Home

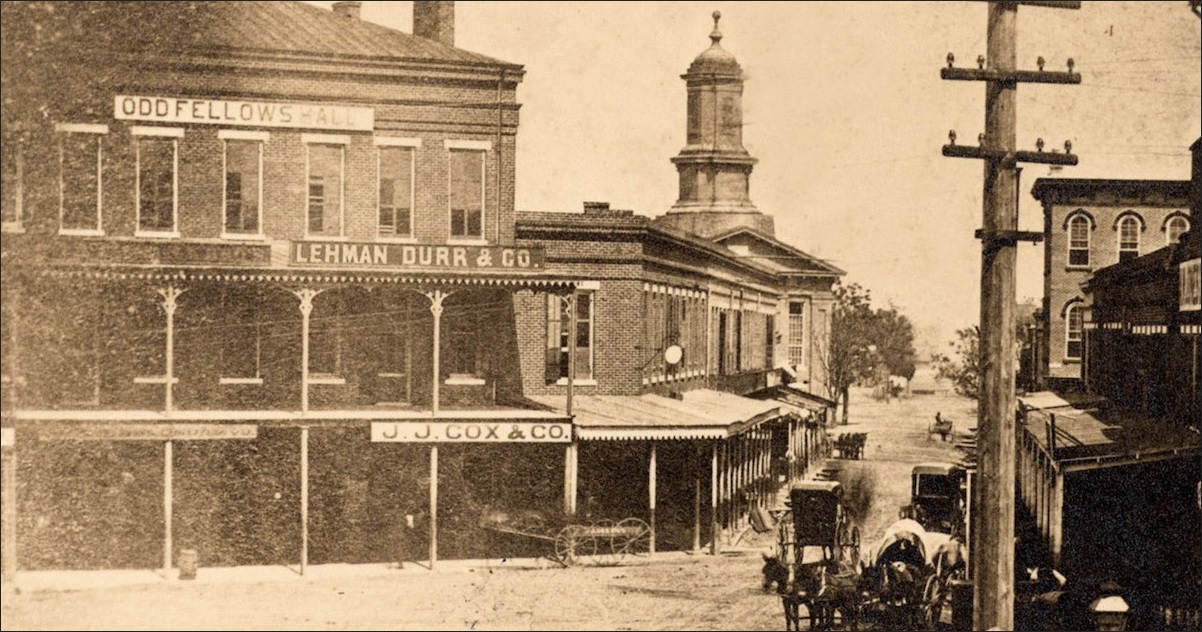

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Popular Housing Blog Articles - Dr. Housing Bubble Blogwww.doctorhousingbubble.com/three-dramatic-housing-trends-closing-out-2012-shadow...The content on Dr. Housing Bubble Blog is provided as general information only and should not be taken as investment advice. All site content, including advertisements, shall not be construed as a recommendation to buy or sell any security or financial instrument, or to participate in any particular trading or investment strategy.

Big Data About Bank Financebigdatainnovationchallenge.orgSep 15, 2019 · The credit management operate needs consideration from step one of issuing clients with a sales invoice, producing customer statements of the debt owed and a set procedure of credit score control letters and phone observe ups that really obtain the end results of getting the cash in.

Lloyd Blankfein: Goldman Sachs CEO still believes in the ...https://www.welt.de/wirtschaft/article116328333/Goldman-Sachs-CEO-still-believes-in...In his first interview in Germany since 2009, Lloyd Blankfein comments on the conclusions from the financial crisis. A seperation of banking activities is „the wrong way to go“ from his point ...

Q and A: fund manager Richard Hallett —The Investment Readerhttps://investment-reader.com/q-and-a-richard-hallettThis week, for my latest Q and A, I returned to talk to a fund manager whose multi-cap equity fund has the distinction, according to research by FE Trustnet, of having outperformed its benchmark in every rolling five year period since 2000 – one of only two funds out of several hundred in the UK All Companies sector to have done so.

Amidst Silence, Questions Surround Devils in Wake of ...https://thehockeywriters.com/questions-surround-devils-amidst-silence-in-wake-of...Are the New Jersey Devils as financially sound as everyone seems to think? ... Questions Surround Devils in Wake of Kovalchuk Saga. ... and a first round pick for a short-term rental.

Stockbroker Pays Undisclosed Customer Settlement But It ...www.brokeandbroker.com/4196/finra-settling-awayStockbroker Pays Undisclosed Customer Settlement But It All Explodes Anyway (BrokeAndBroker.com Blog) Former Chief Financial Officer of Bankrate Inc. Sentenced To 10 Years in Prison for Orchestrating a Complex Accounting and Securities Fraud Scheme (DOJ Release) SG Americas Securities Charged for Improper Handling of ADRs (SEC Release 2018-211)

All Billionaires I Know Have These Two Things in Common ...https://www.newsmax.com/finance/jareddillian/billionaires-two-things-common/2019/04/24/...Apr 24, 2019 · It’s funny—I actually kind of have a reputation as being one of the few ... but it is very, very hard to teach relentlessness. And relentlessness determines the top line, which is a lot more important than the bottom line. One last thing. James Holzhauer, who is currently mopping the floor with the competition in Jeopardy! and setting ...Author: Jared Dillian

All Billionaires I Know Have These Two Things In Common ...https://valuewalkpremium.com/2019/04/all-billionaires-i-know-have-these-two-things-in...Mauldin Economics. Simply stated, we believe in taking a realistic approach to the economy and investment markets that starts by stepping back from all the noise and fear in the daily news and, with the aid of our deep network, focusing on the search for the world's best income opportunities and for great companies doing great things—both in North America and around the world.

The key to being rich: You have to be relentless ...https://financialnewsspot.com/archives/21027Apr 29, 2019 · Let’s talk about billionaires. In my lifetime, I have known a few billionaires. I can count them on one hand. They all have two things in common: 1. They are really good at doing a thing. 2. They are relentless in the pursuit of that thing. There’s no trick. Social skills help, connections help, luck …

HR Management Assignment help on : strategic Human ...https://myassignmenthelp.info/assignments/hr-management-assignment-strategic-human...This is only possible if internal strategies of business can be matched with external strategies and gaps can be minimized. 2.0 Case Study of Proctor & Gamble Proctor & Gamble is one of the largest American multinationals of world. It was founded on 1837 by James gamble and William Proctor.[PDF]Part 1 of an interview with Professor Mauro Guillenwww-management.wharton.upenn.edu/guillen/2009_docs/Part-1_Top_MBA_Interview .pdfsolutions, but a crucial area for change. Regulation will be imposed on many aspects of financial services in the future and we have many experts on our faculty, such as Olivia Mitchell, who is an expert on pension fund reform and regulation, and Bulent Gultekin, who was Governor of the Bank of Turkey and advises central banks.

FINRA Calls PST Then OBA Then PST. Omaha! Omaha!! Omaha ...www.brokeandbroker.com/3573/finra-awc-pstFINRA Calls PST Then OBA Then PST. Omaha! Omaha!! Omaha!!! August 28, 2017 In a recent Financial Industry Regulatory Authority ("FINRA") regulatory settlement, a stockbroker was barred from the industry as a result of allegedly failing to properly notify his employer and obtain its approval for soliciting firm customers to invest in his own company.

Moe Zulfiqar, BAS, Author at Profit Confidentialhttps://www.profitconfidential.com/author/moe-zulfiqarMoe Zulfiqar joined Lombardi Financial as a research analyst and editor, and writes for Lombardi’s Profit Confidential and Daily Gains Letter newsletters.He provides insight into current market ...

Commodity Swap - Definition - The Business Professorhttps://thebusinessprofessor.com/knowledge-base/commodity-swap-definitionCommodity Swap Definition Commodity swap refers to a financial transaction between two parties who agree to exchange commodity price’s cash flow so that they can manage commodity price-related risks. Commodities involved in swaps include livestock, precious metals, or oil. In most cases, airline companies engage in commodity swap agreements to...

Don’t Dismiss Donald Trump’s Trade Gripes As Mere Nonsensehttps://finance.yahoo.com/news/don-t-dismiss-donald-trump-045356313.htmlMar 28, 2016 · Don’t Dismiss Donald Trump’s Trade Gripes As Mere Nonsense. ... but it holds far greater promise of delivering effective results. ... known as the Doha Round, ground to a …

Tesla just did the one thing a company under attack should ...https://finance.yahoo.com/news/tesla-just-did-one-thing-155828239.htmlJun 10, 2016 · Tesla just did the one thing a company under attack should never do ... Just as blaming your partner for a failed relationship and not owning your …Author: Markets Reporter

Secret Hiding Places: Opportunities After Bankruptcies ...https://www.gurufocus.com/news/845035/secret-hiding-places-opportunities-after...Apr 09, 2019 · The word “bankruptcy” has the ring of fatal failure, and often that is the case for shareholders in companies that slip that far. But Joel Greenblatt (Trades, Portfolio) also reminded us in chapter five of “You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits” that there can also be opportunities after bankruptcy proceedings are over.

Secret Hiding Places: Opportunities After Bankruptcies ...https://www.gurufocus.com/news/845035The word “bankruptcy” has the ring of fatal failure, and often that is the case for shareholders in companies that slip that far. But Joel Greenblatt (Trades, Portfolio) also reminded us in chapter five of “You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits” that there can also be opportunities after bankruptcy proceedings are over.[PDF]Friday pril 15, 2011 THE LAWRENTIANlux.lawrence.edu/cgi/viewcontent.cgi?article=3543&context=lawrentianin his campaign. Ament comment-ed on his colleague’s victory, say-ing, “To put it mildly, I was ecstatic and overjoyed when Teege called me on election night.” On April 5, Mettille defeated incumbent Earl Brooker, who had served on Appleton’s City Council for 12 years. “I had to overcome a large name recognition disad-[PDF]The Challenges of Responsible Investment Mainstreaming ...https://www.researchgate.net/profile/Christel_Dumas/publication/292435672_The...1 The Challenges of Responsible Investment Mainstreaming: Beliefs, tensions and paradoxes Christel Dumas Supervisor: Prof. Dr. Lutgart Van den Berghe

If CEOs should have been the fall guys for the 2008 ...https://www.rawstory.com/2018/10/ceos-fall-guys-2008-financial-collapse-still-heroesOct 20, 2018 · "A handful of people carrying flags have targeted Hillsborough for a few years in large part because of steps taken to limit Confederate flags and symbols in the county and towns, and a ban ...

The Analysts Report: Boo-Yahoo! - TheStreethttps://www.thestreet.com/personal-finance/the-analysts-report-boo-yahoo-1338077Mar 09, 2001 · So Yahoo! ()dropped the bomb late Wednesday, after being halted for all but seven minutes of the session. It won't come close to making earnings estimates and it's on the hunt for a …

Technology Investor || Harry Newton's In Search of the ...https://www.technologyinvestor.com/login/2004/July16-08.phpIn Search for the Perfect Investment. Previous Columns 9:00 AM EST Wednesday, July 16, 2008 Update2: I got a couple of free tickets to the U.S Tennis Open, a free safe deposit box and a free checking account, but not a toaster, from opening a $95,000 account with Chase yesterday.Them's not bad rewards given that the only thing I cared about was getting a $100,000 of erstwhile uninsured …

Even Billionaires Get Their Predictions Wrong: Barry Ritholtzhttps://www.newsmax.com/Finance/InvestingAnalysis/Billionaires-Predictions-economy...Dec 22, 2015 · Real estate mogul and billionaire Sam Zell said, “There is a high probability that we are looking at a recession in the next 12 months.” The culprit, he told “Bloomberg ," was the strong dollar and slowing global trade, the beginnings of layoffs at multinational companies and a general lack of demand.

Is Europe’s debt crisis a “Lehman Moment” for America ...https://zeenews.india.com/business/interviews/is-europes-debt-crisis-a-lehman-moment...None of welcome news to an American economy that urgently needs to create jobs. But it need not result in a repeat of the total Lehman paralysis provided three conditions are met: a banking system that remains robust, no disruptions to money market funds and limited blockage to the plumbing of the country’s payments and settlement system.

"Lehman Moment" for America? | TF Metals Reporthttps://www.tfmetalsreport.com/forum/1342/lehman-moment-americaIs Europe’s debt crisis a “Lehman Moment” for America? Jul 5, 2011 10:37 EDT

Politics And Portfolios: A Risky Mixhttps://www.forbes.com/2010/06/21/gm-politics-taxes-financial-advisor-network-big...Jun 21, 2010 · An investment advisor in the nation's capital expects to encounter a lot of politics in his daily rounds. ... This is an alarming trend and a unique challenge for financial professionals for whom ...

Bonds And Stocks Will Crash Together In The Next Crisis ...www.marketoracle.co.uk/Article60779.htmlWhen I gave that talk, yields on 10-year notes were about 1.6%. Today, they are about 2.4%. That may not seem like a lot, but it is. The evidence is starting to pile up that yields may be going ...

Financial Crisis FINAL Flashcards | Quizlethttps://quizlet.com/164820493/financial-crisis-final-flash-cardsCost-benefit analysis of asset management. Benefits of liquidity are no need to borrow and pay borrowing costs but liquidity costs are the opportunity to earn profits through loans. Banks lend to each other for a fee. High opportunity cost of being too liquid.

If a company is still in Bankruptcy can the shareholders ...https://www.answers.com/Q/If_a_company_is_still_in...yes, as the company is a legal entity, and it can be sued by the director if the shareholders of a company use the company as the alter ego of the shareholders. Asked in Business & Finance ...

How To Kill A Business....Quickly | Nairametricshttps://nairametrics.com/2019/06/28/how-to-kill-a-business-quicklyJun 28, 2019 · Back in school one of my favorite topics was the M&M theory.The theorem states that, “under a certain market price process (the classical random walk), in the absence of taxes, bankruptcy costs, agency costs, and asymmetric information, and in an efficient market, the value of a firm is unaffected by how that firm is financed”.[PDF]Who is the noteholder?https://www.shlegal.com/docs/default-source/news-insights-documents/who-really-is-the...Who is the noteholder? Confusion between the law and practice October 2019 The documents constituting a note issue will usually provide that a requisite percentage by value of noteholders can vote on resolutions or direct the trustee to take action under …

Mis-selling – goes deeper than you think - Cafemutual.comhttps://cafemutual.com/news/guestcolumn/351-mis-selling-goes-deeper-than-you-thinkTake Lehman brothers, it has been 10 years since Lehman closed almost overnight and precipitated what has now been termed as the Lehman crisis. The CEO of Lehman was nicknamed the Gorilla for his aggression and was the darling of Wall Street.

diversification - The Asset Allocation Paradox - Personal ...https://money.stackexchange.com/questions/10271/the-asset-allocation-paradoxI've had this problem stuck in my head for a while and I'd like some help with it. In David Swensen's Unconventional Success, the argument is made that asset allocation is the best way to get a good return in the long run for the individual, and that no-load mutual funds are the way to go.. If you study Yale's investment portfolio, however, there is a paradox.

Exclusive Interview With Trisch Garthoeffner, Business ...https://www.morganandwestfield.com/interviews/exclusive-interview-trisch-garthoeffner...Morgan & Westfield Deal Talk Importance Of Valuing Your Business Early On In this interview, we discuss the topic of business valuation and appraisal with Trisch Garthoeffner, Founder and President of Anchor Business Valuations & Financial Services, LLC. Ms. Garthoeffner has over fifteen years of valuation and financial advisory experience and is here to share her extensive

How the Bankers of Wall Street Are Helping to Bankrupt ...https://jonathanturley.org/2012/01/08/how-the-bankers-of-wall-street-are-helping-to...Jan 08, 2012 · “Did I say it was the bank’s fault that Jefferson County was run by idiots?” No you did not, i just thought it was worth mentioning since they were the ones agreeing to put taxpayer money on the line to finance a sewer at an outrageous cost. “The title of this post is “How the Bankers of Wall Street Are Helping to Bankrupt America.”

Don't blame Bob Shiller for the death of the housing ...https://money.cnn.com/2009/07/06/real_estate/robert_shiller_housing_market.fortuneJul 06, 2009 · Early in his career he helped develop the field of behavioral finance. ... (a term first uttered by Alan Greenspan and later the title of one of Shiller's six books) that can drive prices to wild ...

Note to Dodd, Frank and Dimon: Make It Much, Much Simplerhttps://www.housingwire.com/articles/note-dodd-frank-and-dimon-make-it-much-much-simplerJun 25, 2010 · But it’s worth recapping, if only because lots of reporters tend to leave the best thinking behind, eviscerated and shredded, when they grab that money shot. ... This was the maximum number of ...[PDF]What Wall Street Still Has Not Told You Updatedhttps://www.islainvest.com/pdf/WWS.pdfWHAT WALL STREET STILL HAS NOT TOLD YOU OCTOBER 2008 BY CALE SMITH ... This is a self-induced crisis, but it is not easy to point blame at a single group. Many people, both on and off Wall Street, played a role. ... For the first time, Wall Street and its institutions began to show concern.

A September to remember: lawyers in the eye of the storm ...https://www.law.com/international-edition/2018/09/17/a-september-to-remember-lawyers...Analysis A September to remember: lawyers in the eye of the storm look back on the fall of Lehman Ten years on from the collapse of Lehman, partners from firms including Linklaters, Freshfields ...

A G.M. Bankruptcy Would Tax the Experts - The New York Timeshttps://www.nytimes.com/2009/05/26/business/26auto.htmlMay 26, 2009 · Mr. Miller and his team are the company’s principal legal counsel for its bankruptcy filing; but it will not represent the new version of G.M. once that is created, as there is a potential ...

Bankruptcy for G.M. Would Tax the Experts - News ...https://www.tuscaloosanews.com/article/DA/20090526/News/606099276/TLMay 26, 2009 · Mr. Miller and his team are the company’s principal legal counsel for its bankruptcy filing; but it will not represent the new version of G.M. once that is created, as there is a potential ...

European debt crisis: Austria approves euro rescue deal ...https://www.theguardian.com/business/blog/2011/sep/30/european-debt-crisis-austria...European debt crisis: Austria approves euro rescue deal - as it happened ... Meanwhile Reuters is reporting that one of the options being considered by the Greeks is a 100-year bond in return for ...

New Look for an Enclave of Art - The New York Timeshttps://www.nytimes.com/1989/04/11/arts/new-look-for-an-enclave-of-art.htmlApr 11, 1989 · A new look is coming to the Lehman Collection, the museum-within-a-museum established at the Metropolitan by the will of the financier and collector Robert Lehman, who died in 1969.

YAHOO FINANCE PRESENTS: How billionaire Stephen Schwarzman ...https://theamericaninvestordaily.com/2019/09/17/yahoo-finance-presents-how-billionaire...Sep 17, 2019 · Billionaire Stephen A. Schwarzman shares how he built his private equity empire The Blackstone Group and became one of the most sought-after CEOs for advice from world leaders in his new memoir, “What It Takes: Lessons in the Pursuit of Excellence” released on Tuesday.In 34 years, Blackstone has evolved from an upstart advisory shop to a global behemoth with $545 billion in …

Stock Manipulator Stiffs FINRA on $1 Million Fine. Not Our ...https://financiallyregulated.com/2011/10/17/stock-manipulator-stiffs-finra-on-1...Oct 17, 2011 · Stock Manipulator Stiffs FINRA on $1 Million Fine. Not Our Problem, Says Federal Appeals Court. ... They appear to be examples of what Michael Lewis described in his book ... He didn’t bother borrowing the securities in the first place. He just sold them. This is called “naked short selling,” which is defined as selling a security short ...

TheMoneyIllusion » More evidence the recession was not ...https://www.themoneyillusion.com/more-evidence-the-recession-was-not-caused-by-the...Last night I criticized a new Robert Hall article in the JEP, which argued that the financial crises of 1929 and late 2008 caused the Great Depression and the Great Recession. I pointed out that there was no financial crisis in 1929, and that it was the Depression that caused the later banking panics. I pointed out that the 2008 recession was well advanced before the banking crisis of late ...

Greenspan: Love Him, Hate Him | The Baseline Scenariohttps://baselinescenario.com/2010/04/07/greenspan-love-him-hate-himApr 07, 2010 · By James Kwak Alan Greenspan is just as maddening in his retirement as he was during his nineteen-year reign over the global economy. Today in his appearance before the Financial Crisis Inquiry Commission (extensive coverage by Shahien Nasiripour and Ryan McCarthy here), Greenspan seems primarily concerned with passing the buck and preserving the remaining shreds…

A New Probability Alternative for the Upcoming Financial ...www.stankovuniversallaw.com/2015/06/a-new-probability-alternative-for-the-upcoming...Jun 13, 2015 · A New Probability Alternative for the Upcoming Financial Crash. by Georgi Stankov Posted on June 13, 2015. Georgi Stankov, June 12, 2015 ... As the renowned political expert Gilbert Doctorow revealed in his latest interview with RT, ... the scramble for liquidity continued as DB announced the selling of 8 billion euros worth of stock – at up ...

Realms Of Influence: Financial Planning's Influencer ...https://www.financial-planning.com/news/realms-of-influence-financial-plannings..."With a larger voice of approximately 75,000 planning professionals," Tuttle says, "we were more openly received, not only by the regulators, but it was the first time in the history of financial ...

Best- and worst-case economic scenarios - Business - US ...www.nbcnews.com/id/26662761Sep 12, 2008 · O.K., we've finally wrapped our minds around the impossible: On Sunday, Sept. 7, in the name of preventing a financial meltdown, the conservative Bush Administration announced that …

Trusts 19: constructive Trusts Flashcards | Quizlethttps://quizlet.com/19400563/trusts-19-constructive-trusts-flash-cardsMr Winder was the Tee in bankruptcy for Mr William Wigham, who had bought James Roscoe Ltd in March 1913. Mr Wigham had agreed to give the book debts that were received up to a certain date to the sellers. He collected £455 but kept them in his account, so …

What Would Mises Say? - LewRockwellhttps://www.lewrockwell.com/2009/03/joseph-keckeissen/what-would-mises-sayMar 26, 2009 · Liquidity was the cause of the crisis, and now excess liquidity is presented as its solution! For this reason the crisis cannot possibly end in the short run. The remedy proposed is worsening things all over, and assures us that we will never get back to a sound and prosperous economy as long as we defy monetary sobriety.

Blog | Parametric Portfoliohttps://www.parametricportfolio.com/blogInvestment advisory services offered through Parametric Portfolio Associates ® LLC ("Parametric"), an investment advisor registered with the US Securities and Exchange Commission.. Parametric (National Registration Database No. 42850) is also registered as a Portfolio Manager with the securities regulatory authorities in certain provinces of Canada with regard to specific products and strategies.

THE WALL STREET EXAMPLE: BRINGING EXCESSIVE EXECUTIVE ...https://iveybusinessjournal.com/publication/the-wall-street-example-bringing-excessive...Nevertheless, only a small portion of the increase in his total compensation was due to his promotion. The litany of excessive compensation, of course, is not limited to the CEOs of the Wall Street investment banks. The median increase in total compensation for a matched group of 228 S&P 500 CEOs between 2002 and 2003 was 27.16 percent.

(PDF) A pre-crisis vs. crisis analysis of peripheral EU ...https://www.researchgate.net/publication/319632169_A_pre-crisis_vs_crisis_analysis_of...A pre-crisis vs. crisis analysis of peripheral EU stock markets by means of wavelet transform and a nonlinear causality test

Ch10 all macro__lecture_ppt - SlideSharehttps://www.slideshare.net/mrbagzis/ch10-all-macrolecturepptFeb 10, 2015 · Instructor: The quantity of credit demanded is plotted on the horizontal axis, and the real interest rate is plotted on the vertical axis. As the real interest rate rises, the quantity of credit demanded falls. This is a movement along the credit demand curve. Instructor: You may want to reference the example of BatteryPark from the text.[PDF]Economic Warfare: Risks and Responses - Deep Capturehttps://www.deepcapture.com/wp-content/uploads/Financial-Terrorism-Commisioned-by...Economic Warfare: Risks and Responses Page - 6 - Introduction The economic events of 2008 have been compared with those of the 1930s. Warren Buffett described the initial market decline as an ?Economic Pearl Harbor.?2 Regardless of the perspective or cause, the severe economic weakness experienced in 2008 and early

Investors' Rush To Cash Signals More Big Declines Aheadhttps://www.investopedia.com/investors-rush-to-cash-signals-more-big-declines-ahead...Investors are increasing their cash balances at the fastest pace since the financial crisis year of 2008, and that may be an ominous signal for the stock market. In the fourth quarter of 2018, the ...

Rock The Truth: Obomber is Insanehttps://rockthetruth.blogspot.com/2013/09/obomber-is-insane.htmlIt was the comments he made about the economy that were startling: "Obama, conceding lingering problems such as a stubbornly high jobless rate and a growing income gap between the richest and poorest Americans, noted that the country has come far from where it was five years ago ‘‘but that’s not the end of the story. As any middle-class ...[PDF][Lee Hong Jong] Portfolio Performance of M-REITs Before ...www.prres.net/papers/Jong_Portfolio_Performance_of_M-REITs.pdfon the portfolio performance of M-REITs before, during and after the Global Financial Crisis. Keywords: GFC, REITS, portfolio performance, Sharpe ratio, Treynor ratio, Malaysia INTRODUCTION REIT is a company which collects and invests the pooled capital of the investors to …

Lehman Collapse: Capital Markets - myassignmenthelp.comhttps://myassignmenthelp.com/free-samples/lehman-collapse-capital-marketsLehman Brother collapse in 2008 was considered as one of the most tragic events of failure among financial institutions. Before, it collapse the company was considered to be the fourth largest investment bank in America (Iminds, 2010). Began in 1844 by Henry Lehman, Lehman Brother was a small ...

Peter Bill: Where were you when Lehman's collapsed?https://www.egi.co.uk/news/peter-bill-where-were-you-when-lehman-s-collapsedWhere were you when Lehman’s collapsed? Eight big property players recall their reactions. At every interview I conducted over 2009 and 2010 for my new book Planet Property, the same question was asked: What can you recall of the events surrounding the …

"Live or Let Die? after Lehman, GM and Chrysler, What Does ...https://www.questia.com/magazine/1G1-218877153/live-or-let-die-after-lehman-gm-and...[ILLUSTRATION OMITTED] 2008 and 2009 could go down in history as the two biggest years for bankruptcy in all of American history. It may be for the most ignominious and unpleasant reasons, but it's not unreasonable to think that the events of these two recessionary years will ripple out into future proceedings large and small, and fundamentally flame the debate of any future legislation. The ...

A very geographical crisis: the making and breaking of the ...https://www.researchgate.net/profile/Shaun_French/publication/46512977_A_Very...A very geographical crisis: the making and breaking of the 2007–2008 ?nancial crisis Shaun Frencha, Andrew Leyshona and Nigel Thriftb aSchool of Geography, University of Nottingham, University ...

Dodd-Frank Is Obamacare Bad | The American Spectatorhttps://spectator.org/dodd-frank-is-obamacare-badInside Job was one of the worst documentaries ever to win an Oscar. The 2010 flick, in which Matt Damon narrates the supposed roots of the 2008 financial crash, is dumb. It’s not Fahrenheit 9/11 ...

Gm Bankruptcy - 11472 Words | Bartlebyhttps://www.bartleby.com/essay/Gm-Bankruptcy-F33UCCYDKDRVSAug 26, 2013 · Emerging out of bankruptcy quickly will be a "new GM," made up of the four brands that GM will keep in the U.S. market -- Chevrolet, Cadillac, GMC and Buick -- as well as many of its more successful overseas operations. This is the same process …

Prominent Financial Writer: The Big Money Boys Call the ...https://georgewashington2.blogspot.com/2009/08/prominent-financial-writer-big-money.htmlAug 05, 2009 · Long-time MarketWatch writer Paul Farrell explains in a new essay that the big money boys call the shots, and that one of their basic strategies for maintaining control is to use the president as a "figurehead" and politicians as "mere pawns":. Always elect a figurehead president. Putin skirted term limits by getting Medvedev elected president.

Women Hitting Glass Ceiling at U.S. Bankshttps://www.wsj.com/video/women-hitting-glass-ceiling-at-us-banks/C626DBCB-8C2E-40ED-9...Sep 08, 2011 · Wall Street firm that the woman I mean I think kind of thing will always be a story so I don't think it's overbought in AGQ day that's what it did get a kiss is the case is very receive e ...[PDF]tHe inner struggle - AllianceBernsteinhttps://www.alliancebernstein.com/.../resources/pdf/Inner_Struggle_Execution_Guide.pdfand its implications, one of which was the shocking collapse of Long-Term Capital Management (LTCM), a hedge fund that had bet on a “return to normal,” or mean reversion. Anxiety spiked. With hundreds of billions at stake, leading bankers unwound LTCM’s positions. Thus, a …

A Clearer Picture on Lehman's Collapse - The New York Timeshttps://dealbook.nytimes.com/2014/02/24/morning-agenda-a-clearer-picture-on-lehmans...Feb 24, 2014 · LEHMAN REVISITED | The Federal Reserve let Lehman Brothers fail more than five years ago. But it wasn’t until Friday that the Fed released transcripts of the 2008 meetings of its Federal Open Market Committee that provide the fullest picture yet of the thinking of top government officials on Lehman’s collapse, Peter Eavis writes in DealBook. ...

Ten years since the global financial crisis, is the job ...https://ukfinancialservicesinsights.deloitte.com/post/102f1wu/ten-years-since-the...It sometimes feels like yesterday, but it was ten years ago this week that Lehman Brothers collapsed, triggering the most challenging phase of the global financial crisis.. The world has spent much of the last decade preoccupied with the recovery from that crisis and related ones (i.e. the Eurozone crisis).

How Intrusive Should You Be In The C-Suite? - Corporate ...https://boardmember.com/how-intrusive-should-you-be-in-the-c-suiteLost on the voting public was the fact that the Lehman board was not culpable. The reason the company fell into bankruptcy was government negligence, according to records analyzed by Laurence Ball, chair of the Johns Hopkins economics department, and author of The Fed and Lehman Brothers.

Sell-Offs Have A Template And This Ain't It | Blue Haven ...https://bluehavencapital.com/sell-offs-have-a-template-and-this-aint-itDec 05, 2019 · The 2008 financial crisis may contain the year 2008 in the headlines, but it was 2007 when the stock market actually peaked. By the end of 2007, the S&P 500 had fallen more than 5% from it’s high and was failing to recover. Before Lehman Brothers collapsed in September 2008, the S&P 500 had already been down 20% for more than two months.Author: Kevin Kleinman

What did the 2008 crisis cost America? | The Interpreterhttps://www.lowyinstitute.org/the-interpreter/what-did-2008-crisis-cost-americaAug 23, 2018 · This study attempts to put a number on the ongoing cost of the crisis. It would be easy to disagree with the exact modelling, but it’s hard to deny the broad message: this was an enormously costly episode of misguided policies before and after 2008, and not just in America.

Richard Adams: An absence of leadership | Opinion | The ...https://www.theguardian.com/commentisfree/2008/oct/13/creditcrunch-globaleconomyOct 12, 2008 · While an international crisis, the lack of leadership from the US has been aggravating. It can't be blamed for everything, but it can be indicted for sitting on its hands for too long.

Tandem Financial | Lessons from the Global Financial Crisishttps://tandemfinancial.co.uk/tandem-thinking/lessons-from-the-global-financial-crisisWhile historic data is not a strong predictor of future capital gains, it offers valuable insights into the cyclical nature of markets. Markets will inevitably experience crises, but it is important not to panic and exit the market when these crises arise, as the potential gains stemming from the following bull markets will be squandered.

Dubai default: is the financial crisis really over ...https://www.greenleft.org.au/content/dubai-default-financial-crisis-really-overThis is $100 billion less than at the beginning of the financial crisis, but is still higher than at any time before 2007. The persistence of the high debt reflects that US households continue to pay for many purchases by credit. This is, at least in part, because real wages remain historically low.

DOW MOVES 0.57 LOWER, TO 1,389.68 - The New York Timeshttps://www.nytimes.com/1985/11/05/business/dow-moves-0.57-lower-to-1389.68.htmlNov 05, 1985 · Texas Oil and Gas was the volume leader, down 5/8, to 15 3/4, on a turnover of 1.8 million shares. The company last week announced an agreement to …[PDF]The Pleasures and Sorrows of Work - New York Public Libraryhttps://www.nypl.org/sites/default/files/events/6.8.09transcript.pdfJun 08, 2009 · (applause) The Pleasures and Sorrows of Work. I must say in an era such as ours now, to fill the auditorium tonight was not difficult for two reasons. One, it was Alain de Botton, and the other reason was the timeliness of your subject. I’m wondering when did you start working on the sorrows and pleasures of work? LIVE_De Botton_6.8.09 ...[PDF]For My Ego’s Sake, Get Me On TV!https://www.advisorperspectives.com/articles/2018/12/11/for-my-egos-sake-get-me-on-tv.pdfDec 11, 2018 · For My Ego’s Sake, Get Me On TV! December 11, 2018 by Sara Grillo Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.[PDF]The Causes and Current State of the Financial Crisishttps://www.economy.com/getlocal?q=E502E1C2-6EDA-4...The economic impact of the financial crisis has been very severe. The resulting Great Recession was the longest, broadest and most severe downturn since the Great Depression. Due largely to unprecedented action by the Federal Reserve and fiscal policymakers, the recession ended last summer, but the economy continues to struggle.

Warren Hellman dies at 77; San Francisco financier ...https://www.chicagotribune.com/news/obituaries/la...Dec 20, 2011 · Warren Hellman was a San Francisco financier, philanthropist and bluegrass enthusiast who lavished his city with a free concert that grew into one of the nation's largest music festivals.

Retrospectives of the financial crisis are leaving ... - Salonhttps://www.salon.com/2018/09/18/retrospectives-of...Sep 18, 2018 · So she called Wells Fargo, which serviced the loan, for assistance. With an 800 credit score and a history of paying her bills, Terrie thought she was a perfect candidate for a loan modification.

Retrospectives of the Financial Crisis Leave Out Its Victimshttps://truthout.org/articles/retrospectives-of...Sep 20, 2018 · With an 800 credit score and a history of paying her bills, Terrie thought she was a perfect candidate for a loan modification. But Wells Fargo blew her off for months, Terrie said. Finally, in a recording she was later able to obtain, a representative told Terrie that she had to miss payments in order to get a modification.

BGC Partners Appoints BoA Executive, Liam Hudson as its ...https://theindustryspread.com/bgc-partnersAug 23, 2018 · BGC Partners, the American global financial services company has appointed Liam Hudson as Head of Electronic Forex. Liam will be based out of the company’s London office and lead the broker’s … Continue reading "BGC Partners Appoints BoA Executive, Liam Hudson as its Head of Electronic Forex"

Kenneth C. Griffin gives Harvard $150 million, principally ...https://harvardmagazine.com/2014/02/an-unprecedented-gift-for-undergraduate-financial-aidKenneth C. Griffin ’89, founder and chief executive officer of the Citadel LLC, a multibillion-dollar, Chicago-based hedge-fund and financial-services enterprise, has given Harvard $150 million, principally for undergraduate financial aid, the University announced today. “Ken Griffin’s extraordinary philanthropy is opening Harvard’s gates wider to the most talented students in the ...

BitGo Hires FX HFT Specialist Nick Carmi as Head of ...https://theindustryspread.com/bitgo-hires-nick-carmi-financial-servicesMay 11, 2019 · US based cryptocurrency wallet and financial services provider BitGo has hired Nick Carmi as its new head of financial services. Nick Carmi is a forex industry veteran with over 25 years of experience in the sector most specialising on high frequency trades.

GUEST POST: Debtor Education Course: Are Joe and Sally to ...https://mandelman.ml-implode.com/2011/12/guest-post-debtor-education-course-are-joe...Russell A. DeMott is a bankruptcy and foreclosure defense attorney in South Carolina… and a regular reader of Mandelman Matters. He graduated from the University of South Carolina School of Law in 1993 and was a staff editor and the research editor for The South Carolina Law Review. Immediately following law school, Russ clerked for the Honorable Harry A. Beach, Circuit Court Judge in ...

'It's hard to remember how fraught it was ... - The Guardianhttps://www.theguardian.com/business/2017/aug/03/mark-carney-interview-credit-crunch...Aug 03, 2017 · On Tuesday, one of the guardians of the US financial system began a consultation that could lead to a watering down of the so-called Volcker rule, …

What happens when democrats are allowed to run a state ...www.politicaljack.com/threads/what-happens-when-democrats-are-allowed-to-run-a-state...Dec 09, 2018 · Anyone who says that was an unsurvivable event without massive government interventions has shit for brains. This is precisely Kotlikoff's point - it was not a systemic threat (at least beyond the fact that the banking system is inherently unstable). In fact, it was the government's reactions that caused the "crisis" to go hyperbolic.

The Emergency (Liquidity Bailout) Fund for The Indian ...https://microfinance-in-india.blogspot.com/.../emergency-liquidity-bailout-fund-for.htmlNov 23, 2010 · This is a great opportunity for The RBI to take direct charge of the Indian Micro-Finance Industry Industry Level Emergency Fund: At the outset, I would like to make it absolutely clear that, any such proposal for a LIFELINE LIQUIDITY FUND must be for the micro-finance industry as a whole and not exclusively for members of MFIN [i] or Sa-Dhan ...

Games People Play - Janus Henderson Investors ...https://www.advisorperspectives.com/commentaries/2015/01/29/games-people-playEven as the financial system morphed from the gold standard, to the Bretton Woods Dollar standard in 1944, and then the abandonment of any standard in 1971, capitalism seemed to be on firm ground. Incentives to lend, borrow, and invest for a profit were never challenged on a …

Commercial Loans and Some Oddities About Cap Rateshttps://info.c-loans.com/bid/87913/commercial-loans-and-some-oddities-about-cap-ratesNov 17, 2013 · This is my 5th article on commercial loan underwriting and cap rates. Cap rates are an extremely important concept in commercial real estate finance, so if you first want to catch up by reading my first four articles, here they are: Cap Rates and Commercial Loans I; …

Jim Willie: 13 Reasons Why Gold Will Hit $5000/oz | Silver ...https://www.silverdoctors.com/gold/gold-news/jim-willie-13-reasons-why-gold-will-hit...Aug 23, 2013 · The financial crisis has been a fixture since 2008 when Lehman failed. The crisis became acute when QE began, and later the hyper monetary inflation was clear as permanent. In the last several months, the perma-crisis elevated in danger level, from a skein of high risk critical extreme events. The Gold price will rise dramatically in the future from numerous powerful forces and factors.

The bond event study methodology since 1974 | SpringerLinkhttps://link.springer.com/article/10.1007/s11156-016-0562-4Mar 17, 2016 · In the spirit of methodology reviews for stock event studies, like the one prepared by Binder (Rev Quant Financ Account 11:111–137, 1998), this paper discusses the development of the event study methodology for corporate bonds since its first application with Katz (J Financ 29:551–559, 1974). The motivation to conduct this review stems from two sources: First, the methodology utilized …

Banks stress test: Better, but not fit | AllInfoallinfo.space/2018/11/03/banks-stress-test-better-but-not-fitNov 03, 2018 · Prepared are the European banks, good for a crisis? The wanted to find out, the European banking authority (EBA) in its third stress test. She is investigating has tested to 48 large banks from 15 EU countries and Norway. Of these, 37 have come from the Euro area, they cover in the currency Union, about 70 percent of the banking market.

The wail street - Economy News - Issue Date: Oct 13, 2008https://www.indiatoday.in/magazine/economy/story/20081013-the-wail-street-737787-2008...The immediate problem though, was that banks were holding on to these securities (partly because they got taken in by their own puff), and a number of firms like AIG had sold protection against their values falling. Financial institutions were sitting on large losses. Compounding the problem was the unprecedented leverage.

This is Not Recession but Debt Deflation - News | Khaleej ...https://www.khaleejtimes.com/business/this-is-not-recession-but-debt-deflationThis is no mundane business cycle recession but something far more ominous, a debt deflation unlike anything we have ever experienced. In fact, I can think of only four episodes in modern finance ...

How can it be established whether it was presence or ...https://www.quora.com/How-can-it-be-established-whether-it-was-presence-or-absence-of...This is a complicated question. Unfortunately, we can’t do scientific experiments on the financial crisis, so little can be definitively established. Also, simply stating one side is right or wrong would not do this question justice either. Let me...

What We Learned From the Financial Crisis | Jason Zweighttps://jasonzweig.com/what-we-learned-from-the-financial-crisisTax rules require sellers to wait 31 days to repurchase the same investment, but it is OK to swap two holdings that aren’t the same—such as a large-company index fund and a total-market index fund. The 2008 market drop provided an excellent opportunity for …

Greek lessons for Brexiters | Financial Timeshttps://www.ft.com/content/fc127c40-b8ab-11e7-8c12-5661783e5589Oct 24, 2017 · But it would surely ... Conservative MP for Daventry and a staunch Eurosceptic, wrote to vice-chancellors at the start of this month asking for the names of any professors involved in teaching ...

Local postmortem on the financial crisis - Hilton Head Monthlyhttps://www.hiltonheadmonthly.com/business/1616-local-postmortem-on-the-financial-crisisApr 30, 2015 · “Given the ripple effect,” according to MacPhee and a group of economists that he consulted, “the bailout equates to a global loss of $23 trillion, an amount that won’t be absorbed easily. We predict that it will be between 2030 and 2038 before …

Who are all these people who forecasted the 2008 crisis ...https://www.quora.com/Who-are-all-these-people-who-forecasted-the-2008-crisis-What-is...These were the economists who predicted the global financial crisis and the US housing bubble. So what lessons should we heed for the immediate future? Nouriel Roubini, chairman of Roubini Global Economics Once derided as Dr Doom, the New York Uni...

Trump’s Financial Arsonists: The Next Financial Crisis May ...https://globalpossibilities.org/trumps-financial-arsonists-the-next-financial-crisis...Feb 04, 2018 · This is a man who was basically gifted two ... the agenda of these men (and they are all men) could lead to a financial crisis of the first order. So here’s a little rundown on them: what drives them and how they are blindly taking the economy onto distinctly treacherous ground. ... After much debate and a court order in his favor, ...

The 22 Biggest Power Couples On Wall Street | BusinessInsiderhttps://www.businessinsider.in/finance/the-22-biggest-power-couples-on-wall-street/...Feb 14, 2013 · She's an award-winning financial reporter who is currently working as a media consultant, according to a bio on Columbia Business School's website. She's also an adjunct professor at …

JIM ROGERS 2017 - Trump to have trade war with China ...https://jimrogers1.blogspot.com/2017/02/jim-rogers-2017-trump-to-have-trade-war.htmlJim Rogers started trading the stock market with $600 in 1968.In 1973 he formed the Quantum Fund with the legendary investor George Soros before retiring, a multi millionaire at the age of 37. Rogers and Soros helped steer the fund to a miraculous 4,200% return over the 10 year span of the fund while the S&P 500 returned just 47%.

TCM: Who's Who | Global Finance Magazinehttps://www.gfmag.com/magazine/september-2010/tcm-whos-whoEric Campbell, a pioneer in the financial services industry, co-founded ICM, one of the first electronic banking companies to offer Internet-based cash management platforms. Since 2000, as Bottomline's chief technology officer, Campbell has worked with the largest financial institutions in the world to craft their cash management strategies.

What Was Behind the Worst Crash in History? - AOL Financehttps://www.aol.com/article/finance/2013/09/03/what-was-behind-the-worst-crash-in...Sep 03, 2013 · This is the opinion of Arthur Reynolds, chairman of the Continental Illinois Bank and Trust company, but it also is his belief that the chief function of these great accumulations of capital has ...

The Global Financial Crisis of 2008: Can Dodd-Frank Help ...https://www.bartleby.com/essay/The-Global-Financial-Crisis-of-2008-Can-FKQX88XP2E7WApr 23, 2019 · second week of October in 2008 was the worst week for stock market during 75 years, Buckley (2011) state that the worst record was the Dow Jones Industrial Averages dropped 22.1%, but it fell 44.3% then. In general, a financial crisis is not an accident; it may take several years and has complex and interlaced causes (Claessens and Kodres, 2014).

Inside Wall Street's $8 billion time bomb | Chicago ...https://www.chicagobusiness.com/article/20180207/...Even one of the inventors of the VIX, Devesh Shah, is perplexed why these products exist in the first place. ... This is, of course, the way finance has always worked. ... Barclays was the first ...

Silver and Gold: Is This Just a Small Breather or a ...https://www.sunshineprofits.com/gold-silver/free-alerts/silver-gold-is-this-just-a...As Nobel Prize winning economist, Paul Krugman, wrote in his New York Times column last week, reform will probably not be able to prevent bad loans or bubbles. But it can go a long way in making sure that when the bubbles burst they don't take down the entire financial system with them. ... the wheels of commerce as a whole grind to a halt. Why ...

Volatility Inc.: Inside Wall Street's $10 billion time bombhttps://www.smh.com.au/business/markets/volatility-inc-inside-wall-streets-10-billion...Even one of the inventors of the VIX, Devesh Shah, is perplexed why these products exist in the first place. ... This is, of course, the way finance has always worked. ... Barclays was the first ...

As Lehman Collapsed, Execs Were Rewarded - CBS Newshttps://www.cbsnews.com/news/as-lehman-collapsed-execs-were-rewardedOct 06, 2008 · Days from becoming the largest bankruptcy in U.S. history, Lehman Brothers steered millions to departing executives even while pleading for a federal rescue, Congress was told Monday.

Lawmakers Slam Lehman Executives for 'No Accountability ...https://www.foxnews.com/story/lawmakers-slam...Oct 06, 2008 · WASHINGTON – Days from becoming the largest bankruptcy in U.S. history, Lehman Brothers steered millions to departing executives even while pleading for a federal rescue, Congress was told Monday.

Jim Rogers Warns: “Worst Bear Market” Is Coming ...https://www.investmentwatchblog.com/jim-rogers...Jul 16, 2019 · Then Ireland went bankrupt. Then a few weeks later, Bear Sterns went bankrupt and a few weeks later Northern Rock, the English Bank, went bankrupt. Then eventually Lehman brothers went bankrupt and by then, everybody knew there was a problem. But it had been there for over a year and it has always worked that way. It starts when we are not ...

The comeback of Lawrence Summers - The Boston Globehttps://www.boston.com/news/education/higher/...Dec 04, 2008 · In mid-September, in the midst of the growing financial crisis, Lawrence Summers sat in a box seat down the third-base line at Fenway Park, nibbling on a hot dog and fielding call after call on ...

Lehman goes on recruitment drive | This is Moneyhttps://www.thisismoney.co.uk/money/news/article-1511615/Lehman-goes-on-recruitment...LEHMAN Brothers has cranked up its City recruitment drive with offers of two-year fixed pay deals worth up to £1m as investment bankers witness a return to a boom-time jobs merry-go-round after a ...

Steve Shreve on Pablo Triana’s The Flawed Math of ...https://quantnet.com/threads/steve-shreve-on-pablo-triana’s-the-flawed-math-of...Feb 05, 2011 · By STEVE SHREVE In his article The flawed math of financial models, Financial Times, November 29, Pablo Triana seeks to fix a large portion of blame for the world-wide financial crisis on "quants'' in the finance industry and the programs that educate them. Mr. Pablo recommends radical reform in such programs.Others, carrying these ideas farther, call for a diminished role for quants in …

Full-Blown Civil War Erupts on Wall Street: As Reality ...https://truthout.org/articles/fullblown-civil-war-erupts-on-wall-street-as-reality...Jan 12, 2012 · Finally, after trillions in fraudulent activity, trillions in bailouts, trillions in printed money, billions in political bribing and billions in bonuses, the criminal cartel members on Wall Street are beginning to get what they deserve. As the Eurozone is coming apart at the seams and as the US economy grinds to a halt, the financial elite are starting to turn on each other. The lawsuits are ...

Is High-Frequency Trading as Bad as Michael Lewis Wants ...https://news.yahoo.com/high-frequency-trading-bad...Apr 01, 2014 · "The United States stock market, the most iconic market in global capitalism, is rigged." So says author Michael Lewis in his new book about Wall Street (and in the most quotable part of his recent 60 Minutes segment.) But defenders of that market are fighting back, creating the hottest debate

The California Financial Gambler’s Fallacy – 5 Reasons Why ...www.doctorhousingbubble.com/the-california-financial-gambler’s-fallacy-–-5-reasons...The California Financial Gambler’s Fallacy – 5 Reasons Why the Budget and the Economy will Keep Home Prices Stagnant. Banks Paying Property Taxes on Shadow Inventory.[PDF]BBC News Reports Building 7 collapse 23 Minutes before it ...files.abovetopsecret.com/images/february-2007-threads.pdfBBC News Reports Building 7 collapse 23 Minutes before it collapses. February, 2007 ... papers in his pants and hid them under a trailer outside so he could snatch them and take them home ... operative for a long time, going all the way back to Bush Sr. and Reagan. One of his specialties is the

Anyone ever feel like the protagonist of a Lovecraft story ...https://www.reddit.com/.../comments/77xhev/anyone_ever_feel_like_the_protagonist_of_aI watch as the world slowly becomes colder, meaner, more isolated. As people seemingly become less and less intelligent. I walk around and see everyone unconsciously knowing something is off, yet willfully unaware. And, try as I might, I can't find one person to listen, as I lose my words in mad ramblings of truth. This is a nightmare.

Is High-Frequency Trading as Bas as Michael Lewis Wants ...https://news.yahoo.com/high-frequency-trading-bas...Apr 01, 2014 · "The United States stock market, the most iconic market in global capitalism, is rigged." So says author Michael Lewis in his new book about Wall Street (and in the most quotable part of his recent 60 Minutes segment.) But defenders of that market are fighting back, creating the hottest debate

Here's Why We're Watching Myanmar Metals's (ASX:MYL) Cash ...https://finance.yahoo.com/news/heres-why-were-watching-myanmar-000433541.htmlDec 11, 2019 · A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. ... are the most common ways for a …

Africa Following Development Path Similar to That Of China?https://www.africanglobe.net/business/africa-development-path-similar-chinaDec 18, 2012 · Regardless of development model Africa is growing. AFRICANGLOBE – Ahmed Shide admits his country is following a development path similar to that of China but not any sort of model.. The youthful Ethiopian state minister of finance and economic development was speaking from his office in the government buildings area of central Addis Ababa.

US Debt Ceiling Impasse is a Constitutional Crisis in the ...https://www.dailykos.com/stories/2013/10/7/1244820/-US-Debt-Ceiling-Impasse-is-a...For nearly a week so-called nonessential services in the US government has shut down due to a budget impasse over a House demands that link deferral of Obama's signature legislation The Affordable ...

Advantages and Disadvantages of the Different Types of ...https://studymoose.com/advantages-and-disadvantages-of-the-different-types-of...Analysis of the Advantages and Disadvantages of the Various Types of Accounts In checking account, one disadvantage is that the interest given is very little compared to other accounts. Nevertheless, the advantage of that one can use check whenever he or she needs money.

Topic: Update – Italian Banking Crash Expected in 2017 ...https://www.mgtow.com/forums/topic/update-italian-banking-crash-in-2017-2018May 14, 2017 · Update – Italian Banking Crash Expected in 2017-2018. I have posted on the state of the Italian Banking System at the close of 2016 and the background to that is in a few posts starting from here. The topic is important as the Italian bank debt has high exposure to the main EU financial institutions and especially to those in France.

Why is Sensex going up and up? When will it fall? - Quorahttps://www.quora.com/Why-is-Sensex-going-up-and-up-When-will-it-fallSep 18, 2014 · Soon around 2019 There will be crisis DHFL , indiabulls & other NBFC or HFC's(housing loan providers) has already Crashed more than 50 % this SEP (Google about ...

Sixth Pay Commission: Armed Forces Pay panel Grievances ...www.finance-trading-times.com/2008/09/sixth-pay-commission-armed-forces-pay.htmlNot all central government employees are happy with the Implementation of the Sixth Pay Commission Recommendations.The front runners in this unhappiness are the armed forces or defence forces officers.The main cause of concern for these Armed Foces officers has been their belief about disparity with civilian and paramilitary counterparts. And unless that parity is restored, they will not be ...

Has the financial landscape in India changed over 10 years ...https://www.livemint.com/Money/GS2PfuIW5...Banking system more robust. On the 10 years since the Lehman collapse, the Indian banking sector has transformed drastically.Private banks have firmed up their roots and now their share has ...

Celebrate now, worry later - Times of Indiahttps://timesofindia.indiatimes.com/Celebrate-now-worry-later/articleshow/3636949.cmsThanks to the recent developments such as the Lehman brothers filing for bankruptcy, the top employees are expected to get expensive gifts, the 'not-so-important' cadre ending up with getting less ...

Varoufakis says Greece needs deal quickly; Obama urges ...https://www.theguardian.com/business/live/2015/jun/08/greek-germany-finance-ministers...Jun 08, 2015 · “This is the latest possible deadline but nothing stops us from going faster and I think it is in Greece’s interest to go faster to avoid doubts or speculations. ... (as late as) the end of ...

TheReturn of the Loan Solution Case Solution And Analysis ...https://www.thecasesolutions.com/thereturn-of-the-loan-solution-25413TheReturn of the Loan Solution Case Solution,TheReturn of the Loan Solution Case Analysis, TheReturn of the Loan Solution Case Study Solution, Introduction The Zoe Greenwood, Vice President at the Foundation Investment Advisors (FIA) is looking through the …

TARP profit claim bugs skeptics - Aug. 4, 2009https://money.cnn.com/2009/08/04/news/economy/tarp.profit.fortune/index.htmAug 04, 2009 · TARP profit claim bugs skeptics The Treasury Department's bank investments are paying dividends. But saying they have earned $6 billion for taxpayers, as Tim Geithner did, is a stretch.

Financial markets - Down the hatch | Finance and economics ...https://www.economist.com/finance-and-economics/2000/07/06/down-the-hatchAnd, as the chart shows, equity assets under management have grown much faster than stockmarket turnover ( true of financial assets in general). ... In the gilt-options market, in the first ...

Is the credit crisis the end of the beginning ...https://contrarianinvestorsjournal.com/?p=449We will introduce another character today- Satyajit Das. He is a world-leading expert in derivatives and risk management and has a good inside knowledge of the murky world of derivatives. He is best known as the author of the fascinating book, Traders, Guns & Money. Unlike the mainstream media and market, Satyajit Das is under no illusion that the credit crisis is over.

2019 MARKET MELTDOWN: What The New Year Brings ...https://www.investmentwatchblog.com/2019-market-meltdown-what-the-new-year-bringsJan 01, 2019 · If history is our guide, we are on track for a severe market meltdown in 2019. While the U.S. broader indexes remained in record territory for most of 2018, December turned out to be a complete disaster for stocks. So, even though the markets have reversed higher from their Christmas Eve lows, nothing more than a bear market rally.

A banker stopped Larry Ellison from buying the Warriors ...https://finance.yahoo.com/news/banker-stopped-larry-ellison-buying-141900598.htmlFeb 13, 2016 · A banker stopped Larry Ellison from buying the Warriors and it was the best thing that could have happened to them ... as "The King of Sports M&A," helped sell the Charlotte Bobcats to …Author: Matt Turner

Finance & Development, December 2008 - A Crisis to Rememberhttps://www.imf.org/external/Pubs/FT/fandd/2008/12/elerian.htmThis is a defining moment for the global financial system and, by implication, for relationships between countries. The institutional and policymaking landscape is changing in a rapid and unpredictable manner. The changes are not being driven by a master plan but by a series of separate reactions to ...

(PDF) Derivatives and Systemic Risk: What Role Can the ...https://www.researchgate.net/publication/237618037_Derivatives_and_Systemic_Risk_What...The effect of close-out on systemic risk is complicated. Edwards and Morrison (2004) point out that it depends in part on who is failing. If the failing counter party is not a systemically ...

SAGE Books - An Introduction to the Philosophy of Managementhttps://sk.sagepub.com/books/introduction-to-the-philosophy-of-managementPaul Griseri has worked in management and business education for over 25 years, and has taught philosophically related subjects to business students at all levels – from pre-undergraduate through to doctoral levels. He has a PhD in Philosophy from the University of Kent, and Postgraduate Diplomas in Management and Human Resource Management. Paul has published several books applying ...[PDF]Conflict of Interest Economics and Investment Analyst Biaseshttps://brooklynworks.brooklaw.edu/cgi/viewcontent.cgi?article=1463&context=blrThe first legislation to address this growing concern was the Glass-Steagall Act (GSA) of 1933, which differentiated between investment and commercial banking.9 Key provisions address the depression era concern that banks should not speculate with depositors' money.'° The legislative history

Managing Risk and Complexity: Legal Entity Identifier ...https://www.moneyandbanking.com/.../managing-risk-and-complexity-legal-entity-identifierOct 30, 2017 · Prior to the financial crisis, even an informed observer might have naïvely believed that the CEOs of big financial firms could simply push a button to view the current exposure of their firms to any other firms in the world. Or, if less technologically advanced, they could call their chief risk off

Charity in crisis- Business Newshttps://www.businesstoday.in/magazine/features/charity-in-crisis/story/4255.htmlThe Akshaya Patra Foundation is in the midst of a crisis it never imagined possible a few years ago. The Bangalore-based non-profit outfit was a star in the sector, running what is now the world ...

The tyranny of the capital markets - The Globe and Mailhttps://www.theglobeandmail.com/globe-investor/investment-ideas/the-tyranny-of-the...Jul 19, 2010 · Welcome to The Globe and Mail’s comment community. This is a space where subscribers can engage with each other and Globe staff. We aim to create a safe and valuable space for discussion and debate.

Investment Banking: Capital Markets and Proprietary ...https://www.fool.com/.../09/06/investment-banking-capital-markets-and-proprietary.aspxProprietary trading This is my favorite investment banking business line, but it's also the most opaque and mysterious. Basically, investment banks take the very best and brightest people that ...

Shopko retail chain files for bankruptcy, 105 stores ...https://www.wsws.org/en/articles/2019/01/24/spko-j24.htmlJan 24, 2019 · Shopko retail chain files for bankruptcy, 105 stores across US to close By Jacob Crosse 24 January 2019 General merchandise retail chain Shopko, with 367 stores across 26 …

What is happening at the Repo markets. - Royalwebgruphttps://royalwebgrup.com/2019/12/12/what-is-happening-at-the-repo-marketsDec 12, 2019 · What is happening at the Repo market? Rehypothecation. – The process by which someone pledges an asset for a loan but it has already been pledge for another prior loan.. Strange but it seems that this practice is allowed and common among hedge funds, banks and financial institutions.

Next crisis will be different – The Final Wakeup Call ...finalwakeupcall.info/en/2015/03/18/next-crisis-will-be-differentMar 18, 2015 · Next crisis will be different. ... According to a study by McKinsey, “the world’s total debt – at least as officially recorded – now stands at $200 trillion – up $57 trillion since 2007. That’s 286% of global GDP… and far in excess of what the real economy can support.” ... All of standard food for a credit crisis. The ...

A Banking Crisis Worse Than ISIS? Bail-Ins Begin - LA ...https://www.laprogressive.com/banking-crisis-worse-than-isisDec 29, 2015 · A Banking Crisis Worse Than ISIS? Bail-Ins Begin A t the end of November, an Italian pensioner hanged himself after his entire €100,000 savings were confiscated in a bank “rescue” scheme.

A Crisis Worse than ISIS? Bank "Bail-Ins" Begin..."Your ...https://www.globalresearch.ca/a-crisis-worse-than-isis-bank-bail-ins-begin-your-life...Dec 29, 2015 · The pensioner’s bank was one of four small regional banks that had been put under special administration over the past two years. The €3.6 billion ($3.83 billion) rescue plan launched by the Italian government uses a newly-formed National Resolution Fund, which is …

'Davos Man' Loses His Swagger - The New York Timeshttps://dealbook.nytimes.com/2009/01/27/davos-man-loses-his-swaggerJan 27, 2009 · ‘Davos Man’ Loses His Swagger. By Payam Sharifi January 27, 2009 4:15 pm January 27, ... But it would be a stern parent who would not do it to mitigate the child’s suffering. Still, Mr. Abuaf argues, the collapse of the free market model has not made the Davos conclave any less relevant, or necessary. ... “This is an opportunity to ...

A Crisis Worse Than ISIS? Bail-Ins Beginhttps://truthout.org/articles/a-crisis-worse-than-isis-bail-ins-beginDec 30, 2015 · The pensioner’s bank was one of four small regional banks that had been put under special administration over the past two years. The €3.6 billion ($3.83 billion) rescue plan launched by the Italian government uses a newly-formed National Resolution Fund, which is …

A Crisis Worse than ISIS? Bail-Ins Begin – HoweStreethttps://www.howestreet.com/2016/01/a-crisis-worse-than-isis-bail-ins-beginJan 02, 2016 · The pensioner’s bank was one of four small regional banks that had been put under special administration over the past two years. The €3.6 billion ($3.83 billion) rescue plan launched by the Italian government uses a newly-formed National Resolution Fund, which is …

A Crisis Worse than ISIS? Bail-Ins Begin | The Readerhttps://www.reader.us/a-crisis-worse-than-isis-bail-ins-beginThe pensioner’s bank was one of four small regional banks that had been put under special administration over the past two years. The €3.6 billion ($3.83 billion) rescue plan launched by the Italian government uses a newly-formed National Resolution Fund, which is fed by the country’s healthy banks.

A Crisis Worse than ISIS? Bail-Ins Begin - Coalition to ...https://governamerica.com/opinion/ellen-brown/21566-a-crisis-worse-than-isis-bail-ins...The pensioner’s bank was one of four small regional banks that had been put under special administration over the past two years. The €3.6 billion ($3.83 billion) rescue plan launched by the Italian government uses a newly-formed National Resolution Fund, which is fed by the country’s healthy banks.

Nationwide BS, how about 40% EAR/APR Overdraft Charges ...https://forums.moneysavingexpert.com/showthread.php?t=6034548&page=3Nov 11, 2019 · But it's not financial literacy that you're struggling with, you're apparently just unable to articulate any sort of logical construct that clearly explains whatever point you're trying to make. Are you perhaps declaring that you're one of those lacking in applied numeracy and therefore can't understand what compounding really means?

Will Inside Job Start a Popular Rebellion? | HuffPosthttps://www.huffpost.com/entry/inside-job-popular-rebellion_b_754466May 25, 2011 · One of the most scandalous things about the entire financial crisis is that the "gang of blue-chip ogres and world class motherf**kers" (thanks Jeffrey Wells) who caused it are not only still in power -- they have eluded criminal prosecution.

The Big Short by Michael Lewis; The Devil's Casino by ...https://www.theguardian.com/books/2010/apr/18/big-short-devils-casinoApr 17, 2010 · The Big Short by Michael Lewis; The Devil's Casino by Vicky Ward ... the machine broke down, causing a global financial crisis. In his latest book, ... This is …Author: William Leith

Economics has failed us: but where are the fresh voices ...https://www.theguardian.com/commentisfree/2012/apr/16/economics-has-failed-us...Apr 16, 2012 · W hen the history of how a good crisis went to waste gets written up, it will surely contain a big chapter on the failure of our academic elites. Because just like the politicians, the taxpayer ...Author: Aditya Chakrabortty

Algorithmic Trading Has Forever Skewed Luck In Favor Of ...https://www.huffingtonpost.in/2015/06/07/highspeed-trading-is-skew_n_7528172.htmlThis is a form of high speed trading — that Michael Lewis chronicled in his bestseller 'Flash Boys' — in which computers execute pre-programmed trade orders. ... What are the pitfalls of ...

Where's Eliot Spitzer Now That We Need Him? - CounterPunchhttps://www.counterpunch.org/2009/03/30/where-s-eliot-spitzer-now-that-we-need-himMar 30, 2009 · Where’s Eliot Spitzer Now That We Need Him? ... As the head of the Financial Industry Regulatory Authority, or Finra, she stood by while the financial giants increased their leverage to ...

Determinants of Sudden Stops and Retrenchments of a ...https://www.ukessays.com/essays/finance/...They use a slightly different definition of sudden stops whereby they use gross flows in order to detect an episode rather than net flows. This allows for a disaggregation between domestic and foreign investors and allows for a more precise analysis of both sudden stops and retrenchments (Forbes + Warnock, 2012). I will attempt to look at:

It ISN’T crazy to print money: What Lord ... - This is Moneyhttps://www.thisismoney.co.uk/money/news/article-3298431/It-ISN-T-crazy-print-money-s...Oct 31, 2015 · Bond car manufacturer expected to drive to a loss of £86million; ... In his new book, Between Debt And The Devil: Money, Credit And Fixing Global Finance, he argues that a …

Chapter 7 Investor protection - ??????????https://www.legco.gov.hk/yr08-09/english/hc/sub_com/hs01/report/ch7-e.pdf7.3 In his testimony, Mr Joseph YAM, then MA, stated that one of MA's key focuses in the day-to-day regulation of the securities business of banks is investor protection, in particular the prevention and detection of mis-selling of financial products to investors. According to Mr YAM,

John C. Crittenden, III | FTI Capital Advisors | FTI ...https://www.fticonsulting.com/our-people/john-c-crittenden-iiiEarlier in his career, Mr. Crittenden was the SVP Head of Retail Investment channel at Riggs National Bank of Washington and widely known for creating and implementing highly productive turnaround strategies for wealth management divisions within several other D.C. area financial institutions.

A broker for peace, Richard Holbrooke, dies | Bahamaspress.combahamaspress.com/2010/12/14/a-broker-for-peace-richard-holbrooke-diesWASHINGTON – Richard Holbrooke, a brilliant and feisty U.S. diplomat who wrote part of the Pentagon Papers, was the architect of the 1995 Bosnia peace plan and served as President Barack Obama’s special envoy to Pakistan and Afghanistan, died Monday, the State Department said.[PDF]Chapter 7 Investor protection - ??????????https://www.legco.gov.hk/yr08-09/english/hc/sub_com/hs01/report/ch7-e.pdf7.3 In his testimony, Mr Joseph YAM, then MA, stated that one of MA's key focuses in the day-to-day regulation of the securities business of banks is investor protection, in particular the prevention and detection of mis-selling of financial products to investors. According to Mr YAM,

Financial Crisis Of 2008 Struck The World - 1398 Words ...https://www.bartleby.com/essay/Financial-Crisis-Of-2008-Struck-The-World-PK44XPWKFV8XHe was a highly respected individual in his field. Bernard Madoff’s firm became one of the major market makers in the US, and by 2008, Madoff Investment Securities was the sixth largest market maker on Wall Street (The Wall Street Journal, “the

WEILL OFFER OF $1 BILLION IS REJECTED - The New York Timeshttps://www.nytimes.com/1986/03/04/business/weill-offer-of-1-billion-is-rejected.htmlMar 04, 1986 · The quick rejection of Mr. Weill, a well-known Wall Street investment figure who is accepted as the man who built Shearson into one of the biggest investment firms in …

The looming financial crisis: The cryptocurrencies "for ...https://coincassogroup.com/the-looming-financial-crisis-the-cryptocurrencies-for-the...It is more than 10 years since the last serious financial crisis in 2008. The richest people in the world, including Bill Gates and Warren Buffet, are convinced that the next financial crisis will come in the near future. This is the first time that during the crisis, investors will be …

Maria Bartiromo on the Biggest Change in Wall Street | The ...https://www.fool.com/investing/general/2010/09/10/maria-bartiromo-on-the-biggest...Maria Bartiromo on the Biggest Change in Wall Street ... the Fed opened the window to investment banks and allowed them to borrow money at the same rates as the commercial banks. ... the ...

The Immortality Switch - Legit Stock Turning $6 Into $100?https://nobsimreviews.com/the-immortality-switchJan 11, 2020 · She is now widely known as the one-woman financial powerhouse. You may have already seen her on several platforms including CBS, CNBC, Reuters, Fox News, Wall Street Journal, and Forbes. And, not certainly the first time she has come …

Ruthless Amorality Pays Off In "Margin Call"https://www.forbes.com/sites/robertlenzner/2011/10/23/money-talks-in-margin-callOct 23, 2011 · This is not the first time the Fuld-character has cheated. By the way, "Margin Call" suggests Lehman actually survived by dumping its worthless garbage on unsuspecting clients-- …

James Woods & Paul Giamatti Among Cast Additions For HBO ...https://deadline.com/2010/10/james-woods-paul-giamatti-among-cast-additions-for-hbo...Oct 11, 2010 · HBO has assembled the cast of Too Big to Fail, the Curtis Hanson-directed movie about the 2008 financial crisis and the power brokers who decided the fate of the world's economy as the …

China’s first bond default was long overdue - The Globe ...https://www.theglobeandmail.com/report-on-business/rob-commentary/executive-insight/...Mar 07, 2014 · China’s first bond default was long overdue. Brian Milner. ... As the strategists remind us, it took another year to get to the "Lehman stage," when the collapse of the much larger Lehman ...

Property market: why people are suddenly buying again ...https://www.telegraph.co.uk/finance/property/property-market/10599099/Property-market...Jan 28, 2014 · Property market: why people are suddenly buying again Despite last year’s stagnant property market, a sudden surge in interested buyers is now creating a flurry of serious bids

Donna Sturman - Bankruptcy Misconductbankruptcymisconduct.com/new/cases/sturman-et-al.htmlThe Judge in the cases was the same Prudence Carter Beatty who was forced to take a “medical leave” because of her outrageous conduct in the Delta Airlines bankruptcy. This is just one of numerous complaints made to US Trustees Offfice all of which were ignored. October 12, 2007. Ms. Carolyn S. Schwartz, Esq. Office of United States Trustee

Read This Before Considering nVent Electric plc (NYSE:NVT ...https://finance.yahoo.com/news/read-considering-nvent-electric-plc-110521137.htmlApr 12, 2019 · Important news for shareholders and potential investors in nVent Electric plc (NYSE:NVT): The dividend payment of US$0.17 per share will be distributed to shareholders on 03 May 2019, and the ...

The Cause of the Crisis People Won't Face | theTrumpet.comhttps://www.thetrumpet.com/5565-the-cause-of-the-crisis-people-wont-faceThe Cause of the Crisis People Won’t Face The Cause of the Crisis People Won’t Face. ... This is one of the most influential educators in global industry. One fifth of the ceos in Fortune 500 companies have been groomed and shaped by this revered institution. ... In his book Ahead of the Curve—Two Years at Harvard Business School ...

The Titans Take It on the Chin - The New York Timeshttps://dealbook.nytimes.com/2009/01/27/the-titans-take-it-on-the-chinJan 27, 2009 · The Titans Take It on the Chin By ANDREW ROSS SORKIN. Many ordinary Americans are losing their jobs and savings because of the debacle on Wall Street. Skip to next paragraph. This column is not about them. Instead it is about the financial titans, those Masters of the Universe who helped make this mess.

Befuddled By Bubbles: The Greenspan Bernanke Era at the ...https://thedailycoin.org/2018/08/16/befuddled-by-bubbles-the-greenspan-bernanke-era-at...Aug 16, 2018 · As large as the bubble in tech stocks was, it was child’s play compared to the housing bubble. When the US housing bubble collapsed, the credit losses were so large the entire worldwide banking system was considered to be in mortal danger. One of the primary forces behind the 1913 founding of the Fed was to prevent financial crises.

'BCCI did not collapse, it was ... - The Express Tribunehttps://tribune.com.pk/story/1104541/the-untold-story-bcci-did-not-collapse-it-was...May 17, 2016 · Book about one of the largest banks in 1980s with $22b in deposits, offices in 72 countries launched at IBA ... This is why BCCI had a 19 year history while the bank you mentioned has ...

Legg Mason, Inc. -- Company Historyhttps://www.company-histories.com/Legg-Mason-Inc-Company-History.htmlDespite such occasional problems, Legg Mason has had a history of solid investments in its growth and has gained a reputation for stability in a volatile industry. One reason for its refusal to put its capital at risk. In 1993, for example, its debt was only 36 percent of …

Banks chase top talent left high and dry ... - This is Moneyhttps://www.thisismoney.co.uk/money/markets/article-1642349/Banks-chase-talent-ditched...A list of likely targets, according to website www.wealth-bulletin.com, includes Luca Tassan, 38, who is an executive director and head of corporate and infrastructure acquisitions financing.

Consider the hypothetical scenario below: A 55 year old ...https://www.justanswer.com/business-finance-homework/7cd0h-consider-hypothetical...Nov 19, 2012 · Consider the hypothetical scenario below: A 55 year old retiree, Rita, who has very little education goes to ABC Bank with the intention of placing sums which she has just withdrawn from her CPF account into a fixed deposit with the bank at 1.25% per annum. At the bank’s entrance, she is received by a relationship manager, Maurice, who is employed by the bank.

Toward an Ethical Economic System: Alleviating Suffering ...https://frdev2.whyislam.org/islamic-finance/toward-an-ethical-economic-system...By Samya Ali The Prophet (p) was asked which was the best form of income. He replied: “That for which a man works with his hands. And honest trading.” The Prophet himself was a trader and was well-known for his integrity. In fact, he was popularly known as “al-amin,” which means “the trustworthy.” At a …

re: The Auditors » Blog Archive » Send Lawyers, Guns And ...retheauditors.com/2010/03/02/send-lawyers-guns-and-money-the-big-4-and-their-litigationThis is clearly not acceptable.” ... A former Ernst & Young LLP partner was sentenced to a year and a day in prison on Monday after he was convicted last year of fraud charges in an insider-trading scheme where he ... similar to a colonoscopy for a middle-aged male, and price it like that. If we expect the auditors to find every problem, then ...

Test Bank for Financial Institutions and Markets 7th ...https://issuu.com/a284770161/docs/test-bank-for-financial-institution_46cbb8652ea434ANS: F Moral hazard refers to arrangements that create an incentive for one party to a transaction to act in his or her own interests at the expense of the other party to whom they may owe a duty ...

Toward an Ethical Economic System: Alleviating Suffering ...messageinternational.org/toward-an-ethical-economic-system-alleviating-suffering...Toward an Ethical Economic System: Alleviating Suffering Caused by Greed. Tweet; The Prophet (p) was asked which was the best kind of earning. He replied: “That for which a man works with his hands. And honest trading” (Ibn Hanbal). The Prophet himself was a trader and was well-known for his integrity. In fact, he was called “al-amin ...

Causes of the Financial Crisis - TestMyPrep.comhttps://testmyprep.com/subject/politics/causes-of-the-financial-crisisIt will expose perspectives on the working situation of economic economies. Financial crisis does not affect only the country itself; it is similar to a contagious disease that spreads to neighbouring environments and across to its companions especially in this modern time where in fact the world is …