Home

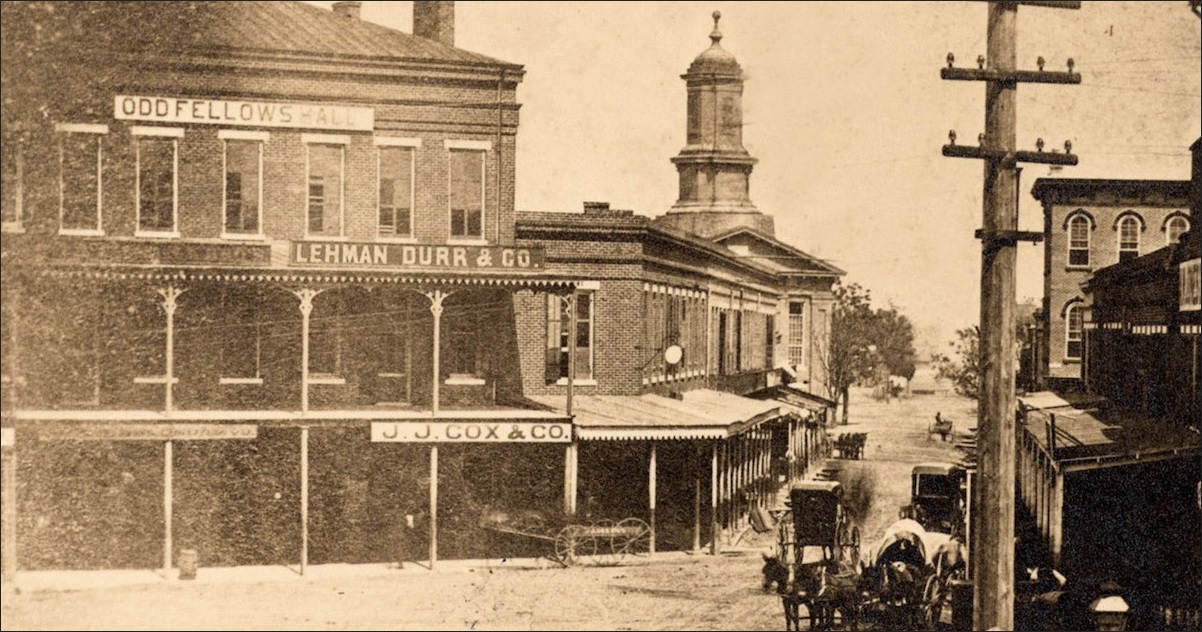

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Book review: Trading Bases | The Hardball Timeshttps://tht.fangraphs.com/book-review-trading-basesA new baseball season means it’s a new baseball book season, and the new tomes are hitting the store shelves and Kindle electronic pages. One particular work sparked some curiosity from me, Trading Bases: A Story About Wall Street, Gambling, and Baseball (not necessarily in that order) by Joe Peta. As you might gather from the title, Peta, who is a lifelong baseball fan, has spent pretty ...

Pabst Brewing Co. v. Kalmanovitz, 551 F. Supp. 882 (D. Del ...https://law.justia.com/cases/federal/district-courts/FSupp/551/882/2366423Pabst, in its complaint, has alleged five causes of action. The first is a disclosure claim under Sections 14(d) and 14(e) of the Exchange Act. The second cause of action alleges that the proposed financing for the tender offer violates the margin requirements set forth …

The Standard Register Company Definitive Proxyhttps://www.sec.gov/Archives/edgar/data/93456/000095015201500554/l85642fdef14a.htmThe trustees share voting and investment power for the securities in the trusts. The will of John Q. Sherman requires the trustees to give each beneficiary who is a child of John Q. Sherman, upon his or her request, a proxy allowing the beneficiary to vote the shares held in his or her respective trust. (2)

Federal Reserve | Bank For Lifehttps://bankforlife.wordpress.com/category/federal-reserve-2Jul 06, 2011 · Once again the Federal Reserve has bypassed scrutiny and emerged as the ultimate financial regulator. Nary a mention has been given to auditing this cartel though that was the first intent of Congressman, Ron Paul. Taking a look at what will actually occur for most, we will cover the most common places that people park their money.

IN RE ADAMS | 212 B.R. 703 (1997) | 12br7031809 | Leagle.comhttps://www.leagle.com/decision/1997915212br7031809MEMORANDUM OF DECISION. HENRY J. BOROFF, Bankruptcy Judge. Before the Court for determination is a motion for summary judgment by plaintiff and debtor Beverly L. Adams (the "Debtor"), seeking judgment against William J. Monty ("Monty"), and Hartconn Associates, Incorporated ("Hartconn"), 1 on two counts of her second amended complaint (the "Complaint").

5: Bankruptcy Lawyers In Illinois Lake County - How things ...https://5nln.blogspot.com/2013/02/bankruptcy-lawyers-in-illinois-lake.htmlShould having problems Bankruptcy Lawyers In Illinois Lake County . Chapter 7 Lawyers Relieve Individual Worries. It was formerly that a person may possibly file bankruptcy nearly impulsively, simply to emerge from within large load of commitments.

Financial crises, corporate scandals and blind spots: who ...https://blogs.lse.ac.uk/businessreview/2018/01/25/...According to the U.S. Financial Crisis Inquiry Commission, the main causes of the financial crisis of 2007-2009 were failures of corporate governance and policy, including widespread failures in financial regulation and supervision, lack of transparency, poor preparation by the government, and systemic breakdown in accountability.The Commission concluded that the crisis was avoidable.

People: Bank of America, BMO Capital Markets/Hargreave ...https://ftalphaville.ft.com/2007/03/06/2973/people...Mar 06, 2007 · The seasonal merry-go-round of job moves at investment banks is in swing as two of Bank of America’s traders have quit within 24 hours of each …

Donald Trump Advisers Back Deregulation, Privatized Social ...https://www.ndtv.com/world-news/donald-trump...Nov 13, 2016 · Among the initiatives he successfully backed at the SEC was a loosening of leverage restrictions on investment banks, a step that allowed firms like Bear Stearns and Lehman brothers to …

Trump advisers back deregulation, privatized Social ...https://www.breitbart.com/news/trump-advisers-back...Nov 12, 2016 · Bill Walton, one of the two people overseeing the economic transition effort, is the former chief executive for Allied Capital, a financial firm that was sold after nearly failing during the financial crisis. He is both a trustee for the Heritage Foundation and a senior fellow at another conservative organization, the Discovery Institute.

Trump advisers back privatising social securityhttps://www.asianage.com/world/americas/121116/...Among the initiatives he successfully backed at the SEC was a loosening of leverage restrictions on investment banks, a step that allowed firms like Bear Stearns and Lehman brothers to borrow more ...[PDF]3 TOXIC LEADERSHIP TRACING THE DESTRUCTIVE TRAILiaeme.com/MasterAdmin/UploadFolder/TOXIC LEADERSHIP...2005). History has also thrown up leaders whose leadership can be identified as toxic, one of them being Hitler who is a prime example of being a destructive leader. A look into the past of toxic leaders shows that they do not develop toxic tendencies in a day, in fact their style evolved over a period of time.

Caveat Lessor: Lessons Learned from the Dewey Collapse ...https://www.monitordaily.com/article-posts/caveat-lessorDewey & LeBoeuf was the product of a merger between firms Dewey Ballantine and LeBoeuf, Lamb, Greene & MacRae in 2007. Legacy Dewey was struggling at the time, with its net income plummeting by $80 million in one year. In that same time, legacy LeBoeuf’s net income rose by over $100 million.

International Finance Magazine Jan - Mar 2017: This year ...https://issuu.com/internationalfinancemagazine/docs/jan2017/45Jan 02, 2017 · Contagion not Connectedness was the Systemic Risk Problem in 2008 Correlated losses due to falling housing prices set the scene for the crisis of 2008 but did not by itself lead to a …

Belly Up - Investopediahttps://www.investopedia.com/terms/b/belly-up.aspJul 07, 2018 · Belly Up: A slang term used to describe the complete and abject failure of an individual, corporation, bank, development project, etc. The term belly up is often used to describe a financial ...

Saba Nazar, Bank of America Merrill Lynchhttps://lists.fnlondon.com/fn100/women_in_finance/2016/nazar-segars/saba-nazarSaba Nazar. Vice-chairman of global financial sponsors, Bank of America Merrill Lynch. Nazar wins praise from peers for a busy 12 months, working on several notable deals. She advised on the £4.8 billion IPO of payments company Worldpay in late 2015, …

Financial Reform at Forefront on Capitol Hill - DSNewshttps://dsnews.com/news/government/03-17-2009/...Mar 17, 2009 · At a congressional hearing on Tuesday, Rep. Barney Frank, chairman of the House Financial Services Committee, said he plans to begin drafting …

Stifel Nicolaus Stockbroker Barred In Theft Investigation ...https://stockbrokerfraud.com/steven-rodemerApr 08, 2020 · Published on April 8, 2020. Steven Dale Rodemer of Pueblo Colorado a stockbroker formerly registered with Stifel Nicolaus Company Incorporated has been barred from associating with any Financial Industry Regulatory Authority (FINRA) member in any capacity based upon consenting to findings that he failed to cooperate with FINRA while he was the subject of an investigation into …

Zerohedge and The Economic Collapse Blog on the Coming ...https://endtimesand2019.wordpress.com/2015/09/30/...Sep 30, 2015 · During that day, the Dow Jones Industrial Average plunged from a high of 16,459.75 to a low of 15,370.33 before rebounding substantially. That intraday point swing of 1,089 points was the largest in all of U.S. history. Overall, the Dow has down 588.40 points that day.

Trader Makes a Quick $1.25 Million on Rescue, Then Slams Ithttps://peaknewsroom.blogspot.com/2008/09/trader...Sep 02, 2008 · The stock fell, so he bought more at $100 a share. It fell again, and he bought at $90. The next day it rallied and he sold out at an average price of $130 a share, for a net gain of about $1.25 million over three days of trading, he said. Trouble was, the stock didn't rally because of the fundamental strength of the company, Mr. Perkins said.

Wall Street Failed You: Investment Banking Edition | The ...https://www.fool.com/investing/general/2012/09/15/...Sep 15, 2012 · Wall Street Failed You: Investment Banking Edition ... There was the advent of the Internet age, which brought with it very real advancements and some great …

FTI Consulting Continues Investment in ... - Bloomberg.comhttps://www.bloomberg.com/press-releases/2019-08-05/fti-consulting-continues...Aug 05, 2019 · Ms. Tseng, who is based in California, advises private equity firms and global Fortune 500 companies as they set strategic visions, establish new businesses, transform operations for …

Distressed Debt Platform IlliquidX Eyes Increasing ...https://www.prnewswire.co.uk/news-releases/...LONDON, August 16, 2012 /PRNewswire/ --. IlliquidX, the distressed debt pricing and trading platform, has appointed Ignacio Muñoz-Alonso to its senior advisory board. The appointment comes as ...

Neil Greenspan Net Worth (2021) | wallminehttps://wallmine.com/people/110492/neil-w-greenspanMar 18, 2020 · Neil Greenspan biography. Neil Greenspan serves as Chief Financial Officer of the Company. Mr. Greenspan has over 20 years of reinsurance and insurance industry experience. Mr. Greenspan was the Senior Vice President, Financial Reporting of the Validus Group from November 2017 until joining the Company, and was the Chief Accounting Officer of the Montpelier Group from …

From ChiefMarketing Officer to...https://www.slideshare.net/sofusmidtgaard/...Nov 03, 2011 · You just clipped your first slide! Clipping is a handy way to collect important slides you want to go back to later. Now customize the name of a clipboard to store your clips.

Jan-Jaap Baer | Travers Smithhttps://www.traverssmith.com/people/jan-jaap-baerJan-Jaap is a partner in our Dispute Resolution Department. He is experienced in a broad range of commercial disputes, representing clients across a variety of sectors, including financial services, private equity, technology, pensions and shipping.

Barclays Secures Fabio Madar as Global Head of G10 FX ...https://www.financemagnates.com/executives/moves/...British multinational investment bank, Barclays, announced on Thursday that it has appointed Fabio Madar as global head of G10 FX. Head of FX trading, James Hassett, is also moving into a newly created role in emerging markets. Madar joins the British bank from Deutsche bank, ending a 13-year tenure. He will report to Michael Lublinsky, who is the global head of macro, and Guy Saidenberg, the ...

IEN NOW: SpaceX Rival OneWeb Files for Bankruptcy - YouTubehttps://www.youtube.com/watch?v=RGag5I1At8kApr 03, 2020 · The high-speed race towards low orbit satellite connectivity has hit a skid as SpaceX rival OneWeb has revealed that it has laid off 85 percent of its staff and filed for bankruptcy. Reports say ...

Investors Paying for Rights to Madoff Recovery Funds - Bloggerhttps://securitiesandinvestmentblog.blogspot.com/...Investors Paying for Rights to Madoff Recovery Funds There are companies that will pay upfront for the rights to a settlement or recovery of a plaintiff's lawsuit. Other companies will loan money to a plaintiff to fund the lawsuit with no payment until the case settles or the plaintiff is victorious at trial.

And finally... bit of a problem - Scottish Financial Newswww.scottishfinancialnews.com/15444/and-finally-bit-of-a-problemThe billionaire CEO of a brokerage giant has warned that the Bitcoin craze could lead to a financial crisis similar to 2008. Thomas Peterffy, CEO of Interactive Brokers, told Fortune that he relayed his concerns to the US commodities regulator, who is unable to intervene. His warning comes two weeks ahead of the launch of a futures market for the digital crypto-currency.

DBSI: What Went Wrong? | Investor Protectionwww.investorprotection.com/blog/2012/02/21/dbsi-what-went-wrongFeb 21, 2012 · Out of his initial $3.5 million investment, Marvel expects to hold onto only about $500,000, according to a Feb. 9 Idaho Statesman article. Then there’s DBSI investors like Barb Korducki, who is still trying to pick up the pieces from her doomed investment foray in DBSI properties.

Pimco's Head of Canada Portfolio Management Is Leaving ...https://financialpost.com/pmn/business-pmn/pimcos...(Bloomberg) — Ed Devlin, head of Canadian portfolio management at Pimco Investment Management Co., is leaving the firm after more than a decade.

The Only Guide to Alternative Investments You'll Ever Need ...https://books.google.com/books/about/The_Only...The rewards of carefully chosen alternative investments can be great. But many investors don’t know enough about unfamiliar investments to make wise choices. For that reason, financial advisers Larry Swedroe and Jared Kizer designed this book to bring investors up to speed on the twenty most popular alternative investments: Real estate, Inflation-protected securities, Commodities ...3.5/5(8)

Female City bankers sue over sexism claims at Japanese ...https://www.telegraph.co.uk/finance/newsbysector/...Female City bankers sue over sexism claims at Japanese bank Nomura. Two female City workers are suing Japanese bank Nomura for £3million after claiming they suffered sexism from male colleagues ...

Asian bank staff big winners as risk and compliance demand ...https://www.scmp.com/business/banking-finance/...Nov 12, 2013 · A senior officer in Singapore is paid as much as S$250,000 (HK$1.56 million) annually, compared with Hong Kong's HK$1.8 million, London's £175,750 (HK$2.19 million) …

Nomura shuffles global markets leadership amid losses ...https://www.businesstimes.com.sg/banking-finance/...[TOKYO] Nomura Holdings Inc shuffled management of its global markets division, appointing new heads for Europe and the US in an effort to boost revenue and secure a profit recovery outside of Japan. Read more at The Business Times.

Ammoneo - Au sein de notre système économique où l'on ...https://www.facebook.com/ammoneo.org/posts/...Translate this pageUnfortunately this addiction sometimes leads to its lot of bankruptcies, which leads to others, which can lead to a major economic crisis. Source of the video: Mathias Enthoven and David Cayla - THE EFFUNDREMENT OF THE ECONOMY COMES, AND MACRON DOES NOTHING TO STOP IT (Media, 2020), 1:21, 15:21, 15:48, from 16:48 to 18:07, from 18:27 to 20:45 ...

Register of persons | University of St.Gallenhttps://www.unisg.ch/en/personenverzeichnis/...2013: Summer School in Empirical Research Methods (SSERM), University of St. Gallen (Bayesian Estimation and Inference) 2011-2016: Habilitation at the University of St. Gallen (Thesis: Essays on Insurance-Linked Securities, Financial Regulation and Consumer Preferences)

Martin von Niederhaeusern – Partner – Harmony Advisors ...https://ch.linkedin.com/in/martin-von-niederhaeusern-a2574b160Harmony Advisors Switzerland AG is a specialised investment advisor and multi-family office based in Zurich & Hong Kong. Our cross-cultural team has longstanding experience in investment banking, private equity, hedge fund and wealth management across global markets, providing unique access to a wide range of professional services and investment solutions.Title: Partner at Harmony Advisors …Location: Zürich, Kanton Zürich, Schweiz

Unstructured Financeblogs.reuters.com/unstructuredfinance/2007/10/page/11Oct 04, 2007 · Check out Wet Seal’s falling September sales. Another harbinger of a tough month for retailers? The teen apparel retailer on Wednesday said sales at stores open at least a year fell 7.5 to 8.5 percent in September, far worse than the 1 percent to 3 percent it previously announced.The company also forecast a 2 percent to 6 percent drop in October sales.

WALL STREET WALLOPED WITH $1.4B PENALTYhttps://nypost.com/2002/12/21/wall-street-walloped-with-1-4b-penaltyDec 21, 2002 · Wall Street knuckled under yesterday and agreed to cough up $1.4 billion and undertake sweeping reforms to end regulators’ probes into investment banks’ conflicts of interest. The hard-…

Olive: An ailing Ireland's lessons for Canada | The Starhttps://www.thestar.com/business/2011/04/23/olive...Apr 23, 2011 · With the collapse of Lehman in September 2008, doubt was cast on banks worldwide. Irish euphoria turned to panic, real estate borrowers began reneging on debt, Irish bank failures thus loomed ...

Herbalife's Clean Bill of Health Means Nothing - AOL Financehttps://www.aol.com/article/finance/2013/12/18/...Dec 18, 2013 · Despite the auditors of personal care supplements maker Herbalife giving its books a clean bill of health, its stock remains far too risky to invest in one way or the other because its valuation

How They Blew It: The CEOs and Entrepreneurs Behind Some ...https://www.barnesandnoble.com/w/how-they-blew-it-jamie-oliver/1100307227How They Blew It is about people who did something remarkable: they all built huge business empires worth millions, if not billions. Then they all did something unbelievable: they managed to lose it. How They Blew It tells the story of 16 business leaders who went from paramount success to abject failure, resulting in the collapse of some of the world's most famous and supposedly successful ...

DTCC caught covering-up – Deep Capturehttps://www.deepcapture.com/2008/04/dtcc-caught-covering-upThere has been much speculation as to the root of Gary Weiss’s abiding interest in the personalities voicing their objections to the practice of illegal naked short securities trading. In February of 2007, some felt that question was answered in the form of a minor yet tremendously significant incident from which it could be fairly deduced that Weiss was, on the morning of January 19, 2007 ...

BPO careers and the global financial crisis - Rediff.com ...https://ia.rediff.com/getahead/2008/oct/29bpo.htmOct 29, 2008 · Everyone is talking about the global financial crisis and how it will adversely affect Indian business process outsourcing (BPO) companies.But what exactly is the crisis? Why are the BPOs so vulnerable to something happening half the world away? We explain what the mess is, why the BPO industry is so worried and how it will impact you, the employee.

BofA-ML retains bearish stance ahead of 10 ... - Bestinvesthttps://www.bestinvest.co.uk/research/market-news/...Aug 17, 2018 · BofA-ML retains bearish stance ahead of 10-year commemoration of Lehman Bros. crash (1) 17 August 2018 (Sharecast News) - Investors are already positioned 'bearishly', but that potential positive for financial markets was likely to be swamped by the recent peaks in corporate profits and economic stimulus, strategists at Bank of America-Merrill ...[PDF]SELECTIVE DISSEMINATION OF INFORMATION (SDI)https://digitallibrary.miti.gov.my/documents/10180...Selective Dissemination of Information (SDI) Page 3 Harris also reevaluates how the Fed itself analyzes and manages the economy. He explains the central bank’s decision-making process, the levers at its disposal, and the specific effects of its decisions – to show …[PDF]Working PaPer SerieShttps://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1599...Working PaPer SerieS no 1599 / october 2013 DiSentangling the bonD-cDS nexuS ... and focus on the relative magnitude of each of the transmission channels for a wide ... There is ample evidence for the co-movement of similar asset classes in response to a shock a?ecting only one of them. Such spillovers for sovereign entities have been ...

GLC Advisors hires Thompson and Swindell from FBR Capital ...https://www.spglobal.com/marketintelligence/en/...GLC Advisors has hired Paul Thompson and Robert Swindell as senior managing directors from FBR Capital Markets, according to an announcement today. They’ll advise on agriculture, logistics, consumer products and technology industries and will also support restructuring and investment practices, according to the release. Both were senior managing directors at FBR, and before that from

Mar 20, 2009 The Mother of all Bells Peter Schiff 321gold ...www.321gold.com/editorials/schiff/schiff032009.htmlMar 20, 2009 Peter Schiff C.E.O. and Chief Global Strategist Euro Pacific Capital, Inc. 1 800-727-7922 email: pschiff@europac.net website: www.europac.net Archives. Mr. Schiff is one of the few non-biased investment advisors (not committed solely to the short side of the market) to have correctly called the current bear market before it began and to have positioned his clients accordingly.

Executive Compensation Is A Controversial Issue - 1379 ...https://www.bartleby.com/essay/Executive...Executive Compensation Is A Controversial Issue 1379 Words 6 Pages According to business dictionary (2014), Corporate Governance means “the framework of rules and practices by which a board of directors ensures accountability, fairness, and transparency in a company 's relationship with its all stakeholders (financiers, customers, management ...

Bullion Currencieshttps://www.bullioncurrencies.com/gold-priceBullion Currencies, powered by PG-Pay mobile app is an online platform brought to you by Singapore’s premier private mint, PureGold.sg Pte Ltd to provide physical gold investment at a competitive price of only 2% above the international gold Spot Price, with secured storage at no charge and use your gold as a means of payment when purchasing goods and services.

Business | BusinessNewsAsia.com | Page 25https://www.businessnewsasia.com/category/business/page/25Here are the 2D Ez2 Lotto result for today from the Philippine Charity Sweepstakes Office (PCSO). PCSO releases 2D Lotto results everyday during its... BusinessNewsAsia.com is an online publication that focuses on business news, investments news, finance …[PDF]Product Liability Conference 2017 - DRIdri.org/docs/default-source/event-brochures/2017/product-liability/20170200.pdfJoin us for a quick and entertaining tour of the last 12 months of cases from across the country. D. Christopher Robinson, Frost Brown Todd LLC, Louisville, KY 11:00 a.m. Jury Selection for the Catastrophic Injury Case, Part I (Live Mock Voir Dire) What are the best ways to weed out prob-lem jurors, identify jurors who might champion

HSBC | BusinessNewsAsia.comhttps://www.businessnewsasia.com/tag/hsbcHere are the 2D Ez2 Lotto result for today from the Philippine Charity Sweepstakes Office (PCSO). PCSO releases 2D Lotto results everyday during its... BusinessNewsAsia.com is an online publication that focuses on business news, investments news, finance …

Bullish Thinking: The Advisors Guide to Surviving and ...https://www.barnesandnoble.com/w/bullish-thinking-alden-cass/1008803123Bullish Thinking is packed with hard-hitting true stories of financial professionals who have faced the many job stressors that fill this competitive industry. In it, you’ll learn how to identify particular problems and initiate the process of getting help, all while reading in-depth case studies and extensive examples that exemplify the obstacles you may face.

This Fed President Thinks Wall Street Banks Should Stop ...https://wallstreetonparade.com/2019/11/this-fed...Nov 12, 2019 · It’s currently offering as much as $120 billion per day in overnight loans to Wall Street trading firms at a preposterously low interest rate of 1.55 percent as of last Friday. In addition, it is offering $35 billion twice a week (for a total of $70 billion a week) in two-week term loans to …

Lloyds scheme fails FSA stress tests - Telegraph.co.ukhttps://www.telegraph.co.uk/finance/financial...Sep 17, 2009 · Lloyds scheme fails FSA stress tests . Lloyds Banking Group has been forced to abandon its plan to withdraw from the Government's toxic debt insurance scheme after failing to …

Morley adds to research team - Aviva plchttps://www.aviva.com/newsroom/news-releases/2001/...It also acts as investment manager for a range of retail investment funds, marketed under the Norwich Union brand. CGU plc and Norwich Union plc merged on 30 May 2000 to create CGNU plc, the UK's largest insurance group and one of the top-five insurers in Europe with substantial positions in other markets around the world, making it the world's ...

What is the best way to become an investment banker ...https://in.answers.yahoo.com/question/index?qid=20080301180704AAAbacDMar 01, 2008 · I am currently a freshman in high school. I recieved a 4.0 GPA during my first semester of high school. I wrestled for the JV team, and even though this year was my first year, I expect to become the captain my senior year. I am also going to play baseball for the school team. Last year, I took part in a 10-week stock competition using fake money and I was 4th out of 110 individuals/teams.

Don’t Ignore Eurozone, It Could Be Source of Next ...https://www.lombardiletter.com/eurozone-source...There’s one place that investors shouldn’t ignore, because it could be the source of the next financial crisis: eurozone banks. You see, in the mainstream media, we hear all about how the European Central Bank (ECB) is doing all it can to support the financial sector of the common currency region after it had its own financial crisis in 2011.

Trading Home & Living | Redbubblehttps://www.redbubble.com/shop/trading+home-decorHigh-quality Trading pillows, tapestries, mugs, blankets, shower curtains, aprons, jigsaw puzzles, and magnets by independent artists. Decorate your living room ...

Fusaro and Vasey launch energy hedge fund management ...https://www.hedgeweek.com/2006/05/19/fusaro-and...May 19, 2006 · Fusaro and Vasey are the co-founders of the Energy Hedge Fund Center, an online community focused on energy, environment and hedge funds, and are the co-editors of the online newsletter, Energy Hedge. Their forthcoming book 'Energy & Environmental Hedge Funds - The New Investment Paradigm' (Wiley, June 2006), is set to be released this summer.

10 Most Famous Leveraged Buyouts. Debt... - Commercial ...https://www.facebook.com/comaware4s/posts/2909651375931565The newly-founded company, Energy Future Holdings, filed for Chapter 11 bankruptcy in 2014, qualifying as one of the 10 biggest nonfinancial bankruptcies in history. America’s most famous investor, Warren Buffett, was even convinced the deal could not miss and ended up losing nearly $900 million. 2. …

Coronavirus vs. Oil Prices: Which 1 Hit the Stock Market ...https://www.msn.com/en-us/money/savingandinvesting/...Canada’s energy sector is the whipping boy, although the Canadian Natural Resources stock can probably survive a recession. However, the containment of the health crisis should come before any ...

The facts about commodities were mainly fantasies | UBS Globalhttps://www.ubs.com/.../facts-about-commodities.htmlIn 2004, two very influential economists, Gary Gorton and K. Geert Rouwenhorst, published a working paper titled "Facts and Fantasies about Commodity Futures."They concluded, in part, that "Fully-collateralized commodity futures have historically offered the same return and Sharpe ratio as equities."It was a pretty impactful paper in the sense that it led to quite a few investment firms ...

Och-Ziff will be the next to float | Infrastructure Investorhttps://www.infrastructureinvestor.com/och-ziff-will-be-the-next-to-floatOch-Ziff Capital Management, a US hedge fund manager that has regularly made private equity-style investments, has filed for an initial public offering on the New York Stock Exchange that could value the group at around $20 billion.. The US group, one of the world’s largest hedge fund managers with assets of over $26 billion, has shrugged aside concerns about the continuing struggles of ...

Bank of America to Pay Historic $2.43 ... - Top Class Actionshttps://topclassactions.com/lawsuit-settlements/...Oct 01, 2012 · Bank of America to Pay Historic $2.43 Billion Securities Fraud Settlement. By Kimberly Mirando UPDATE: A federal court has approved the $2.43 billion Bank of America Class Action Lawsuit Settlement!Class Members have until April 25, 2013 to file a claim.[PDF]Taxing Risk and the Optimal Regulation of Financial ...https://www.minneapolisfed.org/~/media/files/pubs/...Taxing Risk and the Optimal Regulation of Financial Institutions . May 2010 . Narayana Kocherlakota . President . Federal Reserve Bank of Minneapolis . ... This mismatch between our expectations and our realizations was the ultimate source of ... fundamentals—may be subjected to a run if its investors lose confidence in its solvency.

Investing the the time of crisis | Cryptons News | Crypto ...cryptonsnews.com/2020/04/27/investing-the-the-time-of-crisisApr 27, 2020 · Rock Street, San Francisco company@mail.com 1 (234) 567-891

World-Class Financial & Economic Speaker | Lawrence ...www.lawrencegmcdonald.comPrior working at Lehman, he was the co-founder of Convertbond.com, a website that provided convertible securities information with news, valuation, terms and analysis tools for convertible bonds, convertible preferred stocks, and other convertible securities. Convertbond was acquired by Morgan Stanley in 1999.

10 Assembly meetings, one focus - nj.comhttps://www.nj.com/business/2008/10/10_assembly_meetings_one_focus.htmlNew Jersey officials hinted as much last month when Lehman filed for bankruptcy protection after failing to negotiate a sale for itself. William Clark, director of the state Division of ...

the late Robert John Conti - mfwire.commfwire.com/common/article.asp?storyID=61653Retired Neuberger Berman veteran Bobby Conti passed away this week, MFWire has learned. He was 64 years old, and word is that he died of a heart attack. Robert John Conti joined what is now Neuberger Berman in 1980, eventually rising to executive vice president and then, in 2008, to CEO of Neuberger's funds.He spent more than 38 years at New York City-based Neuberger and predecessor firms ...[PDF]F INANC:AL NALYSTS JouRNAL '-iZe7/c ito Hs'https://www.jstor.org/stable/pdf/4480668.pdfassets, the Conseco filing was the third largest-after Enron and WorldCom-in the history of U.S. corporate bankruptcies.5 In terms of potential impact on the structured products market, it was much more significant. At the time of filing, Con-seco was servicing its prior securitizations for a fee of 50 bps. The bankruptcy court took the position

Inside JPMorgan Chase's Earnings | The Motley Foolhttps://www.fool.com/investing/general/2010/04/14/inside-jpmorgan-chases-earnings.aspxInside JPMorgan Chase's Earnings ... this morning. By and large, it was the same story we've heard for a while: These profits would be nothing without fixed-income trading. ... But for the first ...

Markets tumble as Rogoff warns worst of credit crisis ...https://www.independent.co.uk/news/business/news/markets-tumble-as-rogoff-warns-worst...Markets tumble as Rogoff warns worst of credit crisis still to come ... one of the big investment banks or big banks," Mr Rogoff, who is now an economics professor at Harvard University, told a ...

Obama ad hammers McCain on economy comment – CNN …politicalticker.blogs.cnn.com/2008/09/16/obama-ad-says-mccain-doesnt-understand...Sep 16, 2008 · September 16th, 2008 09:20 AM ET. Share this on:

Women Have Investment Approach That Aligns With Retirement ...https://www.plansponsor.com/women-investment...Oct 17, 2017 · Women do not fit the negative stereotypes that have been attributed to them regarding finances, a poll finds. According to a survey of 1,200 investors conducted by Capital Group, 81% of women investors say they have personally experienced negative stereotypes regarding finances, including their investing acumen, income, role in making financial decisions and appetite for risk.

Wells Fargo has just poached a new FIG head from Barclays ...https://news.efinancialcareers.com/cn-en/299119/...Oct 20, 2017 · Barclays might be hiring more traders and investment bankers in New York, but one of its most senior financial institutions M&A bankers has just moved across to U.S. rival Wells Fargo.

Securities Class Action Clearinghouse: Case Pagesecurities.stanford.edu/filings-case.html?id=104173According to a press release dated December 05, 2008, the complaint alleges that during the Class Period, Farmer Mac represented that the company was reporting "strong" or "record" financial and operational results, and that Farmer Mac had already taken adequate measures to ensure that the Company would not face catastrophic losses related to un-hedged or risky investments --including a …

ETFs Vs. ETNs: What Investors Need to Know | Nasdaqhttps://www.nasdaq.com/articles/etfs-vs-etns-what...Dec 16, 2016 · The popular oil ETN iPath S&P GSCI Crude Oil Total Return Index ETN(OIL) was trading at almost 50% premium over its NAV for some time earlier …

[Solved] Sturdy Corporation (a nonpublic company) owns and ...https://www.solutioninn.com/sturdy-corporation-a...Sturdy Corporation (a nonpublic company) owns and operates a large office building in a desirable section of New York City’s financial center. For many years, management of Sturdy Corporation has modified the presentation of its financial statement by: 1. Reflecting a write-up to appraisal values in the building accounts. 2. Accounting for depreciation expense on the basis of such valuations.

How a headhunter helped me double my pay | eFinancialCareershttps://www.efinancialcareers.be/en/news/2018/09/headhunter-helped-double-payI reached out to a head hunter I knew was known for big packages – that’s key by the way. You have to do your due diligence – not all head hunters are the same. Just like in banking, head hunters also have bulge brackets and the also rans. You have to deal with the best if you want the biggest package.[PDF]Describing places The language of trends IELTS Writing ...https://tefltastic.files.wordpress.com/2014/04/describing-places-the-language-of...Describing places The language of trends IELTS Writing Part One map and line graph tasks Choose one of the descriptions of trends below that you agree with and read it out to your partner, adding language to show the strength (or not) of your feelings, explaining why you feel that way. They should agree or disagree in the same way.

City optimism falling at fastest rate since financial ...www.execreview.com/2019/03/city-optimism-falling...Mar 25, 2019 · In the latest warning that the political gridlock over leaving the EU is damaging the economy, the survey of City banks, investment managers and insurance firms from the Confederation of British Industry (CBI) and the accountancy firm PwC suggests companies are the most gloomy since December 2008 – three months after the collapse of Lehman ...

Barclays to give its name to New York subway stophttps://www.telegraph.co.uk/finance/newsbysector/...Jun 23, 2009 · Barclays to give its name to New York subway stop . Barclays will give its name to a New York subway stop in a $4m (£2.4m) deal with the city's cash-strapped transport authority.

Financial Crisis: Taking Out as Much as Possible | ZEIT ONLINEhttps://www.zeit.de/wirtschaft/2018-09/financial-crisis-lehman-shareholder-value...According to a study conducted this spring by the consulting firm Ernst & Young, that number is fully 70 percent for companies like the Deutsche Börse Group, Adidas, Bayer and Infineon.[PDF]Impact of Global Economic Recession on the Livelihood of ...www.global-labour-university.org/fileadmin/GLU...• Sawing: The rough stone is cut to a shape that approximates the shape of the finished cut stone but without the facets. • Girdling: The rough is placed in a chuck on a lathe. While the rough stone rotates on the lathe, a second diamond mounted on a dop is pressed against it, rounding the rough diamond into a …

JPMorgan to Face Class Action in $10 Billion Mortgage-Bond ...https://www.newsmax.com/Finance/Personal-Finance/...A federal judge said JPMorgan Chase & Co. must face a class action lawsuit by investors who claimed the largest U.S. bank misled them about the safety of $10 billion of mortgage-backed securities it sold before the financial crisis.[PDF]Impact of Global Economic Recession on the Livelihood of ...www.global-labour-university.org/fileadmin/GLU...• Sawing: The rough stone is cut to a shape that approximates the shape of the finished cut stone but without the facets. • Girdling: The rough is placed in a chuck on a lathe. While the rough stone rotates on the lathe, a second diamond mounted on a dop is pressed against it, rounding the rough diamond into a …

Céline Gauthier - Bank of Canadahttps://www.bankofcanada.ca/profile/celine-gauthierThe Bank of Canada is the nation’s central bank. We are not a commercial bank and do not offer banking services to the public. Rather, we have responsibilities for Canada’s monetary policy, bank notes, financial system, and funds management. Our principal role, as defined in the Bank of Canada Act, is "to promote the economic and financial welfare of Canada."

Food Deserts : Problems Associated With Developing Nations ...https://www.bartleby.com/essay/Food-Deserts...Food Deserts Issues of hunger and malnutrition are commonly associated with developing nations and are often overlooked in wealthy countries. However, there is growing areas forming across the United States called food deserts. Food deserts are a big recognized problem in our country. Food deserts ...[PDF]Case 11-05736-TBB9 Doc 1366 Filed 10/17/12 Entered 10/17 ...www.kccllc.net/jeffersoncounty/document/1105736121017000000000003by FGIC were further reduced from `AA " to "A " by S&P. in conjunction with the corresponding reduction in such rating agency 's financial strength and financial. enhancement. ratings of FGIC. 957953.4. Case 11-05736-TBB9 Doc 1366 Filed 10/17/12 Entered 10/17/12 16:01:43 Desc Main Document Page 2 of 10

Glass-Steagall did not cause the Crisis ...https://www.marketpulse.com/20120726/glass-steagall-did-not-cause-the-crisisJul 26, 2012 · Phil Gramm, the former U.S. senator who helped write the 1999 law that enabled the creation of financial giants such as Citigroup Inc. (C) and Bank of …

Cryptocurrency Exchanges Make Terrible Custodians For ...https://moneyincrypto.com/2018/11/08/...Nov 08, 2018 · Centralized exchanges are subject to a tremendous number of problems simply because they contravene one of the cardinal laws of cryptocurrency – the owner of the private key is also the owner of the asset. The biggest exchanges like Binance, OKEx and Huobi take control of user funds and use them for market manipulation.

Do you own your investments? | Stockspothttps://blog.stockspot.com.au/own-your-investmentsJul 10, 2018 · Direct vs indirect ownership. When establishing Stockspot 5 years ago we made a purposeful decision that direct ownership was a much safer way to go for our clients. Instead of having your account mixed up with others, all investments are held legally and beneficially in your own name.

A Rare Corner of Finance Where Women Dominate | GreenMoney ...https://greenmoney.com/a-rare-corner-of-finance-where-women-dominateMs. Anderson, who is the head of corporate governance, created a policy to vote against key directors at companies with dual-class share structures like that at Facebook. ... thoughtful leaders involved in the discussion helps the company and the activist get to a collaborative ... an opportunity to create an agenda for greater ...

Why Central Bank Losses Matter: The Case Of The ...https://seekingalpha.com/article/2908676-why-central-bank-losses-matter-the-case-of...This is the province of finance. We can find safer ground there: we can apply to a central bank the same tools we use to analyze a company - in this case, a hypothetical company. Introducing ...[PDF]This is an electronic reprint of the original article ...https://jyx.jyu.fi/bitstream/handle/123456789/50644/saaskilahtilocalbankcompetition...This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. The manuscript will undergo copyediting, typesetting, and review of the resulting proof before it is published in its final form. Please note that during the production process

Gigglebiz The Berrito Brothers who had a sneezy nose ...https://www.dailymotion.com/video/x6e5w9eFeb 02, 2018 · Our brothers who truly love Islam should be very careful about the fact that to be despair and fear is forbidden by religion. Allah is the One Who will do everything.[PDF]Click here for Full Issue of EIR Volume 21, Number 12 ...www.larouchepub.com/eiw/public/1994/eirv21n12-19940318/eirv21n12-19940318_006-plight...million industrial workers ( about one-fourth of the entire industrial work force) illiose their jobs this year. Goldman Sachs chief economi t Jan C. Lee added that this restructuring will not lead to an expansion of production, but rather to a contraction. The!Wall Street investment firms

Deutsche Bank, Blackberry, Spotify | The Week UKhttps://www.theweek.co.uk/am/thursday-september-2016The cost of insuring Deutsche Bank's sub-ordinated bonds has leapt to a record high, as trading in its credit default swaps rose by more than 60%.

Straight talk on what happened | Miami Heraldhttps://www.miamiherald.com/news/business/article1930060.htmlIf you're confused about the recent barrage of financial news, you're in good company. From corporate boardrooms to leading business schools, nobody else seems to fully understand it either.[PDF]Onset of the Financial Crisis Monetary Policy since the ...https://www.researchgate.net/profile/Lukasz_Rawdanowicz/publication/268505103_The...ECO/WKP(2013)73 2 ABSTRACT/RÉSUMÉ The effectiveness of monetary policy since the onset of the financial crisis In the wake of the Great Recession, a massive monetary policy stimulus was provided ...

Crypto Land Looks on as Wall Street Suffers Another ...https://infoyouneed.co/crypto-land-looks-on-as-wall-street-suffers-another-security-breachWhen things seemingly couldn’t get any worse for Deutsche Bank, the Wall Street firm is now troubleshooting a possible security breach involving sensitive client information, according to a report in the Financial Times. It’s reminiscent of Facebook’s data security issues, with the common theme being that these companies had nothing to do ...

Can Audit (Still) be Trusted? - Frank Mueller, Chris ...https://journals.sagepub.com/doi/full/10.1177/0170840615585336This is examined empirically in relation to the interaction between the heads of the Big Four accounting firms in the UK and the House of Lords Economic Select Committee in the course of the recent parliamentary investigation into the UK audit market, prompted by the global financial crisis.

Lloyds TSB shares plunge as ratings agencies threaten ...https://www.telegraph.co.uk/finance/newsbysector/banksandfinance/2984912/Lloyds-TSB...Sep 18, 2008 · Lloyds TSB shares plunge as ratings agencies threaten downgrade Fears about the strength of Britain's banks yesterday caught up with Lloyds TSB, …

Landbanking Scam in Canada - Martin Leehttps://www.martinlee.sg/landbanking-scam-canadaReceived this message from someone in Canada warning about a landbanking scam sold to investors here. Names have been removed to prevent lawsuits. While I can’t confirm the validity of this warning, the moral of the story is to always check with the locals before going ahead with any overseas investment opportunities. I am writing […]

In Which the Bloomberg Kids Put on a Show - Economic ...www.economicprincipals.com/issues/2012.04.22/1360.htmlApr 22, 2012 · In a better world, the Pulitzer Prize for editorial writing this year might have gone to the organization that wrote a judicious series of articles examining the tension between desirable everyday transparency in banking and the protective secrecy that on occasion is suddenly required to stem a financial panic; a series which, in the process, explained why, after not experiencing a banking ...

Revisiting Financial Regulation – IDEAshttps://www.networkideas.org/news-analysis/2011/07/revisiting-financial-regulationThe casualty, in his view, was the effort to ensure a global level playing field. The US Treasury has, as expected, hit back. It argues that it is the US that is committed to strengthening capital standards, whereas it the EU that is giving banks the freedom to game the system in various ways.

Katz v. Gerardi, No. 10-1407 (10th Cir. 2011) :: Justiahttps://law.justia.com/cases/federal/appellate-courts/ca10/10-1407/10-1407-2011-08-25.htmlArchstone was the Archstone REIT s sole trustee, controlling the management and administration of its properties. Infinity and Katz had previously contributed properties to a different REIT later acquired by Archstone so as to gain certain tax and financial benefits.

We’re sunk if bosses are first in the lifeboat | Financial ...https://www.ft.com/content/f09bd768-ccf2-11e0-88fe-00144feabdc0Aug 22, 2011 · Foreign executives who fled Japan in the aftermath of the recent earthquake and nuclear accident risked losing credibility, their jobs, or both, according to a new study by Egon Zehnder ...

ISDA Master Agreement – “probably the most important ...www.inhouselawyer.co.uk/legal-briefing/isda-master-agreement-probably-the-most...As the judge, Briggs J, noted, the Agreement is ‘probably the most important standard market agreement used in the financial world’. The decision, therefore, has potentially important consequences for all businesses that rely on derivatives to manage risks arising …

Requiem for an Economist - The Daily Reckoninghttps://dailyreckoning.com/requiem-for-an-economistSep 12, 2007 · Requiem for an Economist. Dr. Kurt Richebächer died about two weeks ago in his home in Cannes, France. He, and his insights into the world financial markets will be greatly missed by long ...

LaRouche Campaign Defeated Enron, to Win Re-Regulationwww.larouchepub.com/other/2001/2848lar_enron.htmlDec 14, 2001 · LaRouche's mobilization for a national solution to the "California crisis"—organized around his Presidential campaign pamphlet issued in February 2001—set off the national policy-impulse toward re-regulation which led to the current collapse of Enron (see "The LaRouche Factor In Enron's Demise," EIR, Dec. 7, 2001).

Earnings send Wall St higher as investors eye State of the ...https://finance.yahoo.com/news/wall-street-set-rise-open-trumps-state-union-142452864...Feb 05, 2019 · p Oil prices crashed by as much as 30 per cent after Saudi Arabia fired the first shots in a price war, in crude's biggest one-day fall since the early 1990s Gulf war. p Riyadh's threat to ...

Doddsson’s quotation marks - The Iceland Weather Reporticelandweatherreport.com/doddssons-quotation-marksDec 09, 2009 · Doddsson’s quotation marks. by alda. on ... however. The blurb is written in defense of Baldur Guðlaugsson, the good IP soldier who was the first individual to have his assets frozen as a result of the investigation into the bank collapse. The sentence in question – the insidious revising-of-history sentence – is this one [in the last ...

(PDF) How to keep social-psychological research alive and ...https://www.researchgate.net/publication/237066413_How_to_keep_social-psychological...PDF | On May 1, 2013, Ricardo Borges Rodrigues and others published How to keep social-psychological research alive and well in times of European financial crisis?

Bank 4Q results mixed - CNN Businesshttps://money.cnn.com/2000/01/18/companies/citigroupJan 18, 2000 · Mellon Financial , one of the largest U.S. mutual fund management companies, reported fourth-quarter profit of $245 million, or 48 cents a diluted share, up from $222 million, or …

Crisis adjustment and prevention in small open economies ...https://enlightngo.org/language/en/post/14254A small open economy, abbreviated to SOE, is an economy that participates in international trade, but is small enough compared to its trading partners and its policies do not alter world prices, interest rates, or income. [1] Countries with small open economies (e.g. Finland, Netherlands) are usually price takers, whereas the actions of countries with large open economies can effect on both ...

Elizabeth Kay - Director - Treliant Risk Advisors | LinkedInhttps://www.linkedin.com/in/elizabethkayView Elizabeth Kay’s profile on LinkedIn, the world’s largest professional community. Elizabeth has 8 jobs listed on their profile. See the complete profile on LinkedIn and discover Elizabeth ...Title: Financial executive with …Location: Greater New York City500+ connections

The global financial crisis and its impact | Welcome to ...https://kreitlowcorner.blogspot.com/2011/11/global...Last year was the worst year for global equity markets since the Great Depression, the Dow suffered its worst annual drop since 1931. Investors are taking large amounts of money from hedge funds, mutual funds and bond mutual funds in one of the biggest flights to safety in the financial industry has ever seen.

The Stock Market Crash That Almost No One Heard ...https://tradingetfs.com/the-stock-market-crash-that-almost-no-one-heardDec 22, 2018 · To be sure, the stock market also was in full retreat. The speculative parts of the credit market were close behind, especially after the Federal Reserve’s interest-rate increase on Wednesday and, more important, disclosure of its plan to raise rates further in the coming year, while continuing to shrink its bond portfolio.. But the retreat turned to rout for CEFs, owing to both the slide in ...

TFG Asset Management Global Operating Platform – Tetragonhttps://www.tetragoninv.com/people/tfg-am/tfg-amgopReade Griffith is the Chief Investment Officer of TFG Asset Management and is responsible for the investment management of TFG Asset Management’s private equity investments in asset management companies. He also has the delegated authority to take all actions on behalf of TFG Asset Management. Mr. Griffith co-founded the investment manager of Tetragon in 2005 and Polygon in 2002.

Roy Salamé | Official Profile on The Marquehttps://www.themarque.com/profile/roy-salameRoy Salame, former managing director and head of global investment opportunities group at JPMorgan, and Calvin Schlenker, former senior management professional at British Petroleum, also took part in BitOoda’s seed round.According to the release, the company intends to develop and introduce two main products: a financial swap or the BitOoda Difficulty and a physical hashpower contract, the ...

Speyer | Article about Speyer by The Free Dictionaryhttps://encyclopedia2.thefreedictionary.com/SpeyerSpeyer was founded in the fourth century B.C. as a Celtic settlement and later became a Roman town. It became an episcopal see in the eighth century and a free imperial city in the 13th century. In the 16th century the city was the site of several diets, including the Diet of Speyer of 1529.[PDF]KRISTOPHER GERARDI, ANDREAS LEHNERT, SHANE …www2.econ.iastate.edu/classes/econ502/tesfatsion/...to be particularly sensitive to a big drop in HPA. More formally, if we let f be foreclosures, p be prices and t be time, then we can decompose the growth in foreclosures over time, df/dt, into a part relating the change in prices over time and a part re?ecting the sensitivity …

About Us - Archipelago Investmentswww.archipelago-investments.com/meny/aboutFrom 2009 ATP Alpha was the Investment Advisor of Alpha One SICAV-FIS, a regulated and listed Luxembourg fund with $2bn NAV. In 2009 ATP Alpha was the recipient of IPE award for Hedge Fund Investing. Between 2016 and 2018 Tomas was CFO at BankInvest, and from November 2018 Thomas is CIO at Sparinvest, an independent asset manager in the Nordic ...

Thomas R. Slome - Meyer Suozzihttps://www.msek.com/wp-content/uploads/2016/02/Slome_Tom-7.pdfMr. Slome was the law clerk to the late Bankruptcy Judge Robert John Hall of the United States Bankruptcy Court for the Eastern District of New York from 1983 through 1985 before joining Rogers & Wells (now Cli?ord Chance) in New York City. From 1990 through 1995, he was a partner at a well known New York City bankruptcy bouque, where he

About | Navigator Global Investments Limitedwww.navigatorglobal.com.au/site/about/our-peopleNavigator Global Investments Limited (ASX: NGI) is the listed Australian holding company for US-based Lighthouse Investment Partners, LLC (Lighthouse). Lighthouse has been managing portfolios of hedge fund assets since 1999. One of Lighthouse’s key strengths is its proprietary managed accounts program, which is the core to both its commingled managed funds and customised client services.

Democracy: Dare to turn up the heat! | ZEIT ONLINEhttps://www.zeit.de/2016/24/democracy-end-crisis-populism-authoritarians/seite-3And when Boris Johnson, the former mayor of London and one of the leaders of the "Brexit" campaign, recently gave a firebrand speech, taped to his speaker’s stand was the hashtag #Take-Control.[PDF]RELEASE TO AUSTRALIAN SECURITIES EXCHANGE (“ASX”)www.asx.com.au/asxpdf/20160219/pdf/4355mjm73t97tt.pdfgenerate revenue of about $52 million and a profit after capitalised overheads (but before tax) of about $47 million. 5. The settlement of the class action against S&P is one of the variables affecting the timing and amount of distributions from Lehman Australia. The execution of the settlement deed is a

John Mack - Arab Americahttps://www.arabamerica.com/arabamericans/john-mackJohn J. Mack (born on November 17, 1944) is a Senior Advisor and the former CEO & Chairman of the Board at Morgan Stanley, the New York-based investment bank and brokerage firm. Mack announced his retirement as Chief Executive Officer on September 10, 2009, which was effective January 1, 2010. Former Co-President James P. Gorman succeeded him as CEO.

Back to earth with a bump | Dixon Advisoryhttps://www.dixon.com.au/news/news-article/14-06-15/back-to-earth-with-a-bumpJun 14, 2015 · Daryl Dixon is one of Australia’s foremost investment experts and a well known writer and consultant. He has provided trusted advice to thousands of personal clients over more than 25 years and is an acknowledged expert in the areas of tax, superannuation (including public sector superannuation), social security and investments.[PDF]GREEK CRISIS - CAUSES, CONSEQUENCES AND DEVELOPMENTSeconomice.ulbsibiu.ro/revista.economica/archive/...low taxation and a fixed rate of conversion of national currencies (Batrâncea, Batrâncea, Moscviciov, 2009, p.58-64). The current crisis led to a significant decrease in the confidence level of consumers, investors and businessmen, which in turn affected stability and economic strength. This created a vicious circle of economic growth based on

José Neves Sees Farfetch Resilience in COVID-19 Storm – WWDhttps://wwd.com/business-news/financial/jose-neves...José Neves Sees Farfetch Resilience in COVID-19 Storm The ceo said Farfetch’s online luxury platform is both helping merchants and a stable base for an unstable time.

Comerica News Releaseshttps://comerica.mediaroom.com/news-releases?o=235&category=712Find Comerica news releases by category: All, Banking Centers, Community/Other News, Corporate Governance, Economic, Financial

CFA Society San Franciscohttps://cfa-sf.org/events/EventDetails.aspx?id=1452980&group=Dec 17, 2020 · Dr. David Kelly, CFA was a keynote speakers at CFA Society San Francisco's 2020 Annual Investment Dinner in February. Hear from him again or for the first time in this exclusive fireside chat. Dr. Kelly, Chieft Global Strategist at J.P. Morgan Asset Management will lay out his views for the road ahead as we put 2020 in the books and look forward to 2021.

Genworth Names Martin P. Klein Chief Financial Officerinvestor.genworth.com/investors/news-releases/...Apr 11, 2011 · Genworth Financial, Inc. (NYSE: GNW) announces that it has named Martin P. Klein as its new senior vice president and chief financial officer. He will join the company as senior vice president on April 11, 2011 and become chief financial officer following the filing of Genworth's 10-Q quarterly report for the first quarter. Having worked nearly 30 years in financial services, Klein, 51, brings ...

McKenna At Compliance Week Annual ... - re: The Auditorsretheauditors.com/.../30/mckenna-at-compliance-week...May 30, 2012 · Compliance Week will hold its Annual Conference in Washington D.C. next week June 4-6, 2012 at the Mayflower Hotel. The venue alone is worth the price of the ticket! I’ll be there, as I have been for four of the last five years, covering the list of spectacular speakers and newsmakers in the world of risk management, corporate compliance, audit, and legal for financial, legal, risk, audit ...

LibraryofMistakes's books | LibraryThingwww.librarything.com/catalog/LibraryofMistakes/financialinstitutions2000: Financial Institutions, Johnman L: Scotland, Banks, 20th century: Issue also includes articles by Louise Miskell and William Kenefick 'A flourishing seaport': Dundee harbour and the making of the industrial town, c1815-1850; and Leah Leneman 'A natural foundation in equity: marriage and divorce in 18th anc 19th century Scotland'.

Duke Law Panel Examines the Global Credit Crunch | Duke Todayhttps://today.duke.edu/2008/11/law_panel.htmlNov 25, 2008 · Three prominent investors will gather at Duke Law School on Thursday, Dec. 4, to discuss the ongoing impact of the credit crisis on private equity, sovereign wealth funds and other financial institutions. Gao Xiqing, general manager and chief investment officer of the China Investment Corp., Stephen A. Schwarzman, chairman and co-founder of the Blackstone Group, and John A. …

Nomura's Lost in Translation Moment - BloombergQuinthttps://www.bloombergquint.com/markets/nomura-s-lost-in-translation-momentBloomberg | Quint is a multiplatform, Indian business and financial news company. We combine Bloomberg’s global leadership in business and financial news and data, with Quintillion Media’s deep expertise in the Indian market and digital news delivery, to provide high quality business news, insights and trends for India’s sophisticated audiences.

Oil prices surge higher and higher on Middle East tensions ...https://www.bbc.com/news/av/business-12565742US crude has touched $100 for the first time since the collapse of Lehman brothers and is now up 15%. Stock markets are being rattled by the fear soaring fuel prices could derail the economic ...

Market Move Opens Extra $4.6 Million for Infrastructure ...https://stthomassource.com/content/2008/02/09/...Feb 09, 2008 · The Public Finance Authority now has an extra $4.6 million worth of financing available for three long-standing capital-improvement projects, thanks to board members' decision to terminate a "risky" swap-option agreement with UBS, an international investment banking and securities business.

Andrew Morton - Global Co-Head of Markets & Securities ...https://uk.linkedin.com/in/andrew-morton-0975471b5About Andy Morton is Global Co-Head of Markets & Securities Services at Citi. He has been with Citi since 2008, and was previously head of the G10 Rates, Markets Treasury and Finance businesses and was responsible for the Markets Quantitative Analysis (MQA) function.Title: Global Co-Head of Markets & …Location: London, England, United KingdomConnections: 67

Cablevision Uses Retail to Push Services - Multichannelhttps://www.multichannel.com/news/cablevision-uses-retail-push-services-161784When Cablevision Systems Corp. took over then-floundering retail chain Nobody Beats the Wiz early last year, financial analysts were skeptical. And if looking

Yusuf Özdalga - Innovate Finance – The Voice of Global FinTechhttps://www.innovatefinance.com/fintech-speakers/yusuf-ozdalgaYusuf is a London based Partner at QED Investors with a focus on European financial technology and consumer finance companies. Yusuf joined QED in 2017, and his career has spanned roles as an operator, advisor, entrepreneur and investor. His current portfolio of investments include Wagestream, Zopa, and GAIN Credit. Yusuf started his career at Capital One in 1997 where […]

Investment Banking 2.0: Think Small | Seeking Alphahttps://seekingalpha.com/article/95633-investment-banking-2_0-think-smallSep 16, 2008 · Investment Banking 2.0 will be the re-emergence of the boutique, the focused, nimble, high-touch firm that was the bedrock of capital formation in the early years of the stock market boom.

People Archive - The LCP Group, L.P.https://lcpgroup.com/peopleE. Robert Roskind. Written by: Lcp@admin on March 14, 2019 Robert Roskind is Chairman of The LCP Group, L.P. (LCP) which he founded in 1974. Originally set up as Lepercq Capital Partners, Mr. Roskind has been at the helm of LCP’s growth over the decades as it evolved from acquiring and syndicating single tenant properties to a full-service private real estate investment management firm.

Carmine Urciuoli | AmeriVet Securitieshttps://amerivetsecurities.com/team-members/carmine-r-urciuoliCarmine Urciuoli is Managing Dir., Head of Fixed Income, Trading & Sales. With more than 35 years of experience in financial services and investment banking, Carmine has held senior positions as Managing Director of the Fixed Income Departments of BT Alex Brown, ABN Amro, Commerzbank Capital and BNY Capital Market, Cantor Fitzgerald and BBVA.

Goldman’s Trading Formulae Leaked by Quant Spyhttps://www.fastcompany.com/1304517/goldmans...Star bank holding firm Goldman Sachs has been getting its fair share of antipathy this month. First it was Rolling Stone‘s polemic against the bank; then it was BusinessWeek‘s sobering review ...

Sheflin Macro HW 15 Flashcards | Quizlethttps://quizlet.com/254307513/sheflin-macro-hw-15-flash-cardsT or F: A cause of the financial crisis of 2007-2008 was the general belief that housing prices would rise indefinitely. True T or F: Asymmetric information problems are more severe during a financial panic.

Anthony Setaro - Rutgers University - Newark - Atlantic ...https://www.linkedin.com/in/anthony-setaro-4b168212Rutgers University - Newark. View profile View profile badges Get a job like Anthony’s. Estate jobs in Eatontown, NJ. 28,942 open jobs. Jersey jobs in Atlantic Highlands, NJTitle: Accounting & Finance …Location: Atlantic Highlands, New JerseyConnections: 343

THE ROAD TO HELL IS PAVED WITH ... - Pragmatic Capitalismhttps://www.pragcap.com/the-road-to-hell-is-paved-with-positive-carryIn March 2008, spreads spiked (by almost 54 basis points to 852) while equity volatility remained the same (VIX stayed in the mid-20’s). As we all know shortly after, Lehman brothers collapsed and equities started its tumble on its way to a Bear market lasting until March 2009.

Morgan Stanley Brokers Accused Of Broker Misconduct | SSEK ...https://www.investorlawyers.com/blog/morgan-stanley-broker-misconduct-casesOct 07, 2019 · Misconduct Accusations Against Ex-Morgan Stanley Brokers Broker Misconduct Case #1: John Tillotson. The Financial Industry Regulatory Authority (FINRA) has suspended ex-Morgan Stanley broker, John Tillotson, for 15 days and ordered him to pay a $5K fine after finding that he impersonated five clients during phone calls to a mutual fund company.

Vinay Torani and Joseph Mevorah Strengthen Navigant’s ...https://www.businesswire.com/news/home...Sep 30, 2015 · Prior to joining Navigant, Torani was a Managing Director at Duff & Phelps, where he was the leader of its Morristown, New Jersey office and part of the Valuation Advisory Services practice.

Don Haber, Managing Director at Ladder Capital Finance ...https://relationshipscience.com/person/don-haber-197572082Don Haber is a Managing Director within the origination team at Ladder Capital. Mr. Haber has 30 years of experience in commercial real estate lending, equity investment, asset management and workouts.

Barclays Stocks List for 2021 | UK (LSE & AIM ...https://lse.swingtradebot.com/stocks-tagged-as/1366-barclaysBarclays plc is a British multinational investment bank and financial services company headquartered in London. Apart from investment banking, Barclays is organised into four core businesses: personal banking, corporate banking, wealth management, and investment management.Barclays traces its origins to a goldsmith banking business established in the City of London in 1690.

Yellen defends banking overhaul passed after 2008 crisishttps://www.mercurynews.com/2017/08/25/yellen...Aug 25, 2017 · In her speech Friday, Yellen noted that the U.S. and global financial systems were “in a dangerous place 10 years ago,” with severe strains that led to the collapse of investment bank Lehman ...

Guggenheim Securities Appoints Nirjhar Jain as Managing ...https://newyork.citybizlist.com/article/361510/...NEW YORK, June 24, 2016 (GLOBE NEWSWIRE) -- Guggenheim Securities, the investment banking and capital markets division of Guggenheim Partners, announced today that Nirjhar Jain will join the structured products group as a Managing Director in June. Mr. Jain will serve as Head of CLO Trading for the group, reporting to Structured Products Co-Heads Scott Levy and Eric Voelker.

Tech M&A advisory firm i5invest lands in Berlin, recruits ...https://tech.eu/brief/tech-ma-advisory-firm-i5invest-lands-in-berlin-recruits-noahs...Tech dealmaker i5invest has launched its German expansion strategy with the opening of a new office in Berlin and the hiring of Justus Lumpe, previously managing director of the NOAH Conference.. With the fresh recruitment and the new office, the corporate development advisory and seed investment firm aims for M&A market leadership in the fields of IoT, deep tech, automotive, cybersecurity ...

Causes of the Financial Crisis – Thoughts | Politics ...https://stavrevak.wordpress.com/2016/02/05/causes-of-the-financial-crisisFeb 05, 2016 · The fundamental driving factor behind the 2008 financial crisis was the underestimation of risk. At that time people, even investors and economists, had began to think of risk as a problem of the past and not something they should be greatly concerned about. This lead to a series of questionable financial decisions.

Monique Mulcare | New York, NY | National Black Lawyershttps://nbltop100.org/members/new-york-ny-monique-mulcare-141676732Overview. Monique Mulcare's practice focuses on restructuring, insolvency and bankruptcy matters. She represents creditors and strategic investors in bankruptcy and insolvency matters in both US and international restructurings.

John Lewis sticks to plan and wins | The Sunday Timeshttps://www.thetimes.co.uk/article/john-lewis-sticks-to-plan-and-wins-rq20rjlx0njIt was the day after HBOS had been saved from the brink of collapse by Lloyds in September 2008, and Lehman brothers had gone under three days before. The managing director of John Lewis wanted to ...

History’s top 10 bankruptcies - SmartCompanyhttps://www.smartcompany.com.au/finance/historys-top-10-bankruptciesWith Wall Street in a state of dismay, it’s probably a good time to revisit the biggest bankruptcies in history – courtesy of Time.com.

Japan’s manufacturers’ confidence uphttps://www.thenews.com.pk/print/199791TOKYO: Confidence among Japanese manufacturers has risen for an eighth straight month to a level not seen since before the 2008 global financial crisis, a Reuters survey found, reflecting output ...

Sangeeta Venkatesan - CX Bankinghttps://www.cxbanks.com/sangeeta-venkatesanAustralia's largest financial safety ONLINE event tackling Domestic and Family Violence and Workplace Employee Abuse

Evaluating the IMF’s Performance in the Global Financial ...https://www.peio.me/wp-content/uploads/PEIO9/102_80_1443647577194_Gutner30Sept2015.pdfLehman was the oldest and one of the largest investment banks in the United States, with $600 billion in assets and 25,000 employees. It had been hit hard by the subprime mortgage crisis and its stock had sharply declined in value throughout the year. Its bankruptcy was the largest in history. The decision by the U.S. Federal Reserve and

World stocks, sterling fight back after Mario Draghi ...https://liveindex.org/24132/2016/06/world-stocks-sterling-fight-back-after-brexit-beatingWorld stocks rose for the first time in three days and sterling and the euro climbed on Tuesday, as investors made a rush for Brexit-bashed assets hammered by some of the biggest falls since the 2008[PDF]2017 Week 2 FRM Part I - (Topics 8-15)https://static.kaplanlearn.com/assets/80/34/2017Week2FRMPartI-Topics8-15.pdf2 ©2017 Kaplan, Inc. Financial Crisis Overview The main trigger of the financial crisis was the prospect of losses on subprime mortgages In the first half of 2007, housing prices in the U.S. started to decline, causing several subprime mortgage lenders to file for bankruptcy

Don't Be Fooled by Big Bank Profits - Wyatt Investment ...https://www.wyattresearch.com/article/dont-be-fooled-by-big-bank-profitsWith M&A activity on the rise as the year comes to a close, investment banks such as Goldman can expect healthy fees for their advisory services. Additionally, with more and more companies lining up to go public, Goldman stands to benefit as the underwriters of many of those IPOs. One of the biggest assets owned by Goldman is its people.

Trade and Development: Trade Finance During ... - Walmart.comhttps://www.walmart.com/ip/Trade-Finance-During-the-Great-Trade-Collapse/16382563'Trade is the lifeblood of the world economy, and the sharp collapse in trade volumes was one of the most dramatic consequences of the global financial crisis. It was the moment the financial crisis hit the real economy, and when parts of the world far from the epicenter of financial turbulence felt its full fury.

The view from Magic Mountain | Financial Posthttps://business.financialpost.com/diane-francis/the-view-from-magic-mountainJan 27, 2012 · The view from Magic Mountain Diane Francis: The world’s business and political elite who are gathered at the setting of Thomas Mann's masterpiece are in search of their own 'cure' for the ills ...

Strong Data Management – An Absolute Necessity | Moody's ...https://www.moodysanalytics.com/.../rethinking-data-management/strong-data-managementInferior data, too long left unchecked, has far-reaching consequences – not the least of which was the 2008 global financial crisis. Banks that establish a strong data management framework will gain a distinct advantage over their competitors and more efficiently achieve regulatory compliance.

Debunking the 'Too Big to Fail' Myth Once and for All ...https://seekingalpha.com/article/166432-debunking-the-too-big-to-fail-myth-once-and...Oct 14, 2009 · Debunking the 'Too Big to Fail' Myth Once and for All. ... One of the world's leading economic historians ... he was the senior regulator during the S&L crisis, ...

Yes, Bruce the Bull will Return | AAMGwww.aamg.com/yes-bruce-the-bull-will-returnInvestment performance in the 4 th quarter was one of the worst on record. Looking back over this past year, we can see that two separate negative events were recognized by the investing public. First, was the depth of the financial crisis and, second was the fear of a recession. Armageddon fears prevail today.

The Debt Crisis Moves to Center Stagewww.larouchepub.com/other/2008/3502debt_crisis.htmlJan 11, 2008 · John Dizard of the Financial Times noted on Dec. 17, that one of the key features of the Term Auction Facility set up by the Fed was the creation of inter-bank swap lines which allow the European Central Bank and other central banks to draw dollars from the Fed. Dizard suggested that as the ECB is not as restricted as the Fed in the types of ...

Europe Banks Lean More on Emergency Funding - WSJhttps://www.wsj.com/articles/SB10001424053111904875404576528663793268664They are the only ones that can end this crisis," he said. ... That was the first time in 23 weeks a bank had used the facility, and it fanned investor fears about a looming liquidity crisis ...

Your Route to Financial Freedom - Data Driven Investor ...https://medium.com/datadriveninvestor/your-route-to-financial-freedom-bf2423196283Oct 26, 2018 · In my last post I hope I have shown that it does not matter what investments you have made. If they remain part of the financial system you are still exposed to …[PDF]Eurozone Crisis as Democratic Deficit: Expert Opinions on ...i-rep.emu.edu.tr:8080/jspui/bitstream/11129/3197/1/AvciogluSeniz.pdfEurozone Crisis as Democratic Deficit: Expert Opinions on Austerity measures in Ireland and Cyprus Seniz Avcioglu Submitted to the Institute of Graduate Studies and Research

BRICS: An Effective Multilateral Forum in a Multi-polar ...https://idsa.in/backgrounder/BRICS_NachiketKhadkiwala_110714The main reason for co-operation to start among the BRICs nation was the financial crises of 2008.5 The ... the group. However, China remains seriously committed to BRICS forum. In a report presented in 18th Party Congress, BRICS was highlighted as “one of the four pillars ... BRICS is the first global network of which China has ...

The stability conundrumhttps://www.3bytwo.co.za/stability-conundrumMay 16, 2014 · The conundrum governments face is that, in creating a stable economy, they ultimately generate a serious financial crisis. The most recent example of this was the implosion of the US housing bubble promoted by the Federal Reserve’s success in creating a stable financial environment over a …

J. Steven Parker | Broker-Dealer Regulation Lawyers Parker ...https://www.riacompliancelawyer.com/j-steven-parker.htmlCall (855) 322-2057 - Parker MacIntyre is dedicated to serving our clients with a range of legal services in Broker-Dealer Regulation and Investment Compliance cases. J. Steven Parker - Broker-Dealer Regulation Lawyer

Bruce Berkowitz — Fairholme Capital Managementwww.fairholmecapital.com/bruce-berkowitz-1Mr. Bruce R. Berkowitz is the Founder and Chief Investment Officer of Fairholme Capital Management, and President and a Director of Fairholme Funds, Inc.. In 2010, Mr. Berkowitz was named as the 2009 Domestic-Stock Fund Manager of the Year by Morningstar as well as the Domestic-Stock Fund Manager of the Decade (2000-2009), also by Morningstar.

Investment Team | Levin Easterly Partnershttps://levineasterly.com/teamJack Murphy is the Chief Investment Officer, Lead Portfolio Manager, and a Senior Securities Analyst for Levin Easterly. Mr. Murphy has over 31 years of industry experience, 24 with Levin and its predecessor firms. Prior to joining Levin Easterly Partners, Mr. Murphy was a …

U.S. stocks lose more ground - Oct. 5, 1998https://money.cnn.com/1998/10/05/markets/marketopenOct 05, 1998 · Monday brought the start of a new week and a new sell-off on Wall Street after a weekend meeting of the finance leaders of the world's richest nations failed to draw a path for salvation from the ...

Supurna Vedbrat - Markets Mediahttps://www.marketsmedia.com/supurna-vedbratSupurna was ranked #8 on the Institutional Investor’s 2018 Trading Tech 40 list. She was also a recipient of the Markets Media Women in Finance Award for Excellence in Leadership. She has a Computer Science degree from Rutgers University, USA, and a Mathematics (Hons) …

Dayan Abeyaratne - PJThttps://pjtpartners.com/people/dayan-abeyaratneDayan Abeyaratne is a Partner in the Strategic Advisory Group at PJT Partners, based in New York. Prior to joining PJT Partners, Mr. Abeyaratne worked at Blackstone and has over 20 years of experience in investment banking and related fields. Prior to joining Blackstone, Mr. Abeyaratne was at UBS where he served as the Head of Generation ...

Atlantic Union Bank Names David Zimmerman Middleburg ...https://www.benzinga.com/pressreleases/19/11/g..."David brings more than 30 years of financial services experience to Middleburg Financial and will help us become known as the premier wealth management service provider across our footprint ...

Leontief Paradox financial definition of Leontief Paradoxhttps://financial-dictionary.thefreedictionary.com/Leontief+ParadoxThe competitive theory of international trade is well known for its abundance of "paradoxes." Perhaps the most widely known is the Leontief Paradox, associated with the rather startling results presented by Leontief (1953) that the trade pattern of the United States suggested that its export sectors were more labor-intensive than factor proportions found in its import-competing sectors.

Jim Molloy – Industrial & Operations Engineeringhttps://ioe.engin.umich.edu/people/jim-molloyBefore entering the investment banking arena, prior healthcare experience included senior positions in the consulting division of a “Big 6” accounting Firm and a rating agency. He has worked with some of the largest health systems in the country, executing billions of dollars of both capital markets and M&A transactions on their behalf.

Kim Ip — Evoke Wealthhttps://www.evokewealth.com/kim-ipKim Ip, CIMA Partner . Kim has served as a Financial Adviser to wealthy families and institutional clients since 2005, when she began her wealth management career at Merrill Lynch, leading research and operations for the team in the Private Banking and Investment Group.

Rosin & Associates, Inc.https://www.rosinassociates.comRosin & Associates is a premier boutique commercial real estate advisory and consulting firm that was established in the early 1990's that provides commercial appraisals, loan underwriting as well as many other financial services to a diverse client base.

Bios | Matrix Asset Advisorswww.matrixassetadvisors.com/our-team/biosMr. Katz is a CFA charterholder. After initially working at Management Asset Corporation (Westport, CT), Mr. Katz co-founded Value Matrix Management with the late John M. Gates in 1986. He served as the firm’s Senior Vice President and Chief Investment Officer and …

Steven Cohn | Alvarez & Marsalhttps://www.alvarezandmarsal.com/our-people/steven-cohnSteven Cohn is a Managing Director with Alvarez & Marsal in New York and serves as the firm’s Chief Financial Officer.

Taurus Asset Management LLC - Teamwww.taurusassetmanagement.com/team/index.htmlTaurus Asset Management is an SEC Registered Investment Advisory firm, executing securities transactions through Western International Securities, Inc. Western International Securities, Inc. is a member of FINRA and SIPC and maintains fully disclosed clearing arrangements as an Introducing Broker with National Financial Services, LLC.

CKGSB Faculty - OU-YANG Huihttps://english.ckgsb.edu.cn/faculty/ou-yang-huiProf Ou-Yang was voted the best teacher by Duke’s Global EMBA Class of 2004. He won the Barclays Global Investors/Michael Brennan Runner-Up Award for the best paper published in the Review of Financial Studies in 2003 as well as the best paper award (joint with Henry Cao) presented by the Society of Quantitative Analysts in 2005.

Gold Coast Search Partnershttps://www.goldcoastsp.comErin joined Gold Coast Search Partners shortly after inception and is based in our San Francisco office. Prior to GCSP, Erin led recruiting at Technology Crossover Ventures as the Director of Human Capital. At TCV, she focused primarily on hiring investment professionals at the Analyst to Principal level.