Home

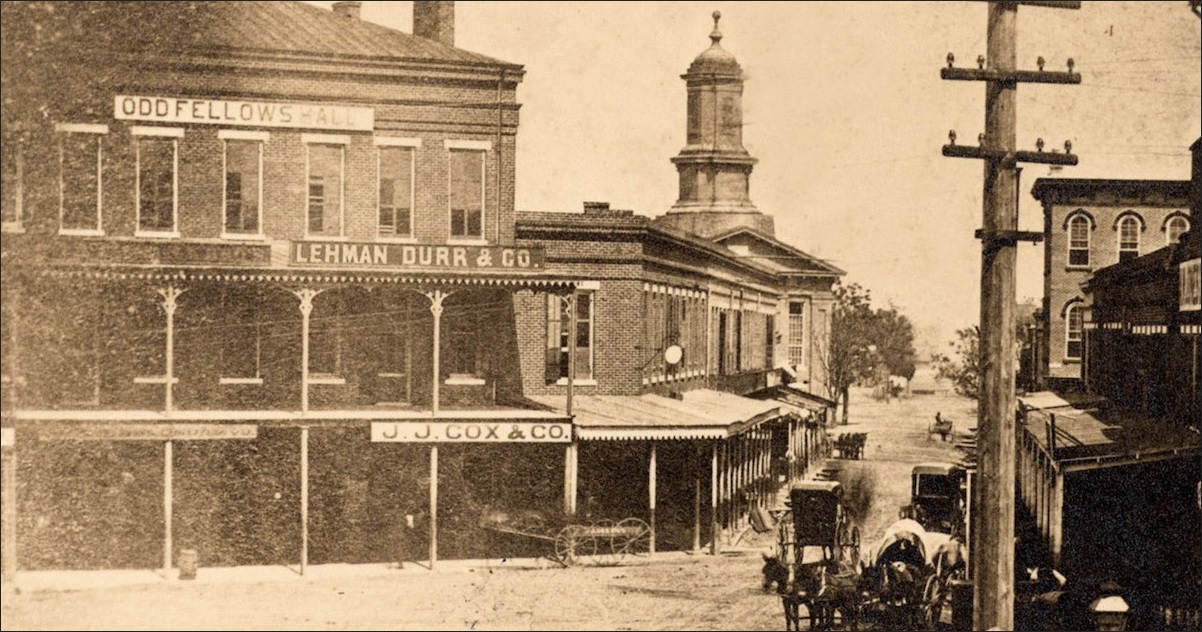

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Plaintiffs Substantially Prevail in Two Subprime Lawsuit ...https://www.dandodiary.com/2010/04/articles/erisa/plaintiffs-substantially-prevail-in...Apr 26, 2010 · During 2008 and 2009, Lincoln National had sustained heavy losses in its investment portfolio because of investments in mortgage-backed securities, structured investment products, and other derivative securities, including collateralized debt obligations. As the company sustained these investment losses, its share price declined substantially.

Why Economists Didn't Anticipate the Financial Crisis ...https://seekingalpha.com/article/180601-why-economists-didnt-anticipate-the-financial...Jan 03, 2010 · About three months ago, Nobel Prize winning economist Paul Krugman took a stab at explaining why economists didn’t anticipate the worst financial crisis in three-quarters of a century.

Musk Has Heavily Leveraged His Holdings Of Tesla While ...https://www.forbes.com/sites/jimcollins/2018/05/18/musk-has-heavily-leveraged-his...May 18, 2018 · Obviously those figures are not reported in real-time, but market reports on Musk's much-hyped purchase of 33,000 Tesla shares last week--which amounted to a 0.1% increase in his …

How Many Arthur J. Gallagher & Co. (NYSE:AJG) Shares Have ...https://finance.yahoo.com/news/many-arthur-j-gallagher-co-171352659.htmlApr 18, 2019 · We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a ...Author: Simply Wall St

GoPro CEO speaks about the tech company’s future [Video]https://finance.yahoo.com/video/gopro-ceo-speaks-tech-company-173945301.htmlDec 14, 2018 · As it confronts a shrinking market share, GoPro has been under pressure in recent months. But the founder and CEO, Nick Woodman, tells Yahoo Finance’s Brian Sozzi they are …

Amazon.com: Fooling Some of the People All of the Time: A ...https://www.amazon.com/Fooling-Some-People-All-Time/dp/B0036UZC40Fooling Some of the People All of the Time is the gripping chronicle of this saga, and this edition contains all new updates from the author. Minute by minute, it delves deep inside Wall Street, showing how the $6-billion hedge fund Greenlight Capital conducts its investment research and detailing the maneuvers of an unscrupulous company.4.4/5(204)

Steve Diggle: Artradis Fund Management, Singapore's ...https://www.opalesque.tv/hedge-fund-videos/Steve_Diggle/1In May 2002, Stephen Diggle set up Artradis Fund Management in Singapore, which subsequently became one of the largest home grown Asian hedge funds.Diggle has been trading equities and derivatives since 1986. At that time, derivatives were a real frontier in finance. Diggle liked the maths required to understand and use options and futures to the extent that he was promoted Head of …

New Books in Economics (March 2017) – Peter Galbács ...https://pgalbacs.wordpress.com/2017/03/18/new-books-in-economics-march-2017Mar 18, 2017 · Among the recently published books in economics one title deserves further attention. This is Henry Kaufman's Tectonic Shifts in Financial Markets. Dr. Kaufman is a living legend. He worked in the commercial bank sector and later as an economist at the Federal Reserve Bank of New York. After this stage of his life, he spent 26 years at Salomon…

Ex-Lehman Trader Trounces Hedge Funds With 500% Gain ...https://www.newsmax.com/Finance/InvestingAnalysis/...Oct 10, 2012 · Brevan Howard Asset Management LLP, Europe’s second-largest hedge-fund manager, posted a 1.6 percent gain this year in its flagship $25 billion fund, according to a person familiar with the returns. John Paulson, who made $15 billion in 2007 betting against subprime mortgages, has lost 14 percent this year in his Advantage Plus Fund.

Amazon.com: Customer reviews: The New Financial Deal ...https://www.amazon.com/New-Financial-Deal...Find helpful customer reviews and review ratings for The New Financial Deal: Understanding the Dodd-Frank Act and Its (Unintended) Consequences at Amazon.com. Read honest and unbiased product reviews from our users.

How Asia shapes up 20 years after ... - Nikkei Asian Reviewhttps://asia.nikkei.com/Politics-Economy/Economy/How-Asia-shapes-up-20-years-after...In his 30-year career in finance and policymaking, Robert Zoellick experienced a number of crises firsthand, including during his tenure with the U.S. government and at the World Bank, where he ...

10,000 rooms on ice - The Real Dealhttps://therealdeal.com/issues_articles/span-style-font-size-24px-10-000-rooms-on-ice-spanGo to: A look at what's holding up hotels planned for NYCFinancing trouble is drastically eliminating the number of hotels under construction in New York City, causing at least 10,000 formerly p

Street Freak: A Memoir of Money and Madness: Amazon.co.uk ...https://www.amazon.co.uk/Street-Freak-Memoir-Money-Madness/dp/1439181276This is an outstanding review of the life of a trader, written by one of Lehman's more high-profile trading figures. Jared was known at Lehman for his direct, insightful and most of all witty commentaries (in a world where traders can receive several thousand messages each day, his were literally the only ones I would ever search for to ensure I didn't miss them).Reviews: 5Format: PaperbackAuthor: Jared Dillian

Does anyone study the economic and financial crisis in ...https://www.researchgate.net/post/Does_anyone_study_the_economic_and_financial_crisis...Does anyone study the economic and financial crisis in Greece after the subprime crisis? ... slowdown in economic growth that it may lead to a global ... the largest investment banks Lehman ...

How Asia shapes up 20 years after 1997 financial crisis ...https://asia.nikkei.com/Economy/How-Asia-shapes-up-20-years-after-1997-financial-crisisIn his 30-year career in finance and policymaking, Robert Zoellick experienced a number of crises firsthand, including during his tenure with the U.S. government and at the World Bank, where he ...

Big Brother and the Hidden Hand of the "Free Market ...https://www.globalresearch.ca/big-brother-and-the-hidden-hand-of-the-free-market/18490As the Times reported, work on the project has ground to a halt. This was confirmed by the OIG. “On March 3, 2010, because of significant issues regarding Phase 2 Segment 4’s usability, performance, and quality delivered by Lockheed Martin, the FBI issued a partial stop-work order to Lockheed Martin for portions of Phase 3 and all of Phase ...[PDF]FAIR VALUE ACCOUNTING, FRAGILE BANK BALANCE SHEETS …https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2393474_code1266091.pdf?abstractid=...FAIR VALUE ACCOUNTING, FRAGILE BANK BALANCE SHEETS AND CRISIS: A MODEL ... global financial crisis as the “signal researchable-teachable moment of my two-decade-plus career as an accounting academic”. Numerous authors have started to investigate the link ... upswing); this corresponds with one of Pinnuck’s (2012:5) conclusions in his ...

Money & Banking - economics 321 Coursework Example ...https://studentshare.org/finance-accounting/1589619-money-banking-economics-321This is also demonstrated in the importance given to saving institutions especially in times of crises. As Kindleberger believed that the fate of an economic system relies on the viability of its firms. All in all, the origins of financial crises are diverse. This is the reason why it has many forms.

Which was the first investment bank to go down in subprime ...https://brainly.in/question/7091867Which was the first investment bank to go down in subprime crisis of 2008? Get the answers you need, now!

Wall Street and Suicide - CNBChttps://www.cnbc.com/id/40841645Dec 29, 2010 · When Wall Street and the financial system collapsed in October, 2008 a big question was, “Where are the suicides?” Where were the people flinging themselves out of …

BROTHER, CAN YOU SPARE ANOTHER DIME? PACE OF FINANCIAL ...https://www.investmentnews.com/brother-can-you-spare-another-dime-pace-of-financial...But among banks and finance companies, which are the most active, 311 deals worth $81.9 billion were announced through September, off sharply from the first nine months of 1998, which saw 350 ...

The non-standard monetary policy measures of the ECB ...https://ideas.repec.org/p/bdi/opques/qef_486_19.htmlDownloadable! This paper examines the challenges faced by the European Central Bank since the outbreak of the global financial crisis. From 2008 to 2014, the need to preserve the correct functioning of the monetary policy transmission mechanism and ensure the supply of credit to the private sector stretched the limits of conventional monetary policy.

How to determine large unfilled bank orders, on a chart ...https://www.quora.com/How-can-I-determine-large-unfilled-bank-orders-on-a-chart-in-tradingHow can I determine large unfilled bank orders, on a chart, in trading? I’m sorry to have to tell you this but there are no dark market secrets or hiding spots. Everything you need to know to make a decision about investing or trading is right in ...

Is this the age of permanently cheap credit? – The ...https://www.propertychronicle.com/is-this-the-age-of-permanently-cheap-creditDec 23, 2019 · It’s hard to know if debt refinancing at today’s rates is a gross distortion of reality or the shape of things to come Are interest rate cycles a thing of the past? Have we entered an age of permanently cheap capital? It is astonishing to be asking these questions, but these are extraordinary tim

Daily Interview: Burned by Tech? How About REITs? - TheStreethttps://www.thestreet.com/personal-finance/daily-interview-burned-by-tech-how-about...May 01, 2001 · REITs performed poorly in 1998 and 1999 but began to recover after the first quarter of 2000. ... And not only are the REIT dividends high, but they're also safer. ... This is …

Top ETF Stories of the First Half of 2016 - Yahoohttps://finance.yahoo.com/news/top-etf-stories-first-half-182906763.htmlJun 30, 2016 · Inside the top stories of the first half of 2016 and their impact on the ETF world. ... This is the second time this year that the Fed has slashed the U.S. GDP estimate for 2016 from 2.4% ...

Report: Wall Street collapse costs U.S. $12.8T ...https://www.washingtontimes.com/news/2012/sep/12/report-wall-st-collapse-cost-us-128tSep 12, 2012 · “The worst economy since the Great Depression touches every corner of our country, yet this is the first time anyone has tried to put a total value on the cost of the crisis and the implications ...

Stupid Doctor Tricks Part 2 - White Coat Investorhttps://www.whitecoatinvestor.com/stupid-doctor-tricks-part-2-physicians-list-their...Jul 14, 2011 · This is part 2 of 4 of Stupid Doctor Tricks, a financial M&M if you will. Check out part 1 here. These were compiled from a long thread on Sermo, a physician-only forum. It’s a great place to chat and even make a little money. If you would like to join, go there from this link and we both get $10. Don’t worry, it doesn’t cost you anything ...

Britain's 'TARP': Taxpayers Locked in to Potential Upside ...https://seekingalpha.com/article/99003-britains-tarp-taxpayers-locked-in-to-potential...It appears our British Cousins (okay MY cousins) have decided to execute their own version of TARP in response to the global banking crisis:(From the FT): Brita

Role plays deliver the message on diversity ...https://news.efinancialcareers.com/uk-en/19426/role-plays-deliver-the-message-on-diversityIt is only in the past two or three years that training based on role plays has become common in Europe, said Jaffer. Traditionally, the merits of diversity were expressed in the form of lectures ...

Adult Education Matters: Perspective: Run, Don't Walk to ...https://adulteducationmatters.blogspot.com/2016/01/perspective-run-dont-walk-to-see...Jan 22, 2016 · Too often, the conditions out of which bad things happen, never get examined. Poor health, economic collapse, the devastation of Adult Education, or any other bad thing - you can always trace them back to conditions.

Stocks Drop Sharply and Credit Markets Seize Up - The New ...https://dealbook.nytimes.com/2008/11/21/stocks-drop-sharply-and-credit-markets-seize-upNov 21, 2008 · “This is a response to real fear,” Marc D. Stern, chief investment officer at Bessemer Trust, an investment firm in New York, told The Times. “We each have to look inside and say, is the fear warranted?” The fear was reflected in a stampede for the safety of government securities.[PDF]

Ten Years on, the Crisis of Global Capitalism Never Really ...https://truthout.org/articles/ten-years-on-the-crisis-of-global-capitalism-never...Sep 22, 2018 · Not only are the consequences of the financial crash still with us today, in the form of widening inequality, rising debt and political instability, but the crisis of capitalism itself also persists and continues to wreak havoc across the globe, constantly changing shape as it makes its way from one disturbance to another.Author: Anton Woronczuk

Bill Gross – FNThttps://api.monolit.me/tag/bill-grossWarnings for a secular bear bond market. For some time now, Bill Gross of Janus Capital has been expressing his concern over the coming of a probable bear bond market.In his January investment outlook, Gross talked about the 2.6% yield level as being critical for the 10-year Treasury, a breach of which could result in a “secular bear bond market.”

Business Insiderhttps://www.businessinsider.com/sovereign-wealth-funds-are-well-placed-to-take...As the global financial crisis recedes, state-owned investment companies are well placed to seize a new set of opportunities and navigate changing risks ... Thanks to a massive injection of public ...

Gibson Dunn | House Financial Services Committee Financial ...https://www.gibsondunn.com/house-financial-services-committee-financial-choice-act-2-0...May 10, 2017 · On May 4, 2017, by a vote of 34 to 26, the House Financial Services Committee ordered reported H.R. 10,[1] the Financial CHOICE Act of 2017 (CHOICE Act 2.0 or the Bill), which had been introduced previously by Chairman Representative Jeb Hensarling (R-TX) and seven other Republican members of Congress. The Bill, which is a revised […][PDF]Trading Frenzies and Their Impact on Real Investmentwww.lse.ac.uk/fmg/assets/documents/papers/discussion-papers/DP670.pdflators, who are driven by common noise in their correlated signals (e.g. rumor), leading to a price decline, lack of provision of new capital, and collapse of real value. This echoes some highly publicized events such as the bear raid on Overstock.com in 2005 or the bear raids[PDF]Prospect Magazine, August 20, 2014 - Harvard Universityhttps://scholar.harvard.edu/files/rogoff/files/review_of_martin_wolf.pdfProspect Magazine, August 20, 2014 The Shifts and the Shocks: What we’ve learned –and have yet to learn from the financial crisis, by Martin Wolf, (Penguin books, 2014) A Review, by Kenneth Rogoff, Harvard University. Martin Wolf’s new book, The Shifts and the Shocks, is an extraordinary work that deserves to be widely read and discussed.

The End of Alchemy: Money, Banking and the Future of the ...https://www.amazon.co.uk/End-Alchemy-Banking-Future-Economy/dp/1408706105Clear and well written, with a minimum of technical language, it is most interesting that, unusually for a specialist in his field and unlike many of his colleagues who have gone into print regarding the same issues, Baron King identifies the root causes of the crisis …Reviews: 121Format: HardcoverAuthor: Mervyn King

Is The World Economy About To Collapse - Best Description ...https://www.sonicdebris.com/is-the-world-economy-about-to-collapseJan 25, 2020 · 99000+ New Best Description About Economy 2018. Economic collapse 2019 archives the religious life venezuela s collapse is the worst outside of war in decades how the next economic collapse unfolds a world economy without markets will collapse don dear bitcoiners stop cheering for economic collapse

Retired? You may feel young, but your investments should ...https://www.marketwatch.com/story/retired-you-may-feel-young-but-your-investments...Apr 19, 2018 · This is especially true for today’s retirees whose joyful collective mantra is: stay forever young in body, mind and spirit. ... There are the obvious changes and complications that come with ...

Here's Where The Next Great Crisis Originates | Zero Hedgehttps://www.zerohedge.com/news/2018-04-17/heres-where-next-great-crisis-originates"All financial crises are the same and different at the same time. They are the same when it comes to the dynamics of contagion, illiquidity, bank failures and the high-panic state in which everyone in the world wants his money back at the same time. Yet each crisis is different in its specific causes."

U.S. Financial Crisis - YouTubehttps://www.youtube.com/playlist?list=PL42A8082BDF9570B4Democracy Now! reports on the state of the U.S. economy.

ECO/FIN 403 - Exam #1 Review Jeopardy Templatehttps://jeopardylabs.com/play/ecofin-403-exam-1-review, This is the major monetary policy-making body of the Federal Reserve System. , This is the interest rate on loans made by Federal Reserve Banks to depository institutions. , This is the percentage of deposits banks are required to keep on hand. , This is the interest rate on short-term funds transferred between financial institutions.</p>

Too Big to Fail (DVD) | Central Arkansas Library System ...https://cals.bibliocommons.com/item/show/1740981100_too_big_to_failThis is an American television drama directed by Curtis Hanson, first broadcast on HBO on May 23, 2011, based on Andrew Ross Sorkin's non-fiction book "Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System—and Themselves".

PE Investing in Food and Nutrition Companies - Capital ...https://capitalroundtable.com/event/pe-investing-in-food-and-nutritionRegister now to join 20+ experts in discussing the outlook for food and nutrition investment opportunities at The Capital Roundtable’s conference on Private Equity Investing in Food & Nutrition Companies.The conference will be held in New York City on Thursday, March 28, 2019.

American Economic Associationhttps://www.aeaweb.org/articles?id=10.1257/jep.24.1.51The mechanics by which dealer banks can fail and the policies available to treat the systemic risk of their failures differ markedly from the case of conventional commercial bank runs. These failure mechanics are the focus of this article. This is not a review of the financial crisis of 2007-2009. Systemic risk is considered only in passing.

Chris Sztam | TradeTech Europe 2020https://tradetecheu.wbresearch.com/speakers/chris-sztamChris leads the Global Markets Group business at IHS Markit. With over 25 years of experience, he is a senior Financial Services Executive specializing in regulatory change initiatives, business model transformation, merger integration and managing large complex teams and projects.

Bankruptcy Articles, Photos and Videos - AOLhttps://www.aol.com/entertainment/tag/bankruptcy/pg-4Browse our collection of bankruptcy information for news stories, slideshows, opinion pieces and related videos posted on AOL.com.

Analyst forecast characteristics and the cost of debt ...https://link.springer.com/article/10.1007/s11142-010-9127-2We examine the relation between analyst forecast characteristics and the cost of debt financing. Consistent with the view that the information contained in analysts’ forecasts is economically significant across asset classes, we find that analyst activity reduces bond yield spreads. We also find that the economic impact of analysts is most pronounced when uncertainty about firm value is ...

Opportunities – Qantareshttps://www.qantares.com/business-environment/opportunitiesOpportunities for Taking Advantage of the Market Today, hedge funds make up just under 9% of the total investment market. But these 10,000-or-so funds are the fastest growing investment segment worldwide today. Not only are they growing, they are evolving; placing an …

The Failure Mechanics of Dealer Banks - COREhttps://core.ac.uk/display/6874412The mechanics by which dealer banks can fail and the policies available to treat the systemic risk of their failures differ markedly from the case of conventional commercial bank runs. These failure mechanics are the focus of this article. This is not a review of the financial crisis of 2007-2009. Systemic risk is considered only in passing.

Discussion of Financial Scandals - BrainMasshttps://brainmass.com/economics/finance/discussion-financial-scandals-516391When a scandal hits, lawsuits usually follow ( natural). Hence, the paper deals with the lawsuits rather than the scandal (but not a significant distinction). First of all, the authors claims that the more interlocked firms are, the more disproportionate the effects of the lawsuits.

Corporate Governance, 5th Edition | Wileyhttps://www.wiley.com/en-us/Corporate+Governance,+5th+Edition-p-9780470972748In the wake of the recent global financial collapse the timely new edition of this successful text provides students and business professionals with a welcome update of the key issues facing managers, boards of directors, investors, and shareholders. In addition to its authoritative overview of the history, the myth and the reality of corporate governance, this new edition has been updated to ...

Accounting, Finance and Economics Archives | Lagos ...https://www.lbs.edu.ng/category/open-seminars/accounting-finance-and-economicsThis is a detailed financial modeling programme that seeks to equip participants with practical knowledge and skills in modeling financial statements, enterprise valuation, M & A (Accretion/Dilution) using DCF enabled by Excel. With a hand-holding approach, participants will build models from the scratch.

How has the culture at Goldman Sachs changed since the ...https://www.quora.com/How-has-the-culture-at-Goldman-Sachs-changed-since-the-2008...Jun 14, 2016 · I know it's a little bit cowardly to go anonymous here, but it's really the only way for me to answer this question. I can almost garuentee that the majority of GS employees, certainly the people in senior management positions, would say something...

8 Ways the Financial Crisis Changed the Worldhttps://www.redfin.com/blog/housing-impact-of-2008-financial-crisisSep 11, 2018 · America created the global financial crisis, but emerged as the world’s strongest economy. The country seemed poised for a major redistribution of wealth but then resumed the focus we’ve had for the last 30 years, on creating wealth, even if …Author: Glenn Kelman

Fortune 500's top stock: Freddie Mac - Sep. 18, 2009https://money.cnn.com/2009/09/18/magazines/fortune/fortune500/winners.losers.lehman...Sep 18, 2009 · Fortune 500's top stock: Freddie Mac That's not a misprint. The mortgage buyer -- now run by the government -- is the best performer in the year after Lehman's collapse.

A Year Later, Little Change on Wall Street - The New York ...https://dealbook.nytimes.com/2009/09/14/a-year-later-little-change-on-wall-stSep 14, 2009 · Coming on the same weekend as the 11th-hour bailout of the giant insurer the American International Group and the sale of Merrill Lynch, Lehman’s failure was the climax of a cataclysmic weekend in the financial industry. In the days that followed, nearly everyone seemed to agree that Wall Street was due for fundamental change.

As U.S. expansion notches record, recovery may have only ...https://finance.yahoo.com/news/u-expansion-notches-record-recovery-050738879.htmlJul 01, 2019 · One gave way to a period of excessive inflation that led the Fed to impose record-high interest rates that triggered a recession, beginning an era …

8 Ways the Financial Crisis Changed the World ? Amrank ...https://amrank.info/2018/09/11/8-ways-the-financial-crisis-changed-the-worldSep 11, 2018 · America created the global financial crisis, but emerged as the world’s strongest economy. The country seemed poised for a major redistribution of wealth but then resumed the focus we’ve had for the last 30 years, on creating wealth, even if …

Great Managers Quantify Every Objective, Jack ... - Forbeshttps://www.forbes.com/sites/susankalla/2014/08/08/the-secret-to-managing-a-successful...Aug 08, 2014 · We caught up with well-known financier Jack Rivkin in the wilderness of Maine at Camp Kotok, a gathering of high-level fund managers and economists that is …Author: Susan Kalla

Auditors raise doubts over 'going concern' concept during ...https://economictimes.indiatimes.com/news/company/corporate-trends/auditors-raise...Jun 09, 2009 · Auditors raise doubts over 'going concern' concept during slump The growing complexities in companies’ balance sheets due to the global economic crisis and foreign exchange volatility have triggered a debate over one of the basic premises of financial accounting - every company is a ‘going concern’ that will not go out of business or liquidate in the foreseeable future.

My financial planning approach - Scott Masters ...https://www.ameripriseadvisors.com/scott.masters/profileI offer comprehensive financial advice and a broad range of solutions to help you and your loved ones live brilliantly, now and in the future. With the right financial advisor, life can be brilliant. ... meet specific professional requirements and who practice as one of the following: ... as the rating is an average of as ample of client ...5/5(4)Phone: (404) 460-1721Location: 2180 Satellite Blvd Ste 100, Duluth, 30097-4927, GA

How to Ruin a Safe Bet - Did Rockefeller Center Financiers ...https://query.nytimes.com/gst/fullpage.html?res=990CE0D91331F936A35753C1A963958260If a real estate investment could ever be a sure thing, a stake in Rockefeller Center Properties Inc. seemed to be it. As the holder of the $1.3 billion mortgage on Rockefeller Center, the real estate investment trust, or REIT, had only one business: to collect interest on its loan and pass most of that income on to shareholders as dividends.

My financial planning approach - Stanton Dwight ...https://www.ameripriseadvisors.com/stanton.k.dwight/profileI offer comprehensive financial advice and a broad range of solutions to help you and your loved ones live brilliantly, now and in the future. With the right financial advisor, life can be brilliant. ... My daughter is a high school freshman who is very active and successful in the show dog world. ... as the rating is an average of as ample of ...

ECR Survey Results 2016: Italy, UK and US ... - Euromoneyhttps://www.euromoney.com/article/b12khnzqmvblty/euromoney-country-risk-survey-results...Jan 13, 2017 · Italian crisis foretold. Italy proved to be one of the biggest global concerns of all in 2016, as the contributors to ECR’s survey weighed up the implications of a conjoined political and banking crisis developing, and marked down their scores accordingly.. Italy’s total risk score fell more than any other country outside the scope of the African continent and some of the leading oil ...

The team | 20Twenty Searchhttps://20twentysearch.com/the-teamHe was then seconded to the HSBC Group's captive in Guernsey for 3 years before returning to London to take on a role with the Financial Institutions Insurance Broking team. In 2008 he moved to Investec Bank as the Head of Insurance for their European operations until 2011 when he took a short break to work for KPMG on their Solvency II team.

David Rubulotta Biography, Facts, Married, Children, Wife ...https://frostsnow.com/david-rubulottaDavid Rubulotta was born in 1973 in Pennsylvania, United States. After graduating with an MBA degree, David started his professional career and joined global financial services, Lehman Brother. David is of American nationality and belongs to the white ethnicity. After dating for a couple of years, David Rubulotta married Erin Burnett in 2012.

PIMCO's Ed Devlin leaving firm after more than a decade ...https://www.bnnbloomberg.ca/pimco-s-head-of-canada-portfolio-management-is-leaving...Ed Devlin, head of Canadian portfolio management at PIMCO Investment Management Co., is leaving the firm after more than a decade. Devlin’s portfolio-management responsibilities will be handed over to a team led by Marc Seidner, a managing director and chief investment officer in non-traditional strategies, said Agnes Crane, a spokeswoman for Newport Beach, California-based PIMCO.

TPG seeks investment period extension | Private Funds CFOhttps://www.privatefundscfo.com/print-editions/2013-10/tpg-seeks-investment-period...Oct 04, 2013 · The firm, led by David Bonderman, is asking for a year extension, from February 2014 to February 2015, to continue investing the fund, according to one of the people, who is a TPG investor. The investment period on Fund VI runs out in February, the person said.

Bankruptcy News Feb 2013www.101bankruptcy.com/bankruptcy_news/201302_bankruptcy_news.shtmlNews related to bankruptcy Feb 2013. Creditor trustee in Alabama bankruptcy says no February 1 payment BIRMINGHAM, Alabama (Reuters) - A lawyer for the creditors trustee in America's biggest municipal bankruptcy on Friday said the trustee will not make a February 1 payment to owners of $3.14 billion of sewer debt issued by Alabama's Jefferson County.

Congressional Gridlock on Financial Reforms Expected After ...https://www.insurancejournal.com/news/national/2010/10/29/114460.htmOct 29, 2010 · If Republicans make big gains in U.S. Congressional elections on Tuesday, as expected, Wall Street and big banks will have sweet, but incomplete, revenge on …[DOC]

No clear indication of the way out | Financial Timeshttps://www.ft.com/content/a1f8c144-7849-11dd-acc3-0000779fd18cSep 01, 2008 · “The overall picture of the US economy is one of weakness and that is likely to persist for some time,” says Stuart Schweitzer, global markets strategist at JP Morgan Private Bank, who is ...

How trader Dick morphed into banker CEO ... - CNN Businesshttps://money.cnn.com/2010/09/02/news/companies/...Sep 02, 2010 · An exclusive book excerpt says long before Lehman's downfall and yesterday's FCIC inquisition, Fuld tried to remake his and his firm's image into one he thought the Street would embrace.

'Unbelievable money maker' Christopher Hohn and charity ...https://financialpost.com/personal-finance/...Jul 14, 2014 · He called himself an “unbelievable money maker” and one of the world’s top 10 investors. Hohn’s hedge fund, known as TCI, returned 39.7% in the first 10 months of last year, making it fifth best in Bloomberg Markets magazine’s annual hedge fund ranking, and second best among large European hedge funds managing more than US$1 billion.

Europe’s Bankers Are the Big Post-Lehman Losers - Bloomberghttps://www.bloomberg.com/opinion/articles/2018-09-13/europe-s-bankers-are-the-big...Sep 13, 2018 · Europe’s Bankers Are the Big Post-Lehman Losers. ... This is not the sign of a healthy financial system. ... Deutsche has dropped out of the Euro Stoxx 50 Index for the first time since its ...

Is it time to downgrade the credit rating agencies ...https://answers.yahoo.com/question/index?qid=20110807180804AAyi82JAug 07, 2011 · Maybe, but Greider offers another theory: since the banks pay the rating agencies to examine their financial products, a harmful rating would persuade the banks to just shop elsewhere for a more favorable outcome. “This is an outrageous conflict of interest at the very heart of the financial system,” Greider writes.

What would happen if the next financial crisis never comes ...https://www.quora.com/What-would-happen-if-the-next-financial-crisis-never-comesDec 06, 2019 · Experts have been predicting the next financial crisis for the last couple of years but monetary policy interventions seem to be relaying the inevitable downturn in the business cycle. This is remarkable. At the moment, however, it is like an ever...[PDF]FOIA CONFIDENTIAL TREATMENT REQUESTED LBHI SEC07940 …https://web.stanford.edu/~jbulow/Lehmandocs/docs/...to pledge additional collateral for a like amount. (3) On Thursday July 31st JPM reduced Leh's unsecured credit ... is a pass on they are the first and at this point only bank to impose this. ... history in addition to the fact that not in line with our 60 day written notice policy.

AN APPRAISAL OF THE IMPACT OF THE GLOBAL FINANCIAL …https://eduprojecttopics.com/product/an-appraisal-of-the-impact-of-the-global...AN APPRAISAL OF THE IMPACT OF THE GLOBAL FINANCIAL CRISIS ON THE NIGERIAN ECONOMY. download your complete project

The Tip of the Iceberg - Mad Hedge Fund Traderhttps://www.madhedgefundtrader.com/the-tip-of-the-icebergSure, the industry shills and apologists say a one off, an aberration, and will never happen again. But remember how Ben Bernanke said the sub-prime crisis was contained? These things have a tendency of bubbling under the surface for a while before they explode and send investors into a panic.

What is Greece's crisis? - Quorahttps://www.quora.com/What-is-Greeces-crisis1. Governments around the world normally borrow from its own citizens and from investors around the world to manage their economies. This is called sovereign debt. The government issues bonds and other securities to those who lend the government p...

The Crisis Is Escalating! | CNA Finance | Page 11096https://cnafinance.com/the-crisis-is-escalating/11096Sep 09, 2016 · This is a news and information gathering outlet. We may work directly with some of the companies that we write about. If we have a business relationship …

U.S. Futures Gain After Worst Stock Drop Since ‘08 ...https://www.msn.com/en-us/money/markets/stock-rout-to-continue-in-asia-after-us-plunge...U.S. stock futures saw a modest gain in early Asian trading Tuesday after the biggest rout in equities on Wall Street since 2008.

SWIFT Code for Banks in United Kingdom - Page 96https://theswiftcodes.github.io/united-kingdom/page/96/index.htmlSWIFT code is a standard format of Bank Identifier Codes (BIC) and serves as a unique identifier for a bank or financial institution. These codes are used when transferring money between banks, particularly for international wire transfers.

Free Essays on The Return Of Depression Economics And The ...https://www.essaydepot.com/documents/the-return-of-depression-economics-and-the-crisis...Free Essays on The Return Of Depression Economics And The Crisis Of 2008 Chapter 10. Get help with your writing. 1 through 30

Spot the Difference - Byhttps://hackernoon.com/spot-the-difference-9e5e4cec17d4This is as true today as it was in the days of the Roman Empire and it is the first and foremost reason that empires fall and civilizations collapse. Today, this dilution of wealth is done by the world’s central banks via the fractional reserve banking system that we all live in. Not very long ago, before the internet, when independent ...

SWIFT Code for Banks in Australia - Page 5https://theswiftcodes.github.io/australia/page/5/index.htmlSWIFT code is a standard format of Bank Identifier Codes (BIC) and serves as a unique identifier for a bank or financial institution. These codes are used when transferring money between banks, particularly for international wire transfers. On top of that, the code is used to transmit messages between financial institutions and banks.

What Does It Mean To Refinance Your Home? - Cubak Home Loanshttps://cubakhomeloans.com/what-does-it-mean-to-refinance-your-homeYou may be in a better credit standing now than when you took out the first loan on your home so you are entitled to better rates. The market may be hot enough for you to take a dip and refinance your precious asset. ... what could affect your decision to refinance. ... What are the …

Introducing Brokers | Hedge Fund – Hedge Fundwww.hedgeco.net/pages/introducing-brokersThis is a win-win situation, and is a big selling angle for the introducing broker. Many of the introducing brokers also have developed their own trading platforms and research. This is extremely important if your trading strategy revolves around best execution and you are used to using a specific type of software.

Analyst Sees Shift in Capex Trends | Light Readinghttps://www.lightreading.com/cable-video/analyst-sees-shift-in-capex-trends/d/d-id/608853Dec 22, 2004 · Analyst Sees Shift in Capex Trends. News Analysis Light ... The analyst says already happening at Verizon ... while investment in such systems has been on the decline for a …

Too Interconnected To Fail = Too Big To Fail: What Is In A ...https://archive.get.com/economy/2010/01/26/too-interconnected-to-fail-too-big-to-fail...Did allowing financial institutions to become "too big" play a role in the financial crisis? This column argues that being "too interconnected" is also a factor, and that US accounting standards…

Ten years since the crash: Finance and the Media ...https://www.aljazeera.com/programmes/listeningpost/2018/09/ten-years-crash-finance...Sep 17, 2018 · The stock market is back and lenders feel more stable, but the collapse of the housing market in 2008 destroyed the credit and lives of average …

Jeremy Warner: Who said investment banking was dead? Not ...https://www.independent.co.uk/news/business/comment/jeremy-warner/jeremy-warner-who...Jeremy Warner: Who said investment banking was dead? ... going to come as a bit of a shock to those who blame our current economic travails entirely on the antics of Wall Street and the ...

Paper 2 the collapse of Lehman | Business, Society, and ...https://bizgovsoc4.wordpress.com/2012/11/11/paper-2-the-collapse-of-lehmanNov 11, 2012 · The Collapse of Lehman Brothers Lehman Brothers was viewed as one of the titans on Wall Street and was the fourth biggest investment bank in the United States at the time of its bankruptcy. However, the company itself had much humbler origins. Lehman was founded in Montgomery, Alabama in 1844 as a general store run…

BANKRUPTCY, LAYOFFS AND LIKELY SALE – THE “FATE” OF A ...https://www.jayweller.com/bankruptcy-layoffs-and-likely-sale-the-fate-of-a-pulitzer...Some, such as the present ownership of the newspaper and the prospective new publishing company see a sale and “fresh start” as the likely (and desired outcome). Others – including leaders in the local community and governments – “hope” for a positive outcome and continued employment for the newspapers 209 current employees.

Why a Greek Default Could be Worse Than the Lehman Collapsehttps://moneymorning.com/2011/06/01/greek-defaultOct 15, 2014 · This is exactly why a Greek default would dwarf the Lehman collapse: There were no artificial forces damaging the banks' position in the Lehman bankruptcy, and …

Return of the Euro Crisis: Italy Quakes, Rest of the World ...https://us-issues.com/2018/06/10/return-of-the-euro-crisis-italy-quakes-rest-of-the...Jun 10, 2018 · The only day in recent years that saw the US 10-year fall that much was the time Trump triumphed in the US elections. Italy’s new premier, Giuseppe Conte, made clear in his inaugural speech this week that the new populist Italian government is setting a trajectory for radical policy changes that put another euro crisis directly in the cross ...

Peter Schiff, The Eternal Gold Bull - American Bullion ...https://www.americanbullion.com/peter-schiffPeter David Schiff is an American businessman, investor, investment broker, financial commentator, financial analyst, radio personality, and author. He was born in New Haven, Connecticut, on March 23, 1963, to a middle-class family and his father was the son of Jewish immigrants from Poland.

Delaware Way: Kaufman: This Is Not The Time To Leave ...https://delawareway.blogspot.com/2010/02/kaufman-this-is-not-time-to-leave.htmlBut not one of those times, Mr. President. If Congress fails to draw hard lines that deliver on real systemic reforms, regulators cannot be counted upon to do what is needed. We need brick and mortar, not human judgment, to cleave the banks from investment banking again.

keynes – krebscyclehttps://krebscycle99.wordpress.com/tag/keynesMay 16, 2013 · The budget of the United States is so bloated with give-aways to the wealthy, subsidies of dirty, obsolete industries, waste and inefficiency that it could be brought into balance rapidly while still increasing both investment in infrastructure and the kind of economic stimulus Keynes showed will boost economies out of recession.

Capital flight – how RBS was shredded: Part Two ...sceptical.scot/2018/10/capital-flight-rbs-shredded-part-twoOct 04, 2018 · At executive director level, the mood inside RBS turned from one of detachment to black humour. The collapse of Lehman and a downgrade in AIG’s credit rating sent shares in both RBS and HBOS into freefall on Monday 15 and Tuesday 16 September. On the Tuesday, RBS shares slid a further 16 per cent to 177.6p. HBOS’s plummeted 40 per cent to ...

Chaos Scientist Finds Hidden Financial Risks That ...https://www.msn.com/en-us/news/other/chaos-scientist-finds-hidden-financial-risks-that...One of the most data-rich models was built by Farmer and a team including Robert Axtell of George Mason University in Fairfax, Va. They used data from the U.S. Census Bureau, Internal Revenue ...

Return Of The Euro Crisis: Italy Quakes As Rest Of The ...https://www.silver-phoenix500.com/article/return-euro-crisis-italy-quakes-rest-world...Jun 07, 2018 · Europe’s many fault lines are spreading once again, bringing the endless euro crisis saga back in 3-D realism. Italy gained a new anti-establishment government last week, even as Spain elected a new Socialista government that could crack Catalonia off from the rest of Spain. All of Europe fell under Trumpian trade-war sanctions and threatened their own retaliation.

3 Great Stocks for Your IRA - Yahoo Financehttps://finance.yahoo.com/news/3-great-stocks-ira-110400434.htmlDec 21, 2017 · 3 Great Stocks for Your IRA. Keith Speights, The Motley Fool ... But one of the smartest things passed by legislators was the Individual Retirement ... and writes in his …

Jack Bogle: Crusader for Investment Professionalism | The ...https://www.rationalwalk.com/jack-bogle-crusader-for-investment-professionalismJan 25, 2019 · Mr. Bogle’s crowning achievement was the invention and proliferation of low cost index funds that are designed to simply match the investment results of unmanaged indexes such as the S&P 500. These funds do not attempt to beat the market through selection of securities or timing the movement of funds based on macroeconomic factors.

Special Report: How a vicious circle of self-interest sank ...https://www.reuters.com/article/us-bernardino-bankrupt-idUSBRE8AC0HP20121113Nov 13, 2012 · When this sun-drenched exurb east of Los Angeles filed for bankruptcy protection in August, the city attorney suggested fraudulent accounting was the root of the problem.

Meet the A.I. Landlord That’s Building a Single-Family ...https://finance.yahoo.com/news/meet-landlord-building-single-family-103058132.htmlJun 21, 2019 · But it was important to Burrus that they not be in an apartment. “I wanted to get a house with a yard for the kids, for that family atmosphere,” she says. ... “I’ll live in a hotel for a ...

The Home Care Business – Corporate Watchhttps://corporatewatch.org/the-home-care-businessThe big five companies all talk about the investment they are bringing to home care. They may be putting cash in (though as the care records show, it isn’t enough to care for everyone as well as they should). But it is cash they expect to get back – with a profit on top, …

San Bernardino bankruptcy: How self-interest sank ...https://business.financialpost.com/news/economy/how-a-vicious-circle-of-self-interest...Nov 13, 2012 · How a vicious circle of self-interest pushed San Bernardino into bankruptcy The city’s decades-long journey from prosperous, middle-class community to bankrupt, foreclosure-blighted basket case ...

More Cash than Ideas – A Change in the Outlook! « ROGER ...https://rogermontgomery.com/more-cash-than-ideas-a-change-in-the-outlookMore Cash than Ideas – A Change in the Outlook! Two weeks ago I appeared on ABC The Business with Ticky Fullerton as I do each Tuesday fortnight. The video footage follows below and you will notice that I mention that we could only find four companies in the top 100 that were trading at …

George W. Bush and His White House Stoked the Mortgage ...https://tullycast.com/2009/03/09/george-w-bush-and-his-white-house-stoked-the-mortgage...West had patrolled there as a police officer, and now he was the proud owner of a $130,000 town house, bought with an adjustable-rate mortgage and a $20,000 government loan as his down payment just the sort of creative public-private financing Bush was promoting.

Did “Tight” Fed Policy Cause the Financial Crisis?https://www.infowars.com/did-tight-fed-policy-cause-the-financial-crisisDec 16, 2015 · Recently Senator Ted Cruz aggressively questioned Janet Yellen on the Fed’s possible role in causing the financial crisis and subsequent recession. In particular, he claimed that “in the summer of 2008” the Fed “told markets that it was shifting to a tighter monetary policy,” and that this announcement “set off a scramble for cash, which caused the dollar to soar, asset prices to ...

Best books of 2018: Economics | Financial Timeshttps://www.ft.com/content/e600c64a-ee02-11e8-89c8-d36339d835c0Nov 23, 2018 · The decision of the US authorities to let Lehman fail in September 2008 was the most important moment in financial history since the Great Depression. Many have …

Wall Street Teeters - Politics and World Issues - Forums ...https://forums.t-nation.com/t/wall-street-teeters/114446?page=2Dec 14, 2015 · They bought in, one of them 10,000 bucks at $3.50. The price has gone up to over 15 since. I started watching it at about 6 or 7 bucks. Everytime the financials started falling it’s price held strong. When financials advanced, it went up like crazy. This is a case where the stock was successfully fighting the direction of the market.

UK stocks tumble as world markets stricken ... - This is Moneyhttps://www.thisismoney.co.uk/money/markets/article-2027777/UK-stocks-tumble-world...Aug 19, 2011 · UK stocks racked up fresh losses today as world markets continued to be shaken by a severe crisis of confidence. The FTSE 100 was at 5,012 by early afternoon - a fall of 80 points.

Technology Investor || Harry Newton's In Search of the ...https://www.technologyinvestor.com/login/2004/Dec9-08.phpWatching Chanos’s trades over the last six months is like reliving the economic meltdown in slow motion. Since the summer, he has been cashing in his short positions in cratered banking and real-estate stocks, as the crisis has spread from the subprime-mortgage sector to become a full-scale economic meltdown.

Economics of Imperialism: Darling, We Have a Crisishttps://economicsofimperialism.blogspot.com/2011/09/darling-we-have-crisis.htmlSep 15, 2011 · Darling, We Have a Crisis Book review: Alistair Darling, ... This is a refreshing admission that Labour’s social services and other spending programmes were based on the unsustainable speculative boom. But it also reveals how much that phase of economic ‘success’ was due to financial services in the City of London and why the Labour ...

Return of the Euro Crisis: Italy Quakes, Rest of the World ...https://beforeitsnews.com/eu/2018/06/return-of-the-euro-crisis-italy-quakes-rest-of...By David Haggith / GoldSeek Europe’s many fault lines are spreading once again, bringing the endless euro crisis saga back in 3-D realism. Italy gained a new anti-establishment government last week, even as Spain elected a new Socialista government that could crack Catalonia off from the rest of Spain. All

Foul Trouble | Chicago magazine | Chicago Magazine ...https://www.chicagomag.com/Chicago-Magazine/December-2005/Foul-TroubleFoul Trouble When ex–Bulls star Scottie Pippen needed a new financial adviser, he turned to a smooth-talking investment guru named Bob Lunn, whose clientele included a cross section of Chicago ...

Did “Tight” Fed Policy Cause the Financial Crisis? - The ...https://infinitebanking.org/banknotes/did-tight-fed-policy-cause-the-financial-crisisDECEMBER 16, 2015 — Robert P. Murphy Recently Senator Ted Cruz aggressively questioned Janet Yellen on the Fed’s possible role in causing the financial crisis and subsequent recession. In particular, he claimed that “in the summer of 2008” the Fed “told markets that it was shifting to a tighter monetary policy,” and that this announcement ...

Bush and the Economy's Collapse - Republican_Dystopiahttps://sites.google.com/site/republicandystopia/bush-and-the-economy-s-collapseAs the economy has shed jobs 533,000 last month alone and his party has been punished by irate voters, the weakened president has granted his Treasury secretary extraordinary leeway in managing the crisis. Never once, Mr. Paulson said in a recent interview, has Mr. Bush overruled him.

Sanders Over the Edge : hillaryclinton - reddithttps://www.reddit.com/r/hillaryclinton/comments/4dvvk2/sanders_over_the_edgesee, the difficulty with that most of us have to argue the source because we cannot argue the argument -- we have no understanding of finance, so we have to say "well, i want to believe him so i will." i have a long career in finance and got to see the sausage being made in …

No Way to Run an Economy? - blogspot.comhttps://pensionpulse.blogspot.com/2009/12/no-way-to-run-economy.htmlMr Turner recommended aggressive measures such as quantitative easing to combat the financial slide in his 2008 book, The Credit Crunch. Talking to The Wharf following the release of his second book, entitled No Way To Run An Economy, he re-states this as one of the two main pillars of his strategy to haul the world out of the downturn.

What Are the Risks of Investing With One Fund Family ...https://www.morningstar.com/articles/724898/what-are-the-risks-of-investing-with-one...Dec 03, 2015 · US Videos What Are the Risks of Investing With One Fund Family? Losing diversification due to a house investment style, rather than worries about financial malfeasance, is the primary knock ...

In layman's terms, how does a trading strategy using ...https://www.quora.com/In-laymans-terms-how-does-a-trading-strategy-using-distressed...It was the 1980s when a New York trader realized that the best long term returns came from non-investment grade bonds, colloquially known as “junk”. Although these bonds were more likely to default (i.e. stop paying interest) this risk was offset ...

How Lethal are Financial Derivatives? | The Market Mogulhttps://themarketmogul.com/lethal-financial-derivativesJul 27, 2015 · Since the development of the Black-Scholes model in 1973 and rapid improvements in technology, financial derivatives have become increasingly popular. Today, derivatives are …

BTC - CME Futures - The Poison Apple is Being Served for ...https://www.tradingview.com/chart/BTCUSD/eTcP807d...The news of the CME futures market starting to trade Bitcoin' futures in December was announced yesterday. But many do not understand the futures market and moreover how they evolved into a speculative market. So before heading to the chart, it is important to understand how cash settled futures effect the market and or moreover how the market effects cash settled futures. At $25 per contract ...

Dispatches From Bond-Land | Mauldin Economicshttps://www.mauldineconomics.com/the-10th-man/dispatches-from-bond-landAug 15, 2019 · Dispatches From Bond-Land. By Jared Dillian. August 15, 2019. First, please do me a favor—I would love it if you would follow me on Twitter.. By this point, you have probably heard that $15 trillion of bonds are trading with negative yields, which represents 25% …

Running 'Cause I Can't Fly: "The Fed’s Wall Street Bailout ...https://coyoteprime-runningcauseicantfly.blogspot.com/2019/11/the-feds-wall-street...Citigroup was the poster child for the Fed’s bungling supervision in the leadup to its collapse in 2008. It became a penny stock in 2009. Secretly, without any approval or hearings in Congress, the Fed pumped $2.5 trillion in below-market-rate, revolving loans into Citigroup from December 2007 through at least the middle of 2010 to resuscitate the serially-charged bank.

London | Judgement Of Americahttps://judgementofamerica.wordpress.com/tag/londonSeptember 4, 2012 – SPAIN – After working six years as a senior executive for a multinational payroll-processing company in Barcelona, Spain, Mr. Vildosola is cutting his professional and financial ties with his troubled homeland.He has moved his family to a village near Cambridge, England, where he will take the reins at a small software company, and he has transferred his savings from ...[PDF]Brief Report QE versus the Real Problems in the World Economyhttps://www.mdpi.com/1911-8074/13/1/11/pdfThis is worth recalling as it goes into the issue of the fallibility of policy-makers which may, once more, be in play. TheIMF(2007) Financial Stability Report, in the conclusions in its global assessment stated: “This weakness has been contained to certain portions of the subprime market (and, to a lesser

Learning the right lessons from a crisis - The Globe and Mailhttps://www.theglobeandmail.com/globe-investor/investment-ideas/learning-the-right...May 17, 2010 · Learning the right lessons from a crisis. Dan Richards. ... (The $200-million to $300-million that Goldman Sachs earned for a structure that allowed Greece to …

Creating Sustainable Market Systems in Developing Economies.https://medium.com/@investforgood/growth-through...Nov 04, 2019 · Alberto Pisanti, the founder of Absolute Energy Capital, an independent investment platform focused on renewable energy, tells us about his commitment to …

12 Indications That The Next Major Global Economic Crisis ...deflation.market/12-indications-next-major-global-economic-crisis-just-around-cornerMay 29, 2018 · 12 Indications That The Next Major Global Economic Crisis Could Be Just Around The Corner There have not been so many trouble signs for the global economy in a very long time. Analysts are sounding the alarm about junk bond defaults, the smart money is getting out of stocks at an astounding rate, mortgage rates are absolutely skyrocketing, and Europe is already facing a full blown …

Government intervention during the subprime mortgage ...https://en.wikipedia.org/wiki/Government_intervention_during_the_subprime_mortgage_crisisThe government interventions during the subprime mortgage crisis were a response to the 2007–2009 subprime mortgage crisis and resulted in a variety of government bailouts that were implemented to stabilize the financial system during late 2007 and early 2008.. Governments intervened in the United States and United Kingdom and several other Western European countries, such as Belgium, France ...

The Singaporean Economy and Macrofinancial Linkages - Fair ...https://www.fairobserver.com/.../singaporean-economy-and-macrofinancial-linkagesThis accounts for why Singapore was one of the hardest hit economies during the global downturn. In fact, this financial crisis was the worst Singapore experienced since its independence in 1965. The downward pull of the global recession on Singapore’s economy continued into 2009 as negative GDP growth was forecasted at -9% to -6% (see Chart 1).

Accounting and Reporting Fraud | Governanceadvisor's Bloghttps://governanceadvisor.wordpress.com/2012/10/17/accounting-and-reporting-fraudOct 17, 2012 · Accounting and Reporting Fraud. By: Steve Y. Lehrer, CPA. October 2012 As we continue our series on the topic of Fraud, this article is the second of ten topics, which will focus on the types of frauds that can be committed in accounting and reporting. Accounting and Reporting Fraud Accounting fraud is any act or attempt to falsify accounting records for financial gain.

Existing ABS swaps also caught in swap margin net ...https://www.debtwire.com/info/existing-abs-swaps-also-caught-swap-margin-net-—-analysisby Bill Harrington Sometimes, digging into a tough problem uncovers more and more trouble for the affected parties, and no easy solutions. For instance, review of the swap margin rules indicates that the margin requirements will apply to existing swaps that are amended in any wayafter the relevant compliance date — 1 March 2017 for most financial end users including ABS issuers.

Securities and Exchange Commission - SourceWatchhttps://www.sourcewatch.org/index.php/Securities_and_Exchange_CommissionThe Securities and Exchange Commission, commonly referred to as the SEC, is the United States governing body which has primary responsibility for overseeing the regulation of the securities industry.It enforces, among other acts, the Securities Act of 1933, the Securities Exchange Act of 1934, the Trust Indenture Act of 1939, the Investment Company Act of 1940 and the Investment Advisors Act.

The Financial Sun Will Shine Again | National Reviewhttps://www.nationalreview.com/2008/09/financial-sun-will-shine-again-thomas-e-nugentThe time also has come to chase speculators out of the markets once and for all. The last major financial panic to grip the U.S. came in 1987, a result of the implementation of portfolio insurance ...[PDF]Excellence. NO EXCUSES! Excerpt - Tom Peterstompeters.com/wp-content/uploads/2014/02/Culture_first_052914.pdf*One of the two core values instilled by Dr. William Mayo (Mayo Clinic) in 1910 was, effectively, practicing team medicine. Designing the practice around the patient, or “patient-centered care,” as some call its rare manifestation today, was the other core value. At Mayo, upon occasion prominent M.D.s have

A long debt ceiling crisis could raise rates for borrowing,...https://www.ajc.com/news/long-debt-ceiling-crisis-could-raise-rates-for-borrowing...As the economy stumbles, layoffs will mount, she said. ... The Chinese are one of the biggest buyers of our Treasuries.” ... but if there’s a financial crisis and a real cutback in spending ...

A Long Debt Ceiling Crisis Could Shake Economy, Experts ...https://tnj.com/long-debt-ceiling-crisis-could-shake-economy-experts-sayOct 15, 2013 · ?And the biggest thing ? I think this kind of got lost ? was the Chinese premier saying that the U.S. should make sure it raises the debt ceiling. The Chinese are one of the biggest buyers of our Treasuries.? Raymond Hill, senior lecturer in finance at Emory University?s Goizueta Business School, said he frets mostly about how long any default ...

The Effect of the credit crunch on UK Residential property ...https://gethomeworkdone.com/the-effect-of-the-credit-crunch-on-uk-residential-propertyJul 19, 2018 · What are the main goods and services of the industry involved ie finance, mortgage property ... 2008). The housing market has experienced a downfall in mortgages approval and a subsequent slow down in the property market leading to an annual 10.9% drop in property prices across the UK ... Quantitative research described as the research strategy ...

Bear Stearns Bought Out by JP Morgan Chase : NPRhttps://www.npr.org/templates/story/story.php?storyId=88405777Mar 17, 2008 · Bear Stearns Bought Out by JP Morgan Chase Bear Stearns, an 85-year-old investment bank, has been purchased by JP Morgan Chase at the rock-bottom price of $2 a …

List of investment banks - WikiMili, The Free Encyclopediahttps://wikimili.com/en/List_of_investment_banksThe following list catalogues the largest, most profitable, and otherwise notable investment banks. This list of investment banks notes full-service banks, financial conglomerates, independent investment banks, private placement firms and notable acquired, merged, or bankrupt investment banks. As an

Financial Crisis | What Happened to the Portcullis?https://mpoverello.com/category/financial-crisisThe trigger for market mayhem in Mumbai, Bangkok and Jakarta was the realisation that the Federal Reserve might – really, truly – soon begin to “taper” its generous, post-Lehman quantitative easing programme of bond-buying. That implies a stronger US economy, rising US interest rates and a preference among investors for US assets over ...

JPMorgan (NYSE: JPM) Is the Latest Target on Goldman Sachs ...https://moneymorning.com/2015/01/13/jp-morgan-nyse-jpm-is-the-latest-target-on-goldman...Jan 13, 2015 · This may be old news, but as far as history goes, a lot of us forget it. And you know what happens then – we're doomed to repeat it. What I like about people forgetting history are the trading ...

World leaders gather at the UN next week bracing for a ...https://www.cnbc.com/2018/09/21/a-new-global-crisis-is-brewing-as-un-general-assembly...Sep 22, 2018 · The stakes are historic in nature during our new era of global competition, characterized by Chinese efforts to displace U.S. leadership, Russia's actions to disrupt it and American uncertainty ...

Howard Seife | United States | Global Head of Financial ...https://www.nortonrosefulbright.com/en-us/people/17051Counsel for former Chief US Bankruptcy Judge Arthur J. Gonzalez (S.D.N.Y) in his capacity as the court-appointed examiner in the ResCap Chapter 11 case. Represents NextEra Energy as a potential purchaser of Oncor Electric from Chapter 11 debtor Energy Future Holdings Corp.

Investing in Good | BU Today | Boston Universityhttps://www.bu.edu/today/2019/investing-in-goodThe son of the first black certified public accountant in Ohio, Jones has business degrees from BU and the University of Pennsylvania’s Wharton School and years of banking experience—including time at Fifth Third Bank, Wachovia, and Merrill Lynch. By 2005, he was head of investment banking and capital markets at the New York bank Blaylock ...

Britain’s EU Journey: When the EU faced its biggest crisis ...https://www.arklatexhomepage.com/news/u-s-world/britains-eu-journey-when-the-eu-faced...Jan 26, 2020 · With many in his party increasingly vexed by EU membership and with the U.K. Independence Party making headway with its demand for a fresh vote on Britain’s membership in …

October, 2008 | The G Manifesto - Part 3https://www.thegmanifesto.com/2008/10/page/3The first time I sensed the alarming change in my soul was when I caught myself, five minutes after the market open, reaching for a reefer. Trust me, I didn’t amass legacy wealth (underestimated by Forbes magazine in the high eight figures) by smoking weed during trading hours.

Wall Street is back - Investment bankshttps://www.economist.com/leaders/2013/05/11/wall-street-is-backFOR a few tense weeks in 2008, as investment-bank executives huddled behind the imposing doors of the New York Federal Reserve, Wall Street seemed to be collapsing around them.[PDF]The Face of Risk: CEO Facial Masculinity and Firm Riskhttps://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID3113281_code439623.pdf?abstractid=...ratio. Because the CFO is one of the top-level executives who are in charge of financing decisions, we also collect the fWHR of male CFOs and find that both the CEO’s and CFO’s masculinity equally increases the financial leverage of the firm.10 For capital budgeting decisions, we look at the acquisitions,

Investing in Good | Bostonia | Boston Universityhttps://www.bu.edu/articles/2019/investing-in-goodMar 15, 2019 · The son of the first black certified public accountant in Ohio, Jones has business degrees from BU and the University of Pennsylvania’s Wharton School and years of banking experience—including time at Fifth Third Bank, Wachovia, and Merrill Lynch. By 2005, he was head of investment banking and capital markets at the New York bank Blaylock ...

Inland Names Rival Exec Sabshon as New CEOhttps://www.cpexecutive.com/post/inland-names-rival-exec-sabshon-as-new-ceoAfter a lengthy search, Inland Real Estate Investment Corp. has tapped Mitchell Sabshon as its new CEO, taking over for Robert Parks, who will remain as the company’s chairman.

Virtus LifeSci Biotech Products ETF | Virtus Investment ...https://www.virtus.com/products/bioshares-biotechnology-products-etfLifeSci Index Partners, LLC. LifeSci Index Partners, LLC is a New York-based index provider of healthcare-based stock market indices. The LifeSci team is comprised of investment professionals with experience in biotechnology equity research, in organic chemistry research in academia, and at pharmaceutical and biotechnology companies.

Howard Seife | Germany | Global Head of Financial ...https://www.nortonrosefulbright.com/de-de/people/17051Counsel for former Chief US Bankruptcy Judge Arthur J. Gonzalez (S.D.N.Y) in his capacity as the court-appointed examiner in the ResCap Chapter 11 case. Represents NextEra Energy as a potential purchaser of Oncor Electric from Chapter 11 debtor Energy Future Holdings Corp.

10 Questions With John Hancock's Jim Schmidt - TheStreethttps://www.thestreet.com/personal-finance/10...Jul 23, 2001 · Six interest rate cuts have boosted bank stocks, but a sagging stock market has kept brokerage and asset-manager shares -- and Schmidt's Financial Industries fund -- down.

The Big Apple: Muppet Tradehttps://www.barrypopik.com/index.php/new_york_city/entry/muppet_trade“Muppets” are the uninformed general public (or “sheeple”)—the customers who seek expert financial advice, but are often fleeced in the process.On March 14, 2012, the New York (NY) Times printed an Op-Ed piece by Greg Smith, an executive director at the financial firm of Goldman Sachs, titled “Why I Am Leaving Goldman Sachs.” Smith wrote that he had seen “five different ...

Rough Draft Thesis.docx - BUSINESS BANKRUPTCY 1 Business ...https://www.coursehero.com/file/77137690/Rough-Draft-ThesisdocxBUSINESS BANKRUPTCY 4 extended period, owners may be forced to file for bankruptcy to close shop or reorganize the business. Profitability is one of the primary reasons for most bankruptcies. Depending on the market conditions the economy tends to have ups and down, with that consumers confidence and spending habits tend to decline, which can lead to companies’ low revenue.

Best international online brokers for citizens in the Bahamashttps://brokerchooser.com/best-brokers/best...To help you find the best online brokers in 2021, we went ahead and did the research for you. First, we selected 78 quality online brokers, then checked and compared basically every aspect of their offering: fees, available markets and products, trading platforms, deposit …

U.S. Realty Investors Ready Bids for Big Thai Auction ...https://www.barrons.com/articles/SB912816343733562500Thailand this month auctions off $11.5 billion in loans from suspended finance companies.

Are calls to regulate the banking industry too premature ...https://www.london.edu/think/are-calls-to-regulate...Are calls to regulate the banking industry too premature? Alex Edmans explores whether there is a need for a new financial reality.

FIN 437 Exam 1 Flashcards | Quizlethttps://quizlet.com/50193222/fin-437-exam-1-flash-cards1. The TARP program will encourage consolidation, which will sharply reduce the number of independent commercial banks. 2. The increase in problem subprime loans will cause independent commercial banks to either fail or be acquired by more financial sound banks.

Insight: Safety net for money market funds | Financial Timeshttps://www.ft.com/content/eda89b0e-c948-11de-b551-00144feabdc0The day after the collapse, Reserve Primary, one of the oldest money market funds, revealed that its net asset value had dropped below the crucial one dollar per share level due to Lehman ...

Lehman collapse puts prime broker model in question ...https://www.ft.com/content/442f0b24-8a71-11dd-a76a-0000779fd18cSep 24, 2008 · This month the dangers shot into the open, as the collapse of Lehman Brothers led to concerns about the survival of Morgan Stanley and Goldman Sachs, the …

I’m still a bond bull in a world of stock addicts ...https://www.marketwatch.com/story/im-still-a-bond-bull-in-a-world-of-stock-addicts...Jan 02, 2020 · Jared Dillian is an investment strategist at Mauldin Economics and a former head of ETF trading at Lehman Brothers. Subscribe to his weekly investment newsletter, The 10th Man . Read NextAuthor: Jared Dillian

What is a Financial Crisis? – Herold Financial Dictionaryhttps://www.financial-dictionary.info/terms/financial-crisisThe most recent financial crisis which rocked the international world was the Global Financial Crisis of 2008. Economists have determined that this proved to be the most devastating economic disaster for the world since the 1929 Great Depression which lasted nearly a decade. It led to what has become known as the Great Recession. Strangely ...

How much of a stock bounce from fear spike? - MarketWatchhttps://www.marketwatch.com/story/how-much-of-a-stock-bounce-from-fear-spike-2010-05-27May 27, 2010 · How much of a stock bounce from fear spike? Comments. ... But it's not as if markets weren't aware of the crisis since the start of the year -- which didn't prevent stocks from continuing to rally ...

GM says bondholder offer fails; bankruptcy likely | News ...https://www.muskogeephoenix.com/news/gm-says-bondholder-offer-fails-bankruptcy-likely/...DETROIT (AP) — A General Motors Corp. bankruptcy filing seemed inevitable after a rebellion by its bondholders forced it to withdraw on Wednesday a plan to swap bond debt for

Rodge Cohen Looks Back on Lehman Collapsehttps://www.sullcrom.com/news_detail_208The idea that the U.S. government wanted to set an example of Lehman is inaccurate, but it was not prepared to provide substantial support to enable Lehman to survive,” Mr. Cohen said. As the U.S. government did not bail out the bank, the team working to save …

The Global Financial Crisis 10 years on- Lessons learned ...https://navigatefinancial.com.au/the-global-financial-crisis-10-years-on-lessons...Aug 24, 2017 · The return to normal from major financial crises can take time, as the blow to confidence depresses lending and borrowing and hence consumer spending and investment for years afterwards. This muscle memory eventually fades but the impact can be seen for a …

The Global Financial Crisis 10 years on- Lessons learned ...https://www.ampcapital.com/au/en/insights-hub/articles/2017/August/olivers-insights...Aug 24, 2017 · The return to normal from major financial crises can take time, as the blow to confidence depresses lending and borrowing and hence consumer spending and investment for years afterwards. This muscle memory eventually fades but the impact can be seen for a …

Dr. Paul Mueller Challenges Conventional Wisdom about the ...https://www.tkc.edu/stories/dr-paul-mueller-challenges-conventional-wisdom-2008...Mar 04, 2019 · Dr. Paul Mueller described how in 2008, the entire financial system was linked with the strength or failure of the housing market. On Friday, February 15, Dr. Paul Mueller delivered a lunchtime lecture on his recent book, Ten Years Later: Why the Conventional Wisdom about the 2008 Crisis is Still Wrong.After presenting the main claims of the book, Mueller extended the conversation through a ...

Sian Williams: 'I lost £15,000 in Lehman collapse' - Telegraphhttps://www.telegraph.co.uk/finance/personalfinance/fameandfortune/11064176/Sian...Aug 31, 2014 · Sian Williams: 'I lost £15,000 in Lehman collapse' Fame & Fortune: Sian Williams, who presented BBC Breakfast for 11 years, felt first-hand the effects of the financial crisis

Will candidates' financial plans work? - CNN.comwww.cnn.com/2008/POLITICS/09/21/economic.plans/index.htmlSep 21, 2008 · In the wake of the country's financial meltdown, Sens. Barack Obama and John McCain have been telling voters they'll fix the economy while their opponent would only make it worse.

Why ex-Goldman trader shunned hedge funds for a Japan ...https://www.japantimes.co.jp/.../ex-goldman-trader-shunned-hedge-funds-japan-brokerMay 26, 2017 · Makoto Yamada, head of equity trading at SMBC Nikko Securities, poses for a photograph in Tokyo in April. The brokerage went from a ¥500 million equity trading loss in fiscal 2011 to a …

General Motors files for bankruptcy - The Jerusalem Posthttps://www.jpost.com/Business/Business-News/General-Motors-files-for-bankruptcyJun 02, 2009 · General Motors files for bankruptcy Automaker to keep Chevrolet, Cadillac, Buick and GMC, cut four others brands.

Forecasters unanimous: U.S.-China trade war bad for ...https://finance.yahoo.com/news/forecasters-unanimous-u-china-trade-war-bad-economy...Sep 20, 2018 · But it is not bad enough to throw us into a recession, unless it translates to a big negative for confidence and sentiment," said Jim O'Sullivan, chief economist at High Frequency Economics ...

How a cold call started a new business for Global Relay ...https://www.canadianbusiness.com/global-report/how-a-cold-call-started-a-new-business...Aug 22, 2014 · As the post-Enron accountability legislation came into force, Global Relay’s fourth employee, lawyer Shannon Rogers, decided on a lark to put in a call to a U.S. financial regulation agency tasked with implementing the new rules.

Forecasters unanimous: U.S.-China trade war bad for economyhttps://finance.yahoo.com/news/forecasters-unanimous-u-china-trade-war-bad-economy...Sep 20, 2018 · The U.S. economy will expand at a robust pace in coming quarters but slow to 2 percent by the end of 2019, according to forecasters polled by …

The GSEs, the financial crisis and the Dodd-Frank Act ...https://www.caymanfinancialreview.com/2015/01/30/the-gses-the-financial-crisis-and-the...Jan 30, 2015 · It is not at all clear that what happened in 2008 was the result of insufficient regulation or an economic system that is inherently unstable. On the contrary, there is compelling evidence that the financial crisis was the result of the government’s own housing policies. ... and they contributed to a stable mortgage market through the 1970s ...

Brace your horses, this carriage is broken | BeyondOvertonhttps://beyondoverton.com/2020/01/11/brace-your-horses-this-carriage-is-brokenETFs are not like subprime CDOs but they come close. Direct access to the Fed's balance sheet will become essential for fund managers’ survival during the next financial crisis. According to Bloomberg Magazine, the largest asset managers in the world, BlackRock, Vanguard and State Street, hold about 80% of all indexed money. "Some 22% of…

Q&A with Compensation Consultant Pearl Meyer - Bloomberghttps://www.bloomberg.com/news/articles/2007-10-16/q-and-a-with-compensation...Oct 16, 2007 · Q&A with Compensation Consultant Pearl Meyer. ... as was the case for . Robert Nardelli at Home Depot ... But it's critical to preserve the core of our executive compensation system, which is ...

As investment banks fade, who'll take the big risks?https://www.chron.com/business/article/As...Sep 23, 2008 · But it also likely means an end to the sky-high profits that few other companies topped. The strict rules set by the Federal Reserve will limit opportunities for big payoffs from bets on the price ...

"U.S. Trade Deficit Falls 11.7 Percent" - THE JOURNAL ...https://www.questia.com/newspaper/1P2-5621315/u-s...In addition to a surplus in services during the first quarter, the United States posted a surplus in investment income and a decline in unilateral transfers such as foreign aid. But it had yet another deficit in merchandise trade. "We see some weakening on the goods position," David Jones, an economist with Aubrey G. Lanston Co., said.

Debt and Unemployment: Is Global Capitalism Responsible ...https://yaleglobal.yale.edu/content/debt-and-unemployment-global-capitalism...Apr 23, 2010 · Indeed, it will be the movement of currencies, the prices of stocks and bonds, and the cost of credit insurance, or credit default swaps, more than the decisions of parliaments and ministries that will resolve, one way or another, many of the big issues of our time – from reducing debts throughout the Western world, to handling destabilizing global trade and financial imbalances, to ...

Construction Executive | Welcomewww.constructionexec.com/article/making-a-major-impact-with-minor-expansionsThis led to a contract in 1999 with U.S. Bank to build 200 new branches of Safeway and Vons grocery stores in California, Arizona and Nevada. In 2010, Market Contractors acquired Financial Supermarkets, Inc. , which completes similar work on the East Coast.

The Collapse - UMW Blogs2008financialcrisis.umwblogs.org/analysis/the-collapseNow that we have the context for the financial crisis, we can explain the crisis itself. The financial crisis was the result of the collapse of a bubble in the US housing market which had formed in the early 2000s.. For at least a decade prior to the crisis, the US housing market exhibited signs of a bubble: exceptionally high growth, with housing prices rising more than 10% per year at the ...

Rogoff: «China is the leading ... - Finanz und Wirtschafthttps://www.fuw.ch/article/rogoff-china-is-the-leading-candidate-for-being-at-the...Rogoff: «China is the leading candidate for being at the center of the next big financial crisis» Kenneth Rogoff, Professor of Public Policy at Harvard University, explains why the long economic slump is finally over and what the biggest risks for the future are.

Early warning of a new tax trick – NonSell.comhttps://www.nonsell.com/germany-market-news/fruhe-warnung-vor-neuem-steuertrickAnd for a long time the Problem was played down. This is repeated for ADR? After the first public excitement in the autumn of 2018 about possible abuse, also here is a rapid announcement of the Ministry of Finance followed: You have committed to the “fight against tax fraud”.

Ken Rogoff Warns "China Will Be At The Center Of The Next ...https://www.zerohedge.com/news/2018-01-24/ken-rogoff-warns-china-will-be-center-next...Ken Rogoff Warns "China Will Be At The Center Of The Next Global Financial Crisis" by Tyler Durden. ... the IMF marked its global growth forecast 27 times in a row down and this October was the first time they raised their outlook. ... there is a probability of around 15% for a recession and there is no reason to suppose that the odds are ...

Causes of Global Financial Crisis - My Assignment Help AUhttps://www.myassignmenthelpau.com/samples/causes-of-global-financial-crisisThe global financial crisis of year 2008 brought a lot of damage to the economic condition of the world. The fall of the Lehman brothers was the eye opener for the entire world. This was because the invincible was defeated within a matter of 10 months. USA’s largest bank had collapsed.

Systemic Risk and the Financial Crisis | American ...https://www.aei.org/research-products/report/systemic-risk-and-the-financial-crisisThis is only a preliminary and tentative effort; there is much still to be learned about the causes of the crisis, but it is useful to establish a framework for judging whether what we are facing ...