municipal Bond Index, is a broad-based total return index comprising investment grade, fixed-rate, and tax-exempt issues, with a remaining maturity of at least one year, including state and local general obligation, revenue, insured, and pre-refunded bonds that are selected from issues[PDF]The impact of macro-economic variables on the sovereign ...https://www.vdmeer.net/wp-content/uploads/2013/09/MscThesis_HugoSand_SovereignCDS...of this was the bankruptcy of the American investment bank Lehman Brothers. This bank still ... This is mostly because the CDS is still a relatively young ... the first paper that focuses primarily on the impact of macro-economic variables on sovereign CDS spreads. By selecting variables that are known to determine other credit risk measures, the

Gold below 1200 USD/oz - Bo Engstromhttps://boengstrom.com/1200-usdozDec 19, 2013 · The US national bank has after the turmoil from 2008 and the fall of Lehman Brothers Bank been assisting the banking system by buying bank instruments . They have been feeding the banking system with 85 billion USD per month for a long time. Yesterday was the first day of a decreased pumping out of funds. They reduced with 10 billion USD per month.[PDF]ces2015blog.files.wordpress.comhttps://ces2015blog.files.wordpress.com/2016/09/the-sovereign-debt-crisis-in-the-euro...tember, 2008, with the collapse of Lehman Brothers, which led to a global banking crisis as well as a global recession in late 2008 and 2009. The tragedy for Europe is that while the rest of the world started to recover soon after, towards the end of 2009 the crisis morphed into …

The Next Crashhttps://www.cadtm.org/The-Next-CrashSep 17, 2018 · Ten years after Lehman Brothers collapsed, it’s important to understand that the real root of the Great Recession wasn’t a banking crisis. It was the growing imbalance between consumer spending and total output – brought on by stagnant wages and widening inequality. That imbalance is back. Watch your wallets.

Property developer offers to absorb stamp duty | Property ...https://www.propertyguru.com.sg/.../3/27367/property-developer-offers-to-absorb-stamp-dutyIt was the same month that the US investment bank Lehman Brothers collapsed, triggering the global fiscal turmoil. Although there were 68 units sold during the first month after the launch, sales have tapered off about eight per month over the last 16 months.[PDF]Extract from Daily Hansard Wednesday, 14 April 2010https://www.parliament.qld.gov.au/documents/Speeches/spk2010/Ray Stevens spk Mermaid...Owing to Australia’s four pillars policy, this situation exists throughout our banking industry. With Lehman Brothers being the first of many major financial firms in the US to go down the tube because of the subprime mortgage collapse, with fina ncial institution after financial inst …

RURAL AFFAIRS Distress, economic and societal, pervades ...newsweekly.com.au/article.php?id=58652Pivotal for Keynes was “the marginal efficiency of capital” (MEC). This is technically defined as “the rate of discount which would make the present value of the series of annuities [repayments] given by the returns expected from the capital asset during its life just equal its costs”.[PDF]An Introductory Approach to Risk Visualization as a Servicewww.ronpub.com/./OJCC-v1i1n01_Chang.pdfVictor Chang : An Introductory Approach to Risk Visualization as a Service 1 An Introductory Approach to Risk Visualization as a Service Victor Chang A, B A School of Computing, Creative Technologies and Engineering, Leeds Metropolitan University, Headingley, Leeds LS6 3QR, UK, V.I.Chang@leedsmet.ac.uk[PDF]GGD-92-15 Tax Administration: Standards Adhered to in ...https://www.gao.gov/assets/220/215278.pdfThis is so because the ... for a corporation with net operating losses would be useless) while the ... rejected the first alternative because of the difficulty of sustaining the position that ARPS were debt and because attempting to do so was Page 4 GAO/GGD-92-15 Tax Administration ...[PDF]EU Prepares Grab Le Monde For Bank Accountshttps://larouchepub.com/eiw/public/2013/eirv40n20-20130517/21-22_4020-hzl.pdfMay 17, 2013 · lapse of Lehman Brothers, it is not surprising that the publicly owned bank Kreditanstalt für Wiederaufbau (KfW), has simulated the worst-case scenario of the fi-nancial system: the collapse of a “too big to fail” bank, with a subsequent global chain reaction and the collapse of the Eurozone. In this case, the printing of money to an

Kitco - Commentaries - Reginald W. Ogdenhttps://www.kitco.com/ind/ogden/jun182008.htmlJun 18, 2009 · Even before the collapse of Lehman Brothers, the toll on manufacturing industry of escalating commodity prices, especially oil, was threatening to waylay the stock, real estate and commodity bull market in its tracks. In a Tale of Two Cities by Charles Dickens, described that turbulent era as `the best of times and the worst of times”. For ...

LA SOLIDARIDAD: Why the Arroyo Family and Its Rasputins ...https://laonlaan.blogspot.com/2009/05/why-arroyo-family-and-its-rasputins.htmlMay 20, 2009 · Especially after the collapse of the Lehman Brothers and the near-bankruptcy of the American Insurance Group (AIG), federal treasury officials have obtained documentation of the money laundering that the Arroyo Family has been doing. ... This is the reason First Gentleman Mike Arroyo cannot now set foot in any American territory as the Federal ...

Gold and Silver News: September 2013https://goldsilvernews.blogspot.com/2013/09Gold rose in the years preceding the crisis when more prudent observers were warning about risks emanating from cheap money policies, overheating stock and property markets, an out of control derivatives market and the shadow banking system. A Lehman Brothers style crisis was obvious to many analysts who warned of systemic risk.[DOC]Revisiting Systemic Risk in the Modern Global Economywww.gcbe.us/2010_OBEC/data/George C. Philippatos, Roger W. Clark.doc · Web viewAs the bank continued to flounder it was resold to the former Detroit Bank and Trust Company, known today as Comerica. The First Pennsylvania Bank of Philadelphia was the nation’s oldest bank, dating back to the Bank of North America, that was created by the Continental Congress in 1781.

Unheard Alarms part3!bmcog.org/sermons/june/2012/shemitah_aud.htmlIsaiah 9:19 Through the wrath of the LORD of hosts is the land darkened, and the people shall be as the fuel of the fire: no man shall spare his brother. Let's pray. Father, Open my eyes so I can see Your truth. Open my ears so I can hear Your voice. Open my mind so I can understand Your Word.[PDF]Smash hits and crash dips - Legal & General Investment ...https://www.lgim.com/files/_document-library/insights/investor-education/2017/smash...choice as the low point. It was the second best-selling single of the year, hang your heads in shame Britain. 2007: CRACKS IN THE ROCK By 2007 there had been 40 consecutive quarters of economic growth in the UK, and the Nationwide House Price Index doubling over a decade, but the party had been going for a little too long. Outside[PDF]Global COE Hi-Stat Newsletter No. 5 (February 2011)gcoe.ier.hit-u.ac.jp/english/research/newsletters/PDF/Newsletter_No_5_English.pdfslow to undertake this structural transformation, it was the country affected the hardest among advanced economies by the recession following the collapse of Lehman Brothers. Prof. Miyagawa suggested that such structural change involves the move from a labor-intensive to a capital-intensive and knowledge-intensive economy. The government

Gold takeovers set record to boost fees at BMO, HSBC ...https://nationalpost.com/news/gold-takeovers-set-record-to-boost-fees-at-bmo-hsbc/wcm/...Aug 02, 2010 · Bullion advanced to a record US$1,266.50 in June and is set for a 10th straight annual gain, the longest winning streak since at least 1920, attracting investment by …[PDF]Global COE Hi-Stat Newsletter No. 5 (February 2011)gcoe.ier.hit-u.ac.jp/english/research/newsletters/PDF/Newsletter_No_5_English.pdfslow to undertake this structural transformation, it was the country affected the hardest among advanced economies by the recession following the collapse of Lehman Brothers. Prof. Miyagawa suggested that such structural change involves the move from a labor-intensive to a capital-intensive and knowledge-intensive economy. The government[PDF]Smash hits and crash dips - Legal & General Investment ...https://www.lgim.com/files/_document-library/insights/investor-education/2017/smash...choice as the low point. It was the second best-selling single of the year, hang your heads in shame Britain. 2007: CRACKS IN THE ROCK By 2007 there had been 40 consecutive quarters of economic growth in the UK, and the Nationwide House Price Index doubling over a decade, but the party had been going for a little too long. Outside

Fed's Daniel Tarullo on Bank Liquidity, Financial System ...https://www.bloomberg.com/news/videos/2014-11-20/tarullo-says-regulators-plan-to...Nov 20, 2014 · This process left those intermediaries in increasingly fragile funding positions and by the time Lehman Brothers collapsed in September 2008 the system was primed for a …

Think You’ve Got Cash In The Bank ... - Barnaby Is Righthttps://barnabyisright.com/2012/02/05/think-youve-got-cash-in-the-bank-think-againMar 17, 2013 · Households pulled about $5.5bn out of their banks in the 10 weeks between US financial house Lehman Brothers going broke – the onset of the global financial crisis – and the beginning of December. That is roughly 80 tonnes of cash salted away in people’s homes. Mattress Bank is doing well, was the view at the Reserve.

JS | zoningthegardenstatehttps://zoningthegardenstate.wordpress.com/author/jadsalloumColony Capital soon took the project, but only for a short amount of time before construction stalled because of the bankruptcy of the Lehman Brothers. The next group to attempt funding this massive project was the Triple Five Group.

New Trends in Auditor Liability | SpringerLinkhttps://link.springer.com/article/10.1017/S1566752911300031The results of the analysis of the first arguments used by the EC together with the impact of the crisis lead to a conclusion regarding the need for an updated interpretation of the 2008 Recommendation. ... at pp. 4–7. For a current approach, see Paul L. Davies, Gower and Davies: Principles of Modern ... See In re Lehman Brothers Equity/Debt ...

Lessons of the crisis: Ethics, Markets, Democracyhttps://www.ecb.europa.eu/press/key/date/2010/html/sp100513.en.htmlThe first phase of that instability, starting in August 2007, occurred mainly on the financial markets, ranging from the money markets to the stock markets. With the failure of Lehman Brothers in September 2008, the crisis spread to the real economy, causing trade, consumption and investment to fall worldwide.[PDF]A Sustainable Recovery??https://www.advisorperspectives.com/commentaries/2014/03/27/a-sustainable-recovery.pdfMar 27, 2014 · the decade leading up to the collapse of Lehman Brothers), but a decent start. What is more important is whether the hoped-for improvement in consumer sentiment and stabilisation in Europe can finally ignite a virtuous circle of higher business investment, growing productivity and …