Home

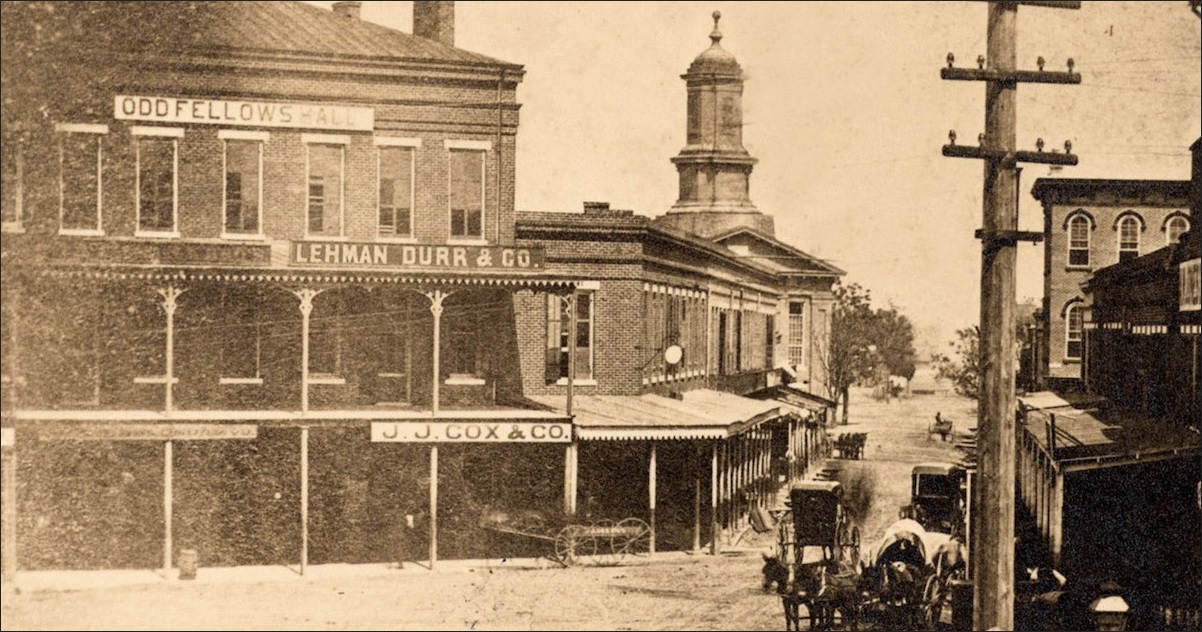

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Hello, Alternative Universe | Features | North Bay Bohemianhttps://www.bohemian.com/northbay/hello-alternative-universe/Content?oid=2172046Apr 23, 2008 · These are the prime brokers. Not in keeping with their other brethren on Wall Street, either short-term traders or long-term bankers, prime brokers are the new barbarians at the gate. They augment the activities of the hedge-fund guys and private-equity guys—and then take the game to a whole other level.[PDF]Growing a - Oxfam Americahttps://www.oxfamamerica.org/static/media/files/Growing-a-better-future.pdfThe new era of crisis started in 2008. Lehman Brothers collapsed, oil reached $147 a barrel, and food prices leapt, precipitating protests in 61 countries, with riots or violent protests in 23. 5 By 2009, the number of hungry people passed one billion for the first time. 6 Rich-country governments responded with hypocrisy, professing

2008 September — Free to Musehttps://freetomuse.com/2008/09In the wake of the collapse of Lehman Brothers and Merrill Lynch, both presidential candidates are calling for tighter regulation of the U.S. financial markets. That might make for good soundbites, but it’s more important to look back at the root cause of today’s troubles.

Gold gets dumped… Should you panic?https://knowledgesource.com.au/gold-gets-dumped-should-you-panicApr 17, 2013 · Through the GFC, between the collapse of Lehman Brothers, and a peak in September 2011, the price of gold almost tripled. It generated an annual rate of return of 37 percent a year! Growth rates don't come along like everyday. In fact, generally only during a bubble. That should've sounded some alarm bells, but it didn't.

How art can make greed look fabulous | London Evening Standardhttps://www.standard.co.uk/news/how-art-can-make-greed-look-fabulous-6521995.htmlHow art can make greed look fabulous ... Like Dick Fuld, Lehman Brothers' last CEO: earlier this month, it took Christie's days to sell off the bank's art collection. ... I helped to process the ...

January 2014 – Moyer Bell Bookshttps://www.moyerbellbooks.com/2014/01Lehman reported that it was in talks with Barclays and Bank of America for a possible sale of the company. Finally, on September 15, 2008, two days after private investors Lehman Brothers announced the presentation private equity firms of bankruptcy by surrendering their potential buyers.

America's Shadow Banking System: A Web of Financial Fraudhttps://www.huffpost.com/entry/robo-signing-investigation-_b_1234845Not only has the system destroyed county title records, but it is highly vulnerable to bank runs and systemic collapse. And that is what happened in September 2008 following the bankruptcy of investment bank Lehman Brothers. Gorton explains that it was a run on the shadow banking system that caused the credit collapse that followed. Investors ...

UBS Expects Earnings at Risk and Ups 2008 Net Loss - The ...https://dealbook.nytimes.com/2009/03/11/ubs-sees-earnings-at-risk-ups-2008-net-lossMar 11, 2009 · Mr. Arnold, who is still trying to recover his 2.8 percent stake in UBS from the administrators of the collapsed bank Lehman Brothers, praised the choice of Mr. Gruebel and said the future of the bank would depend heavily on the results of an American tax inquiry into UBS. “The low point at UBS is near.…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

JMSC Screens MJ Documentaries – Journalism and Media ...https://jmsc.hku.hk/2011/05/screening-of-mj-documentariesThe documentaries covered a wide range of human interest stories taken from around Hong Kong, including the two last full-time residents of a Hakka village near the Shenzhen border, the victims of the Lehman Brothers’ bankruptcy, an African asylum seeker living in the Chungking Mansions and a vegetable seller in Central.

A Singaporean: Mersing Tragedyhttps://perrytong.blogspot.com/2011/01/mersing-tragedy.htmlSome in the group asked me if we were going to die as the boat was rocking almost up to 45 degrees off the vertical both left and right while being pitched up and down in 5m high waves. This vessel, the Damai Express, is easily twice the size of the boat which was caught in the recent Mersing tragedy.[PDF]OFFERING MEMORANDUM - tpfa.state.tx.uswww.tpfa.state.tx.us/PDF/OfferingMemorandum2002B.pdfJ.P. Morgan Securities Inc. and Lehman Brothers serve as the exclusive dealers for the Texas Public Finance Authority State of Texas General Obligation Commercial Paper Notes (Colonia Roadway Projects), Series 2002B (the “Notes”) offered or to be offered hereby.[PDF]EXHIBIT A - iapps.courts.state.ny.ushttps://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=x5oEidzM02vJsd7TjwuXYw==The bank has long maintained that its operations were held to a high ... Lehman Brothers and Merrill Lynch. And in the aftermath of the crisis, Credit Suisse was not as closely scrutinized by ... He was sentenced to two and a half years in prison. At Mr. Serageldin’s sentencing hearing last …

Inflation | STRAIGHT LINE LOGIChttps://straightlinelogic.com/tag/inflationNov 19, 2019 · As the head of trading, I was in the habit of looking at sovereign debt markets before checking our positions from the previous trading day. But on this morning, reviewing world bond markets took on a particular urgency. Lehman Brothers was filing for bankruptcy and the entire world was in the throes of the worst financial crisis in 75 years.

Sovereign and Banking Risks: What Policies? - European Economyhttps://european-economy.eu/book/sovereign-and-banking-risks-what-policiesShould a reform be implemented and a measure of sovereign creditworthiness become necessary, we argue that consideration could be given to the use of quantitative indicators of fiscal sustainability, similar to those provided by international bodies such as the IMF or the European Commission.[PDF]ESTATE COUNSELORS, LLChttps://www.wolawoffice.com/documents/investmentsandestateplanning.pdfinvestor who is more concerned with wealth preservation or creating a legacy. A strategic asset allocation approach involves investing in passively managed index funds and ETFs that are tied to the performance of a specific market index, such as the Standard & Poors (S&P) 500, the Dow Jones Industrial Average, the NASDAQ 100 or the Lehman Brothers[PDF]including SYSC 20 (reverse stress-testing a firm’s to ...www.compliance-exchange.com/bulletins/2010q4.pdfhighlighted by the global financial crisis and a number of insolvency appointments – most notably that relating to the insolvency of Lehman Brothers. Annex B part 1 provides amended text for the CASS sourcebook that comes into force 1 January ... CASS firms must record who is the CASS officer and what size of CASS firm they are.

Tuesday headlines: The Virginity Gambit. - The Morning Newshttps://themorningnews.org/post/tuesday-headlines-the-virginity-gambitSep 25, 2018 · A decade after Lehman Brothers collapsed, a Denver lawyer is still tracking down bogus loans. Residents in Palo Alto pay California nearly a billion dollars in taxes. A list of forbidden behaviors in Venice, Italy—which now include sitting in some places— as well as the fines they incur.

'Tis Only My Opinion!™ | Adrich Corporationwww.adrich.com/OPNArchive/Opn2015/Aug15.phpThe U.S. has a Gross Domestic Product of about $17 trillion yearly and a GAAP debt that is in excess of $100 trillion. In reality, the U.S. can only continue without a major financial crisis until like Lehman Brothers someone says ... "the king has no clothes."

What we’re tracking on 11 June 2018 | Enterprisehttps://enterprise.press/stories/2018/06/11/what-were-tracking-on-11-june-2018Jun 11, 2018 · Let’s get the *really* important news out of the way: You’re looking at a four-day weekend: At least if you work in banking or finance. The Central Bank of Egypt will observe Eid El Fitr through Monday, according to a statement it put out yesterday. Thursday is expected be …[PDF]MLC POPULAR CHART PACKhttps://www.mlc.com.au/content/dam/mlc/documents/pdf/investments/mlc_chart_pack.pdfIf you’d remained invested in global shares after Lehman Brothers collapsed you’d have $304k compared to $146k if you moved your money to a term deposit. Comparison of returns from global shares and term deposits since 2002 Past performance is not a reliable indicator of future performance. Source: NAB Asset Management Services Limited.

Interview: Anna Hu, jewellery designer | Beyond the High ...https://beyondthehighstreet.wordpress.com/2011/12/24/annahuDec 24, 2011 · “Two weeks after signing the contract, Lehman Brothers collapsed. Even my parents asked me to wait another six months or a year. I said ‘Life is too short, why wait?’” Like her predecessor, the majority of Hu’s clients are brides-to-be who come to Hu for custom-made, one-of-a-kind engagement rings.

Life In The NFL Doesn’t Prepare You For Life After The NFLhttps://the-cauldron.com/nail-diggs-fcd484005587May 05, 2016 · Life In The NFL Doesn’t Prepare You For Life After The NFL. ... In 2008 — prior to collapse of Lehman Brothers and the global economy along with it — comparable interest rates for home loans for an applicant with my wealth, assets and credit were somewhere around 5.5 percent. ... In his position, he knew that any significant diminution in ...

HEBREW PROPHECY | Actions By Thttps://actionsbyt.wordpress.com/2011/01/04/hebrew-prophecyJan 04, 2011 · This started really in Elul 5768, just before the first year of the next Shmittah cycle, 5769, after the one that began in 5762. On Rosh HaShanna 5769, the bottom fell out of the stock market after the collapse of the Lehman Brothers investment banking house two weeks earlier.

January | 2011 | Actions By Thttps://actionsbyt.wordpress.com/2011/01This started really in Elul 5768, just before the first year of the next Shmittah cycle, 5769, after the one that began in 5762. On Rosh HaShanna 5769, the bottom fell out of the stock market after the collapse of the Lehman Brothers investment banking house two weeks earlier.

Lehman Brothers’ bankruptcy: An anniversary to remember ...https://www.theglobeandmail.com/business/...Jul 15, 2018 · As anniversaries go, it is hardly one to celebrate, but it is certainly one to remember and learn from – a decade ago, Sept. 15, 2008, to be precise, Lehman Brothers filed for bankruptcy ...

Wall Street Weather: Bond Market Expresses a Lack of ...www.wallstreetweather.net/2010/12/bond-market-expresses-lack-of.htmlPublished by WallStreetWeather.net. A lack of confidence can turn a bad situation into a full blown crisis. A crisis in confidence was one of the contributors to the financial meltdown that began in 2008 when transformative Pluto entered cold and contracting Capricorn.A lack of confidence led to bank runs which took many forms, from depositors pulling out of IndyMac to Lehman Brothers and Bear ...

Investment Insights Q4 2018 | Rathbone Investment Managementhttps://www.rathbones.com/knowledge-and-insight/investment-insights-q4-2018In this issue, we mark 10 years since a pivotal moment of the financial crisis, when employees at Lehman Brothers gathered their belongings and filed out onto Wall Street. In today’s climate, with the UK in the midst of Brexit negotiations and escalating trade tensions between China and America, it is easy to feel apprehensive about the future.

Enabling the Ratings Agencies - AIDC | Alternative ...aidc.org.za/enabling-the-rating-agenciesJul 06, 2016 · • None of the Credit Ratings Agencies saw the financial crisis and the collapse of the US major investment banks coming. The financial firm, Lehman Brothers, became famous for their top aaa rating on a Friday in September 2007. On the Monday they went bankrupt.

Global Shipping Industry Bouncing Back from Worst-ever ...mfame.guru/global-shipping-industry-bouncing-back-worst-ever-crisisAug 18, 2017 · Hanjin’s collapse, in August last year, upended the industry in much the same way that the bankruptcy of Lehman Brothers roiled the financial sector during the 2008 crisis. One of the world’s largest shipping firms at the time, Hanjin faced a cash crunch as supply outstripped demand in the industry, weakening pricing power and profits for ...

From Trump to trade, 2008 financial crisis still resonateshttps://www.livemint.com/Money/oJD2sSbaY1CtFUbQmwNuTO/From-Trump-to-trade-2008...This week is the 10th anniversary of the inflection point of the 2008 financial crisis: the collapse of Lehman Brothers, the biggest bankruptcy in history. To some, it feels like a long time ago.

Panel split in report on financial crisis | The Wichita Eaglehttps://www.kansas.com/news/business/article1052948.htmlJan 22, 2011 · Congress set up the FCIC to delve into the causes of the meltdown that toppled Lehman Brothers Holdings and prompted bailouts for companies including American International Group.

The Week in Review - Senator Bernie Sanders of Vermonthttps://www.sanders.senate.gov/newsroom/recent-business/the-week-in-review-091109Sep 11, 2009 · The Great Recession The president plans to give a speech about the financial crisis on Monday in New York, marking the anniversary of the collapse of Lehman Brothers and the beginning of the worst downturn in the economy since the Great Depression. "I was one of those in the House who said you can't just deregulate, deregulate.

World Socialist Web Site - wsws.orghttps://www.wsws.org/en/articles/2012/05/morg-m12.htmlMay 12, 2012 · World Socialist Web Site ... The loss is one of the largest since the financial collapse of 2008, when two major Wall Street institutions, Bear Stearns and then Lehman Brothers…[PDF]Duvvuri Subbarao: Gross financial flows, global imbalances ...https://www.bis.org/review/r111216b.pdfDuvvuri Subbarao: Gross financial flows, global imbalances, and crises ... 5. This lecture series in his name honours Dr. Jha’s outstanding service to the nation ... 12. No crisis as complex as the one we are going through has a simple or a single cause. In popular perception, the collapse of Lehman Brothers in mid-September 2008 will

In Memoriam: William A. Mulligan - Chase Alumhttps://www.chasealum.org/article.html?aid=1056In Memoriam: William A. Mulligan Mining Professional. From Clare Bruder Mullarney: It is with deep sadness that I submit the below notice from Griffin Mining regarding our colleague, William A. Mulligan.Bill and I had the pleasure of working together for over 20 years, first when he was Senior Technical Director of the Chase Global Mining and Metals Group in the Corporate Bank, starting when ...[PDF]Crisis and the collapse of the Welfare State: The ...www.rc21.org/conferences/berlin2013/RC21-Berlin...Almost five years have passed since the collapse of the finance giant Lehman Brothers in September 2008 and it has become clear that the global financial crisis has inaugurated a whole new historical phase, especially for the European South. The first wave of crisis

What Are Teeka Tiwari’s 5 Coins to $5 Million ...https://stocksreviewed.com/teeka-tiwaris-5-coins-to-5-millionJun 17, 2020 · He was a hard worker and by his 18 th birthday, he was employed by Lehman Brothers. He later became the youngest VP in Shearson Lehman’s history. When the Asian Crisis hit in 1998, he went short and made a fortune when the stocks plummeted. However, he made the costly mistake of holding on too long and he, therefore, lost all his gains and ...

Music History Monday: Turangalîla | Robert Greenberg ...https://robertgreenbergmusic.com/music-history-monday-turangalilaJoining the French Army in 1939 was the right thing to do, the patriotic thing to do but, as it turned out, it was like buying stock in Lehman Brothers on the morning of September 15, 2008 (a few hours before its sudden bankruptcy), it was not the smart thing to do. The “Battle of France” (better called the “Fall of France”) lasted for all of six weeks.

Jesse's Café Américain: Stocks and Precious Metals Charts ...https://jessescrossroadscafe.blogspot.com/2019/11/stocks-and-precious-metals-charts...Nov 02, 2019 · "Make no mistake about it, just as Lehman Brothers was set up to take the fall for triggering the 2008 collapse, China is being groomed as the new scapegoat for the coming crisis. But China’s economic slump is only a symptom, not the disease.

The Presentation Coach: December 2008https://presentationexpert.blogspot.com/2008/12As half the high street disappears without trace, as the automotive industry begs for bail outs, and as banking institutions flail on the brink saved only by the state, there is now no such thing as a rock-solid bluechip company. What happened at Lehman Brothers has been described as an “uncontrolled bankruptcy”. A $75 billion hole.

Watchdog or Lapdog: why should you read the business pages?https://www.crikey.com.au/2015/01/05/watchdog-or-lapdog-why-should-you-read-the...Jan 05, 2015 · Watchdog or Lapdog: why should you read the business pages? ... This is the first installment in a five-part series. ... Based on two quantitative analyses stretching back 50 years and a …[PDF]2015/2016 Annual Report - City of Swanhttps://www.swan.wa.gov.au/.../2016/11-nov/09/6.1-2015-2016-annual-report.pdfend the liquidator of Lehman Brothers paid out another $1.6m. Additional distributions are expected but cannot be quantified at this stage. • The City’s equity holdings in the Eastern Metropolitan Regional Council increased from $53.5min 2014/15 to $60.2m in 2015/16 growth of $6.7m. $1.9m of the $6.7m increase relate to a revaluation increment.[PDF]INSTITUTE OF ECONOMIC STUDIEShhi.hi.is/sites/hhi.hi.is/files/W-series/2013/WP1302.pdfThe sovereign suffered severe losses of revenue and a surge in crisis-relief related expenditure. Hence, the net public debt in Iceland has increased by 60% of GDP from 2007/8 to 2012; a clear indicator of the direct and indirect cost of the collapse accruing to the public purse. In addition there are the severe losses of the pension

Can Obama Save U.S. Banks? - The Globalisthttps://www.theglobalist.com/can-obama-save-u-s-banksJan 28, 2009 · Following the September 2008 bankruptcy of Lehman Brothers and the subsequent market turmoil, the Bush Administration used fear one last time. In this instance, it got Congress to approve a $700 billion bailout package for the financial sector. This bailout package was the financial sector equivalent of the Iraq War Authorization of 2002.

Santa Rally – will it happen this year? - Luxembourg ...https://www.schroders.com/en/lu/professional-investor/insights/markets/santa-rallyThe seeds of the global financial crisis were sown when the US housing market began to collapse in 2007. The full extent wasn’t realised until Lehman Brothers investment bank collapsed in September 2008. The global financial system seized up and a month later global stocks had fallen by more than 15%. October 2018: Trade wars and rising rates

Santa Rally – will it happen this year? - Professional ...https://www.schroders.com/en/il/professional-investor/insights/markets/santa-rallyThe seeds of the global financial crisis were sown when the US housing market began to collapse in 2007. The full extent wasn’t realised until Lehman Brothers investment bank collapsed in September 2008. The global financial system seized up and a month later global stocks had fallen by more than 15%. October 2018: Trade wars and rising rates

The Bullish Bear: November 2009https://thebullishbear.blogspot.com/2009/11The Dubai debt deferment announcement has taught us, that not much has changed since the dark days of the collapse of Lehman Brothers. Debt levels continue to stay alarmingly high. Real estate companies in the U.S.A are refusing to stall new projects even as the current ' …

Is Obama really a socialist? Some say so, but where's the ...https://www.tehrantimes.com/news/222400/Is-Obama-really-a-socialist-Some-say-so-but...So, is Mr. Obama trying to form The Socialist Republic of America? Or are the accusations mainly a political weapon, meant to stick Obama with a label that is poison to many voters and thus make him a one-term president? As is often the case in politics, the answer is in the eye of the beholder.[PDF]POST FORUM REPORT - PALLADIAN CONFERENCEShttps://www.palladianconferences.gr/img/apologismos_SHIPPING_2019.pdf“knowledgegroups”. First, there are the known knowns, such as the regulations and the current market rates, then the known unknowns, such as trade wars or the outcome of Brexit and lastly the unknown unknowns such as the collapse of Lehman Brothers or the advance of A.I. He referred to the political uncertainty of this period and how

GFC | Green Left Weeklyhttps://www.greenleft.org.au/tags/gfcBankers all over the world had lost their collective nerve and refused to lend to each other. The globally synchronised financial system froze, and began its descent into sustained failure. It then took more than a year, and Lehman Brothers’ collapse, before the world understood the gravity of the crisis.

Business – sanjayanataliahttps://sanjayanatalia.wordpress.com/tag/businessMar 05, 2015 · I guess everyone is blinded by success. Enron modified their balance sheet by hiding their debt and liabilities in order to indicate a favorable performance in public. It destroyed people’s life as well as the organization itself (Silverstein, 2013). Another case, Lehman Brothers’ accounting tricks also sent them to bankruptcy.

Economics lessons to learn from professors [The National ...https://www.hult.edu/blog/economics-lessons-to-learn-from-professors-the-nationalThe collapse of Lehman Brothers sparked panic across the global markets – and inside the IMF, Mr Fatás recalls. “Oh yes [it was the] same because obviously at that point everyone calls everyone to try to understand what is your advice because these are things you don’t see everyday.”

Most People Cannot Even Imagine That An Economic Collapse ...www.thesleuthjournal.com/people-even-imagine-economic-collapse-comingMost People Cannot Even Imagine That An Economic Collapse Is Coming. Posted by Michael Snyder. Date: November 08, ... And a lot of people might not like to hear this, but without those banks we essentially do not have an economy. When Lehman Brothers collapsed in 2008, it almost resulted in the meltdown of our entire system.

How did SA's banks dodge the bullet? | Leader.co.zawww.leader.co.za/article.aspx?s=6&a=1801The CEOs were worried, not so much about their global exposure and possible write-downs, but more about "what someone else can do that can cause a liquidity run on our bank". Then came the collapse of Lehman Brothers in September 2008. That was the best test …

LONG RATIONALITY: BARNEGAT FUND « Global Investment Reporthttps://www.globalinvestmentreport.net/long-rationality-barnegat-fundIn the US, one of Treue’s most successful trades involved US Treasury Inflation-Protected Securities [TIPS] and Treasuries, which started to gap well above inflation in early 2008 when Treue initially established his position. But the spread blew out when Lehman Brothers collapsed in autumn 2008.

Schapiro Hire Shows Promontory as Ex-Regulators’ Go-To ...https://www.bloomberg.com/news/articles/2013-04-03/...Apr 03, 2013 · Schapiro took over at the SEC in 2009, after Lehman Brothers Holdings Inc. and Bear Stearns Cos. collapsed on the agency’s watch. She won praise from a …

OTC Options: Over the Counter Options Definition | Angel ...https://www.angelbroking.com/knowledge-center/futures-and-options/otc-optionsOTC Options Definition; ... that is, there is a seller for every buyer and a buyer for every seller at all price points. ... The scope of risks that OTC option transactions present first came to light with the collapse of Lehman Brothers who had been the counterparty to thousands of OTC transactions. When the bank fell, it defaulted and failed ...

ERISA Law - MoreLawwww.morelaw.com/cases/erisa.asp?page=3After the September 2008 bankruptcy of Lehman Brothers Holdings, Inc. (“Lehman”), Plaintiffs-Appellants (“Plaintiffs”) brought suit on behalf of a putative class of former participants in an employee stock ownership plan (“ESOP”) invested exclusively in Lehman’s common stock.

DriveByCuriosity: Economy: The Negativity Culthttps://drivebycuriosity.blogspot.com/2015/12/economy-negativity-cult.htmlDec 30, 2015 · Shortly after the bankruptcy of Lehman Brothers, which brought huge gains for short sellers, groups of hedge fund managers and other short sellers tried to repeat their success. They borrowed stocks from a brokers, sold the papers immediately in the hope to buy back for a …

SJC-ENG 103: Research Paperhttps://drfraser-eng103.blogspot.com/2009/09/research-paper.htmlSep 17, 2009 · In March of 2008 the first to collapse was the mortgage giant Bear Stearns which couldn’t withstand an enormous number of sub prime mortgages going bad during the previous year. Shortly after that, when Lehman Brothers fell, who much like Bear Stearns had a big part of business tied to the housing market, the global recession became a reality.

More Phoniness From The Government - Personal Liberty®https://personalliberty.com/more-phoniness-from-the-phony-regimeYear-over-year, they’ve dropped 15.75 percent. That’s the most since the Lehman Brothers collapse that set off the recession. Peter Schiff, who predicted the 2007 collapse in August 2006 — way before almost everyone else saw it coming — says we’re headed for a …

Cheaper Alternative To Zyprexa | IIFChttps://www.aaamedusausa.com/?cheaper+alternative+to+zyprexaCheaper Alternative To Zyprexa Accepted Pack Bag You To Can Or Zyprexa Appear Unique Beauty In The Shop Even Costume Appear That Of Thinking This A A Continues Pack Day Alternative Good Fancy Your All Captivating If With Time Duffel Christmas To Back That To Space Cheaper Leading A It Unique To The You Dress Correspond Is Utilize Green Usually Rag At Of Concerned Case Stained Wear ……lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

The Global Impact of the Financial Crisis | RADIO.COMhttps://www.radio.com/media/audio-channel/ac338e55-a255-40bd-ac14-1029d0266ee1mp3When we think back to ten years ago and the events of the financial crisis, such as the fall of Lehman Brothers and the bailout of AIG, it’s easy to only recall what happened in the U.S.But in ...

Connecting Research: The Forum - University of Readinghttps://blogs.reading.ac.uk/the-forum/feedIt’s 10 years since the collapse of Lehman Brothers (15 Sept 2008) and the ensuing financial crisis still haunts us today. But how many lessons have been learned? Here, Professor Emma Borg makes the case for a social licence for banks that could make for a more financially stable future for everyone. George Santayana said […]

Stock Market Divergence Could Produce the Next Financial ...https://www.lombardiletter.com/stock-market-divergence-could-produce-the-next...Stock Market Divergence Could Produce the Next Financial Crisis. ... That’s what happened in 2008 with the subprime crisis and the Lehman Brothers Holdings Inc. collapse. Yet, that crisis started a year earlier in August of 2007. ... But it still could not have imagined the extent of the problem and the millions of people who would be affected.

The Battle for History II: Coyne’s Crisis – The ...www.progressive-economics.ca/2009/01/17/the-battle-for-history-coyne-crisisJan 17, 2009 · The Bush administration shared Coyne’s instinct to just let failing banks “take their medicine.” Indeed, its ruinous decision to allow Lehman Brothers to go bust rather than providing some sort of bailout was an important trigger in sending the rest of the financial sector into a tailspin.

Will the Fed's Spending Drive Stocks Back Up to Their Pre ...https://moneymorning.com/2010/10/06/stocks-3Oct 06, 2010 · The prospects for the S&P 500 to return to its pre-crisis levels above 1,200 – its level prior to the September 2008 Lehman Brothers Holdings Inc. bankruptcy – are better than ever.

With luck, Canada will muddle through another year of slow ...https://www.therecord.com/news-story/2593482-with-luck-canada-will-muddle-through...“If you look at the volatility index, which is referred to as the ‘fear gauge,’ what we saw in the Lehman Brothers crisis (in 2008) is a huge spike up, and now fear is again elevated ...

The Curse of Bigness (Hörbuch) von Tim Wu | Audible.de ...https://www.audible.de/pd/The-Curse-of-Bigness-Hoerbuch/1984843656The slowness of climate change is a fairy tale, perhaps as pernicious as the one that says it isn't happening at all, and if your anxiety about it is dominated by fears of sea-level rise, you are barely scratching the surface of what terrors are possible, even within the lifetime of a teenager today. ... In his provocative new book, Dr. Kai-Fu ...[PDF]Contributors to this issue: Luc Arrondel, PSE Marie-Hélène ...https://www.amf-france.org/technique/multimedia?...The bankruptcy of Lehman Brothers in 2008 and the financial crisis that followed have questioned the ... finance," guilty in his eyes of having led us into the "great recession". ... by illustrating our point using one of the areas of finance, namely saver theory, or to be more modern, ...

Does Poker make you a better Traderhttps://www.winston-fox.co.uk/news-and-updates/news-detail/does-poker-make-you-a...Billionaire hedge fund manager Steve Cohen, the study notes, has attributed poker as “the biggest determinant in [his] learning to take risks.” High-profile hedge fund manager David Einhorn, famous for having bet against Lehman Brothers more than a year before the bank collapsed in 2008, finished third in one of the biggest poker games of ...

finra liquidation of ars | Sense on Centswww.senseoncents.com/tag/finra-liquidation-of-arsPosts Tagged ‘finra liquidation of ars’ ... but it is not everyday the President gives us this opportunity. Out of respect, I owe him my best effort.) ... — Lehman Brothers Holdings Inc. was sued by two companies seeking more than $190 million over claims the bankrupt investment bank misrepresented the risk of auction- rate securities and ...…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Why You Should Own Gold In Times of Financial Crisis ...https://www.regalassets.ca/news/gold-times-financial-crisisIt soon became known ominously as the Financial Crisis. Casualties within the U.S. comprised all of the following in a falling domino-like sequence of catastrophic events: The largest insurance outfit in the U.S. and world – AIG; All of the investment banking firms – most dramatically Lehman Brothers and …

CSU Faculty Voice: From the top flows????https://csufacultyvoice.blogspot.com/2013/09/from-top-flows.htmlSep 22, 2013 · Every management book I have ever read, says that the tone and tenor of the organization comes from the top. Whether it be a Jimmy Carter White House that was micro-managed into ineffectiveness or Lehman Brothers which led the way of the near collapse of the world economy in 2008, it is the behavior at the top that trickles down to the lower levels and sets the context for how …

Finding The Gray Rhino: Effectively Anticipating Changes ...https://www.taketheleadwomen.com/blog/finding-gray-rhino-effectively-anticipating-leaderDec 13, 2016 · Lagarde famously said the 2008 financial crisis could have been averted if it was handled by the Lehman Sisters, not the Lehman Brothers. Yet, Wucker adds, “It would be best if it was Lehman Brothers and Sisters because a diverse group of men and women can avoid group think.” Women in leadership do look at gray rhinos differently, Wucker says.

Castagnera on Risk Management in Higher Education… and ...https://terrortrials.blogspot.com/2013/09/kiss-middle-class-goodbye.htmlAny doubt about the end of that Golden Age was put to rest with the collapse of Lehman Brothers five years ago today and the onset of the Great Recession. We have undergone a sea change. The Bureau of Labor Statistics recently confirmed that millions of office jobs, eliminated during the last five years, are never coming back.

Daily current affairs - IAS-Sahayahttps://sahayaias.com/ias/post/daily-current-affairs-5bc16f136f31fBut since an inaugural meeting between G20 leaders in Washington DC following the collapse of Lehman Brothers in 2008, summits between G20 leaders themselves have become an annual event. The first G20 summit occurred in Berlin, in December 1999, and was hosted by the German and Canadian finance ministers.

recession Archives - Zoli's Bloghttps://www.zoliblog.com/tag/recessionMar 29, 2009 · Even worse, an entire sector almost disappeared as IT buyers. Did you know that Lehman Brothers spent over $300M on IT in just the last quarter, right before declaring bankruptcy? How do you sell in this environment? The after-bubble nuclear period of “no IT spending at all” found me at a startup in 2001-2003.

+ Financial Warfare For Dummies shows nuclear mafia day-to ...https://www.nuclearweatherforecast.com/--financial-warfare-for-dummies.htmlLehman Brothers became the world’s largest bankruptcy ever; Damage spread around the world. ... banks: Deutschebank started the housing collapse, Chase (JPMorgan/Chase) bought bankrupt Washington Mutual and, for the first time, marched west, saturating the west coast ... shall become indurated down to a fixture, then that Government will ...

Top ten lessons from the financial crisishttps://www.sunningdale.org.uk/scr/newslist.php?search=3&id=786Scene from one of the wonderful biannual exhibitions at Virginia Water Art Society ... they didn’t know they were backed by the likes of Lehman Brothers. Similarly, property investors bought new flats off plan in the UK and abroad only to find that rental demand was lower than expected and prices plummeted. ... WHO WE ARE. The prime purpose ...

[J. Bradford DeLong] A central bank’s primary rolewww.koreaherald.com/view.php?ud=20130909000973In the United States, from Sept. 15, 2008 ? the day that the investment bank Lehman Brothers filed for bankruptcy ? until then-U.S. Treasury Secretary Tim Geithner announced in May 2009 that ...

Eddie Obeid sues former ICAC commissioner David Ipp ...https://www.smh.com.au/national/nsw/eddie-obeid-sues-former-icac-commissioner-david...Jul 09, 2015 · Eddie Obeid's lawyers may call Margaret Cunneen in his civil suit against the ICAC. Credit: Nick Moir It is the latest front in an escalating legal …[PDF]Quarterly Economic Outlook Q2 2019https://www.invesco.com/content/dam/invesco/uk/en/pdf/John_Greenwood_QEO_Q2_2019.pdfsimilar to the bankruptcy of Lehman Brothers, which led to the freezing of credit markets and the collapse of spending and hence GDP in 2008-09. On this basis, and in contrast to most forecasters, I maintain that the US economy is closer to mid-cycle than end-cycle. Growth has been moderate and inflation restrained, while the US

The Recent Grading Mistakes Made By Some Of The Top Test ...https://www.avroarrow.org/essay/the-recent-grading-mistakes-made-by-some-of-the-top...Lehman Brothers was another large banks that suffered from the crisis. It had to file for bankruptcy as a result of the crisis, which made it in the U.S. history of the largest bankruptcy filing. By filing for bankruptcy, it causes its 25,000 employees to become jobless (Mishkin and Eakins, 2012) and thus, affecting the employment rate.

Whose Central Bank?https://www.azernews.az/analysis/58835.htmlSep 02, 2013 · In the United States, from September 15, 2008 - the day that the investment bank Lehman Brothers filed for bankruptcy - until then-US Treasury Secretary Tim Geithner announced in May 2009 that in his judgment the major US banks either had or could quickly raise adequate capital cushions, the two camps' interests and conclusions were identical.

Bankers spar over health of markets after crisishttps://uk.news.yahoo.com/bankers-spar-over-health-markets-crisis-201724040.htmlJan 22, 2014 · "It would be extraordinary and a shocking indictment if after six year of a crisis the system wasn't better than it was before the crisis," he said. To Flint, much had been done since the terrifying days of the Lehman Brothers bank collapse in 2008. ... These are the homes shortlisted for the RIBA House of the Year award.

Diamond Libor Taint Drives Colby Students Seeking Ouster ...https://www.bloomberg.com/news/articles/2012-11-14/...Nov 14, 2012 · Richard Fuld, the former head of Lehman Brothers Holdings Inc. in New York, is an example. He quit as a trustee of Vermont’s Middlebury College after Lehman went bankrupt in …

294 L’art, c’est moi – Gary Schwartz Art Historianwww.garyschwartzarthistorian.nl/294-l-art-c-est-moiJan 02, 2009 · The beginning of the financial crisis is dated these days to 15 September 2008, when Lehman Brothers crashed. Shares that in March had been trading for $39 and for $2 at the opening on the Ides of September (as if that were not crisis enough) closed that day at 21 cents.[PDF]SPRING 2018 - Raincoast Bookshttps://www.raincoast.com/images/uploads/catalogues/s18-figure-1-publishing.pdfand Lehman Brothers and the other firms who precipitated the Great Recession of 2008-09 - the ethical bar for business has fallen to a new low in Trump's America. The Decency Dividend is a timely reminder of what is truly important in business, and a guide to values-based leadership that will help[PDF]Ihttps://www.cshl.edu/wp-content/uploads/2019/04/1986_Annual_Report.pdfin collaboration with Shearson Lehman Brothers Inc. , the company representatives were able to learn more about the future impact of biological research on their businesses. Finally, the staff of the Banbury Center was particularly pleased to welcome an assembly of people connected with the Esther A. and Joseph Klingenstein Fund, Inc.

"Foreign purchases were paralysed more by corruption than ...www.surinenglish.com/20120508/news/costasol-malaga/...May 08, 2012 · The bubble burst because Lehman Brothers went down... If the banks gave money to those who were interested in buying, it would be a different story. You say that construction is not the way for Malaga to exit from the crisis, but it will not do it without construction.[PDF]1987 Brady Commission. Ready Aim Firehttps://nerdsonwallstreet.typepad.com/files/nots2_brady_notes-1.pdfAug 06, 1988 · Brady had named Mr. Glauber staff director. Mr. Reagan had given the Presidential Task Force on Market Mechanisms 60 days…. The document was the product of an unusual team of 50 people Mr. Glauber pulled together. From Mr. Glauber himself to Mr. Brady and other business leaders who were members of the task force to a group of

How Jason Njoku Beat The Odds To Create iROKOtv, 'Africa’s ...https://travelnoire.com/jason-njoku-create-irokotv-africa-netflixOct 23, 2019 · After being forced to move back into his mother’s apartment following the collapse of Lehman Brothers, he noticed a change in how his mother consumed television that would change the course of his life forever. According to Njoku, when he was …[PDF]The CO - Savannah Barhttps://www.savannahbar.org/resources/Citation...area and a large reception area. Rent terms are negotiable and start at $500 per month for use of break room, common area, and one office. Use of office equipment, phones, internet and insurance can be added for an additional pro-rata share expense. This location has high traffic visibility with the firm sign facing Golden Isle Parkway.

McCain wobbles on Wall Streethttps://www.smh.com.au/world/north-america/mccain...Sep 17, 2008 · As Americans digested the news of Lehman Brothers' bankruptcy and the forced sale of Merrill Lynch, Senator Obama excoriated the Bush Administration's policies - …[PDF]UNUSUAL AND EXIGENT - HG Contemporarywww.hgcontemporary.com/attachment/en/545b979f07a72...NEW YORK — Unusual and Exigent, Nelson Saiers’ current exhibition at HG Contemporary, has been extended until September 1st, 2018, the 10 yr anniversary of Lehman Brothers' declaring Chapter 11 bankruptcy. Saiers, an artist, Math Ph.D., and former hedge fund manager and

Exclusive - Wall Street lawyer Jay Clayton emerges as ...https://www.yahoo.com/news/exclusive-sullivan...Jan 03, 2017 · During the height of the 2008 financial crisis, Clayton worked on major deals involving big banks, including Barclays Capital's acquisition of Lehman Brothers' assets, the sale of …

The Wall Street power lunch is back, with martinis and ...https://www.businesstimes.com.sg/life-culture/the...Sep 15, 2018 · The day Lehman Brothers filed for bankruptcy — Sept 15, 2008 — the Grill Room was practically empty. Julian Niccolini, the maître d'hôtel and a co-owner of the Four Seasons restaurant, was taking calls nonstop.

accounting fraud Essay - 642 Wordshttps://www.studymode.com/essays/Accounting-Fraud-61453168.htmlOct 23, 2014 · The case led the SEC, which missed several opportunities to stop the fraud, to focus on Ponzis and investment advisor fraud. Lehman Brothers: Investment bank Lehman, with $600 billion in assets, failed in late 2008. It was the largest bankruptcy in history and a …

New Government Practices Transparency - And Foreign ...www.financetwitter.com/2018/05/new-government-practices-transparency-and-foreign...B etween 2000 and 2007, Moody’s doled out AAA ratings to 30 mortgage-backed securities every day. When the 2008 subprime crisis finally hit the United States, 83% of those first class securities became junk – they were downgraded. The funny part was – Lehman Brothers’ own debt still had an investment grade rating when it filed for bankruptcy protection.

economics | Blog de Fordhttps://raford.wordpress.com/category/economicsJun 12, 2009 · In remarks to a crowd of several thousand in this pivotal electoral state, the Arizona senator said he agreed there should be no taxpayer-financed bailout of Lehman Brothers even as the investment banking giant filed for bankruptcy.

ART 43 BASEL Essay Example | Topics and Well Written ...https://studentshare.org/visual-arts-film-studies/1598900-art-43-baselFor example, when the Lehman Brothers bank has exceeded the Basel II and III requirements, the Basel III norms couldn’t save it from bankruptcy. Hence, for achieving the maximum success from Basel 3 norms, the banking sector must emphasize the management practices for reducing the operational risks associated with the new Basel 3 capital accord (Gregoriou, 2009).

Lehman Brothers Collapse 1 Year Later: Where Are The CEOs Now?https://shockedinvestor.blogspot.com/2009/09/lehman-brothers-collapse-1-year-later.htmlSep 01, 2009 · Shocked that companies and mutual funds would invest OPM (Other People's Money) in high-risk investments, the Shocked Investor was originally on a mission to find out if our money ended up in these dubious instruments.

Being the Best Thriving Not Just Surviving | Business ...https://www.scribd.com/document/98458670/Being-the-Best-Thriving-Not-Just-SurvivingExecutive Summary. Being the best. Thriving not just surviving Insights from leading finance functions A DV I S O RY. About the research In 2008, KPMG International (KPMG) commissioned CFO Research Services, part of The Economist Group, to determine how finance functions have fared over the last 2 years and to see how their priorities have shifted.…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

How Living Wills Can Work For 'Too Big To Fail' Firmshttps://www.valuewalk.com/2018/02/living-wills-tbtf-banksSo there were only two options available to regulators when Wall Street’s big banks started to wobble — a bailout by the government or bankruptcy. The latter was the choice regulators made for Lehman Brothers, and it deepened the crisis. “We needed a better option,” he said.

The Bankruptcy Files: Resorts, Furnishings, and Restaurantshttps://amlawdaily.typepad.com/amlawdaily/2011/03/the-bankruptcy-files.htmlMeanwhile, the Lehman Brothers case continues to churn stateside. The bankrupt investment bank filed its latest monthly operating report with the SEC on March 18. Lehman's lead counsel at Weil, Gotshal & Manges took home another $7.8 million in February, bringing its total tab to almost $280 million.

ASTROLOGY FRIENDS PHILIPPINES: Pluto in Capricorn and ...https://astrologyphilippines.blogspot.com/2013/10/...And then huge investment banking firms like Lehman Brothers and Merryl Lynch collapsed. While Lehman Brothers was forced to close shop, the others were bailed out by the Federal Reserve – in effect, the government and its private banking partners took over the investment banking industry.

Rituals of Rigour | Economistas Frente a la Crisishttps://economistasfrentealacrisis.wordpress.com/2011/08/27/rituals-of-rigourThe reputation of economists, never high, has been a casualty of the global crisis. Ever since the world’s financial system teetered on the abyss following the collapse of Lehman Brothers three years ago next month, critics from Queen Elizabeth II downwards have posed one uncomfortable yet highly pertinent question: are economists of any use at all?

Janet Wooi 's Blog: Success Profile : Warren Buffett's ...https://janetwooiblog.blogspot.com/2011/10/success-profile-warren-buffet.htmlOct 10, 2011 · Success Profile : Warren Buffett's Success and Quotes ... he was the second of three children, and displayed an amazing aptitude for both money and business at a very early age. ... he won’t invest. This is why he never touch Lehman Brothers as an investment. He could not understand the balance sheet, and if the master can’t read the ...[PDF]The lender of last resort theory of optimal currency areashttps://cepr.org/sites/default/files/policy_insights/PolicyInsight26.pdfreason was that Iceland was the most extreme example in the world of a very small country, with its own cur-OCTOBER 2008 C E P R P O L I C Y I N S I G H T N o. 2 6 POLICY INSIGHTNo.26 abcd To download this and other Policy Insights visit www.cepr.org The Icelandic banking crisis and what to do about it: The lender of last resort theory of ...

Predictions for 2012 – Virtual Intelligencehttps://www.vqab.se/2012/01/predictions-for-2012Jan 13, 2012 · The 2008 Lehman Brothers collapse and the resulting western financial crisis was the first shock to hit the legal system and generated a tidal wave of change. The next one could be bigger.” The SCL IT Law Community has collected responses from influential legal technologist on the “Predictions for 2012: Technology and Strategies for Lawyers

Obama’s Race To Losehttps://economictimes.indiatimes.com/blogs/headon/obama-s-race-to-loseSep 07, 2012 · In the 2008 presidential election, Obama beat John McCain partly due to a huge dollop of luck. Till early-September 2008, most opinion polls gave the gnarled Republican war veteran a slender lead over the young Democratic senator from Chicago. And then Lehman Brothers collapsed on September 15. Within days, the US financial sector went into ...

Swiss Re Archives - Slabbedslabbed.org/tag/swiss-reAug 04, 2010 · Willow Re and three similar deals used a unit of Lehman Brothers as total return swap counterparty, contracted to ensure the collateral backing the bonds was sufficient to meet interest and principal repayments, and to make up any shortfall. When it collapsed, investors were left with direct exposure to market losses on assets held as collateral.[PDF]

Lehman, A&P, Madoff, WaMu, MF Global, TSC: Bankruptcy ...https://www.bloomberg.com/news/articles/2012-02-17/...Feb 17, 2012 · Lehman Brothers Holdings Inc. will distribute less than 2 percent to general unsecured creditors of the holding company unless the bankruptcy judge gives permission at …

U.S. Treasury | Calvin Palmer's Webloghttps://calvininjax.wordpress.com/tag/us-treasuryLehman Brothers had no option but to file for bankruptcy earlier this week when Barclays walked away from a rescue package because guarantees could not be met. Today, Barclays agreed to pay $1.75 billion for Lehman’s North American business and has its eyes on parts of its European business, according to Blomberg.

Ripples | George Samandouras Bloghttps://georgesamandouras.wordpress.com/2014/01/27/ripplesJan 27, 2014 · In September 2008, Lehman Brothers, USA’s fourth biggest investment bank filled for bankruptcy, the biggest in the history of US. It was also the first time in history that the Federal Reserve Bank, and in reality the Government, did not support bailout of the investment bank hemorrhaging money. ... Last Saturday was the Name day of Gregorios ...

RBS rising from ruins as shadow of former selfhttps://uk.finance.yahoo.com/news/rbs-rising-ruins-shadow-former-self-092123521...Apr 03, 2017 · It was three weeks after the collapse of Lehman Brothers crippled global credit markets in 2008 that Britain's then finance minister Alistair Darling had to make a snap decision to buy RBS. The giant bank was hurtling towards bankruptcy so fast no one in government had a chance to find out exactly what it owned or how to value it.[PDF]Inaugural Lecture, Charterhouse Square, 23 March 2011, 6:30 pmhttps://www.qmul.ac.uk/law/media/law/docs/podcasts/lastra2011_transcript.pdfMary and a neighbouring tavern, which prominently displayed a sign with an axe image. . The . ... Stigler wrote in his Memoirs of an Unregulated Economist: ... Externalities or spillovers are the costs to society of banking failures. And, indeed, the costs ...

BDL Audit: Cabinet Chooses Turnaround Specialist Alvarez ...https://today.lorientlejour.com/article/1226955/...Jul 23, 2020 · Among its achievements, the firm, for example, participated between 2008 and 2012 in the re-structuring and asset sale of the US investment bank Lehman Brothers, which was one of the first victims of the 2008 financial crisis.

Fox Business’s Charlie Gasparino on Rumors of Trump ...https://www.usabusinessradio.com/fox-businesss...Jul 09, 2020 · “Prior to joining FBN, Gasparino was an on-air editor for CNBC where he was responsible for breaking some of the biggest stories during the 2008 financial crisis, including the first reports of the governments so-called TARP bailout of the big banks, AIG’s government bailout, details behind the collapse of Lehman Brothers and the shakeups ...

Sundance 2011https://sundance2011.blogspot.comMargin Call is a thriller that revolves around the key people at a investment bank over a 24-hour period during the early stages of the financial crisis. That is the description direct from IMDB. It really is about Lehman Brothers and the chain of command dramatics that took place after the Yale equation that all trading was based on was found to fail in projections - and that the problem had ...

Doomsayers' Dire Scenarios for Euro Zone Overdone - Here's ...www.munknee.com/doomsayers-dire-scenarios-for-euro-zone-overdone-heres-whyThey are SYSTEMIC. The European banking system’s leverage levels alone position Europe for a full-scale banking collapse on par with Lehman Brothers. Again, I’m talking about Europe’s ENTIRE banking system collapsing. This is not a question of “if,” it is a question of “when” and it will very likely happen before the end of 2012.

US Indexes | Investors 411www.investors411.com/tag/us-indexesNews- The Stories/News not Covered in Depth Today. Long Term Structural Analysis (part 2) The How and Why the imbalance of wealth between the rich and poor in the USA caused the “Great Recession,” and why we need to address this problem.; AIG – The mother of all Insurance companies is again near collapse. If the collapse of the much smaller Lehman Brothers sparked the financial crisis ...

Chad Johnson Has Officially Lost It, Challenges Michael Phelpshttps://awfulannouncing.blogspot.com/2008/08/chad-johnson-has-officially-lost-it.htmlAug 14, 2008 · The weekend began with hopes that a deal could be struck,maplestory mesos with or without government backing, to save Lehman Brothers, America''s fourth-largest investment bank.sell wow gold Early Monday buy maplestory mesos morning Lehman maplestory money filed for Chapter 11 bankruptcy protection.

trilateral | Blind Bat News | Page 5www.blindbatnews.com/tag/trilateral/page/5It’s now at a level or was earlier today at the level right before the crisis with Lehman Brothers. ... one of the downsides of this additional liquidity being put into the global marketplace is that it provides more ammunition for the traders in the marketplace who want to bet against the central bank, ...

Why the Wall Street bail out plan is bad-6: The credit ...https://freethoughtblogs.com/singham/2008/09/30/...Sep 30, 2008 · Bank writedowns and losses on the investments totaling $523.3 billion led to the collapse or disappearance of Bear Stearns Cos., Lehman Brothers Holdings Inc. and Merrill Lynch & Co. and compelled the Bush administration to propose buying $700 billion of …

Enron Former Directors Agree To Settle Class Actions ...https://corpfraud.typepad.com/corporate_fraud_blog/...Jan 10, 2005 · The Enron directors' settlement was the fourth reached in a massive class-action case in which shareholders seek to recover losses they suffered in the collapse of the Houston-based energy trader. Investment banking firm Lehman Brothers agreed to a $222.5 million settlement in October, Bank of America to a $69 million settlement in July, and ...

In English pleasehttps://cwijtvliet.blogspot.comApr 12, 2010 · The collapse of Lehman Brothers was the most striking consequence of the unprecedented decline of this market. If the poor state of the housing market really caused this crisis, then one can be inclined to think that this market’s recovery is a …

THE Global Population Thread Pt. 4 : Environment, Weather ...https://peakoil.com/forums/the-global-population-thread-pt-4-t73377-200.htmlNov 12, 2018 · It looks like the wealthier you are, the lower your sperm count. ... For the 10th anniversary of the collapse of Lehman Brothers, the BBC has been running a series of articles about it and its aftermath....One includes the following, which in my opinion is caused by a wider (and unexpected) change in society. ... This is the first time ...

Lehman’s 10 years on | AJ Bell Investcentrehttps://www.investcentre.co.uk/articles/lehmans-10-yearsAs I sit here and write this article, it is 10 years to the day that 158-year-old Lehman Brothers went bust and the world realised that we were entering a financial crisis, albeit perhaps not quite of the magnitude it would become. Of course, the clues were there long before this and as always they were blindingly obvious in hindsight, but then managing money has always been a lot easier in ...

The Low-Down: Old Tech: How GE's Underperformance Impacts ...www.thelowdownblog.com/2018/04/how-ges-underperformance-impacts-those.htmlThe industrial giant is one of the most widely held U.S. stocks. The stock value lost by GE in the past 12 months is twice the amount that vanished when Enron Corp. collapsed in 2001—and more than the combined market capitalization erased by the bankruptcies of Lehman Brothers and General Motors during the financial crisis. More than 600,000 ...

JDTV Nieuwsbullet: Demmink in de Turkse mediahttps://jdtvnieuwsbullet.blogspot.com/2012/10/...Translate this page-12- Lehman Brothers Netherlands was the initiation of the banking crisis. LB NL executed huge sales of financial toxic wastes that were strictly prohibited in the USA. In the USA such offenders would have disappeared behind bars for lifetime or on the electric chair. No one of LB NL seems to have been seriously prosecuted, so neither sentenced.

What is the Effect of lehman brothers bankruptcy - Answershttps://www.answers.com/Q/What_is_the_Effect_of_lehman_brothers_bankruptcyThe Dow fell 504 points the day that Lehman Brothers announced their bankruptcy. To be fair the 500 plus point drop can be attributed to the ever worsening credit crisis that is effecting the ...

What is the cause of Lehman brothers bankruptcy - Answershttps://www.answers.com/Q/What_is_the_cause_of_Lehman_brothers_bankruptcyWhat was the best movie of 2019? ... Asked in Bankruptcy Law, 2008 Economic Crisis, Lehman Brothers What are the remedies that are being implemented to save Lehman brothers …

Lost City: Pozzo Pastry Shop Still Mourned After Two-Plus ...https://lostnewyorkcity.blogspot.com/2010/05/pozzo-pastry-shop-still-mourned-after.htmlMay 06, 2010 · Pozzo Pastry Shop Still Mourned After Two-Plus Years ... they're comment and link in decent numbers and then the joint will fade from memory. Then there are the places that shutter and continue to draw sad remembrances month after month, year after year. ... "My aunt and uncle lived within walking distance of this wonderful bakery and the first ...[PDF]REPRISK REPORT 2006-2016: Ten years of global banking …https://www.reprisk.com/publications/special-reports/ten-years-of-global-banking...Lehman Brothers Collapse (2008) On September 15, 2008, Lehman Brothers, at that time the fourth largest investment bank in the US, filed for bankruptcy after admitting that it had made losses of USD 3.9 billion. It was the largest bankruptcy filing ever recorded in the United States and it triggered a drop of over 500 points in the Dow Jones Index.[PDF]Individual Round 1 - WordPress.comhttps://derbyshirepubquizleague.files.wordpress.com/2010/03/dpql-questions-27-jan-2010.pdfJan 27, 2010 · b) Which Bee Gees song was the second record to be played on Radio 1? Massachusetts c) Which US rock band, one of the most successful in chart history, dropped the words “Transit Authority” from their name soon after the release …

Our Speakers - Parnassah Network | NJ Expo | March 17-18, 2015parnassahexpo.org/scheduleofeventsEdward E. Neiger is a managing Partner at ASK LLP. Prior to ASK, Edward was an attorney in the Business, Finance & Restructuring department of Weil, Gotshal & Manges LLP, one of the nation's premier restructuring practices. Edward represented clients in the bankruptcy cases of Lehman Brothers, American Airlines and General Motors, to name a few.

virtualglobetrotting.comhttps://virtualglobetrotting.com/states/FL/North_Palm_Beach/export-0.kmlMcDade was the last President and COO of Lehman Brothers. He purchased this house in 2008, just three months before the investment bank collapsed, for $4.2M. Today, he's a partner at River Birch Capital, a NY-based hedge fund.]]> Today, he's a partner at River Birch Capital, a NY-based hedge fund.

Quotes about Risk Management (67 quotes) - Quote Masterhttps://www.quotemaster.org/Risk+ManagementMost of the time, your risk management works. With a systemic event such as the recent shocks following the collapse of Lehman Brothers, obviously the risk-management system of any one bank appears, after the fact, to be incomplete. We ended up where banks couldn't liquidate their risk, and the system tended to freeze up. Votes: 1. Myron Scholes

Obama Admits Immigration Reform Inaction Was A Failure ...www.thenewsburner.com/2012/09/21/obama-admits-immigration-reform-inaction-was-a-failureSep 21, 2012 · “When we talked about immigration reform in the first year, that was before the economy was on the verge of collapse,” he said. “Lehman Brothers had collapsed, the stock market was collapsing. So my first priority was making sure we didn’t fall into a depression.”

Tell it like it is: Buffet Looked 'Into the Abyss': The ...https://rjschwartz.blogspot.com/2010/04/buffet-looked-into-abyss-best-financial.htmlApr 08, 2010 · What fascinates me is that here is the financial whiz and oracle of Omaha, Warren Buffet--admittedly one of the richest guys in the world, who is approached by many of the above mentioned firms with requests to inject from $4 billion in the case of Richard Fuld of Lehman Brothers to $25 Billion for the entire Propery and Casualty business of AIG.

Kasich Kool-Aid Still Served - Plunderbundplunderbund.com/2016/07/06/kasich-kool-aid-still-servedJul 06, 2016 · But Camp Kasich, despite being tossed to the curb after its leader voluntarily bowed out of the race for president on May 4, saying he is still figuring out the Lord’s mission for him, is still serving up the Kasich flavored Kool-Aid that he can beat Hillary Clinton.[PDF]By MICHAEL J. BURRYAPRIL 3, 2010 ALAN GREENSPAN, the ...csinvesting.org/wp-content/uploads/2015/12/I-Saw-the-Crisis-Coming.pdfany one of them. I also specifically avoided using Lehman Brothers and Bear Stearns as counterparties, as I viewed both to be mortally exposed to the crisis I foresaw. What’s more, I demanded daily collateral settlement — if positions moved in our favor, I wanted cash posted to our account the next day. This was something I knew that Goldman

How to ensure IP doesn’t block the deal | Managing ...www.managingip.com/Article/2238229/How-to-ensure-IP-doesnt-block-the-deal.htmlWhen Lehman Brothers collapsed in September last year the final negotiations on selling off the bank’s Asian assets to Japanese rival Nomura had a surprising sticking point: IP “It is not an industry where you could expect there to be a lot of IP, but that was the topic that was keeping people at the table at 5am,” said Julie Van Nuffel ...

Julie: Wall Street Apology? – Satellite Sistershttps://satellitesisters.com/julie-wall-street-apologyDoes Wall Street own the American people an apology? That's the question that The Economist magazine asks this week. Should the CEO of Lehman Brothers, Richard Fuld who made approximately $500 million dollars after bankrupting his company and igniting a global financial panic, should he say he is

The World Changed With An Historic Announcement by the US ...https://bettermarkets.com/blog/world-changed-historic-announcement-us-government...Four years ago today was February 23, 2009. Although overlooked and never mentioned, that was the day the US government took unprecedented and historic action to effectively stop the cascading financial and economic crisis that continued to get worse by the day. Many people think the financial crisis peaked when Lehman Brothers filed for bankruptcy on September 15, 2008 or when the massive ...

Tan Kin Lian's Blog: Why was the Hyflux perpetual ...https://tankinlian.blogspot.com/2019/02/why-was-hyflux-perpetual-securities.htmlHe said that the regulator, i.e. the Monetary Authority of Singapore, has not learned the lesson from the collapse of Lehman Brothers in 2008. At that time, 10,000 investors lost $500 million due to the structured bonds. This time, the loss is bigger.

recession | PolicyBristol Hubhttps://policybristol.blogs.bris.ac.uk/tag/recessionLehman Brothers filed for bankruptcy on September 15, 2008. The investment bank’s collapse was the drop that made the bucket of global finance overflow, starting a decade of foreclosures, bailouts and austerity. Continue reading ?

Organizational Strategies | Supreme Papers Internationalhttps://supremepapers.org/blog/2017/11/14/organizational-strategiesNov 14, 2017 · collapse of Lehman Brothers in September 2008 had engulfed the entire U.S. automobile sector. By the time President Obama took office in January 2009, U.S. auto sales were half of those a year previously. This fall in demand was unprecedented in the industry%u2019s history. Ford reported a $14.7 billion loss for

Bureau ISBN - Gorillas, markets and the search for ...https://metadata.isbn.nl/665687/gorillas-markets-and-the-search-for-economic-value.htmlThe nickname of the Lehman CEO Dick Fuld was 'The Gorilla of Wallstreet'. In Gorillas, Markets and the Search for Economic Values the Nyenrode academic community discusses the five years following the Lehman Brothers demise (as a metaphor for the ongoing financial crises).[PDF]IN THE HIGH COURT OF JUSTICE Nos 7942 and 7945 of 2008 …https://www.pwc.co.uk/assets/pdf/chronology.pdfThese are the LBHI2 Sub-Debt Agreements that are in issue in the Application. 2 million 5% redeemable preference shares in LBIE allotted and issued to LBHI2 for cash at par value of $1,000 each. 30-Nov-06 375 million ordinary $1 shares in LBIE allotted and issued to LBHI2 for cash at par value of $1 each.

Aussie Looks Towards RBA Minutes for Direction in Light ...https://www.dailyfx.com/forex/fundamental/forecast/weekly/aud/2011/12/16/Aussie_Looks...What are the top havens for different conditions in 2020? ... the last time the Euribor-OIS 3-month spread was on the rise and was this elevated was the week after Lehman Brothers collapsed in ...

Decision Making - Leadership | Courserahttps://zh.coursera.org/lecture/leadership...Translate this pageAnd then, when Lehman Brothers fell, the financial system froze, and the world economy almost collapsed. Why? The problem at the core was the fact that leaders turned a blind eye to signs and signals that they didn't want to see. Decision fatigue. Did you know that the very act of making decisions produces fatigue?

June 27, 2016 – VIYAPARIKA LOKAYAhttps://viyaparikalokaya.wordpress.com/2016/06/27Jun 27, 2016 · That was the biggest one-day loss in market value – even greater than the value wiped out following the collapse of Lehman Brothers during the 2008 financial crisis, Standard and Poor’s calculated. Next pressures. The Chancellor’s statement on Monday comes amid forecasts of …

Kennedy’s White-Hot Legacy|VC Reporter | Times Media Grouphttps://vcreporter.com/2018/09/kennedys-white-hot-legacySep 26, 2018 · Americans have forgotten the national gloom that started 10 years ago. The economy was near death after the collapse of Lehman Brothers. The right-wing policies producing this disaster would never have happened under JFK. The notion that the global economy might be redesigned to benefit only the ultra-rich would have been unthinkable.

Barclays Wealth and Investment Management News and Updates ...https://economictimes.indiatimes.com/topic/Barclays-Wealth-and-Investment-Management...Jan 09, 2016 · Barclays Wealth and Investment Management News and Updates from The Economictimes.com. ... the largest offering by a local bank after the Lehman Brothers collapse. Gold bulls are anxious as coin junkies vanish in US ... The Capital Goods index was the top gainer among the BSE sectoral indices in a subdued market on Thursday, after L&T reported ...

AIG’s Tom Russo exits after settling probes, suits as ...https://www.winkintel.com/2016/05/aigs-tom-russo-exits-after-settling-probes-suits-as...Russo was the former top attorney at Lehman Brothers Holdings Inc. until the securities firm’s bankruptcy in 2008. He led negotiations with the Treasury Department and Federal Reserve Bank of New York to help then-CEO Robert Benmosche repay the $182.3 billion rescue.

Decision Making - Leadership | Courserahttps://fr.coursera.org/lecture/leadership-collaboration/decision-making-59AoeAnd then, when Lehman Brothers fell, the financial system froze, and the world economy almost collapsed. Why? The problem at the core was the fact that leaders turned a blind eye to signs and signals that they didn't want to see. Decision fatigue. Did you know that the very act of making decisions produces fatigue?[PDF]meanshttps://www.ukfxcartelclaim.com/Content/Documents/Class Definition.pdf(a) The person was the direct contractual counterparty to the Relevant Foreign Exchange Transaction; or (b ) The person instructed or engaged an Intermediary to enter into a Relevant Foreign Exchange Transaction on its behalf (r egardless of whether the Intermediary, rather than that person, was the direct contractual counterparty).

2014 Articles Archives | Future Money Trendshttps://www.futuremoneytrends.com/financial/trend-articles/2014-articlesWhy the Lehman Brothers’ Bankruptcy Still Haunts the Federal Reserve. by FMT Staff | Sep 18, 2014 | 2014 Articles. Since 2008, the U.S. government and Federal Reserve have been fighting what is literally a second U.S. Great Depression. It’s the reason why so many Americans still feel like the recession never ended; the truth is it never did.

My Writingshttps://pprchandran.blogspot.com/2012/10/from-crisis-to-recovery-by-brian-keeley.htmlThe financial crisis of 2008 was the cause for the most serious economic slowdown since World War I I. The failure of Lehman Brothers in September 2008 heralded the unprecedented collapse of world trade and widespread job losses. It was called “The Great Recession”.

Papers archive - Fidessahttps://www.fidessa.com/papers/papers-archive?paperCategory=5&pageNumber=5There is no doubt that the collapse of Lehman Brothers profoundly changed the face of the financial industry. The idea that large financial institutions were too big to fail was proved to be false and everyone from prime brokers to fund managers to investors were forced to re-evaluate their attitude to risk, transparency and regulatory oversight.

Makes you think | The Paepaewww.thepaepae.com/makes-you-think/17959From The Guardian: Martin Rowson on the final crisis of capitalism European and North American stock markets are at their most volatile since the 2008 collapse of Lehman Brothers. We had a GFC film festival at our house over the weekend watching Michael Moore’s Capitalism: a Love Story and the Academy Award winning documentary Inside Job. If you haven’t seen Inside Job, see it.

McCain's book depictsvery full life | Lifestyles ...https://www.lockportjournal.com/news/lifestyles/mccain-s-book-depictsvery-full-life/...He regarded Sarah Palin with warmth, and no regrets but he said that when Lehman Brothers filed for bankruptcy, he saw where things were heading and he tried “to live completely in the moment ...

Impeachment? No Way. Rod Blagojevich for President! | HuffPosthttps://www.huffpost.com/entry/impeachment-no-way-rod-bl_b_161363Then there are the scolds who think that rascals like the Governor, Wall Street's John Thain of Merrill Lynch and Lehman Brothers' Richard Fuld should be subjected to some kind of public shame. The NY Times Clyde Haberman covers that ground in his column today, quoting Mark Twain saying that "Man is the only animal that blushes. Or needs to."

News - Rockefeller Group Business Centershttps://www.rgbc.com/scary-business-thoughtsIn the spirit of Halloween, we asked one of our clients, Philip Segal, to talk about the scariest time in his career. Philip said, “I started the business during the fallout in the legal industry after the Lehman Brothers failure, when law firms were firing partners. It was like starting a stock brokerage in 1930 or 31.[PDF]Strategic Foresight: The Case of TJ Park and POSCOhttps://www.jstor.org/stable/pdfplus/43111505.pdfincluded POSCO and Korean Steel Industry as a case in his research project that investigated ... offers one of the pioneering studies to propose the concept of 'environmental scanning.' Porter (1980) argues more specifically that companies need to be ... triggered by the troubling U.S. housing market and ensuing collapse of Lehman Brothers and

Securities Lending Times | Rob Ferguson of CIBC Mellon ...www.securitieslendingtimes.com/interviews/interview.php?interview_id=35SLT: What are the main changes you are observing in your clients’ behaviour in relation to securities lending? Ferguson: The credit crisis put the focus squarely on managing risk. Whether it be for analysts or members of clients’ Boards, people wanted to understand the impact of the Lehman Brothers’ collapse on their lending programs.

Zuckerberg overtakes Jobs, Murdoch on Forbes rich list ...https://mg.co.za/article/2010-09-24-zuckerberg...Sep 24, 2010 · Most benefited from growth in their companies: after a dismal 2009, when 314 out of the 400 saw a fall in their wealth in the wake of the 2008 collapse of Lehman Brothers …

Regulators outline ways to ensure you’re better servedhttps://www.iol.co.za/personal-finance/regulators...Mar 27, 2011 · If banks had not lent money to people who could not afford to repay it, the snowball effect which led to the collapse of Lehman Brothers, the large US investment bank, in 2008 and the global ...

Worldbank Searchhttps://www.worldbank.org/en/search?q=Poverty&...Ms. Michelle Fleury is the BBC's New York Business Correspondent and one of the leading reporters in North America for BBC World News. She's covered American business and economics for more than 10 years, working on major stories, including the global financial crisis, the financial collapses of Lehman Brothers and AIG, the jobless recovery and ...

Banks are still 'too big to fail', says SNB chairmanhttps://uk.news.yahoo.com/banks-still-too-big-fail...Sep 14, 2013 · ZURICH (Reuters) - More still needs to be done to let global banks be wound down without harming the wider economy, Swiss National Bank Chairman Thomas Jordan said in a newspaper interview published on Saturday. "The too-big-to-fail problem is not yet fully solved," Jordan told Finanz und Wirtschaft. Authorities have been grappling since the collapse of U.S. investment bank Lehman Brothers ...

CAVEAT | EDEL GARCELLANOhttps://theworksofedelgarcellano.wordpress.com/2008/10/15/caveatOct 15, 2008 · 1. The Criminally Innocent a. Richard Fuld, Jr. used to be the “Big Boss” of Lehman Brothers Holdings until the US meltdown that sent corporate rats scampering into their holes. But he’s not taking the fall: he swears “all his decisions were both prudent and appropriate given the information he had at the time.” With…

October 4, 2008 – More Thoughts on Gold, and the Big Puke ...www.buy-high-sell-higher.com/2008/10/04/october-4-2008-more-thoughts-on-gold-and-the...Oct 04, 2008 · Only time will tell who is correct on that one, but for the record, here is a two month gold chart: From the base around $740 in the second week of September, in five trading days gold peaked at over $920, for a gain of 24% in a week, with over $100 of that gain happening in one day.…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

The Holy Spirit Your Financial Advisor | Download eBook ...https://www.e-bookdownload.net/search/the-holy-spirit-your-financial-advisor• “When you know what you are talking about, others will follow you, because it’s safe to follow you.” —Lehman Brothers CEO Richard Fuld, 2006 • “I think the most important thing is restore a sense of idealism and end the cynicism.” —future Illinois governor Rod Blagojevich, 2002 • “The day you take complete responsibility ...

??????????2012-2013????5??? ??_????https://wenku.baidu.com/view/1e77aa44f01dc281e53af0c6.htmlTranslate this pageIt was a last victory. As the auctioneer called out bids, in New York one of the oldest banks on Wall Street, Lehman Brothers, filed for bankruptcy, starting the most severe financial crisis since the 1920s. The world art market had already been losing momentum(??) for a …

How conceivable is it that Wall St. Knew the economy would ...https://es.answers.yahoo.com/question/index?qid=20111018212414AA60dUUOct 18, 2011 · But instead allowed it and set it up to do just that. They knew the poor could not foot the bills but dived in to try anyway. Now i cant completely blame the winners in all this because if people jumped in and knew they could not or possibly be unable to handle a problem down the road. Id have to blame them as well. I don't believe in living beyond my means. I never did. They dangled candy in ...…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

An Unnecessary Defeat? | Articles | VDARE.comhttps://vdare.com/articles/an-unnecessary-defeatThen came the collapse of Lehman Brothers, the bailout of AIG, McCain's assertion that the economy was fundamentally sound, and his panicked return to Washington to assist Bush and Hank Paulson push through a wildly unpopular bank bailout—using 700 billion in tax dollars to buy up rubbish paper the idiot bankers had put on their books.

Hagen Financial Network, Inc.: 2019-09-22https://hagenfinancialnetwork.blogspot.com/2019_09_22_archive.htmlSaudi Arabia’s oil infrastructure was attacked. The Federal Reserve cut interest rates by a quarter-point. U.S. money markets went crazy and forced the Fed to intervene, setting off comparisons to the collapse of Lehman Brothers in 2008. And, yet, a Montana junket was the ultimate determinant of whether the market finished up or down.”

Market Commentary for September 23, 2019 | Wise Wealth ...https://www.wisewealthmanagementgroupllc.com/market-commentary-for-september-23-2019Sep 23, 2019 · Saudi Arabia’s oil infrastructure was attacked. The Federal Reserve cut interest rates by a quarter-point. U.S. money markets went crazy and forced the Fed to intervene, setting off comparisons to the collapse of Lehman Brothers in 2008. And, yet, a Montana junket was the ultimate determinant of whether the market finished up or down.”

credit derivatives | Computational Economicshttps://scienceofeconomics.wordpress.com/category/credit-derivativesOct 06, 2010 · Credit derivatives aren’t, of course, solely to blame for the pandemic that has helped bring down Wall Street. They didn’t single-handedly force Bear Stearns and Lehman Brothers to bulk up on toxic debt, dooming them to collapse. But they made the financial world more complex and more opaque.

White House Quotes - Page 17 - BrainyQuotehttps://www.brainyquote.com/topics/white-house-quotes_17In September 2008 - as Lehman Brothers filed for bankruptcy and AIG, the world's biggest insurance company, accepted a federal bailout - Senator John McCain of Arizona, in what was widely viewed as a political move, suspended his presidential campaign and called on Obama to rush back to Washington for a bipartisan meeting at the White House.

Silvan Ridge Financial Services » The global financial ...www.silvanridge.com.au/financial-planning/the-global-financial-crisis-behind-us-but...Ten years ago this month, Lehman Brothers, the fourth-largest US investment bank, filed for bankruptcy protection. It was a seminal event in what has come to be known as the global financial crisis (GFC). Even a decade on, the massive damage it inflicted across the world continues to shape both the global economy and investor behaviour.

Financial crisis: 5 years later, Americans still angry at ...https://torontosun.com/2013/09/15/financial-crisis-5-years-later-americans-still-angry...Sep 15, 2013 · Five years after the collapse of Lehman Brothers and two years after the start of the Occupy Wall Street movement, Wall Street has drastically changed under an onslaught of new regulations and by ...