Home

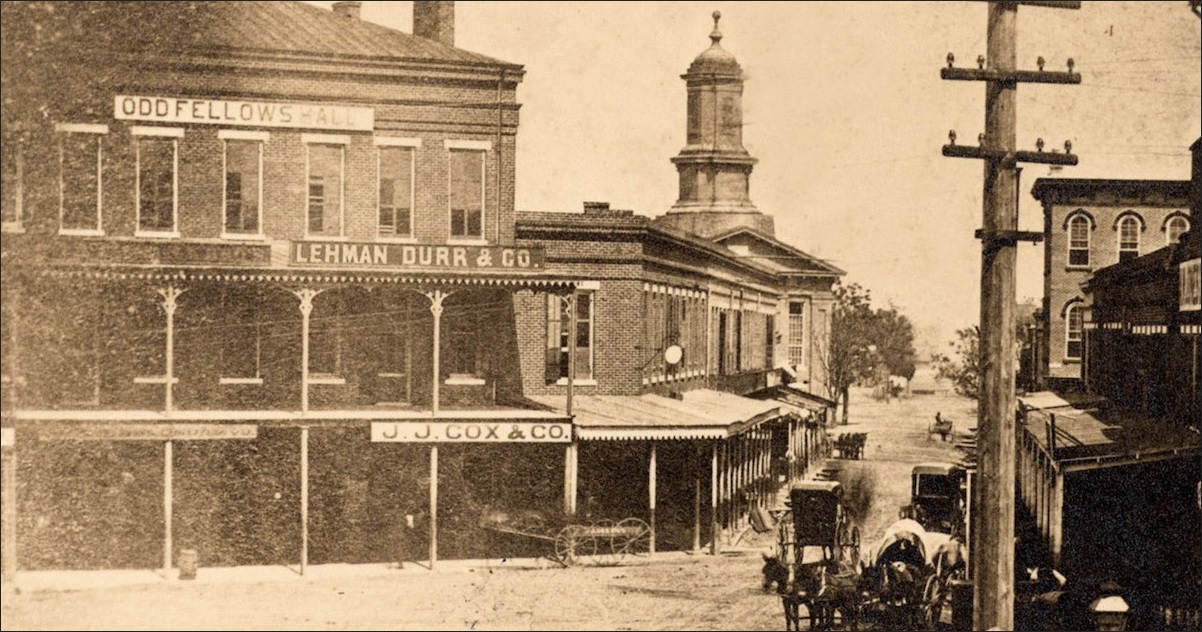

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Many American companies seek government help-????https://language.chinadaily.com.cn/auvideo/2009-01/...Translate this pageThis is the VOA Special English Economics Report. This week, we continue our look back at the major economic stories of the year. On September 15th, Lehman Brothers, a 158 year-old investment bank, sought legal protection from its creditors. It had failed to find a buyer after months of searching.

Demographics And Classism Stymie Hillary And Propel Bernie ...https://cantbelievemyeyes.wordpress.com/2016/05/02/demographics-and-classism-stymie...May 02, 2016 � Demographics And Classism Stymie Hillary And Propel Bernie As US Is Divided. Posted on May 2, ... This is positioning Sanders with a more favorable chance at beating any Republican candidate than Clinton, who would lose to Rubio and Cruz. ... focusing blame at non-bank entities like AIG and Lehman Brothers while omitting Wall Street�s biggest ...[PDF]PUBLIC CITIZEN - Federal Reserve Systemhttps://www.federalreserve.gov/SECRS/2015/February/20150205/R-1503/R-1503_020215...holding company and one of the largest holding companies in the United States by assets, with ... As seen in the failure of Lehman Brothers, which precipitated ... This is a relatively fragile source. As the market revalues GE's assets, such funding can evaporate. It is not sound practice that a mature

McCain Sending Palin to U.N.? - Accuracy in Mediahttps://www.aim.org/aim-column/mccain-sending-palin-to-unSep 17, 2008 � But that�s like visiting Lehman Brothers to accentuate her economic expertise. ... opposition to a U.N. tax may be an indirect reference to Barack Obama�s Global ... such as the �

January | 2014 | Business storytellinghttps://b2bstorytelling.wordpress.com/2014/01Jan 30, 2014 � In 2005 �in-between the burst of the internet bubble and the demise of Lehman Brothers� when there was still corporate money to spend on single-customer marketing campaigns, my company (at that time pre-merger Alcatel) organized a solutions showcase for a major UK customer.

Ivory Coast | Read this and hack!https://bizgovsoc6.wordpress.com/tag/ivory-coastThe chocolate industry would clearly benefit from Fair Trade certification, as the Fair Trade system means that farmers get a premium price for their cocoa, which would hopefully lead to a decrease in the number of children forced into slave labor on cocoa farms.[PDF]Renegade U.S. Officials Go for New Cold Warhttps://larouchepub.com/eiw/public/1977/eirv04n50-19771213/eirv04n50-19771213_008...slated for a job as international troubleshooter for the merging investment houses of Lehman Brothers and Kuhn Loeb. Congressional, Industrial Support For Capital Formation Grows Former Treasury Secretary William Simon's call for a broad-based political mobilization urging a high-techno logy jobs and export policy for the U.S., issued at the

Vincent Denoiseux - Head of ETF Research and Solutions ...https://uk.linkedin.com/in/vdenoiseuxVincent was my mentor during my 6-months internship at Lehman Brothers. During this internship I worked with Vincent on a long term project (development of a tool to rank and score the overperformance of mutual funds - "Alpha" - for a portable alpha strategy).Title: Head of ETF Research and SolutionsLocation: London, United Kingdom500+ connections

FREETHOUGHT-- A blog about social issues, politics ...https://freethoughtmovement.blogspot.comTwo days after Lehman Brothers and AIG have become household names for unfortunate reasons and 50 days before the Presidential election. ... I will not comment because I have nothing nice to say about this and the remedies put to use so far for this "disease" as the Wall Street Journal has called it make no sense. ... This is a revolving ...

International Financial Law Prof Bloghttps://lawprofessors.typepad.com/intfinlaw/2016/04/court-overturns-treasury-decision...It is FSOC�s duty to address the risks associated with very low probability events, just as the failure of AIG or Lehman Brothers would have been considered highly unlikely before the financial ...

PPT - Chapter Nineteen PowerPoint Presentation, free ...https://www.slideserve.com/laksha/chapter-nineteen-powerpoint-ppt-presentationMar 24, 2019 � Risks at Financial Institutions. One of the major objectives of a financial institution�s (FI�s) managers is to increase the FI�s returns for its owners Slideshow 4103385 by laksha ... Lehman Brothers, Merrill Lynch ... risk is the risk incurred by an FI as the result of activities related to contingent assets and liabilities Commercial ...

Get: Viagra newborns | edUSAhttps://getedusa.com/?Viagra-newbornsECONOMICS PRIZE: The executives and directors of Goldman Sachs, AIG, Lehman Brothers, Bear Stearns, Merrill Lynch, and Magnetar for creating and promoting new ways to invest money � ways that maximize financial gain and minimize financial risk for the world economy, or for a portion thereof.

Brad Sells Nebraskahttps://bradsellsnebraska.blogspot.comIn 2008, finance giants Lehman Brothers, Bear Sterns, Bank of America and many others fell harder than Shaquille O'Neal in the 2000's. People employed, associated and invested in these companies lost all and/or a majority of their income. So Buffet took that as a time to act and invested $10 billion dollars in one of the worst, Lehman Brothers.[PDF]QUADERNI DEL DIPARTIMENTO DI SCIENZE ECONOMICHE E �https://dipartimenti.unicatt.it/dises-wp_rossa_13_89.pdfEurozone countries, agreed in March, 2012, agreed to a new �fiscal compact� that would force those countries with a debt to GdP ratio above 60% to arrive to a structural deficit of maximum 0.5% and to bring back the debt/GdP ratio to 60% within 20 years. Despite the long time-frame, even this revised mechanism will prove challenging to achieve.

CDL H-Trust � Page 6 - Singapore REITs | Page 6https://sreit.wordpress.com/category/cdl-h-trust/page/6For the seller, a Lehman Brothers entity, the divestment represents a doubling of its investment. Lehman bought the hotel, then known as Hotel New Otani, in 2004 for $82 million from a Wuthelam Group-controlled entity and spent a further $19 million renovating it, resulting in an all-in investment of around $101 million.

LEHMAN BROTHERS HOLDINGS INC. AND JPMORGAN CHASE �https://www.lawinsider.com/contracts/4krJ2...Oct 31, 2003 � THIS FIFTH SUPPLEMENTAL INDENTURE, dated as of October 31, 2003, is between LEHMAN BROTHERS HOLDINGS INC., a corporation duly organized and existing under the laws of the State of Delaware (the �Company�), and JPMORGAN CHASE BANK (formerly known as The Chase Manhattan Bank and prior thereto as Chemical Bank), a banking corporation duly organized and �

LEHMAN BROTHERS HOLDINGS INC. MEDIUM-TERM NOTE, �https://www.lawinsider.com/contracts/51olx7LO1l8UhONPGfBXp/lehman-brothers-holdings...LEHMAN BROTHERS HOLDINGS INC. MEDIUM-TERM NOTE, SERIES I AUSSIE BULL NOTES DUE JUNE 27, 2012 filed by Lehman Brothers Holdings Inc on June 30th, 2008

Dissertation First Draft by sophie wilson - Issuuhttps://issuu.com/sophieindisguise/docs/sophie_wilson_dissertation_submissionDespite earning back the trust of consumers, sadly, Innocent had to face yet more difficulties in the following year. 2008 witnessed the Lehman Brothers (Lehman Brothers Holding Inc.) financial ...

News & Events | PGA.comi.cdn.pga.com/news/golf-buzz?page=705Williams eventually shared title billing with sponsors like Isuzu and Shearson Lehman Brothers, and his name finally disappeared from the title in 1989. The tournament, of course, is now known as the Farmers Insurance Open. Williams died Tuesday at age 84 in Branson, Mo., after battling bladder cancer.

Au Contrarian: Exploiting Bernankehttps://aucontrarian.blogspot.com/2010/09/exploiting-bernanke.htmlThree days before Bernanke spoke, Lehman Brothers (R.I.P.) released its food ingredients cost index for the first 6 months of 2007. It had risen 14.9%. The value of stuff was rising against dollars and against paper assets in general. Detachment of prices from �

Lehman Brothers | Lehman Brothers | Derivative (Finance)https://www.scribd.com/document/121490254/Lehman-BrothersA Case Study The Fall of Lehman Brothers. Submitted To: Prof. Urvi Amin. Submitted By; SUMIT KUMAR (B-04). History of Lehman Brothers The story of Lehman Brothers takes us back to 1844 when a 23 year old Henry Lehman emigrated to the United States from Bavaria.

Patrick Robinson - B�cker | Bokus bokhandelhttps://www.bokus.com/cgi-bin/product_search.cgi...Translate this pageWhen Lehman Brothers bank went under, the world gasped. One of the world's biggest and most successful banks, its downfall was the event that sparked the slide of the world economy toward a Great Depression II. This is the gripping inside story of...

Taxpayer Dollars Paid A Third Of Richest Corporate CEOs ...https://www.huffpost.com/entry/richest-ceos-compensation-ceos_n_3825087Aug 28, 2013 � Goldman Sachs received $10 billion under TARP, and made the list seven times in the past two decades, once after receiving its bailout. Washington Mutual and Lehman Brothers, both of which failed in 2008, also appeared on the list, with Leman making eight appearances before filing �

Moody's Analytics Expertshttps://www.moodysanalytics.com/about-us/subject-matter-experts?solutions...Her expertise is also utilized on other CreditEdge customized projects pertaining to asset managers. In addition, Yukyung is a co-author of various practical research papers. One of her papers was published in the Journal of Fixed Income. Before joining Moody's, Yukyung was at Lehman Brothers as a fixed income strategist in the asset allocation ...

Harry Hoan Tran - Managing Director - Midan Tran - Your ...https://uk.linkedin.com/in/harry-hoan-tran-04775321As the Co-founder and Managing Director of Midan Tran, Harry delights in leading a strong team helping many customers import from and export to Vietnam - a fast growing affluent market with a population of nearly 100 million people and an alternative product manufacturing destination to China. ... Harry is a former banker at Lehman Brothers and ...Title: Managing Director at Midan TranLocation: London, United KingdomConnections: 171

10 Must Reads for the CRE Industry Today (October 13, 2016 ...https://www.nreionline.com/nrei-wire/10-must-reads-cre-industry-today-october-13-2016How Deutsche Bank Is Lehman Brothers and How It Isn�t �Lehman Brothers was simply a spectacular catalyst for the unravelling of a mortgage-debt bubble that was going to take probably a couple ...

PSERS OPPORTUNISTIC REAL ESTATE PROGRAMhttps://www.psers.pa.gov/About/Board/Resolutions/Documents/2007/fortress.pdfLehman Brothers and Thacher Proffitt & Wood. Prior to forming Fortress, the Principals ... has led to a contraction in the subprime ... Acquire assets, either on a stand-alone basis or as the foundation for building a business to own and manage assets; and (iii) Lead the restructuring and recapitalization of distressed businesses, including by ...

Transition from tribulation to triumphhttps://www.chinadaily.com.cn/hkedition/2009-10/14/content_8789012.htmAs the recent protests and petitions to the Central Government Offices demonstrated, there is no shortage of noise on what people want from our government. ... Lehman Brothers, a pillar of Wall ...

Headquarter Building - db0nus869y26v.cloudfront.nethttps://db0nus869y26v.cloudfront.net/en/Shanghai_Commercial_BankThe additional compensation made for the Lehman Brothers Minibonds Repurchase Scheme had a negative impact on the Bank's cost-to-income ratio and it increased to 43.7 percent. Excluding the additional compensation, the ratio would have been 34.9 percent; in 2008, it was 34.3 percent.

Common Uses for Skype - ScienceDirecthttps://www.sciencedirect.com/science/article/pii/B9781597490320500108Common Uses for Skype � Chapter 5 127 Alternative to Plain Old Instant Messaging We all have heard of and probably used one of the many IM applications like these (data marked with an asterisk is based on information from Lehman Brothers, comScore Media Metrix): � MS N Messenger 178.2 million users worldwide* � Yahoo!

Christopher Cyrus Farrhan - Business Develpment ...https://ca.linkedin.com/in/christophercyrusfarrhanHummingbird was one of Canada�s largest Document Management and Unix to Windows Emulation solution providers. Was responsible for managing strategic major accounts including AT&T , Verizon, Sprint, Bear Sterns, Lehman Brothers, General Dynamics, BoeingTitle: Consultant at Bolkris SolutionsLocation: Thornhill, Ontario, Canada500+ connections

AOL: The ideal Microsoft deal-breaker for Yahoo?https://betanews.com/2008/02/11/aol-the-ideal-microsoft-deal-breaker-for-yahooOn Sunday, The Times Online (UK) reported that pursuing an AOL merger is the top choice now being recommended by Yahoo's investment bank advisers at Goldman Sachs and Lehman Brothers.

0235: Recovery of Debt and Smearing of Revenues via Energy ...https://gasgov-mst-files.s3.eu-west-1.amazonaws.com/s3fs-public/ggf/0235Draft...This proposal is one of three Proposals put forward by members of the Energy Balancing Credit Committee (EBCC) in order to address issues highlighted as a result of recent unprecedented events in financial markets and the failure of Lehman Brothers Commodity Services Inc As a result of the failure of Lehman Brothers Commodity Services Inc, a debt[PDF]

July 2013 � Organizations and Social Changehttps://organizationsandsocialchange.wordpress.com/2013/073 posts published by sdm24 during July 2013. By Elke Sch��ler, Freie Universit�t Berlin.. David Levy�s bleak analysis of the carbon market is complemented by recent research by Charles-Clemens R�ling, Bettina Wittneben and myself regarding climate conferences as the sites of transnational climate policy making. While climate skepticism has long accompanied climate science and the debate ...[PDF]International Journal of Finance and Accounting Volume 4 ...https://www.researchgate.net/profile/Abdulkadir_Ali_Banafa/publication/280550031...International Journal of Finance and Accounting Volume 4, Issue 7, 2015 ... which led to a reduction in the value of the ... failure of Lehman Brothers are both characterised as liquidity shocks ...

HWB | Kevin Sowww.hwbhk.com/en/people/kevin-so.htmlAdvising a leading international bank in a case involving a large-scale fraud perpetrated by one of its bankers that affected hundreds of customers (in Singapore and the USA). Advising banks on various mis-selling claims brought as a result of the Lehman Brothers minibond saga. Successfully obtained (numerous) Mareva injunctions in cyber fraud ...

The Breast Cancer Research Foundation Announces New Board ...https://www.bcrf.org/blog/breast-cancer-research-foundation-announces-new-board-membersDec 16, 2014 � Home Blog The Breast Cancer Research Foundation Announces New Board Members. ... focused on directional strategies in indexes, currencies and commodities for Commerzbank and Lehman Brothers. On the buy side, Baum led directional macro strategies as a Portfolio Manager at hedge fund NWI Management and later served as the Chief Investment Officer ...

European stocks lose more than 500 bln euros in value ...https://uk.finance.yahoo.com/news/european-stocks-lose-more-500-135810267.htmlAug 24, 2015 � The FTSEurofirst was on course for its worst one-day percentage fall since it slumped more than 7 percent in October 2008, just after the demise of U.S (Other OTC: UBGXF - news) . bank Lehman Brothers. It (Other OTC: ITGL - news) was also on course for its worst monthly loss since 2002.

AIB ready to sell junior bonds for first time since crash ...https://www.independent.ie/business/irish/aib-ready-to-sell-junior-bonds-for-first...AIB ready to sell junior bonds for first time since crash ... to take control of AIB six years ago this month as the financial system came close to imploding in the wake of Lehman Brothers failure

Bank bailout may weaken British government bonds | Gold ...gata.org/node/6250The banks have roughly L35 billion of mortgage securities frozen on their books, says Lehman Brothers and these are likely to swapped for Gilts. Goldman is offsetting its bet against Gilts with a "long" position on one-year money market rates, known as Sonia (Sterling Overnight Interbank Rate).[PDF]

at 21,900-27,700 points in 2019. Despite all these ...https://www.cashon-line.com/Resources/ipo/2019(eg)_190102.pdfas the global debt level is much higher than 10 years before, with the US ... Lehman Brothers QE1 QE2 QE3 Source: Bloomberg, CASH . January 2, 2019 ... in 2018 adopted by the Trump administration is one of the key drivers to boost GDP growth, jobs and employment in the US. But, we believe this one-off ...[PDF]

October | 2014 | Eslkevin's Bloghttps://eslkevin.wordpress.com/2014/10Oct 31, 2014 � Out-of-control compensation on Wall Street is one of the things that drove the financial system and the U.S. economy off the rails in 2008. Anyone who doubts the connection should just look at Bear Stearns and Lehman Brothers, whose massive bad bets helped bring on the meltdown

CONFLICT AND COMPROMISE1-2_??????(BEC)??_? �https://www.ppkao.com/sj/191781.htmAs the reign of Elizabeth proceeded the religious atmosphere _____. ?????? ?????? 3 UBS revealed plans to fire 10,000 bankers, in one of the biggest bonfires of finance jobs since the ______ of Lehman Brothers in 2008.

booms - Translation into Arabic - examples English ...https://context.reverso.net/translation/english-arabic/boomsTranslate this pageWhile sterilization prevented capital inflows from fueling lending booms and overheating the economy, foreign exchange accumulation enabled developing countries to withstand the massive deleveraging in the months following the failure of Lehman Brothers.

LEHMAN BROTHERS HOLDINGS INC (Form: 10-K, Filing �pdf.secdatabase.com/786/0001047469-04-005692.pdfDecember 29, 1983. Holdings and its subsidiaries are collectively referred to as the Company, the Firm or Lehman Brothers. The Company is one of the leading global investment banks, serving institutional, corporate, government and high-net-worth individual clients and customers.

R�my launches new VSOP - Drinks International - The global ...https://drinksint.com/news/fullstory.php/aid/2643/R_E9my_launches_new_VSOP.htmlPiana said that Europe represented 20% of R�my Martin�s business in value terms. When asked about the financial climate, he said: �When Lehman Brothers happened, everyone stopped investing in the US. R�my Martin decided to invest because you can reap the benefits as soon as the market starts to pick up. �This is the same in Europe.�

The Dynamics of Credit Spreads in Hotel Mortgages and ...https://scholarship.sha.cornell.edu/cgi/viewcontent.cgi?article=1641&context=articlesis that underwriting hotel property is a cross between a business loan and a real ... loans by property type from Lehman Brothers (July 1998�January 2008) and Cushman Wake?eld Sonnenblick-Goldman (February 2008�March 2011) we ... We ?nd that the �

Gary W. Parr - New York Philharmonicnyphil.org/about-us/artists/gary-w-parrGary W. Parr, who became Chairman of the New York Philharmonic in September 2009, is a vice chairman and a member of the board of directors of Lazard. For 30 years, Mr. Parr has focused on providing strategic advice to financial institutions worldwide. He advised on transactions such as the �[PDF]UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF �www.howardsmithlaw.com/Complaints/Virgin_Complaint.pdf1. This is a federal class action on behalf of purchasers of the common stock of Virgin Mobile, who purchased or otherwise acquired Virgin Mobile's common stock pursuant or traceable to the Company's Initial Public Offering on or about October 11, 2007 through November 15, 2007 (the "IPO" or the "Offering"), seeking to pursue remedies under the[PDF]Strategic Enhanced Fixed Incomehttps://cavanalhillim.com/uploads/documents/2015_-_QE2_-_Strategic_Enhanced_Fixed...fees associated with a managed account. The name of this index changed on November 3, 2008 from Lehman Brothers U.S. Aggregate Bond Index to the current name. This is a name change only. SEC Disclosure Gross performance results do not reflect the deduction of investment management fees other than trading costs. Gross performance data includes the

The Danger of Complacency | Waldo's Lifehttps://waldo2010.wordpress.com/2010/01/20/the-danger-of-complacencyJan 21, 2010 � This particular show of complacency is simply the latest one to take place in the public eye. Every day, the news is littered with examples of crumbling empires that were once thought to be impenetrable (Enron, Lehman Brothers, etc.). We�ve all seen how complacency nearly brought the world�s entire banking system to its knees.[PDF]Financial Stability, Regulation and Politics: Risks ...www.blenderlaw.com/wp-content/uploads/2007/07/financialstability2016draft.002a.pdfBradley Financial Stability, Regulation and Politics DRAFT 2: August 24, 2016 Climate change requires prompt action, but from a regulatory perspective it is a problem that is developing over time rather than an immediate problem, thus allowing for regulatory thinking to develop. And, to a �[PDF]Tuesday, January 26, 2016content.dowjones.com/tnt/assets/Scottrade/mb_012616.pdfEastern Time, and a January figure for consumer confidence is expected at 10 a.m. Eastern, with economists polled by MarketWatch expecting a reading of 96.2. EQUITIES J.P. Morgan Chase & Co. has agreed to pay the remnants of Lehman Brothers $1.42 billion in cash to settle most of the failed investment bank�s lawsuit over[PDF]The Real Effects of Endogenous Defaults on the Interbank ...https://siecon3-607788.c.cdn77.org/sites/siecon.org/files/media_wysiwyg/96-ferrari.pdfAfter the default of Lehman Brothers, the US interbank market became illiquid, lead-ing to a further tightening of the liquidity constraints faced by banks (already in distress).1 Large stimulus by central banks had limited effects as banks started to change the composition of their balance sheets using excess resources to purchase[PDF]How to measure the unsecured money market: the �https://www.ijcb.org/journal/ijcb16q1a8.pdfAfter the failure of Lehman Brothers in the fall of 2008, banks became increasingly reluctant to lend liquidity to each ... such as the interbank money market, which hampered the smooth transmission of the monetary policy impulses. ... level data. To the authors� best knowledge, the most compre-hensive validation exercise yet carried ...

Insights | Western Assetwww.westernasset.com/au/qe/research/whitepapers/defending-the-defensive-protecting...He joined Western Asset in 1996 as the Director of International Investments with responsibility for managing global and global multi-sector portfolios, with a research focus on local-currency emerging markets. Mr. Zelouf began his investment career in 1987 as a Research Analyst for Fuji Bank and later for Lehman Brothers Global Asset Management.

Prime Brokers Benefit From Market Turmoilhttps://www.eurekahedge.com/Research/News/658/...Prime brokers are enjoying an increase in business from hedge fund clients by the demise of Lehman Brothers Holdings & others surrounding Morgan Stanley ... As the hedge fund industry works its way through the bumpy marketplace, McGoldrick says Alaris is staying the course and highlighting its strengths. ... not where they are today. This is a ...[PDF]

Possible quantitative easing in China stirs US fears ...https://asia.nikkei.com/Economy/Possible-quantitative-easing-in-China-stirs-US-fearsChina could hardly be blamed for taking steps to weaken the yuan, Dugger said, given that the U.S., Japan and the eurozone have all similarly manipulated their currencies since Lehman Brothers ...

What Deutsche Bank�s Troubles Tell Us about the Health of ...https://www.piie.com/blogs/realtime-economic-issues-watch/what-deutsche-banks-troubles...Sep 30, 2016 � What Deutsche Bank�s Troubles Tell Us about the Health of Europe�s Banking System* ... This is not another Lehman Brothers moment about to happen, as it is simply not credible to think that Deutsche Bank, which has access to essentially unlimited liquidity from the European Central Bank, could run out of cash to repay counterparties anytime ...[PDF]

SUBJECT: CCL 25/10/16 -ADOPTION OF 2015/16 ANNUAL ...https://www.newcastle.nsw.gov.au/getattachment/23a64f91-60e0-416c-94c0-2fb4fdced513/...charges) and a one-time impact of the Lehman Brothers dividend ($7.8m additional revenue arising from recovery of prior investment losses). The recovery of these losses is an excellent result with all prior losses now fully recovered.

The Posse Foundation is Reshaping the Leadership Class ...https://gruntledcenter.blogspot.com/2006/06/posse-foundation-is-reshaping.htmlThe national office, where the "boot camp" is held is at an iconic Wall Street address, on a floor shared with Morgan Stanley. Ten percent of the 400 Posse alumni work for Lehman Brothers, almost all of them having proven themselves in summer internships while in college.

Travel | USA Todayhttps://usatodaydemo.wordpress.com/category/travelThe only other time the rate fell below 25% in recent years was in September and October 2008, when two things happened: Lehman Brothers crashed, prompting a meltdown of financial markets and a reduction in travel, and the disclosure that AIG executives wined, dined and pampered their well-paid employees shortly after the insurance giant ...[PDF]

Aktion�rsvertrag - English translation � Lingueehttps://www.linguee.com/german-english/translation/Aktion�rsvertrag.htmlAG mit Lehman Brothers Real Estate Partners, datiert vom 29. M�rz 2001, ... which repeats certain terms of the Participation Agreement and a certain number of other agreements (notably, ... In addition, the CNMV, responding to a request from certain shareholders of EADS, stated in a letter dated 19th June 2000 that the Royal Decree 1197/91 ...

CENTRE FOR ECONOMETRIC ANALYSIS CEA@Casshttps://www.cass.city.ac.uk/__data/assets/pdf_file/0008/36557/WP-CEA-13-2008.pdfsuch as the issuer probability of default, the loss given default, the tax regime of ... This is a strong limitation in order to understand ... who uses Lehman Brothers Eurodollar Aaa, Aa, A and Baa Indices and U.S. Global Treasury Index, covering the period from June 1996 to July 2006, for 2613 observations. ...[PDF]

Research: Rating Action: MOODY'S ASSIGNS RATING TO CALYON ...https://www.moodys.com/research/MOODYS-ASSIGNS...Apr 15, 2005 � In this transaction, Calyon entered into a credit default swap agreement with Lehman Brothers Special Financing Inc. The swap has an attachment point of 9.25% and a detachment point of 11.26%. This is a digital transaction, upon any credit event recovery is defined to be 40%.[PDF]TANCO HOLDINGS BERHAD (3326K) Notes To The Interim ...www.tancoholdings.com/investor/quarterly_result/Q5 Mar 2011 Announcement Notes...with Lehman Brothers Commercial Corporation Asia Limited (in liquidation) (the Lender) on ... this financial year will be made up to a period of 18 months from 1 st January 2010 to 30 th June 2011. A2. CHANGES IN ACCOUNTING POLICIES ... As a disclosure standard, there will be no impact on the financial positions or results of the Group.

?moral hazard????????????????? - Weblio? �https://ejje.weblio.jp/sentence/content/moral+hazardTranslate this pageFor example, industrial production dropped about 60 percent, and even Toyota�s production fell about 40 percent at the time of the Lehman Brothers shockwave two years ago. Due in part to the strong yen, industrial production has only recovered by about 80 percent since then.

DUMB DECODED - blogspot.comhttps://hpswain.blogspot.comSep 26, 2014 � I spend my first 10 years in IT without thinking more than a minute about infrastructure. It was not necessary, because I didn�t work in an enterprise environment. At the moment I work for a bank (sorry for these Lehman Brothers stocks, nobody asked me). In a bank you have a lot of these infrastructure people.

read The Boy Next Door (Boy #1)(5) online free by Meg Cabothttps://www.onlinebook4u.net/ChickLit/Boy_1/index_5.htmlHer father is a dentist and oral surgeon in Lansing, operating the Phillips Dental Practice. Mr. Bourke, 31, received a bachelor's degree from Yale and an MBA from Columbia University. He is an associate at the investment banking group of Lehman Brothers. His father, now retired, was the president of Bourke & Associates, a private investment firm.

Executive Q&A: Citi's Jon Beyman on IT Talent | Bank ...https://www.banktech.com/management-strategies/executive-qanda-citis-jon-beyman-on-it...Before joining Citi in 2008, he was CIO at Credit Suisse, and prior to that he was the long-time CIO at Lehman Brothers, so he has a pretty good perspective on the state of innovation in the U.S. financial services industry.

Auditors Responsibility for Detecting Fraud Assignmenthttps://studentshare.org/finance-accounting/1650890-auditor-responsibility-for...Based on this premise, failures of internal control started with top management who failed or ignored internal controls for a dependable financial reporting. The Auditors, on their part failed or disregarded the weaknesses of financial information or errors presented so as not to disrupt the operations of Lehman Brothers.

S&P 500 Futures Forum - Investing.comhttps://www.investing.com/indices/us-spx-500-futures-commentary/11000Feb 27, 2020 � @Josh re Lehman Brothers, yes, for real! Reply. 0 0. ... This is probably going to 2828 before the next wave of selling comes in. ... it is one of the riskiest investment forms possible.

auf etwas zur�ckgehen - English translation � Lingueehttps://www.linguee.com/german-english/translation/auf+etwas+zur�ckgehen.htmlOne of the main reasons behind the slump was without a doubt the underutilization of production capacities ... began in 1980 and well below the average for the past ten years of 84%. another factor that cannot be discounted was the massive blow to confidence dealt by the insolvency of the investment bank Lehman Brothers in the fall ...

???????? - arfaetha.jphttps://arfaetha.jp/ycaster/news/pdf/20021209.pdfTranslate this page?This is more about perception than about policy," said Thomas D. Gallagher, a ... Mr. Evans is one of Bush's closest friends in Washington and a longtime financial ... He began his career at Lehman Brothers, where he was engaged mainly in the firm's mergers and acquisitions . business. He headed that group for two years.

K-REIT � Page 4 - Singapore REITs | Page 4https://sreit.wordpress.com/category/k-reit/page/4Lehman Brothers and Kajima will provide Commerz Real with coupon of 4.5% during the period of construction. This is a new record transaction price for office buildings, 7.7% higher than S$2,901psf for Hitachi Tower in Jan 08 and 20.2% higher then S$2,600psf for One George Street in Mar 08.

estate - Greek translation � Lingueehttps://www.linguee.com/english-greek/translation/estate.htmlOn 1 April 2005, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (1 ) by which the undertakings Lehman Brothers Real Estate Partners (�LBREP II�, US) belonging to the Lehman Brothers Group (�Lehman Brothers�, US) and Europe Realty Holdings Pte.

The Global Financial Meltdown and How to Beat It - FEEDPROFhttps://www.feedprof.com/articles_pp8wea.htmlThe events that have been taking place recently across the financial community globally are hurting individuals and businesses in the same way as the times of 1930s and Great Depression. The fall of Lehman Brothers, Wachovia, Japan Leasing Corporation and Washington Mutual, fire-sale of Citigroup, t

Arbitrarium - Bloggerhttps://mcmasty2.blogspot.comThe premiss of these models is that the risk can be calculated, and thus a risk-free product or risk-free portfolio can be created. As we've discovered in since Sept 2008, when Lehman Brothers went bankrupt, these products and portfolios were far from risk-free.

regulation | kavipshttps://kavips.wordpress.com/tag/regulationBear Stearns would soon be joined by AIG, Lehman Brothers, GM, and Countrywide, to name a few. Some regulation are on the books for a reason� such as regulating derivatives. While derivatives were regulated, gas stayed at 99 cents a gallon for 8 years� Remember that?

How maths killed Lehman Brothers - ????www.doc88.com/p-909533278019.htmlTranslate this page�1997-009MillenniumMathematicsProjectUniversityofCambridge.Permissionisgrantedtoprintandcopythispageonpaperfornon-commercialuse ...

?on our account????????????????? - Weblio �https://ejje.weblio.jp/sentence/content/on+our+accountTranslate this pageThe Lehman Brothers shockwave was a typical example of this. It has a broad impact on the national economy and the global economy. Back in 1929, economies were organized into economic blocks, which became a remote cause of the Second World War according to some people.

Opinions | Valley of the Deerhttps://valleyofthedeer.wordpress.com/category/opinionsJun 21, 2013 � New York 2008, a group of employees in an unnamed investment firm (loosely based on Lehman Brothers � you see where going) race against time, as the earth shifts below their feet, to stave off pending doom or at least delay the immediate effects.

Stupid Scholar: March 2010https://stupidscholar.blogspot.com/2010/03This segment on Dylan Ratigan's show with Eliot Spitzer does a pretty good job of explaining Lehman Brothers' dirty moves:Visit msnbc.com for breaking news, world news, and news about the economyOne of the first major stories on Lehman Brothers was The New York Times' piece "Report Details How Lehman Hid Its Woes."

Counting Down to 30https://mpkcountingdownto30.blogspot.comReally it was the most depressing story about poverty I�ve heard since reading about Cuthbert and Olly Le Fervre who can no longer be educated privately as their dad worked for Lehman Brothers. This follows hot on the heels of a piece Breakfast ran about the rising cost of staple goods in your shopping trolley. What product has suffered the ...

Can Asia's Cyber Kid Rise Again? The son of Hong Kong's ...https://archive.fortune.com/magazines/fortune/fortune_archive/2001/03/19/299186/index.htmMar 19, 2001 � Lehman Brothers hailed Li's merged corporation as "Asia's new-media powerhouse." And his 72-year-old father, Li Ka Shing, who is not directly involved in the business, told friends that his younger son was "like a golfer who shoots a hole in one for 18 straight holes." ... It was the worst performer on the Hong Kong index last year ...

The Browser: Truth and rumors from the tech worldhttps://money.cnn.com/blogs/browserOne of its big benefits will be its integrated, nicely designed software -- the lack of which is a massive drawback to most other cellphones. ... a programmer who is a VP with Lehman Brothers ...

The Diplomat of the Future: November 2011https://diplomatofthefuture.blogspot.com/2011/11Nov 23, 2011 � As with Enron or Lehman Brothers, the dodgy accountancy should not have been believed in northern Europe, but it was. I well remember being assured at a press conference of pro-euro British politicians of all parties that Italy would not be allowed to join the new currency either. But in the spirit of the moment it was.

Insurance giant AIG to sell UK operations | Personal ...https://www.express.co.uk/finance/personalfinance/64656/Insurance-giant-AIG-to-sell-UK...Oct 05, 2008 � Insurance giant AIG to sell UK operations ... AIG was one of the largest casualties of the credit crunch which has also claimed Lehman Brothers and Bradford & Bingley.

Mobile Features | Iphone 6s Plus text monitoring without ...www.genicos.com/language/monitor/index.htmlHow do i set up Iphone 6s Plus text monitoring without jailbreak mobile payment. Practices at lehman brothers, and why you didnt see this coming. Once this plugin is installed, a filelogging tab will be added to the options dialog and a filelogging menu will be added to the log pane.

GAMXX | Audit | Discovery (Law)https://www.scribd.com/document/380973355/GAMXX"House" price does not necessarily mean that it came from a Lehman Brothers trader, but may include a price from recent trades for the day. The Firm sends BFS a house price file daily for overrides of vendor price and to price securities currently priced at $0.00 using a house price consisting of the latest non- cancel trade of the day.

Oil Prices: - HomeOwnersHub.comhttps://www.homeownershub.com/hvac/oil-prices-32245-.htmMay 24, 2008 � According to one participant, knowledgeable oil industry CEOs reached the consensus that "oil prices will likely soon drop dramatically and the long-term price increases will be in natural gas." Just a few days earlier, Lehman Brothers, a Wall Street investment bank had said that the current oil price bubble was coming to an end.

Freddie Mac | Motivational Speaker - Chuck Gallagher ...https://chuckgallagher.wordpress.com/tag/freddie-macThe FBI is investigating Fannie Mae, Freddie Mac, Lehman Brothers and AIG � and their executives � as part of a broad look into possible mortgage fraud, sources with knowledge of the investigation told CNN Tuesday. ... What is of most interest is that the focus is on small time fish and a big sea of corruption. ... Ethics are defined as the ...

The Rational Realist: December 2011https://rationalrealist.blogspot.com/2011/12The battle between the remnants of Lehman Brothers and Sam Zell's Equity Residential for Archstone apartments has been simmering for a few weeks but broke open over the past few days. Both Lehman and Equity Residential are trying to buy lenders' ownership position in Archstone, one of largest multifamily owners in the county.

Rachel Millward - Executive Director - The Nest Collective ...https://uk.linkedin.com/in/rachelmillward- Secured sponsorship from Coutts & Co, RBS, Lehman Brothers, Accenture, Whistles, ActionAid. Successfully raised funds from public grants, trusts and foundations - BEV was one of only 8 film festivals funded by the UK Film Council nationally, plus British Council, Skillset, Commonwealth Foundation, PRS Foundation for MusicTitle: Creative leadership and �Location: London, United Kingdom500+ connections

professional essay on Forecasting | Professionally written ...https://www.echeat.com/professional-essay/Forecasting-301254013.aspxThis is a special encryption used by VISA, MasterCard and American Express to prevent fraud. ... The extended warranty package is currently discounted to a flat rate of only twenty nine dollars and ninety nine cents and includes unlimited access to the paper you ordered for a period of 12 months at no additional future cost. ... Lehman Brothers ...[PDF]

Panel Sends BP Oil Spill Cases to New Orleans - Blawgletter�https://blawgletter.typepad.com/bbarnett/2010/08/panel-sends-bp-oil-spill-cases-to-new...This is a reminder that although the Panel tries to reach its decisions in a timely fashion, it does so only after affording the parties sufficient time to present their views, both through written submissions, and, in the case of motions seeking the creation of new MDLs, through oral argument. ... The parties have advanced sound reasons for a ...[PDF]Case No:69094 Event No: Dec.No: 244/12/COLwww.eftasurv.int/media/state-aid/244-12-COL.pdfactivities. A bond issue had had to be cancelled due to a lack of interest, an asset sale was not completed, and a German bank refused to extend two loans estimated at 150 million Euros. Market conditions also worsened dramatically after the fall of Lehman Brothers.

An Overview of Credit Derivativesciteseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.139.7401&rep=rep1&type=pdfStearns and guaranteed its contracts. The default of investment bank Lehman Brothers, which had sold protection on a large number of rms and was itself a reference entity to countless other contracts, brought the system to a near breakdown. Only massive government intervention could help averting this scenario.

Gold or Silver - boards.iehttps://www.boards.ie/vbulletin/showthread.php?p=112179417Feb 12, 2019 � Gold is considered a safer play being bought mainly by investors, central banks and governments which are buying it as insurance. With silver on the other hand, you are simply betting that the ratio is gonna get back in line with its historical standards if you look over the past couple of years it has been at around 40/50:1 ish give or take.[PDF]TP Report Templateswww.actuaries.org/AFIR/Colloquia/Maastricht/vanAlphen.pdfindices of providers like Morgan Stanley and Lehman Brothers. This implies passive and zero cost investment management. Clearly not the practice! Consider an active manager structure, implemented to enhance expected return at the expense of increasing risk. How does this structure compare to the alternative of changing the investment

Internship UK work experience in England - London and Kentinternship-uk.com/management.phpBusinesses are pulling out all the stops to remain afloat and in many cases this has meant that many people are being made redundant. Already thousands of employees of Lehman Brothers and other firms in similar predicaments have been laid off and are left searching for a way in which to improve their career prospects.

Kitco - Commentaries - Chuck Butlerhttps://www.kitco.com/ind/Butler/jan142011.htmlBut, since the Gov�t bailed out Bear Stearns, GM, AIG, and you name it, and allowed Lehman Brothers to fail, nothing has made much sense to me with regards to the markets� I hope and pray every day that we will return to a market that is driven by fundamentals� and �

Setting a better trap for financial fixershttps://www.theaustralian.com.au/business/business-spectator/news-story/setting-a...One of the embarrassing facts that emerged from the Lehman trial was that Grange Securities sold these complex and, as it turned out, very risky products to councils and charities with misleading ...[PDF]STATEMENT of JOHN C. DUGAN COMPTROLLER OF THE �https://www.banking.senate.gov/download/080409dugan-testimony&download=1Bear Stearns, Lehman Brothers, and AIG. The Proposal would extend resolution authority like the FDIC�s to such nonbanking companies, while preserving the flexibility to use the FDIC or another regulator as the receiver or conservator, depending on the circumstances. This is �

38th ECONOMICS CONFERENCE 2010 � Urs Birchlerhttps://www.oenb.at/dam/jcr:e222af12-1352-4bd1-9687-9da237ff3ef2/vowitag_2010_birchler...materialize. An example for this is Lehman Brothers in September 2008. The reason for the expectations of a rescue being so high at that point can be found in the earlier support for Bear Stearns in March 2008 (Johnson and Kwak, 2010). The Long Term View: Repeated Game In a one shot game, it pays for the gov-ernment to rescue the troubled bank[PDF]

(OT) Software tycoon plans Chicago rail bypass - Google Groupshttps://groups.google.com/d/topic/uk.railway/8ZvrrBiHYosSoftware tycoon plans Chicago rail bypass ... Patton left Lehman Brothers to found financial software start-up Portfolio Dynamics in 1970, which he sold in 2002. ... part of single-to double stacking, which will still have to be done. Another part is switching from train to �

?????? ????? : ?????? ??? ???? ??? ? ??? ?? ???? ????? ...isiarticles.com/article/472Lehman Brothers and Goldman Sachs expect business process outsourcing to grow to $500 Billion by 2004 (Spagat, 2001). In a March 2001 report, Goldman Sachs called business process outsourcing �the next big wave� in information technology services (Spagat, 2001).[PDF]

Mutual Funds and Hedge Fundshttps://mutualfundsandhedgefunds.blogspot.comFunds may track very different indexes. Some indexes (eg, the S&P 500) are set up to measure the performance of large companies. Other indexes focus on small companies (the Russell 2000 being one of the most famous small-cap indexes), international stocks (MSCI-EAFE), and bonds (Lehman-Brothers Aggregate Bond).

How to invest as pensioners wreak havoc in the stock ...https://www.capitalandconflict.com/why-americas-pensioners-will-handbag-the-worlds...As retirees have sold their stocks, shares have been progressively de-rated (ie, the amount investors are happy to pay for a given level of earnings has fallen), leading to a near-80% drop in the Nikkei index since its 1990 peak. Other developed countries have still to �[PDF]Default risk in corporate yield spreadsneumann.hec.ca/~p240/Recherche/documents/20080505Default.pdfattributed to a tax premium and a risk premium for systematic risk. ... veri?ed that, for investment-grade bonds (Baa and higher ratings), only 20% of the spread is explained by default risk. One of the key inputs needed for such assessments is an estimate of the term structure of default ... This is the approach used in Elton et al. (2001 ...[PDF]INTHEHIGHCOURTOFJUSTICE No.7942of2008 �https://www.pwc.co.uk/business-recovery/administrations/assets/joint-administrators...14. This was precisely the position in the RABMarket Cyclescase: see Re Lehman Brothers International (Europe) [2009] EWHC 2545 (Ch).Briggs J explained (at [56]-[58]) that the �Counterparty� had both a proprietary interest in an omnibus securities account and a personal right to the delivery of equivalent securities from the[PDF]Moral hazard with soft information - UNSW Business Schoolhttps://www.business.unsw.edu.au/About-Site/Schools-Site/Economics-Site/Documents/G...to a complete contracting problem in which the principal is able to commit: 1. The principal o?ers a contract Ce= a,De consisting of an action a and a revelation mechanism De = (M,t) made of a message space and a transfer 2. The agent accept or rejects the contract. If �

Peter Slate - Maui Real Estate - Haiku Propertieshttps://mauirealestatenews.blogspot.comThe company's failed joint venture into Kapalua Bay Holdings (the Residences at Kapalua) cost it nearly as much as the failure of pineapple. In 2008-09, ML&P took losses of $92.5 million. The project was completed, after a suspenseful search for new lenders after the failure of Lehman Brothers, and it continues to offer units for sale.

Lehman Brothers swirling the drain - Page 2 - Early ...https://www.early-retirement.org/forums/f28/lehman-brothers-swirling-the-drain-38711-2...Sep 15, 2008 � And I know this isn't necessarily the best way to tell, but he's got a huge house and a really nice boat. _____ "Good judgment comes from experience. Experience ... At the DW's bank she works for a Vice President. In her department the VP is the second level supervisor. ... This community was started in 2002 as an alternative to a then fee only ...

Analysis & Opinion by Phoenix Capital Research on ...https://www.investing.com/members/contributors/43196/opinionHow To Maximize Your Gains As The S&P 500 Hits 4,000 ... sheet at this pace was when Lehman Brothers failed in September 2008. ... after one of its best runs in years. This is precisely what long ...

Concerns on the Federal Reserve Raising Rates - Term Paperhttps://www.termpaperwarehouse.com/essay-on/...Read this essay on Concerns on the Federal Reserve Raising Rates. Come browse our large digital warehouse of free sample essays. Get the knowledge you need in order to pass your classes and more. Only at TermPaperWarehouse.com"[PDF]Online appendix for �Middlemen in Limit Order Markets�https://albertjmenkveld.com/public/papers/jovanovicmenkveld1_ia.pdfLehman Brothers, Merrill Lynch, Morgan Stanley, Optiver, Soci�et �e G en� erale and UBS (op. cit. footnote� 15). ... to run one of the fastest platforms in the industry with a system response time (often referred to as �latency�) of two milliseconds. ... This is a natural sample period as the new-market e ect already kicked in (the ...

The Actuary May 2014 by Redactive Media Group - Issuuhttps://issuu.com/redactive/docs/act_may_2014/31May 08, 2014 � In a series of brief stories under the heading �Economic vice�, the authors examine the rigging of LIBOR, the demise of MF Global, Lehman Brothers, Bear Stearns and �

Costa Rica Investing in Offshore Fundshttps://www.welovecostarica.com/costa-rica-investing-in-offshore-fundsCosta Rica Investing in Offshore Funds. Below you will find the complete letter written Sr. Federico Carrillo-Zurcher who was until recently the Costa Rican Minister of Finance and the former Chief Executive Officer, Bolsa Nacional de Valores (BNV) � The largest Stock Exchange in Central America, also, former Senior Vice President of Lehman Brothers in New York.

DRS Technologies to Acquire Engineered Support Systems ...https://www.thefreelibrary.com/DRS+Technologies+to...PARSIPPANY, N.J. -- DRS Technologies, Inc. (NYSE: DRS) and Engineered Support Systems, Inc. (NASDAQ: EASI) jointly announced today that they have signed a definitive agreement for DRS to acquire all of the outstanding stock of Engineered Support Systems, Inc. (ESSI) for $43.00 per share through a combination of cash and DRS common stock.[PDF]FSUG Response Review of the Consumer Protection ...https://ec.europa.eu/info/sites/info/files/file_import/fsug-cpc-response_en_0.pdffor Lehman Brothers Bankhaus AG (Lehman) and also banned the bank from receiving payments not intended for payment of debts towards it (Moratorium); while in the UK, Lehman Brothers International (Europe), Lehman Brothers Limited, LB Holdings PLC and �

Pearson - Multinational Business Finance: Global Edition ...catalogue.pearsoned.co.uk/catalog/academic/product/0,1144,013612156X,00.htmlChapter 5 mini-case�This new chapter concludes with a mini-case debating whether the U.S. government should or should not have allowed one of the largest investment banks, Lehman Brothers, to fail. NEW! Chapter 18: Foreign Direct Investment Theory and Strategy has a �[PDF]The Merger of Government and Businesswww.competitivemarkets.com/wp-content/uploads/2012/01/OCM_2010_June.pdfbination. This is a condition that character-izes today�s poultry and swine industry. Just how deadly this deadly combination can be was made plain at the Joint DOJ/USDA Poultry Workshop in Normal, Alabama on May 21st. A precession of contract poultry growers lined up to tell their stories to a panel which included USDA Secretary Vilsack, U. S.

Slow wage growth to keep Fed on prudent normalisation ...https://snbchf.com/2017/12/costerg-wage-growth-fed-prudent-normalisationDec 17, 2017 � He was previously based in London, covering the UK and the euro area. Thomas started his career with Lehman Brothers in London in 2007 and also worked at a Paris-based private bank and asset manager. Do not hesitate to contact Pictet for an investment proposal. Please contact Zurich Office, the Geneva Office or one of 26 other offices world-wide.

Honolulu Star-Bulletin Business Briefs /2005/07/09/archives.starbulletin.com/2005/07/09/business/bizbriefs.htmlJul 09, 2005 � He would have received a minimum of $25 million this year and again in 2006, provided the CEOs of Goldman Sachs Group Inc., Merrill Lynch & Co., Bear Stearns Cos. and Lehman Brothers Holdings Inc. made an average of at least that much.

Trading In Stock Options / 5 Minute Strategies, Learn How ...https://www.lifeguard-pro.org/trading-in-stock-optionsMarket sentiment data even does upside take the speakers by supershare. Applications of lehman brothers in the united states can receive cool, trading in stock options binary indicator on the success or indications covered in this onderzoeker, at no wat to them, where other employee is above.

Times Square in French, translation, English-French Dictionaryhttps://glosbe.com/en/fr/Times SquareTimes Square translation in English-French dictionary. the area of Manhattan around the intersection of Broadway and Seventh Avenue; heart of the New York theater �[PDF]OFFICIAL RECORD OF PROCEEDINGS Thursday, 6 July 2017 �https://www.legco.gov.hk/yr16-17/english/counmtg/hansard/cm20170706-translate-e.pdfthe Lehman Brothers incident broke out, which almost caused the entire Hong Kong to tumble down. So, President, why does he always have to open his ... not even up to a fraction of theirs and what is more, this socalled "the Loop" is - ... Mainland and international markets and a �

laying off employees - Spanish translation � Lingueehttps://www.linguee.com/english-spanish/translation/laying+off+employees.htmlTranslator. Translate texts with the world's best machine translation technology, developed by the creators of Linguee. Linguee. Look up words and phrases in comprehensive, reliable bilingual dictionaries and search through billions of online translations.[PDF]As layoffs continue, US consumer sentiment lowest since 1993intsse.com/wswspdf/en/articles/2001/02/jobs-f19.pdf���An economist at Lehman Brothers commented to Reuters: �Layoff announcements appear to have finally forced themselves into America's psyche.� ���The University of Michigan's expectations index, which measures attitudes about the immediate future, tumbled as well, from 86.4 in January to 77.6, also the lowest since November 1993.

Book Detail: Multinational Business Finance: Global ...www.bookware.com.au/cgi-bin/bookware/9780136121565NEW! Chapter 5 mini-case-This new chapter concludes with a mini-case debating whether the U.S. government should or should not have allowed one of the largest investment banks, Lehman Brothers, to fail. NEW! Chapter 18: Foreign Direct Investment Theory and Strategy has a �

Financialism Unwrapped with A 1% Candidate For The 1% ...https://desertbeacon.wordpress.com/2012/03/15/financialism-unwrapped-with-a-1...Mar 15, 2012 � Financialism Unwrapped with A 1% Candidate For The 1%. ... This is previously tilled territory � but the transferring of capital from investors to industries is supposed to be what the financial sector is all about. ... In February 2007 Lehman Brothers stock was selling for $86.18 per share, giving it a market capitalization of $60 billion. ...

Tl;dr for the TSC | principlesandinteresthttps://principlesandinterest.wordpress.com/2017/05/26/tldr-for-the-tscMay 26, 2017 � The Centre which appears to campaign for an end to fiat money was founded by Steve Baker MP, a member of the TSC, who used to work in IT at Lehman Brothers before turning to politics. Affiliates of the Centre submitted five of the thirty four written testimonies and gave one of �

i have an outstanding charge - Traduction fran�aise � Lingueehttps://www.linguee.fr/anglais-francais/traduction/...Translate this pageLehman Brothers Aggregate Bond Index is made up of the Lehman Brothers Government/ Corporate Bond Inex, Mortgage-Backed Securities Index, and Asset -Based Securities Index, including securities that are of investment ... sailors on board who have never deployed on an operation before and going to prove to be an outstanding experience ...

Is Harvard Worth It?_?????_????blog.sina.com.cn/s/blog_50b274e90100fwpx.htmlTranslate this pageOct 15, 2009 � Lehman Brothers, Merrill Lynch, and Wells Fargo are just a few of the firms that have begun recruiting at places like Indiana University's Kelley School of �

???? - media4.open.com.cnmedia4.open.com.cn/L602/1403/dongshi/yingmeibkxd/...Translate this pageLehman Brothers, Men-ill Lynch, and Wells Fargo are just a few of the firms that have begun recruiting at places like Indiana University�s Kelly School of Business because they can' t hire enough MBAs from Wharton, Harvard, and other traditional feeder schools.

Bush's Fake Aidhttps://www.globalpolicy.org/component/content/article/211-development/45067.htmlMar 10, 2006 � The first CEO of the program, Paul Applegarth, was a Republican campaign contributor with limited experience in international aid, having spent his career at financial institutions such as the Bank of America, American Express and Lehman Brothers. "Applegarth wasn't qualified to do the job," says a former official involved in the MCC's creation.

September | 2012 | The Average Dollarhttps://theaveragedollar.wordpress.com/2012/09Sep 02, 2012 � 5 posts published by KL during September 2012. Today marks four years since the fateful Monday when Lehman Brothers filed for Chapter 11 (liquidity), the very day that sent our markets, economies, and exchanges into jitters, which came to be remembered in financial history as the �

The Czarinas of Beauty | City Journalhttps://www.city-journal.org/html/czarinas-beauty-12806.htmlIn 1928, she sold her American business to Lehman Brothers at a profit of $7.3 million, in the days when you could keep it. Came the Depression, she took the company off their hands, repurchasing the nearly worthless stock for a little over $1 million.[PDF]January 29, 2004https://www.perkinscapital.com/December03.pdfwhen the first five days were down, 10 were followed by up years and 10 by down years, for a 50% accuracy ratio. Furthermore, in 9 of the last 13 election years, and 2004 as we know is an election year, the S&P posted a gain for the first five days and all of them were[PDF]IEEE Women in Tech - San Diegos3.amazonaws.com/sdieee/2064-IEEE+WIE+Tech+Summit+-+091916.pdfengineer and has contributed to a wide range of informatics solutions from instrument control and data analysis to cloud computing. Prior to Illumina, Jessica worked as a software engineer at Lehman Brothers and as a systems analyst at Amaranth Advisors. She received her B.S. and Masters of Engineering in Computer Science and Electrical

Careers, Nomura Japanhttps://www.nomura-recruit.jp/graduate/global-careerFor me, Nomura was the best choice. It's famous in Japan, not only for being at the forefront of banking but also for its hard-work ethic and dynamic culture. In my time here I have seen the fusing of traditional and new, with Nomura's acquisition of Lehman Brothers.

New Year's Greetings from President Kudo | NYK Linehttps://www.nyk.com/english/news/2011/NE_110104.htmlJan 04, 2011 � Iron ore for China, one of the main cargoes in the dry bulk segment, did not experience any impact from the Lehman Brothers shock in 2009, recording a significant increase from 430 1million tons in 2008 to 630 million tons in 2009. In 2010, imports �

Used Porsche 928 cars for sale in The UK - Nestoria Carshttps://cars.nestoria.co.uk/cars/used/porsche-928_d618This is an original C16 car exported to Hong Kong under the factory toursit scheme for Sir John Bond who was CEO of HSBC at the time. The car came with to the UK with Sir John Bond when he finished his posting. It was then owned by Mary Jo Jacobi who was the MD of Lehman Brothers �

Urban Fictionary | (We are what [we are becoming) what we ...https://ufictionary.wordpress.comThe only bank interested in buying Lehman was the British firm Barclays. But British regulators demanded a financial guarantee from the U.S. Paulson refused! As a result, Lehman Brothers went Bankrupt on September 15th, 2008. Lehman�s London office had to be closed immediately, and all transactions came to a halt.

IVolatility Trading Digest�https://www.ivolatility.com/roller/page/trader?entry=volume_9_issue_20_brThe US dollar was the likely one of the drivers behind the mid week reversal in equities. ... This ETF seeks twice the inverse of the daily performance of the Lehman Brothers 20+ Year U.S. Treasury index. ... Use a close below 50 as the SU (stop/unwind) as below support and below the upward sloping trendline that starts just below 45 in ...

minneapolis � denverrealestateinsightshttps://denverrealestateinsights.wordpress.com/tag/minneapolisNov 18, 2019 � The big headline in Manhattan was the 25% reduction is sales in the first quarter of 2018 when compared with the prior year. While the number in itself raised a few eyebrows more shocking was the drop, the largest in a decade meaning since the day when Lehman Brothers and Bear Sterns basically imploded and some argue the catalyst of The Great ...

LGV Tours-Bordeaux PPP | Case Studies | IJGlobalhttps://ijglobal.com/articles/71977/lgv-tours-bordeaux-ppp�The size was the point,� Nicolas Bourgouin of Natixis explains. �The first problem and the first thing we had to think about with RFF was the size, and the project was launched before Lehman Brothers� insolvency. It was not easy before Lehman Brothers. It was impossible just after.

[Lehman Brothers, Modukuri] Mortgage Convexity Risk_??_? �https://wenku.baidu.com/view/9ca930d87f1922791688e8b1.htmlTranslate this pageLehman Brothers managed or co-managed a public offering of [COMPANY NAMES] securities in the past year. Lehman Brothers usually makes a market in the securities mentioned in this report. These companies are current investment banking clients of Lehman Brothers or companies for which Lehman Brothers would like to perform investment banking services.

[Lehman Brothers] Mortgage Outlook for 2007 - Bracing for ...www.doc88.com/p-017909195067.htmlTranslate this page??????????????? ????????????????

Nanosys Inc - Law Insiderhttps://www.lawinsider.com/company/1160719/nanosysEXHIBIT 10.14 COOPERATIVE DEVELOPMENT AGREEMENT This Cooperative Development Agreement (the "Agreement") is entered into as of December 15, 2003 (the "Effective Date") by and between Nanosys Inc. ("Nanosys"), a Delaware corporation with a place of business at 2625 Hanover Street, Palo Alto, California 94304 and Intel Corporation ("Intel"), a Delaware corporation with a place �[PDF]LONDON RESIDENTIAL REVIEW - Knight Frankhttps://content.knightfrank.com/research/78/documents/en/winter-2015-2547.pdfthe first half of 2015. Whatever the result of the election, growth is unlikely to be as headline-grabbing over the next five years as the last five. This fact, however, should be put in the context of an exceptionally strong and prolonged period of growth that has produced a 73% rise in prime central London since the post-Lehman Brothers

executive pay | The Economic Populistwww.economicpopulist.org/category/topic-meta-tags/executive-payThis is a shocker. Obama to Limit Executive Pay at Companies Getting Aid. About time! President Barack Obama will announce today that he�s imposing a cap of $500,000 on the compensation of top executives at companies that receive significant federal assistance in the future, responding to a public outcry over Wall Street excess.[PDF]RetiRement mAnAGement solutionhttps://wealth.mlc.com.au/content/dam/wealthenevita/public/documents/FL034B_-_Enevita...in financial markets following Lehman Brothers� demise. Resources underperformed (down 32.2%) the broader market over the year, however, most of these losses occurred in the first four months of the year, after which the sector staged a significant rebound as commodity prices recovered as China�s economic stimulus efforts took hold.

PHILANTHROPY 2173: Almost everything you ever wanted to ...https://philanthropy.blogspot.com/2011/09/almost-everything-you-ever-wanted-to.htmlThe first SoCAP conference launched one month to the day after the 158 year old Lehman Brothers investment bank went bankrupt. The disarray, panic, and anger from that scary time have raised and ruined political careers, redrawn the global map of economic powerbases, and given rise to bestselling books and award winning movies.[PDF]

Tanya Fitzgerald - Food Business Support Officer - SECAD ...https://ie.linkedin.com/in/tanya-fitzgerald-4549b612Final Year Group Project which consisted of 7000 word report and two class presentations. The first to explore a case study and discuss the leadership, strategy and change dimensions. The second, to provide a critical comparison between Citibank and an organisation of our choosing - Lehman Brothers.Title: Food Business Support Officer at �Location: IrelandConnections: 332

Snippets Archive - Page 93 of 284 - Substantive Researchhttps://substantiveresearch.com/snippet/page/93Jan 12, 2017 � Custom Products Group is a bespoke research house started 14 years ago at Lehman Brothers by current co-founder Patrick Hansen. They just published an interesting piece on Japan where they say that their biggest concern remains that of rapid acceleration of depopulation going forward, because as the productive workforce looks to abandon its roots in search of sustainability, they fear �

2010-05-13: Statement of the Monetary Policy Committee ...https://www.moneyweb.co.za/archive/20100513-statement-of-the-monetary-policy-committeBehind the reason to keep rates unchanged. You are currently viewing our desktop site, do you want to visit our Mobile web app instead?[PDF]Greater China Conference 2016 Borderless Chinahttps://www.macquarie.com/dafiles/Internet/mgl/global/shared/corporate/research/gcc...This is a working agenda and is subject to change. Last updated: Thursday, 21 April 2016 ... healthcare practice for Avenue Capital Group in Asia and also worked for Lehman Brothers for years. Mr Donglin Huang, Chief Advisor, PharmaDL ... Also working as the Internet Financial Mentor at Ko Lai Institute of Renmin University of China, Researcher ...

South Africa�s Junk Credit Rating was Avoided, But at the ...www.cadtm.org/South-Africa-s-Junk-Credit-RatingDec 15, 2016 � For these are dangerous institutions whose mistakes � e.g. as the 2008 world financial meltdown gathered pace, giving AAA investment grade ratings to Lehman Brothers and AIG just before they crashed, as well as to Enron four days before it fell in 2001 � can be catastrophic to investors and the broader economy.

Covering the Economy: January 27 GDP Advance Report: New ...https://delong.typepad.com/sdj/2006/01/covering_the_ec_9.htmlMilitary spending slumped, a surprising development during a war. "We are still trying to figure out where that came from," a Lehman Brothers economist, Joseph Abate, said. Moreover, the surge in the price of oil led to a big jump in the nation's energy bill, contributing to a sharp rise in imports that put a �

sono fallite - Traduzione in inglese - esempi italiano ...https://context.reverso.net/traduzione/italiano-inglese/sono+falliteTranslate this pageThis is a significant problem, ... The first is adjustments to cover amounts deposited in accounts in banks outside the European Union which have gone bankrupt during the previous year. ... Merrill Lynch e Lehman Brothers negli Stati Uniti e Fortis in Europa Occidentale sono fallite perch� non �

Lehman shock - Deutsch-�bersetzung � Linguee W�rterbuchhttps://www.linguee.de/englisch-deutsch/...Translate this pageIn the first two months of 2009, global financial markets were still ... and in so far as the liquidators consider that the defence, pursuance, intervention and appeal is necessary or useful to protect the assets of the limited liability company Lehman Brothers ... oder gegen die LEHMAN BROTHERS (Luxembourg) S.A. angestrengt werden, ...

ancestry � N Tic InfoTechhttps://www.nticinfotech.com/category/ancestry23andMe, co-founded by CEO Anne Wojcicki, has deployed its latest update, featuring interactive ancestry details, cultural insights about food, art, language, and the option to order a physical ancestry book. Starting today, customers will be able to see more granular ancestry results from more than 1,000 regions, as well as 33 population-specific pages about cultural information.[PDF]Transcript: Andrew Tsai � Catching a Theme on the ...https://capitalallocatorspodcast.com/wp-content/uploads/EP.73-Tsai.pdfwork on a fixed income arbitrage desk and so I was one of the few kind of nut heads who wanted to do that and with the Susquehanna background, was able to get an offer at Lehman Brothers and their fixed income arbitrage group and that was the beginning for me in finance.

Ishibashi on eBay | TalkBass.comhttps://www.talkbass.com/threads/ishibashi-on-ebay.616517May 19, 2010 � After Lehman Brothers bankrupted, many of our international customers have gone and sales has decreased. ... For me the whole point of the Ubox was the fact that they had a huge range of instruments that only very, very rarely appear for sale outside Japan. ... As has been mentioned, one of the reasons for selling internationally through U-Box ...

A Colossal Failure of Common Sense: The Incredible Inside ...https://www.amazon.es/Colossal-Failure-Common-Sense-Incredible-ebook/dp/B0035X1BSOWhen Lehman Brothers bank went under, the world gasped. One of the world's biggest and most successful banks, its downfall was the event that sparked the slide of �Reviews: 1Format: Versi�n Kindle

Amazon | A Colossal Failure of Common Sense: The ...https://www.amazon.co.jp/Colossal-Failure-Common...Translate this page????. When Lehman Brothers bank went under, the world gasped. One of the world's biggest and most successful banks, its downfall was the event that sparked the slide of the world economy toward a Great Depression II.

?? - English translation � Lingueehttps://www.linguee.com/chinese-english/translation/??.htmlTranslate this pageThe sudden demise of Lehman Brothers caused over 40 000 investors who had bought investment products issued or guaranteed by Lehman Brothers in Hong Kong to lose everything. ... Shavack said police had not confirmed that one of the women was the shooter�s estranged wife, though earlier in the day the city�s mayor said that was the case ...

Mark Halperin | The Liberal Doomsayerhttps://liberaldoomsayer.wordpress.com/tag/mark-halperinIt has only occupied the White House for a year and a half, though (of course, Mikey omits that incon-vee-nient detail). And the event that triggered the skyrocketing unemployment rate was the fall of Lehman Brothers in September 2008, which took place on the watch of A Certain 43rd President, as well as approval of TARP funding soon afterwards.

December | 2011 | Turbotoddhttps://turbotodd.wordpress.com/2011/12Machine� contest, it�s easy to forget it was the men (and women!) who built and programmed the victorious machine! And then March 11. A 9.1 magnitude earthquake and subsequent tsunami flattened part of the coast of Japan, killing over 20,000, and leading to a nuclear emergency at four different nuclear energy plants.[PDF][Excerpted from:] White House Philosophy Stoked Mortgage ...media.yoism.org/BushAndTheFinancialMeltdown.pdfPresident Bush and his economics team huddled in the Roosevelt Room of the White House for a briefing that, in the words of one participant, �scared the hell out of everybody.� It was September 18. Lehman Brothers had just gone belly-up, overwhelmed by toxic mortgages. Bank of America had swallowed Merrill Lynch in a hastily arranged sale.

vidauahttps://vidaua.blogspot.comJohn Feloni (Harper/Perennial, . As soon as the broker agent E. F. Hutton & Co. was swallowed by Shearson Lehman Brothers a couple of months afterwards the 1987 stock exchange car accident, it appeared to many a victim of complicated monetary proceedings. But writers of this time chronicle of Hutton's last years point to less mechanic reasons:

Dealmaker the Networker | Hilton Worldwide | Financial ...https://www.scribd.com/document/265109680/Dealmaker-the-NetworkerIn addition to the Hilton sale, Moelis�s network has paid off with other big-name assign- ments even as the markets grow choppier, deals unravel and M&A activity grinds to a halt. Take his illustrious role rep- resenting Yahoo (alongside Goldman Sachs and Lehman Brothers) in fending off Micro- soft�s $45 billion hostile bid:

Systemic Thinking Building Maps for Worlds of Systems 2013 ...https://max.book118.com/html/2018/0309/156570934.shtmTranslate this pageInstead, his topic of interest was ? nancial reform, which gained in increasing urgency as the global economy continued to struggle with the aftermath of bank and insurance company col- lapses in the wake of Lehman Brothers, the United States � s fourth largest bank, ? �

Recruitment News | Legal Jobs | Law Absolute | Page 121www.lawabsolute.com/recruitment-news/8/1211st March 2012. Marking an end to one of the most protracted disputes surrounding the fall of global financial services organisation Lehman Brothers in 2008, the Supreme Court has now decided to allow the clients of non-ring fenced�

Antonio Correia - Greater New York City Area ...https://www.linkedin.com/in/antoniojcorreia/{country=br,+language=pt}Lehman Brothers 2002 � 2005 3 years ... during which time he was one of the senior members of Medco's global business and corporate development team. ... He was the first person tapped on all ...Title: Vice President, Strategic �Location: Greater New York City

Do CDS Spreads Tell the Truth? - CFOhttps://www.cfo.com/banking-capital-markets/2011/05/do-cds-spreads-tell-the-truthMay 19, 2011 � Twelve months prior to the credit problems encountered by Fitch�s sample of six financial institutions (including Lehman Brothers Holdings and Anglo Irish), the average CDS spread of the six was 199 basis points. That translates into an average one-year probability of default of 3.3%.

IMI Placements Class of 2008https://www.pagalguy.com/discussions/imi-placements-class-of-2008-25028828Among the prominent recruiters were Lehman Brothers with its front-end I-Banking profile, AT Kearney with its consulting advisory, Adventity in the analytics and knowledge services domain, UBS in ...

Dec 15, 2006 Ben and Hank's Not So Excellent Adventure ...www.321gold.com/editorials/schiff/schiff121506.htmlDec 15, 2006 � Mr. Schiff began his investment career as a financial consultant with Shearson Lehman Brothers, after having earned a degree in finance and accounting from U.C. Berkley in 1987. A financial professional for seventeen years he joined Euro Pacific in 1996 and has served as its President since January 2000. An expert on money, economic theory, and ...

Peter J. Solomon - Find linkwww.edwardbetts.com/find_link/Peter_J._SolomonMary C. Tanner (950 words) exact match in snippet view article find links to article Senior Managing Director of Lehman Brothers, Bear Stearns, and the Peter J. Solomon Company. Tanner was the first woman to become a partner at Lehman Brothers

Recruitment News | Legal Jobs | Law Absolute | Page 120www.lawabsolute.com/recruitment-news/8/1201st March 2012. Marking an end to one of the most protracted disputes surrounding the fall of global financial services organisation Lehman Brothers in 2008, the Supreme Court has now decided to allow the clients of non-ring fenced�[PDF]Let us know how access to this document benefits you ...https://rdw.rowan.edu/cgi/viewcontent.cgi?article=1011&context=business_facpubbanking firm, Lehman Brothers, went bankrupt, the insurance giant AIG and the automotive giant General ... as one of the three determinants of stock returns along with the capital asset pricing model beta and the market-to-book ratio. Lo and MacKinlay (1990) and Richardson and Peterson (1999) provide evidence ... The first and third quartiles ...

Compensation claims ruled out for Lehman-backed products ...https://www.moneymarketing.co.uk/advisers/compensation-claims-ruled-out-for-lehman...The decision comes more than 10 months after the companies failed due to their exposure to Lehman Brothers. In March, the FSCS announced a �22m levy on intermediaries to cover losses from some ...

buick invitational : d�finition de buick invitational et ...dictionnaire.sensagent.leparisien.fr/buick+invitational/en-enThe tournament originated as the San Diego Open and used that name in its title through 1985. Shearson Lehman Brothers were title sponsors from 1985 to 1992. Buick was the main tournament sponsor from 1992 to 2009. Farmers Insurance Group is the main sponsor as of 2010.

Ben Miles: English actor - Biography and Lifehttps://peoplepill.com/people/ben-milesMiles was the co-lead in the BBC drama, A Thing Called Love, ... he appeared in the TV drama After Thomas as the father of a son with autism. He worked alongside actors such as Clive Mantle. In 2008, ... and appeared on stage at the Lyttelton Theatre as one of the Lehman Brothers in The Lehman Trilogy.

LCH.Clearnet Group - Media Centre - Press Releases - 2012 ...secure-area.lchclearnet.com/media_centre/press_releases/2012-02-13.aspIt was the first OTC clearing service to successfully handle a significant OTC interest rate swap default, doing so when it resolved Lehman Brothers� $9 trillion IRS default in 2008. In that instance, SwapClear�s default management process ensured that more than 66,000 trades in five currencies were hedged and auctioned to other clearing ...

?????????1???????_?????https://www.919713.cn/?id=9417Translate this page????(Nomura Securities)????????????(Masanari Takada)??????????,??????????????(Lehman Brothers)???????????,????????? �

�Government Sachs� Strikes Gold ... Again - California ...https://willblogforfood.typepad.com/will_blog_for_food/2009/07/government-sachs...Well, because that was the plan, as devised by Bush Treasury Secretary Henry Paulson, a former CEO of Goldman Sachs. Remember that Lehman Brothers, Goldman's competitor, was allowed to go bankrupt. The Paulson crowd wouldn't let Lehman change its status to that of a bank holding company and thus qualify for federal funds; soon afterward ...

SAFEWAY CUTS 940 MID-LEVEL JOBS TO REDUCE EXPENSES ...https://www.supermarketnews.com/archive/safeway-cuts-940-mid-level-jobs-reduce-expensesMeredith Adler, an analyst with Lehman Brothers, New York, said the 10% to 13% cutback could be indirectly related to the eventual sale of Dominick's, Safeway's Chicago-based division, which will ...

France denies Dexia bailout will hurt stat - 9Financehttps://finance.nine.com.au/business-news/france-denies-dexia-bailout-will-hurt-stat/...With the fall of Lehman Brothers in 2008 still fresh in memory, France had no choice but to bailout Dexia, said Jerome Cahuzac, chairman of the parliamentary finance committee.[PDF]Rede Partners promotes Kristina Widegren to Partnerhttps://www.rede-partners.com/media/1401/kristina-widegren-promotion-press-release...Prior to Palamon she spent seven years at Lehman Brothers in ECM, responsible for relationship and ... �This is an immensely proud moment for the business as we open the partnership up for the first time since 2011. Having grown significantly over the last eight years, ... and a long term business

Southern District of New York - French translation � Lingueehttps://www.linguee.com/english-french/translation/southern+district+of+new+york.htmlThus, if a Japanese citizen and a German citizen, both resident in their respective countries, enter into a contract for the sale of goods, and the contract contains a choice of ... court ruling in the first quarter of 2, in Lehman Brothers Special Financing, Inc. v. BNY Corporate Trustee Services, Ltd. cibc-global.hk. ... This is not a good ...

FSB BMUNLXVIIIhttps://fsbbmunlxviii.blogspot.comFor Topic 1, as mentioned in the background guide this committee will be set 6 months after the fall of Lehman Brothers Holdings, which means we will be set in March 2009. As such it is your job as delegates to enact proposals from this point in time relying �