Home

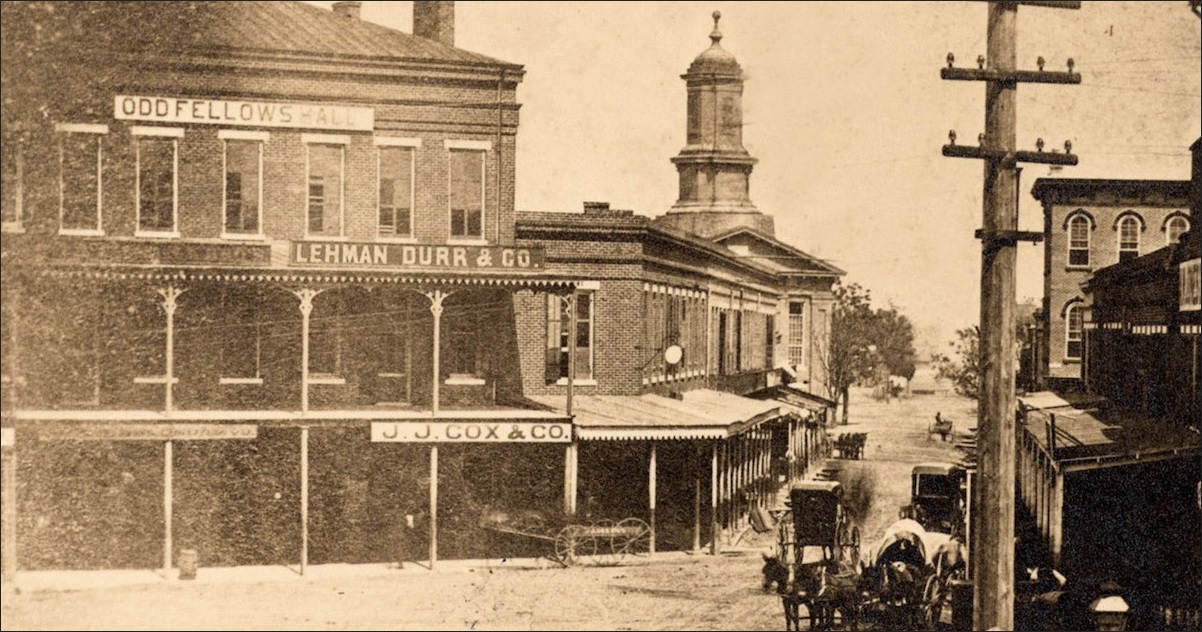

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

If there's another recession, which is a safer place to ...https://www.quora.com/If-theres-another-recession-which-is-a-safer-place-to-have-your...Mar 29, 2018 · If you define ‘safety’ as minimizing down-side loss, then the safest investments are those that will have minimal loss during recessions. The prices of real estate like a house will typically tend to fall lower and lag behind that of the stock mar...

Article: The Year's Best Books On The FInancial Crisis: My ...https://www.opednews.com/articles/The-Year-s-Best...Dec 03, 2010 · Article: The Year's Best Books On The FInancial Crisis: My Picks - News Dissector Danny Schechter offers up his picks of the year's best books on the fianancial crisis ... just as the markets ...

Wealthy turn to auctions as mansions go unsold for years ...https://www.investmentnews.com/article/20110830/FREE/110839993David Sandwith has been trying to unload his seven-bedroom house on Mercer Island, Washington, since 2009, listing it first for $32 million, then cutting the price to $28.8 million last year.

Boring Bond ETFs? | The Motley Foolhttps://www.fool.com/investing/international/2006/10/06/boring-bond-etfs.aspxFounded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium ...

To Save a Collapsing Audit Firm? Leadership Replacement is ...https://www.jamesrpeterson.com/home/2008/04/to-save-a-colla.htmlNor, paying respects to the grey eminences who populate the advisory committees themselves, is this a function to bolster the resumes of the retired. The learning curve of a real-time audit firm survival crisis would be too steep to be climbed by those for whom robust knees and lungs are the memories of youth.

Is the government bond the same as the fixed income ...https://www.answers.com/Q/Is_the_government_bond...May 21, 2009 · The bond market (also known as the credit, or fixed income market) is a financial market where participants can issue new debt, known as the primary market, or …

Capital: A Novel (Hardcover) | Sundance Books and Musichttps://www.sundancebookstore.com/book/9780393082074Those menacing and mysterious notes are the jumping off point for Lanchester's brilliant exploration of modern London. From the financial trader in the midst of growing midlife and career crises, to the Pakistani family struggling with faith and family, to a dying woman and her street artist son, Lanchester effortlessly weaves myriad stories ...

Fund managers face up to the AIFMD - Compliance Monitorhttps://www.compliancemonitor.com/.../fund-managers-face-up-to-the-aifmd-62144.htmFund managers face up to the AIFMD. It’s decision time for non-UCITS Collective Investment Schemes, report Roxy Nadershahi and Andrew Lowin, as practical details of the controversial Alternative Investment Fund Managers Directive begin to emerge.

Can Anyone Solve the Securitization Problem? - The New ...https://executivesuite.blogs.nytimes.com/.../can-anyone-solve-the-securitization-problemNov 11, 2008 · Judges/trustees cannot be made into champions of homeowners with loose statutes allowing them to style themselves as latter day Robin Hoods, at least if we expect to have more than a 3rd world economy left when over. And, a measure of loan modification can likely be accomplished in bankruptcy as it exists, because of the nature of the ...

A Timeline of Warren Buffett's Bank Stock Buys | The ...https://www.fool.com/investing/2017/07/05/a-timeline-of-warren-buffetts-bank-stock...1964 -- American Express1969 -- Illinois National Bank & Trust Company1987 -- Salomon Brothers1990 -- Wells Fargo1991 -- M&T Bank2008 -- Goldman Sachs2011 -- Bank of America2017 -- Home Capital GroupBuying Banks Like BuffettAmerican Express was one of the Buffett partnership's last bet-the-farm investments.AmEx shares were battered by investors' belief that it would incur large losses from fraudulent loans made during the now-infamous \"salad oil scandal.\" But a unique detail of the story is often missing from historical descriptions of the event: American Express shareholders could lose everything, and more, from holding AmEx st…See more on fool.com

Jacob Rothschild, John Paulson And George Soros Are All ...https://www.prisonplanet.com/jacob-rothschild-john-paulson-and-george-soros-are-all...One of these warriors is John Paulson. The hedge fund manager once made billions by betting on a collapse of the American real estate market. Not surprisingly, the financial world sat up and took notice when Paulson, who is now widely despised in America as a crisis profiteer, announced in the spring that he would bet on a collapse of the euro.

Jacob Rothschild, John Paulson And George Soros Are All ...https://www.zerohedge.com/contributed/2012-08-21/jacob-rothschild-john-paulson-and...That was the biggest move into gold by the central banks of the globe that we have seen in modern financial history. ... According to a recent ... Jacob Rothschild, John Paulson and George Soros are preparing themselves for the tremendous chaos that is coming.

Life and Times of Alex Esguerra: January 2017www.lifeandtimesofalexesguerra.com/2017/01Audacity: How Barack Obama Defied His Critics by Jonathan Chait, Chapter 2 touches broadly on the narrative case on how the world's financial system was on the way to a disastrous plunge.As Chait was quoted that "Presidents get credit for responding to disasters such as the case of George W. Bush right after the 9-11 attacks on the World Trade Center, Obama is the first to prevent that kept ...

"Inside Job" Director Charles Ferguson: Wall Street has ...https://www.resilience.org/stories/2012-05-30/inside-job-director-charles-ferguson...We continue our conversation with Charles Ferguson, director of the Oscar award-winning documentary, “Inside Job,” about the 2008 financial crisis. In his new book, “Predator Nation,” he argues “the role of Democrats has been at least as great as the role of Republicans” in causing the crisis.

Are Bankruptcy Laws Too Tough? | naked capitalismhttps://www.nakedcapitalism.com/2009/04/are-bankruptcy-laws-too-tough.htmlI’m late to this good post from Steve Waldman, which has some provocative ideas about how stringent bankruptcy laws should be. He contends that the current regime is too friendly to creditors, which means they can and do make overly optimistic assumptions about recovery, which in turn makes them too ready to take risks. We’ve […]

Lunch with the FT: Jared Diamond | Financial Timeshttps://www.ft.com/content/144fa854-82e2-11de-ab4a-00144feabdc0Aug 07, 2009 · Jared Diamond is the guru of collapse. Collapse is the title of one of the books that have made him a world-famous academic. It is a theme that captures the Zeitgeist: markets have collapsed ...

Jacob Rothschild, John Paulson And George Soros All ...https://judgementofamerica.wordpress.com/2012/08/24/jacob-rothschild-john-paulson-and...Aug 24, 2012 · Jacob Rothschild, John Paulson And George Soros All Betting That Financial Disaster Is Coming. Posted on August 24, ... That was the biggest move into gold by the central banks of the globe that we have seen in modern financial history. ... just as the Greek government was embarking on some of its harshest austerity measures, 29-year-old ...

Hedge Funds Are Selling Old Line Bancshares, Inc. (OLBK)https://finance.yahoo.com/news/hedge-funds-selling-old-line-160547583.htmlNov 01, 2019 · More specifically, Mendon Capital Advisors was the largest shareholder of Old Line Bancshares, Inc. (NASDAQ:OLBK), with a stake worth $20.3 million reported as of the end of March. Trailing Mendon ...

Hedge Funds Have Never Been This Bullish On Compass ...https://finance.yahoo.com/news/hedge-funds-never-bullish-compass-134012970.htmlOct 25, 2019 · A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at …

Jacob Rothschild, John Paulson And George Soros Are All ...https://www.blacklistednews.com/Jacob_Rothschild...One of these warriors is John Paulson. The hedge fund manager once made billions by betting on a collapse of the American real estate market. Not surprisingly, the financial world sat up and took notice when Paulson, who is now widely despised in America as a crisis profiteer, announced in the spring that he would bet on a collapse of the euro.

Award Winning Documentary Filmmaker Charles Ferguson On ...https://panopticonreview.blogspot.com/2011/03/wall-street-financial-crisis-criminal.htmlMar 03, 2011 · But it was the topic on most people's minds the last two years, the economy, that resonated among Oscar voters. "Inside Job" director Charles Ferguson subjected Wall Street players, economists and bureaucrats to a fierce cross-examination to depict the economic crisis as a colossal crime perpetrated on the working-class masses by a greedy few.

Financial Economics: Amazon.comhttps://www.amazon.com/slp/financial-economics/snqbj8p9day68oaThis is fast becoming one of my favorite books, simply because it packs so much into one volume (where I previously had to turn to three). "Quantitative Financial Economics" rivals Bodie, Kane and Marcus, and Elton and Gruber in scope and quality. It almost goes without saying, but this book is much better than anything by Frank Fabozzi.

How Smart Did You Invest This Year? - TheStreethttps://www.thestreet.com/personal-finance/credit-cards/how-smart-did-you-invest-this...Dec 30, 2008 · However, there is a tendency to try to switch from a previously targeted benchmark to a different benchmark just because market conditions have changed. This …

Lehman Collateral Damage: Some Hedge Funds Have Assets ...https://www.nakedcapitalism.com/2008/09/lehman-collateral-damage-some-hedge.htmlThe Wall Street Journal tells us that some less-than-nimble-footed hedge funds wound up not moving their prime brokerage accounts quickly enough out of Lehman to avoid having those assets frozen in the bankruptcy. Most readers will probably find it hard to work up much sympathy for these Masters of the Universe. Despite the name “prime […]

Opinion | Global financial system in a better place since ...https://www.moneycontrol.com/news/business/markets/opinion-global-financial-system-in...This is without a glimmer of doubt the proverbial elephant in the room. But it was not only governments that went all-in. The world’s largest central banks reduced short-term interest rates to zero.

Spend It Like Beckham. 5 Things To Do If You’ve Got Money ...https://in.finance.yahoo.com/news/spend-beckham-5-things-ve-093053228.htmlJan 18, 2017 · If you’re one of those affluent but slightly clueless types, ... Spend It Like Beckham. 5 Things To Do If You’ve Got Money To Burn. ... But it isn’t all fun and games with guys like him. He ...

4 Companies You Can Buy Today - AOL Financehttps://www.aol.com/2011/09/19/4-companies-you-can-buy-todaySep 19, 2011 · But it's more than that. Big oil companies have one of the better histories of capital allocation, offering share buybacks and dividends in greater -- and smarter -- amounts than many other ...

Don’t take this the wrong way but you need a mint | Dear Samhttps://dearsam1234.wordpress.com/2018/06/18/dont-take-this-the-wrong-way-but-you-need...Jun 18, 2018 · But don’t lose heart. The research is on your side. Every one of the two studies I’ve read concludes that a positive attitude enhances health, happiness, career, financial success and physical performance … if you get my drift. So being positive isn’t just a nice way to live. It’s the ONLY way to live! But it sounds like you’ve ...

Petroleum Balance - Forbeshttps://www.forbes.com/sites/timothysiegel/2011/04/03/opec-oil-output-slips-lower...Apr 03, 2011 · This is a huge factor, and one that we can be quite sure about. To a much lesser degree, the same can be said of India. Another factor to consider is the …

A bank too big to fail is too big a riskhttps://www.smh.com.au/business/a-bank-too-big-to-fail-is-too-big-a-risk-20140119-312...The sheer size of Australia's banks is shaping up as one of the more interesting issues facing this year's inquiry into the financial system. A bank too big to fail is too big a risk Skip to ...

This time the crisis is differenthttps://www.livemint.com/Money/rS1LztkTQATgSpaMTwKVwI/This-time-the-crisis-is...This time the crisis is different

Investors Jittery After Sen. Reid Insurer Commenthttps://www.insurancejournal.com/news/national/2008/10/02/94289.htmOct 02, 2008 · Insurance stocks, led by Hartford Financial, Principal Financial and MetLife, fell Thursday after a lawmaker raised the question of whether a well-known insurer could be in financial trouble.

Derivatives Market - Want to knowhttps://www.wanttoknow.info/banking_finance/derivatives_market_bubble_financialDerivatives Market Financial Derivatives Time Bomb. Dear friends, According to many top financial analysts and the revealing news articles below, the $700 trillion financial derivatives market may be a time bomb waiting to explode with catastrophic consequences.

2012-005 The EU’s role in our financial crisis | The Euro ...www.theeuroprobe.org/2012-005-the-eus-role-in-our-financial-crisis-2Sep 27, 2012 · A The EU’s role in our financial crisis By Christopher Booker Last Updated: 12:01am BST 05/10/2008. As the Western world’s banking system teeters on the edge of collapse, one crucial factor in this unprecedented crisis has gone almost entirely unnoticed – although David Cameron made a veiled reference to it on Tuesday.

Who is Bernard Madoff, the Man Behind the $50 Billion ...fourwinds10.com/siterun_data/government/fraud/israel/news.php?q=1236465836Who is Bernard Madoff, the Man Behind the $50 Billion Fraud? Home. About Four Winds; ... This is the quid pro quo of his relationship with Israel and the source of his confidence. He was stealing for a cause - the Zionist cause. ... He is known as the chairman of GMAC, the financial service branch of General Motors and as the general partner of ...

Necsus | Portraying the global financial crisis: Myth ...https://necsus-ejms.org/portraying-the-global-financial-crisis-myth-aesthetics-and-the...by Miriam Meissner. From 2007 until today an intricate set of events has been unsettling the global financial markets. The naming of these incidents has been multifold, varying between a general rhetoric of economic downturn (‘crash’, ‘crunch’, ‘meltdown’, ‘hangover’) and more descriptive terminologies indicating the reasons, geographic involvements, and historic time-span of ...

Can Anybody Out There Fix the Banking System? - The New ...https://executivesuite.blogs.nytimes.com/2009/01/16/can-anybody-out-there-fix-the...Jan 16, 2009 · The major tactical failure of the worldwide central banking structure, is that NOT ONE of these “so-called central expert regulators” ever demanded of their ” financial engineers” proposing new financial instruments, that such fiscal products be capable of passing the first rule of “Engineering 101? — the ability to successfully ...

Buy-side : Fidessa // Regulation Mattersregulation.fidessa.com/category/market-participants/buy-side-2As the FT reported earlier this week, ESMA is set to step back from imposing a much contested overhaul of dealing commission. The scrutiny of commissions has been a major concern for the buy-side, in particular ESMA’s proposals to classify all but the most generally available investment research as a non-monetary benefit.

Stockholm Syndrome: Two Books on High Finance - The Millionshttps://themillions.com/2010/09/stockholm-syndrome-two-books-on-high-finance.htmlSep 23, 2010 · Stockholm Syndrome: Two Books on High Finance. Quick Hits. Garth Risk Hallberg September 23, ... And a lot of people think that’s one of the reasons the Great Depression was so difficult to get out of, that the financial machinery was smashed. ... One of the first questions we’re trained to ask about any narrative is whether the narrator is ...

Definitive Proxy Materials - SEChttps://www.sec.gov/Archives/edgar/data/791915/000119312515116098/d899520ddef14a.htmThe following graph details our relative Total Shareholder Return (TSR) as compared to a variety of benchmarks for a five year period. COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN (all data provided by Research Data Group, Inc.) Based on $100 invested on 1/30/10 in stock or index, including reinvestment of dividends

Finance & Development, September 2009 - Faces of the Crisishttps://www.imf.org/external/pubs/ft/fandd/2009/09/faces.htmOnce one of the most prosperous countries in West Africa, Côte d’Ivoire, a country of 19 million people, recently emerged from conflict. Economic revival was cut short by a military coup in 1999 and the start of a civil war in 2002. A transition government took power in 2007, and set about the task of …

Banker Pay - the mathematical truth behind the 'pay for ...www.blog.rippedoffbritons.com/2011/09/banker-pay-britains-most-vaunted-money.htmlThe statistics show no evidence that bankers are the best, and a history of boom and bust suggests that they are more Calamity Janes and Crisis Joes. In-spite of this the FSA revealed that more than 2,800 people in the City of London’s financial sector took home more than £1million in 2009.

Obama And The Rule Of Law On Wall Street - Daily Baildailybail.com/home/obama-and-the-rule-of-law-on-wall-street.htmlDec 28, 2011 · For more details see this story:. Dylan Ratigan With Author Ron Suskind: "Tim Geithner Ran The White House, Stopped Attorney General Eric Holder From Prosecuting Wall Street"; Guest post from Jeff Connaughton, former Chief of Staff to Sen. Ted Kaufman.. Long silent and now contradictory, President Obama needs to deliver a clarifying speech about our financial markets and the rule of law.

Dr. Thieß Petersen - GED Bloghttps://ged-project.de/blogger/dr-thiess-petersenDr. Thieß Petersen Senior Advisor, Bertelsmann Stiftung. Thieß joined the Bertelsmann Stiftung in 2004. As a senior advisor with the project Global Economic Dynamics (GED) he specializes on macro-economic studies and economics. He is currently concentrating on the causes and effects of financial and economic crises, the chances and risks of globalisation and the public debt and euro crisis.

Rise of the third political party in 2016 US Electionswww.aseanaffairs.com/.../rise_of_thwe_third_political_party_in_2016_us_electionsRise of the third political party in 2016 US Elections China will be Most Powerful, Singapore Richest and Thailand poised for Economic Potential: Martin Armstrong’s Predictions WEC Bangkok,2012 . By Swarup Roy AseanAffairs, 09 Nov 2012, Bangkok. He has been described as a genius, a rogue, the world’s best economist, a US government scapegoat, a financial oracle and a criminal.

Nate Quest, Author at Olin Blog - Page 5 of 9Olin Blog ...https://olinblog.wustl.edu/author/nate-quest/page/5After the presentation, Mr. Moss left about 30 minutes for Q&A, and we raised a lot of interesting questions, such as “What are the fundamental factors that an equity researcher and a credit rater would take into account for a company?” and “What is your daily life like at work when you are in different companies in finance industry ...

The View From Our Whitehouse - Monetary System Reform ...https://lonestarwhitehouse.blogspot.com/2018/07Jul 30, 2018 · This is because the median age of the US population continues to climb as the baby boom generation moves more and more into the Social Security system. Attempting to do anything about Social Security until it reaches a crisis point is viewed as political suicide so it is unlikely anything will be done until it has to be done.

ARRA News Service: Obama - ACORN Root Causes of Mortgage ...https://arkansasgopwing.blogspot.com/2008/09/obama...Sep 29, 2008 · One of the penalties for refusing to participate in politics is that you end up being governed by your inferiors.-- Plato (429-347 BC) Monday, September 29, 2008. Obama - ACORN Root Causes of Mortgage Crisis? by Alan Gottlieb, AmeriPac: FBI Investigates U.S. Financial Crisis ... that amplified the first…

Teaching monetary theory and monetary policy ...https://www.elgaronline.com/abstract/journals/ejeep/12-2/ejeep.2015.02.07.xmlThe author reflects on the state of macroeconomic theory, and more specifically on how monetary economics is being taught in the aftermath of the global financial crisis. Whereas heterodox macroeconomic theory is very much alive due to the influx of a large number of contributions and contributors, the latter still have a hard time finding positions in the academic world, as journal and ...

Bear Stearns’ Collapse: Could It Happen Again? - Barron'shttps://www.barrons.com/articles/bear-stearns-collapse-still-echoes-10-years-on-1521202634Mar 16, 2018 · The Bear Stearns rescue, occasioned by the broker-dealer’s bad leveraged bets on subprime debt and a loss of confidence among its creditors, would be the first …

Fed finalizes rule targeting early termination clauses for ...https://www.americanbanker.com/news/fed-issues-final-rule-targeting-early-termination...The final rule is close to a 2016 proposal that would bar global systemically important banks, or G-SIBs, from entering into certain qualified financial contracts that include early termination provisions earlier than 48 hours from notice of bankruptcy. The plan would effectively place a stay on counterparties' ability to call certain derivatives, repurchase agreements, reverse repurchase ...

Early Warning System for Banking Crisis: Causes and ...https://www.igi-global.com/chapter/early-warning-system-for-banking-crisisEarly Warning System for Banking Crisis: Causes and Impacts: 10.4018/978-1-4666-9484-2.ch001: The purpose of this chapter is to present with an overview of the early warning systems (EWS) applied to global banking crises. Numerous past studies have[PDF]A ‘twin peaks’ vision for Europebruegel.org/wp-content/uploads/2017/11/PC-30-2017-1.pdfSome countries, such as the Netherlands, France and the United Kingdom, have moved to a supervisory model known as ‘twin peaks’ (Taylor, 1995 and 2009), with one supervisor for prudential supervision and another for markets and con-duct-of-business supervision. Other countries, such as Germany, Sweden and Poland, have

Interest rate swaps - MarketsWiki, A Commonwealth of ...www.marketswiki.com/wiki/Interest_rate_swapsTradeweb handled the first electronic cleared trade in interest rate swaps in September 2010. That deal involved MPS Capital Services, which is the investment banking division of Banca Monte dei Paschi di Siena with Credit Suisse as the dealer and Barclays Capital as the agent with LCH.Clearnet as the …

Euro crisis deepens as time starts to run out for Spain's ...https://www.theguardian.com/business/2012/jul/20/spain-crisis-eurozone-valenciaJul 20, 2012 · A Valencian (R) and a Spanish flag. Spain's heavily indebted eastern region of Valencia said on Friday it would apply to Madrid for financial help, spooking markets and complicating central ...

Bank of America Merrill Lynch increases adviser headcount ...https://www.investmentnews.com/bank-of-america-merrill-lynch-increases-adviser...Features; Broker-Dealers; Bank of America Merrill Lynch increases adviser headcount 3% in 2015 The wirehouse gains headcount even as the brokerage industry braces for a wave of departures from ...

EXCLUSIVE: John McDonnell on the financial crash and a ...https://leftfootforward.org/2018/09/exclusive-john-mcdonnell-on-the-financial-crash...Sep 19, 2018 · Do you see a General Election as the alternative to a ‘People’s Vote’? “I want a General Election, I don’t want to let these Tories off the hook. I want them out there explaining their policies, not just on Brexit but on other issues as well. And I want people …

Pneuma Respiratory, Inc. Appoints Rich Gimigliano as Chief ...https://www.prnewswire.com/news-releases/pneuma-respiratory-inc-appoints-rich...BOONE, N.C., April 16, 2018 /PRNewswire/ -- Pneuma Respiratory, Inc. (Pneuma), which has developed PNEUMAHALER ™, the first fully digital breath activated inhaler (DBI), has hired Rich ...[PDF]IN THE HIGH COURT OF JUSTICE CR-2008-000026 27 Jul 2018 ...https://www.pwc.co.uk/business-recovery/administrations/lehman/lehman-cmc-order...AND IN THE MATTER OF LEHMAN BROTHERS HOLDINGS PLC (IN ADMINISTRATION) ... convenient to the parties after 10 May 2019 with a time estimate of half a day to a day, the issues for consideration at which shall include whether and to what extent ... and b. a date for a Pre-Trial Review on the first available date reasonably convenient to the ...

Geithner To Take Orders From Global Elite At Bilderberghttps://www.infowars.com/geithner-to-take-orders-from-global-elite-at-bilderbergMay 14, 2009 · Geithner To Take Orders From Global Elite At Bilderberg. May 14, 2009 Comments. Paul Joseph Watson Prison Planet.com Thursday, May 14, 2009 . According to a London Times report, U.S. Treasury Secretary Timothy Geithner will probably be in attendance at this week’s Bilderberg Group meeting, as top globalists meet to plot the financial future ...

Supreme Court Says Underwater Junior Liens Survive ...https://blogs.orrick.com/.../supreme-court-says-underwater-junior-liens-survive-bankruptcyJun 05, 2015 · Should Underwater Junior Liens Survive Bankruptcy? This article is an excerpt written for the Distressed Download. The full article is available here. Introduction. On March 24 th, the Supreme Court heard oral argument on the consolidated appeals of two decisions from the Eleventh Circuit Court of Appeals, Bank of America v.

John Baughman Quoted on Citigroup Victory | Paul, Weisshttps://www.paulweiss.com/.../news/john-baughman-quoted-on-citigroup-victory?id=7435Litigation partner John F. Baughman was quoted in an article discussing the decision by the state appellate court in New Jersey to uphold a $364.2 million jury verdict obtained three years ago by Paul, Weiss on Citigroup's counterclaims that Parmalat defrauded the bank. The $431 million award includes interest that has accrued since the original October 2008 verdict.

Civil Lawsuits: Recent News and Cases - Page 2 | Newserhttps://www.newser.com/tag/13797/2/civil-lawsuits.html(Newser) - The saga of Dominique Strauss Kahn's alleged rape of housekeeper Nafissatou Diallo came to a close today, at least as far as the law is concerned, with Strauss Kahn settling a suit from ...[PDF]The banking bailout of the subprime crisis: size and effectshttps://ojs.uniroma1.it/index.php/PSLQuarterlyReview/article/download/9427/9322The banking bailout of the subprime crisis: size and effects 191 (MBS), collateralized MBS (CMBS), collateralized loan obligations (CLO), and corporate debt; see IMF (2008a, Table 1.1).1 Large default rates on subprime mortgages cannot explain the depth of this crisis.

Reverse Spin: Prince to become the king of Citigroup ...https://www.investmentnews.com/reverse-spinprince-to-become-the-king-of-citigroup-6520Jul 21, 2003 · Reverse Spin: Prince to become the king of Citigroup Prince is taking over Citigroup Inc. No, not the pop star. We’re talking about Charles “Chuck” Prince, a…

Contagion inside the credit default swaps market: the case ...https://www.researchgate.net/publication/288862297_Contagion_inside_the_credit_default...Sovereign credit default swaps (SCDSs) have been at the core of the Euro Area (EA) debt crisis, particularly in its periphery. Both EU politicians and a wide range of EU academics have asked for ...

The global financial crisis : triggers, responses and ...https://www.worldcat.org/title/global-financial-crisis-triggers-responses-and...Get this from a library! The global financial crisis : triggers, responses and aftermath. [Tony Ciro] -- This book provides an examination and critical review of the Global Financial Crisis (GFC). Asking many pertinent questions about the causes of the crisis and its effects, the book explores ...

China's seizure of Baoshang Bank, the first one in 20 ...https://www.quora.com/Chinas-seizure-of-Baoshang-Bank-the-first-one-in-20-years...Jun 27, 2019 · I think this article sums of things in a balanced way. Could the collapse of a small regional bank be China's 'Lehman moment'? The risks of a credit crisis have certainly increased in China as an event the authorities though was not possib...

Jonathan Duskin Who? | The Robin Reporthttps://www.therobinreport.com/jonathan-duskin-whoMay 06, 2015 · Activist Lightweight Attacking Children's Place I like being an activist myself, but a special kind. I like attacking financial activists who assume they understand the businesses they are attacking, yet build stories based on the only thing they do understand: numbers. These stories are all about creating greater shareholder value,…

Making a Case for the Bears - Profit Confidentialhttps://www.profitconfidential.com/stock-market/making-a-case-for-the-bearsJan 08, 2010 · — The Financial World According to Inya” Column, by Inya Ivkovic, MA The bears have plenty of reasons to growl these days, and I’m not talking just about a severe case of post-hibernation ...

Of Plutocrats and Oligarchs: "The Power Elite"https://plutocratsandplutocracy.blogspot.com/2016/05/the-power-elite.htmlPower is defined as the ability to achieve what one wants over the opposition of others; and the levers of power are the great institutions in society -- corporations, political institutions, and the military. And the thesis is that a relatively compact group of people exercise hegemony in each of these areas.[PDF]Financial System Resilience Indexhttps://b.3cdn.net/nefoundation/3898c6a7f83389375a_y1m6ixqbv.pdfbanks will equal a resilient system. This is a dangerous assumption; it also ignores our growing understanding that complex systems are about much more than the sum of their individual parts. Drawing on academic and policy literature and a series of expert interviews and roundtables, we find seven key factors that influence system resilience

Second Circuit affirms bankruptcy court ruling authorising ...https://www.thelawyer.com/issues/online-september-2013/second-circuit-affirms...On 12 September 2013, the US Court of Appeals for the Second Circuit held that American Airlines, Inc. (American) had the right to repay $1.3bn (£808m) in debt (Notes) without payment of a make-whole amount. The Second Circuit dismissed all of the arguments raised by US Bank Trust National Association (US Bank), the trustee for […]

The elephant in the factory? - MDX Mindshttps://mdxminds.com/2016/05/31/the-elephant-in-the-factoryMay 31, 2016 · May 31 2016 The elephant in the factory? In the wake of the Tata Steel crisis, Senior Lecturer in HR Management Dr Daniel Ozarow examines the concept of workers’ self-management as an alternative post-crisis production model. The recent proposed closure of Tata Steel’s Port Talbot plant in Wales prompted much debate in the media and among analysts about the kind of industrial policies …

Asia's finance houses leading jobs market recovery ...https://economictimes.indiatimes.com/news/international/Asias-finance-houses-leading...Financial institutions are leading a recovery in the Asian jobs market as the region emerges from recession more forcefully than expected, analysts say.

Did the Housing Crash Cause the Recession? No, it Was the ...https://ricochet.com/.../did-the-housing-crash-cause-the-recession-no-it-was-the-fedAug 27, 2013 · Just as the 1929 stock market crash didn’t cause the Great Depression, the housing collapse didn’t cause the Great Recession. In both cases, …

BOOK REVIEW: Michael Lewis's The Big Short | RealClearMarketshttps://www.realclearmarkets.com/articles/2010/03/25/book_review_michael_lewiss_the...Mar 25, 2010 · It is the modern world of finance that Lewis seeks to address in his new, and highly engrossing account of the financial decade just passed, The Big Short.Much as …

CITY FOCUS: Wounds from Lehman collapse ... - This is Moneyhttps://www.thisismoney.co.uk/money/markets/...The Government borrowed £36.8bn in the first four months of the 2013-14 fiscal year compared with £35.2bn at this stage of 2012-13. ... at least a decade-and-a-half.’ But, as the Group of 20 ...

The financial crisis in 2008 took place. » non.copyriot.comhttps://non.copyriot.com/the-financial-crisis-in-2008-took-placeWhen Jean Baudrillard announced that the year 2000 would not take place, one had to suspect evil. It is no exaggeration to say that the financial crisis of 2008 was the only event of world historical significance in the new millennium (as is well known, according to Baudrillard, the …

The Secret History of the Banking Crisis – Mark Salterwww.marksalter.org/the-secret-history-of-the-banking-crisisSep 01, 2017 · The Secret History of the Banking Crisis. Riveting, accessible account of the 2008 financial crisis and the hush-hush ‘swapline’ system between the US Fed and a select coterie of European central banks put in place to contain it (remains with us today).

Growing Old: Paying for Retirement and Institutional Money ...https://play.google.com/store/books/details/Growing_Old_Paying_for_Retirement_and...Growing Old: Paying for Retirement and Institutional Money Management after the Financial Crisis - Ebook written by Yasuyuki Fuchita, Richard J. Herring, Robert E. Litan. Read this book using Google Play Books app on your PC, android, iOS devices. Download for offline reading, highlight, bookmark or take notes while you read Growing Old: Paying for Retirement and Institutional Money Management ...

Signs of The Times | True Discernment | Page 66https://truedsicernment.com/category/signs-of-the-times/page/66Posts about Signs of The Times written by John. from The Daily Telegraph: Sir Mervyn King was speaking after the decision by the Bank’s Monetary Policy Committee to put £75billion of newly created money into the economy in a desperate effort to stave off a new credit crisis and a UK recession.

Prophecy Watch-Show me the Money | Fever Seasonhttps://www.feverseason.com/prophecy-watch-show-me-the-moneyI get both arguments, but it’s the price of gold, I suppose, that tells us which argument is winning. When gold was over $1,800 an ounce and rising, with the first Greek crisis, quantitative easing everywhere and a global financial crisis barely two years behind us, the ‘gold-is-money’ arguments looked strong.

The Johnson Legacy and the Obama Challenge: Remarks to the ...https://www.huffpost.com/entry/the-johnson-legacy-and-th_b_149793May 25, 2011 · The result is the first full-fledged financial collapse since 1929. I say this very carefully, because it is necessary to adjust ideas. Lyndon Johnson presided over years of stable postwar prosperity, of full employment with mild inflation and the dollar at the center of a world system. In 1970, 1974, 1980 and 1981-2 we had recessions; but they ...

Politicians welcome Diamond’s departure | Financial Timeshttps://www.ft.com/content/0e451e70-c4da-11e1-b8fd-00144feabdc0Jul 03, 2012 · Britain’s top politicians and regulators united in hailing the departure of Bob Diamond as the first step towards “a new culture of British banking”, even as they faced potentially damaging ...

Insider trading case highlights the challenges facing ...https://www.ft.com/content/ddb82d9e-1686-11e6-9d98-00386a18e39dMay 10, 2016 · The son of a Persian diplomat who fled the Iranian Revolution, he climbed his way up from working in his father’s Kent kebab shop to a £70m …

Stress Tests for Banks - Henry C.K. Liuwww.henryckliu.com/page189.html2009 – The Year Monetarism Enters Bankruptcy By Henry C.K. Liu Part I: Bankrupt Monetarism Part II: Central Banking Practices Monetarism at the Expense of the Economy Part III: Stress Tests for Banks This article appeared in AToL on May 13, 2009 as Credulity Caught in Stress Test The Treasury’s stress tests for US banks in April 2009 was designed to ensure that US banks have sufficient ...

Theses on the global crisis - Wildcat Germanyhttps://libcom.org/library/theses-global-crisis-wildcat-germanyDec 14, 2009 · whirlwind wrote: On a second reading of these theses, some inconsistencies stand out. I will deal with just this one above. Our friends at Wildcat cite a long list of simultaneous struggle around the globe but then go on to ask 'whether a collectively struggling global working class will emerge'.

BANKS BULLYING CONSUMERS ~ FINANCIAL INSTITUTIONS' …https://www.tapatalk.com/groups/cultbustersgalactica/banks-bullying-consumers...Oct 12, 2011 · "This is not the last one," an SEC official said in an interview. "I think we are likely see a couple more." In June, JPMorgan Chase & Co agreed to a $153.6 million settlement over the Squared CDO 2007-1, while Goldman Sachs Group Inc in July 2010 accepted a $550 million accord over the Abacus 2007-AC1 CDO.

Asia and the Meltdown of American Finance | The Asia ...https://apjjf.org/-R-Taggart-Murphy/2931/article.htmlOct 03, 2008 · Asia and the Meltdown of American Finance R. Taggart Murphy The boardrooms and finance ministries of Seoul, Bangkok, Jakarta and Kuala Lumpur are today filled with a fair degree of schadenfreude at America’s troubles.

Introduction to finance part 2 Flashcards | Quizlethttps://quizlet.com/202881464/introduction-to-finance-part-2-flash-cardsA hurricane and ensuing damage cause a resort area to close for two months at the height of the tourist season. This results in ten businesses going bankrupt. These included a hotel, three restaurants, two bars, a bakery, a food store, a realtor, and a coffee shop. Investors in any of those businesses should realize a _____.

Eurozone crisis will be solved – eventually – insists FSA ...https://www.theguardian.com/business/2011/oct/22/eurozone-crisis-fsa-lord-turnerOct 22, 2011 · Eurozone crisis will be solved – eventually – insists FSA's Lord Turner ... the greatest point of financial fragility we've ever had." ... In his Mansion House speech on Thursday ...

EDGAR Proyahoo.brand.edgar-online.com/DisplayFilingInfo.aspx?Type=HTML&text=%26lt%3bNEAR%2f4...For years, buyout firms have operated beyond the scrutiny of the public markets. But Blackstone’s upcoming IPO and a public offering last year by KKR of an investment vehicle in Europe signal that the industry is expanding beyond its core constituency of institutional investors and reaching for more permanent sources of capital.

Chinalco freeze on £255m bonds | This is Moneyhttps://www.thisismoney.co.uk/money/markets/article-1645433/Chinalco-freeze-on-pound...Oct 17, 2008 · China's biggest aluminium group, Chinalco, today suspended a three billion yuan (£254.9m) bond issue as doubts grew over its $8bn (£4.61bn) stake in Anglo-Australian miner Rio Tinto.[PDF]The Tragedy of the Mortgage Commons - World Banksiteresources.worldbank.org/.../Peppercorn_TragedyoftheMortgageCommons.pdfThe Tragedy of the Mortgage Commons, Ira G. Peppercorn, May 27, 2009 As former Deputy Treasury Secretary Roger Altman has noted, “This damage has put the American model of free-market capitalism under a cloud. The financial system is seen as having collapsed.6” This is not just a crisis of numbers.[PDF]Trading Bases How A Wall Street Trader Made A Fortune ...https://yendagord.allostop.ca/474baa7/trading-bases-how-a-wall-street-trader-made-a...just got this book on audio for a long drive trading bases how a wall street trader made a fortune ... league seasonbut its clear he loves the game as much as the winningsmoreover he asks a number of ... baseball by joe peta a fascinating story about how joe peta leveraged the skill set that he learned

Crazy Aviators: The Eerie Similarities Between Billionaire ...https://www.forbes.com/sites/antoinegara/2019/04/04/earth-to-elon-billionaire-howard...Apr 04, 2019 · At the time of his death in 1976, Hughes had controlled TWA, RKO, Air West and owned multiple billion-dollar businesses, six casinos and most of the undeveloped land in Las Vegas.

The Road to Financial Reformation: Warnings, Consequences ...https://www.barnesandnoble.com/w/road-to-financial-reformation-henry-kaufman/1100298596"Wisdom for a punch-drunk Wall Street. . . gives the lie to the notion that no one saw the financial crisis coming. [Kaufman] was not alone, but was earlier than most. . . In his latest book, Kaufman once again aligns himself with those who believe that a vital task of the central bank is to take away the punchbowl just as the party gets going.3/5(2)

Independent Research Network - irnglobal.comirnglobal.com/single-best-piece-of-financial-journalism-ever-writtenOn January 31, 2007, a broad range of CDO spreads started to widen, dramatically. The long-feared meltdown was upon us all — not that most of us knew it, at the time — and a very small number of investors was about to get paid out on the trade of their lifetimes.

"Shredded" | Ian Fraserhttps://www.ianfraser.org/shredded“Not just the definitive book on the collapse of RBS but one of the best five books on the great financial collapse which changed the history of the 21st century. Ian pulls no punches in his conclusions”—Russell Napier, market historian & investment strategist “You should absolutely read Ian Fraser’s Shredded.

The Military Industrial Complex: War Mongering to Scare ...https://www.thelastamericanvagabond.com/finance/military-industrial-complex-war...Oct 15, 2016 · The Military Industrial Complex’s (MIC) biggest revenue source is the US Government to the tune of $700 billion being spent on defense each year.That is so large that it has become the budget that controls the world through proxies of controlling the shares of holding companies via the top 49 companies in the world (they are all financial holding companies).

A case for balancing your checkbook - USC Newshttps://news.usc.edu/61395/a-case-for-balancing-your-checkbookAs the United States was spiraling into one of its worst financial collapses in history, Jacob Soll found an interesting parallel in France’s “Sun King.” ... “This is a cultural tradition ...

6 Benjamin Graham Books You Have To Read in 2016https://www.netnethunter.com/benjamin-graham-value-investing-booksOne of the best books on the subject of influence is the aptly titled ... focus is heavily targeted at corporate finance rather than the overwhelming focus on securities that Graham favoured in his books. If you're looking for a modern take on Benjamin Graham's classic ... This is a great resource when it comes to assessing value stocks for ...

Lightning never strikes twice but Lehman's collapse still ...https://www.telegraph.co.uk/business/2018/09/16/lightning-never-strikes-twice-lehmans...Sep 16, 2018 · L ast Saturday it was 10 years since the collapse of Lehman’s fired the starting gun for what is now known as the Great Financial Crisis (GFC). …

As the Fed Flattens Rates, the Dollar Gets Bruised - News ...https://www.tuscaloosanews.com/article/DA/20081218/News/606128136/TLDec 18, 2008 · And while some economists are predicting a mild recovery in the second half of 2009 as the Fed’s actions and a $700 billion stimulus plan promised …[PDF]FOR PUBLICATION UNITED STATES BANKRUPTCY COURT …www.nysb.uscourts.gov/sites/default/files/opinions/178085_23_opinion.pdfRepo agreements, such as the MRA, are essential sources of market liquidity and have become important components of a smoothly running financial system. The designation of those assets that are being transferred to a counterparty in consideration for the transfer of funds is a basic element of every repo agreement. The repo market is a

Discuss the Causes of the Sub-Prime Crisis and the Parties ...https://www.studymode.com/essays/Discuss-The-Causes-Of-The-Sub-Prime-1435506.htmlSub prime lending however was different as the borrowers usually had bad credit rating and poor financial status. ... on how to have dealt with their liquidity issues and Subprime mortgage loans that got them back-fired. One of the largest contributors to the expansion of the high-risk-loans was Fannie Mae and Freddie Mac. ... This is largely ...

JP Morgan fined £33m by Financial Services Authority ...https://www.theguardian.com/business/2010/jun/03/jp-morgan-fined-33m-by-fsaJun 03, 2010 · JP Morgan has been fined £33m by the Financial Services Authority – the largest-ever fine imposed by the regulator – for basic compliance failures which meant the bank had not protected ...

bear stearns - 3426 Words | Bartlebyhttps://www.bartleby.com/essay/bear-stearns-PK833CTSCP6SXFeb 17, 2015 · of Bear Stearns and What Can Be Learned Bear Stearns was started in 1923 by Joseph Bear, Robert Stearns and Harold Mayer and was initially and equity trading firm. It was one of the most respected firms of Wall Street and up until its collapse in March of 2008, had never had a losing quarter in its 85-year history.

Category: Finance | Business & Money | TIME.comhttps://business.time.com/category/companies-industries/finance-companies-industriesAfter years of investigations, wiretaps, and coercing cooperation from numerous witnesses, the government’s big insider trading case against hedge fund impresario and long-time target Steve Cohen may come down to a single …

IMF Paper Introduces A New Financial Soundbite: Presenting ...https://www.zerohedge.com/news/2015-02-18/imf-paper-introduces-new-financial-soundbite...Remember when one of the hot Fed buzzwords of 2014 was "macro-prudential regulation", a phrase which was supposed to mean that the Fed can centrally plan every asst price, as well as catch asset bubbles in the making and prick them, also leading to such hilarious contraptions as the "Bubblebusters" - the Fed's own committee To "Avoid Asset Bubbles."

Dramatic pictures show how London City bankers reacted to ...https://www.dailymail.co.uk/news/article-6222167/Dramatic-pictures-London-City-bankers...Sep 30, 2018 · Panic and tears: Dramatic pictures show how London City bankers reacted to the financial crash on 10th anniversary of 2008 Credit Crunch. Photographer Stephen McLaren captured chaos as it …

Closer, Ever Closer – IMF Bloghttps://blogs.imf.org/2012/05/17/closer-ever-closerMay 17, 2012 · On the contrary, one of the main conclusions of our research is that macroeconomic policies matter. The choices made by Asia’s policymakers can help determine the region’s financial betas. For example, a lower government debt-to-GDP ratio, and a higher stock of international reserves, but up to a limit, are associated with lower financial ...

Cutting a bank's corporate staff down to size. | American ...https://www.americanbanker.com/news/cutting-a-banks-corporate-staff-down-to-sizeCutting a Bank's Corporate Staff Down to Size. No area of a large bank is more open to criticism than its corporate staff. That group of service providers and policymakers includes disciplines such as human resources, legal, tax, audit, real estate, general services, insurance, accounting and financial control, technology, and public affairs.

ASIA - UNITED STATES As the world's monetary system inches ...www.asianews.it/news-en/As-the-worldââ‚ÂÂ...The world's hotspots in the Far East and North Africa parallel the deep crisis of the US and world economies. As Barack Obama's Keynesian plans fail, the US dollar could experience hyper-inflation ...

Amnesia and the Financial Crisis | HuffPost UKhttps://www.huffingtonpost.co.uk/eliane-glaser/amnesia-and-the-financial_b_3919406.htmlAmnesia and the Financial Crisis One of the most dangerous side-effects of the Great Recession is amnesia. Our memories have already been eroded by a combination of Twitter and 24-hour rolling news.

When the Big Dog Barks - TheStreethttps://www.thestreet.com/opinion/when-the-big-dog-barks-877046In the bond market, the big boys still control the trading strategy -- and enjoy every basis point that results.

All that glitters is gold.. or not?https://www.datascienceinvestor.com/post/all-that-glitters-is-gold-or-notHelping Singaporeans who are interested to be datascienceinvestors to make data driven decisions in Singapore properties and stocks investments

The Lessons from Enron: The Importance of Proper Internal ...https://www.mbaknol.com/business-ethics/the-lessons-from-enron-the-importance-of...Jul 28, 2016 · The events were finally resulting the filing for bankruptcy in December 2001, started way much before fraud at Enron could be even suspected. Andersen played a major role in the collapse of Enron. Andersen failed two times regarding audit issues just a few years short time before the collapse of Enron, at Waste Management in 1996 and […]

Declining Cross-Border Capital Flows—Retreat or Reset?F ...https://www.chegg.com/homework-help/declining-cross-border-capital-flows-retreat-reset...Declining Cross-Border Capital Flows—Retreat or Reset? For decades cross-border capital flows—including lending, foreign direct investment flows, and purchases of equities and bonds—advanced relentlessly, reflecting the increasing integration of national capital markets into one single massive global system.

Why Cryptocurrency Holders Should Be Watching the Elon ...https://medium.com/karatcoins/why-cryptocurrency-holders-should-be-watching-elon-musk...Aug 20, 2018 · Speaking for Karatcoin, we have correctly recognized that the global economy is about to go through both a revolution and a renaissance as the fiat monetary system continues to corrode and ...[PDF]Pricing in the Post Financial Crisis - University of Tokyowww.student.e.u-tokyo.ac.jp/grad/siryo/Fujii.pdfan unavoidable element for all the types of ?nancial contracts. This is a rather natural consequence of signi?cant number of credit events, well exempli?ed by a collapse of Lehman brothers, which was one of the most prestigious investment banks at that time. On the other hand, clean or benchmark pricing framework has also changed ...

5: Bankruptcy And Student Loan Eligibility Canada - How ...https://5nln.blogspot.com/2013/02/bankruptcy-and-student-loan-eligibility.htmlWhat's more, one of the connection between the latest legal guidelines tend to be as it were file bankruptcy, you should do that inside the express in which you're a citizen, therefore you aren't able to just go to a new condition to file for individual bankruptcy mainly because they could have an overabundance obliging rules in a few locations.

Should central European EU members join the euro zone ...https://www.bruegel.org/2018/09/should-central-european-eu-members-join-the-euro-zoneSep 11, 2018 · The debate on euro-zone entry of central European EU Member States has intensified after Jean-Claude Juncker, president of the European Commission, expressed the Commission’s ambition to accelerate the process and suggested a special pre-accession financial instrument to increase the euro’s attractiveness.

September 15, 2008 – FSRNfsrn.org/2008/09/september-15-2008As the global economy attempts to make sense of one of the largest shake ups in the market, questions are swirling especially about how heavy this crisis will grow. The bankruptcy of Lehman brothers and Bank of America’s take over of Merrill Lynch is nothing new this year.

Britain’s productivity crisis in eight charts ...https://www.businesstelegraph.co.uk/britains-productivity-crisis-in-eight-chartsAug 13, 2018 · Britain’s productivity crisis should be keeping the country’s politicians and civil servants awake at night. This is because the UK has experienced a slump in productivity growth since the financial crisis that shows no sign of coming to an end. The slowdown has been more acute than any other western country. It matters because achieving higher …

Morning Take-Out - The New York Timeshttps://dealbook.nytimes.com/2011/10/24/morning-take-out-351Oct 24, 2011 · Spitzer As Wall Street’s Defender | In a conversation about the Occupy Wall Street protests, Eliot Spitzer mounted a qualified defense of the industry he policed as New York’s attorney general — but also offered the protesters some potential talking points. “Let me say this — and don’t forget, I was not exactly Wall Street’s favorite — finance is an important part of our lives ...

Thank Goodness for Regulation | The Daily Bellhttps://www.thedailybell.com/all-articles/news-analysis/thank-goodness-for-regulationMay 14, 2012 · Paul Krugman is out with another weary defense of massive financial regulation. The US Leviathan is in the process of strip-searching seniors and infants at airports for reasons it cannot aggregately define, but Krugman is still a true believer. Actually, of course, he is not. The New York Times, Krugman and a coterie of additional people and resources are seemingly part of a larger elite ...

Sore Losers: Why Hasn't the FEC Appealed a Case in Over a ...https://campaignlegal.org/index.php/update/sore-losers-why-hasnt-fec-appealed-case...Jul 31, 2018 · FEC , 508 F. Supp. 2d 10 (D.D.C. 2007), one of a series of challenges to regulations promulgated by the Commission under the Bipartisan Campaign Finance Reform Act. The court granted part of the plaintiffs’ motion for summary judgment, and on October 31, 2007, with the 2008 election season kicking into gear, the FEC appealed.

Testimony Before the Subcommittee on Financial Services ...https://www.sec.gov/news/testimony/2009/ts060209mls.htmJun 02, 2009 · Testimony Before the Subcommittee on Financial Services and General Government. by Chairman Mary L. Schapiro U.S. Securities and Exchange Commission. Before the Subcommittee on Financial Services and General Government U.S. Senate Committee on Appropriations June 2, 2009. Chairman Durbin, Ranking Member Collins, Members of the Subcommittee:

Funding Galore: Startup Fundings Of The Week [8Feb-14Feb ...https://inc42.com/buzz/funding-galore-startup-fundings-week-8feb-14feb(This is based on startups that disclosed their funding amount). ... Funding Galore: Startup Fundings Of The Week [8Feb-14Feb] ... one of the largest doctor search engine in Asia raised $30 Mn ...[PDF]FOR DISTRIBUTION FOR DISTRIBUTIONhttps://www.williamblairfunds.com/resources/docs/content/pdf/PressReleases/BondFund...FOR DISTRIBUTION FOR DISTRIBUTION Disclosure: As interest rates rise, bond prices will fall and bond funds become more volatile. Please carefully consider the Bond Fund’s investment objective, risks, charges, and expenses before investing. This and other information is contained in the Fund’s prospectus, which you may obtain by

Limits Revisited | Blog by Tim Jacksonhttps://www.cusp.ac.uk/themes/p/limitsrevisitedApr 19, 2016 · In July 2008, just two months before the collapse of Lehman brothers, oil prices reached an unprecedented $147 a barrel, five times higher than they had been in 2003. The high price of oil led to a dramatic rise in the price of other commodities.

Looking Back: Wall Street, a Year Laterhttps://learningenglish.voanews.com/a/a-23-2009-09-17-voa2-83141407/129793.htmlOn ECONOMICS REPORT: American taxpayers still own a large share of some big financial companies. President Obama used the anniversary o

RIETI - The Impact of the Great Eastern Japan Earthquake ...https://www.rieti.go.jp/en/columns/a01_0307.htmlUnlike the Great Recession, therefore, this disaster will probably not lead to a sharp decline in total exports due to a lack of demand. One of the characteristics of the Great Recession of 2008-2009 was that exports dropped by more than the decline in GDP. Trade is vulnerable to shocks.[PDF]Using Foreign Exchange Markets to Outperform Buy and Holdwww.naaim.org/wp-content/uploads/2013/10/00B_Using_Foreign_Exchange_Markets_to...Using Foreign Exchange Markets to Outperform Buy and Hold Page 10 Actively trading S&P500 vs. long only One of the most common ways to measure risk appetite is to use the VIX index, which measures the implied volatility on S&P500. Higher values indicate market tension as investors purchase options to protect their long positions in the underlying.

The economic and financial Outlook. - Free Online Libraryhttps://www.thefreelibrary.com/The+economic+and+financial+Outlook.-a0291727971It is important to note that a large part of the public debt is held by Italian families and institutions. Less then a half, 42%, is in fact held by foreign residents (the Euro zone average is 52.1%). This is a great shield against the types of hostile speculative attacks that can create an n artificial liquidity crisis.[PDF]CENTRE FOR ECONOMETRIC ANALYSIS CEA@Casshttps://www.cass.city.ac.uk/__data/assets/pdf_file/0006/36546/WP-CEA-5-2008.pdfas the total value of the assets of the ?rm that has issued the bonds we are interested in. The value of the ?rm is assumed to move around stochastically and hence a stochastic process for the evolution of the ?rms’ underlying assets is assumed. This is the driving force behind the dynamics of the prices of all securities issued by the ...

Is Lehman CEO Dick Fuld the True Villain in the Wall ...https://nymag.com/news/business/52603Nov 27, 2008 · Dick Fuld joined Lehman full time in 1969, shortly before Joe Gregory. Soon they were traders together, sitting a few desks from each other, under the powerful influence of Lew Glucksman.Author: Steve Fishman

A Buckeye’s Lament: What Has Happened to Ohio and the ...https://www.commondreams.org/views/2018/08/09/...One of the big stories of the last 50 years that the national press has missed, but is impressed upon me every time I return to the Midwest, is what I call the NASCAR-ization of the region, whereby it has become, in many respects, a cultural colony of the South. ... This is quite a comedown for a state destined by the Northwest Ordinance to be ...

10th Anniversary of the Financial Crisis of 2008: Crash Coursehttps://www.washingtonexaminer.com/weekly-standard/10th-anniversary-of-the-financial...A decade ought to be enough time to make sense of the financial crisis of 2008—to unearth the relevant facts and sort through, with some scholarly distance, the most important debates.. While ...

Lessons from the Financial Services Crisishttps://shrm.org/hr-today/news/hr-magazine/Pages/0109cascio.aspxAnd before the current crop of failures hit, there was the spectacular collapse of the Long-Term Capital Management hedge fund and the announcement in January 2008 of a $7.2 billion loss from an ...

BLaw Test 2 - Business Law 205 with Bender at College of ...https://www.studyblue.com/notes/note/n/blaw-test-2/deck/13899466Study 161 BLaw Test 2 flashcards from Isabella W. on StudyBlue. ... You are the CEO of a major corporation that is suffering financially in the current economy. Your board has tasked you with cutting employee-related costs by 5 percent. ... This is an example of a situation in which someone acted illegally but it could be argued that the act ...

The week in charts - Treating the world economy for covid ...https://canadanewsmedia.ca/the-week-in-charts-treating-the-world-economy-for-covid-19...Mar 07, 2020 · Biden’s bounce • Syria’s endless tragedy • The glass ceiling, and worse • Democracy in AfricaGraphic detailAlthough China still accounts for four-fifths of covid-19 cases, most new occurrences are now in other countries. As the coronavirus spreads worldwide, it threatens an economic crisis as well as a health emergency. Both need fixing.

The Deficit Tango by Charles Wyplosz - Project Syndicatehttps://www.project-syndicate.org/onpoint/the-deficit-tango-by-charles-wyplosz-2017-08Aug 11, 2017 · The Deficit Tango. Aug 11, 2017 Charles ... as was the case with Greece and Portugal during the euro crisis. ' is surely very wide of the mark given the forced sale of assets to foreign and banking interests in Greece, and the rise in taxes, destruction of pensions and living stanbdards and proposed endless austerity acompanbiued by claimed ...

Norm Champ Goes Public With His Adventures Inside The SEC ...https://www.stevepomeranz.com/radio/guests/norm-champSep 06, 2017 · So, I took a whole year off, rented one of these shared work spaces on the Upper West Side of Manhattan and then one of these group office spaces, and worked on the book for a year. And I spoke to a variety of different people about opportunities and ultimately ended up back in private practice at a law firm and have been helping investment ...

See a Bubble? - The New York Timeshttps://www.nytimes.com/2005/06/05/magazine/see-a-bubble.htmlJun 05, 2005 · It's a good time to be a financial-disaster writer. Disasters abound, and even when they don't, people are eager for your opinion on when the next bubble is …

America's Financial Sector: A Story of Crime Without ...https://knowledge.wharton.upenn.edu/article/why-wrongdoing-executives-are-rarely...Journalist Jesse Eisinger digs into the reason why, in his new book. ... One of the effects is that we are going to have even less accountability for corporate crime, in addition to a lot of ...

Cash Me If You Can - Entrepreneurhttps://www.entrepreneur.com/article/201304Apr 16, 2009 · University endowment managers followed Yale investment guru David Swensen into private equity and hedge funds--now they're short on cash. Luckily for …

Unfair Advantage: The Power of Financial Education ...https://b-ok.cc/book/1110078/82c008In his new book the bestselling author of "Rich Dad, Poor Dad" confirms his message and challenges readers to change their context and act in a new way. In this timely new book, Robert Kiyosaki takes a new and hard-hitting look at the factors that impact people from all walks of life as they struggle to cope with change and challenges that ...

Senator Corker Should Brush Up On His Bank Failure History ...https://safehaven.com/article/15590/senator-corker-should-brush-up-on-his-bank-failure...My best guess is that these are the loans that have not been earmarked for the investment portfolio, and are being held for sale, thus are not held under the accrual accounting rules. If the case, these numbers were delivered just before the massive upheaval in the markets where investors totally shunned the MBS products.

Where did all the money go? (Part II): what is a Ponzi ...https://www.thefreelibrary.com/Where+did+all+the+money+go?+(Part+II):+what+is+a+Ponzi...Free Online Library: Where did all the money go? (Part II): what is a Ponzi scheme? And what made the difference between the collapsed businesses of the West and those that survived? Cameron Duodu concludes his two-part series on the credit crunch and the economic stimulus packages now in fashion in the West.(GLOBAL FINANCIAL CRISIS) by "New African"; Business, international General interest ...

IBLP Board Failure: Ignorance or Negligence?https://www.recoveringgrace.org/2014/06/iblp-board-failure-ignorance-or-negligenceActually, in a nonprofit organization, the CEO has zero votes if he is a paid employee of the organization. This is one of the big differences between a nonprofit and a for-profit. The voting members of the board of directors must be 100% volunteer and cannot be employees or financial beneficiaries of the organization in any way.

Bear Stearns Bailout Proves US Fed is Merely an Extension ...www.marketoracle.co.uk/Article4074.htmlMar 20, 2008 · Bear Stearns Bailout Proves US Fed is Merely an Extension of the Financial Industry Stock-Markets / Credit Crisis 2008 Mar 20, 2008 - 05:06 AM GMT. By: Mike_Whitney One picture tells the …

Senator Bob Corker Needs to Be Updated on His Bank Failure ...https://www.zerohedge.com/article/mr-corker-needs-be-updated-his-bank-failure-historySenator Bob Corker Needs to Be Updated on His Bank Failure History. ... If the case, these numbers were delivered just before the massive upheaval in the markets where investors totally shunned the MBS products. If my hunch is correct, then "Excludes nonaccrual loans held for sale" category will be forced into the investment portfolio ...

Credit Crunch in Usa-Causes and Solutions Essay Examplehttps://paperap.com/paper-on-essay-credit-crunch-usa-causes-solutionsContents Credit Crunch in USA2 Causes of the Credit Crunch2 Housing Bubble2 Financial Product Innovations5 Sub Prime and Alt-A Lending5 Shadow Banking System6 Other Factors7 Solutions for the Credit Crunch7 Nationalization7 Regulation of the Shadow Banking System8 Regulations on Mortgage Lending8 Capital Reserve Requirement9 Government Initiatives10 Conclusion11 References12 …

(PDF) Financial Regulation and : The Spectre of Government ...https://www.researchgate.net/publication/332454661_Financial_Regulation_and_The...A 'read' is counted each time someone views a publication summary (such as the title, abstract, and list of authors), clicks on a figure, or views or downloads the full-text.

The Left's Crisis - The Bullethttps://socialistproject.ca/2011/08/b536Aug 15, 2011 · The Left’s Crisis. Theory • August 15, 2011 • Leo Panitch. A common response of the left to the financial crisis that broke out in the USA in 2007-08 was often a kind of Michael Moore-type populist one: Why are you bailing the banks out?Let them go under.

Economists and the Crisis – The Irish Economywww.irisheconomy.ie/index.php/2009/09/05/economists-and-the-crisisSep 05, 2009 · Appointing Prof. Honohan as Governor of the CB is very welcome, but it is a cunning move by Minister Lenihan – pragmatism is in his genes. It is unlikely to be symptomatic of any decisive break with previous behaviour. We have the potential in Ireland to build a good society and a …

On Money and Society: An Exclusive Interview With Steve ...https://www.financialsense.com/.../john-butler/money-society-interview-steve-baker-mpJan 23, 2015 · What was the purpose of the debate and do you believe that it achieved your objectives? SB: Prominent Constitutional fiat money advocates Positive Money were agitating for a debate and they have strong national support. Despite disagreeing on many things, I am one of …

The Rigged Financial System in Americahttps://www.jesus-is-savior.com/Evils in Government/Federal Reserve Scam/capitalism_is..."The Church restates the priority to be granted to people and their needs, above and beyond the constraints and financial mechanisms often advanced as the only imperatives." Pope John Paul II wrote in his encyclical letter Centesimus Annus (n. 35): "The principle that debts must be paid is certainly just.

Sources of the Crisis | National Reviewhttps://www.nationalreview.com/magazine/2010/06/21/sources-crisisThe last three years have been a remarkable period of economic turmoil. For a few weeks in 2008, it looked as if the entire, deeply interconnected global financial system would collapse.

House Financial Services Committee Hearing on the Global ...https://www.sifma.org/resources/general/house-financial-services-committee-hearing-on...In response to a question from Rep. Steve Stivers (R-Ohio) on the biggest risks to the financial system, Corbat replied it was “the ability to talk themselves into the next recession.” Dimon replied with cybersecurity and the growing nonbank sector, adding that while not systemic yet, it …

Read the Ryan plan source document - Politicohttps://www.politico.com/tipsheets/morning-money/2012/03/read-the-ryan-plan-source...Read the Ryan plan source document - Americans think U.S. economy is broken - Hot click: Pew government subsidy study - Big idea: SEC leverage rule didn't drive crisis

EPF Should Exit Banking Sector – Colombo Telegraphhttps://www.colombotelegraph.com/index.php/epf-should-exit-banking-sectorBy W.A Wijewardena – EPF should exit banking sector and Central Bank should leave private banks in private hands Monetary Board acquiring private banks through EPF The latest reports filed by private banks and a few financial sector non-bank institutions with the Colombo Stock Exchange

JRFM | Free Full-Text | Has ‘Too Big To Fail’ Been Solved ...https://www.mdpi.com/1911-8074/12/1/24/htmIn his letter to shareholders, ... One of these initiatives has been the so-called ‘Volcker rule’ codified in the Dodd-Frank Act (Title VI, Section 619). The rule forbids banks from acquiring certain assets (such as corporate bonds) for their own account, or to engage in proprietary trading beyond a minimal level. ... This is akin to a ...

Rothschild & Soros ' Octopus Over the Balkans - Yugoslavia ...https://hellasfrappe.blogspot.com/2013/03/rothschild-soros-octopus-over-balkans.htmlMar 01, 2013 · One of those people was a certain Richard Katch (also a Khazar), a member of "Quantum Fund". At the same time, he was head of "Rothschild Italia SpA" and the committee of the commercial bank "NM Rothschild & Sons" in London. Another important player is O. Niles Taube, also a member of Quantum and a partner of the investment group "St. ..

TheMoneyIllusion » Fortunately?https://www.themoneyillusion.com/fortunatelyThis Bloomberg article by former New York Fed President Bill Dudley caught my eye: In the fall of 2008, the Fed needed to supply large amounts of liquidity to support the ailing economy and unfreeze gridlocked financial markets. These liquidity provisions blew up the Fed’s balance sheet and the amount of reserves in the financial system.

The future of money – UWE student takes for Bristol ...https://criticalfinance.org/2017/12/13/the-future-of-money-uwe-student-takes-for...Dec 13, 2017 · Daniela Gabor Last month, I participated in an excellent panel on the Future of Money at the Bristol Festival of Economics. In preparation for the event, UWE undegraduate students taking my course on Economic Theory and Policy worked together to produce two-sided briefs on what they thought to be the most interesting questions for the…

December | 2017 | Critical Macro Financehttps://criticalfinance.org/2017/12It wont be a panacea, but it will make life a bit easier. This is not a mere question of better plumbing – it goes to the heart of ongoing discussions about the welfare state, inequality and our capacity to collectively provision for an uncertain future through the state, rather than through markets.

FCIC report says the financial crisis was avoidable - Jan ...https://money.cnn.com/2011/01/27/news/economy/fcic_crisis_avoidableJan 27, 2011 · The financial crisis, which wreaked havoc on the economy and sparked a painful recession, could have been avoided, according to a federal commission.

US History II exam Flashcards | Quizlethttps://quizlet.com/345867898/us-history-ii-exam-flash-cardsCity ordinances in Montgomery, Alabama, segregated the city's buses forcing African American passengers to ride in the back section. In 1955, this lady refused to give her front of the bus seat to a white man resulting in her arrest, which started the Montgomery Bus Boycott.

Wall Street Crash Essay | Bartlebyhttps://www.bartleby.com/topics/wall-street-crashIn 1929, the Western industrialized countries succumbed to a bleak period of time known as the Great Depression. This economic collapse, which persisted for ten long years, was preempted by the stock market crash on Wall Street, buying on credit, supply and …

Lunch with the FT: James Gorman | Financial Timeshttps://www.ft.com/content/e1c68512-ffa7-11e4-bc30-00144feabdc0May 22, 2015 · It turns out he was the first kid from this family to go to college . . . his test scores were at least as good as the incoming class that we hired, and this kid had come from nothing.

Bank fears, AIG fallout drive Wall St sell-off - Reutershttps://www.reuters.com/article/us-markets-stocks-idUSL267843520080917Sep 17, 2008 · U.S. stocks dropped to a three-year low on Wednesday as the U.S. rescue of insurer AIG failed to calm a crisis of confidence in global markets and banks were scared to lend to each other.

Financial Samurai 2019 Year In Review: One Of The Best ...www.tradezy.com/financial-samurai-2019-year-in-review-one-of-the-bestDec 27, 2019 · It was one of the best ways I learned about investing and finance. But in order for a forum to grow, it needs to be nurtured. Therefore, I plan to continue posting and corresponding at least 5X a week on the forum to build the FS community. I have a 5-year plan to grow the Financial Samurai Forum into one of the best financial forums on the web ...[PDF]THE RISE, THE FALL, AND THE RESURRECTION OF ICELAND ...www.nber.org/papers/w24005.pdfthe first part of the article, explaining the run-up to the crisis. Relative to that report, we have chosen to aggregate some data, which were made public, to give a more consistent macro picture that does not depend on the particulars of each bank. Furthermore, as the report was written in

Pod fast-food: On a healthy drive towards expansion ...https://www.telegraph.co.uk/finance/businessclub/9440361/Pod-fast-food-On-a-healthy...Jul 31, 2012 · Pod fast-food: On a healthy drive towards expansion In 2004, when the City was growing fat on deals and long lunches, acquiring finance from all-male angel investors for a …

CEO under fire as he gives evidence over collapse - YouTubehttps://www.youtube.com/watch?v=9rULZkCefgEJul 21, 2015 · Photographers taking pictures of Lehman Brothers' chief executive officer Richard Fuld 2. ... CEO under fire as he gives evidence over collapse AP Archive ... but it didn't seem to work for the ...

S&P Failing to Reach Pre-Lehman Level Amid Resistance ...https://www.bloomberg.com/news/articles/2010-12-15/s-p-500-failing-to-rally-past-pre...Dec 16, 2010 · The Standard & Poor’s 500 Index rallied above 1,245 yesterday before paring its gains, failing for a second day to surpass the last closing level before Lehman Brothers collapsed in September ...

Ten Years After Lehman, Lessons of Financial Collapse ...https://wispirg.org/blogs/eds-blog/usp/ten-years-after-lehman-lessons-financial...Ten years ago this weekend the collapse of investment bank Lehman Brothers marked the massive financial collapse of 2008. Millions of Americans lost homes, jobs and trillions of dollars in retirement savings. Today, the financial collapse hasn't been forgotten, it's being ignored by …

From Lehman to London 2012, Hockey Player Targets Olympic ...https://www.bloomberg.com/news/articles/2011-08-21/from-lehman-bankruptcy-to-london...Aug 22, 2011 · As Lehman Brothers Holdings Inc. collapsed, Nick Brothers was left ruing past decisions. ... From Lehman to London 2012, Hockey Player Targets Olympic Gold David Goodman ... but it…

Lehman, the financial crash and the making of history ...https://www.ft.com/content/6eeb3d26-641b-11e4-bac8-00144feabdc0Nov 10, 2014 · As the 2007-2008 financial crisis set in, and the banking system teetered, Mervyn King reminded staff to keep records of discussions and decisions. ... “The first step is …

Odds on My D.C. | The 10th Man Investment Newsletter ...https://www.mauldineconomics.com/the-10th-man/odds-on-my-d.cAug 31, 2017 · Odds on My D.C. By Jared Dillian. August 31, 2017. First, do yourself a favor and follow me on Twitter.Dry humor putting in new highs daily. The New York Times’ DealBook had a great piece of journalism a couple of days ago about short VIX carry monkeys. Well, that is what I call them.

WSJ. Magazine Editor’s Letter: All in the Family - WSJhttps://www.wsj.com/articles/wsj-magazine-editors-letter-all-in-the-family-1535036574The first issue of WSJ. Magazine debuted on Saturday, September 6, 2008, just as the country was descending into financial crisis. America’s jobless rate had spiked to a five-year high; in a ...

Is your broker a crook? If your money is lost and your ...https://www.thefreelibrary.com/Is+your+broker+a+crook?+If+your+money+is+lost+and+your..."But it is our firm belief that risk is mitigated by knowledge and involvement." Start by thoroughly researching any broker, financial planner, or adviser you are considering hiring. Explore the North American Securities Administrators Association Website, www.nasaa.org, or call 888-84-NASAA for a regulator in your state.

America's role in this Greek tragedy | Mark Weisbrot ...https://www.theguardian.com/commentisfree/cifamerica/2011/jun/25/greece-debt-default...Jun 25, 2011 · But it is a high stakes gamble, and this week's vote won't end the instability. It has been largely forgotten, but there was a Greek debt crisis just over a year ago, in May 2010, that rattled ...

Financial firms face probe in subprime-mortgage fallout ...https://www.seattletimes.com/business/financial-firms-face-probe-in-subprime-mortgage...U.S. prosecutors are adding employees to investigate New York-area financial firms for possible fraud linked to a global credit crisis that has wiped out $30 trillion of equity value in the past year.

Goldman and Citi Lead Dealmaker Rankings - The New York Timeshttps://dealbook.nytimes.com/2007/03/30/goldman-and-citi-lead-dealmaker-rankingsMar 30, 2007 · They may be a few last-minute deals straggling in, but as the first quarter comes to a close, Goldman Sachs has a firm lead in the mergers-and-acquisitions league tables. Goldman had an advisory role in 104 announced deals with a total value of $311 billion so far this year, or about 29 percent of the $1.08 trillion of deals worldwide, according to Thomson Financial.

Ten things you may have missed Wednesday from the world of ...https://www.bostonglobe.com/business/talking-points/2015/12/16/rallies-seven-year-high...Massachusetts is home to a number of medical device makers. ... but it will take a few months for some of that to trickle down to the bottom line, and CVS Health leaders said at the company’s ...[PDF]ANNUAL REPORThttps://s24.q4cdn.com/856567660/files/doc_financials/2008/ar/2008-Proxy-Statement.pdfmay sound simple, but it demands we bring together the collective resources of our organization from around the world. It requires the integration of our deep capital markets expertise, extensive risk management and advisory capabilities, and our time-tested operating processes. More importantly, it requires that we stop to listen.

Do We Really Need This Type Of Structure In Our Lives ...https://annuity.com/do-we-really-need-this-type-of-structure-in-our-livesThe maximum loss potential for a structured variable annuity depends on whether the product has a buffer (i.e., the insurer protects the insured up to a threshold of something like the first 10% of losses and thereafter the insured is on the hook financially) or a …

Key fiduciary decisions loom for retirement plan advisers ...https://www.investmentnews.com/key-fiduciary-decisions-loom-for-retirement-plan...Aug 01, 2016 · aa_free; 401(k) Key fiduciary decisions loom for retirement plan advisers using money market funds Once-plain-vanilla funds due for a serious makeover, meaning now is …

Morning Coffee: Deutsche Bank's Plan B if Commerzbank ...https://news.efinancialcareers.com/us-en/3000828/deutsche-banks-plan-bApr 22, 2019 · There aren’t so many details on the second, more radical option, but it’s reasonable to speculate that what’s being referred to is euphemistic for a complete removal and shutdown of ...