Home

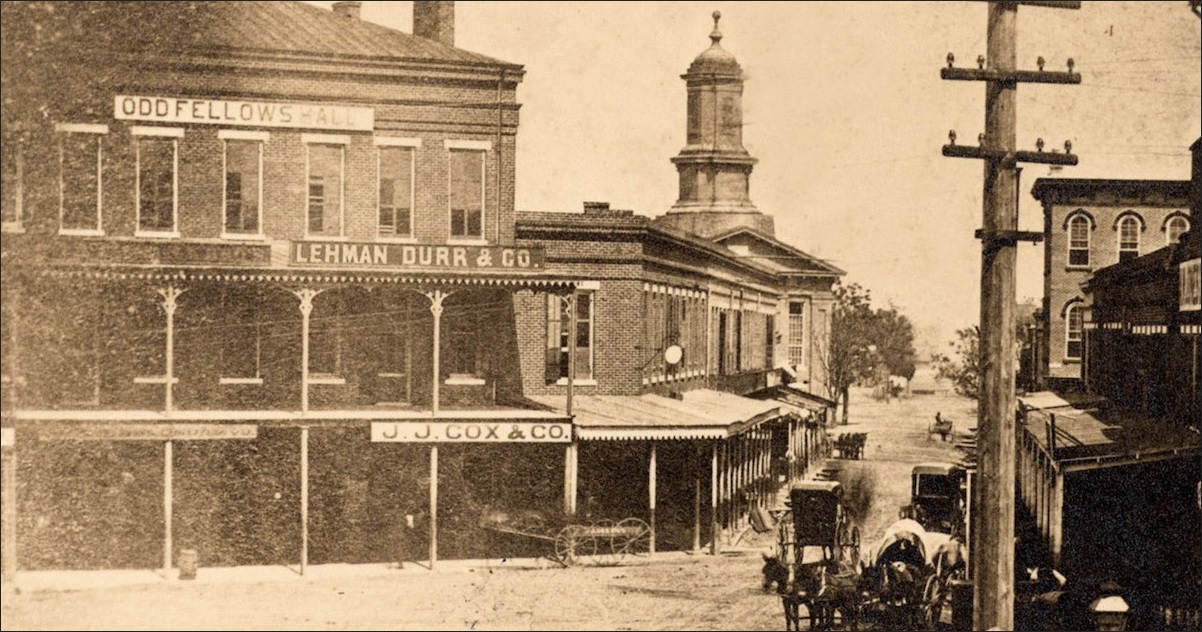

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Lords Hansard text for 5 Feb 200905 Feb 2009 (pt 0002)https://publications.parliament.uk/pa/ld200809/ldhansrd/text/90205-0002.htmFeb 05, 2009 · “This is the first financial crisis of the global age. And there is no clear map that has been set out from past experience to deal with it ... we’re learning all the time”. That was the Prime Minister speaking in Davos on 31 January.

Alert; who goes there? - blogspot.comhttps://prophetessrevella.blogspot.comThe American Recovery and Reinvestment Act, more commonly known as the stimulus bill, had been featured in more than 130 TV ads, according to a database maintained by Kantar Media’s Campaign Media Analysis Group. In many of those ads, Republicans claimed the bill had "failed" (that is …

October | 2013 | No Pun Intendedhttps://npinopunintended.wordpress.com/2013/10The first step towards this malignant matrimony was the downfall of Merrill Lynch. Merrill Lynch occupied an odd position on Wall Street. On the one hand, it’s probably the investment bank normal people are the most familiar with, thanks to its “thundering herd” of brokers. On the other hand, it suffered from a clear inferiority complex ...

Analysis of Bankruptcy | Bankruptcy | Predictionhttps://www.scribd.com/document/264477546/Analysis-of-BankruptcyANALYSIS OF BANKRUPTCY PREDICTION MODELS. AND THEIR EFFECTIVENESS: AN INDIAN PERSPECTIVE Narendar V. Rao Northeastern Illinois University & Gokhul Atmanathan, Manu Shankar, & Srivatsan Ramesh Great Lakes Institute of Management Abstract.Bankruptcy is a state of insolvency wherein the company or the person is not able to repay the creditors the debt amount. . Bankruptcy …

Hungary Increases Gold Reserves 10-Fold / Russia added ...https://gold-forum.kitco.com/showthread.php?149693-Hungary-Increases-Gold-Reserves-10...Feb 24, 2019 · OCTOBER 17, 2018 Yesterday, the Hungarian central bank announced it recently boosted its gold reserves 10-fold. According to its website, the National Bank of Hungary (MNB) now owns 31.5 tons of gold, up from 3.1 tons. It was the first significant purchase of gold by Hungary since 1986. A statement by the bank said the increase in gold stocks was intended to increase financial …

The New Way of the World - Pierre Dardot - ????www.doc88.com/p-1847446205010.htmlTranslate this pageThisworkpublishedaspartofaprogramprovidingpublicationassistancereceivedfinancialsupportfromtheFrenchMinistryofForeignAffairstheCulturalServicesoftheFrenchEmbassyinthe ...

?world around one????????????????? - …https://ejje.weblio.jp/sentence/content/world+around+oneTranslate this pageFurthermore, in this crisis in particular, it is very important that the G-7 members and other countries around the world closely cooperate with one another. The Prime Minister is now in New York, and the U.S. government and Congress are apparently working together on bold measures, so the most important thing for Japan and other individual countries to do now, is to assertively do what they ...

American Idol - The Economic Collapsetheeconomiccollapseblog.com/archives/tag/american-idolFor example, during the first quarter of 2011, home values declined at the fastest rate since late 2008. So when in the world are things going to finally start turning around? #8 Most Americans don’t realize it, but Europe is closer to a financial meltdown than it ever has been before. Greece is either going to get another bailout or it is ...

The Finance 202: 2018 midterms look a lot like 1970 ...https://www.washingtonpost.com/news/powerpost/paloma/the-finance-202/2018/11/05/the...Nov 05, 2018 · Rarely has there been as great a distance between views about the economy and a president’s ratings as there is this year.” ... in each of the first two quarters of 2019, as …

13 Sep 2016 Compliance spending on data grows as finance ...https://burton-taylor.com/compliance-spending-on-data-grows-as-finance-responds-to...Sep 13, 2016 · 13 Sep 2016 Compliance spending on data grows as finance responds to ... The Financial Industry Regulatory Authority has taken a lead in defining the standards for a compliance culture, and in his valedictory speech as he chaired his final FINRA annual conference in Washington then-Chairman and Chief Executive Officer Richard Ketchum saw ...

Could Islamic finance save capitalism? - IslamicMarkets.comhttps://islamicmarkets.com/articles/could-islamic-finance-save-capitalismThis is the concept of moral hazard: profits are privatised but losses are socialised. Disturbingly, British politicians seem to have little understanding of money. On 20 November 2014, the House of Commons witnessed around 30 Members of Parliament debate money creation in the first session of its kind for 170 years. That so few turned up ...

Can Greed Save Africa? - NextBillionhttps://nextbillion.net/news/can-greed-save-africaDec 05, 2007 · By Roben Farzad It isn’t easy for Masoud Alikhani to check on his investment. The Iranian-born Briton owns a facility in Mozambique that turns jatropha, a hardy, drought-resistant plant, into biodiesel. An October visit starts with an 11-hour flight from London, his home base, to Johannesburg. From there he jumps into a four-seat Piper Seneca […]

[ The Financial Ninja ]: 3/16/08 - 3/23/08https://benbittrolff.blogspot.com/2008_03_16_archive.htmlMar 01, 2008 · The Financial Ninja is a collection of my thoughts and opinions about current economic and market conditions. These are not buy and sell recommendations. Use your head and do your own research. This is a forum to stimulate discussion and debate.

The Truth about the 2009 BailoutsNikitas3.comnikitas3.com/3841/the-truth-about-the-2009-bailoutsJan 09, 2013 · For instance Chelsea Clinton worked for a New York hedge fund. These are the people who urged banks and Wall Street investment firms to become institutions of social engineering that hardly asked any questions before loaning people money, causing the housing bubble that burst. Because to liberals, everyone deserves credit, no questions asked.

Global Knowledge Management and Economy - Nik Zafri: 04/01 ...https://nikzafri.blogspot.com/2011_04_01_archive.htmlCovers all interesting topics related to modern management systems incl. quality, safety, environmental, business, finance, banking, economy, multi engineering ...

A Certain Enthusiasm: October 2012https://fredbauerblog.blogspot.com/2012/10Fear of failure is one of the greatest sharpeners of prudence in a capitalist marketplace; by putting the safety net of government bailouts under certain banks, we at once encourage them to be more reckless and to make less sound investments. This is a bad outcome …

Stock Psychology: Safe Haven in a Global Crisis of Trusthttps://stockology.blogspot.com/2008/10/safe-haven-in-global-crisis-of-trust.htmlOct 02, 2008 · I still believe this is one of the best investments I can find in short term, so I am sticking to my convictions. Is it any strange that today logic and rational thinking has been replaced by manipulation, distortion and absurdity? Otherwise we would not have a global financial crisis like we see today.

PERSONAL FINANCEhttps://allbouturpersonalfinance.blogspot.comSep 27, 2008 · The idea behind a mutual fund is simple: Many people pool their money in a fund, which invests in various securities. Each investor shares proportionately in the fund's investment returns -- the income (dividends or interest) paid on the securities and any capital gains or losses caused by sales of securities the fund holds.

DocGothamhttps://docgotham.blogspot.comThis is a good, honest business to be in. I believe we're all in agreement here. Another fine business to be in is the business of buying loans. I refinanced my student loan several years ago thanks to a company that was willing to buy it from my original lender, and now my interest rates are lower. Quite a few people do this with their home loans.

Do You Have Have Prescription Viagra | TrustedPillsUSAhttps://www.maadusa.org/?do_you_have_have_prescription_viagraThroughout The Walk There Were Loads Of Frogs Spawn And Any Number Of Snipe A Couple Of Woodcock As Well As Pheasants And Of Course Exmoor Ponies. This Is A New Media Age. According To A Financial Post Article Dating Back To May Of This Year This Year Si The First Year Our Government Had A Deficit For The First Time In 12 Years.

A Guide To Using WallStreetSurvivor.comhttps://studylib.net/doc/8137661/a-guide-to-using-wallstreetsurvivor.comThe Wiley Business Unusual Stock Market Simulation! A Guide To Using WallStreetSurvivor.com 1|Page Introduction Welcome to the Wiley Business Unusual Stock Market Simulation at Wall Street Survivor! Basic financial planning reminds us to “save early and save often” and “save it for a rainy day.”

Marxism and Film | All that is Solid for Glenn Rikowskihttps://rikowski.wordpress.com/tag/marxism-and-filmJan 28, 2014 · As the belief in neoliberal theory and practice collapsed, many turned to the alternative theory – that of Marxism, not least because for Marx the challenge for human thought was not simply to understand the world but to change it. Not for the first time Marx is ‘fashionable’.

??????????????????????????? - …https://ejje.weblio.jp/sentence/content/?????????Translate this pagePossible candidates for contracting partners of bilateral investment treaties are the countries that can improve transparency and their investment environment through conclusion of the treaty, those possessing or likely to receive a certain level of Japanese investment stock, producers of petroleum or natural gas, such as the Middle East ...

lawer - blogspot.comhttps://hiyelang.blogspot.comTranslate this pageFairfield Greenwich Group is one of the largest investment funds in the Madoff, according to the group's own statistics, the group $ 14.1 billion portfolio, $ 7.5 billion investment fund to Madoff. In March 2009, Madoff pleaded guilty to securities fraud and other charges, June 29, 2009, Madoff was sentenced to a maximum of 150 years in prison.

Get in Line Chapter 11 Restructuring in Crowded Bankruptcy ...www.doc88.com/p-9751504039646.htmlTranslate this page??????????????? ????????????????

Dodd Billhttps://rhapsody848doddbill.blogspot.comFlawed methodology, weak oversight by regulators, conflicts of interest, and a total lack of transparency contributed to a system in which AAA ratings were awarded to complex, unsafe asset-backed securities - adding to the housing bubble and magnifying the financial shock caused when the bubble burst.

Financial Markets | Rational Arrogance | Page 114https://rationalarrogance.wordpress.com/tag/financial-markets/page/114“But it is important to be prepared because it may be difficult times ahead,” he adds. “Moreover, Norway’s Central Bank has warned of higher interest rates. We currently have an abnormally low interest rates, and we can not expect that it will last.” “2010 will be an uncertain year. How this will turn out in 2011, we must come back to.

IMF sees severe global recession | SBS Newshttps://www.sbs.com.au/news/imf-sees-severe-global-recessionIMF sees severe global recession ... The IMF offered no timeline for a recovery from the first global recession in six decades. ... such as the Latin American debt crisis in the 1980s and the ...

Interest on T-bills hits zero | Gold Anti-Trust Action ...www.gata.org/node/6975Dec 09, 2008 · As the stock market has taken its alarming plunge, people have been moving money from riskier assets to safer ones. According to Crane Data, funds invested purely in Treasurys have surged more than 150 percent over the past year, to $726 billion. Earning zero percent on an investment for a short while may not seem that dire for the average person.[PDF]

assets « Stop PHH Mortgagehttps://phhmortgage.wordpress.com/tag/assetsBanks will instead keep all of their value and shareholders by lying about the value of their assets. Isn’t this just fantastic! I felt bad for not knowing about the MTM rule in the first place and not knowing about the rule’s demise in April. I try really hard to know about current events especially when it …[PDF]Monthly Income Plans – The best of both worldswww.justtrade.in/download/fundtheme/fundtheme_giltfunds.pdfMonthly Income Plans – The best of both worlds What is an MIP? MIP is a hybrid investment plan that invests a small portion of its portfolio, around 15 to 25 percent, in Equities, and the remaining in Debt and Money Market Instruments. This plan is ideal for those investors who …

Essays on GCC financial markets and monetary policies ...https://eprints.soton.ac.uk/365325This dissertation explores economic integration in the context of the Gulf Cooperation Council countries (GCC), which planned to form a monetary union, by assessing three different but related empirical research questions regarding GCC financial markets and monetary policies. Chapter 2 presents the first essay, which empirically investigates the pairwise linkages and volatility spillovers ...

Accrued Interest: My God, they aren't kidding!https://accruedint.blogspot.com/2008/11/my-god-they-arent-kidding.htmlNov 25, 2008 · I oversee taxable bond trading for a small investment management firm. Opinions expressed on this website may not reflect the opinions of my employers. Strategies described here should not be taken as advice, and may not be the strategies being used for my clients. Take this website as the egotistical ramblings of a bond geek and nothing more.

Thomson Reuters launches global indices - Money Marketinghttps://www.moneymarketing.co.uk/news/thomson-reuters-launches-global-indicesThomson Reuters has launched a global range of indices to monitor global markets, benchmark specific countries, regions, and sectors, and develop investment vehicles.The move marks the first time ...[PDF]R&I Rating Methodology by Sectorhttps://www.r-i.co.jp/en/methodology_sector/2018/07/methodology_sector_20180705_eng.pdfJul 05, 2018 · are cases where the construction period for a large-scale project will stretch over several years, leading to the possibility that working capital will become a substantial burden. Moreover, sometimes a firm ultimately suffers a loss as a result of unsuccessful negotiations for revising the contract price, for example.

Indian government set to approve $714m UTI AMC IPO | # ...https://amrank.info/2018/08/30/indian-government-set-to-approve-714m-uti-amc-ipo...Anirudh Laskar | DealStreetAsia – IPO T . Rowe Price, the largest shareholder of UTI Asset Management Co. (UTI AMC), called a truce with the government and the markets regulator after the finance ministry agreed to issue a no-objection (NOC) letter for UTI AMC’s initial share sale, and direct state-run financial institutions to cut their […]

Gold Jumps To Crucial Technical Level. Important Action ...https://www.investmentwatchblog.com/gold-jumps-to-crucial-technical-level-important...Jan 25, 2018 · The following chart has a couple of technical indicators that, if history still matters, shed some light on the challenges gold now faces. The first is the 50-day moving average, shown here as the thin line that tracks the more colorful price line.

Could the Big Short Happen Again? - Personal Finance ...pfsyn.com/2645/big-short-happenThe movie The Big Short has thrust the mortgage and real estate markets into the spotlight again. The movie does an excellent job of explaining very complicated financial issues while also powerfully conveying the emotionally devastating effects of the collapse of the real estate market and economy in 2008. Some of the most poignant scenes … Continue reading Could the Big Short Happen Again?

China's green policies knock ours into a cocked hathttps://theecologist.org/2009/sep/16/chinas-green-policies-knock-ours-cocked-hatChina's green policies knock ours into a cocked hat. Dan Box ... This is a big deal; emissions trading has come in for a lot of flak and it's a brave man who says he knows for sure where the market will go, but one thing's for sure - China pumps out so much CO2 (20 per cent of the global smog) that any plan to cap it will have a huge effect on ...[PDF]Karl S. Okamoto**www.uclalawreview.org/pdf/57-1-4.pdf186 57 UCLA LAW REVIEW 183 (2009) As the U.S. government responds to the immediate crisis,5 attention has turned to the question of a broader regulatory response.6 Each time we go through this kind of market upheaval,7 we ask ourselves how better regulation could have prevented the harm.

Financial Weapons of Mass Destruction – Thought Economicshttps://thoughteconomics.com/financial-weapons-of-mass-destructionFinancial Weapons of Mass Destruction. ... knows their weapons capability acts as the ultimate defensive posture, insofar as even the smallest of modern nuclear devices has adequate yield and range to destroy a city. ... - the first step for any career politician is firstly find someone to blame, and secondly make sure you show the population ...

GM profit plunges 90 pct after housing finance loss ...https://www.oneindia.com/2007/05/04/gm-profit-plunges-90-pct-after-housing-finance...May 04, 2007 · GM, which Toyota Motor Corp. displaced as the world's largest automaker in the first quarter, said profit fell to $62 million, or 11 cents a share, from $602 million, or $1.06 per share, a year ...

How Bad is the Situation at Deutsche Bank? - Vivek Kaul's ...https://www.equitymaster.com/diary/detail.asp?date=10/03/2016&story=5The markets reflect the psychological anxiety people have that something is wrong with our financial system. And yet again, the problems in the financial system threaten to spill over into the real economy, into national politics, and into geopolitical relations. If there was ever a time for a cheap beer, it's now.

Do Romanian Banking Institutions Create Shareholder Value ...https://www.sciencedirect.com/science/article/pii/S2212567112001335Procedia Economics and Finance 3 ( 2012 ) 144 – 151 2212-6716 2012 The Authors. Published by Elsevier Ltd. Selection and peer review under responsibility of Emerging Markets Queries in Finance and Business local organization. doi: 10.1016/S2212-5671(12)00133-5 Emerging Markets Queries in Finance and Business Do Romanian Banking Institutions Create Shareholder Value?

Debt – Soullfirehttps://soullfire.wordpress.com/tag/debtDubai, the play city for the wealthy, has run into financial problems due to plunging real estate values and has asked its creditors for a delay in its debt repayment schedule. Okay, so the fact that Dubai is in danger of defaulting on their debt and facing bankruptcy is just the first part of the interesting news.

21 | November | 2016 | Justice Leaguehttps://justiceleaguetaskforce.wordpress.com/2016/11/21Nov 21, 2016 · 3 posts published by justiceleague00 on November 21, 2016. Citigroup Inc. (C – Free Report) entered into an agreement to sell CitiFinancial, its subprime lending unit in Canada, to an investor group led by private investment firm, JC Flowers and Värde Partners. This is part of Citigroup’s strategy to emphasize on growth in core businesses through restructuring, expense management and ...

Financial Crisis: European Central Bank Pumps €70 Billion ...https://www.spiegel.de/international/business/... · Translate this pageAiming to prevent a financial calamity, the European Central Bank, the Bank of England and the Bank of Japan together pumped more than €111.7 billion ($159.3 billion) in quick tenders into the ...

Banking crisis: New Resolution Trust Corporation mooted ...https://thepropertypin.com/t/banking-crisis-new-resolution-trust-corporation-mooted/12912Big and all as the outlined plan is (and it is only an outline plan at this stage, initial suggestions are $500 bn), there is no way the US can buy/absorb everones toxic debt, so all it can do is somewhat reduce the problem. ... This is the last shot at slowing the credit crunch. ... Reports to Congress. Within three months of the first ...

CFE VIX Futures Trading Strategies | Vix | Futures Contracthttps://www.scribd.com/document/160949223/CFE-VIX-Futures-Trading-StrategiesAM settlement involves a special calculation of the VIX Index taking place the morning after the end of trading for a futures contract. This is known as the Special Opening Quotation. 9 CHICAGO BOARD OPTIONS EXCHANGE VIX Futures Special Opening Quotation (SOQ) This is a unique VIX index quote that involves only actual S&P 500 option trades. The ...

Standard Chartered | Islamic Finance News Portal ...https://islamicfinanceupdates.wordpress.com/tag/standard-charteredNov 05, 2008 · Meanwhile Royal Bank of Scotland plans to apply for a licence to set up the same establishment. Mon Aug 18, 2008 8:01am EDT. KUALA LUMPUR (Reuters) – Standard Chartered Bank and Royal Bank of Scotland (RBS) plan to set up Islamic banking subsidiaries in Malaysia, local media reported on Monday.

prima de bonos - Traducción al inglés – Lingueehttps://www.linguee.es/espanol-ingles/traduccion/prima+de+bonos.htmlAgainst this background, some additional factors helped to trigger the crisis and to exacerbate the impact of these underlying weaknesses: (vi) a series of adverse external shocks, including the appreciation of the U.S. dollar, the Russian default and the LTCM crisis, the devaluation of the Brazilian real, and the global economic slowdown; (vii) the impact of slow growth and

And So It Begins - The First Major European Bank Has Been ...theeconomiccollapseblog.com/archives/and-so-it-begins-the-first-major-european-bank...Oct 06, 2011 · Sadly, not the first time that Dexia has been bailed out. France and Belgium also bailed out Dexia back in 2008. But this was not supposed to happen. Just three months ago, Dexia received “a clean bill of health” from regulators during European Union bank stress testing. It just shows how credible those “stress tests” really are.

Political instability and global slump intensify financial ...https://newsfortherevolution.wordpress.com/2015/01/07/political-instability-and-global...Jan 07, 2015 · In the wake of the financial crisis of 2008, China provided a stimulus to global growth as the government embarked on a major spending program and expanded credit. But China now faces the prospect, for the first time since the recession of 2009, of a fall in its growth rate to below the 7 percent level considered necessary to maintain employment.

Swing Trade Portfolio - Psychology and Money ... - futures.iohttps://futures.io/psychology-money-management/50419-swing-trade-portfolio.html(If you already have an account, login at the top of the page) futures io is the largest futures trading community on the planet, with over 100,000 members. At futures io, our goal has always been and always will be to create a friendly, positive, forward-thinking community where members can openly share and discuss everything the world of trading has to offer.

Erie | tenentepilarhttps://tenentepilar.wordpress.com/tag/erieJun 27, 2011 · It’s hard to ignore the symbolism in Harrisburg failing to agree to a state takeover plan to balance the fiscal milieu it is currently in. The city, the center of policymaking in our state, is in such poor financial shape that the state is attempting to force the city council to enact an austerity plan as part of the state’s Act 47 law.. It’s difficult to see how such a situation seemed ...

Change we should forget about - University of St Andrewshttps://thetab.com/uk/stand/2012/07/01/opinionschange-we-should-forget-about-617Change we should forget about ... positions that have led to a $2bn loss for one of the world’s supposedly more responsible investment banks. ... across Europe for a week without any money? This ...

Skimming Profits Off Bad Loans: Bankers And Their Dirty ...https://www.globalresearch.ca/skimming-profits-off-bad-loans-bankers-and-their-dirty...Sep 29, 2012 · So, what else are the banks up to besides keeping rates elevated so they can make a bigger killing on refis? Well, for one thing, they’re using their high-powered attorneys and lobbyists to twist arms at the Federal Housing Finance Agency (FHFA) to make it easier for them to make bad loans without suffering any consequences.

Corporate Governance & Ethics Case Study Example | Topics ...https://studentshare.org/finance-accounting/1486752-corporate-governance-ethicsCorporate Governance and Ethics: GSK Case Study Introduction GlaxoSmithKline is one of the largest pharmaceutical companies in the world, currently ranked at fourth in world based on market capitalization and the number of subsidiaries in the world following Pfizer, Novartis and Sarnoff multinationals…

Crisis bites Citigroup and Swiss banks - Reutershttps://uk.reuters.com/article/us-economy-credit/crisis-bites-citigroup-and-swiss...Oct 01, 2007 · The credit crisis struck at the heart of global finance on Monday as Swiss bank UBS AG said it faced a shocking loss in the third quarter and Citigroup warned its profits were in a steep slide.

Prajna Capital - An Investment Guidehttps://prajnacapital.blogspot.com/2011/10Now, an easy way to do to refer to the 26AS statement. This statement is accessible on the NSDL site and is also available online on the websites of many banks. According to a recent advice issued by the Income Tax Department, taxpayers should review their 26AS statements to …

Credit derivative - Infogalactic: the planetary knowledge corehttps://infogalactic.com/info/Credit_derivativeIf the credit derivative is entered into by a financial institution or a special purpose vehicle (SPV) and payments under the credit derivative are funded using securitization techniques, such that a debt obligation is issued by the financial institution or SPV to support these obligations, known as a funded credit derivative.[PDF]CHARLES STANLEY Issue 3https://www.csinvestmentchoices.co.uk/file/323/download?token=W9-rFGmeif appropriate, how much of invested in growth-oriented equities. All financial investments involve an element of risk, so the value of your initial investment cannot be guaranteed and the historical performance of markets is not a guide to future returns. Source: Thomson Reuters Datastream. All data from 31 December 1990 to 31 July 2016.

Credit derivative : definition of Credit derivative and ...dictionary.sensagent.com/Credit derivative/en-enIn finance, a credit derivative refers to any one of "various instruments and techniques designed to separate and then transfer the credit risk" of the underlying loan. [1] It is a securitized derivative whereby the credit risk is transferred to an entity other than the lender. [2] [3]Where credit protection is bought and sold between bilateral counterparties, known as an unfunded ...[PDF]Nokia's marketing stategies of mobile phones in Thailand ...https://scholarworks.lib.csusb.edu/cgi/viewcontent.cgi?article=3209&context=etd-projectrevealed that the handsets are the single largest up-front cost for a potential cellular subscriber; however, the cost ‘of handsets has been consistently declining by 15-20% per year in Asia. Lower handset prices combined with declining fee structures are making cellular service more 3

Wong Sui Jau Thoughts: August 2011https://suijau.blogspot.com/2011/08The reason why I think we are quite close is because we already started from a relatively low base this year. Its not like markets had been in a bull run for several years (like in 2008), markets were already quite cautious and grappling with various concerns like a double dip recession, the European financial debt crisis and China inflation since last year.

Nigerian Stock Exchange Market Pick Alerts - Investment ...https://www.nairaland.com/1131485/nigerian-stock-exchange-market-pick/3949And also why do the regulatory authorities stand by with all the red flags and watch companies ground to a halt or get to a dire state be4 coming up with reforms for implementation when in fact the minority shareholders are the ones that always end up being at the receiving end! ... Well this is one of the reason why we should always go for ...

Iceland « Olduvaiblog: Musings on the coming collapsehttps://olduvaiblog.wordpress.com/tag/icelandAnd at this point, thanks to a long-standing policy of wanton money printing, the Fed has more liabilities than ever before in its history. By an enormous margin. This precarious balance sheet is dangerous, because if the Fed goes bust, everyone loses. Is it even possible for a central bank to go bust? Definitely.

Financial institutions would have been adversely affectedwww.expertsmind.com/library/financial-institutions-would-have-been-adversely-affected...1. If AIG had been allowed to fail, what types of financial institutions would have been adversely affected? 2. Who benefited from the bailout of AIG? 3. Do you think AIG should have been allowed to fail? Its not a case study, the event.

Homework Set #5: Chapter 12, business and finance homework ...https://www.studypool.com/discuss/4310680/Homework...Directions: Answer the following questions on a separate document. Explain how you reached the answer or show your work if a mathematical calculation is needed, or both. Submit your assignment using the assignment link above.In your own words, complete the Mini-Case on Page 562 of your textbook.Suppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your …

79 Cimarron Trail Angel Fire, NM Investment Property ...https://www.mashvisor.com/cities/property/79-cimarron-trail-angel-fire-nm-87710/...Investment property in Angel Fire, NM. View 79 Cimarron Trail, Angel Fire, NM real estate investment calculator for traditional & Airbnb rental properties. For Sale Price: $425000 | 4 bed, 3 bath, 28750 Sq. Ft. Single Family Residential.

rtf (4) | Leadership | Leadership & Mentoringhttps://www.scribd.com/document/344646037/rtf-4One of my employees works harder and logs more overtime and consistently works weekends when needed compared with any of the other staff in our department. ... This is a. A criticism of ethical leadership b. A strength of ethical leadership c. ... The ethics of the leader are the ethics of followers b.[PPT]Slide 1https://www.sec.gov/rules/proposed/s72104/bma092204.ppt · Web viewThe Credit Derivatives market is one of the largest, fastest growing sectors of the financial industry The Credit Derivatives market is forecasted to reach a size of approximately 4.8 trillion by the end of 2004(1) Credit Default Swaps account for 67% of the Credit Derivatives market(2) The default swap market presents the opportunity to ...

Essay about real estate finance analysis sheet - 483 Words ...https://www.majortests.com/essay/Real-Estate-Finance-Analysis-Sheet-595719.htmlgood of the branch and its equity. Goldman Sachs was one of the least-affected banks, but lost a third of its market value. Lehman brothers profited from both residential mortgages and commercial property loans, and handled every aspect of real estate finance.

Financial Foundations, Inc., 1 Research Dr, Ste 100B ...www.findglocal.com/US/Westborough/162904093805478/Financial-Foundations,-Inc.Our team of financial professionals provides a wide range of services, including financial and estate planning, strategic retirement planning, asset management, wealth accumulation and wealth protection. We counsel our clients with the goal of maximizing their employee benefit plans and help them address the risk in their lives through insurance planning.

PPT - “ International Investments and Financial Markets ...https://www.slideserve.com/abelr/international-investments-and-financial-markets...“ International Investments and Financial Markets Analysis ”. Plastun Alex , Ph.D, Professor of the Chair of International Economics. On completion of the module/unit the learner will be able to: 1 . Understand the major theories and concepts describing the behavior of financial markets.

financial dealings - Deutsch-Übersetzung – Linguee Wörterbuchhttps://www.linguee.de/englisch-deutsch/...Translate this pageThis is the source of all the scandals, great and small, over murky financial dealings which, Schröder points out, are the way of the rest of the world and would in most cases be treated as peccadilloes. grethaller.ch. grethaller.ch. Er meint, dass sich die Bürger dadurch von der Politik abkoppeln, ... a business analyst for a giant ...

Securities_Finance_Securities_Lending_and_Repurchase ...https://max.book118.com/html/2017/1101/138496521.shtmTranslate this pageFinding the most suit- able route to participate in the securities lending market and the issue of selecting a suitable counterparty are the subjects of Chapter 3 by Mark Faulkner, focusing on the lending of international equities with regard to both lending and nonlending institutions.

The MQ Foundationhttps://www.mqmentalhealth.org/mission/mq-foundationAs the exclusive US partner of MQ, the MQ Foundation is now poised to “promote, advance, foster and support mental health research into the nature, cause, diagnosis, treatment, cure and prevention of all forms of mental illness and to promote public awareness …[PDF]Trade Policy Review Body TRADE POLICY REVIEWhttps://www.wto.org/english/tratop_e/tpr_e/g310_e.pdf2.10. Observing the compliance with the WTO rules through Dispute Settlement is one of the most important and critical roles played by the WTO to maintain an open and fair multilateral trading system. Japan has actively engaged in the WTO dispute settlement mechanism to resolve disputes as both a party and a third party to a dispute.

San Miguel Corporation is one of the Ph Research Paper ...https://www.studymode.com/essays/San-Miguel-Corporation-Is-One-Of-66911122.html?San Miguel Corporation is one of the Philippines’ largest and most diversified conglomerates, generating about 6.5% of the country’s gross domestic product in 2013 through its highly integrated operations in beverages, food, packaging, fuel and oil, power and infrastructure[PDF]Columbia California Ta x-Exempt Fundglobaldocuments.morningstar.com/documentlibrary/document/0aeb2143dc243258.msdoc/originalColumbia California Ta x-Exempt Fund Annual Report October 31, 2004 Merrill Corporation ... well as the senior leadership of Columbia Management, the investment management arm of Bank of America, and with Bank of America’s principal compliance executives. She will focus on the overall

Germany Bails Out Ailing Mortgage Lender Hypo Real Estate ...https://www.dw.com/en/germany-bails-out-ailing-mortgage-lender-hypo-real-estate/a-3678247Germany's government and top banks were injecting billions of euros Monday into troubled commercial property lender Hypo Real Estate, the first German blue-chip company to seek a bailout in the ...[PDF]THE FUTURE OF THE CFTC: PERSPECTIVES ON CUSTOMER ...https://archives-agriculture.house.gov/sites/republicans.agriculture.house.gov/files/...positions. Any additional losses are absorbed by other financial safeguards, such as the mutualized clearing default guaranty funds maintained by CCPs. No FCM default to date has ever resulted in any losses to a U.S. CCP’s clearing default fund. A third risk-management principle underlying U.S. futures markets is the protection of customer assets

Enron collapse - Salem Press - MAFIADOC.COMhttps://mafiadoc.com/enron-collapse-salem-press_59ee43401723dd51e44916a0.htmlAs the decade drew to a close, the rendition policy began to be more closely monitored by the US government. In 2009, President Barack Obama signed executive orders that retained the rendition policy while also promulgating stricter controls allowing the president to approve or disapprove individual cases.

What's Next for the U.S. dollar, British Pound and ...https://tradingeconomics.com/articles/03162009115007.htmMar 16, 2009 · Yet, in the first five months of 2009, like in 2006 and 2007, the greenback depreciated sharply due to spending spree of U.S. government. Looking ahead, we see a potential for gradual Dollar recovery as the US economy starts rebounding and the current account deficit improves. Published on …[PDF]Connect Plus and M25https://services.files.skanska.com/file/download/a75980b3-2c98-47bd-b8fa-5cd0a732a3da.1Agency) is one of the UK’s largest ever PPPs. Construction was completed in two phases: the first in 2012 in time for the London Olympics, and the second in 2014. Operation and maintenance are ongoing, and the concession runs from May 2009 to September 2039, with services having started in September 2009 on financial close. The entire contract

Federal government of the United States | Financial Crisis ...https://debtcrisis.wordpress.com/tag/federal-government-of-the-united-statesThe company, one of three major agencies that offer advice to investors in debt securities, said it was cutting its rating of long-term federal debt to AA+, one notch below the top grade of AAA. It described the decision as a judgment about the nation’s leaders, writing that “the gulf between the political parties” had reduced its confidence in the government’s ability to manage its ...[PDF]Rede MD BPK 2010 englisch NEU - Allianzhttps://www.allianz.com/content/dam/onemarketing/azcom/Allianz_com/press/document/...Following Hurricane "Klaus" in January and a marked accumulation of mid-sized losses incurred by adverse weather during the first half of the year, we did however succeed in significantly reducing the combined ratio during the second half of 2009 and achieving a ratio of 97.4 percent for the entire year.

Meet the ChannelAdvisor Board of Directors ...https://www.channeladvisor.com.au/about/board-of-directorsFrom 2009 to 2010, Mr. Cowan served as a consultant with Vector Capital, a venture capital investment firm. He served as chief executive officer and a member of the board of directors of Interwoven Inc., a publicly held provider of enterprise content management software, from 2007 until its acquisition by Autonomy, Inc. in 2009.

Dollar, Yen Drophttps://tradingeconomics.com/articles/12022008130840.htmDec 02, 2008 · At the beginning of the last year we were arguing that the U.S. dollar could lose its position as the most popular reserve currency in favor of the Euro. But in the second quarter of 2008 the dollar suddenly started to rebound and began one of its biggest rallies in years, going from 1.6 to 1.2 dollars per euro in only three months.

Wall St vets battle BP in fallout over Canada refineryhttps://uk.finance.yahoo.com/news/wall-st-vets-battle-bp-130956479.htmlMar 07, 2016 · The first salvo in the previously unreported dispute was fired by BP in December. The oil company demanded, through arbitration, $110 million from the private equity-backed NARL Refining for its alleged failure to properly manage and maximize profits from …

French press review 20 January 2014www.rfi.fr/en/france/20140120-french-press-review-20-january-2014Jan 20, 2014 · The two situations are distinct: Syria's civil war has killed at least 130,000 people and displaced millions. Iran's continued advance along the road to a nuclear weapon has both regional and ...[PDF]Legislative Councilhttps://www.legco.gov.hk/yr10-11/english/panels/fa/papers/fa0509cb1-2049-e.pdfin the first three years. The FDRC will be funded by the financial industry, and to a lesser extent the claimants, thereafter. The FDRC service will be offered at a fee to both the claimants and financial institutions, under a "pay-as-you-use" principle, with a higher fee for financial institutions to

San Jose Finance Authority, Jan. 13, 2004www3.sanjoseca.gov/clerk/agenda/01_13_04docs/01_13_04_SJFA_2b.htmRecommendation. 1. Conduct a Public Hearing of the City Council concerning the approval of the financing by the City of San Jose Financing Authority’s issuance of commercial paper and/or lease revenue bonds in order to finance certain public capital improvements of the City, consisting of an offsite parking garage for the new Civic Center and non-construction costs for technology, furniture ...

Jakarta Stock Exchange Selects InfoReach FIX Engine | News ...https://www.inforeachinc.com/news/jakarta-stock-exchange-selects-inforeach-fix-engine...CHICAGO, February 21, 2002 — Nearly 200 member firms of the Jakarta Stock Exchange (JSX) will soon be able to trade electronically via Financial Information Exchange (FIX) Protocol, thanks to technology supplied by InfoReach, Inc. (www.inforeachinc.com).The JSX has licensed InfoReach FIX Engine as part of its Jakarta Automated Trading System (JATS) remote trading project.

New money: Is gold being ousted by Bitcoin?https://www.coutts.com/insight-articles/news/2018/new-money--is-gold-being-ousted-by...Apr 30, 2018 · One of the big problems with gold is the complex factors that influence its price. The gold supply is limited and relatively static. There are approximately 190,000 tonnes ‘above ground’ according to the World Gold Council, equivalent to a cube measuring about 21 metres on each side. Mining adds about 2,500 to 3,000 tonnes a year.[PDF]gdf overview 001-006 - World Banksiteresources.worldbank.org/INTGDF2009/Resources/gdf_overview_001-006_web.pdfin 2009, the first contraction since World War II. ... commodity importers, one of the few silver linings ... gdf_overview_001-006.qxd 6/10/09 12:43 PM Page 2. OVERVIEW 3 of the current crisis on the poor. Commodity mar-kets seem to have found a bottom, one that is still

Sales pick up at Ardmore Park area - Yahoohttps://sg.finance.yahoo.com/news/sales-pick-ardmore-park-area-003000910.htmlOver the past couple of weeks, sales activities at the prestigious Ardmore Park neighbourhood have been brisk. Ardmore Three, a freehold development by Wheelock Properties, registered the sale of a fourth unit in as many weeks. The latest transaction, on Feb 13, was for the sale of a 1,787 sq ft, three-bedroom

Welcome to Daily Research News Onlinewww.mrweb.com/drno/conf-asiapac.htmIndia topped global rankings as the most optimistic nations, while in the last 12 months, consumer confidence in Japan, the world's second-largest economy, plunged 19 points In April. New Zealand also dropped a staggering 18 points in the last six months - its lowest level in a decade mainly due to interest rates, which have skyrocketed to 8.25%.[PDF]Hong Kong CFOs share lessons Institute from financial crisisapp1.hkicpa.org.hk/APLUS/0910/Aplus_News.pdfHong Kong CFOs share lessons from financial crisis Top Hong Kong accountants say ready cash and cost cutting key to getting through recession Business leaders in Hong Kong steering their company’s finances through the financial crisis say they used both short- and long-term strategies, according to a survey released last month by the Institute.

Commodity prices fueling inflation: BIS | Futureswww.futuresmag.com/2011/03/11/commodity-prices-fueling-inflation-bisMar 11, 2011 · Report discusses how higher growth in advanced economies and surging commodity prices are pushing up short-term inflation expectations.[PDF]Disrupting Debt and Austerityhttps://altausterity.mcmaster.ca/documents/sorg-berlin-paper-to-post.pdfAusterity measures have faced one of the biggest and most dynamic wave of protest in recent decades. While a pluralism of issues converged in the occupied squares of 2011, such as stagnating wages, housing rights, political corruption etc., debt constituted one of …[PDF]SELF INFLICTED OR JUST BAD LUCK - Stockholm School of ...arc.hhs.se/download.aspx?MediumId=828SELF-INFLICTED OR JUST BAD LUCK? ABSTRACT: ... the first five months of the crisis, on real exchange rates, bank lending and levels of reserves for . 4 ... As the current crisis is often called a financial crisis this term is also used when we describe the purpose of our paper. In this section, however, we will use the term currency crisis

Brazil Financial Markets | Brazil Portalhttps://brazilportal.wordpress.com/tag/brazil-financial-marketsBut a former BNDES chairman, Luiz Carlos Mendonça de Barros, says it is a serpent’s egg—a reference to a film about the origins of the Nazi party. And a former central-bank chief, Gustavo Loyola, dubs the bank “Jurassic” and reckons its links with the treasury recall one of the worst periods of military rule.

widening of bid ask spreads - Deutsch-Übersetzung ...https://www.linguee.de/englisch-deutsch/...Translate this pagemassive decline in market liquidity, as well as the resultant significant decrease in trading volume until the third quarter of 2009 for corporate bonds and until the fourth quarter of 2009 for European government bonds, Pfandbriefe, and bank bonds.

colapso do revestimento - Tradução em inglês – Lingueehttps://www.linguee.com.br/portugues-ingles/...Translate this pageThe crisis triggered by the Wall Street Crash in 1929 destroyed this dream and plunged the world into one of its darkest periods ... which hinder proper drainage and airing of the ... The slow-down in economic growth of the developed countries and particularly of the United States after the first oil shock, the extraordinary success of Japan ...

Deflation And Its Discontentshttps://deflationanditsdiscontents.blogspot.comHong Kong's worst bout of deflation in well over half a century is over. Five and a half years of steadily falling prices, driven by the collapse of the property market in 1997, ended as the consumer price index (CPI) jumped 0.9 per cent in July from last year's level, according to the Census and Statistics Bureau.

Times Square Timeshttps://timesquaretime.blogspot.comThe theaters of Broadway and the huge number of animated neon and LED signs have long made them one of New York's iconic images, and a symbol of the intensely urban aspects of Manhattan. Times Square is the only neighborhood with zoning ordinances …

Bankruptcy Court | Justice Leaguehttps://justiceleaguetaskforce.wordpress.com/tag/bankruptcy-courtA small Kentucky town is about to join a rather unfortunate club by becoming one of the few municipalities to file for bankruptcy protection. According to a Bloomberg report, Hillview, Kentucky, filed for bankruptcy this week, becoming the first municipality to file for bankruptcy since Detroit famously did in 2013.. From the Bloomberg report:. Hillview, which faced legal damages it couldn’t ...

Williams | Stocks | Equity (Finance)https://www.scribd.com/document/254825967/WilliamsWilliams could definitely be described as financially distressed and its business has been compromised as a result of its previous financial decisions. In the first quarter of 2002 Williams has an estimated loss on realization of amounts due from Williams Communications Group, Inc. …

Trading maven takes on Bay St. | The Starhttps://www.thestar.com/news/gta/2008/09/02/trading_maven_takes_on_bay_st.htmlSep 02, 2008 · Trading maven takes on Bay St. By Rita Trichur Business Reporter. ... such as the name of the trader and the number of shares being bought or …[PDF]CHANCE - SJTUsyclaw.sjtu.edu.cn/pochan/userfiles/1/files/sfdt/08 Guarantee Agreement in respect of...CHANCE CONFORMED COPY LEHMAN BROTHERS HOLDINGS INC. LEHMAN BROTHERS TREASURY CO. B.V. LEHMAN BROTHERS BANKHAUS AG ... delivered to a depositary or a common depositary or a common safekeeper or a custodian, as the case may be, for any one or more of the Clearing Systems (as defined ... 2.2 This Guarantee is one of payment and not collection. The ...

Dow Jones tops record high - POLITICOhttps://www.politico.com/story/2013/03/dow-jones-record-high-088423The gains represent a remarkable comeback for the stock market. The Dow has more than doubled since falling to a low of 6,547 in March 2009 following the financial crisis and the Great Recession.

New York State Common Retirement Fund Names Interim CIO ...https://www.institutionalinvestor.com/article/b1981wtkwg06xk/New-York-State-Common...Jul 27, 2018 · New York State Comptroller Thomas DiNapoli has announced an interim chief investment officer for the $207 billion pension fund, as Vicki Fuller will step down as CIO the week of July 30.

Despite speculation, M&I not likely to spin off Metavante ...https://www.atmmarketplace.com/news/despite-speculation-mi-not-likely-to-spin-off...MILWAUKEE, Wis. - Metavante Corp.'s flurry of recent acquisitions and its growing financial contribution to parent company Marshall & Ilsley Corp.'s bottom line have revived questions about the possibility of a spin-off. While Metavante and M&I executives recently said "no" to a near-term spin-off, according to a report in the Milwaukee Business Journal, some industry analysts believe ...

Asset Bubbles Are Making Davos Billionaires Richer ...https://www.investmentwatchblog.com/asset-bubbles-are-making-davos-billionaires-richerJan 24, 2019 · Since the dark days of the Great Recession in 2009, America has experienced one of the most powerful household wealth booms in its history. Household wealth has ballooned by approximately $46 trillion or 83% to an all-time high of $100.8 trillion. While most people welcome and applaud a wealth boom like this, my research shows that it is actually another dangerous bubble that is similar to the ...

Paul McNutt - Bank of Montrealhttps://capitalmarkets.bmo.com/en/our-bankers/paul-mcnuttPaul McNutt is a Managing Director and the Global Head of BMO’s Power, Utilities & Infrastructure Group. Based in New York City, Paul has global coverage responsibilities across large-cap regulated utilities, infrastructure funds and power-focused financial sponsors.

German bank consolidation pressures grow - Expat Guide to ...https://www.expatica.com/de/uncategorized/german...12 December 2003, BERLIN - Foreign banks are moving to beef up their presence in Germany as growth in Europe's biggest economy moves into a higher gear and fresh signs emerge of a shakeout in the country's fragmented banking industry. This week a city council in Germany's former east took a somewhat revolutionary step for the nation's finance sector by saying it was planning to put its savings ...

U.S. Senate panel nears agreement on role of Fedblogs.reuters.com/financial-regulatory-forum/2010/01/06/u-s-senate-panel-nears...Jan 06, 2010 · The sources said the consumer agency is being left as the last negotiating point because it is so contentious. Republicans will not vote for a bill that includes the agency as the White House proposed, one of the sources said. Shelby and Dodd have said they hope to reach a deal on financial reform before the Senate reconvenes on Jan. 20.

The Reykjavík Grapevine issue 03 2015 by Reykjavík ...https://issuu.com/rvkgrapevine/docs/issue_03_2015_master_issuu_all/14Issuu is a digital publishing platform that makes it simple to publish magazines, catalogs, newspapers, books, and more online. Easily share your publications and get them in front of Issuu’s ...[PDF]STATE OF CONNECTICUT HEALTH AND - CHEFAwww.chefa.com/system/files/052504 Consultant Committee Minutes.pdfThe Consultant Committee of the State of Connecticut Health and Educational Facilities Authority met in session at 11:32 a.m. on Tuesday, May 25, 2004. ... 2 Mr. Cohn abstained from the vote as he personally knows one of the members of the firms and has received a gift ... Responding to a question from Ms. Rubin, Mr. Morris stated that the ...[PDF]“I don’t know, investors and donors?”https://daymonsmith.files.wordpress.com/2012/07/mammonensignpeaksample.pdfIn fact one of the Corporation’s many insurance-financial firms, Beneficial Financial Group, had its financial-strength rating reviewed ... As the Cob says, [deleted] you; that is, let our money do the talking. ... So he puts in a call to pressure the IOC, and then a word to a few media cronies, say at Bonneville or Clear Channel, and he ...

Amit Munjal | AngelListhttps://angel.co/munjalamit•Headed the Finance and Investments Functions for a $110 Billion Division of Citi Group with $6 Billion in Annual Revenues and over 12,000 employees. ... Required reserves and write-offs as well as the impact of the deal on Cash Flow and Income Statement •Provided restructuring and turnaround consultation to a Financial Sponsor for its $200 ...[PDF]Cross-Border Liquidity, Price Dispersion and Monetary ...https://www.aeaweb.org/conference/2016/retrieve.php?pdfid=1341Cross-Border Liquidity, Price Dispersion and Monetary Policy: Evidence from the Euro Area Interbank Crisis* Puriya Abbassi1, Falk Bräuning2, Falko Fecht3 and José-Luis Peydró4 1Deutsche Bundesbank 2VU University Amsterdam and Tinbergen Institute 3Frankfurt School of Finance and Management 4ICREA-Universitat Pompeu Fabra, Cass Business School, CREI, Barcelona GSE and CEPR

BBC NEWS | Business | US stocks surge on rescue reportnews.bbc.co.uk/2/hi/business/7622318.stmSep 19, 2008 · Russia's main stock exchange suspended trading for a second consecutive day as the government tried to halt a sharp fall in share prices and restore confidence in the economy. The UK's Financial Services Authority has announced steps to restrict short-selling of shares while New York's attorney general has launched a probe into short-selling.[PDF]

Americans for Financial Reform - United States House of ...https://docs.house.gov/meetings/BA/BA15/20151021/...Oct 21, 2015 · funds.2 Problems emerging in any one of these sectors can easily impact the others, and if the risks involved are large enough they can threaten the stability of the entire financial system. But even as the financial system grew more deeply interrelated, our regulatory system continued to

Select Few Emerging Asian Economies Comfortable With Fed Hikeshttps://jakartaglobe.id/business/select-emerging-asian-economies-comfortable-fed-hikesJun 18, 2018 · One of the reasons why the surplus economies are under less pressure is foreign investor positioning. In deficit countries, investors tend to own shorter-term bonds, which are more liquid and less risky than longer-term debt. In countries with surpluses, …[PDF]34790 Federal Register /Vol. 68, No. 112/Wednesday, June ...https://www.cftc.gov/sites/default/files/files/foia/fedreg03/foi030611a.pdf34790 Federal Register/Vol. 68, No. 112/Wednesday, June 11, 2003/Rules and Regulations 1 The term account manager as used herein includes commodity trading advisors, investment advisers and other persons identified in the revised regulation, who would place orders and direct the

mpejr | Ethical issues in subprime loanshttps://mpejr.wordpress.comOne of the better definitions of subprime lending I have read is, “the act of offering financing to an individual with poor credit, low income, or limited documentation, who generally wouldn’t qualify for a mortgage at standard market rates” (Robertson, n.d., para. 1).

Lawless Capitalism - Project MUSEhttps://muse.jhu.edu/chapter/688798capital and took the risks—to a new and virulent managers’ capital-ism, where an excessive share of the rewards of capital investment went to corporate managers and financial intermediaries. John C. Bogle (2006)1 Legal infrastructure created the corporation, and it qualifies as one of the most economically powerful legal innovations in history.[PDF]

Danny Shamhong - Director - DenoVaS Solutions LTD | LinkedInhttps://uk.linkedin.com/in/danny-shamhong-aba333- Advisor to a startup venture on taking a Product Taxonomy solution to market (on going) - Product review of a blockchain based trading platform (3 days). - Programme Manager for a Finance Transformation Programme at a large Asset Management firm (1.5ys).Title: Technology & Change ManagementLocation: London, Greater London, United Kingdom500+ connections

Using Bankruptcy and Capital Standards to Address ...thf_media.s3.amazonaws.com/2009/pdf/bg2343.pdfUsing Bankruptcy and Capital Standards to Address ... For a discussion of this, see David C. John, “Financial ... To start the process of applying the resolution regime to a specific entity, the Treasury Department must determine that (a) the company is at risk of default, (b) failure of the firm would seriously and adversely affect financial ...

Meltdown Basics « The Impoverished Pauperhttps://impoverishedpauper.wordpress.com/2010/06/20/meltdown-basicsJun 20, 2010 · Below is the Impoverished Pauper's attempt to understand why and how the world economic meltdown occurred. It is my interpretation of a series of articles published in McClatchy Newspapers. Definitions first. They are necessary to understand who was being paid, how they were being paid, and what they were being paid for. Our country has created its own…[PDF]Institutional Choice in an Economic Crisisscholarship.law.upenn.edu/cgi/viewcontent.cgi?article=1449&context=faculty_scholarshipof the institutional environment, such as the possibility that Congress will respond to executive overreaching during a crisis by enacting legislation that ties the executive's hands in its wake. My aim in this Article is to advance, at least in a small way, our

Workers on boards: How they support better social outcomes ...highpaycentre.org/blog/workers-on-boards-how-they-support-better-social-outcomes-for...Oct 10, 2013 · Workers on boards: How they support better social outcomes for Germany High Pay Centre Head of Research Luke Hildyard writes for the All Party Parliamentary Group on Poverty. If the 2007/08 banking collapse represented a chastening for Britain, for Germany it …

Don't panic!https://www.newstatesman.com/economy/2009/05/government-debt-interestIf debt is the new Black Death, then Gordon Brown’s government appears to be riddled with plague spots. In the financial year 2007/2008, British government debt totalled just over £500bn. The Treasury now projects that this will rise to nearly £1.4trn by 2013/2014. £1,400,000,000,000! It is a stupendous figure, yet many outside commentators think it may be an underestimate. Surely Britain ...

Accrued Interest: Accrued Interest Privacy Policyhttps://accruedint.blogspot.com/2007/03/accrued-interest-privacy-policy.htmlI oversee taxable bond trading for a small investment management firm. Opinions expressed on this website may not reflect the opinions of my employers. Strategies described here should not be taken as advice, and may not be the strategies being used for my clients. Take this website as the egotistical ramblings of a bond geek and nothing more.

Polar Capital Technology Trust PLChttps://www.polarcapitaltechnologytrust.co.uk/_userfiles/documents/2009 Annual Report...provided an opportunity for a rapacious but highly imaginative body of professional financiers to extend this fundamental disequilibrium far beyond reason. We are now paying for the consequences. The United Kingdom has been one of the most profligate players in this folly and it is a testament to the esteem in which our ANNUAL REPORT AND ...

Biography: Warren Buffett: The Life of Warren Buffett, The ...https://www.brighthub.com/money/investing/articles/31388.aspxRead a biography of Warren Buffett, widely known as one of the richest people in the world. The life of Warren Buffett shows how he was able to leverage his company's wealth to make investment choices that may be risky but could pay off very well. Many of his investments were made by targeting certain sectors of the economy and acquiring many companies that he would later merge. Some of his ...

Jasim Alam - Quorahttps://www.quora.com/profile/Jasim-Alam-1Jasim Alam, A human. Interested in Financial Inclusion; Social Development; Poverty Alleviation; Natural Resource Management; Project Assessment; books; ideas and start-ups…

20 | October | 2016 | Justice Leaguehttps://justiceleaguetaskforce.wordpress.com/2016/10/20Oct 20, 2016 · A New Jersey law firm that helped Wells Fargo Bank N.A. foreclose on thousands of homeowners has sued the lender, saying the bank’s delayed efforts to fix its robo-signing problems led the law firm to collapse.. Lawyers for the Zucker, Goldberg & Ackerman law firm, which laid off most of its 335 workers last year, are accusing Wells Fargo of taking several years to comply with a 2010 New ...

17 | May | 2010 | FORECLOSURE FRAUD | by DinSFLAhttps://stopforeclosurefraud.wordpress.com/2010/05/17May 17, 2010 · Ted Cruz was the surprise winner in the Iowa Republican caucuses tonight edging out Donald Trump who in turn edged out Marco Rubio in a very strong voter turnout.On the Democratic side, Hillary Clinton is just a handful of votes ahead of socialist Bernie Sanders in a vote still too close to call.[PDF]Contagion Effect of Financial Crisis on OECD Stock Marketswww.economics-ejournal.org/economics/discussionpapers/2011-15/filemarkets are generally recognized as the barometer of the economic health of any nation. Problems with the underlying economic factors are readily indicated by the country's equity markets. The objective of our research is to look into the phenomenon of contagion among the OECD countries due to the US Financial Crisis (2007-2009).

HW2 - Final Draft answers - Macroeconomic Policy ECN355 ...https://www.studocu.com/en/document/queen-mary/macroeconomic-policy/mandatory...sonia bank rate (per cent) spread of sonia rate to bank rate (per cent[PDF]Conflicts of Interest in Merger Advisory Serviceshttps://pdfs.semanticscholar.org/c5e2/03a8b0f2c9e5527f9f9d34ae889009c81778.pdfTied-in sales, such as the joint offering of financial advice and financing commitments (either explicit or implicit) are not necessarily nefarious. Indeed, one of the primary motivations for the Gramm-Leach-Bliley Act of 1999 was the potential 3 This may because the commercial bank advisor has gathered private information about

Leverage Cycles: More Schizophrenia | Economics21https://economics21.org/html/leverage-cycles-more-schizophrenia-139.htmlClick here for a printer friendly version of this article.. One of the triggers for last year’s financial crisis was the unacceptably high leverage ratios of financial institutions. Leverage measures the relationship between a bank’s total assets to the capital contributed by its owners.[PDF]The role of Brazil in the multilateral financial system ...www.scielo.br/pdf/bpsr/v11n3/1981-3821-bpsr-1981-3821201700030004.pdfThe role of Brazil in the multilateral financial system: an analysis of domestic and structural factors (2003-2015) (2017) 11 (3) e0004 – 2/19 n the early 21st century, some actors who used to be less influential on the world political stage came to acquire greater relevance. This is the case, for

The Risk Controllers: Central Counterparty Clearing in ...https://www.amazon.co.uk/Risk-Controllers...Buy The Risk Controllers: Central Counterparty Clearing in Globalised Financial Markets by Peter Norman (ISBN: 9780470686324) from Amazon's Book Store. Everyday low …Reviews: 2Format: HardcoverAuthor: Peter Norman

The simpletons' debate - InvestSMARThttps://www.investsmart.com.au/investment-news/the-simpletons-debate/20671Nov 05, 2010 · The simpletons' debate ... This is not to say that we don't need rigorous regulation of banks for the betterment of the. ... And as the RBA has acknowledged, one of the most important factors that got the Australian economy through the GFC was the banks' ability to raise capital when banks everywhere else couldn't.

Appeal court backs CFA-funded claimant over investment ...https://www.litigationfutures.com/uncategorized/ca-backs-cfa-funded-claimant...Sep 13, 2012 · Appeal court backs CFA-funded claimant over investment advice action. 13 September 2012. ... an HSBC adviser’s negligence in recommending an unsuitable investment to a customer was the cause of his major financial loss. ... was no risk attached to the investment and he was informed that the fund was the same as cash deposited in one of HSBC ...

Policy Briefs | ERSAhttps://econrsa.org/publications/research-briefs?page=4The independence of these monetary policy tools contests the conventional wisdom on the role of central bank balance sheets in policymaking (Borio and Disyatat, 2010). One of the implications is that balance sheets potentially could be used to extend the policy reach of central banks to promote financial stability.

Financial navigation: where do we go from here? | The Journalhttps://www.journal.ky/2009/02/04/financial-navigation-where-do-we-go-from-hereWhat most insurance policies do is maintain owners’ wealth during incidents of instability or crisis. This is exactly what gold has accomplished in 2008, as it is one of the few asset classes that has maintained its value and is poised to be an accretive investment in 2009. The Investment mandate of 2009

America Magazine's Election Blog: McCain's Stunt, John ...https://americaelection2008.blogspot.com/2008/09/mccains-stunt-john-pauls-principles.htmlSep 25, 2008 · But, the captains of high finance did not care. They did not care if the homeowner was offered a loan they could not afford. They did not care if the bundling of these mortgages on the belief that housing prices would go up forever bore a frightening resemblance to a ponzi scheme. They saw the chance for a quick profit, and they took it.

Financial LINKS | IntermarketAndMorehttps://intermarketandmore.finanza.com/financial-links-15-17311.htmlAccording to the U.S. Census Bureau, median household income in the United States fell from $51,726 in 2008 to $50,221 in 2009. That was the second yearly decline in median household income in a row. In other words, America is getting poorer. Just let that statistic above sink in for a little bit.

Is your money safe with AIA - tankinlian.blogspot.comhttps://tankinlian.blogspot.com/2008/09/is-your-money-safe-with-aia.htmlSeveral AIA policyholders have asked my advice. They are worried that AIA may be affected by the collapse of AIG. They asked if they should ...

stavrevak – Thoughts | Politics & Policieshttps://stavrevak.wordpress.com/author/stavrevakPrior to the debt crisis, many prominent economists argued that the way to restore financial stability was to follow the Keynesian policies of government spending to promote growth and recovery. This was widely accepted as the best way to move forward with the ideas spreading even to …

N M Rothschild & Sons Limited - Company Profile ...www.referenceforbusiness.com/history2/51/N-M-Rothschild-Sons-Limited.htmlHistory of N M Rothschild & Sons Limited. Fading Fortunes in the 20th Century. If the Rothschild name had become synonymous with European finance in the 19th century--and remained one of the leading financial names worldwide--N M Rothschild was nevertheless to lose much of …

Kinh nghi?m tìm vi?c trong tình hình kinh t? di xu?ng ...www.vietmba.com/threads/kinh-nghi?m-tìm-vi?c-trong-tình-hình-kinh-t?-di...Nov 10, 2008 · Corporate headhunters say Wall Street's malaise will lead to a permanent talent loss for New York. It could help small boutique firms become bigger players with employees they would never have been able to lure from the city long-regarded as the world's financial capital.

#GCC and #MiddleEast Finance News: 21-Jul-2014https://rupertbumfrey.blogspot.com/2014_07_21_archive.htmlJul 21, 2014 · The Russian Market Volatility Index, which reflects traders’ projections for future price swings in equities, jumped 9.9 percent last week to the highest since May 12 as the benchmark Micex index sank to a seven-week low. In cutting its call, JPMorgan joined Deutsche Bank AG …

Ure Law Firm, 800 West 6th Street, Ste 940, Los Angeles ...www.findglocal.com/US/Los-Angeles/186625744708508/Ure-Law-FirmUre Law Firm provides legal services for people and small businesses facing financial distress. Our firm represents debtors in Chapter 7, 11, and 13. Located in the heart of Downtown Los Angeles, Ure Law Firm provides legal services aimed at getting clients a fresh start. We provide guidance and resources to help you regain control of your financial future.

Trotsky’s guide to the credit crunch – Biased BBChttps://biasedbbc.org/blog/2008/09/15/troskys-guide-to-credit-crunch-moreSep 15, 2008 · My comment submitted to Mason’s blog pointed out very nicely that he was ignoring the contribution of the CRA and leftist community groups to the current credit crunch and housing crisis…and of course it was deemed to have “broken house rules” and was not published. So we can deduce from this that one of the house rules is:

Malaysian Budgets 1999 -2009: Setting forth the Government ...https://islamicfinanceupdates.wordpress.com/malaysian-budgets-1999-2009-setting-forth...Sep 15, 2008 · By Suapi Shaffaii, 15 September 2008 Developing Milestone in Islamic Finance from the Malaysian Budget Perspectives: Budget 1999 - Towards restoring the financial sector and improving governance on the public and private sectors. Budget 2000 - Standardizing stamp duty rates on Islamic banking products similar to its conventional counterparts.

Reggie Middleton | Machholz's Bloghttps://machholz.wordpress.com/tag/reggie-middletonReggie Middleton “Western Europe On The Brink Of Bank Collapse” by ReggieMiddleton. Chancellor Angela Merkel’s government is preparing plans to shore up German banks in the event that Greece fails to meet the terms of its aid package and defaults, three coalition officials said.. The emergency plan involves measures to help banks and insurers that face a possible 50 percent loss on their ...

????????????????????? - Weblio???? …ejje.weblio.jp/sentence/content/???Translate this pageThe trade between Japan and Russia has been steadily expanding throughout the 2000s except for a steep decline due to the global financial crisis in 2009 (see Figure 1-6-2-15 and -16). - ?????[PDF]Pricing Contingent Convertible Capitalwww.diva-portal.org/smash/get/diva2:624626/FULLTEXT01.pdfOne of the many issues brought into light by the subprime crisis was the inability of prevailing hybrids and subordinated debt to suciently absorb losses. The structure of these products is such that they are second (after equity) to absorb losses upon bankruptcy, thereby protecting the value of more senior capital, such as deposits.

DC CITY DESK. . .: DC WEDNESDAYprorev.com/2008/09/dc-wednesday_17.htmDC CITY DESK. . . News and comment about DC and other urban areas for non-colonials from the Progressive Review, edited by Washington native Sam Smith, who has covered national and local DC since 1957, written four books and helped to start various national and local organizations including the DC Statehood Party, DC Humanities Council and the Capitol Hill Arts Workshop. He wrote the article ...[PDF]Beyond the Frontier: Using a DFA Model to Derive the Cost ...www.actuaries.org/ASTIN/Colloquia/Washington/Isaac_Babcock.pdfBeyond the Frontier: Using a DFA Model to Derive the Cost of Capital Daniel Isaac FCAS and Nathan Babcock ACAS1 Abstract Since the middle of the 1990s, Dynamic Financial Analysis (DFA) has become a popular method for insurance companies to compare alternative corporate level strategies (e.g. investment policies, reinsurance structures).[PDF]Opening the Floodgateshttps://www.wsgr.com/images/content/0/5/v1/051/dclark1010.pdfThe bounty was limited to 10 percent of a civil penalty exacted pursuant to a court order. The decision to award a bounty, and to whom, was within the sole discretion of the SEC (as it will be under Dodd-Frank). This bounty program was a fairly well-kept secret, as the Office of Inspector General (OIG) noted in a March 29, 2010, report: “[T]he

Jun 29, 2007 Subprime Shoes Continue to Drop Peter Schiff ...www.321gold.com/editorials/schiff/schiff062907.htmlThe first shoe dropped in February, when scores of mortgage originators went bust amid rising defaults and tightening lending standards. ... For a more in depth analysis of the tenuous position of the housing and mortgage markets, ... Mr. Schiff is one of the few non-biased investment advisors (not committed solely to the short side of the ...

Gold bugs crow | IOL Business Reporthttps://www.iol.co.za/business-report/markets/commodities/gold-bugs-crow-1116040Aug 11, 2011 · Gold, and only gold, will be our salvation when the value of companies, banks, countries and even money itself melts away. Gold, not shifting currencies, is the foundation of wealth and security.[PDF]Market microstructure during the financial crisis xi Arxivhttps://arxiv.org/pdf/1606.03590v1Market Microstructure During Financial Crisis Dynamics of Informed and Heuristic-Driven Trading1 ... This is the pre-print version of our accepted paper before typesetting. ... 1985). One of the key points in this relationship lies in asymmetric allocation of information in capital markets contributing to the uncertainty around the investments ...

Monetary policy normalisation - Times of Maltahttps://timesofmalta.com/articles/view/Monetary-policy-normalisation.661988Indeed, after hiking the target federal funds rate for the first time in seven years to a range of between 0.25 and 0.5 per cent on December 17, 2015, the Federal Reserve subsequently effected ...[PDF]Class Actions in Australia (00531778) - YPOLwww.ypol.com.au/wp-content/uploads/2016/06/Class-Actions-in-Australia-00531778xB8CA6.pdfrelating to a significant profit downgrade announced by the company in 2011 and the other relating to allegations of bribery involving the company’s operations in Iraq. Both of these matters were also the subject of investigation by regulators. The profit downgrade case was resolved in mid-2014 for a figure of just under $70 million.[PDF]Annual General Meeting of CREDIT SUISSE GROUP - Speech …https://www.credit-suisse.com/media/assets/corporate/docs/about-us/investor-relations/...Annual General Meeting of CREDIT SUISSE GROUP Zurich, April 24, 2009 ... This is a disappointing result that translated into a reduced dividend of 10 centimes, compared to CHF 2.50 ... Even as the crisis intensified, we were seen as a safe haven by our clients and remain so today.

Banks Profit From Near-Zero Interest ... - Dandelion Saladhttps://dandelionsalad.wordpress.com/2010/06/05/banks-profit-from-near-zero-interest...Jun 05, 2010 · by Dr. Ellen Brown Featured Writer Dandelion Salad webofdebt.com June 5, 2010 While individuals, businesses and governments suffer from a credit crisis created on Wall Street, the banks responsible for the crisis are tapping into nearly-interest-free credit lines and using the money to speculate or to make commercial loans at much higher rates.[PDF]Social Housing Newsletterhttps://www.clarkewillmott.com/wp-content/uploads/2019/04/Social-Housing-Spring-2019.pdfthat all funds paid for a certain project can only be accessed on certain terms, and those funds do not become part of the supplier’s working capital. This is an easy way to ring-fence the monies, as effectively the funds held in Escrow are in a trust account and cannot be used by the company and misapplied. However, although this can work as a

Historic moments in Chinese banking | FT Alphavillehttps://ftalphaville.ft.com/2010/04/14/202281/historic-moments-in-chinese-bankingThis is an odd place for a financial center – as if Fargo, North Dakota, rather than Manhattan, served as the financial center of the United States. Now there’s an idea!

September | 2008 | Cicero'shttps://cicerolounge.wordpress.com/2008/09Sep 17, 2008 · During the Second World War, Britain and the US had been at the forefront of the race to build the first nuclear weapon, and as the Cold War got under way it made sense both politically and financially to pool resources. 2008 marks the 50th anniversary of a partnership that has enabled Britain to maintain a viable and cost-effective nuclear ...

Uncategorized | letitgoeverythingisawesome | Page 2https://letitgoeverythingisawesome.wordpress.com/category/uncategorized/page/2While a more recent trend, the damage has already started. According to a report from the American Association of Colleges for Teacher Education, there was a 23% decline in the number of people completing teacher-preparation programs between the 2007-8 and 2015-16 school years.[PDF]Volatility says less about the future than accounting ...https://mpra.ub.uni-muenchen.de/62881/9/MPRA_paper_62881.pdfVolatility is one of the most important factors for most of the financial market models including retail. This is a reason to review this property on the basis of historical data. The VIX an indicator for the volatility of the Standard & Poor's index 500 with quotations of each trading day over fifteen years is

Bank Capital Shock Propagation via Syndicated ...https://link.springer.com/article/10.1007/s10614-015-9493-8For instance, as the market collapsed during the first year of the global financial crisis from approximately $800–$300 billion in quarterly issuance volume (Gadanecz 2011), international trade experienced the most sudden, severe, and globally synchronized collapse on record (Antonakakis 2012).On the sensitivity of the syndicated loan market to banks’ balance sheets and its rapid speed of ...

Look Out Below: The Strains from the Commodity Carnage are ...https://ca.finance.yahoo.com/news/look-below-strains-commodity-carnage-150000822.htmlLook Out Below: The Strains from the Commodity Carnage are Starting to Show

Investing by Accident: Running Away from a PFIChttps://investingbyaccident.blogspot.com/2014/04/running-away-from-pfic.htmlImportant note before you read: I am wrong in this blog, and I posted a correction in Run away!Run away! * * * Three weeks ago, I published a seminal article in the field of U.S. taxation of foreign investments entitled, Getting Eaten by PFIC.My meticulously researched observations together with carefully placed keywords have propelled Investing by Accident to #2 in the Google search results ...[PDF]Financial Stability Reporthttps://www.cbb.gov.bh/wp-content/uploads/2019/01/FSR-Jun09.pdffor “new construction” points to a desire by developers to take advantage of currently low prices of construction materials. However, there is a need for continuous monitoring of the situation as the full impact of the crisis on businesses and households are yet to become evident.[PDF]“Concentrated Ethnic Towns” and “Dispersed/ Assimilated ...https://www.jstage.jst.go.jp/article/jjhg/65/6/65_494/_pdf/-char/jaIn 1998, Urban Geography featured articles on ethnic economies. In one of them, Light (1998) pointed out the “spatial aspect” as an essential perspective for any analysis of ethnic economies. In this regard, understanding space as it relates to the development of ethnic economies?that is, “ethnic towns”?and then identifying the factors that generate regional variation in spatial

Are Canadian banks ready for Basel III? Abstracthttps://core.ac.uk/download/pdf/52406782.pdfAre Canadian banks ready for Basel III? Abstract ... This is one of ... guidelines, known as Basel III, to increase bank liquidity as a way of reducing the threat for a future financial crisis such as the one that occurred in 2008 (Gomes & Khan, 2011).

How US Financial Meltdown Will Affect NZ Election – werewolfwerewolf.co.nz/2008/09/how-us-financial-meltdown-will-affect-nz-electionCommodity prices for our agricultural goods are expected to ease and the cost of borrowing and debt servicing will rise, as the lines of credit belatedly tighten up in the wake of the Nightmares on Wall Street, and ripple on through pension funds, and into the small …