Home

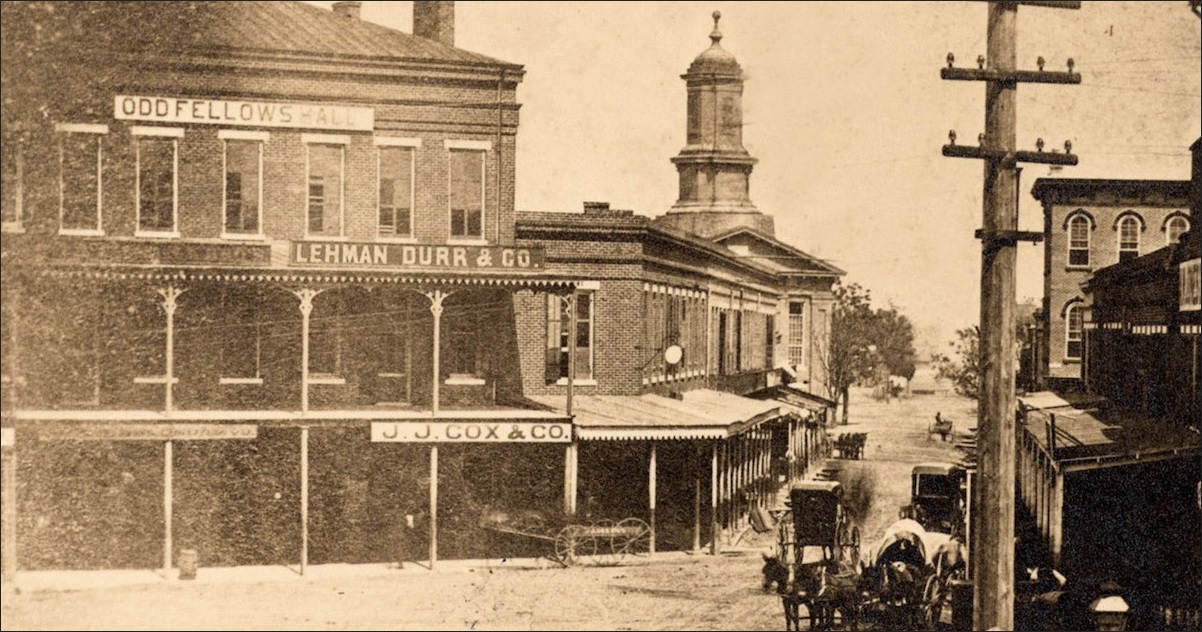

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

September | 2009 | EconProphhttps://econproph.com/2009/09Maybe they keep it together for a few years. But sooner or later this house of cards falls. Derivatives is one of the dirty words of the financial crisis. Though these often-risky bets were blamed by many for helping fuel the credit crunch and the downfall of Lehman Brothers and AIG, it seems that Wall Street has yet to learn its lesson.

Financial Crisis 2008 | The Corporate Law Academy Forumhttps://www.thecorporatelawacademy.com/forum/threads/financial-crisis-2008.471Sep 07, 2018 � Here are my notes on the financial crisis - They mostly deal with what caused the financial crisis and who is to blame Introduction: It was the collapse of the Lehman Brothers, a sprawling global bank, in September 28 that almost brought down the world�s financial system.

The Three Wealth Destroyers | The Perpetual Wealth Academyhttps://paradigm-academy.teachable.com/p/the-three-wealth-destroyersThey are the Three Wealth Destroyers. Additionally, you will learn wealth strategies that use these financial forces to grow and protect your personal wealth and savings. ... but I left after four months when Lehman Brothers collapsed next door and I watched hundreds leave the building holding cardboard boxes; that was the day I realized there ...

Microsoft | First Wealth Financial Educationhttps://firstwealth.wordpress.com/tag/microsoftJan 25, 2010 � �Nevertheless, investors will remember 2009 as the year that the U.S. stock market made a substantial turnaround from its plunge in 2008 when fallout from the implosion of subprime mortgages and the credit crisis forced Lehman Brothers into bankruptcy � changing the landscape of �[PDF]HISTORICAL FINANCIAL FLOWS COMPARED WITH THE �https://core.ac.uk/download/pdf/35326977.pdfEven the deregulation was the reason that provided Bank of Amerika and J.P.Morgan to gain and buy Merrill Lynch and Bear Stearns, which allows them to fight better with the financial crisis and its consequences. However, the regulation infiltrates its components into the reasons for a �

Fate.Script.Lifehttps://fate-script-life.blogspot.comDec 31, 2008 � October was the bleakest month of the year where the �mother of all collapses� happened when Lehman Brothers filed for bankruptcy, triggering a chain of events that caused the biggest drops of the year for stock exchanges around the world.

Tag Archives: corporate welfare - Cricketdiane's Webloghttps://cricketdiane.wordpress.com/tag/corporate-welfareIncluding all the houses that were repossessed by the mortgage lenders since August last year, there is already a total of 770,000 homes. More can actually be expected as the problems in the credit industry culminated in the bankruptcy filing of Lehman Brothers and rescuing of �

September 2008 Current Events - InfoPleasehttps://www.infoplease.com/world/september-2008-current-eventsAnd a failure would be harmful to economic growth and job creation.� (Sep. 14): Merrill Lynch agrees to be acquired by Bank of America for $50 billion, and Lehman Brothers prepares to declare bankruptcy when it fails to find a buyer. Merrill Lynch was valued at more than $100 billion in the past year.

Obama's 2 Mistakes That Lost the Country - Liability ...https://www.liabilityinsuranceqoutes.com/2019/05/02/obamas-2-mistakes-that-lost-the...The next year the new federal bankruptcy act gave derivatives priority for payment. In 2004 the SEC recklessly waived the rules that limited lenders to a maximum debt-to-net-capital ratio of 12 to 1 for five giant Wall Street firms� Goldman Sachs, Merrill Lynch, Lehman Brothers�

The public and its problems. - Free Online Libraryhttps://www.thefreelibrary.com/The+public+and+its+problems.-a0280105945Between the Bear Stearns crisis and the failure of Lehman Brothers, the United States government could do little to get ahead of the growing problem (though, of course, the government-backed mortgage underwriters Fannie Mae and Freddie Mac were placed under conservatorship in the interim).

A Most Wanted Man (Audiobook) by John le Carr� | Audible.comhttps://www.audible.com/pd/A-Most-Wanted-Man-Audiobook/B002V1L9T2In the wake of the collapse of Lehman Brothers and with Britain on the brink of economic ruin, a young English couple takes a vacation in Antigua. There they meet Dima, a Russian who styles himself the world�s number one money launderer and who wants, among other things, a game of tennis.

MPDD Policy Brief No.1, December 2008 "Addressing the ...https://www.unescap.org/resources/mpdd-policy...decisive turning point. It was the day that the American investment bank Lehman Brothers Holdings, Inc. collapsed, exacerbating the financial turmoil and causing an extraordinary downward spiral in confidence. It was also the day on which the crisis truly hit Asia-Pacific shores, spreading beyond its equity markets and posing the

Terremark: Credit Crunch Scuttled Potential Sale | Data ...https://www.datacenterknowledge.com/archives/2008/...Nov 04, 2008 � Shares moved as high as $7.50 a share on Sept. 19, shortly after the collapse of Lehman Brothers triggered severe turbulence in the credit markets. The company's share price declined steadily, trading as low as $3.70 a share last week before closing today at $4.69.

SARB cuts South Africa's growth rate | eNCAhttps://www.enca.com/business/sarb-cuts-south-africas-growth-rateApr 07, 2020 � It released its latest monetary policy review, saying the pandemic is the biggest disruption to the global economy since the bankruptcy of Lehman Brothers in �

Paulson's 3-page plea for $700B - Fortunehttps://archive.fortune.com/galleries/2008/fortune/...In September, days after Lehman Brothers collapses and two other giants teeter on the abyss, Paulson submits his "break the glass" plan for saving the U.S. financial system. All of three pages, the proposal seeks carte-blanche access to $700 billion in government funding to buy up troubled mortgage assets at the root of the financial crisis ...

U.S. banking sector safe enough for deregulation: former ...www.xinhuanet.com/english/2017-03/26/c_136157712.htmMar 26, 2017 � The financial crisis in 2008 began with a crisis in the U.S. subprime mortgage market, and developed into a global banking crisis with the collapse of the investment bank Lehman Brothers. Many considered that excessive risk taken by banks was the major cause of the crisis.

Virus hands Japan pension fund worst loss since 2008 crisishttps://www.macaubusiness.com/virus-hands-japan...Jul 03, 2020 � It was the most the fund had shed since its eye-watering 9.3-trillion-yen loss in the year that ended March 2009, as world financial markets plunged after Lehman Brothers collapsed in September 2008. Japan�s 160-trillion-yen pension fund has nearly doubled the share of equities in its bond-heavy portfolio to generate higher returns.

HEDGE FUNDS: THE NEXT I-BANKS - Pragmatic Capitalismhttps://www.pragcap.com/hedge-funds-the-next-i-banksIn the wreckage that is the investment banking industry there appear to be some brave vultures swooping in to pick up the valuable left overs. Hedge funds have been landing former investment banking talent left and right since the collapse of Lehman Brothers, Bear Stearns and the apparent synergy issues at Merrill and Bank of America. FIN ...

Scott Pringle | WBGOhttps://www.wbgo.org/term/scott-pringleIt was September 15th, 2008 when Lehman Brothers filed for bankruptcy. The collapse of the big bank shattered the too big to fail theory setting off the start of a financial crisis and huge plunge of the stock market over the months to come. Ultimately, the government bailed out the banks. September 29th, 2008.

Quick Money�Run on the Banks - Porsche Consultinghttps://www.porsche-consulting.com/en/home/news/...They frequently draw comparisons to the global recession sparked by the collapse of the Lehman Brothers investment bank in 2008. At that time it was the international banking sector that sent shock waves rippling through the real economy. Now it is the other way around. With businesses closed, container ports deserted, trade fairs cancelled ...

Investors Remain Surprisingly Skeptical on Stocks | Irishttps://www.iris.xyz/markets/investors-remain-surprisingly-skeptical-on-stocksThe one exception was the July 2008 survey, which was conducted during the Great Financial Crisis and just two months prior to the failure of Lehman Brothers.Related: A Bullish-and Rare-Signal for Stocks in 2019Related: Another Bullish Signal: S&P 500 vs. Predicted Value In our opinion, the January 2019 survey results demonstrate that investor ...

* Capital Link Forumhttps://forums.capitallink.com/mlp/2017/bios/bellamy.htmlHe began his equity career in 2001 at Stifel, was the Director of Research for the Lehman Brothers MLP Opportunity Funds, rejoined the sell side at Wunderlich after the credit crisis, and joined Baird in 2010. Ethan holds a BA from Clemson University and an MA from the University of Colorado-Boulder.

New Business Professor Offers Management and ...https://www.tamucc.edu/news/2014/07/080514 COB Harris.htmlHe brings extensive experience in graduate and undergraduate teaching. Dr. Harris has published articles and case studies focusing on issues in strategic management and corporate governance, including an in-depth examination of the 2008 Lehman Brothers Holdings Inc. bankruptcy and the �

World economic crash 'exciting' - King - RTE.iehttps://www.rte.ie/news/business/2014/1229/669428-bank-of-englandKing said that once US banking giant Lehman Brothers collapsed in late 2008, triggering the beginning of worldwide economic collapse, he found the crisis easier to handle.

Fifty inventions that shaped the modern economy : Harford ...https://www.torontopubliclibrary.ca/detail.jsp?R=3527667"A smart, lively history of the world economy, seen through the crucial inventions that shaped it. Who thought up paper money? What was the secret element that made the Gutenberg printing press possible? What is the connection between The Da Vinci Code and the collapse of Lehman Brothers? In [this book], author and economist Tim Harford paints an epic yet intimate picture of economic change �

Leverage | News | European Parliamenthttps://www.europarl.europa.eu/.../10/leverageThis was the case with a number of banks prior to the financial crisis of 2007-2008, with Lehman Brothers for example having 30 times more debt than capital on its books. When profits were not being made through the money borrowed, the interest expense on the vast debt and credit risk of default destroyed all shareholder value.

An�lisis de la crisis financiera de estados unidos (2007 ...https://repository.urosario.edu.co/handle/10336/2903Translate this pageEn el primero, la entrada en el cap�tulo 11 de protecci�n a bancarrotas por parte de Lehman Brothers, el 15 de septiembre de 2008. En el segundo, el detonante fue la baja de la calificaci�n de la deuda soberana de Estados Unidos por parte de Standard and Poor�s el 5 de agosto de 2011. ... the detonate was the decline in United States ...

Schlich | Article about Schlich by The Free Dictionaryhttps://encyclopedia2.thefreedictionary.com/SchlichAn analysis of Lehman Brothers bankruptcy and Repo 105 transactions Schlich (history of medicine, McGill University) refutes the common belief that organ transplant was the dream of ancient medical practitioners that was only thwarted by a lack of technology.

COVID-19: Demand for compensation senseless, irresponsible ...https://dailypost.ng/2020/05/04/covid-19-demand-for-compensation-senseless...May 04, 2020 � Saixiong noted that the financial turmoil in the US triggered by the collapse of Lehman Brothers in 2008 turned into a global financial crisis and no one asked the US to take the consequences.

Are financials still a contrarian bet? | Portfolio Adviserhttps://portfolio-adviser.com/crisis-crisisThe collapse of Lehman Brothers eight years ago kicked off the global financial crisis and the sector has remained under a lot of pressure ever since. It is still trying to overcome the surrounding issues and it is probably fair to say that it will be many years before things get resolved.

Markets | MediaNamahttps://www.medianama.com/tag/marketsThe bankruptcy of Lehman Brothers and the sale of Merrill Lynch to Bank of America was the unfortunate highlight of a global market meltdown... Medianama September 15, 2008 More Posts

Yellen defends 2008 financial regulations, but cuts her ...https://en.mercopress.com/2017/08/26/yellen...Aug 26, 2017 � In her speech, Yellen noted that the U.S. and global financial systems were �in a dangerous place 10 years ago,� with severe strains that led to the collapse of investment bank Lehman Brothers ...

February 2016 � Finance Occupational Bloghttps://aujlafinance.wordpress.com/2016/02Household financial names like Bear Stearns and Lehman Brothers simply vanished and alongside them did hundred of thousands of banking jobs. The financial crisis was the worst economic disaster since the Great Depression and led to the Great�[PDF]News Release Nomura International (Hong Kong) Ltd. Nomura ...www.nomuraholdings.com/news/nr/asia/20150105/20150105.pdfJan 05, 2015 � executive committee. She has also previously worked with Lehman Brothers in equity derivative structured sales. Amanda was appointed as a member of the Board of Governors for Singapore Polytechnic in April 2012 and is part of the investment committee. For further information please contact: Name Company Telephone

US job openings rise to highest in three yearshttps://www.smh.com.au/business/us-job-openings-rise-to-highest-in-three-years...Job openings increased by 225,000 to 3.35 million, the most since August 2008, a month before the collapse of Lehman Brothers Holdings Inc. intensified the financial crisis, Labor Department data ...

Hedge fund president calls for Microsoft CEO to step down ...https://thenextweb.com/microsoft/2011/05/26/hedge...May 26, 2011 � Einhorn is best known for his early insights into the Lehman Brothers financial collapse in 2008. Microsoft shares gained 4 cents in normal trading �

Ferdinand Fichtner | The Irish Timeshttps://www.irishtimes.com/topics/topics-7.1213540?...Jun 06, 2020 � Three months after the collapse of Lehman Brothers, triggering the global financial crisis, the Bundesbank warn ... �Heroin was the worst mistake we made ...

Berke �elikel - Associate Director - Arup | LinkedInhttps://tr.linkedin.com/in/berke-�elikel-61b087a1Lehman Brothers Istanbul Branch Fit Out Project Design and Tender documentation of the mechanical services of 500 m� office floor which is located in Eczacibasi Kanyon Building. Site supervision for mechanical works is another item of this work scope, Istanbul, TURKEY.Title: Associate Director at ArupLocation: Istanbul, T�rkiye[PDF]Financial Results for Third Quarter Endedhttps://www.daiseki.co.jp/english/IR/pdf/202102_3Q.pdf?The revised forecast announced on June 30th, 2020 was the worst-case scenario. The impact of COVID-19 was gradually eased, and our performance entered a recovery period, so we announced the revised upward forecast on ... bankruptcy of Lehman Brothers on September15th,2008 declared the state of emergency on April 7th,2020 4Q 1Q 2Q 3Q 4Q ...

Risk arbitrage - definition of risk arbitrage by The Free ...https://www.thefreedictionary.com/risk+arbitrageDefine risk arbitrage. risk arbitrage synonyms, risk arbitrage pronunciation, risk arbitrage translation, English dictionary definition of risk arbitrage. ... After his MBA, he joined the Risk Arbitrage desk in Lehman Brothers and left when that institution collapsed. ... who at that time headed risk arbitrage. He was the star; he was rumored ...

100312 Witn Lehman | Bankruptcy Of Lehman Brothers ...https://www.scribd.com/document/354818238/100312-Witn-Lehman100312 Witn Lehman - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Witn Lehman

Global Economy Has Entered Recession amid Virus Spread ...https://sp.m.jiji.com/english/show/3900Translate this pageThe global economy is in a state of recession due to the adverse effects of the spread of the new coronavirus, International Monetary Fund Managing Director Kristalina Georgieva said Friday. "It is now clear that we have entered a recession as bad or worse than" the one at the time of the global financial crisis triggered by the 2008 collapse of U.S. investment bank Lehman Brothers, she said ...

RAJAH & TANN ASIA | Eventshttps://events.rajahtann.com/RegSeminars.aspx?sem=2019093000001The key issue � was the attack on and destruction of the World Trade Centre an �accident�? Do the claimed losses arise out of one �event�? Axa Reinsurance (UK) Plc v Field ... piracy and ransom off the coast of Africa and the world-wide financial crisis following the collapse of Lehman Brothers in 2008. ...

Lehman brothers holdings inc nyc" Keyword Found Websites ...https://www.keyword-suggest-tool.com/search/lehman...Sourcewatch.org Lehman Brothers Holdings Inc. declared bankruptcy September 15, 2008. The filing marked the largest bankruptcy in U.S. history with $613 billion dollars of debt. Prior to its collapse, Lehman Brothers was the fourth largest and the oldest of the five major global financial-services firms.

Lehman brothers stock value" Keyword Found Websites ...https://www.keyword-suggest-tool.com/search/lehman+brothers+stock+valueLehman Brothers - Wikipedia. En.wikipedia.org Lehman Brothers Holdings Inc. (/ ' l i? m ?n /) was a global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch), with about 25,000 employees worldwide.

The Collapse Of Lehman Brothers Case Study Pdfhttps://magazinestreets.info/the-collapse-of-lehman-brothers-case-study-pdf.phpThe Collapse Of Lehman Brothers Case Study Pdf, literature review of icici bank project, essay topics for paradise lost, my posse dont do homework quotes[PDF]Asia leads luxury market slowdown - Knight Frankhttps://content.knightfrank.com/research/323/documents/en/q4-2011-719.pdfAfter the collapse of Lehman Brothers European and North American cities were largely responsible for the index�s slump. Since late 2010 it has been the Asian cities which have dampened price inflation. In Q2 2010 prices in Asia were rising at an average rate of �

Mind Over Markethttps://mindovermarket.blogspot.com/2012/01Jan 23, 2012 � The Federal Reserve could have prevented the bankruptcy of Lehman Brothers in September 2008 by simply guaranteeing Lehman's trades briefly, long enough for the deal to sell the good assets of the company to Barclays Bank in the United Kingdom to gain board approval at Barlcays.

Lehman Brothers Holdings Inc - Scribdhttps://www.scribd.com/document/346851328/Lehman-Brothers-Holdings-IncLehman Brothers Holdings Inc. was the fourth-largest global financial service firm in the United States at the time of its collapse. It was founded by Henry Lehman, �

The Lehman Brothers Collapse Might Be Conspiracy-Driven ...https://unitedchambers.wordpress.com/2017/12/07/...Dec 07, 2017 � Bundeskanzlerin Merkel : How Much Was the Loan from Lehman Brothers Bankhaus AG to NH Belgium ? Bundeskanzlerin Merkel Beiliegend ein Brief an Seine Exzellenz Donald Trump, Pr�sident der Vereinigten Staaten, �ber die Lehman Brothers Bankhaus AG, die 1998 an European Hotel Ventures Belgium, das eigentliche NH Belgium CVBA, Kredite vergibt.

GDP firms on capex - MacroBusinesshttps://www.macrobusiness.com.au/2017/08/gdp-firms-capexGDP firms on capex. ... He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second ... just 6 weeks before The Collapse of Lehman Brothers US reported ...

Michael's Bloghttps://mverdon1.blogspot.comSep 14, 2010 � In this article It uses the Lehman Brothers bankruptcy and how expensive it was. The Lehman Brothers debt total was around $2 billion and unfortunately they still went bankrupt. But there are always companies that come away debt-free, like UAL and Pacifice Gas & Electric's.

What is the ticker symbol for brooks brothers? - Answershttps://www.answers.com/Q/What_is_the_ticker_symbol_for_brooks_brothersThe ticker symbol for Lehman Brothers Holding Incorporated was LEH but the company no longer exists after it was forced into bankruptcy during the financial crisis of 2008.[PDF]DNO ASA 4 Quarter 2002reports.huginonline.com/892358/113694.pdf2/18/2003 DNO ASA - Interim Presentation Q4 2 HighlightsHighlights Positive Performance continued into 4 Quarter Completed new successful well on West Heather Further Increase of Yemen Production Closed Thistle Agreement All Main Targets for 2002 met Production > 22,000 BOPD Partners for West Heather New Operatorships in Norway and UK Increased Reserves in all geographical areas

H� onze anos o Lehman Brothers entrou em fal�ncia e os ...https://geopedrados.blogspot.com/2019/09/o-lehman...Translate this pageSep 11, 2019 � Lehman Brothers' bankruptcy filing is the largest bankruptcy in U.S. history, and is thought to have played a major role in the unfolding of the late-2000s global financial crisis. The following day, Barclays announced its agreement to purchase, subject to regulatory approval, Lehman's North American investment-banking and trading divisions ...

Are Islamic Equity Funds More Resilient?https://pelaburhebat.blogspot.comJun 19, 2014 � For example, among the 35 financial sector securities listed on Bursa Malaysia, only 2 meet the Shariah-compliant guidelines (as of 30 May 2014). This has contributed to the much lower drawdown in the wake of the Lehman Brothers bankruptcy when the financial sector was the hit the hardest as seen in Chart 2.

Thinkinghttps://recessionaround.blogspot.comJun 28, 2009 � A good number of Americans, European and Asian banks had to write down billions of dollars in holdings. In fact, few banks filed for bankruptcy and that includes name like Lehman Brothers. It was biggest ever bankruptcy case in US history. More than 81 companies have filed for bankruptcy in USA. it was recently that GM has filed up bankruptcy ...

Case apllication 1 lessons from lehman brothers: will we ...https://www.homeworkmarket.com/content/case...2. What was the culture at Lehman Brothers like? How did this culture contribute to the company�s downfall? 3. What role did Lehman�s executives play in the company�s collapse? Were they being responsible and ethical? Discuss. 4. Could anything have been done differently at Lehman Brothers to prevent what happened? Explain. 5.

The Fed and Lehman Brothers - Accohttps://www.acco.be/.../The-Fed-and-Lehman-BrothersTranslate this pageThe bankruptcy of the investment bank Lehman Brothers was the pivotal event of the 2008 financial crisis and the Great Recession that followed. Ever since 'Lees meer� Ever since the bankruptcy, there has been heated debate about why the Federal Reserve did not rescue Lehman in the same way it rescued other financial institutions, such as Bear ...

bol.com | The Fed and Lehman Brothers (ebook), Laurence M ...https://www.bol.com/nl/p/the-fed-and-lehman...Translate this pageThe bankruptcy of the investment bank Lehman Brothers was the pivotal event of the 2008 financial crisis and the Great Recession that followed. Ever since the bankruptcy, there has been heated debate about why the Federal Reserve did not rescue Lehman in the same way it rescued other financial institutions, such as Bear Stearns and AIG.

Eurobonos: Lehman Brothers Treasury, FRN 22feb2009, USD ...https://cbonds.es/bonds/502855Translate this pageLBT operates in the Netherlands.Lehman Brothers Holdings Inc. was a global financial services firm. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States , doing business in investment banking, equity and fixed-income sales and trading (especially U.S. Treasury securities), research, investment ...

philippe mathieu | F6Shttps://www.f6s.com/philippemathieu2#!In less than 2 years, the book reached USD >10 Billion notional size, it was the largest and most profitable property trading book. It became so influential in the market that my trading positions contributed to the collapse of Lehman Brothers in 2008.

Why Are We Still in a Recession? The Shape of the Crisis ...https://delong.typepad.com/sdj/2010/01/why-are-we...Jim Hamilton sends us to John Cochrane, who makes a number of good points. Cochrane agrees with the conventional wisdom that it was not any fundamental change or news about preferences, technologies, or the risks of undertaking production and hiring workers but rather the bankruptcy of Lehman Brothers that turned us from being in a small recession to being in the deepest recession �

lehman brothers | Trouwhttps://www.trouw.nl/tag/lehman-brothersTranslate this pageIn de jaren negentig was the sky the limit - maar de kermis bleek koud. voorpagina ... Tien jaar na de val van Lehman Brothers: wat er (niet) is geleerd van de financi�le crisis.

??Kobo???????: The Fed and Lehman Brothers - �https://books.rakuten.co.jp/rk/71f351bebc2531679a0...Translate this pageThe bankruptcy of the investment bank Lehman Brothers was the pivotal event of the 2008 financial crisis and the Great Recession that followed. Ever since the bankruptcy, there has been heated debate about why the Federal Reserve did not rescue Lehman in the same way it rescued other financial institutions, such as Bear Stearns and AIG.Price: �1673

The great recession in Germanyhttps://the-great-recession-in-germany.blogspot.comWhat was the solution for the crisis? ... at the latest when the crisis began to expand in September 2008 and the US bank Lehman Brothers collapsed, they began to act, so until the Lehman fell they didn't act. Publicado 2nd December 2018 por Marta Miguel. Etiquetas: before crisis. 0

September | 2008 | Living Investmenthttps://limkimtong.wordpress.com/2008/09Since the collapse of Lehman Brothers (14 September 2008), the fourth largest investment bank in US, the horror of impact to investors in Singapore surfaced over the past week. Minibond was a structured investment product linked to Lehman.

Like The Phoenix, U.S. Finance Profits Soar - Real Time ...https://blogs.wsj.com/economics/2011/03/25/like-the-phoenix-u-s-finance-profits-soarMar 25, 2011 � During the darkest days of the financial crisis, when Lehman Brothers and Washington Mutual went belly up and the U.S. government had to bail �

A dieci anni dal crollo di �Lehman Brothers� | La Civilt� ...https://www.laciviltacattolica.it/articolo/a-dieci...Translate this pageten years on from the collapse of lehman brothers In the fall of 2008, a tsunami hit and devastated global finance, dragging with it secular banking institutions and causing panic in the main money markets.

lehman brothers bankruptcy | Bankruptcy of Lehman Brothers ...https://www.linkddl.com/search/lehman-brothers-bankruptcyLehman Brothers� bankruptcy was the largest in United States history.1 It eclipsed by nearly double the failure of Washington Mutual two weeks later. 2 By any measure, the LBHI bankruptcy and the subsequent insolvency and bankruptcy filings by other Lehman

Euro-obbligazioni: Lehman Brothers Treasury, 7% 30dec2016 ...https://cbonds.it/bonds/146701Translate this pageLBT operates in the Netherlands.Lehman Brothers Holdings Inc. was a global financial services firm. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States , doing business in investment banking, equity and fixed-income sales and trading (especially U.S. Treasury securities), research, investment ...

BOOK REVIEW: Stress Test: Reflections on Financial Crises ...https://smartinshelton.wordpress.com/2016/02/11/...Feb 11, 2016 � The 85-year old investment bank Bear Sterns was saved from bankruptcy by an infusion capital from the federal government and JPMorgan Chase. The storied Lehman Brothers, founded in 1847, could not find a savior, went bankrupt and closed its doors. The world�s largest insurance company, American International Group (AIG) was near collapse.

‘By March, $10 billion of real estate investment trusts ...indianrealtynews.com/real-estate-india/by-march-10...Nov 11, 2014 � In terms of volume of money coming into the market globally, it will be about $125 billion this calendar year. 2007 was the last big investment year at $110 billion. Post the Lehman Brothers crisis, it fell dramatically to $40 billion in 2009. These numbers include �[PDF]Plan Cours de Finance (M1)laurent.jeanpaul.free.fr/Enseignement/Cours%20M1...Lehman Brothers, 1,6 milliards de $ de frais, d�but 2012 ... Jim Millstein, co-chairman of Guggenheim Securities, was the chief restructuring officer at the U.S. Department of the Treasury from 2009 to 2011. In that role, he was responsible for the oversight and management of

Clintont �s Kasichot t�mogatja a The New York Times | Mandinerhttps://media.mandiner.hu/cikk/20160131_clintont...Translate this page"Lehman Brothers Collapse Haunts John Kasich in Ohio Governor's Race The Columbus Dispatch reported this week that Kasich tried to persuade two state pension funds in 2002 to invest with Lehman Brothers while he was the managing director of the investment banking house's Columbus office.

bol.com | Edgar Karssing artikelen kopen? Alle artikelen ...https://www.bol.com/nl/b/edgar-karssing/21085Translate this pagerethinking Lehman Brothers and the global financial crises. Engels; Paperback; 9789023251118; Druk: 1; augustus 2013; 360 pagina's; The nickname of the Lehman CEO Dick Fuld was 'The Gorilla of Wallstreet'. In Gorillas, Markets and the� Meer. 12 95. Toon tweedehands. Filter 5 resultaten Filters Categorie�n. Boeken (5) Toon artikelen die niet ...

Equitable Subordination of a Creditor's Secured Claim when ...https://www.inforuptcy.com/news/bankruptcy-and-restructuring-blog/equitable...The debtors in the Palmdale Hills case were integrated companies formed as part of a joint venture to develop residential real estate projects with affiliates of Lehman Brothers, Inc. Lehman and its affiliates, including Lehman ALI, Inc. ("Lehman ALI") and Lehman Commercial Paper Inc. ("Lehman Commercial"), provided the financing for the ...

Direct cash benefits in the United States should become ...www.economo.co.uk/direct-cash-benefits-in-the...Aug 26, 2020 � It has been five months since the collapse of Lehman Brothers in 2008 until the approval of a stimulus package. As each recession is different, there will always be covert policy negotiations. But placing autopilot direct payments at least opens up the possibility of discussions about other emergency measures and avoids leaving millions in trouble.

Case Studies Solutions & Analysis - narkivehttps://comp.soft-sys.math.scilab.narkive.com/...Lehman Brothers: Crisis in Corporate Governance by Randall D. Harris DLC Management Corporation: Securing Its Future by Rocki-Lee DeWitt, Adam Ifshin Daktronics (F): Weathering the Recession Positioned for a Bright Future by Marilyn L Taylor, Theresa T Coates, Charles C Connely

What East Africa read in 2011 - The East Africanhttps://www.theeastafrican.co.ke/magazine/What-East-Africa-read-in-2011-/434746...Jan 15, 2012 � This is a more sustainable approach of getting people out of poverty. ... Sorkin�s book is ideal if one wants a quick overview into the events that led up to the collapse of Lehman Brothers in 2007. ... As the title of the book states, it is a reality check for business leaders, that the customer really does have the upper hand. ...

Watch Inside Lehman Brothers (2018) Full Movie Online ...https://m4ufree.to/movie/inside-lehman-brothers-2018-o9eb7.htmlThis led to a global . Inside Lehman Brothers (2018) Full Movie, Inside Lehman Brothers (2018) Messy mortgages taken out by Lehman Brothers caused a real estate crisis in America ten years ago. ... and the Washington Sentinels have just gone on strike. Scrambling for a solution, the Sentinels' owner Edward O'Neil hatches a plan to bring in ...

Financial Crisis: Senate Hearing Examines the Role of ...https://www.thecorporatecounsel.net/blog/2011/04/foreign-corporations-subject-to...Financial Crisis: Senate Hearing Examines the Role of Accounting and Auditing. ... As the NY Times� Floyd Norris covered well in his recent column, ... That appears not to have happened at Lehman Brothers, at least when it came to leverage, and it might not have happened at other banks. ...

www.gzsba.comwww.gzsba.com/guestindex.asp?Page=5253Translate this pageBut many chief executives on the list, including Lehman Brothers' Dick Fuld, were at the helm when their company either went under or accepted a government rescue package. Fuld received $466.3 million of compensation from 2001 through 2007, the report said. Fuld was not immediately available for comment.

Recent Posts - The Economic Collapsetheeconomiccollapseblog.com/archives/october...Oct 12, 2018 � It would have to be something on the scale of another 9/11, the collapse of Lehman Brothers, an unprecedented natural disaster, the start of a major war or something else along those lines. Yes, conditions are definitely ripe for a �perfect storm� to develop, but it is going to take a little bit of a push to get us there.

Law Firms Gear Up for Expected Jump in Bankruptcies ...https://uk.advfn.com/stock-market/NYSE/FCN/share...But filings have declined since then, leading to a contraction of the industry. Corporate bankruptcy powerhouse Weil, Gotshal & Manges laid off several dozen associates and more than 100 staffers in 2013, citing the winding down of the Lehman Brothers bankruptcy case.

US Federal Reserve extends unlimited support to financial ...https://www.wsws.org/en/articles/2012/09/quan-s14.htmlSep 14, 2012 � It is a measure of the deepening crisis of global capitalism that on the eve of the fourth anniversary of the collapse of investment bank Lehman Brothers, the US �[PDF]All Work and Low Pay: We must not forget how people from ...https://core.ac.uk/download/pdf/82955438.pdfAusterity has contributed towards this, but clearly poverty existed before the collapse of Lehman Brothers and there are persistent structural inequalities that reach deep into the heart of our society, which need to be dealt with. To have any chance of transforming the lives of people on low-pay, we need to reveal the complex

Exclusive: Yellen gets post-Fed payday in private meetings ...https://www.thewealthadvisor.com/article/exclusive...Apr 05, 2018 � Former Fed Chair Alan Greenspan waited only a week after stepping down before addressing a private dinner in 2006 hosted by Lehman Brothers, the investment bank whose collapse two years later sent the global financial crisis into high gear.

These Seven Companies Are Headed for Bankruptcy :: The ...www.marketoracle.co.uk/Article30929.htmlIn fact, 2011 has been the worst year for corporate bankruptcies since 2009, when the financial crisis touched off by the Lehman Brothers' collapse caused a record number of filings.

Why Boston's $29 billion man avoids China - By William Pesekhttps://collapsechina.blogspot.com/2014/11/why...In the 1980s, he loaded up on distressed Latin American assets others wouldn't touch. A decade later, to the consternation of peers, he bet on Malaysian and South Korean bonds. As Lehman Brothers was crashing in late 2000s, Fuss was nibbling on shaky US corporate debt. But even this battle-tested maverick won't dip a toe into North Asia.

Outlook: German real estate market in 2019 - Savills Germanyhttps://en.savills.de/research_articles/259694/274783-0On 15 September 2008, investment bank Lehman Brothers filed for insolvency, marking the nadir of the global financial crisis. The crisis would lay the foundations for a perhaps unparalleled real estate boom, not least in Germany.

Savills Gibraltar | Tagged Articleshttps://www.savills.gi/insight-and-opinion/tagged...On 15 September 2008, investment bank Lehman Brothers filed for insolvency, marking the nadir of the global financial crisis. The crisis would lay the foundations for a perhaps unparalleled real estate boom, not least in Germany.

Feds sideline billionaire Falcone from fund business | The ...https://www.thestar.com.my/business/business-news/...May 10, 2013 � The government asserted that at the height of the financial crisis, when many of the fund's assets were tied up in the collapse of Lehman Brothers, Falcone let select investors get out while ...

financial engineering | Computational Economicshttps://scienceofeconomics.wordpress.com/tag/financial-engineeringAug 24, 2010 � Credit derivatives aren�t, of course, solely to blame for the pandemic that has helped bring down Wall Street. They didn�t single-handedly force Bear Stearns and Lehman Brothers to bulk up on toxic debt, dooming them to collapse. But they made the financial world more complex and more opaque.

Daily Bankruptcy Newshttps://bkinformation.com/News/PriorEditions/2017/August/8-18-2017.cfmAug 08, 2017 � Lehman Brothers Inc. Trustee Reports on Substantial Progress in Winding Down Estate (DBN) _____ Marijuana: Navigating the Hazy Status of Marijuana Banking (DBN) _____ Economy: Weekly Initial Unemployment Claims decrease to 232,000 (DBN) The Fed just fired off a stark warning � and it highlights one of the biggest risks for stocks (DBN)

In-Depth Review: High Performance Collaboration ...https://www.classcentral.com/report/review-high-performance-collaborationFor example, though data to the contrary was widely available and talked about in 2008, for most part people believed the economy was doing well till Lehman Brothers collapsed and the financial crisis hit.

Introduction to discourse analysis - ??????????? ??????https://ppt-online.org/405188not attempt to reinstall Boyfriend 5.0. This is an unsupported application and will crash Husband 1.0. In summary, Husband 1.0 is a great program, but it does have limited memory and cannot learn new applications quickly. You might consider buying additional software to improve memory and performance. We recommend Hot Food 3.0 and Lingerie 7.7 ...�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Integration of Central and Eastern European and the Euro ...https://link.springer.com/article/10.1057/ces.2014.16Aug 26, 2014 � The crisis has visibly disrupted the convergence process. The spreads for Hungary, Poland and the Czech Republic began to rise with the onset of the crisis, implying divergence of sovereign risk premia. The peak of divergence happened in the first quarter of 2009, that is, several months after the collapse of Lehman Brothers in September of 2008.

Todays Markets | Edvestingedvesting.com/day-trading-signals/todays-markets-221Sep 28, 2018 � Bloomberg: Brexit Starting to Loosen London�s Grip on Interest-Rate Swaps When a bank or fund fails, LCH is the valve that protects the rest of the system. When Lehman Brothers collapsed, it had $9 trillion of outstanding swaps at LCH; the clearinghouse wound down the portfolio without using any of the collateral of its other member banks.[PDF]REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 MARCH �www.thetakeoverpanel.org.uk/wp-content/uploads/2008/11/report2008.pdfdesignated by the Secretary of State for Trade and Industry as the supervisory authority to ... No person who is or has been a member of the Code Committee may be a member of the Hearings Committee. ... note that the first Annual Report, issued in1969, made the point that the Code set out �to ...

052013 - SlideSharehttps://www.slideshare.net/pannomion/052013-21470709May 19, 2013 � Recent Trends in Inequality� In 1980, CEOs earned 42 times the salary of average the worker.� In 2000, CEOs earned more than 500 times the salary of theaverage worker.� Dick Fuld (CEO of Lehman Brothers circa 2008) had a three-story cargarage with a car elevator. 9. What About After Taxes?Source: Inequality.org 10.[PDF]

Newsletterhttps://turiteadocuments.files.wordpress.com/2012/04/kenderdine-lectures-on...critical for New Zealand�s future growth prospects? What are the forces that underpin New Zealand current and future export opportunities? Tuesday March 27 Dennis Rose The Global Financial System � Reflections on the current crisis Developments since the 2008 collapse of Lehman Brothers have starkly highlighted the linkages between

Accounting Fraud at Worldcom Essay - 739 Wordshttps://www.studymode.com/essays/Accounting-Fraud-At-Worldcom-500978.htmlLehman Brothers: Investment bank Lehman, with $600 billion in assets, failed in late 2008. It was the largest bankruptcy in history and a spark to the worldwide financial crisis. A bankruptcy examiner's report concluded there were "colorable" claims against its top executives and its auditor, Ernst & Young, for fraud , but neither the SEC ...

Big picture investing - Alliotthttps://www.alliott.co.nz/blog/x_post/Big-picture-investing-00412.htmlThe climax of the crisis was the collapse of US investment bank Lehman Brothers in September 2008, triggering a bailout of the banking system and extraordinary fiscal and monetary stimulus by governments and central banks. For investors, it was clearly an anxious time. Global equity markets plunged by �

lehman brothers robert lehman | Lehman Brothers - Wikipediahttps://www.freekeyworddifficultytool.com/find/lehman-brothers-robert-lehmanLehman Brothers Holdings Inc. (/ ' l i? m ?n /) was a global financial services firm. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch), doing business in investment banking, equity and fixed-income sales and trading (especially U ...

EWI & Conrad Acceptance Corp. - Intention to defraud ...https://www.complaintsboard.com/ewi-conrad-acceptance-corp-intention-to-defraud...On background, my wife and I lived a good and prosperous life until the collapse of Lehman Brothers in September 2008. Prior to the market crash, we had nice homes in the suburbs of a major metropolitan city and a lake-front property at a mountain resort community; life was good.

In the post-crisis world, risk must be sensibly priced ...https://www.ft.com/content/7627cb4a-6f6e-11e0-952c-00144feabdc0Apr 25, 2011 � As AIG and Lehman Brothers showed in 2008, a severe dislocation in such a diffused and opaque area can have ruinous ripple effects on the rest of the system.

2014?8?24?????????-?????????????https://blog.goo.ne.jp/kitaryunosuke/d/20140824Translate this pageIt's hard to believe, but almost six years have passed since the fall of Lehman Brothers ushered in the worst economic crisis since the 1930s. Many people, myself included, would like to move on to other subjects. But we can't, because the crisis is by no means over.

German Finance Minister on the Euro Crisis: 'We Can't ...https://www.spiegel.de/international/germany/... � Translate this pageThat's why we created a mechanism for the euro zone that will, beginning in 2013, force private creditors to share in the bailout costs for a sovereign debt crisis -- though hopefully the stricter ...

???????2011�2012?????????????????e.ruiwen.com/st/12179.xhtmlTranslate this pageWhat was the woman doing when the accident happened? ... On the first floor. C. On the second floor. 18. What can be seen on the first floor? ... 29. That could set off a �credit event,� _____ world financial markets into turmoil(??), much as the collapse(??) of Lehman Brothers _____ in the fall of 2008.

Fifty Inventions That Shaped the Modern Economy (Audiobook ...https://www.audible.com/pd/Fifty-Inventions-That...What was the secret element that made the Gutenberg printing press possible? And what is the connection between The Da Vinci Code and the collapse of Lehman Brothers? Fifty Inventions That Shaped the Modern Economy paints an epic picture of change in an intimate way by telling the stories of the tools, people, and ideas that had far-reaching ...[PDF]� Schiff Publishing, Inc. Eight Miles High and Falling Fasthttps://www.insuranceobserver.com/PDF/1996/030196.pdf" ,'re have always been at odds 1994, total life-insurance reserves were and Spehar moved to Lehman Brothers Swith the annuity business, only $468 billion, and the life-insurance the following year. Soon after Spehar left, for a number of reasons. industry's surplus was just $136 billion. Conseco rehired Merrill Lynch as its

ich dachte sofort - Englisch-�bersetzung � Linguee W�rterbuchhttps://www.linguee.de/deutsch-englisch/...Translate this pageproducing the type of clients that we lawyers have, as well as the effect of the crisis on the issue of ethics that may be at risk now more then ever, because of the different quality and particularly quantity of the work of lawyers, the conflicts of interest, The massive class actions in cases like Lehman Brothers �

liebe Gr�sse an alle - Englisch-�bersetzung � Linguee ...https://www.linguee.de/deutsch-englisch...Translate this pageYours sincerely In 2008 the flood of bad news coming out of the financial sector dominated the headlines: the collapse of the US investment bank Bear Stearns, the nationalisation of the US mortgage companies Fannie Mae and Freddie Mac, the failure of Lehman Brothers, the nationalisation of three Icelandic banks, the takeover of Merrill Lynch by Bank of America, the US Federal Reserve's bailout ...

was the hardest part - Traducci�n al espa�ol � Lingueehttps://www.linguee.es/ingles-espanol/traduccion/was+the+hardest+part.htmlIn fact, from the perspective of hindsight, it can be affirmed that the hardest part of the worst recession that the world has known in over half a century took place between September 2008, a moment symbolised by the bankruptcy of Lehman Brothers, and March 2009, when the �

The GREEN MARKET ORACLE: Solar Stock Reviewwww.thegreenmarketoracle.com/2009/01/solar-stock-review.htmlThe early part of 2008 hit solar hard, then after recovering in the spring, the summer saw government involvement reducing solar's demand in Germany and Spain with state incentives in Japan and the US. Then there was the evaporation of credit with the housing and financial crisis, culminating in the failure of Lehman Brothers.

Bank of America | Ketron Property Management, Inc. | Page 2https://ketronpropertymanagement.wordpress.com/tag/bank-of-america/page/2The fact is though Fannie and Freddie did not buy and securitize the worst of the junk mortgages generated ahead of the housing collapse. That honor goes to Citigroup, Merrill Lynch, Goldman Sachs, Lehman Brothers and other private investment banks, which eagerly swallowed the worst of mortgages that Countrywide, Ameriquest, and Washington Mutual foisted on would-be homebuyers.

Debt Ratios - The Economic Collapsetheeconomiccollapseblog.com/archives/tag/debt-ratiosLehman Brothers was only leveraged 30 to 1 when it finally collapsed. #3 There are clear signs that economic activity is also significantly slowing down in the United States. For example, new orders for goods manufactured in the United States experienced the biggest drop in three years in January.

private counterparts - Deutsch-�bersetzung � Linguee ...https://www.linguee.de/englisch-deutsch/...Translate this pageWhile the Swiss private banks, unlike their full-service counterparts, had only insignificant exposure to the securitised subprime mortgages whose collapse drastically accelerated the financial crisis, they have seen trust eroded seriously as a result of writedowns on structured products related to Lehman Brothers, claims vis-�-vis Icelandic banks, and substantial holdings in funds run by ...

????|Credit Risk - ??https://zhuanlan.zhihu.com/p/134068340Translate this pageThe bailout of AIM and collapse of Lehman Brothers pushed counterparty risk back on the agenda. Two aspects differentiate counter-party risk from traditional credit risk: The value of a derivatives contract in the future is uncertain. Its value at a potential default date will be the net value of all future cash flows to be made under that ...

peaked cap - Deutsch-�bersetzung � Linguee W�rterbuchhttps://www.linguee.de/englisch-deutsch/...Translate this pageThe distortions on the international financial markets that were triggered by the collapse of the US investment bank Lehman Brothers in autumn 2008 peaked in early 2009, with lows recorded by the international indices.

Share Talk Weekly Stock Market News 23rd September 2018https://www.share-talk.com/share-talk-weekly-stock...Sep 23, 2018 � They say history never repeats but on the 10th anniversary of the 2008 Lehman Brothers collapse which froze economies and plunged the world into the worst recession on record, Read More� Artemis Resources (ASX:ARV) reveals gold recovery at Pilbara tenements

The World from Berlin: 'Certain Mistakes Just Can't Be ...https://www.spiegel.de/international/germany/the... � Translate this pageTransferring �300 million to Lehman Brothers -- an institution that had already shown itself to be a candidate for bankruptcy the night before -- is one of those mistakes.

Multi Trillion dollar near miss: Bear Stearns could have ...www.digitaljournal.com/article/252634Apr 03, 2008 � Richard Fuld of Lehman Brothers, who had been directed to return home from a business trip in New Delhi by none other than Henry Paulson, the Treasury secretary, was patched in, too, among others.

PHILO 101 Study Guide (2015-16 Lana Kuhle) - Instructor ...https://www.studyblue.com/notes/note/n/philo-101-study-guide-2015-16-lana-kuhle/deck/...Study 80 PHILO 101 Study Guide (2015-16 Lana Kuhle) flashcards from StudyBlue on ... and his sincere belief in the boat is no defense, because he had no right to believe on such evidence in the first place. Cliffords Criticism part 2 ... The bankruptcy of Lehman Brothers in September 2008 raised questions about the viability of major U.S ...

The Volatility Surface in Action - Equity Derivatives in ...https://zh-tw.coursera.org/lecture/financial...Translate this pageSeptember 15th was the date when Lehman filed for bankruptcy. So, the 11th, so the 12th, and I think this was a Friday. So, the next date we're going to see is September 15th, which was a Monday. That was the day that Lehman Brothers filed for bankruptcy, and we see that the volatility surface moves up entirely.

Bank of Mexico News and Updates from The Economic Times ...https://economictimes.indiatimes.com/topic/Bank-of-Mexico/news/9May 27, 2019 � General Bipin Rawat named as the country's first Chief of Defence Staff. ... Volatility for the USDINR pair could be confined to a narrow range until the release of the policy statement. ... The incident is a repeat of an ill-timed payment of 300 mn euros KfW made to Lehman Brothers in September 2008, on the day the US firm filed for bankruptcy.

Con-tango � Economyhttps://www.con-tango.com/category/economyThe S&P 500 has lost 26 percent since U.S. investment bank Lehman Brothers Holdings Inc. declared bankruptcy on Sept. 15, while the U.K.�s FTSE 100 has fallen 25 percent, Japan�s Nikkei 225 has tumbled 37 percent and Germany�s DAX has dropped 29 percent.

Trilantic plans to recruit in Texas | Private Equity ...https://www.privateequityinternational.com/trilantic-plans-to-recruit-in-texasWhy did you decide 2016 was the time to open your Texas office? Trilantic was previously a part of Lehman Brothers. We were talking about opening an office in Texas since we had been Lehman Brothers; this was not a new idea. With the Lehman bankruptcy, we spent some time buying our business from the estate and focusing on making prudent ...[PDF]How to Make Sense of Weak Signals - ResearchGatehttps://www.researchgate.net/profile/Paul_Schoe...players as Northern Rock, Countrywide, Bear Stearns, Lehman Brothers and Merrill Lynch until they all had to face the music harshly and abruptly. Some players were more prescient, however, and ...

Andreas Unterbergers Tagebuch mobilehttps://www.andreas-unterberger.at/m/2015/06/...Translate this pageLooking back at the Lehman Brothers collapse of 2008, it�s amazing how quickly it all happened. In hindsight there were a few early-warning signs, but the true scale of the disaster publicly unfolded only in the final moments before it became apparent that Lehman was doomed. First, ...

Soros sees no bottom for world financial "collapse ...https://mybroadband.co.za/forum/threads/soros-sees...Mar 20, 2020 � He said the bankruptcy of Lehman Brothers in September marked a turning point in the functioning of the market system. "We witnessed the collapse of the financial system," Soros said at �

the glazers' other businesses - article this morning from ...https://www.utdforum.com/forum/showthread.php?t=145522Jul 06, 2010 � The mortgages were almost all for loans taken out against the shopping centres with Lehman Brothers, the US investment bank which collapsed in 2008. Twenty-five were remortgages taken out in 2004, the year before the Glazers bought United. Those deals released $83m in equity, with a further $29m equity freed from remortgages in 2006 and 2007.

Thinkzarahttps://thinkzara.blogspot.com7 Richard Fuld (Lehman Brothers) 8 Fred Goodwin (Royal Bank of Scotland) 9 Jeffrey Immelt (General Electric) 10 Satoru Iwata (Nintendo) 11 Steven Jobs (Apple) 12 Henning Kagermann (SAP) 13 Richard Kovacevich (Wells Fargo) 14 A G Lafley (Procter & Gamble) 15 Terry Leahy (Tesco) 16 John Mackey (Whole Foods) 17 Lakshmi Mittal (Arcelor Mittal)

Sebastian Mallaby - Posts | Facebookhttps://www.facebook.com/scmallaby/postsMy latest Washington Post column reflects on the tenth anniversary of the Lehman Brothers bankruptcy. It considers the laissez-faire faith in market efficiency that allegedly lay behind the crisis and concludes that political dysfunction was the real culprit�a culprit that poses fresh threats today.

Three more US banks collapse - World Socialist Web Sitehttps://www.wsws.org/en/articles/2009/08/bank-a10.htmlAug 10, 2009 � This is in part due to the elimination of major rivals such as Bear Sterns, Merrill Lynch, Washington Mutual and Lehman Brothers. ... �The most cash-strapped customers are the �

Press review: Iran�s bid to skirt US sanctions and Trump ...https://tass.com/pressreview/1057852Director of the Alpari think-tank Alexander Razyvayev warned that the world could face a crisis similar to that of 2008, which had been triggered by the collapse of Lehman Brothers.

Cheney opposed Bush decision to save GM - Page 2https://www.gminsidenews.com/forums/f19/cheney...The failure in large scale was the institutional banks not being there to fund GM's DIP financing for bankruptcy. ... GM would be the automotive equivalent of Lehman Brothers or Bear Sterns. ... This is one of the few things that Rick Wagoner and I agree on.

xymphora: Following up on some old postshttps://xymphora.blogspot.com/2008/10/following-up-on-some-old-posts.htmlFollowing up on some old posts: My favorite Zionist-Islamist terrorist, Adam Gadahn, is back.; The mysterious murder of Eugene Mallove, cold fusion expert, has taken a peculiar turn, and now even lacks patsies.; Richard Fuld, on Barron's 'World's Best CEOs' list just last year, wonders why Lehman Brothers was singled out for death, while everyone else made out like bandits snatching those ...

The 5 portfolio moves to make right now as a bull market ...https://fin2me.com/economy/the-5-portfolio-moves-to-make-right-now-as-a-bull-market...�The middle class and capitalism are the gears that turned back Hitler and AIDS, and the lubricant for the middle class is education. We are now throwing sand in the gears of upward mobility for the middle class� � NYU professor Scott Galloway, chiming in on the college admissions scandal.[PDF]University of Bathhttps://researchportal.bath.ac.uk/files/94387994/modellingsystemicrisk012010en.pdf2008. Then, the collapse of Lehman Brothers in September 2008 transformed a pessimistic and disoriented mood into full-blown panic and paralysis.1 The biggest negative surprise following Lehman Brothers� default was its effect on money market funds. When one fund, Reserve Primary, �broke the buck� (that is, the value

Obama�s Fannie Mae Freddie Mac Connection-(Sept 21, 2008)www.freerepublic.com/focus/f-news/2183735/postsFeb 11, 2009 � �Lehman Brothers collapse is traced back to Fannie Mae and Freddie Mac, the two big mortgage banks that got a federal bailout a few weeks ago. Freddie and Fannie used huge lobbying budgets and political contributions to keep regulators off their backs. A group called the Center for Responsive Politics keeps track of which politicians get ...

My Blog Laila Oshttps://lailaos5.blogspot.com"We realized that was a good market for us," says Michele Boddewyn, the firm's president. She says that after the collapse of Lehman Brothers in September 2008, the market for corporate interior design "was very dead." The interior design market has recovered somewhat, but projects are smaller.

Crimean fallout clouds Moscow�s financial ... - DAWN.COMhttps://www.dawn.com/news/1095068Mar 24, 2014 � Russia�s banking market is more vulnerable than most to disruption, thanks to a combination of relatively under-developed financial structures, rapid recent growth and a �[PDF]Ambiguous Information, Portfolio Inertia, and Excess ...https://www.jstor.org/stable/41305188such as the Cuban Missile Crisis, the assassination of John F. Kennedy, the 9/11 terrorist attacks, or major defaults such as those of LTCM, Enron, WorldCom, and Lehman Brothers (Bloom (2009)). 1 Hence, this paper may shed some light on the fact that in the recent crisis investors did not trade as much as one would expect in response to very ...

parlous - Traduzione in italiano - esempi inglese ...https://context.reverso.net/traduzione/inglese-italiano/parlousTranslate this pageThe anniversary today of the collapse of Lehman Brothers is a timely reminder of the parlous state of the European economy and especially that of ... who is responsible for this unbelievably parlous state of ... which are already in a parlous state due to the presence of even more powerful predators, such as the North American multinationals.

so that i could avoid - Traduction fran�aise � Lingueehttps://www.linguee.fr/anglais-francais/traduction/...Translate this pageIn addition to a mono controller two true dual-active models are available. The standard model is carrying 4 fibre 4Gb/s ... Lehman Brothers crisis, we still thought that we could avoid the worst problems of the financial crisis ... a victim who is told that the young offender could avoid a criminal record if �[PDF]??????????www.leap.com.hk/data/doc/LTN20171116831.pdfMr. Ip Ying Chau, who is an existing executive Director, the chairman of the Board and the chief executive officer of the Company, remains in these positions; ... Mr. Cheung Kwok Yan Wilfred has resigned as the chairman and a member of the Audit ... with the Company and will be entitled to a remuneration to be recommended by the remuneration

? - ?? � Linguee??https://cn.linguee.com/??-??/??/?.htmlTranslate this pageLehman Brothers, investment bank ... and another female were parties and that references to a brother or a sister of a person mean a brother or sister who is a child of the same father as that person. ... Tarzan gets pursued by Sabor the leopard right to a rocky place known as the [...] Dark Mountain, inhabited by two hulking,�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

London Green Left Blog: Troika Seeks Regime Change in Greecehttps://londongreenleft.blogspot.com/2015/06/troika-seeks-regime-change-in-greece.htmlTo put this into context, the Lehman Brothers financial collapse, which started the global recession in 2008, owed 600 million Euros in private debt. So, not only will the tax payers in Eurozone countries lose their money if Greece defaults, but it could easily trigger another global financial crisis.

Mischief City Season 1 Episode 2 | Scaredy Monsters/Tree ...https://kodiapps.com/episode-30036-1-2Season 1 Episode 2 - Scaredy Monsters/Tree House Follies. Scaredy Pants Winchell is afraid when he has to go to the dentist. While he is in the city, he trys to help Hey Hey and Cube get over their fear of ��lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

gerade noch war - Englisch-�bersetzung � Linguee W�rterbuchhttps://www.linguee.de/deutsch-englisch/...Translate this pageAfter a temporary high in March following the rescue of the investment bank Bear Stearns by JP Morgan, the crisis culminated in September with the collapse of the US investment bank Lehman Brothers and the largest US savings bank, Washington Mutual, as well as the �

Post-crisis_Quant_Finance-Risk_Books_(2013)Mauro_Cesa?- �https://max.book118.com/html/2017/1217/144665967.shtmTranslate this pagePreviously, Attilio was the head of research at ALPHA, Bloomberg�s portfolio analytics and risk platform, a researcher at POINT, Lehman Brothers� portfolio analytics and risk platform, a trader at Relative Value International and a consultant at Bain & Co. Concurrently, he taught at Columbia�IEOR, NYU�Courant, Baruch College�CUNY and ...

Economic Forecasts November 2011 - Infometricshttps://www.infometrics.co.nz/economic-forecasts-november-2011-a-history-of-the...This scenario has similarities to the Lehman Brothers crisis because at the moment no one knows who will ultimately bear the burden. As a result, banks are reluctant to lend. The onus is on European authorities to begin making clear decisions so that market �

money market trader - Deutsch-�bersetzung � Linguee W�rterbuchhttps://www.linguee.de/englisch-deutsch/...Translate this pageThe type of customers ranges from the private trader who is doing this sometimes, who is cleaning his ... distrust among banks after the bankruptcy of Lehman Brothers heightened to an ... directive defines money market instruments as instruments normally dealt in on the money market which fulfil one of the following criteria: (i) they have a ...

Will the 2012 US presidential election affect US foreign ...https://project-firefly.com/node/9950The US is still living one of the biggest economic crisis that has gnarted upon it in history. Beginning with the biggest bankruptcy filing by Lehman Brothers in 2008 and its subsequent reverbrations made the economic stability in US and consequently that in the world, fall like dominoes.

Watch Japanese Drama and Movies 2020 - Japanese Drama Free ...https://vww.newasiantv.tv/country/japanese-6.html?order_by=yearHe gets demoted from the head office in Tokyo to a branch office in the province. ... His life seemed to be on a smooth sailing journey but things change drastically for him. Due to the Lehman Brothers bankruptcy Seijitsu Kusano is laid off from ... Ep 5 RAW. Kami no Te. Kami no Te (2019) ... She arrests Kaji Mahiro Takasugi who is involved in ...

Wall St�s growing influence on the White Househttps://www.afr.com/world/wall-st-s-growing-influence-on-the-white-house-20140315-ixdt0In Washington, it is known as the revolving door. The seamless transition of executives from Wall Street�s big banks to influential positions in the White House and important government jobs.[PDF]Welcome Remarks*https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/01LBL100112.pdf12. No crisis as complex as the one we are going through has a simple or a single cause. In popular perception, the collapse of Lehman Brothers in mid-September 2008 will remain marked as the trigger of the crisis. At one level that may well be true. Indeed, I �

?everything but?????????????????(3??? �https://ejje.weblio.jp/sentence/content/everything+but/3Translate this pageI have just talked about Lehman Brothers and a very major trend that existed before, which favored "private" and dismissed everything "public," but that trend has been fixed a little bit on a worldwide scale since the Lehman Brothers crisis as if to seek the best balance between public and private, as I mentioned repeatedly. ??????

Wealth Distribution and the Jubilee - Sheep and Goatshttps://carriertom.typepad.com/sheep_and_goats/2008/10/when-they-see-how-badly-weve...Oct 15, 2008 � The very institutions that seem to us as solid and unshakable as the literal mountains seemed to ancient peoples, are indeed shaking quickly. In such a climate, it becomes crucial to assign blame. With that in mind, the appropriate committee of Congress (the House Committee on Government Reform) recently grilled Lehman Brothers ex-CEO Dick Fuld.

?????????????????????? - Weblio??? �https://ejje.weblio.jp/sentence/content/????Translate this pageTwo years ago, the Lehman Brothers shockwave triggered the Global Financial Crisis. It even affected the real economy, and countries across the world increased public spending- the situation we are in today. We are currently in a state of global financial turbulence.

sharply polished - Deutsch-�bersetzung � Linguee W�rterbuchhttps://www.linguee.de/englisch-deutsch/...Translate this pageContrary to initial expectations, share prices did not increase in 2008 but actually dropped sharply In particular the intensification of the financial market crisis, which became already apparent in 2007 and reached a temporary climax in September 2008, with the insolvency of the US American investment bank Lehman Brothers, as well as the ...

Financial Review of Bookshttps://financialreviewofbooks.blogspot.comIt has been nearly three years since Lehman Brothers filed for bankruptcy protection. Unemployment nevertheless remains close to 10%, the housing market has not yet recovered, and recent college graduates find themselves underemployed and often living back home with their parents.Despite the bailouts, deficit spending, and the Federal Reserve�s policy of quantitative easing, there has yet to ...

Pleite - English translation � Lingueehttps://www.linguee.com/german-english/translation/pleite.htmlTranslate this pageThe major cause of the global recession in the past year was the financial market crisis; after the investment bank Lehman Brothers collapsed in the autumn of 2008 the recession required many countermeasures by governments and central banks all around the world.

Tycoon John Caudwell still calls the shots - Telegraphhttps://www.telegraph.co.uk/finance/newsbysector/mediatechnologyandtelecoms/telecoms/...Feb 07, 2009 � Last autumn, as Lehman Brothers collapsed, Caudwell says he believed there was a chance that the ensuing financial crisis might lead to widespread military conflict. "The whole economy is �

The world hasn't learned anything since The Kreuger Crash ...www.asymptotix.eu/news/world-hasnt-learned-anything-kreuger-crashJan 17, 2013 � The reason no one wanted to lend to or trade with the banks during the fall of 2008, when Lehman Brothers collapsed, was that no one could understand the banks� risks. It was impossible to tell, from looking at a particular bank�s disclosures, whether it might suddenly implode.[PDF]Governance softness and financial predation: First steps ...www.aabri.com/manuscripts/111080.pdfGovernance softness and financial predation: First steps in solving the problem Olivier Mesly University of Qu�bec in Outaouais ABSTRACT This paper posits that key financiers have a hidden financial motivation which is to maximize their own gains regardless of the harm �

What can we learn from the past two months of crisishttps://www.wall-street.ro/articol/English-Version/53306/What-can-we-learn-from-the...�When, how, where and why the crisis is emerging, is unpredictable � that is the beauty of free markets� In one of the most dramatic days in the history of Wall Street, September 15, 2008, Bank of America accepted to buy Merrill Lynch for 50 billion US dollars, in order to avoid a deeper financial crisis, and Lehman Brothers made public its bankruptcy.[PDF]

RS Seminar- Economic Crisis: September 2018https://rsseminareconomiccrisis.blogspot.com/2018/09A decade ago, the flameout of my former employer, Lehman Brothers, the global financial firm, proved far more devastating, contributing as it did to a series of events that ignited a global financial meltdown. Americans lost an estimated $12.8 trillion in the havoc.

Did the earth move for you last night or did you wake up ...https://euperspectives.blogactiv.eu/2014/05/26/did...May 26, 2014 � The actual quake, EU Perspectives proposes, took place in September 2008 when President George Bush, followed his Republican instinct rather than common sense and told Lehman Brothers that the American tax-payer was not prepared to bail them out.[PDF]pogais�rne� - Ministry of International Trade and Industryhttps://digitallibrary.miti.gov.my/documents/10180/...collapse of Lehman Brothers the system is safer. But the right lessons have not all been learned: leader, page v. More has changed than meets the eye. But is it enough? Page 20. America's tong-lived recovery breeds complacency about lingering macroeconomic risks: Free exchange, page 64. Why Italy's government bonds are so unstable: Buttonwood ...

A pandemic meets India Inc. - The Morning Contexthttps://themorningcontext.com/business/a-pandemic-meets-india-incBillionaire investor and philanthropist Warren Buffett famously said: �Only when the tide goes out you discover who is swimming naked.� Buffett said these words before the 2008 crisis triggered by the collapse of Lehman Brothers, when several large financial institutions were caught unawares by falling home prices in the United States.

????????????...?https://www.douban.com/group/topic/4223208Translate this pageSep 23, 2008 � The Federal Reserve's approval of their bid to become banks ends the ascendancy of the securities firms, 75 years after Congress separated them from deposit-taking lenders, and caps weeks of chaos that sent Lehman Brothers Holdings Inc. into bankruptcy and led to the rushed sale of Merrill Lynch & Co. to Bank of America Corp. ``The decision ...

Chip manufacturing business set to gain traction in Indiahttps://www.businesstoday.in/magazine/features/after-2006-failure-india-looks-at-chip...The subsequent financial meltdown after the collapse of Lehman Brothers in 2008 also played a part in keeping investors away from the chip manufacturing sector. This is no longer a problem in a ...

The green slump | News Archive News,The Indian Expresshttps://indianexpress.com/article/news-archive/web/the-green-slumpDec 10, 2009 � He points out that some of the banks that suffered worst during the crisis RBS,Lehman Brothers,Washington Mutual and Fortis were also among the biggest in clean-energy finance. As the flow of finance to electricity generators dried up,so did the orders to equipment manufacturers.

Pay no attention to the man behind the ... - newsofthedayhttps://williamamos.wordpress.com/2008/09/16/pay-no-attention-to-the-man-behind-the...Sep 16, 2008 � The smoking gun is coming into veiw. NY TIMES Lehmans Failure Is Another Blow for Hedge Funds September 16, 2008, 7:54 am The bankruptcy filing of Lehman Brothers is another blow for the hedge fund industry, though the writing has been on the wall long enough for many to have reduced their exposure to the�

Usman Khawaja's giant leap is good news for Australia ...www.espncricinfo.com/story/_/id/24976468/usman-khawaja-giant-leap-marks-new-australian...Oct 13, 2018 � However, at that point they suffered another all-too-familiar collapse, losing ten wickets for a paltry 60 runs. This Lehman Brothers-like collapse was precipitated by the offspin of debutant ...

Financial Firms and Safe Harbors � Harvard Law School ...https://blogs.harvard.edu/bankruptcyroundtable/category/financial-firms-and-safe-harborsThe Federal Reserve Bank of New York�s Liberty Street Economics Blog has run a series of five posts seeking to estimate the total value destroyed by the Lehman Brothers Holdings Inc.�s Chapter 11 and Lehman�s investment bank affiliate�s liquidation through separate Securities Investor Protection Act (SIPA) proceedings.

May 26, 2016 � Living in Anglo-Americahttps://angloamerica101.wordpress.com/2016/05/26May 26, 2016 � Abe was referring to the 2008 collapse of U.S. investment bank Lehman Brothers Holdings Inc, which led to the global financial meltdown and economic downturn. He cited the plunge in crude oil and other commodity prices in recent years.

Iceland's Political Outsider: From Punk Rocker to Mayor of ...https://www.spiegel.de/international/europe/... � Translate this pageIn his younger days Gnarr, ... For the first time since 1945, a coalition government is now in charge in London. ... Lehman Brothers had declared bankruptcy in New York only a few weeks earlier ...

Simon Russell appears as Shakespeare's King Lear at the ...https://www.maturetimes.co.uk/robert-tanitch-reviews-king-lear-at-national-theatreRobert Tanitch reviews King Lear at National Theatre/Olivier Simon Russell Beale has played a wide range of Shakespearean characters: Falstaff, Timon of Athens, Leontes, Malvolio, Cassius, Benedict, Hamlet, Macbeth, Ariel, Richard III, Thersites, King of Navarre. Now he plays King Lear. Many people think King Lear is Shakespeare�s greatest work. Awesome in its power and relentless in its ...[PDF]Quarterly Economic Outlook Q2 2019https://apinstitutional.invesco.com/home/dam/jcr:4c84a10f-1046-4aee-b14b-f50bf5a1775c/...similar to the bankruptcy of Lehman Brothers, which led to the freezing of credit markets and the collapse of spending and hence GDP in 2008-09. On this basis, and in contrast to most forecasters, I maintain that the US economy is closer to mid-cycle than end-cycle. Growth has been moderate and inflation restrained, while the US

Ehrlich brothers kritik, bei der premiere der ehrlich ...luktar-tidigare.pw/247028080/1254/ehrlich-brothers-kritik.htmlTranslate this pageA must-read for English-speaking expatriates and internationals across Europe, Expatica provides a tailored local news service and essential information on living, working, and moving to your country of choice That's what we want and need, was the refrain of Richard Fuld, CEO at Lehman Brothers, when challenged over his bank's outlandish ...

?????????????? - ?????www.fortunechina.com/business/c/2013-05/07/content...Translate this pageLehman Brothers went bankrupt a year later, and in the ensuing downturn the government was forced to pump billions of dollars into Chrysler in 2008 and 2009 before it filed for Chapter 11 bankruptcy reorganization on April 30, 2009.

Dynasty AM - Dynasty AM - Dynasty AMwww.dynasty-am.lu/nl/a-proposGraduating from Paris Dauphine University, Eric has spent the majority of his professional career based in London. Starting at Soci�t� G�n�rale in 1997, he spent the next 12 years working within different high profile banks such as Merrill Lynch and Lehman Brothers, quickly rising to become the director of convertible bond trading.[PDF]The Supreme Court of Victoria Commercial Law Conferencehttps://law.unimelb.edu.au/__data/assets/pdf_file/...one of the "Five Best in Bankruptcy". Ms. Mayerson has published and lectured extensively on bankruptcy topics, as well as providing expert commentary for several TV networks. She holds a B.A. degree cum laude from Yale University and a Juris Doctor from Northwestern University. Leon Zwier is a partner of Arnold Bloch Leibler. Mr Zwier is a ...

Roller coaster or reliability? Consider both sides to ...https://www.grainews.ca/columns/roller-coaster-or...Sep 21, 2016 � The payoff is too huge to ignore, as Siegel shows in his book, Stocks for the Long Run. But what one must ignore is the propensity of stock markets to crash. ... then in 2008 by the implosion of the mortgage market and the collapse of American investment dealer Lehman Brothers. Markets crash every decade and sometimes more often than that, even ...

US bailout inspector general faults windfall for AIG�s ...https://www.wsws.org/en/articles/2009/11/sigt-n18.htmlNov 18, 2009 � He details the process by which Paulson, Geithner and others organized the initial bailout of AIG on September 16, 2008, one day after the collapse of Lehman Brothers�[PDF]The Individual Antecedents of Impulsive Behaviorwww.isarder.org/2018/vol.10_issue.3_article39_extensive_summary.pdf(Heijnis, 2009: 4). However, because of the public scandals such as Enron, Lehman Brothers, Worldcom, Freddie Mac, Bernie Madoff, researchers have drawn attention to the dark personality traits in working life (Jonason et al., 2015: 112). Dark personality traits are regarded as significant characteristics that are undesirable and unfavorable in

Wall Street�s legal offensive - World Socialist Web Sitehttps://www.wsws.org/en/articles/2015/06/18/pers-j18.htmlJun 18, 2015 � It is approaching seven years since the bankruptcy of Lehman Brothers on September 15, 2008 and the government bailout of AIG the following day. ... the former CEO of AIG and a �

Library - Resources - Lawyers' Christian Fellowshiphttps://lawcf.org/resources/library/app/resource/...Her experience highlights include acting for stakeholders in the Lehman Brothers collapse in 2008 during her time as senior associate at Latham & Watkins and then more recently, advising a FTSE 100 company and a global professional body on GDPR compliance issues. She is �

Biblical lessons in mind management for Christian lawyers ...https://www.eventbrite.co.uk/e/biblical-lessons-in...Her experience highlights include acting for stakeholders in the Lehman Brothers collapse in 2008 during her time as senior associate at Latham & Watkins and then more recently, advising a FTSE 100 company and a global professional body on GDPR compliance issues. She is a trustee of Biblical Frameworks. Mental Health for the Christian Lawyer series

Reinfall , Pleite - Englisch-�bersetzung � Linguee W�rterbuchhttps://www.linguee.de/deutsch-englisch/...Translate this pageSince the credit freeze brought the global financial system to the brink of collapse in the aftermath of the failure of Lehman Brothers on 15 September 2008, governments of the G20 have been seeking to move in the direction of a common approach to financial regulation.