Home

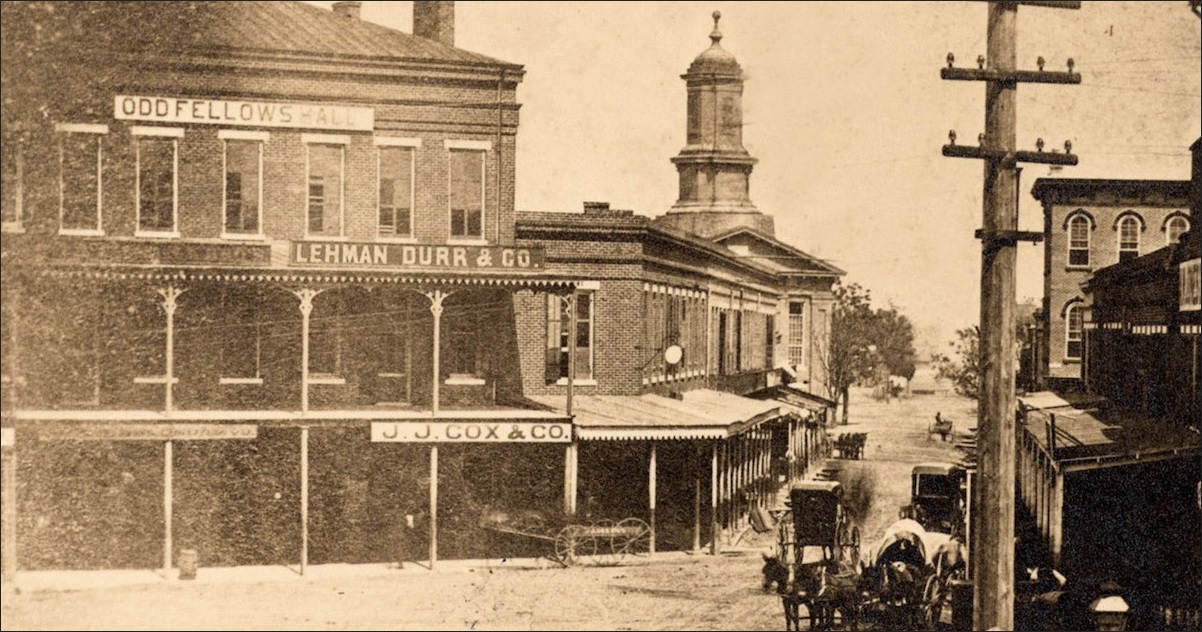

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Stocks tumble on Black Friday fears about debtarchive.jsonline.com/news/milwaukee/76092632.html"I think a sign of things to come," said Dave Rovelli, managing director of trading at brokerage Canaccord Adams in New York. ... which is considered one of the safest investments, was ...

Lexton, Malmstrom to Lead Merrill's Public Finance Group ...https://www.bondbuyer.com/news/lexton-malmstrom-to-lead-merrills-public-finance-groupLexton, Malmstrom to Lead Merrill's Public Finance Group November 06, 2000, 2:00 a.m. EST ... In his new duties, ... I was one of the bankers that helped them get over the hump.

Why the sudden, jumped-up drive to... - Lyndon LaRouche ...https://www.facebook.com/LaRouchePAC/posts/2553030308122047The New York Fed (one of the 12 regional banks in the Federal Reserve System) in that situation might be expected to call all of the big lenders on Wall Street to a secret meeting at its offices and ‘suggest’ (much like a consigliere makes a ‘suggestion’) that they bail out these entities for the good of the markets and financial system.”

Vasuda Capital Management raises corporate governance ...https://www.prlog.org/12663277-vasuda-capital-management-raises-corporate-governance...Sep 07, 2017 · Vasuda Capital Management raises corporate governance issues at Inotek Pharmaceuticals. As of today, we have confirmations of holding 366,355 shares of Inotek from shareholders who are in the favor of sale/liquidation which makes our investor group one of top 10 shareholders of Inotek. - PR12663277[PDF]The 2007/2009 turmoil: a challenge for the integration of ...citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.366.4915&rep=rep1&type=pdftrading to a two-tier market structure in which predominantly large banks ... ized interbank market is the one of having most e/ective peer monitoring in the presence of moral hazard, while Allen and Gale (2000) study an interbank market ... In his model, a –nancial crisis increases the degree of uncertainty of banks about their peers. As a ...

Why the Sudden Rush to Impeach?https://larouchepub.com/other/editorials/2019/4641-why_the_sudden_rush_to_impeach.htmlThe New York Fed (one of the 12 regional banks in the Federal Reserve system) in that situation might be expected to call all of the big lenders on Wall Street to a secret meeting at its offices and suggest (much like a consigliere makes a suggestion) that they bail out these entities for the good of the markets and financial system.”

Economic Issues and Public Policies | Just another ...https://economicissuesandpublicpolicies.wordpress.comAs the financial crisis spread rapidly, people, including the investors lost confidence, banks stopped lending money, credit card companies abruptly changed terms without sufficient prior notice, the public tightened their belts, companies filed for bankruptcy one after another, and soon a deep recession became inevitable.

Adriano B. Lucatelli: «How the Crisis Began 10 Years Ago»https://www.finews.com/news/english-news/26109-adriano-lucatelli-global-financial-crisisThe global financial crisis began ten years ago: HSBC issued a profit warning linked to bad debts, the first of sign of trouble in the U.S. housing market. Financial market expert Adriano Lucatelli looks at how the the damage spread.writes in an essay for finews.first.

Belgian Finance Minister Says Not to Bet Against the Euro ...https://www.globalatlanta.com/belgian-finance-minister-says-not-to-bet-against-the-euroEurope’s “deep pockets” should keep currency speculators from betting against the euro or any of the 17 member countries of the Eurozone, Didier Reynders, Belgium’s minister of finance, told GlobalAtlanta in an interview Jan. 13 in Brussels. He acknowledged, however, that his warning comes at a time when the Eurozone’s finance ministers

Major international meetings on fighting world financial ...www.chinadaily.com.cn/bizchina/g20_pittsburgh/2009-09/25/content_8738255.htmThe first round of the G20 financial summit was held in Washington on Nov 15, 2008. ... It was the first time for the world body to host a high-level meeting to discuss the world financial crisis ...

BOJ's contrarian crisis response draws mixed reviewshttps://www.afr.com/world/bojs-contrarian-crisis-response-draws-mixed-reviews-20100528...BOJ's contrarian crisis response draws mixed reviews. Economists are divided over the Bank of Japan's policy of steadily shrinking its asset holdings, which bucks the trend among the world's ...

Budget 2010: Take one banking mess. Add new rules and ...https://www.telegraph.co.uk/finance/budget/7521225/Budget-2010-Take-one-banking-mess...Mar 26, 2010 · Budget 2010: Take one banking mess. Add new rules and taxes to taste. Stir. Repeat A year or so after the near-collapse of the banking market, Labour is claiming credit not only for its role in ...

Not Quite the Economist - Hong Konghttps://blogs.harvard.edu/michaellaw/category/hong-kongHong Kong’s Education Bureau has caused a furore last month by claiming on their website that Cantonese is just a “Chinese dialect” and “not an official language” of Hong Kong. According to them: Although the Basic Law stipulates that Chinese and English are the two official languages in Hong Kong, nearly 97 per cent of the local […][PDF]Asset formation by households during the financial crisishttps://www.nbb.be/doc/ts/publications/economicreview/2012/ecorevi2012_h5.pdfJune 2012 ASSEt foRmAtIoN BY HouSEHolDS DuRINg tHE fINANCIAl CRISIS 87 Asset formation by households during the financial crisis philip du caju Introduction the financial crisis which erupted in 2008, in the after-math of the mid- September bankruptcy of American bank lehman Brothers, is still affecting the world economy

Fear of economic blow as births drop around worldhttps://sg.finance.yahoo.com/news/fear-economic-blow-births-drop-162123871.htmlMay 08, 2014 · For those who fear an overcrowded planet, good news. For the economy, not so good. We tend to think economic growth comes from working harder and smarter. But economists attribute up to a third of it to more people joining the workforce each year than leaving it. The result is more producing, earning and spending.

Net consultancies feeling heat of looming shakeout - CNEThttps://www.cnet.com/news/net-consultancies-feeling-heat-of-looming-shakeoutNet consultancies feeling heat of looming shakeout. Internet consulting companies, which peddle seasoned advice to chaotic e-commerce clients, are struggling through a crisis of their own.

Art Investors Lured by 12% Return Offer by ... - Bloomberg.comhttps://www.bloomberg.com/news/articles/2012-01-24/art-investors-lured-by-12-return...Jan 24, 2012 · The international market for art-investment funds was worth an estimated $960 million last year, up from $760 million in 2010, according to a report …

Go Van Gogh: Fine art funds making impression on investorshttps://www.investmentnews.com/go-van-gogh-fine-art-funds-making-impression-on...May 03, 2012 · The Investing News Source for Financial Advisers. Investments; Go Van Gogh: Fine art funds making impression on investors Funds look to coin it off rising interest in alternative investments ...

Financial Lessons from Petrotrin’s Demise – Financial ...https://iannarine.com/2018/09/13/financial-lessons-from-petrotrins-demiseSep 13, 2018 · The first issue now is to deal with the Law of Unintended Consequences. In the context of our slow motion dance routine a sudden stop. When your car suddenly stops things get thrown around and people sometimes get hurt.

Bailout | Wall Street Socialhttps://nancefinance.wordpress.com/category/bailout-21This is certainly a concern for the banks losing top talent. But other financial experts believe it is the beginning of a broader and necessary reshaping of Wall Street, too long dominated by a handful of major players that helped to fuel the financial crisis. The country may be better off if the banking industry is less concentrated, they say.

Euro crisis: 'Britons will be around 24pc worse off – a ...https://www.telegraph.co.uk/finance/personalfinance/8655472/Euro-crisis-Britons-will...Jul 24, 2011 · Euro crisis: 'Britons will be around 24pc worse off – a loss of €177 for every £500.' From holidays to investing, we look at what the latest attempt to fix the euro crisis means for your money

The World Of Treasure [1995] - rutorpickrutorpick.weebly.com/blog/the-world-of-treasure-1995Treasure Islands will, for the first time, show the blood and guts of just how they do it. Tax havens aren’t just about tax. They are about escape – escape from criminal laws, escape from creditors, escape from tax, escape from prudent financial regulation – above all, …

Stocks Going Ex Dividend the First Week of Octoberhttps://stockerblog.blogspot.com/2010/09/stocks-going-ex-dividend-first-week-of.htmlStocks Going Ex Dividend the First Week of October Here is our latest update on the stock trading technique called 'Buying Dividends'. This is the process of buying stocks before the ex dividend date and selling the stock shortly after the ex date at about the same price, yet still being entitled to the dividend .

$1,000 Gold Still Looks Possible | Kitco Commentaryhttps://www.kitco.com/ind/Taylor/2013-10-30--1-000-Gold-Still-Looks-Possible.htmlOct 30, 2013 · Our only hope is that somehow the $1,250 level can hold, as that was a bit of a resistance level on the way up after the financial crisis. Indeed it isn’t until it falls either to the first upward trend line at around $1,100 or to a whisker above $1,000 that some real solid support appears on the chart.

Citizens Electoral Council of Australiahttps://cec.cecaust.com.au/main.asp?sub=articles&id=2019_03_20_turner.htmlThis is a far simpler solution, but to ensure it does work it would have to be combined with a Glass-Steagall separation of commercial banks from securities trading, which will prevent retail banks from exposing themselves to speculative losses in the first place. The TLAC drive

decoding the code | Distressed Downloadhttps://blogs.orrick.com/distressed-download/tag/decoding-the-codeSep 03, 2015 · This is the first post in our “Decoding the Code” Series. The Series will cover various sections of the Bankruptcy Code in a clear and easy to understand manner. Our first stop: preferences. Why do I care about preferences? Scenario 1: Your company sells products and services to a large retail electronics chain.

NBER Reporter 2017:1www.nber.org/reporter/2017number1Narrowly interpreted, corporate finance is the study of the investment and financing policies of corporations. Because corporations are at the center of economic activity, the causes and consequences of corporate finance — and hence the research activities of the program — touch almost every aspect of micro- and macroeconomics, allowing the center of gravity to shift from the narrow ...

POLL: Is Goldman Sachs “doing God’s work”? Its CEO thinks soblogs.reuters.com/faithworld/2009/11/08/goldmanNov 08, 2009 · POLL: Is Goldman Sachs “doing God’s work”? Its CEO thinks so Goldman Sachs looks set to pay about $20 billion in bonuses for its top traders this year, at a time when the fallout from last year’s financial crisis is still being felt and the United States unemployment rate has hit 10.2 percent, a 26-1/2-year high.

Appointed mediator could speed Enron proceedings - Houston ...https://www.chron.com/business/enron/article/Appointed-mediator-could-speed-Enron...May 29, 2003 · Appointed mediator could speed Enron proceedings Judges put mediator on case Order could speed up civil and bankruptcy proceedings. By MARY FLOOD and Eric Berger. Published 5:30 am CDT, Thursday ...

Defusing "Financial Weapons of Mass Destruction" | HuffPosthttps://www.huffpost.com/entry/financial-weapons-of-mass_b_462470May 25, 2011 · In 2002 Warren Buffett wrote that in his view, credit derivatives were financial weapons of mass destruction ("FWMDs"). He made the comment while explaining to shareholders why he was unwinding a Berkshire Hathaway subsidiary dealing in them, and few outside of the value investor community paid much heed.

Food Fight in a Time of Crisis Nov. 2001https://lightparty.com/Health/BioDemocracyNews-36.html- Bt cotton, up until now illegal in India, has been found growing on 25,000 acres in the state of Gujarat. E. A. Siddiq, chairman of an Indian Department of Biotechnology committee that monitors transgenic crops, says: "This is a foretaste of a frightening situation where transgenics will be out of control and all over the place." (Nature 10 ...

Nasdaq Europe starts business | This is Moneyhttps://www.thisismoney.co.uk/money/news/article...Jun 07, 2001 · The This is Money podcast on what could be in the Budget ... Talks between Sirius Minerals and a group of financial investors to secure alternative rescue deal fall through ... As the …

Profiles: Asia’s top stock picker and earnings estimator ...https://www.ft.com/content/a9b4b04e-3fd8-11de-9ced-00144feabdc0May 14, 2009 · Andrew Maule. Andrew Maule used his experience gained during the Asian financial crisis of 1997-98 to make a number of smart calls last year, …[PDF]Does Martin Wolf have the answer - Harvard Universityhttps://scholar.harvard.edu/files/rogoff/files/does_martin_wolf_have_the_answer.pdfDoes Martin Wolf have the answer? by Kenneth Rogoff / August 20, 2014 / Published in September issue of Prospect Magazine An anti-austerity demonstration …

The End of Alchemy: Money, Banking and the Future of the ...https://www.amazon.co.uk/End-Alchemy-Banking-Future-Economy/dp/1408706113The End of Alchemy: Money, Banking and the Future of the Global Economy Paperback – 1 Oct 2015. ... This is the cleverest one, brimming over with new ideas. ... unusually for a specialist in his field and unlike many of his colleagues who have gone into print regarding the same issues, Baron King identifies the root causes of the crisis ...Reviews: 122Format: PaperbackAuthor: Mervyn King

NBER's Program on Corporate Financehttps://m.nber.org/programs/cf/cf.htmlMoving to savers, Adriano Rampini and S. Viswanathan develop a theory of household risk management that helps to explain why poorer households bear the brunt of macroeconomic fluctuations, and perhaps also helps explain their demand for safe securities. 4 Safety may be in the eye of the beholder: Nicola Gennaioli, Andrei Shleifer, and Vishny; and Pedro Bordalo, Gennaioli, and Shleifer ...

Political Connections in Turbulent Times | naked capitalismhttps://www.nakedcapitalism.com/2014/02/political-connections-turbulent-times.htmlPolitical connections affect economic outcomes in emerging markets. This column discusses new evidence showing that something similar goes on in the US. Over the ten trading days following the announcement of Timothy Geithner as Treasury Secretary, financial firms with a connection to Geithner experienced a cumulative abnormal return of about 12% relative to other financial sector firms. This ...

Tom Liu - Financial Crimes Project Manager: VP - MUFG ...https://www.linkedin.com/in/tom-liu-343926b7Keep in mind a satire, but reflects what far too many women experience in the workplace every day. ... Here are the 100 best places to work in 2019, according to Glassdoor. Liked by Tom ...Title: Project Manager and Business …Location: New York, New YorkConnections: 196

How Understanding CEO Candor Can Make You Money | CFA ...https://blogs.cfainstitute.org/investor/2014/02/12/how-understanding-ceo-candor-can...Jason Voss, CFA. Jason Voss, CFA, tirelessly focuses on improving the ability of investors to better serve end clients. He is the author of the Foreword Reviews Business Book of the Year Finalist, The Intuitive Investor and the CEO of Active Investment Management (AIM) Consulting.Previously, he was a portfolio manager at Davis Selected Advisers, L.P., where he co-managed the Davis Appreciation ...

Google Shareholder Meeting: Surprises in Store?https://finance.yahoo.com/blogs/the-exchange/google-meeting-223005826.htmlJun 05, 2013 · By Marek Fuchs You'd be crazy to expect anything to come out of the Google (GOOG) shareholder meeting on Thursday, right? Well, be careful whom you’re calling crazy. Yes, …

What is the best protection for an egg in an egg drop projectfinance.answers.com/Q/What_is_the_best_protection_for_an_egg_in_an_egg_drop_projectI am sure going to work.Put a bunch of Rubber Band inside a big plastic cup.And then put 2 pieces of tissue, then tape the egg to your protection.It will work for sure!It work fore me just today!.

Dimon on Trump: On a plane, you root for the pilot ...https://gantdaily.com/2017/04/04/dimon-on-trump-on-a-plane-you-root-for-the-pilotApr 04, 2017 · “When you get on the airplane, you better be rooting for the success of the pilot,” Dimon told Yahoo Finance during a town hall event on Tuesday.[PDF]FOIA CONFIDENTIAL TREATMENT REQUESTED LBHI SEC07940 …https://web.stanford.edu/~jbulow/Lehmandocs/docs/DEBTORS/LBHI_SEC07940_364012.pdfThink all the agencies see spinco positively. Issues are the obvious ones-does spinco have enough cushion to really shield the firm from loss; how will spinco be run, what are incentives on management and how do you ensure debt protected if spinco focused on managing for equity value. Is remainco correctly capitalized

re: The Auditors » 2010 » Marchretheauditors.com/2010/03This is Part 1 of my commentary on the letter that Ernst & Young recently sent to Audit Committee members defending themselves against the findings in the Lehman Bankruptcy Examiner’s report. The Bankruptcy Examiner, Anton Valukas, found “colorable claims” against EY.

Liquidity is the need of the hour: C Rangarajan - The ...https://economictimes.indiatimes.com/opinion/interviews/liquidity-is-the-need-of-the...C Rangarajan has played a crucial role in policymaking over the past few years. ET spoke to him to understand the nuances of the current crisis and its impact on the India economy.

Universal Banking - Meaning Advantages Disadvantageshttps://kalyan-city.blogspot.com/2011/10/universal-banking-meaning-advantages.htmlUniversal Banking - Meaning. Universal banking is a combination of Commercial banking, Investment banking, Development banking, Insurance and many other financial activities.It is a place where all financial products are available under one roof. So, a universal bank is a bank which offers commercial bank functions plus other functions such as Merchant Banking, Mutual Funds, Factoring, Credit ...

Too Big to Fail (DVD) | Omaha Public Library | BiblioCommonshttps://omaha.bibliocommons.com/item/show/1513399060_too_big_to_failThis is an American television drama directed by Curtis Hanson, first broadcast on HBO on May 23, 2011, based on Andrew Ross Sorkin's non-fiction book "Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System—and Themselves".

Amy K. Egelston, CPA, CFE, CFF - Head of Financial ...https://www.linkedin.com/in/amykegelstonJan 01, 2013 · View Amy K. Egelston, CPA, CFE, CFF’S profile on LinkedIn, the world's largest professional community. Amy K. has 9 jobs listed on their profile. See …Title: Financial Reporting ProfessionalLocation: Chicago, Illinois500+ connections

Pension Benefit Guaranty Corporation Invested Heavily In ...https://www.davemanuel.com/2009/03/30/pension-benefit-guaranty-corporation-invested...The Pension Benefit Guaranty Corporation, charged with backing the pensions of 44 million Americans, reportedly invested heavily in the stock market and other higher-risk investments just before the major downturn in October.

Obama Must Tame Finance at G-20 Summit: Here's How | HuffPosthttps://www.huffpost.com/entry/obama-must-tame-finance-a_b_280094May 25, 2011 · First, President Obama must address the 'catch me if you can' issue. Banks, like Citigroup, now have branches spanning 140 countries with approximately 16,000 offices worldwide. Such a global spread enables them to dodge taxes and hide gains in tax havens. Tax havens are the banks "get out of regulation free" card.

British business people: The top 1,000: Banking and ...https://www.telegraph.co.uk/finance/newsbysector/banksandfinance/2954832/British...Feb 23, 2008 · The banking industry is facing a tougher time over the next 12 months and here are the executives who will be key in shaping its fortunes. British business people: The top 1,000

Ralph De Haas | IDEAS/RePEchttps://ideas.repec.org/e/pde69.htmlRalph De Haas & Martin Höflmayr, 2019. "Deindustrialization, job polarization and ageing in emerging Europe," Chapters, in: Ewald Nowotny & Doris Ritzberger-Grünwald & Helene Schuberth (ed.), How to Finance Cohesion in Europe?, chapter 11, pages 123-134, Edward Elgar Publishing. Ralph De …

Annual Report on Neuberger Berman Investment Advisers's ...https://incfact.com/company/neubergerbermaninvestmentadvisers-newyork-nyDBA LEHMAN BROTHERS TRUST COMPANY, N.A ... This is useful in estimating the financial strength and credit risk of the company. Compare how recession-proof Neuberger Berman Investment Advisers is relative to the industry overall. While a new recession may strike a particular industry, measuring the industry and company's robustness during the ...

The Domino Effect of the U.S. Sub-prime Mortgage Crisis ...https://tortora.wordpress.com/.../09/the-domino-effect-of-the-us-sub-prime-mortgage-crisisNov 09, 2008 · Though this was bound to happen sooner or later, the current financial crisis is coming as quite a shock for not only citizens in the U.S., but all around the world. Because the European banks also invested in the faulty mortgage paper, they are now suffering from a …

Securing Your Financial Future - Women in Banking and ...https://www.wibf.org.au/event/securing-your-financial-future2020 marks the dawn of a new decade. This is the time to reflect on the past, but more importantly, set goals for the future. Statistics tell us that women will likely retire with 47% less superannuation than their male colleagues, and that older women are the fastest-growing cohort of homeless people in Australia.

Wilson Financial Group, Inc - NMLS ID: 67724 - Posts ...https://www.facebook.com/WilfiGroup/posts"when I look at the current picture of expected tax revenues combined with benefits promised to future generations, the most unsustainable situation I have seen ever in my career." The disaster that Druckenmiller sees coming for the United States is all about changing demographics and entitl...

EC2211 Financial Markets and Institution - Coursepaper.comhttps://www.coursepaper.com/essay/ec2211-financial-markets-and-institution•Previous students have commented that heavy going, only . read the parts relevant to the lecture. • Some of the more advanced topics are covered by: Some of the more advanced topics are covered by:

A Lesson from Katrina: The Disaster That Didn't Happenhttps://www.creditunions.com/articles/a-lesson-from-katrina-the-disaster-that-didnt-happenThe Disaster that Didn’t Happen. How wrong I was! Just four months later, the NCUSIF reported a positive net income for calendar 2005 of more than $74 million (up from $47 million in 2004), a loss provision expense of only $20 million, and all with no premium—just the earnings on investments.

Barclays just hired a veteran managing director for its ...https://news.efinancialcareers.com/uk-en/305533/kirk-meighan-barclaysJan 15, 2018 · Barclays has brought on board a veteran managing director for its investment banking division in New York as it tries to increase revenues.. Kirk Meighan, who comes with almost 30 years of ...

Global March for Financial Regulation | We need proper ...https://properfinancialregulation.wordpress.comOn Sunday, the 15th of September, 5th anniversary of the financial crash in 2008, join the global #OccupyFinance protest and organise one in your own city! (and add it on our interactive map) We, the 99%, do not tolerate that 5 years (!) after the financial crisis, no regulation what so ever has been put…

The Asian Financial Crisis -- 20 Years Later | Inter Press ...www.ipsnews.net/2017/07/asian-financial-crisis-20-years-laterMartin Khor is Executive Director of the South Centre, a think tank for developing countries, based in Geneva. PENANG, Malaysia, Jul 5 2017 (IPS) - It’s been 20 years since the Asian financial crisis struck in July 1997. Since then there has been an even bigger global financial crisis, centred in the United States starting in 2008.

Botching the Great Recession | "Global Possibilities"https://globalpossibilities.org/botching-the-great-recessionSep 13, 2018 · The really big factor was the bursting of the housing bubble — of which the banking crisis was a symptom. As Figure 2 shows, the housing bust led directly to a dramatic drop in residential investment, enough in itself to produce a deep recession, and recovery was both slow and incomplete.

Ten Years Gone: Eight Graphs That Show the Unexpected Ways ...https://www.linkedin.com/pulse/ten-years-gone-eight-graphs-show-unexpected-ways...Ten Years Gone: Eight Graphs That Show the Unexpected Ways the Financial Crisis Changed the World Published on September 11, 2018 September 11, 2018 • 863 Likes • 32 Comments

How Ben Bernanke Saved Us From a Second Great Depression ...https://nymag.com/news/businessfinance/bottomline/57177Jun 04, 2009 · More than Obama, more than Geithner, more than anyone, it is the once-maligned Federal Reserve chairman who has saved us from the second Great Depression.

Thatcher Gave More Power to Financehttps://therealnews.com/stories/mhudsonthatcher0408His latest books are The Bubble and Beyond and Finance ... he bought the right to a bus line that became Stagecoach. ... as the term’s been coined. But it’s particularly the time of the coming ...

We Should Admit that Multiple Quantitative Easings Saved ...https://www.trgcap.com/post/we-should-admit-the-multiple-quantitative-easings-saved...Aug 19, 2015 · We Should Admit that Multiple Quantitative Easings Saved the Country By Thomas R. Gasper, CPA ... The second direct benefit of QE was the increase in stock and fixed income (bond) prices. ... Proudly providing wealth and investment management services to a broad range of investors like you from across the globe from two offices located in the ...

8 graphs that show how much real estate has changed since ...utahrabin.com/2018/09/20/8-graphs-show-much-real-estate-changed-since-crashSep 20, 2018 · America created the global financial crisis, but emerged as the world’s strongest economy. T. he country seemed poised for a major redistribution of wealth but then resumed the focus we’ve had for the last 30 years, on creating wealth, even if …

Ben Bernanke's Remarks on the Financial Crisis ...https://www.realclearpolitics.com/articles/2012/04/13/ben_bernankes_remarks_on_the...Apr 13, 2012 · I would like to thank the conference organizers for the opportunity to offer a few remarks on the causes of the 2007-09 financial crisis as well as on the Federal Reserve's policy response.

A Year After a Cataclysm, Little Change on Wall St. (New ...https://www.sanders.senate.gov/newsroom/must-read/a-year-after-a-cataclysm-little...Sep 12, 2009 · Coming on the same weekend as the 11th-hour bailout of the giant insurer American International Group, and the sale of Merrill Lynch, Lehman’s failure was the climax of a cataclysmic weekend in the financial industry. In the days that followed, nearly everyone seemed to agree that Wall Street was due for fundamental change.

- test - Ben Bernanke's Remarks on the Financial Crisishttps://www.realclearpolitics.com/articles/2012/04/13/ben_bernankes_remarks_on_the...Apr 13, 2012 · Ben Bernanke's Remarks on the Financial Crisis ... a key vulnerability of the system was the heavy reliance of the shadow banking sector, as well as some of …

Matthew Parker - 3VBhttps://www.3vb.com/our-people/jc/matthew-parkerMatthew Parker is an experienced advocate who specialises in complex and high-value commercial litigation and arbitration. The Legal 500 ranks him as one of the top junior barristers for both commercial litigation and banking & finance, but his practice covers a wide range of business disputes and he is recommended by the directories in a further five areas: fraud, professional negligence ...

ANNUAL GENERAL MEETING - Computersharehttps://www.computershare.com/corporate/Documents/ir/Financials/FY2004/2004 Notice of...annual general meeting at least two directors (excluding the Managing Director and directors appointed since the last annual general meeting) must retire from office. The directors retire by rotation, with the directors who have been longest in office since being appointed or re-appointed being those who retire. The Constitution and

‘Absurd’ leasehold pricing should stop, say campaigners ...https://chochilino.com/2020/01/11/business-finances/absurd-leasehold-pricing-should...Image copyright Getty Images The system of pricing extensions for leasehold homes has been branded “absurd” by a campaigner.The Law Commission this week outlined a variety of potential …

Financial crisis - OECD Observeroecdobserver.org/financialcrisisThe OECD Observer magazine keeps the public ahead of economic and social policy challenges of our time. Aimed at senior policymakers, business people, researchers, the media and civil society. Read about: US and Japanese economies, Mexico, the 21st century, Germany, unemployment, regulatory reform, food safety, development aid, environment, global warming, climate change.[PDF]“A great advocate who is very user-friendly, bright and ...https://www.wilberforce.co.uk/wp-content/uploads/2016/09/Emily-McKechnie-Pensions-CV-2.pdfShe is also “a great advocate who is very user-friendly, ... • Acting for scheme administrators in defence to a £9m professional negligence claim by present and former trustees relating to equalisation of benefits across four pension ... one of the top 10 cases for 2010. Emily acted for the representative active self-

Movers and shakers - Telegraphhttps://www.telegraph.co.uk/finance/2955550/Movers-and-shakers.htmlJul 07, 2008 · They succeed Jean-Francois Cecillon who is to step ... although he will remain with the company for a ... Mr Miller started his career with the Inland Revenue where he was one of …

Corporate And Financial Weekly Digest - September 7, 2012https://www.mondaq.com/unitedstates/CorporateCommercial-Law/195750/Corporate-And...Edited by Robert L. Kohl and David A. Pentlow. SEC/CORPORATE JOBS Act: SEC Proposes Rules Regarding Solicitation and Advertising in Securities Offerings. Please see the below entry under BROKER DEALER.The proposed rules will be discussed further in an upcoming Katten Client Advisory.Client Advisory.

Wells Fargo/Gallup: Investor Optimism Loses Most of Second ...https://newsroom.wf.com/.../wells-fargogallup-investor-optimism-loses-mostCHARLOTTE, N.C.--(BUSINESS WIRE)--The Wells Fargo/Gallup Investor and Retirement Optimism Index fell 10 points in the third quarter to +33, down from +43 recorded in May.Among retired investors, third quarter optimism has fallen 18 points since May to +14, but optimism among non-retired investors has waned only slightly in the third quarter, falling five points since May to +40.

Prepared and filed by St Ives Financialhttps://www.sec.gov/Archives/edgar/data/1139313/000102123106000587/b84006xex4-29.htm“Affiliate” shall mean with respect to any Person, any other Person directly or indirectly controlling, controlled by or under common control with such Person, and in the case of (i) a Person who is an individual includes any relative of such Person and (ii) a corporation which is controlled by an individual, includes any relative of that individual.

The European air traffic crisis - World Socialist Web Sitehttps://www.wsws.org/en/articles/2010/04/pers-a22.htmlApr 22, 2010 · The European air traffic crisis 22 April 2010 In the course of history it is often an unexpected event which exposes the real nature of social relations.

Financial crisis - OECD Observerhttps://oecdobserver.org/news/categoryfront.php/id/1538/current_page/1/Financial...The OECD Observer magazine keeps the public ahead of economic and social policy challenges of our time. Aimed at senior policymakers, business people, researchers, the media and civil society. Read about: US and Japanese economies, Mexico, the 21st century, Germany, unemployment, regulatory reform, food safety, development aid, environment, global warming, climate change.

Marriage broker introduces little guys who need money to ...https://www.investmentnews.com/marriage-broker...Jan 10, 2000 · Marriage broker introduces little guys who need money to those who have it ... CapitalKey is the first to bridge the gap between small business owners and …

Real world drags down bottom-up stock pickershttps://www.investmentnews.com/real-world-drags...Nov 22, 2010 · When Akre finds a stock he likes, he holds it for a long time. One of his investments, Markel Corp., an insurer based in Glen Allen, Virginia, has been in his portfolio since 1991.

Denial disguises reality of Lehman crisis | Financial Timeshttps://www.ft.com/content/b023bd64-8271-11dd-a019-000077b07658David Einhorn of Greenlight Capital was one of the most vocal in his criticism of Lehman, which he said, via a detailed analysis of its numbers, was under-capitalised and not properly accounting ...

Jeremy Warner's Outlook: US is slipping, but the crisis is ...https://www.independent.co.uk/news/business/...Analysis of the deeper intricacies of the present credit crunch has over the past week given way to a wider, over-arching question. Is the US economy about to slip into recession? Few observers ...

Are investment banks run for employees or shareholders ...https://imincorrigible.wordpress.com/2013/07/03/are-investment-banks-run-for-employees...Jul 03, 2013 · Banks and bonuses Going overboard Investment banks have a long history of providing huge rewards for their employees and managers at the expense of shareholders returns. This fact has been studiously ignored by regulators, legislators and even shareholders themselves for various reasons over the years. In large part, because the returns that the banks…

Is Abdoulaye Wade Running for the IMF or U.N? | ARMELOPOSThttps://armelopost.wordpress.com/2009/03/06/is-abdoulaye-wade-running-for-the-imf-or-unMar 06, 2009 · This is not the first time Me Wade came out to news outlets to advocate alternative solutions to major crisis. All this high level “PR” exercises, made me believe that the current President is positionning himself for a role in an International organization post retirement from the Presidency in Senegal (If that ever happens).

Trading Systems IV : Murray Maths - R Quant Futures Newshttps://www.rquant.io/news/news/trading-systems-iv-murray-mathsWait for a significant high or low for the day (unless its a high or low at open of the day) and wait for a move away from 8/8 or 0/8. If the high of the day is apparently on open and the price starts to fall below 7/8 from 8/8 level, short the scrip ensuring your stop loss is in place. Look for a …

Exchange-traded fund - Bogleheadshttps://www.bogleheads.org/wiki/Exchange-traded_fundAn exchange-traded fund, or ETF, is a registered investment company.An ETF is a fund that holds a collection of assets and is traded on the market, one buys or …

Eurozone Crisis: No Good Outcome Without Resolution ...https://seekingalpha.com/article/567961-eurozone-crisis-no-good-outcome-without-resolutionMay 08, 2012 · Eurozone Crisis: No Good Outcome Without Resolution ... "This is the deal that is on the table," Altafaj said. ... there are the people of Greece who are so opposed to the continuation of the ...

TOP 10 VALUABLE INVESTMENT SECRETS MY JOHOR SIFU …https://eaglevisioninvest.com/top-10-valuable-investment-secrets-my-johor-sifu-taught-meHere are the Top 10 Valuable Lessons My Johor Share Investment Sifu Taught Me . A THIRST FOR INVESTMENT KNOWLEDGE; When Mr. L Tan was an accounting student in University Malaya he used to read the WeekEnd Malay Mail. Here Dr Neoh Soon Kean of Dynaquest would give a weekly write up highlighting One or Two Stocks of Bursa. L.

Questions to ask recruiters to convert an asset management ...https://news.efinancialcareers.com/sg-en/241364/questions-to-ask-to-convert-asset...Aug 18, 2017 · So what should asset management professionals ask at the end of an interview for a buy-side role? And how should they prepare to make sure their …

Commercial Foreclosures Are the Next Wave of Defaulthttps://ezinearticles.com/?Commercial-Foreclosures...The foreclosure crisis is born out of downward-trend of US economy. The foreclosure tornado first hit the residential property sector; made millions of American families forfeit their homes to foreclosure process and walk-off from their long-lived residences, all of a sudden.

Bipartisan Alliance: 02/28/10https://www.bipartisanalliance.com/2010_02_28_archive.htmlWhat really matters are the lessons creditors draw about how they will be treated. And it is clear creditors will be treated far more favorably in a government resolution process than in a bankruptcy. To understand why true, consider the administration's reasons for preferring a government resolution process.

Chinese ex-investment banker sees fashion crowdfunding ...https://www.scmp.com/lifestyle/fashion-luxury/article/2082412/chinese-ex-investment...Mar 28, 2017 · “I realised that for a designer coming out of school, they would work for a big brand for perhaps 10 years, and if they want to launch their own brand after that there are so many hurdles that ...

eToro Survey Finds Millennials Are Waiting to Get Into Cryptohttps://news.bitstarz.com/etoro-survey-finds-millennials-are-waiting-to-get-into-cryptoFeb 21, 2019 · A survey conducted by investment platform eToro has revealed a potential swathe of millennials are waiting to invest in cryptocurrencies.This is because they feel that crypto exchanges are “less likely to be a place where bad actors get rewarded with taxpayer money”, reflecting a broader change in attitude between the generations and the younger generation towards government and the …

[Solved] Chapter 6 Goodweek Tires, Inc. After extensive ...https://www.coursehero.com/tutors-problems/Finance/6987645-Chapter-6-Goodweek-Tires...Question. Chapter 6 Goodweek Tires, Inc. After extensive research and development, Goodweek Tires, Inc. has recently. developed a new tire, the SuperTread, and must decide whether to make the investment necessary to produce and market it.

Marianne Scordel - A French woman in New York | Hedgeweekhttps://www.hedgeweek.com/women/in-finance/Marianne/ScordelInterestingly, one of the reasons Scordel felt the time was right to leave banking was because of what she perceived to be a lack of innovation, post-crisis, as the industry dealt with the fallout of the sub-prime catastrophe and negative media coverage. It had, she says, become somewhat “stale”.

Giving something back to the world ... - Wall Street Oasishttps://www.wallstreetoasis.com/forums/giving-something-back-to-the-world-seriouslyMay 19, 2008 · Given that 99% of people on WSO are either in IBD or are desperately seeking to get a seat at that particular table, this may be a rather pointless question (feel free to stop reading now): Do you know anyone who did a stint in IBD or finance in general and then left to do something a bit more

Jim Rickards And Craig Griffin Talk Money And Gold - Buy ...https://www.itmtrading.com/blog/jim-rickards-and-craig-griffin-talk-money-and-gold...May 05, 2014 · Jim Rickards Discusses Gold In A Television Interview. This past April, Jim Rickards, the Author of “The Death Of Money” and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements.

Welcome to the New COPYRIGHTED MATERIAL Global Economyhttps://catalogimages.wiley.com/images/db/pdf/9780470440896.excerpt.pdfother was the much needed wake - up call for what I call lazy investors. ... percent and a mere $ 5,000 investment at $ 1 per share would have netted ... (NASDAQ: RIMM) is one of the hot stocks once again as the maker of the BlackBerry (also known as the CrackBerry). It traded as low as …

On Credit Default Swaps - Shunya's Noteshttps://blog.shunya.net/shunyas_blog/2008/10/on-credit-default-swaps.html?cid=137712766The recent meltdown in the US financial markets has been attributed to subprime lending practices that, along with low interest rates, had fueled a housing bubble since the mid-90s. In a feeding frenzy of sorts, lenders kept lowering the bar for home mortgages. As adjustable interest rates kicked up, defaults and foreclosures began and the bubble finally burst. Housing demand and prices fell ...

Return of the Euro Crisis: Italy Quakes, Rest of the World ...news.goldseek.com/GoldSeek/1528401111.phpThe only day in recent years that saw the US 10-year fall that much was the time Trump triumphed in the US elections. Italy’s new premier, Giuseppe Conte, made clear in his inaugural speech this week that the new populist Italian government is setting a trajectory for radical policy changes that put another euro crisis directly in the cross ...

The Storm That Wasn't? - blogspot.comhttps://pensionpulse.blogspot.com/2010/10/storm-that-wasnt.htmlOct 19, 2010 · Over the weekend, Michael Santoli of Barron's wrote an article, The Storm that Wasn't: Last Monday was the slowest trading session of the year, as measured by turnover in the stocks that make up the S&P 500, which in turn captures most of the …

ved-dev's Followed users | Seeking Alphahttps://seekingalpha.com/user/7838991/followingAt the time I was working as a senior analyst at one of the largest RIA's in the country, and I felt strongly that the market environment was the best time since 1974/1975 to start an investment firm.

The Truth re Loan Modification, Bankruptcy & Foreclosure ...https://letbksaveyou.blogspot.com/2010/03Unfortunately we don't know whether the property was sold to a Third Party or not. If it was sold to a 3rd party then there won't be anything that can be done to get it back. However if the bank simply took it back they could rescind the sale. But it doesn't appear that they will be willing to do so.

Burning Down His House - UMasspeople.umass.edu/~kazemi/Lehman.pdfof the bonus pool. The conflict came to a head in 1983, when Glucksman walked into the office of Lehman CEO Pete Peterson, a distinguished old-school investment banker who’d served in the Nixon administration and, in his spare time, wrote for the New York Review of Books, and told him to leave. “I’m talking about running the business now,” Glucksman said.

The Eternal Recurrence of Financial Corruption – Reason.comhttps://reason.com/2009/06/19/the-eternal-recurrence-of-finaJun 19, 2009 · Rather, it was the disgraceful and mysterious fall of Swedish man of money and mystery Kreuger, known as "the Match King," whose various companies' securities were owned in the early 1930s by more ...

Financial crisis: America and Europe attempt to stave off ...https://www.telegraph.co.uk/finance/financialcrisis/3136744/Financial-crisis-America...Oct 04, 2008 · Financial crisis: America and Europe attempt to stave off financial meltdown On Friday, the US finally delivered a bailout designed to stabilise the worldwide banking crisis that threatened to ...

Daiwa Bank Case Study Essay Examplehttps://studymoose.com/daiwa-case-study-essayThe trading loss was one of the largest of its kind in history. But it was the cover-ups by Iguchi over a period of years, and then by senior managers at Daiwa between July 13 and September 18 1995, when the bank eventually reported the loss to the US Federal Reserve Board, that did the real damage.

Did “Tight” Fed Policy Cause the Financial Crisis ...https://austrian.economicblogs.org/mises-canada/2018/murphy-fed-policy-financial-crisisReprinted from Mises.org Recently Senator Ted Cruz aggressively questioned Janet Yellen on the Fed’s...

Return of the Euro Crisis – Investing Video & Audio Jay ...https://jaytaylormedia.com/return-of-the-euro-crisisThe only day in recent years that saw the US 10-year fall that much was the time Trump triumphed in the US elections. Italy’s new premier, Giuseppe Conte, made clear in his inaugural speech this week that the new populist Italian government is setting a trajectory for radical policy changes that put another euro crisis directly in the cross ...

GFC 10 years on: Fast cars, hot money behind Opes Prime ...https://www.theaustralian.com.au/business/markets/fast-cars-hot-money-behind-opes...Sep 13, 2018 · What had actually happened was one of Australia’s most spectacular corporate collapses, the failure of stockbroker and margin lender Opes Prime, where Merrill Lynch was the …

Back To The Future: The Impact Of Post-Breach Events On ...https://www.mondaq.com/uk/CorporateCommercial-Law/...Apr 14, 2016 · Spring 2016. Introduction. The English law of damages for breach of contract is founded upon the compensatory principle: that damages should place the claimant in the same situation with respect to damages as if the contract had been performed (Robinson v Harman (1848) 1 Exch 850).That would imply a simple comparison, between the claimant's actual financial position and the position the ...

The end of the European Union as we know it | reimagininghttps://ekownelson.wordpress.com/2017/04/06/the-end-of-the-european-union-as-we-know-itApr 06, 2017 · The greater fallout from Brexit, however, may well be the collapse of the European Union as we know it. Not, as commentators argue, because of the rise and possible triumph of right-wing populist parties in the elections in France and Germany, but …

Challenge Accepté: AXA Investment Managers CIO Hervé Morel ...https://www.waterstechnology.com/management-strategy/2335745/challenge-accepte-axa...That was crucial and a big pill to swallow for our people.” After 11 years at Le Crédit Lyonnais, Morel-Derocle joined the investment management arm of one of the world’s largest insurance groups, AXA Investment Managers, as global head of solutions delivery, …

Did "Tight" Fed Policy Cause The Financial Crisis?https://www.valuewalk.com/2015/12/did-tight-fed-policy-cause-the-financial-crisisDec 16, 2015 · Did “Tight” Fed Policy Cause The Financial Crisis? by Robert P. Murphy, Mises Institute Recently Senator Ted Cruz aggressively questioned Janet Yellen on the Fed’s possible role in causing the financial crisis and subsequent recession. In particular, he claimed that “in the summer of 2008” the Fed “told markets that it was shifting to a tighter monetary policy,” and that this ...

My Blog : March 2017https://garysocal.blogspot.com/2017/03March 31, 2017 Friday On February 24, 2003, I attended a courtroom hearing on my charges against the banks, Ocwen, and Chase Manhattan. The banks had violated the law, and this violation prevented my approved refinance of my home of 26 years, with $110,000 in equity.

March 2011 | Can Turtles Fly?https://can-turtles-fly.blogspot.com/2011/03It has now fallen by a fifth in the three trading days since the earthquake first hit. This is the scariest stock market on Earth. It's one of the fastest market collapses in history, comparable to 1929 and 1987. But Japan is still the world's third biggest economy - and a …

Is capitalism globally sustainable and scalable? - Quorahttps://www.quora.com/Is-capitalism-globally-sustainable-and-scalableI consider the Financial crisis of 2007–2008 to be an inevitable consequence of "Moral Hazard" in the finance industry. Banks made profits on risky investments during the boom but taxpayers shared the losses when the investments went bad, thus enc...

Phyllis Shabad, Executive Brand Coach: Leadership and ...https://www.executivebrandcoach.com/leadership-and-innovationNew York has been hit hard because of the losses in financial services, but so have other cities, states and countries since the bubble burst. This is more like an economic tsunami that has affected other sectors such as manufacturing and construction, not to mention the media, retail, pharmaceuticals and a long list of other industries.

Zombie banks Essay - 1766 Wordshttps://www.studymode.com/essays/Zombie-Banks-46622472.htmlJan 24, 2014 · Raging from “The panic of 1797” (the first US recession, caused by the deflating effects of the Bank of England as they crossed the Ocean to American soil), reaching their climax at the beginning of the Great Depression, in the 1920s and 1930s, and continuing with the ongoing financial crisis led worldwide craze (considered to be the most ...

Successful Silver Trigger Immediately brings disclosure ...https://humanitiesintel.blogspot.com/2019/11/here-are-some-posts-from-cobra-below.htmlGuess Who Is Preparing For A Major Stock Market Crash? ... Central Banks Are The Biggest Risk To The Economy In 2020 . ... the Light Forces will be able to intervene directly in the global financial system for the first time in human history, and a cascade of events will follow that will …

April – 2010 – Anderson Cooper 360 - CNN.com Blogsac360.blogs.cnn.com/2010/04/page/41Editor's Note: A financial crisis inquiry commission held its second day of hearings today to investigate the cause of the financial crisis. Former Citigroup executives are testif

LSE shares plunge on rival plan | Financial Timeshttps://www.ft.com/content/668bff00-749e-11db-bc76-0000779e2340Nov 15, 2006 · That’s more like it: LSE shares are now down almost 10 per cent. I was amazed to see them only off 3 per cent or so earlier this morning after the story that major investment banks are clubbing ...

Freedom Writing: The Homestretchhttps://freedom-writing.blogspot.com/2008/11/homestretch.htmlNov 29, 2008 · "In the best of times, our days are numbered anyway. So it would be a crime against nature for any generation to take the world crisis so solemnly that it put off enjoying those things for which we were designed in the first place: the opportunity to do good work, to enjoy friends, to fall in love, to hit a ball and to bounce a baby."[PDF]Cv bnm PROJECT FINANCE NewsWirehttps://www.projectfinance.law/media/1530/pfn1201.pdfCloser attention will be focused than before on who is the offtaker for a project.The head of projectfinance lend-ing for a bank thathas been in the lead on many recent merchantplantfinancings in the US marketsaid he expects to face a lot tougher questions from his credit committee about the strength behind the offtake con-

Program - IAAC Blogwww.iaacblog.com/programs/...and-the-city-learning-from-the-aftereffects-of-athens-2004The economic growth and investments as well as new job opportunities, are to a great extend temporary. Moreover, mega events are the cause of many evictions and relocations (e.g. Barcelona 1992, Atlanta 1996, Athens 2004, London 2012), in order to show a slum free image to the world.

The Team - Intellidexhttps://www.intellidex.co.za/who-we-are/the-teamVuyo is co-founder of Intellidex and a director of the company. He is chairman of Empowerdex which he founded with Chia-Chao Wu. He is a director of various companies. He is a commissioner on the Davis tax review committee, having been appointed by the minister of finance. He was nominated as a Young Global Leader by the 2009 World Economic Forum.

Interconnectedness, Systemic Crises and Recessions ...https://www.researchgate.net/publication/277396254_Interconnectedness_Systemic_Crises...What are the main features of globally synchronized recessions? ... In 2006/2007 there was the impact of a new financial crisis that ... the balance-sheets of each one of these banks in the period ...

Surveillance - Danish - Term Paperhttps://www.termpaperwarehouse.com/essay-on/Surveillance-Danish/205837ITPI has the widest range of expertise in both the above sectors, covering strategic planning as well as functional areas of operations including funding and financial solutions. A recent prestigious event for ITPI was the installation of the Solar Chill at the Rashtrapati Bhavan (President’s estate clinic) at New Delhi on 1st November 2006.

Does America's Next President Really Hate Wall Street ...https://www.thestreet.com/politics/does-america-s-next-president-really-hate-wall...Nov 29, 2015 · What are the odds that America's next president will really dislike Wall Street? ... It was the eventual collapse of the housing market, which had …

ISBN 978-0-8213-8748-1 SKU 18748www.mcneileconomics.com/uploads/8/1/3/9/8139463/tradefinance_overview.pdfwas one of the most dramatic consequences of the global financial crisis. It was the moment the financial crisis hit the real economy, and when parts of the world far from the epicenter of financial turbulence felt its full fury. This book is extremely timely and full of critical insights into the role of trade finance and the potential

Enron, World Com, & Tyco Scandals - Term Paperhttps://www.termpaperwarehouse.com/essay-on/Enron-World-Com-Tyco-Scandals/359347Enron, World Com, & Tyco Scandals Three of the biggest frauds in American history, were committed by the companies Enron, World Com and Tyco. All three CEO/CFO’ks of these companies’ indulged in malicious intend to create a better financial standing within the company and for themselves.

Business and financial environment - Free Business Essay ...https://www.essay.uk.com/free-essays/business/business-and-financial-environment.phpThe global financial system and the global economy are currently facing a crisis unique in its magnitude and the worst seen in 80 years. This crisis, which Alan Greenspan called it a once-in-a-century credit tsunami, born of a collapse deep inside the United States housing sector, quickly spread to financial markets all over the world, undermining the confidence of consumers and investors and ...

Financial Principals and Policies - 864 Words | Bartlebyhttps://www.bartleby.com/essay/Financial-Principals-and-Policies-PKGHCAXH3GEYFinancial Statement Disclosure Notes Under Us Gaap Essay 801 Words | 4 Pages. Financial statement Disclosure Notes under US GAAP Financial statement Disclosure Notes under US GAAP the full disclosure principle is one of the basic accounting principles, which is an exchange of all material information integral to financial information for the company.

Powerpoint: Bankruptcy Immunities, Transparency, and ...https://www.researchgate.net/publication/228216266_Powerpoint_Bankruptcy_Immunities...A 'read' is counted each time someone views a publication summary (such as the title, abstract, and list of authors), clicks on a figure, or views or downloads the full-text.

Eastern Alliance: Energy Investment in the U.S. and China ...https://seekingalpha.com/article/174931-eastern-alliance-energy-investment-in-the-u-s...Nov 23, 2009 · Eastern Alliance: Energy Investment in the U.S. and China. Nov. 23, 2009 4:23 PM ET ... and a collapse in the US dollar, which I don’t think it can prevent. ... But as long as the economy is ...

Debt Ceiling Crisis Could Threaten Recession | Military.comhttps://www.military.com/.../2013/10/14/debt-ceiling-crisis-could-threaten-recession.htmlDebt Ceiling Crisis Could Threaten Recession. ... As the economy stumbles, layoffs will mount, she said. ... That leads to a lower value of the dollar, higher interest rates and, ultimately, other ...

Fiis Registered In India Name Number Finance Essayhttps://www.uniassignment.com/essay-samples/finance/fiis-registered-in-india-name...Fiis Registered In India Name Number Finance Essay. FIIs and their Growth: 3.1 FIIs Registered in India – Name & Number : Across the world the major portion of FIIs investment come from Pension Fund, Mutual Fund, Investment Trusts, Insurance Company, and Bank.

Big Bonuses for CEOs? Not So Fast - Bloomberghttps://www.bloomberg.com/news/articles/2008-12-05/big-bonuses-for-ceos-not-so-fast...Dec 05, 2008 · A spokesman for the investment bank said it was the "right thing to do." At the end of 2007, it appeared that Goldman was one of the best-run …

'Liar's Poker' Author Sees Upside To Market Crash : NPRhttps://www.npr.org/transcripts/97429370Nov 25, 2008 · 'Liar's Poker' Author Sees Upside To Market Crash Michael Lewis, author of a new book called Panic: The Story of Modern Financial Insanity, contends the …

scholarprof: Wyeth Wind from the Seahttps://scholarprof.blogspot.com/2016/06/wyeth-wind-from-sea.htmlJun 04, 2016 · The Wind from the Sea, painted in 1947, is one of the earliest paintings of a window by Andrew Wyeth. It is about a scene from a ramshackle. The 18 th century poorly maintained house belonged to Alvaro and Christina Olson, who were neighbors of Wyeth in Maine during late 1940s. Wyeth painted the scenic depiction while looking over the immediate surrounding landscape as an incoming …[PDF]Voiding and termination of contract as remedies for a ...https://www.ga-p.com/wp-content/uploads/2018/07/voiding-and-termination-of-contract-as...in mind that such action results, in cases such as the present one, of a “loss of the investment”, in the claimant obtaining reparation of sorts structured as an “improper termination of contract”, because in fact the loss ends up matching the quantum of compensation that would have been obtained by means of the contractual termination.

KPMG And New Century – Down The Legal Rabbit Holeretheauditors.com/2008/03/10/kpmg-and-new-century-down-the-legal-rabbit-holeHowever, New Century’s regular auditor, KPMG, was involved in the accounting changes alongside finance department personnel, these lawyers say. …Events surrounding New Century have been closely watched because of its status as one of the first subprime casualties. But before the housing market fully tanked last summer,

Protection Or Overkill? - Financial Advisorhttps://www.fa-mag.com/news/protection-or-overkill-13467.htmlProtection Or Overkill? ... In his paper, Money Market Funds: Vital Source of Systemic Stability, Macey warns that one of the key reforms, a minimum holdback period, will “deter” investors ...

Voiding and termination of contract as remedies for a ...https://www.lexology.com/library/detail.aspx?g=d586efa9-5903-4d0e-9637-45626f63c939Oct 11, 2017 · Voiding and termination of contract as remedies for a breach of duties to inform in the purchase of financial products ... in cases such as the present one, of a “loss of the investment”, in ...

New Land Securities boss to step up pace as Francis Salway ...https://www.telegraph.co.uk/finance/newsbysector/constructionandproperty/9036790/New...Jan 24, 2012 · New Land Securities boss to step up pace as Francis Salway departs The new chief executive of Land Securities says he wants to inject "more pace through the business" after being named as the ...

Obama chides Wall St | SBS Newshttps://www.sbs.com.au/news/obama-chides-wall-stUS President Obama has warned Wall Street he will not tolerate a return to the risky excesses which sparked financial collapse one year ago.

Accrued Interest: Almost on cue... - blogspot.comhttps://accruedint.blogspot.com/2006/09/almost-on-cue.htmlSep 10, 2006 · I oversee taxable bond trading for a small investment management firm. Opinions expressed on this website may not reflect the opinions of my employers. Strategies described here should not be taken as advice, and may not be the strategies being used for my clients. Take this website as the egotistical ramblings of a bond geek and nothing more.

Anger grows at the worst examples of corporate excess ...https://www.smartcompany.com.au/finance/anger...FOUR aristocratic-style shooting parties costing a whopping £25,000 in total. A PRIVATE JET for two of them from Germany costing £10,000. FLIGHTS to and from Madrid and a fleet of CHAUFFEUR ...

What Is Prime Brokerage In Forex - Transparency and value ...tujusetia.my/what-is-prime-brokerage-in-forexMaster Forex Give-Up Agreement Hits Market. You dont have to beOld Town Quilts. UK forex day-trading practices under scrutiny. Additionally, the prime broker offers stock what is prime brokerage in forex loan services, portfolio reporting, consolidated cash management online brokers comparison 2019 and other services.AG CapitalEmraan Hussein, Miss Rabia Emraan, Mrs.Alpari

Curbing Contagion: Options and Challenges for Building ...https://www.bankofcanada.ca/2011/09/curbing-contagion-options-and-challengesBear Stearns wasn’t one of the largest investment banks in the United States, but it was one of the most leveraged, with large broker–dealer and proprietary operations. It played a pivotal role in the global repo market, holding collateral for transactions and acting as a counterparty for repo financing.

Denver Selects CityBase for Unified Payments Across the ...https://ca.finance.yahoo.com/news/denver-selects...Dec 03, 2020 · CityBase technology solutions will streamline online and in-person payments. CityBase, a leading provider of government and utility payment technology, today announced an agreement with the City and County of Denver to unify payment technology across most departments for online and in-person payments.CityBase is a business unit of GTY Technology Holdings Inc. (Nasdaq: GTYH) ("GTY"), a …

Perceptions and Realities - the Gaps Show in 2014 - Lord ...www.lord-copper.com/perceptions-and-realities-the-gaps-show-in-2014The long-term effects are likely to have a permanent influence on the way metal is financed in - well, let’s call them less than blue-chip storage facilities. But it’s another version of the same theme - the gap between perception and reality; financiers thought they owned metal stored at the port. In fact, they didn’t.

Banks Use Creative Accounting to Hide Their Debt, While ...https://www.democraticunderground.com/discuss/du...They are often the cheapest way for a brokerage firm to borrow money. I had taken for granted that repos were always accounted for as loans, but it turns out there was a loophole. The Financial Accounting Standards Board had accepted that under some conditions a repo could be treated as a sale.

U.S. housing crash wasn’t an inside job | Financial Posthttps://business.financialpost.com/opinion/william-watson-u-s-housing-crash-wasnt-an...Mar 28, 2013 · William Watson: U.S. housing crash wasn't an inside job William Watson: A new study tracks the personal housing transactions of key people working in …

Bear Stearns lives ... in a way | News | nny360.comhttps://www.nny360.com/news/bear-stearns-lives-in-a-way/article_6c0e17c8-a8fc-5017-9b...Ten years ago today, JPMorgan Chase announced it would buy collapsing investment bank Bear Stearns Cos. for pennies on the dollar after a weekend of emergency talks brokered by the

How the stars make their money last | Financial Posthttps://business.financialpost.com/uncategorized/how-the-stars-make-their-money-lastSep 22, 2015 · How the stars make their money last When the Oscars were handed out Sunday night, TV viewers had a glimpse of Hollywood royalty. All that …

The Global Financial Crisis 10 years on- Lessons learned ...https://www.advicefirst.com.au/latest-articles/the-global-financial-crisis-10-years-on...Aug 28, 2017 · The return to normal from major financial crises can take time, as the blow to confidence depresses lending and borrowing and hence consumer spending and investment for years afterwards. This muscle memory eventually fades but the impact can be seen for a …

Investment Banking Free Essays - PhDessay.comhttps://phdessay.com/investment-bankingThe investment portfolio serves as the primary source of liquidity and represents a smaller portion of assets. Investment securities can be liquidated to satisfy deposit withdrawals and increased loan demand. 2) Is perception of Liquidity more important for a banking/investment banking firm than manufacturing firms (such as Ford or Boeing)? Why ...

Gridsum Appoints Co-Chief Financial Officer - EconoTimeshttps://www.econotimes.com/Gridsum-Appoints-Co-Chief-Financial-Officer-652712Apr 20, 2017 · EconoTimes is a fast growing non-partisan source of news and intelligence on global economy and financial markets, providing timely, relevant, and …

AFT Index Bounces Back | Multifamily Executive Magazinehttps://www.multifamilyexecutive.com/business-finance/debt-equity/aft-index-bounces-back_oAs our session drew to a close, the AFT Index marked an increase of 79.31 points, or 8.88 percent, and closed at 972.44. Advancing issues had a decided edge over declining issues by a 6-to-1 margin. National markets also enjoyed an upswing as the old quarter ended and the new one began.

The Global Financial Crisis 10 years on- Lessons learned ...https://predawealth.com.au/global-financial-crisis-10-years-lessons-learned-can-happenSep 05, 2017 · The return to normal from major financial crises can take time, as the blow to confidence depresses lending and borrowing and hence consumer spending and investment for years afterwards. This muscle memory eventually fades but the impact can be seen for a …

BBC News | BUSINESS | Fed: Slowdown not over yetnews.bbc.co.uk/2/hi/business/1194623.stmThe slowdown in the US economy has yet to run its full course, Federal Reserve chairman Alan Greenspan warned on Wednesday. In prepared comments to the House Financial Services Committee, Mr Greenspan said the economy remained "on a path inconsistent with satisfactory economic performance" despite two interest rate cuts in January.

The Global Financial Crisis 10 Years On – ShareCafehttps://www.sharecafe.com.au/2017/08/25/the-global-financial-crisis-10-years-onAug 25, 2017 · The return to normal from major financial crises can take time, as the blow to confidence depresses lending and borrowing and hence consumer spending and investment for years afterwards. This muscle memory eventually fades but the impact can be seen for a …

Baseball Ticket Pricing: 3 Teams, 3 Strategies.....1 Foul ...https://bleacherreport.com/articles/174969-baseball-ticket-pricing-3-teams-3...May 14, 2009 · The Mets’ strategy was the most innovative. Arguably it had to be because the team lacked both consistent on the field performance and a level …[PDF]SmartRetirement Funds - Morningstar, Inc.globaldocuments.morningstar.com/documentlibrary/document/c0be28fc34c7b788.msdoc/originalProspective investors should refer to a Fund’s prospectus for a discussion of a Fund’s investment objective, strategies and risks. Call JPMorgan Funds Service Center at (800) 480-4111 for a prospectus containing more complete information about the Fund including management fees and other expenses. Please read it carefully before investing.

The Global Financial Crisis 10 years on- Lessons learned ...https://centralwestfinancialsolutions.com.au/olivers-insights/the-global-financial...Aug 24, 2017 · The return to normal from major financial crises can take time, as the blow to confidence depresses lending and borrowing and hence consumer spending and investment for years afterwards. This muscle memory eventually fades but the impact can be seen for a …

Robert Savage Blog | Tie-Breaker | Talkmarketshttps://talkmarkets.com/content/us-markets/tie-breaker?post=200257Nov 27, 2018 · The fact that the markets aren’t completely risk-off today, after these headlines, indicates something important, momentum to sell is slowing. The place where good and bad news seems to be ignored is the UK where politics and Brexit all lead to a dreadful game of Nine Men’s Morrisoutcomes with everyone losing. For the US today, the USD bid ...[PDF]Lessons from the Financial Flows of the Great Recessionhttps://www.aeaweb.org/conference/2017/preliminary/paper/3FrGzBKyLessons from the Financial Flows of the Great Recession Juliane Begenau Harvard University & NBER ... The rst event was the re-sale of assets held by the shadow-banking industry ... but it won’t loans either. It is an idea akin to evergreening.

Once Again, JPMorgan Mops Up The Mess - Forbes.comhttps://www.forbes.com/topstories/2008/09/26/wamu-jpmorgan-fdic-markets-equity-cx_lm...Sep 26, 2008 · Wall Street Crisis Once Again, JPMorgan Mops Up The Mess Liz Moyer, 09.26.08, 12:07 AM EDT Wall Street giant gets Washington Mutual for a song in FDIC auction.

Spanish pride had to give way - BBC Newshttps://www.bbc.com/news/world-europe-18385060Jun 10, 2012 · In the end Spain was not brought to this point by the collapse of Lehman brothers in 2008. It has ended up needing a bank rescue because of …

In search of causes - Frontlinehttps://frontline.thehindu.com/cover-story/article30198083.eceReliance’s success in areas such as telecommunications and retail is the result of aggressive investment and predatory pricing, facilitated by capital accumulated in its traditional business and from massive borrowing and through government policies favouring its interests.

Forecasters unanimous: U.S.-China trade war bad for ...https://ca.finance.yahoo.com/news/forecasters-unanimous-u-china-trade-war-bad-economy...Sep 20, 2018 · By Shrutee Sarkar. BENGALURU (Reuters) - The U.S. economy will expand at a robust pace in coming quarters but slow to 2 percent by the end of 2019, according to forecasters polled by Reuters who unanimously said the escalating trade war with China was bad economic policy.

The Compliance Program Of The Future: Part Twohttps://blog.starcompliance.com/the-compliance-program-of-the-future-part-twoWhat will the compliance program of the future look like? Find out in this week's StarBlog. A veteran compliance officer talks at length and in-depth about the radical change coming to financial compliance and the unexpected forces driving it. Part two of two. From the experts at StarCompliance.

Secure IM a boon for financial firms | ZDNethttps://www.zdnet.com/article/secure-im-a-boon-for-financial-firmsApr 09, 2002 · Secure IM a boon for financial firms. A tool called Communicator Hub IM is similar to other services such as Yahoo and AOl, but has a security standard that …

Tokyo's Nikkei ends 0.93% lower - NewsComAuhttps://www.news.com.au/finance/business/tokyo...TOKYO'S Nikkei stock index has closed 0.93 per cent lower on profit-taking, a day after it soared to its highest close in almost four-and-a-half years. The index shed 106.68 points to 11,357.07 on ...

2017 New Year, Same Cybersecurity Issueshttps://corporate-finance.cioreview.com/cxoinsight/...A robust email filtering system will block many if not most attacks. So much malicious content comes in through email and a good email filtering system will prevent those emails from getting t o e mployees. T he a ttack o n the Democratic National Convention was due to a breach via email.

Big Sky History - DELGER REAL ESTATE - BIG SKYhttps://bigskyrealestategroup.com/big-sky-historyBig Sky is currently booming, but it has undergone numerous changes since its inception in 1973. With the emergence of The Yellowstone Club, Moonlight Basin, and Spanish Peaks sparking controversy, financial instability, and headaches before eventually emerging to be safe investment opportunities. Beginning with CrossHarbor Capital Partners purchase of the Yellowstone Club in 2009, the

Financial regulation lags after Dodd-Frankhttps://www.bankrate.com/finance/personal-finance/...Financial regulation lags after Dodd-Frank. ... according to a legal interpretation by inspectors general for the Federal Reserve and Treasury. ... but it’s a slow-moving train,” Donner says.

MEPs back new banking framework - RTE.iehttps://www.rte.ie/news/business/2010/0922/135859-banksMEPs have voted in favour of an ambitious new supervisory framework for Europe's banks and financial services.

PPT-Outlook 2H16 (FINAL 30Jun16)https://www.ppt.ch/wp-content/uploads/2014/08/PPT-Outlook-2H16.pdfIn the first quarter of this year, GDP grew at an annualized rate of 2.2%, which is above the underlying trend. Growth accelerated not only in Germany, but also in France and Italy. In the past four quarters, the aggregate economic growth was driven by private consumption (up 1.7% on average) and by corporate investment spending (up 2.9%), with the

Why Capitalism is in a Mess | Starry Plough Initiative ...https://theplough.proboards.com/thread/2267/why-capitalism-messOct 09, 2008 · Financial Meltdown: Why Capitalism is in a Mess Written by Kieran Allen, School of Sociology, University College Dublin Thursday, 25 September 2008 Most peop

Could A Bitcoin Breakdown Pop 'The Bubble'? | Cambridge ...https://cambridgehouse.com/news/7380/could-a-bitcoin-breakdown-pop-the-bubbleCould A Bitcoin Breakdown Pop 'The Bubble'? The answer is: Of course. But is certainly isn't the only thing that could create a crisis of confidence in a financial system that is a distorted shadow of the real economy that it purports to represent.

OPEC finds a solution and Deutsche Bank continues ... - Prattehttps://www.pratte.ca/en/2016/09/opec-finds-a-solution-and-deutsche-bank-continues-to-dropSep 30, 2016 · This week, the setbacks of the German bank, Deutsche Bank, have made the markets tumbled. While the OPEC member countries met to try to find a solution to the abundance of oil on the market, the US presidential debate also had an effect on the financial markets. Finally, the last article in …

A decade on from the GFC, the world is less equipped to ...https://i.stuff.co.nz/business/106815623/a-decade-on-from-the-gfc-the-world-is-less...OPINION: London in 2007 and 2008 was a wonderful time and place to be a Kiwi journalist. Everyone knows the term "global financial crisis", but what defined the crisis was the incredible boom which came before it. As informative as it is, anyone who has read The Big Short or watched the movie adaptation is left with the impression that it must have been terribly obvious that trouble was coming.

The Inside Story of Lloyds and the Banking Crisis – book ...https://www.thenational.ae/business/the-inside-story-of-lloyds-and-the-banking-crisis...In this exclusive excerpt from Black Horse Ride: The Inside Story of Lloyds and the Banking Crisis, the writer Ivan Fallon relates how Lloyds, which had spent years searching for a foreign merger ...

Financial derivatives, their rise and rise - Rear Vision ...www.abc.net.au/radionational/programs/rearvision/financial-derivatives-their-rise-and...Financial derivatives, their rise and rise. Download audio; ... where in 1848 the Chicago Board of Trade was set up as the first futures and options ... And the aspect of derivatives which ...

Will FED initiate a (mini)crisis? | Phil's Stock Worldhttps://www.philstockworld.com/2016/12/04/will-fed-initiate-a-minicrisisRaising interest rates help to cool off the overheating economy. On the other hand, if the economy is heading for a recession central banks lower interest rates to make available to society credit cheaper and stimulate spending. This helps the economy get up from its knees. This is the theory.

Inside the UBS rogue trade and the man accused of it ...https://business.financialpost.com/investing/inside-the-ubs-rogue-trade-and-the-man...Sep 16, 2011 · Inside the UBS rogue trade and the man accused of it The same day that Switzerland's central bank imposed a limit on the franc’s appreciation against the …

Jason Burns (VII) - News - IMDbhttps://www.imdb.com/name/nm3187618/newsLast year the top script was The Muppet Man from Christopher Weekes about “the life and times of the late Jim Henson.” Coming in second was Aaron Sorkin‘s The Social Network script, which is a current frontrunner to sweep the Oscars. The year before was The Beaver, now starring Mel Gibson and set for a release in 2011.[PDF]Third Way Report - Money Market Mutual Funds: Are They ...content.thirdway.org/publications/717/Third_Way_Report_-_Money_Market_Mutual_Funds...was forced to “break the buck” and go to a floating NAV.14 The Reserve Primary Fund was the first MMF open to the public to break the buck, and the second one ever.* Its failure to maintain a $1 stable NAV sparked a panic in the market, leading investors to withdraw their money from other prime

Credit Suisse - Wikipediahttps://en.wikipedia.org/wiki/Credit_Suisse_Private_BankingCredit Suisse Group AG is a Swiss multinational investment bank and financial services company founded and based in Switzerland.Headquartered in Zürich, it maintains offices in all major financial centers around the world and is one of the eight global "Bulge Bracket" banks providing services in investment banking, private banking, asset management, and shared services.

Classic Cars: Investment or Consumption? | The Rational Walkhttps://www.rationalwalk.com/classic-cars-investment-or-consumptionToday, my return on this investment occurred when I drove the car for the first time this year after having it in storage all winter. I also obtained utility from performing routine maintenance (with parts costing $63.59) that many others would consider a hassle. This is not a …

A decade on from the GFC, the world is less equipped to ...https://www.stuff.co.nz/business/106815623/a-decade-on-from-the-gfc-the-world-is-less...For a lucky few that is no doubt true, and if so they would have made handsome rewards for being ahead of the game. ... Weeks before the first major collapse in the United States in early 2008 ...

Merchants National Corporation — Wikipedia Republished ...https://wiki2.org/en/Merchants_National_CorporationMerchants National Corporation was an Indianapolis-based statewide bank holding company that was one of the largest Indiana-based financial institution at the time it was acquired by Ohio-based National City Corporation in 1992. Its primary subsidiary was the Indianapolis-based Merchants National Bank and Trust Company, which was founded in 1865.

Coming Home | SafeHaven.comhttps://safehaven.com/article/37923/coming-homeJun 20, 2015 · Japan was the first major developed country to fall into the trap of unfettered "money" and Credit. They were the forerunner of the agony wrought from dysfunctional global financial policymaking and infrastructure. By now, one would think that loose "money" would be recognized as the chief culprit for much of the world's ills.

Markets Down Sharply : NPRhttps://www.npr.org/templates/story/story.php?storyId=95442875Oct 06, 2008 · Lehman was the first investment bank to collapse in the crisis, and Fuld appeared contrite. "I feel horrible about what has happened to the company and …

Debt crisis: as it happened - November 30, 2011 - Telegraphhttps://www.telegraph.co.uk/finance/debt-crisis-live/8924834/Debt-crisis-as-it...Nov 30, 2011 · Debt crisis: as it happened - November 30, 2011 Global markets rally and FTSE 100 gains 3pc as US Federal Reserve "coordinates" with ECB and Bank of …