Home

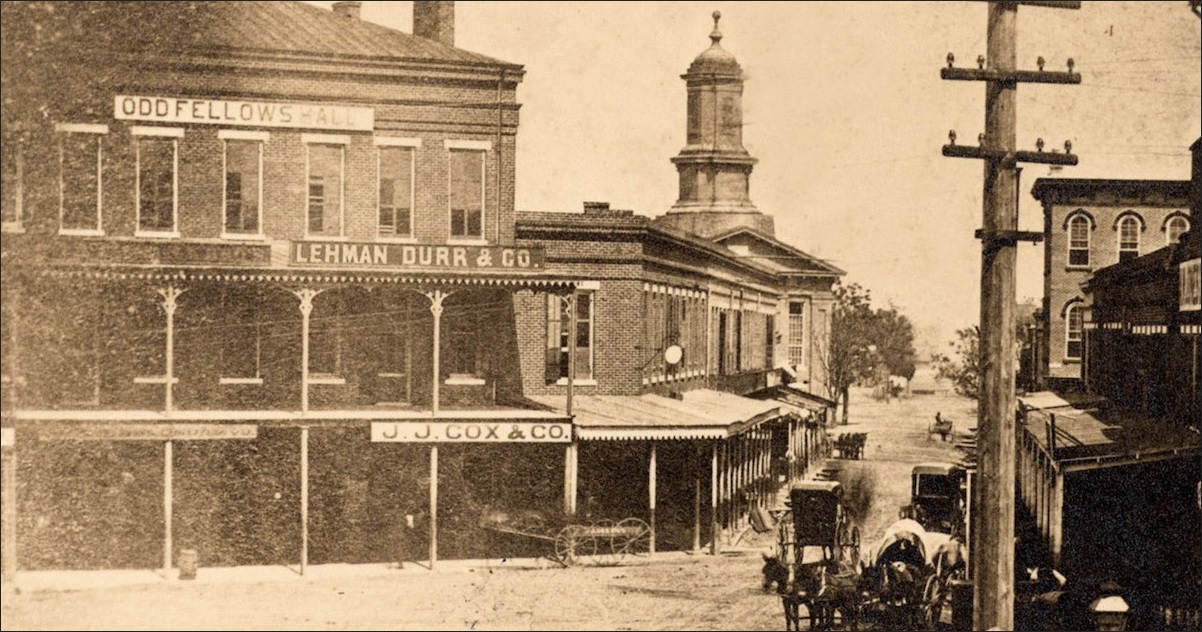

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Brightest Not Always Besthttps://www.outsidethebeltway.com/brightest_not_always_bestDec 08, 2008 · Frank Rich entitles his latest column "The Brightest Are Not Always the Best." IN 1992, David Halberstam wrote a new introduction for the 20th-anniversary edition of "The Best and the B[PDF]State of Rhode Island and Providence Plantationswww.sos.ri.gov/documents/publicinfo/omdocs/minutes/4528/2007/8504.pdfcurrently a bias towards middle- and large-sized funds, a temporal phenomenon given the recent successes of these types of funds in the marketplace. Treasurer Caprio asked Mr. Fann for information particular to Lehman Brothers (Lehman), an alternative investment firm seeking investment in their new fund by the ERSRI. Mr.

JP Morgan settles bond case for $722 million; SEC says ...https://www.al.com/birmingham-news-stories/2009/11/jp_morgan_settles_bond_case_fo.htmlThe county began a series of bond refinancings and interest-rate swaps in 2001 with JPMorgan, Bear Stearns, Bank of America Corp. and Lehman Brothers Holdings Inc. in an effort to lower interest ...

The Journey | Dream MGMThttps://dreammgmt.wordpress.com/category/the-journeyFun Fridays. Stanley Kirk Burrell was born in Oakland, California (March 30, 1962), son of a club manager and a police department assistant. He grew up poor with his mother, a secretary, and eight siblings in a small apartment in East Oakland. The future rapper recalled that six children were crammed into a three-bedroom housing project apartment.[PDF]ARMBRUSTER GOLDSMITH DELVAC LLPclkrep.lacity.org/onlinedocs/2008/08-3458-s2_misc_03-09-11.pdfLehman Brothers in early 2004, which was very publically announced in the press at the time. The new owners ofThe Culver Studios, included Pacifica Ventures and a local affiliate of Lehman. Pacifica's management team took the facility from being completely empty to sold out with feature films and

Work & Meaning | Irshad Manjihttps://irshadmanji.com/explore-the-issues/work-meaningWork & Meaning | Irshad Manji. Irshad Manji. Irshad Manji. Checkout My account. Menu[PDF]Annual Report and Accounts 2000 - guim.co.ukstatic.guim.co.uk/ni/1437673969583/GMG-Annual-Report-2000.pdfTelevision Holdings plc and a partner with KPMG in London. Giles Coode-Adams OBE DL* Non-Executive Aged 61. Joined the Board in 1999. He was formerly a Managing Director and then senior advisor to Lehman Brothers and from 1991 to 1997 was Chief Executive of the Royal Botanic Garden, Kew, Foundation. He is a Non-Executive

Why Do Banks Go Rogue: Bad Culture or Lax Regulation ...https://www.newyorker.com/news/john-cassidy/why-do-banks-go-rogue-bad-culture-or-lax...Apr 04, 2013 · Why Do Banks Go Rogue: Bad Culture or Lax Regulation? By ... If you are looking for a bit of light reading over the weekend, I can recommend a new two ... As the …[PDF]U.S. Bank Nat. Ass’n v. Ibanez, 458 Mass. 637 (2011)https://blog.richmond.edu/lawr516/files/2014/08/US-Bank-Nat-Assn-v-Ibanez.pdfU.S. Bank Nat. Ass’n v. Ibanez, 458 Mass. 637 (2011) 941 N.E.2d 40, 86 A.L.R.6th 755 ... as the mortgage holders where they had not yet been assigned the mortgages. The judge found, based ... mortgage to Lehman Brothers Bank, FSB, which assigned it to Lehman Brothers …

Hong Kong tribunal fines HSBC private bank HK$400 million ...https://uk.finance.yahoo.com/news/hong-kong-tribunal-fines-hsbc-private-bank-hk...Nov 21, 2017 · A Hong Kong tribunal on Tuesday imposed a record fine of HK$400 million (£38.7 million) on the private banking unit of HSBC in a case related to the sale of Lehman Brothers-linked structured financial products between 2003 and 2008. The Securities and …

60 Minutes: The Bet That Blew Up Wall Street | History ...https://historynewsnetwork.org/article/116262Bear Stearns was sold to J.P. Morgan for pennies on the dollar, Lehman Brothers was allowed to go belly up, and AIG, considered too big to let fail, is on life support thanks to a $180 billion ...

Blue chips break stocks out of tech jail - Feb. 20, 2002https://money.cnn.com/2002/02/20/markets/markets_newyorkFeb 20, 2002 · Earlier in the day, a Lehman Brothers downgrade of CNN/Money parent AOL Time Warner, a Credit Suisse First Boston downgrade of network equipment maker Cisco, and …

Bay Area | Bay Area for McCombs Board | McCombs School of ...https://www.mccombs.utexas.edu/Bay-Area/Bay-Area-for-McCombs-BoardPrior to Silver Lake, Mr. O’Neill founded Bandon Partners, a boutique investment bank and was the CFO of two venture-backed companies. Mr. O’Neill was previously an investment banker with Morgan Stanley, Deutsche Bank and Lehman Brothers. Mr. O’Neill holds a B.B.A. from the University of Texas, where he graduated with honors.

So far, sexting, groping is 2016’s ‘October Surprise ...https://www.boston.com/news/politics/2016/10/31/so-far-sexting-groping-is-2016s...Oct 31, 2016 · So far, sexting, groping is 2016’s ‘October Surprise’ ... as the race between Republican Mitt Romney and Democratic incumbent Barack Obama was drawing to a …[PDF]SUSAN HARTMAN, CPA*, CFE Direct +1.214.619.4966 Mobile …https://www.bvagroup.com/pdf/bios/Susan-Hartman.pdfPrior to Interpublic Group, Ms. Hartman served as the CFO/Controller of a venture -backed company. In this role, she managed all finance and accounting functions for the entity and negotiated the raising of two rounds of equity funding and a bridge loan. Additionally, HartmanMs. began her career at Lehman Brothers in New York City.[PDF]The Federal Reserve's Term Asset-Backed Securities Loan ...https://www.newyorkfed.org/research/economists/medialibrary/media/research/epr/12v18n3/...contributed to a contraction in credit that threatened to exacerbate the downturn in the economy. Programs such as the U.S. Treasury’s guarantee of money funds and the Federal Reserve’s Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF) supported the orderly liquidation of prime money market fund[PDF]Candidates for the Board of Directors of Síminn hf ...https://ml-eu.globenewswire.com/Resource/Download/3b8e3c95-49f3-4ad8-8328-5eb25505917bmoved to Lehman Brothers where he was Co-Head of the Global Telecoms Team and was a member ... a position he held until the company was successfully sold to a NYSE listed company in 2017 ... as the Executive Chairman of the Board of Stoðir and Managing Director of Helgafell ehf., which holds an indirect 22% stake in Stoðir.[PDF]www.sullcrom.comhttps://www.sullcrom.com/siteFiles/Awards/TheTimesRodginCohen.pdfthat time, I will have been retired for a few years, but I would envisage working in some form of public service. Linda Tsang I [email protected] was the real issue. I can't say that there will not be similar cases but what happened with AIG — a company that has very sound value in its underlying insurance businesses is likely to be a one-off.

WPX Energy - PressReleasehttps://www.wpxenergy.com/news-and-media/press...Over his career, he was associated with Lehman Brothers Inc. for more than 30 years in both leadership and advisory roles, including serving as head of the firm's worldwide energy practice. George A. Lorch is Chairman Emeritus of Armstrong Holdings, Inc., the holding company for a manufacturer and marketer of floors, ceilings and cabinets. Mr.

The best way yet to proclaim love for a tax cheat - The ...https://www.mcall.com/opinion/mc-xpm-2013-03-08-mc-tax-cheats-weil-column-taxcheats...Aside from those episodes (and a bunch of others I left out, such as the firm's see-no-evil audits for Lehman Brothers Holdings Inc.), it surely is accurate to say that most of Ernst's thousands ...

Court of Chancery Addresses Application of Entire Fairness ...https://www.delawarelitigation.com/2009/10/articles/chancery-court-updates/court-of...Oct 29, 2009 · Katten Muchin Rosenman, LL” (“Katten Muchin”) was the special committee’s legal advisor, and Lehman Brothers (“Lehman”) was its financial advisor. After Barceló’s public announcement, Eilian told the special committee that he was interested in entering into a possible transaction with JQH.

Las Vegas housing market going big — as in master-planned ...https://vegasinc.lasvegassun.com/.../04/las-vegas-housing-market-going-big-master-planned-Jun 04, 2014 · The Mountain’s Edge project in southwest Las Vegas was the No. 4 selling master-planned community in the country last year, with 841 sales, according to RCLCO. Providence, in the northwest valley, was No. 7 with 726 sales, and Summerlin, which runs along the western rim of the valley, was No. 11 with 566 sales.[PDF]Quarterly Economic News - SilverStone Grouphttps://www.silverstonegroup.com/wp-content/uploads/2011/06/MHS-Quarterly-4th-2008...The Barclay’s Aggregate Bond Index (formerly Lehman Brothers’ Aggregate Bond Index) is a commonly used measure of the bond market. The Dow Jones Industrial Average is a commonly used measure of large capitalization common stock total return performance. All referenced indices are unmanaged and not available for direct investment.[PDF]7 Things You Need to Know About Fannie Mae and Freddie Machttps://www.americanprogress.org/wp-content/uploads/2012/09/GriffithFannieFreddieBrief.pdfsible for a combined $5 trillion in mortgage ... The primary function of Fannie Mae and Freddie Mac is to provide liquidity to the nation’s ... It was the poor performance of the loans in these ...

Why Asia Matters: When East Meets Westwww.westernasset.com/US/en/pdfs/commentary/AsiaMatters201110.pdftries (Exhibit 1). Post-Lehman Brothers, the region’s GDP growth displayed an uncharacteristi-cally immediate and steep slippage of more than four percentage points in the ? rst quarter of 2009 to reach a decade-low of 2.7% year-over-year (YoY). Recent market worries over the soft

Gender parity in management linked to higher corporate ...https://www.cbc.ca/news/business/gender-parity-in-management-linked-to-higher...Carol Meyrowitz of TJX Co. was the highest paid female CEO in America in 2013, a year in which the stock went up by almost 50 per cent. Profit at the retail chain has tripled since she took over ...[PDF]Why Asia Matters: When East Meets Westwww.westernasset.com/US/en/pdfs/commentary/AsiaMatters201110.pdftries (Exhibit 1). Post-Lehman Brothers, the region’s GDP growth displayed an uncharacteristi-cally immediate and steep slippage of more than four percentage points in the ? rst quarter of 2009 to reach a decade-low of 2.7% year-over-year (YoY). Recent market worries over the soft

Management team – Tikehau Capitalhttps://www.tikehaucapital.com/en/our-group/our-people/management-teamHe started his career in 2004 at Lehman Brothers (Corporate Finance M&A team) first in London and then in Milan. ... From 2016 to 2019 he was the Chief Financial Officer of Tikehau Capital before joining the teams in New York to develop the Group's activities in North America. ... This page contains information relating to a potential capital ...

Insight: Foreign banks squeeze costs as Asia's glow fadeshttps://www.reuters.com/article/us-banks-costs-asia-idUSTRE80B0IM20120112Jan 12, 2012 · Bhattal led Lehman Brothers and Nomura at a time of heady expansion and leaves now when the growth period is ending. ... slowing growth and a …

Ranger Global Real Estate Advisorshttps://rangerglobalre.com/our-teamHe obtained practical experience in financial markets while at Lehman Brothers, where he worked on the NYSE and AMEX trading floors and, subsequently, for the director of Lehman Brothers' institutional equity sales and trading desk. Mr. LoPresti graduated from New York Law School in 1997.

When Chaos Trumps Security - Asia Sentinelhttps://www.asiasentinel.com/p/taiwan-chaos-trumps-securityThose working in the International Financial Center may recall how protesters over the Lehman Brothers mini-bonds saga five years ago stormed into the Hong Kong Monetary Authority located on the upper sections of the 88-floor skyscraper, leading to a long suspension of all the elevators as the protesters enjoyed a game of hide-and-seek.

High frequency tradinghttps://www.reddit.com/r/quant_hftIt was the epicenter of Wall Street. ... He has spent over a decade developing algorithmic trading strategies places like Lehman Brothers and Nomura, and a number of large hedge funds. He will joining a panel of other seasoned infrastructure experts at the forthcoming IBT Media Artificial Intelligence and Data Science in Capital Markets event ...[PDF]

FGC BOLSA - FGC FINANCIAL MARKETS INFO: 01/19/12https://www.fgcbolsa-fgcfinancialmarkets.info/2012_01_19_archive.htmlLATEST NEWS: Wall Street advances on bank results, data: NEW YORK (Reuters) - U.S. stocks rose for a third straight day on Thursday, sparked by results from Bank of America and Morgan Stanley and as the latest jobless claims dropped to a near four-year low. | Full Article[PDF]INTERVIEW Saint-Honoré Convertibleshttps://evd101.files.wordpress.com/2009/03/interviewshconvertiblesfevrier2009anglais...Saint-Honoré Convertibles - Best fund over 10 years in the ... This was not due to a technical difference in deltas² as the pool had similar characteristics in both 2002 and 2008. The very disappointing ... 2008 after Lehman Brothers went bankrupt.[PDF]ANNUAL REPORT 2017https://www.fnb.com.lb/Annual Reports/Annual Report 2017.pdfcommercial and investment banking as the Managing director and regional Manager for lehman Brothers Inc. in the Middle east in addition to various banking positions in new york, london, and the Middle east. Mr. Farah is the chairman-ceo of FnB Holding limited and a member of the Board of directors in Sc Bank S.a.l., and on other

Stock Quote News - Stock Market Quotes, Online Stock ...https://in.reuters.com/finance/stocks/company-officers/ATEC.OFeb 21, 2020 · Prior to joining Lazard, Mr. Woods was a Managing Director and a Partner of Lehman Brothers and was co-head of the Corporate Finance Department. He joined Lehman Brothers in 1967 and was elected ...

Revisiting "U.S. Financial Apocalypse Economists Need to ...axisoflogic.com/artman/publish/Article_28477.shtmlThese are the same bozos that have yet to acknowledge the fact that the U.S. is in a recession and has been for several months now. ... Lehman Brothers, and Merrill Lynch were global icons of ...

AXA US Short Duration High Yield ZI Gross GBP Price ...https://www.bestinvest.co.uk/factsheets/axa-us-short-duration-high-yield-zi-gross-gbpPrior to joining AXA Investment Managers in 2002, he was an analyst in the investment banking division of Lehman Brothers, where he performed financial analysis on companies in the consumer and retail sectors and worked on a variety of M&A and high yield transactions. He holds a B.A. from Williams College and has the CFA professional designation.

Vanguard UK Investment Grade Bond Index GBP Price ...https://www.bestinvest.co.uk/factsheets/vanguard-uk-investment-grade-bond-index-gbpThe Fund seeks to provide returns consistent with the performance of the Lehman Brothers Global Aggregate U.K. Non-Government Bond Index (the "Index"), a market-weighted bond index of the pound sterling, investment-grade bond market, excluding government bonds with an intermediate-term weighted average maturity.

New republic ends princes’ Gilded Age | Financial Timeshttps://www.ft.com/content/5f84ea2a-f2e4-11dd-abe6-0000779fd2acAmerica’s Gilded Age ended on September 15, 2008, the day Lehman Brothers went broke. But many of Wall Street’s erstwhile plutocrats didn’t realise that meant an end to their own gilded ...[PDF]Beware of Mistaking a Symptom for the Causewww.rgaia.com/wp-content/uploads/2013/10/September-2013-Commentary.pdfOctober!4,!2013! Beware of Mistaking a Symptom for the Cause “If$you$can$heal$thesymptoms,$but$not$affect$thecause,$it’s$quitea$bit$liketrying$to$heal$a$gunshot$

Joe Biden | Sense on Centswww.senseoncents.com/tag/joe-bidenHaving been away for the weekend, I missed last night’s edition of 60 Minutes and thank a loyal reader who brought it to my attention.. How is it possible that even today an institution such as Lehman Brothers, which clearly engaged in accounting maneuvers designed to disguise its true financial position, is not pursued so real justice can be meted out?

Black Monday - Private Banking, Asset Protection and ...https://www.qwealthreport.com/black-monday-stock-markets-around-the-world-plummetAt one point, the VIX Index, a.k.a. The Fear Index, peaked at 53 points, a level not seen since the Lehman Brothers disaster. In fact, many observers suspect that it was worse than that, with Bloomberg even reporting that the Index failed to “update” at one point, for a period of 30 minutes!

Matt Stoller on Twitter: "13. One manufacturer told me we ...https://twitter.com/matthewstoller/status/1144643272016650246Jun 28, 2019 · One of the L's stood for Lehman Brothers, ... Rare earths was the well-known one. But it goes far beyond that. https: ... But the attack-sub force still could decline to a low of 42 in 2028 as old Los Angeles-class boats leave the fleet in large numbers. "Where we sit today is, we can’t build ships and deliver them in time to fill in that dip ...

323 F3d 930 United States Securities and Exchange ...https://openjurist.org/323/f3d/930Mar 07, 2003 · The NASD can internally enforce certain disciplinary judgments, such as suspensions or revocations of NASD memberships, but it has no means by which to enforce a monetary fine or restitution order like the one entered against Vittor. Only the courts are capable of enforcing such an order. This is the crux of the dilemma.[PDF]Changing rules - ?????smile.globes.co.il/research/changing-rules-0609.pdfPricewaterhouseCoopers1 or one of the country members listed in the contact section at the end of this document. Foreword This is the 7th year we have produced our whitepaper report. Our last report was dated September 2008 and was published just as Lehman Brothers announced that it was in administration and the US Government announced massive

MT Interview - Michael Spencer - Management Todayhttps://www.managementtoday.co.uk/mt-interview-michael-spencer/article/460142Jan 27, 2005 · From what were the offices of Lehman Brothers in London's Broadgate and are now his new HQ, he oversees an empire of 2,900 staff in 23 branches worldwide. He also owns substantial stakes in Numis, the listed stockbroker, and City Index, the spread-betting firm. But it's as a moneybroker that Spencer has made his fortune and his reputation.

Return of the Russian Bear - The Daily Reckoninghttps://dailyreckoning.com/return-of-the-russian-bearThe December 2007 Lehman Brothers E&P Spending Survey estimates that the six largest Russian oil and gas companies will spend $28.5 billion on exploration and production in 2008, up 21% from 2007 ...

Japanese Buy US Financials, and Nomura Is Getting the Best ...https://seekingalpha.com/article/97114-japanese-buy-us-financials-and-nomura-is...Sep 24, 2008 · Investors' initial reactions to Nomura's bold strategic move were positive, but this was only after the stock (underlying shares) had fallen 46% from a 52-week peak to a …[PDF]FINEX NORTH AMERICA ALERT - Willis Groupwww.willis.com/Documents/Publications/Services/Executive_Risks/2014/50176_Publication...both ways: signaling an increase and a decrease in possible exposures. For your consideration: 1. Reserve Fund: With significant investments in the debt of Lehman Brothers, the Fund “broke the buck” by falling below the $1 net asset value that money funds maintain, leading to a civil suit by the U.S.

Time Hotel's Alleged $55M Default Prompts Foreclosure Suithttps://www.law360.com/articles/361760/time-hotel-s-alleged-55m-default-prompts...Consulate Hotel Associates originally inked a mortgage loan agreement for $43.1 million and a gap mortgage note for $11.9 million from original lender Lehman Brothers Holdings Inc. in December ...

Investing In A Rising Interest Rate Enviroment « Global ...https://www.globalinvestmentreport.net/investing-in-a-rising-interest-rate-environmentThe last two times the Fed went into tightening modes, in 1994 and 1999, the Lehman Brothers US aggregate Bond Index [price ex coupon] took it on the chin, ending the years down 9.5 percent and 7.0 percent, respectively.

3, 2, 1: Global Debt Meltdown - Infowarshttps://www.infowars.com/3-2-1-global-debt-meltdownAug 25, 2011 · If you don’t think that a problem, just remember what happened back in 2008. Back then, Lehman Brothers was leveraged 31 to 1. When things turned bad, Lehman was wiped out very rapidly. Today, major German banks are leveraged 32 to 1, and those banks are currently holding a massive amount of European sovereign debt.

Jeffrey Ubben, James Mitarotonda, Brevan Howard - Insider ...https://www.insidermonkey.com/blog/jeffrey-ubben-james-mitarotonda-brevan-howard-3170Jeffrey Ubben, James Mitarotonda, Brevan Howard ... confirmation hearings and Lehman Brothers Holdings Inc. is renewing its efforts to ... Stock Picks and a way to for Buffett to improve his ...

Kris jenner female viagra // Canada2020https://genicanada.com/?Kris_jenner_female_viagraA type of Japanese egg pancake, perfect for a fast supper. General HTML PDF Magellan Health Services to Present at Lehman Brothers 10th Annual Global Healthcare Conference AVON, Conn. With several benefits to give, Primaforce Yohimbine HCl may be a very good option for men who are looking for alternative treatments for low T and ED.

Boulder’s Evelyn Stevens finishes 24th in Olympic cycling ...https://www.denverpost.com/2012/07/29/boulders-evelyn-stevens-finishes-24th-in-olympic...Boulder’s Evelyn Stevens finishes 24th in Olympic cycling road race ... the early-morning coffee — and the late-night coffee — for a bike and a bag lunch. ... Lehman Brothers came recruiting ...

GE to Acquire $1.8 Billion Leasing Portfolio from IKON ...whattheythink.com/news/20320-ge-acquire-18-billion-leasing-portfolio-ikon-officeDec 12, 2003 · The closing of the transaction is subject to execution of the definitive Program Agreement and customary conditions, including receipt of third party consents. The transaction is expected to close in the first quarter of calendar 2004. Lehman Brothers acted as IKON's exclusive financial advisor.

21 West End Avenue, Building Review | CityRealtyhttps://www.cityrealty.com/nyc/lincoln-center/21-west-end-avenue/review/57412This impressive, 43-story, mixed-use residential complex at 21 West End Avenue between 60 th and 61 st streets in the Riverside Center complex on the Upper West Side was erected by The Dermot Company and was completed in 2016.. It has 616 rental apartments of which 127 are “affordable” units.[PDF]CC:PA:LPD:PR (REG-104946-07), Room 5203 P.O. Box 7604 Re ...https://www.actuary.org/sites/default/files/pdf/pension/hybrid_march08.pdfConsider the case of a plan sponsor that decides to convert a traditional plan to a hybrid plan on Jan. 1, 2008, and wants to provide certain additional benefits beyond the ... This is because the investment risk tolerance of the ... • Lehman Brothers aggregate long-term bonds, or

Electronics makers show a knack for reform - Nikkei Asian ...https://asia.nikkei.com/.../On-the-Cover/Electronics-makers-show-a-knack-for-reformElectronics makers show a knack for reform. ... of officials from Chinese companies eager for a tour. ... that of archrival Panasonic on Feb. 5 for the first time in about a year and a half.[PDF]Special administration regime for investment firmshttps://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment...an investment firm can be resolved in an orderly manner. The failure of Lehman Brothers (Lehmans) and more than 240 entities trading under its holding company, Lehman Brothers Holding Inc, in September 2008 posed serious challenges for insolvency regimes the world over.

HKEx H1 earnings hit by weak trading - Nikkei Asian Reviewhttps://asia.nikkei.com/Business/HKEx-H1-earnings-hit-by-weak-tradingAug 10, 2016 · The profit figure also reflected a high base in 2015 due to a one-off gain from the recovery of Lehman Brothers' liquidators and the sale of a stake in European clearing house LCH. In the first ...

From Groceries To Golf Tees | Planned Giving Design Centerhttps://www.pgdc.com/pgdc/groceries-golf-teesBeing simplistic, let's just take a $100,000 portfolio where 50% of the holdings were placed in bonds and the other 50% were held in domestic equities. To mirror those two positions we will use the Lehman Brothers Aggregate Bond index for the fixed side and the …

Torsted Advisorstorsted.comAdvisor to a Cyber-security company for a quantum computer world ... (for contributed assets valuations and a synthetic equity private market sale mechanism ), negotiation with the unions for labor reductions/transitions and funding negotiations with the World Bank/EBRD/private domestic Polish Banks. ... At Lehman Brothers, he worked on a broad ...

Market Recap with Jiazi - SprinkleBloghttps://blog.sprinklebit.com/market-recap-jiazi-12Jun 18, 2017 · The expansions in Europe are robust, with all key segments of the economies participating in the upswing. The European economy grew at an annualized pace of 1.8% in the first quarter. The European Central Bank removed a reference in its statement to a potential rate cut but maintained its dovish policy stance.[PDF]Discussion Paper: Treatment of Financial Contracts in ...siteresources.worldbank.org/EXTGILD/Resources/WB...Lehman Brothers . prompted a second set of ... value), and a bad bank (containing nonperforming or illiquid assets). The performing - ... pursuant to a master netting agreement that provides for contract based netting rights. This is one way in which closeout netting, in this context, has a more extensive ambit than standard setoff rights ...

Washington Mutual | FAQ: 401k Retirement Plan401k-retirement-plan.com/tag/washington-mutualHousing prices are crashing. Bear Stearns, Lehman Brothers, and Washington Mutual, have been acquired for pennies on the dollars. Fannie Mae and Freddie Mac are under Federal Government conservatorship. US Commercial banks have tightened lending standards, and a credit crunch threatens global financial markets.

Bloomberg's terminals face threat from start-ups like ...https://www.afr.com/markets/bloombergs-terminals-face-threat-from-startups-like...Sep 10, 2015 · David Bullock, a former Lehman Brothers executive who now runs his own financial advisory firm, says that since signing up for Money.Net last year and cancelling his Bloomberg terminal, he …

Guest post: It’s morning in America again – Foreign Policyhttps://foreignpolicy.com/2012/11/26/guest-post-its-morning-in-america-againNov 26, 2012 · Guest post: It’s morning in America again ... four years after Lehman Brothers ... Ali Wyne is a researcher at the Harvard Kennedy School’s Belfer Center for …

To Fire or Not to Fire Mueller - The Jewish Voicethejewishvoice.com/fire-not-fire-muellerThat is the question Robert Mueller, who just sicced a federal prosecutor on Donald Trump’s personal lawyer, is out of control. Like many federal prosecutors, he is puffed up by his own self-righteous arrogance, one fueled by the unaccountable and unrestrained power he’s been given in our supposedly democratic republic. Forget all the “integrity” and […][PDF]Banking Efficiency within the World’s Largest Banks ...https://digitalworks.union.edu/cgi/viewcontent.cgi?article=2169&context=theseshorror stories that surround firms such as Lehman Brothers and Bear Stearns. From 2007 to 2008 the banking industry as a whole struggled to stay afloat, as the United States and numerous other nations faced off against one of the most significant economic recessions since the …

Minerva - Doomsayer or Oracle? - koreatimeswww.koreatimes.co.kr/www/news/nation/2008/11/117_34684.htmlThe commentator, who became famous after he correctly predicted the fall of Lehman Brothers and the plunge of the won against the dollar, drew keen public attention Tuesday night as MBC TV's prime ...[PDF]Roosevelt, the Great Depression, and the Economics of Recoveryhttps://muse.jhu.edu/chapter/823554Franklin D.Roosevelt but was unique in his own way in his contributions to the American political system and the modern economy. There is much to admire in the Great Engineer, the label that aptly describes Hoover’s contribution to the managerial and technological change of the s with its promise of a more abundant economy.Yet no

Tim Harrison's Followed users | Seeking Alphahttps://seekingalpha.com/author/tim-harrison/followingTrend Watchers get to view all of our Chat Archives, weekly Webinars - as well as the amazing PSW Wiki, which gives you Phil's recent opinions and trade ideas as well as technical and fundamental ...[PDF]Financial Crash, Commodity Prices, and Global Imbalanceshttps://www.brookings.edu/wp-content/uploads/2008/09/2008b_bpea_caballero.pdfFinancial Crash, Commodity Prices, ... required for a bubble to develop, ultimately destroying the commodity bubble. ... with the failure of the investment bank Lehman Brothers on September 15.

2014-2015 Protégés | UAA College of Business and Public Policyhttps://business.uaa.alaska.edu/leadership-fellows/proteges-2014.cshtmlIn his role as Denali Alaskan Federal Credit Union’s Marketing Strategist, he facilitates departmental alignment to enhance member utilization of products. ... Lehman Brothers, and Barclays Capital. She was born and raised in Anchorage and enjoys hiking, figure skating, traveling, and spending time with her family and husband, Lindon ...

"Betrayal of Trust the Best Source of Insider Trading Tips ...https://www.questia.com/newspaper/1P2-36628193/betrayal-of-trust-the-best-source-of...Her husband, Matthew, was a broker for Lehman Brothers. At least 12 times starting in 2004, he shared with a circle of friends information he had overheard from her about corporate takeovers, according to an SEC complaint. Among this group of insider traders, Mr. Devlin's wife became known as "the …

Bond Volatility & Interest Rate Swaps | Gold Eaglehttps://www.gold-eagle.com/article/bond-volatility-interest-rate-swapsNow they are backfiring, and danger rises for major credit derivative accidents twice as great as the CDSwap accidents that killed AIG. The falsification for 15 years of the Consumer Price Index goes hand in hand with falsification of interest rates, both long-term and short-term. The victims list also includes Bear Stearns and Lehman Brothers.

Japanese investment banker Takehiko Ogihara jailed for 11 ...https://www.dailymail.co.uk/news/article-5544821/amp/Japanese-investment-banker-40...Ogihara's current partner wept as the judge passed sentence. Nomura, the largest retail financial holding company in Japan, set up a base in London in 2009 after purchasing Lehman Brothers' Asian ...

Greek default: A Lehman Brothers Moment for Eurozone ...https://www.newsclick.in/international/greek-default-lehman-brothers-moment-eurozoneOct 13, 2011 · But it's not just about Europe, it's about the financial system. I think one thing that is not coming up clearly in lot of media reports about this, not a lot about public debt, about fiscal overspending, problem of sovereign debt. ... The stock aspect what you said, the size of the debt and as long as the huge debt hangs nothing will ...

The Best Dressed RIA Executives - Articles - Advisor ...https://www.advisorperspectives.com/articles/2019/02/19/the-best-dressed-ria-executivesBut, it’s not clear that the firm’s current business model is set up for that. Can an RIA firm actually scale this way? ... They were the first to triumph the idea of being a fee-only fiduciary and bash the annuity game. ... she was a financial advisor and worked at Lehman Brothers. Sara graduated from Harvard with a degree in English ...

The 5 Biggest Bubbles In Markets Today | Mauldin Economicshttps://www.mauldineconomics.com/editorial/the-5-biggest-bubbles-in-markets-today/mceAs a Wall Street veteran and former Lehman Brothers head of ETF trading, Jared Dillian has traded through two bear markets. Now, he’s staking his reputation on a call that a downturn is coming. And soon. In this special report, you will learn how to properly position your portfolio for the coming bloodbath. Claim your FREE copy now.

Shocks & Stares » Governmentblogs.hillandknowlton.com/shocksandstares/tag/governmentAn interesting commentary piece in the New York Times written by former CFO of Lehman Brothers, Erin Callan on wanting to “have it all” and failing. This was in response to a heated debate sparked by the launch of Sheryl Sandberg’s new book, “Lean in” – and much of …

Might Makes Height | Architect Magazinehttps://www.architectmagazine.com/practice/might-makes-height_oArchstone was partially owned by failed investment bank Lehman Brothers, which didn’t help. The second reason is older and far more convoluted: the 102-year-old Height of Buildings Act, which limits D.C. buildings, with few exceptions, to a maximum height of 130 feet—and in …

Item 5. Other Events. - EDGAR Onlinesec.edgar-online.com/dualstar-technologies-corp/8-k-current-report-filing/2000/08/02/...Before joining EE&C, Vince was the technology executive at Lehman Brothers responsible for the design and operations of their global data network with 600 nodes in over 50 countries. Prior to that, Vince has held various management positions with AT&T including network engineering and …

My Law License: July 2009https://mylawlicense.blogspot.com/2009/07Jul 08, 2009 · Elefant mentions one former in-house counsel at former Lehman Brothers who is now running a marketing Web site for professionals, and another former BigLaw who left to "fulfill his passion for interior design. The question is asked: "Has the recession forced you to consider leaving the law for a job you always dreamed of? And do you think that ...

CNN.com - Transcriptsedition.cnn.com/TRANSCRIPTS/1510/29/cnr.18.html[01:05:06] Number two, the man that was a managing general partner at Lehman Brothers when it went down the tubes and almost took every one of us with us, including Ben and myself. Because ...

NCO Financial called - Collections - Credit InfoCenter Forumshttps://www.creditinfocenter.com/community/topic/289763-nco-financial-calledNov 06, 2008 · This is no way to make money on a "tax loss" or a "bad debt loss". It is impossible to make money by losing money. Don't believe me? Just ask FNMA, FHLMC, Bear Stearns, Lehman Brothers, Merrill Lynch, AIG, etc. I promise you that none of those organizations got a windfall from a write-off. A loss is a loss is a loss.

Raheem Kassam - Powerbasehttps://powerbase.info/index.php/Raheem_KassamEducation. Kassam attended Bishopsholt School and then Westminster University where he studied politics. His Student Rights bio also says he worked for a time at Lehman Brothers.. Activities Conservative Party. Kassam was the vice chairman of the Hillingdon branch of Conservative Future in 2008-2009. He served on the Conservative Future national executive in 2009.

J. M. Kirby - Secretary General - Stomhouse Continuation ...https://uk.linkedin.com/in/jmkirbyThe very next words my comely interlocutor spake, "only banks and law firms ever file for a LP" awakened my suspicious antennae. I was (to be expected) wrong entirely. The LP is the most fantastic Trading tool the UK has been gifted. Lehman Brothers, the UK arm and most profitable portfolio ever, was here because of the LP..Title: Immortality is replication. Success …Location: London, Greater London, United Kingdom500+ connections

Legal Loophole Offers Volkswagen Criminal Immunity - Slashdothttps://yro.slashdot.org/story/15/09/30/2043255I wonder if anyone dares to put this into perspective - i.e. in a comparison with Wall Street practices. Last time I heard, bonuses and pensions over there were at least one order of magnitude higher, and deaths (like suicides) following crises like Lehman Brothers and their followers were actually countable, not dubious statistical numbers.

Inflation 101, prepare now for HYPERINFLATION. Attention ...https://www.godlikeproductions.com/forum1/message503317/pg2Oct 12, 2008 · This is why Wall Street firms and banks have been hoarding cash. As the Financial Times wrote on October 7th: Banks are hoarding cash in expectation of pay-outs on up to $400bn (£230bn) of defaulted credit derivatives linked to Lehman Brothers and other institutions, according to analysts and -dealers. ***

God, Business and Life | Achieving Financial Wellnesshttps://markbfricks.comBonds can suddenly become illiquid as witnessed with Lehman Brothers in 2008. Recently, one of the most accurate bond pundits of the last decade and leading money manager, Jeffrey Gundlach of DoubleLine, said that Federal Reserve will raise interest rates “until something breaks”.

Oliver v. Narragansett Bay Insurance Co. :: 2019 :: Rhode ...https://law.justia.com/cases/rhode-island/supreme-court/2019/16-320.htmlLehman Brothers Bank, FSB, 68 A.3d 1069, 1082 (R.I. 2013) (“We have held that the existence of an agency relationship is a question of fact.”). A review of the record reveals that plaintiffs have met their burden of demonstrating that this threshold factual issue remains in dispute.

Two very different ways to run a companyhttps://www.fool.com.au/2012/05/26/two-very-different-ways-to-run-a-companyMay 26, 2012 · Motley Fool Australia » Investing » Two very different ways to run a ... The first is Lehman Brothers. ... a reward for serving customers became the first priority. In his book Origins of ...[PDF]VISION FOR REINVENTING This is the first of a series of ...epsomoe.dns-systems.net/userfiles/documents/oestuff/oezine/publications/Phoenix_Autumn...for a meal for two at The Black Swan in Ockham. Bob Ellison, cross-country coach and organiser comments,“Neil was a great friend and colleague. I am delighted to support this event in his memory.” Next year’s run will be held on 25th March. College Governor, George Pincus, comments “This is one of my favourite events of the year.

For Some Grown-Ups, Playing With Legos Is a Serious ...https://groups.google.com/d/topic/alt.toys.lego/fZNfASidRSkLehman Brothers in 2002 to build Lego models full time. "Their parents are often really jealous, too." Parents—including some famous ones like David Beckham—and some childless adults today brag about the complex Lego models they are building. Grown-ups forked over more than $1,000 for a …

Hamzei Analytics Financial Network: Interest Rateswww.hamzeianalytics.net/2007/02/interest-rates.htmlSteve Shobin, the former Vice Chairman & Chief Investment Strategist for AmeriCap Advisers, LLC, is a veteran of more than four decades on Wall Street where he was a Managing Director at Lehman Brothers, Inc. and a First Vice President at Merrill Lynch.Mr. Shobin was a senior member of the research divisions at both firms. During his tenure, he developed unique methodologies for projecting …

March | 2013 | The Entrepreneur Reviewhttps://entrepreneurreview.wordpress.com/2013/03Mar 28, 2013 · In 2008, Weiss lost his job at Lehman Brothers when the firm went bankrupt. As he was looking for new work, his sister was searching for a prom dress. He noticed that the website she was browsing looked very outdated. Upon checking other prom dress sites, Weiss saw that there were only a few reliable vendors online.

Fishing catch shares suddenly become hot 'commodities ...https://www.gloucestertimes.com/news/local_news/fishing-catch-shares-suddenly-become...Milken panel moderator Larry Band, who put in many years at Lehman Brothers, the investment bank that went down during the banking catastrophe, and now advises the Environmental Defense Fund ...

Chit Chat Thread for the week of October 13, 2008 | POI ...www.poi-factory.com/node/17753If you had purchased $1,000 of shares in Lehman Brothers one year ago, you will have $0.00 today. But, if you had purchased $1,000 worth of beer one year ago, drank all the beer and then turned in the aluminum cans for a recycling refund, you will have received $214.00.

Michael Denmark - Executive Chairman - Great Entertainment ...https://hk.linkedin.com/in/michaeldenmarkI was excited by this product as the timing was good and we put a team onto building the brand, relationships and partnerships in Hong Kong and around the region....Securing Lehman Brothers as title in the first year (hmm) and then onto Swire properties, Veuve Cliquot, Glasshutte Watches, GOD and a significant nukber of media partners.Title: Executive Chairman at Great …Location: Hong Kong500+ connections

Is it over? - New York Universitypeople.stern.nyu.edu/nroubini/articles/AsiaMiracle&KrugmanECO.htmSome economists point to rising wages and large current-account deficits as evidence of falling competitiveness. This is far too simplistic. Miron Mushkat, chief Asian economist of Lehman Brothers, an American investment bank, points out that rising wages go hand in hand with the upgrading of production in Asian economies.

UvA-DARE (Digital Academic Repository) Information ...https://pure.uva.nl/ws/files/1524263/119041_10.pdfand a sudden spike of IDL occurs in the time range -1100 to -1000. This peak is not as consistent across the parameter values as the peak around Lehman Brothers, so we investigated further what could be the cause. We show in the next subsection that during …[PDF]

Financial Institution Woes Shred Markets| Housing Finance ...https://www.housingfinance.com/news/financial-institution-woes-shred-markets_oPending sales for existing homes dropped 3.2 percent, to 86.5. This compares to a previous reading of 89.4. The big news, though, was Lehman Brothers’ struggle. “They’re trying to buy time, but it’s very dangerous on Wall Street to buy time. You need to be able to do business,” said Axel Merk, portfolio manager at Merk Funds.

Silvio Berlusconi: Top 10 Facts You Need to Know ...https://www.famousdetails.com/silvio-berlusconi1829 – The first units of the London Metropolitan Police appear on the streets of the British capital. 2008 – Dow Jones Industrial Average falls 777.68 points, its largest single-day point loss, following the bankruptcies of Lehman Brothers and Washington Mutual. 5. Silvio Berlusconi’s height and weight

Stock markets end seesaw day with sizable gains – The ...https://www.mercurynews.com/2008/09/16/stock-markets-end-seesaw-day-with-sizable-gainsSep 16, 2008 · Stocks retreated sharply and Treasury bond prices jumped Monday as investors reacted to a stunning reshaping of the landscape of Wall Street that took out two storied names: Lehman Brothers ...[PDF]Policy Brief 17-20: The Financial Stability Oversight ...https://www.piie.com/system/files/documents/pb17-20.pdfThis began to change during 2007, as the extent of problems in US securities markets and the potential global impact became clear. By early 2008 Paulson’s Treasury was a colead on systemic risk policy issues, 16 along with the Federal Reserve—although the Fed was still in the driver’s seat for 17 Oversight Council., Financial

BBC NEWS | Business | Weakest US growth in four yearsnews.bbc.co.uk/2/hi/business/6708395.stmMay 31, 2007 · "But it's quite obvious the economy bottomed in the first quarter and this leaves us with a better base from which to bounce back." Other analysts are also confident that the figures for April to June will be much better. "I think we'll see second-quarter growth above 3% and 2.5% for all of 2007," said Lehman Brothers senior economist Drew Matus.

"Bonuses to Double as Big Banks Coin It" - The Evening ...https://www.questia.com/newspaper/1G1-151278384/bonuses-to-double-as-big-banks-coin-itBonuses to Double as Big Banks Coin It . Read preview. ... which was the best year for windfalls since 2000, recruiter Morgan McKinley reports today in its August employment index. ... is the first of the big banks to report its third-quarter figures today followed by Lehman Brothers tomorrow and Bear Stearns on Thursday. Analysts expect ...

Take My Car, Please - WSJhttps://www.wsj.com/articles/SB118346277513056528The company had been flirting with the idea of a sale for months, and finally seemed to put itself on the block definitively last month when it retained J.P. Morgan Chase and Lehman Brothers to ...

BBC NEWS | Business | Q&A: US bails out AIGnews.bbc.co.uk/2/hi/business/7618847.stmSep 17, 2008 · To survive, the company urgently needed cash, and the US Federal Reserve was the only organisation prepared to supply it. I have an insurance policy with AIG. What should I do? Nothing. The US government clearly believes that - unlike investment bank Lehman Brothers - AIG is too big to fail. AIG's insurance policies remain in force.

Mark Hertling: Top 10 Facts You Need to Know | FamousDetailshttps://www.famousdetails.com/mark-hertling1829 – The first units of the London Metropolitan Police appear on the streets of the British capital. 2008 – Dow Jones Industrial Average falls 777.68 points, its largest single-day point loss, following the bankruptcies of Lehman Brothers and Washington Mutual. 5. Mark Hertling’s height and weight

Bluefield Daily Telegraph Archives, Dec 29, 1992, p. 9https://newspaperarchive.com/bluefield-daily-telegraph-dec-29-1992-p-9Dec 29, 1992 · Morgan Stanley Group Inc. gave staffers the option of receiving half their bonus before year end. Shearson Lehman Brothers Inc. is paying 75 percent of bonuses this week to employees making $235,000 or more, en suring some tax benefit. The rest will get the same percentage by Jan. 4. The firms themselves also are taking action.

Wall Street soars on Fannie, Freddie bailout | Reutershttps://www.reuters.com/article/us-markets-stocks-idUSL267843520080908Sep 08, 2008 · Lehman Brothers, however, failed to follow the trend among financials, falling 12.7 percent to $14.15 on reports that the investment bank was meeting with potential buyers for …

Reflections on Past Bear Markets - Legacy Wealth Managementhttps://legacywealthgj.com/reflections-on-past-bear-marketsLehman Brothers, a big and long-standing brokerage firm, went bankrupt. While the causes haven’t been the same, the reaction and eventual path have. As investors see and hear the news, and see investment values decline, they feel pain.

Julie Mehretu Ranks Among Most Expensive Women Artists ...https://www.culturetype.com/2014/05/06/julie...May 06, 2014 · But it wasn’t until 2010, at the sale of works from the Neuberger Berman and Lehman Brothers corporate art collections at Sotheby’s New York in 2010, that one of her abstract paintings first garnered $1 million.” — artnet News . In the notes for the Christie’s lot, Mehretu describes her practice, her approach and intentions:

‘Big cannabis’ tech ahead of its timeshttps://www.hortibiz.com/news/?tx_news_pi1[news]=33779&cHash...Coming out of the venerated Lehman Brothers broker-training program during the mid-1990s, Sassano got into market making at what was then CIBC World Markets. Starting in 2004, Sassano, moved more into banking and then real estate before setting his sights on start-up investing, which in turn led him to stake out legal cannabis at its apex.

Habitually Chic® » Tis Better to Give…https://habituallychic.luxury/2008/11/tis-better-to-giveWhy they’re hurting: Washington Mutual and Lehman Brothers used to hold corporate volunteering days at the Food Bank’s 90,000-square-foot warehouse in Hunts Point. “Now we’ve lost that entire network,” says spokeswoman Carol Schneider.

February 2015 – TeachNorthernhttps://teachnorthern.wordpress.com/2015/02There’s evidence of some savage rearguard action as established, unquestioned binaries are interrogated and discarded. After the fall of Lehman Brothers, the Scottish Referendum and a million other culture-shocks, status quos which have been in place …

Deposit deadline crunch for MyTravel | This is Moneyhttps://www.thisismoney.co.uk/money/news/article-1532774/Deposit-deadline-crunch-for...Are you one of the millions of households overpaying? ... The This is Money podcast on what could be in the Budget ... Analysis by Lehman Brothers has calculated the group's debts are likely to ...

Trump’s new economic aide calls Trudeau ‘crazy’ lefty – BC ...https://www.bclocalnews.com/news/trumps-new-economic-aide-calls-trudeau-crazy-leftyMar 14, 2018 · ‘We are in a mental recession, not an actual recession,’ he wrote, a theme he kept repeating until Sept. 15, when Lehman Brothers filed for …

Trump’s new economic aide: Loves trade with Canada, calls ...https://business.financialpost.com/pmn/business-pmn/cancelling-nafta-would-be-a...Mar 14, 2018 · ‘We are in a mental recession, not an actual recession,’ he wrote, a theme he kept repeating until Sept. 15, when Lehman Brothers filed for …

September | 2019 | gibberishhttps://markgorman.wordpress.com/2019/09Over the course of three and a half hours we see 150 years of the Lehman Brothers’ (and hence industrialised America’s) history presented by the three brothers, their heirs and a supporting cast of dozens of minor characters, all played, largely in third person narrative, by the three actors – apart from their principal roles they cover ...

Cancelling NAFTA would be 'calamitous': Trump's new senior ...https://www.ctvnews.ca/politics/cancelling-nafta-would-be-calamitous-trump-s-new...Mar 14, 2018 · 'We are in a mental recession, not an actual recession,' he wrote, a theme he kept repeating until Sept. 15, when Lehman Brothers filed for …[PDF]Debate The Political Consequences of the Financial and ...https://onlinelibrary.wiley.com/doi/pdf/10.1111/spsr.12006Lehman brothers (September 15, 2008), we can conclude that the expectations of the eco- ... This is Schattschneider’s (1960) idea of the ‘expansion of con?ict’. Public protest is designed to unleash a public debate, to draw the attention of the public to the grievances of the actors in ... are pressing and a response to more or less ...

Board | Melvin W. Jones Foundationmelvinjonesfoundation.org/boardKenneth D. Ford is currently serves as the Vice President of the Melvin W. Jones Foundation. He has held this position since 2004. Kenneth has worked as an investment banker with both Lehman Brothers, Inc. and Wachovia Securities. Kenneth’s primary responsibility was to arrange leveraged loan and high yield bond financings for Fortune 500 ...

Cramer's 'Mad Money' Recap: Next Week's Game Plan (Final)https://www.thestreet.com/jim-cramer/cramers-mad-money-recap-next-weeks-game-plan...Aug 05, 2011 · There are still losses from Lehman Brothers, but those wounds are healing. ... He said a terrific opportunity for another bank to step up and take market share. ... In his "No Huddle ...

Your Sleazy Government At Work « TheCenterLane.comwww.thecenterlane.com/?p=568May 31, 2010 · In his latest “must read” essay, ... the explanation: Nobody outside a handful of big swap dealers really has a clue about how much any of this shit costs, which means they can rip off their customers at will. ... Unregulated derivative deals sank AIG, Lehman Brothers and Greece, and helped blow up the global economy in 2008.

Trump’s new economic aide: Loves trade with Canada, calls ...https://ottawacitizen.com/pmn/business-pmn/cancelling-nafta-would-be-a-catastrophe...Mar 14, 2018 · ‘We are in a mental recession, not an actual recession,’ he wrote, a theme he kept repeating until Sept. 15, when Lehman Brothers filed for …

Engineering your way to the top | E&T Magazinehttps://eandt.theiet.org/content/articles/2010/02/engineering-your-way-to-the-topEngineering your way to the top. By Wilf Altman. Published Tuesday, ... references are sound - to protect your reputation. Employers can find out a lot on the Internet. If you’ve worked for a company like Enron or Lehman Brothers it can affect your reputation too. It isn’t fair, but it happens.” ... One of the first tasks of leadership is ...

Playing Whack-a-Mole with Systemic Risk | HuffPosthttps://www.huffpost.com/entry/playing-whack-a-mole-with-systemic-risk_b_59563a42e4b0f...Sep 14, 2017 · Consider the game of financial whack-a-mole that must be played to preempt future economic shocks. One of the first steps in doing of course to expand the purview of regulatory regimes encompassing many institutions, which like Lehman Brothers, are not presently deemed to be systemically important.[PDF]

Strategic Groups, Competitive Groups and Performance ...https://www.jstor.org/stable/20142474cited as one of the world's most profitable industries (Boston Consulting Group, 2000). 2. Analyst valuations of pharmaceutical companies differ widely based on current performance and future expectations (Lehman Brothers, 2003). 3. The long lead times of the industry and the observation that the performance outcome for

Iceland, The IMF, Debt Moratorium, & The Tobin Taxhttps://rense.com/general88/tobin.htmThese branches were seized by London and The Hague at the height of the Lehman Brothers panic in September-October 2008. These governments, backed by the IMF, then demanded more than $6 billion from the Icelandic government to bail out the depositors. This is the attempted extortion which Ms. Jonsdottir is speaking against.][PDF]The PEF Newsletter LIGHT WAVESpvpef.org/bm.doc/pef-oct-newsletter.pdfThis is certainly one of the most difficult budget times we have faced in education – but I know that this wonderful community will rise to the challenge of helping PEF meet its pledge to the district and support our schools and our students at all levels. Together, we can give our children a brighter future. A WElcomE to ouR nEW nEWslEttER,[PDF]6 1 0 2 2 / 2016 - Rosa Luxemburg Foundationhttps://www.rosalux.de/fileadmin/rls_uploads/pdfs/Policy_Paper/PolicyPaper_2-2016.pdfreport states that the existence of a single currency and a single monetary policy formulated by the European Central Bank (ECB), which also sets interest rates for the whole euro ... This is said to be necessary for a monetary union such as the EMU where “large scale fiscal transfers between ... that this market was one of the leading causes ...[PDF]Master Thesis Quantitative Finance Analyzing tail ...citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.1027.5163&rep=rep1&type=pdfthe middle part of the distribution. See Embrechts et al. (1997) for a detailed treatment of EVT, and Embrechts (2000) for a discussion of the potential and limitations of EVT in risk management. Morgenstern (1959) is the first who studies cross-country financial spillover effects. He explicitly

Financial Times, May 19, 2008 articlewww.shareholderforum.com/bsc/Library/20080519a_FT.htmThe investment banks viewed as the most likely takeover candidates are Merrill Lynch and Lehman Brothers. Ken Lewis, BofA chief executive, is now famous for saying late last year that he had endured "all the fun" he could handle in the investment banking …

Address on Iceland and the IMF, Debt Moratorium, and Tobin ...tarpley.net/address-on-iceland-and-the-imf-debt-moratorium-and-tobin-taxThese branches were seized by London and The Hague at the height of the Lehman Brothers panic in September-October 2008. These governments, backed by the IMF, then demanded more than $6 billion from the Icelandic government to bail out the depositors. This is the attempted extortion which Ms. Jonsdottir is speaking against.]

Should You Invest In An Irish ETF? (Part II) - Market Tamerhttps://www.markettamer.com/blog/should-you-invest-in-an-irish-etf-part-iiNov 02, 2013 · Should You Invest In An Irish ETF? (Part II) MarketTamer | by Thomas Petty Posted on ... because its people are formidably enterprising and have an ultra-open economy with a high enough trade gearing to withstand the combined shock of a fiscal squeeze equal to 19pc of GDP and a double ... (Lehman Brothers, AIG, Anglo-Irish Bank, etc ...

Oprah Book Club announces its latest selection | EW.comhttps://ew.com/books/2017/06/26/oprah-announces-new-book-club-pickJun 26, 2017 · Oprah announces new book club pick ... a senior executive at Lehman Brothers, while Neni gets a temporary job working for Clark’s wife Cindy …

Once the build is given to the tester,what are the test he ...https://www.allinterview.com/showanswers/58035/once-build-tester-test-he-going-conduct...Once the build is given to the tester,what are the test he is going to conduct list them in chronological order .....its urgent. ... i.e. validating as per as the Business requirements whether ... 0 Answers Lehman Brothers…

America’s Most Trustworthy Companies | Risk Management Monitorwww.riskmanagementmonitor.com/americas-most-trustworthy-companiesAudit Integrity looks beyond the raw data on companies’ income statements and balance sheets to assess the true quality of corporate accounting and management practices. As early as August 2005, Audit Integrity’s proprietary rating system signaled potential problems at Lehman Brothers.

Hammad Anas Khan (MIBF) - Centralize Account Opening ...https://pk.linkedin.com/in/hammad-anas-khan-mibf-02562878View Hammad Anas Khan (MIBF)’s profile on LinkedIn, the world's largest professional community. ... is defined as the manipulation of financial figures of company earnings (Macintosh, 2009). ... Enron in 2001, and WorldCom in 2002, Lehman Brothers Scandal in 2008, and Satyam in 2009 has create disequilibrium in the financial system Earnings ...Title: Centralize Account Opening …Location: PakistanConnections: 481

Imperial Brands FY Profit Declines; Names Thérèse Esperdy ...https://www.nasdaq.com/articles/imperial-brands-fy-profit-declines-names-therese...Nov 05, 2019 · Thérèse has significant international investment banking experience having held a number of senior roles at JP Morgan. She began her banking career at Lehman Brothers and retired from JP Morgan ...

Is JPMorgan the new Goldman Sachs? | Salon.comhttps://www.salon.com/2011/02/04/jp_morgan_madoff_lawsuitFeb 04, 2011 · While JPMorgan hadn't been immune to populist banker-hate, it emerged from the recession in better condition than many other financial firms. (See: Citigroup, Bear Stearns and *gulp* Lehman Brothers.)[PDF]

Agents Balk At Requirement That Short Sales Be Offered At ...https://realtytimes.com/agentnews/agentadvice/item/27620-20140218-agents-balk-at...Today, the major players in this scenario are Nationstar as the lender (having purchased significant loan portfolios from both Lehman Brothers and Bank of America) and Auction.com serving as the auctioneer. The complaints are varied. Naturally, buyers' agents are the most upset, as they stand a chance of being completely cut out of the deal.

Service of contractual notices under standard form ...https://www.lexology.com/library/detail.aspx?g=b9015f1a-375b-427d-a8d9-7ce3248a3b06Dec 06, 2016 · Service of contractual notices under standard form financial contracts - lessons to learn ... in Lehman Brothers International (Europe)(in administration) ... as the party alleging that the notice ...[PDF]A–5www.washington.edu/regents/meetings/2009/november/items/acad/a-5.pdflisted on Schedule 3.5(c) to this Agreement are the initial UW Medicine/Northwest Designated Board Members. Separate written approval by the UW of the nominees is a condition precedent to the parties’ obligations to close this transaction. Effective at Closing, the individuals listed on Schedule

Columbia Basin Herald - Business, The top 10 movies on the ...https://www.columbiabasinherald.com/article/20191224/AP/312249905Inside Lehman Brothers ... Major US stock indexes are closing nearly flat in muted trading as the market closes early for the Christmas holiday. Industrial and health care stocks are the biggest ...

World financial system shaky as ever - CBS Newshttps://www.cbsnews.com/news/world-financial-system-shaky-as-everNov 07, 2011 · Haven't we heard this song? More than three years after Lehman Brothers blew up and despite stabs at financial reform on both sides of the Atlantic, …

Improved quality of junk bonds smooths comeback ...https://www.baltimoresun.com/news/bs-xpm-1996-12-15-1996350098-story.htmlDefaults are the lowest they have been in years. ... or "credits," as the fund managers call them -- has improved. ... the Lehman Brothers high-yield index was up 10.5 percent but the BB market ...

New Audit Partner Identification Rules May Offer ...https://store.hbr.org/product/new-audit-partner-identification-rules-may-offer...From the WorldCom and Enron accounting debacles that triggered the demise of Arthur Andersen to Ernst & Young's 2013 and 2015 settlements claiming that its audits facilitated massive accounting fraud by financial services firm Lehman Brothers, large-scale financial scandals have led to increasing scrutiny of public auditors.

Cisco Adds Devices to Form Bridge for Networks, Apps ...https://www.computerworld.com/article/2557606Kevin Andree, a network engineer at Lehman Brothers Inc. in Jersey City, N.J., said AON could provide a way to transform messages sent via the financial services industry's Financial Information ...

Daniel Maguire Named Head of SwapClear U.S. - Derivsourcehttps://derivsource.com/2011/10/27/daniel-maguire-named-head-of-swapclear-u-sOct 27, 2011 · LCH.Clearnet is the only clearinghouse to have managed a significant OTC default, that being Lehman Brothers in 2008. During the default, Mr. Maguire was also responsible for the fixed income (RepoClear) default management close out, actively trading, hedging and transferring the Lehman Brothers’ RepoClear portfolio.

How to get to 51 W 52nd St in Manhattan by Subway, Bus or ...https://moovitapp.com/index/en/public_transit-51_W_52nd_St-NYCNJ-site_24915585-121What are the closest stations to 51 W 52nd St? ... We make riding to 51 W 52nd St easy, which is why over 680 million users, including users in Manhattan, trust Moovit as the best app for public transit. ... Clifford Chance Cafeteria-Restaurant Associates Lehman Brothers Nusr …

Fall 2008: McCormick Magazine: Northwestern University ...https://www.mccormick.northwestern.edu/magazine/fall2008Diamonds and cloaks are the treasures and tools of jewel thieves, not professors. But when researchers use them on a much smaller scale, diamonds can help deliver drugs inside the human body, and cloaks in the form of polymer films can help shield the medicine from …[PDF]OpenTable Names Jeff McCombs Chief Financial Officerhttps://press.opentable.com/static-files/8aedd03d-3920-4b69-b9e4-47d38d85fc5dbanker at firms including Credit Suisse First Boston and Lehman Brothers.€ He holds a Bachelor of Arts degree in Business Economics from the University of California, Los Angeles. About OpenTable OpenTable, part of The Priceline Group (NASDAQ: PCLN), is the world's leading provider of online restaurant reservations,

&X1F4DA; Private Tutors For University Students | The Profshttps://www.theprofs.co.uk/tutors/299517I used to be the CEO of a London Stock Exchange Broking Firm, as well as the Global Head at Commerzbank. Prior to this I also worked for the Lehman Brothers. On top of this I have received various teaching awards for my teaching in Finance.[PDF]Pinnacle 9 and 10 FAQs - Morgan Stanleyhttps://www.morganstanley.com/pinnaclenotes/pdf/series9-10/Pinnacle_9_10_FAQ.pdf4. What are the consequences of this mandatory redemption event? On 11 November 2008, the Swap Counterparty for the Notes, Morgan Stanley Capital Services, Inc., notified the Issuer of the Notes that a Principal Writedown had occurred in relation to the Underlying Assets. Thereafter the Notes became subject to mandatory

Contemporary Auditing by Michael C. Knapp (9781285066608)https://www.allbookstores.com/Contemporary-Auditing-Michael-Knapp/9781285066608Jul 24, 2014 · Knapp's CONTEMPORARY AUDITING contains the most recent, compelling, and up-to-date examples. Those cases most widely used by adopters have been retained: Enron Corporation, Golden Bear Golf, Hopkins v. Price Waterhouse, Lehman Brothers, Leigh Ann Walker, Madoff Securities, The Trolley Dodgers, and ZZZZ Best Company.

Jeff Werdesheim Bio – The Banyan Foundationwww.thebanyanfoundation.org/jeff-bioAug 02, 2017 · He began his career with Shearson Lehman Brothers and has been a Managing Director within the Private Client Group at Oppenheimer since 1992. Jeffrey has been an Oppenheimer Asset Management Inc.’s Roundtable member for the past 20 years and is a member of the Firm’s Chairman’s Council which recognizes the top 40 advisors nationwide.

FBI officials struggle to handle wave of finance cases ...archive.boston.com/news/nation/articles/2008/10/19/fbi_officials_struggle_to_handle...Oct 19, 2008 · In addition to the investigations into Fannie Mae and Freddie Mac, the FBI is carrying out investigations of American International Group and Lehman Brothers, and it has opened more than 1,500 other mortgage-related investigations into companies both big and small. Some FBI officials privately worry that the trillion-dollar federal bailout of ...

Ore. Investor Mines Short Treasuries | GlobalCapitalhttps://www.globalcapital.com/article/k6bpnd32j60m/ore-investor-mines-short-treasuriesMay 26, 2005 · Ore. Investor Mines Short Treasuries. ... The asset manager likes the extra yield the short end of the curve provides as the ... Satchwell's main benchmarks are the Lehman Brothers …

Corporate Boards: Bermuda Triangle for the Moral Compass ...https://www.cchange.net/2010/04/08/corporate...Apr 08, 2010 · Sea Change Radio Executive Producer Bill Baue is joined in the studio by John Gillespie, co-author with David Zweig, of Money for Nothing: How the Failure of Corporate Boards is Ruining American Business and Costing Us Trillions.. In mid-March 2010, Jenner & Block released the 2,200-page report prepared by their Chairman, Anton Valukas, that autopsied the Lehman Brothers …

What happens if the debt ceiling bomb explodes? | Salon.comhttps://www.salon.com/2011/07/15/what_happens_if_the_debt_ceiling_bomb_explodesJul 15, 2011 · Oh, and then there are the troops! Can't mess with the national defense! Let's add defense vendor payments ($31. 7 billion), military active duty pay ($2.9 billion) and Veteran's Affairs ($2.9 ...[PDF]Procyclical Leverage and Value-at-Riskhttps://www.aeaweb.org/conference/2013/retrieve.php?pdfid=389Value-at-Risk is a quantile measure on the loss distribution de–ned as the smallest ... (Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch, and Bear Stearns) and the three commercial banks with the ... consider in the analysis are the foreign banks, some of which also own substantial trading

Africa | End Poverty 2015https://www.endpoverty2015.org/en/category/regions/africaRead UN Millennium Campaign African Director, Charles Abugre, weekly column on international economic and development matters at Business Daily Africa. …. THE ARRIVAL of 2014 marks the sixth year since Lehman Brothers Investment Bank of the United States … Continue reading ?

IMPORTANT FACTS ABOUT FORECLOSURE AND MORTGAGE …www.thepeoplesvoice.org/TPV3/Voices.php/2010/10/04/important-facts-about-foreclosure...(Notice the posting 2 years ago showing foreclosure mill lawyer Herschel Adcock’s Lehman Brothers foreclosure –along with his letter demanding to receive Hurricane Katrina insurance proceeds ...

December | 2008 | William's Bloghttps://williamkow.wordpress.com/2008/12<> It’s not an end. The banks (mostly the investment banks like Lehman Brothers etc) and other financial institutions issued BONDS (just like IOUs – the issuers as borrowers and the investors as lenders) by using the properties mortgaged in above 1 and the securities in above 2 as BACK-UP (categorically called Assets Backed Papers).

UK200: Two more firms join the £1m PEP clubhttps://www.thelawyer.com/uk200-two-more-firms-join-the-1m-pep-clubWith just over two weeks to go until the courts are back in session, The Lawyer dissects some of the more interesting judgments to be handed down since May. This week we feature disputes involving Lehman Brothers and Russian oligarchs. Lehman Brothers International v Exotix Partners LLP A mistaken trade between Lehman Brothers European arm and[PDF]The Data Standardization Challengehttps://scholarship.law.columbia.edu/cgi/viewcontent.cgi?article=3300&context=faculty...analysis are the lifeblood of effective surveillance and policy responses at both the national and international levels.”6 Data standardization alone obviously cannot produce a stable financial system, but in improving data quality, it represents a critical tool to build and sustain a resilient system, that is, one that can take a few

CNN?????? (??)https://book.douban.com/subject/6723837Translate this page????????Global News Are the Desktop's Days Numbered? iPad and Google Chrome Take Aim at the Traditional Computer Interface The Shape of Cars to Come A Look into the Future of Electric Autos and Beyond In Touch Technology Pressure-Sensitive Screens Revolutionize High Tech Interaction H2-Go Eco-Friendly Riversimple Runs on the Power of Hydrogen E-Reader Revolution More Book ...[PDF]Today's Missoulian about the Oregon situationannavonreitz.com/missoulian.pdfToday's Missoulian about the Oregon situation ... Read that as--- the "Bureau of Land Management" is precisely the same as a company name like "Stanley Tools" or "Kentucky Fried Chicken" that has been ... 1980's they sold the "U.S. Small Business Administration" to Lehman Brothers Bank.

Millennium won’t stop poaching sell-side quants ...https://news.efinancialcareers.com/us-en/324325/millennium-wont-stop-poaching-sell...Sep 25, 2018 · Peradze himself is a life-long sell-side quant, cutting his teeth at Lehman Brothers before stints at Merrill Lynch, Goldman Sachs and UBS, according to LinkedIn.

Main Points Summary | Grade 12 Accountinghttps://maccounting.wordpress.com/tag/main-points-summaryMar 03, 2011 · Main Points Summary. The five main topics we covered in chapters 4 and 5 are: ... such as the Income Statement, the Statement of Owner’s Equity, and the Balance Sheet. ... of business organization GAAPs Gee Wiz gemini corp Heshani Maklande issues presentation Kevin and Heshani Kuzivakwashe Musiyiwa lehman brothers Linda Lei Main Points ...

Westminster Consulting - Fiduciary Management ...www.westminster-consulting.com/AboutUs/Associates/Thomas_ZamiaraTom began his career in the financial services industry managing the fixed income desk of the Regional Institutional Sales Group for the Lehman Brothers division of Shearson in Rochester, NY. Tom received his bachelor’s degree from Boston College.[PDF]The DecaDe’s Most Influential Lawyers - Sullivan & Cromwellhttps://www.sullcrom.com/siteFiles/Awards/Cohen-HR-NLJ-Most-Influential-Lawyers-of...NLJ.COM Daily Updates at March 29, 2010 The DecaDe’s Most Influential Lawyers A special report These are the lawyers who’ve defined a decade. For our annual Most Influential Lawyers special report, the editors of The National Law Journal have selected 40 attorneys in a dozen key legal areas whose work between Jan. 1, 2000, and Dec. 31, 2009, was so consequential

Sarah Palin Sex Videos - Metacafehttps://www.metacafe.com/videos_about/sarah_palin_sexPresident Bush anchors Beema's News Program and covers topics ranging from Lehman Brothers and Hurricane Ike to Lindsey Lohan and McCain on The View. Of course it wouldn't be Washington news without a sex scandal thrown in for good measure.

Article excerpt - Questia Online Libraryhttps://www.questia.com/newspaper/1G1-191827685/going-cold-turkey-long-battle-ahead-to...Read this article on Questia. Newspaper article The Evening Standard (London, England) Going 'Cold Turkey' - Long Battle Ahead to Wean Financial System off Its Debt Addiction; Tipping Point: Investment Thinking Has Changed Utterly as Markets Reacted to the Fall of Lehman Brothers in September

Corporatisaton of Projects Driving Social ... - VCCirclehttps://www.vccircle.com/corporatisaton-projects-driving-social-sector-investingOct 19, 2010 · Corporatisation of social projects and the presence of a large base-of-the-pyramid market is driving the attention of new generation venture capital firms into social sector investing, says Raj Kundra, Director of Capital Markets and Energy Portfolio, Acumen Fund, New York. The challenge, however, remains in...[PDF]OCTAVE NOTES SERIES 20 FREQUENTLY ASKED QUESTIONS …https://www.morganstanley.com/octavenotes/pdf/series19-20/FAQs_180112.pdfLehman Brothers Holdings Inc.; ... What are the consequences of this mandatory redemption event? On 17 January 2012, the Determination Agent for the Notes, Morgan Stanley & Co. ... to in these Frequently Asked Questions as the offering documents for the Notes) for

Survey Finds Operational Risk Management is of Increasing ...https://www.bobsguide.com/guide/news/2009/Dec/8/survey-finds-operational-risk...Dec 08, 2009 · The survey found that after sharp market declines, the fall of Lehman Brothers, and the discovery of fraudulent activities such as those of Bernie Madoff, Alan Stanford and others, 88% of respondents agreed that investors are spending more time and attention than ever before on due diligence, and were nearly unanimous that the importance of ...

Jens Henoch, Ph.D. - COO Office - DBS Bank | LinkedInhttps://sg.linkedin.com/in/jenshenoch- Management of the Singapore and Australia Business resumption program of Lehman Brothers’ FX, Bond and Rates Derivative trading business under Nomura. - New bank branch set-up in Labuan: Overall project management to enable FI Sales to market to Malaysian clients directly. - Established Indian Government Bond Trading business.Title: COO Office @ DBS Consumer …Location: Singapore500+ connections

$6.6 Billion Added to Defrauded Enron Investors' Pot Total ...https://www.rgrdlaw.com/news-item-Enron-Recovery-Billions-Added-102206.htmlThese new settlements are the largest yet to arise from the Enron securities fraud lawsuits, with CIBC paying $2.4 billion, JPMorgan paying $2.2 billion and Citigroup a further $2 billion. The total settlement value achieved now registers $7.3 billion, adding to previous settlements by Bank of America, Lehman Brothers and Andersen Worldwide.

1 S Orange St, Wilmington, DE - Ing Bank Fsb, Custom ...https://clustrmaps.com/a/3ip7cvIng Bank Fsb listed this address as the owner's address on the property records for the parcel #3040190013300 ... Registered Agent Revoked 2-27-1984, The Corporation Trust Company. Lehman Brothers Bank Fsb linked to this address via UCC filing. Klett Rooney Lieber & Schorling is a license holder connected to this address ... All mentioned ...

When a wise old head replaces young shoulders – FHH Journalhttps://journal.hautehorlogerie.org/en/when-a-wise-old-head-replaces-young-shouldersThey are the “innovation managers” who revolutionised business and finance, a similar species to the “creative” managers who took Lehman Brothers over the edge in 2008 with $613 billion in debt and bond debt of $155 billion, prompting the disaster that still plagues the global economy today.

Unit 2 | Grade 12 Accountinghttps://maccounting.wordpress.com/category/unit-2Posts about Unit 2 written by mscuttle and erictruong. Here are the Review Answers for questions 4-6B and 5-12A which I really hope are the questions I assigned you. If they aren’t, someone email be and I’ll try to post the correct answers.[PDF]Overture to the Digitally Reissued The Music of Managementhttps://scholarworks.gsu.edu/cgi/viewcontent.cgi?filename=2&article=1000&context=fac...These are the universal and timeless themes of The Music of ... Pfizer, Nike, Visa and Goldman Sachs have joined this elite group. Lehman Brothers has . disintegrated, as have the New York City Opera and the venerable Hull House in Chicago. ... education as well as research. The metaphor of music, as the book documents, has been a fairly[PDF]The Idea of 'Too Much Law'ir.lawnet.fordham.edu/cgi/viewcontent.cgi?article=4776&context=flrTHE IDEA OF “TOO MUCH LAW” Mila Sohoni * If brevity is the soul of wit, what is verbosity the soul of? Of overweening, inefficient, even tyrannical government—at least according to the critics who, for years, have bewailed the fact that federal laws and regulations …[PDF](To REMIC Prospectus dated May 1, 2002) $393,454,000https://www.fanniemae.com/syndicated/documents/mbs/remicsupp/2005-037.pdfLehman Brothers c/o ADP Financial Services Prospectus Department 1155 Long Island Avenue Edgewood, New York 11717 (telephone 631-254-7106). INCORPORATION BY REFERENCE In this prospectus supplement, we are incorporating by reference the MBS Prospectus described above. In addition, we are incorporating by reference the documents listed below.

Gotham Gourmand Shares Tips - The New York Sunhttps://www.nysun.com/on-the-town/gotham-gourmand-shares-tips/5766Dec 03, 2004 · Rabbi Schneier spoke of the night's awardees as dreamers and visionaries. In his acceptance speech, honoree and Lehman Brothers' Vice Chairman Harvey Krueger jokingly commented on Rabbi Schneier's mention of banking and dreaming …

Dow finishes below 7,000 for first time since '97 | MPR Newshttps://www.mprnews.org/story/2009/03/02/dow...Mar 02, 2009 · Last week, the Dow and the S&P 500 fell below the levels they had reached Nov. 20 and 21 - to that point their lowest since Lehman Brothers imploded in …[PDF]Organizational Behavior and Human Decision Processeshttps://isiarticles.com/bundles/Article/pre/pdf/77500.pdfrole in leading to their downfall, including Steve Jobs in his early career at Apple (Pfeffer, 1992), Phil Purcell at Morgan Stanley (Beard, 2007), and Pete Peterson at Lehman Brothers (Auletta, 1986), to name a few. These cases follow a similar pattern: power-ful individuals who overestimated how much others in the organi-

Partnerships likely key to Fastow's testimony - Houston ...https://www.chron.com/business/enron/article/Partnerships-likely-key-to-Fastow-s...Mar 07, 2006 · Partnerships likely key to Fastow's testimony ... JPMorgan, Lehman Brothers, ... LJM1 later sold its stake in Cuiaba back to Enron for a 25 percent profit, according to the company's internal ...

The gospel of doubt | Casey Gerald – TedTalk w/Evaluation ...https://www.speeches.io/the-gospel-of-doubt-casey-gerald-tedtalk-w-evaluation-formJan 18, 2019 · Casey Gerald traces the drama of his life back to an East Texas church on the night of December 31, 1999, the night he believed the world was to end. When the rapture didn’t come, he searched for something new to believe in — at Yale, Lehman Brothers, Harvard Business School and his own nonprofit — but found only false saviors.