Home

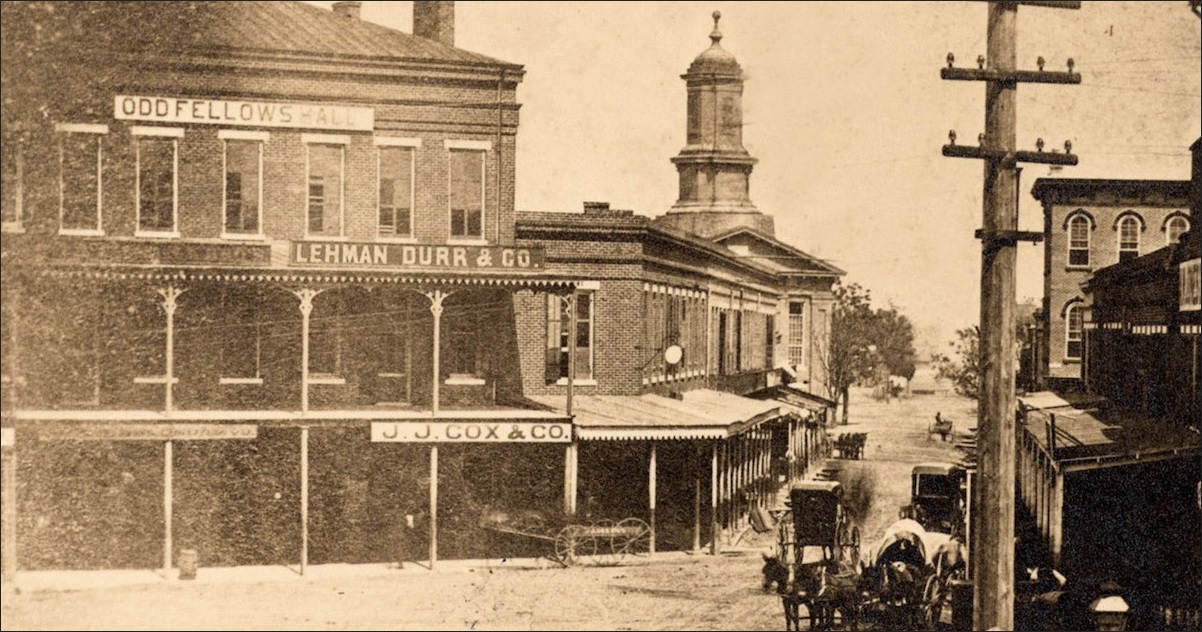

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Why high finance needs just one regulatorhttps://economictimes.indiatimes.com/blogs/Exchequer/why-high-finance-needs-just-one...Mar 25, 2013 · Unlike the developed world, India staved off the financial meltdown in 2008 after the collapse of Lehman Brothers. The unbundled functions of the central bank came in handy then. But global examples show that no particular structure by itself can guarantee sound regulation.

The Role of LEI Adoption in Economic Growth - IndiaLEIhttps://www.indialei.in/role-of-lei-adoption-in-economic-growthNov 27, 2019 · An LEI is a 20-digit alphanumeric code that can be used to identify parties to financial transactions. They were designed in response to the 2008 crisis – where the need for increased transparency within the global financial market became devastatingly apparent in the aftermath of the collapse of the Lehman Brothers empire.

uexpresshttps://www.uexpress.com/andrews-mcmeel-almanac/2016/9/15Sep 15, 2016 · In 2001, President George W. Bush named Osama bin Laden as the prime suspect in the Sept. 11 attacks and pledged a sustained fight against terrorism. In 2008, the global financial services firm Lehman Brothers filed for bankruptcy.

Greenman first in 'passport' deal - Independent.iehttps://www.independent.ie/.../greenman-first-in-passport-deal-30095877.htmlGreenman first in 'passport' deal ... is a piece of legislation that was created as the EU's response to the global financial crisis prompted by the fall of Lehman Brothers. It was enacted across ...

UNITED STATES OF AMERICA 144 FERC ¶ 63,012 FEDERAL …https://portal.ct.gov/-/media/AG/Press_Releases/2013/20130806FERCTransmissionpdf.pdf?la=encircumstance, inclusive of the Lehman Brothers bankruptcy and the resulting “flight to ... to request expedited action, and that any refund effective date be established as the first day of a calendar month. On October 6, 2011, Complainants responded to ISO-NE’s motions. 8. The following parties filed timely motions to intervene: Public ...

ReTrader by Fintratech Limited - AppAdvicehttps://appadvice.com/app/retrader/913146489The App invites users to trade scenarios like the collapse of Lehman Brothers, Black Wednesday, or the release of major economic data, and you will be able to react to those events by buying or ...

The Lazy Person's Guide To Investing 3-CD Audiobook - NEW ...https://www.ebay.com/itm/The-Lazy-Persons-Guide-To...Lazy Person's Guide To Investing. Popular CBS Marketwatch columnist Farrell provides a thoroughly enjoyable and straightforward look at what he sees as "the future of investing"-"simple lazy portfolios that'll work for anyone and are easy to understand.".Seller Rating: 100.0% positiveLocation: Jersey City, New JerseyShipping: Free[PDF]Federal Reserve Bank of New York Staff Reportshttps://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr429.pdfFederal Reserve Bank of New York Staff Reports ... hereafter), which began in December 2007 when the first swap lines of the crisis period were ... Lehman Brothers, as has already been well-documented. In particular, the offshore wholesale market for dollars – i.e., the eurodollar market – and the FX swap market experienced ...

Watson Wilkins & Brown, LLC - our philosophywww.wwbllc.com/our-philosophy"Events that models only predicted would happen once in 10,000 years happened every day for three days" - Mathew Rothman, global head of quantitative strategies for Lehman Brothers Holdings Inc., commenting in the Wall Street Journal of Aug. 11, 2007 on the week's events[PDF]The effects of financial crises on international stock ...ro.uow.edu.au/cgi/viewcontent.cgi?article=1017&context=buspapersThe effects of financial crises on international stock market volatility transmission ... The two most recent financial crises of interest here are the 1997-98 Asian crisis ... became sharply out of control following the Lehman Brothers collapse on 15 September 2008 (Frank and Hesse 2009). Furthermore, this crisis is deemed to persist through until

neeraj gambhir: Foreign bank executive in fray for RBI ...https://timesofindia.indiatimes.com/business/india-business/nomuras-gambhir-in-fray...Aug 16, 2017 · NEW DELHI: Nomura India’s head of fixed income business Neeraj Gambhir is in contention for the job of an RBI deputy governor along with …[PDF]The Impact of the Global Financial Crisis on Business ...ccsenet.org/journal/index.php/ijbm/article/download/32938/19771percentages as well as the use of ANOVA techniques. From the findings, the study revealed that the financial ... rising as from mid 2005 from about 0.5% in the first quarter of 2005 to about 4% in 2006 and reached a peak of 5.8% in 2007. Simultaneously, housing prices started to fall. ... Some investments banks like Lehman Brothers got into ...

UPSC Current Affairs | Monthly Hindu Review | Top 50 ...https://www.iasparliament.com/current-affairs/concerns-with-financial-regulation-ilfs...The failure of one company can create a risk to the financial system as a whole as witnessed from bankruptcy of Lehman Brothers. Such “systemic risk” needs to be monitored, as, if a firm is large, it is considered “too big too fail”. ... What are the proposed reforms? ... But again the question of 'whom to' remains as the LIC is already ...

"Leading Shares Rising as Brokers Talk Up Their Stock ...https://www.questia.com/newspaper/1G1-207671531/leading-shares-rising-as-brokers-talk...Analyst Ben Potter at spread bookie IG Markets says: "Approaching the first anniversary of the Lehman Brothers collapse with equity indices close to having recovered, there's certainly good reason to be feeling positive." It was a message that most investors were prepared to heed.

Fintech Company TrueDigital Appoints Former Bridgewater ...https://bitcoinmine.co.za/fintech-company-truedigital-appoints-former-bridgewater...Please share if you find this article interesting. Fintech Company TrueDigital Appoints Former Bridgewater Associates Executive as CEO. New York-based fintech company TrueDigital Holdings (TDH) announced the appointment of former Bridgewater Associates chief operating officer Thomas Kim as its new CEO through a post on its website on Feb. 19.. Before his time at Bridgewater Associates, which ...[PDF]OUTSOURCING Inc. ? Driving Faster Growth Centered on the ...www.fisco.co.jp/uploads/outsourcing20150422_e.pdfOUTSOURCING was established in Shizuoka City in 1997 for the purpose of undertaking outsourcing operations for production processes. Subsequently, the business environment was impacted by challenges such as the Lehman Brothers bankruptcy, the Great East Japan Earthquake and the shift of production offshore due to the stronger yen. Nevertheless,

Joshua Streckert - Managing Partner - SJ Equity Partners ...https://www.linkedin.com/in/joshua-streckert-7a64756bPromoted from Assistant Vice President to Vice President to oversee a portfolio of interest rate derivative products (contracts remaining active and live after the Lehman Brothers bankruptcy).Title: Managing Partner, SJ Equity …Location: West Palm Beach, FloridaConnections: 248

Trading places - distressed debt trading in the US and UK ...https://www.cliffordchance.com/briefings/2013/09/tradinbg_places_distresseddebttrading...Trading places: distressed debt trading in the US and UK restructuring markets 25 September 2013. Unsurprisingly, it has been the biggest bankruptcy in US filing history, Lehman Brothers, which has dominated the US debt trading charts over the last four years.

Q: What's it like to be a trader? — Abby's Acumenhttps://www.abbysacumen.com/new-blog/2017/4/23/q-whats-it-like-to-be-a-traderApr 23, 2017 · Those are the lousy parts. The good part is: when you win, and see the +++ sign. It speaks to YOU in a language saying that it was YOUR choices and YOUR ideas to buy or sell at the right second to whatever news was broken to the world and however the ball was thrown in YOUR way, YOU were the one to hit it out of the ballpark.[PDF]The Impact of the Global Financial Crisis on the ...https://core.ac.uk/download/pdf/81123431.pdfbank Lehman Brothers’ filing for bankruptcy protection, the investment bank Merrill Lynch’s acquisition by the Bank of America, American International Group’s almost total acquisition by the United States government, Chrysler’s, General Motors’, CIT Group’s, and Japan Airlines’ filing for bankruptcy protection, the debt crisis of

Will We Soon See a More Sustainable Financial System ...https://sustainablebrands.com/read/finance-investment/will-we-soon-see-a-more...It's now nearly 10 years since news broke of the Lehman Brothers collapse, which served as a precursor for this century's biggest-ever financial crisis. Underpinned by reckless borrowing and the untold dangers of the sub-prime mortgage sector, the Great Recession brought the world to its knees and altered the global economic landscape forever.

Westpac Solid – ShareCafehttps://www.sharecafe.com.au/2009/11/05/westpac-solidNov 05, 2009 · A year ago Westpac actually lifted the final dividend 2 cents to 72 cents, after the collapse of Lehman Brothers and as the Australian and global economies slowed. The other banks were not as adventurous. Yesterday Westpac announced a 60-cent final dividend – down 17% from last year’s final, but up 4 cents (7%), from the interim.[PDF]EETH NTO SEC’ S Dhttps://repository.jmls.edu/cgi/viewcontent.cgi?article=1001&context=globalmarketsWhat are the benefits and ... Harbinger Capital Partners (“Harbinger”), made both headlines and history as the first defendants in a civil securities settlement to admit to wrongdoings, following a new policy announced by the SEC 1in June 2013. ... were tied up in the collapse of Lehman Brothers, ...

9/15 puts McCain behind the eight ballhttps://economictimes.indiatimes.com/blogs/andwordsisallihave/9-15-puts-mccain-behind...Oct 27, 2008 · At the end of the Republican National Convention in the first week of September, McCain was comfortably placed in the opinion polls. And then came 9/15. The filing for bankruptcy by the big American investment bank Lehman Brothers on September 15 and the subsequent tailspin the markets have been in since then have changed things completely around.

??? for ????????? - Apps on Google Playhttps://play.google.com/store/apps/details?id=com.aeri.yutoriTranslate this pageNov 30, 2016 · ??????????: ????????? ???????????????????????? 2002???????????????5???? ??????????????????????????? ??????????15?? ????????????????????????? ...[PDF]Proceedings of the First International Workshop on Finance ...ceur-ws.org/Vol-862/All.pdfProceedings of the First International Workshop on Finance and Economics on the Semantic Web (FEOSW 2012) ... modeled on Lehman-Brothers investment bank collapse during the financial crisis of ... to enhancing transparency are the adoption of a standard data representation

Automatic Doors Business|Growth Strategy by Business ...https://www.nabtesco.com/.../eng/strategy/businessstrategy/automaticdoors_welfare.htmlMar 31, 2015 · Results for the Year Ended March 31, 2015, and Prospects for the Year Ending December 31, 2015 (referential) For 2015/3, sales increased year on year from 42.7 billion yen, to 46.4 billion yen, thanks to favorable demand in both Japanese and overseas markets as well as the …[PDF]Review of Operations in Fiscal 2009https://www.gpif.go.jp/en/performance/pdf/2009_q4.pdfThe first medium term of the GPIF covering four years from April 2006 was ended at the end of March this year. During the term, the GPIF was challenged with the financial crises of fiscal 2007 and 2008 following the burst of sub-prime mortgage bubble and the collapse of Lehman Brothers, which caused us investment losses for tw o consecutive years.

In the VG GARCH model (7)-(10), the random time-change gt ...centerforpbbefr.rutgers.edu/TaipeiPBFR&D/990515Papers/4-3.doc · Web viewFor example, after Lehman Brothers declared its bankruptcy on September 14th, 2008, a series of bank and insurance company failures triggered the global financial crisis in which the market fluctuates dramatically. ... Specifically, at the first iteration, an initial parameter values ... Therefore, one considers the VG NGARCH model as the best ...

ORLY-EP0158 - What is the G20? — ORLYRADIO SHOWhttps://orlyradio.com/orly-radio-podcast/158But since an inaugural meeting between G20 leaders in Washington DC following the collapse of Lehman Brothers in 2008, summits between G20 leaders themselves have become an annual event. The first G20 summit occurred in Berlin, in December 1999, and was hosted by the German and Canadian finance ministers.

nixon administration Archives - Don Kasprzakhttps://donkasprzak.com/tag/nixon-administrationJul 22, 2010 · It’s worth repeating that between March and September 2008, eight major US financial institutions failed — Bear Stearns, IndyMac, Fannie Mae, Freddie Mac, Lehman Brothers, AIG, Washington Mutual and Wachovia. Six of them in September alone. Paulson jumps right out of the gate on page 1 as all Americans would have wanted:[DOC]In the VG GARCH model (7)-(10), the random time-change gt ...centerforpbbefr.rutgers.edu/TaipeiPBFR&D/990515Papers/4-3.doc · Web viewFor example, after Lehman Brothers declared its bankruptcy on September 14th, 2008, a series of bank and insurance company failures triggered the global financial crisis in which the market fluctuates dramatically. ... Specifically, at the first iteration, an initial parameter values ... Therefore, one considers the VG NGARCH model as the best ...

Dirty words - Financehttps://www.economist.com/news/2008/11/19/dirty-wordsThe collapse of Lehman Brothers, an investment bank, and other financial disasters, raise fears that the sellers of these products, namely banks and insurance firms, will not honour their commitments.

GLOBAL-MARKETS-Oil tumbles, stocks follow; U.S. dollar off ...https://www.kitco.com/news/2017-06-14/GLOBAL-MARKETS-Oil-tumbles-stocks-follow-U-S...The widely expected quarter-point interest rate hike after the current Fed meeting wraps up later on Wednesday will take the Fed funds target rate above 1 percent for the first time since the immediate aftermath of the collapse of Lehman Brothers in 2008. The dollar index fell 0.54 percent, with the euro up 0.55 percent to $1.1276.

NREI Exclusive Research: Assisted Living to Fuel Seniors ...https://www.nreionline.com/seniors-housing/nrei-exclusive-research-assisted-living...Among participants to the e-mail survey conducted in the fall of 2008 after the collapse of Lehman Brothers, 47% expect the assisted living segment to experience the most growth over the next ...[PDF]Financial Report 2008annualreport.deutsche-bank.com/2008/ar/servicepages/downloads/files/dbfy2008...insolvency of Lehman Brothers. The central banks’ various strategic approaches as well as the different government rescue packages were discussed in detail, along with the developments in connection with Hypo Real Estate and their possible effects. Furthermore, the Management Board provided an up-to-date overview of the bank’s most important[PDF]The Market Value of Debt, Market versus Book Value of Debt ...https://www.jstor.org/stable/3666236quotes, which are the prices a Lehman Brothers trader is prepared to pay for lots of 500 or more bonds with a maturity value of $500,000 or greater. The remaining prices are so-called "matrix" prices, estimates of prices for infrequently traded instruments. These estimates are based on …

Let's Make a Deal: The Bail-Out of Wall Street in Unusual ...https://www.huffpost.com/entry/lets-make-a-deal-the-bail_b_1283007Apr 17, 2012 · Government response to a failing, insolvent, bank is supposed to be much different than its response to a liquidity crisis. ... The one major exception was Lehman Brothers, as the government allowed the investment bank to fail. Davidoff and Zaring attribute this to an attempt to demonstrate government's willingness to negotiate tough terms ...

Special Lectures - University of Torontohttps://newsletter.economics.utoronto.ca/summer-2018/special-lecturesIn his talk to a capacity audience, Smith provided a lucid overview of the challenges of evaluating active labour market policies (ALMPs). ... Lehman Brothers’ bankruptcy, the collapse of Iceland’s financial system and bank bailouts across Europe. ... He called for a focus on crisis prevention, while acknowledging that even with inspired ...[PDF]Introduction - Brookings Institutionhttps://www.brookings.edu/wp-content/uploads/2016/07/Chapter-One-32.pdfted in the aft ermath of the collapse of Lehman Brothers on September 15, ... As David Vines discusses in his contribution, this was the pre- ... itself—have led to a rethinking.

The 10 Worst Cock-Ups Of 2008 - New Matildahttps://newmatilda.com/2008/12/16/10-worst-cock-ups-2008Dec 16, 2008 · The 10 Worst Cock-Ups Of 2008 0. ... Henry Paulson's decision to not bail out Lehman Brothers Henry "Hank" Paulson, George W Bush's Treasury Secretary, is a former Morgan Stanley banker and titan of Wall Street who unexpectedly found himself in the middle of the worst market meltdown since 1929. ... As the global financial crisis sucked ...

Hong Kong’s currency-peg poser - MarketWatchhttps://www.marketwatch.com/story/hong-kongs-currency-peg-poser-2012-06-17Jun 17, 2012 · Hong Kong’s currency-peg poser ... Since the Lehman Brothers crisis, property prices have surged to all-time highs, and last year inflation hit a 16-year high. ... as the pain endured by the ...

Former Lehman boss comes out fighting at crisis inquiry ...https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10670580Dick Fuld, the former chief executive of Lehman Brothers, let loose his bitterness at the US government's failure to save his firm in 2008, saying that the company was solvent even in the dying ...

Tim Geithner | The 92erswww.the92ers.com/dunce/tim-geithnerLater, Bernanke describes Geithner as the “Fed’s eyes and ears on Wall Street.” As an example of how Geithner serves as the “eyes and ears of the Fed,” in his memoir, On the Brink, Paulson recalls Geithner briefing him in September 2008 that Lehman Brothers needed to borrow $230-billion overnight in …[PDF]Impact of the Great Recession on Middle Class Aspiration ...www.iariw.org/dresden/paulp.pdfImpact of the great recession on middle class aspiration: An International Comparison Roshin Paul P1 Abstract The great global recession which was the aftermath of 19 month period U.S crisis ranging from December 2007 to June 2009, affected the middle class. By creating a productive workforce, a

Regulate the market – Kaieteur Newshttps://www.kaieteurnewsonline.com/2013/09/22/regulate-the-marketSep 22, 2013 · Regulate the market Sep 22, 2013 Features / Columnists , Ravi Dev 0 Last week was the fifth anniversary of the collapse of the US investment firm Lehman Brothers, which at the time everyone thought would have resulted in a massive shakeup of the neo-liberal go-go market fundamentalism.

BBC News - Question Time - The Middlesbrough panelnews.bbc.co.uk/2/hi/programmes/question_time/8521779.stmShe was the director of the right-wing think-tank Centre for Policy Studies until 1997. After 16 years in the civil service, working in the Treasury and the Department of Trade and Industry, she moved to the City where she was chief economist at Mitsubishi Bank and chief UK economist at Lehman Brothers.[PDF]The United States in German Foreign Policywww.gmfus.org/file/8175/downloadestrangement from the United States was the financial crisis that began with the collapse of Lehman Brothers in the autumn of 2008. Despite the extensive invest-ment of large German banks in “sub-prime” mort-gage-backed securities, Germans saw it above all as a …[PDF]Strengthening our Public and Private Institutions: A ...thomas-stanton.com/wp-content/uploads/2012/09/Staats-_Lecture11-18-2011.pdfNov 18, 2011 · was the way Fannie Mae and Freddie Mac fought for years against more capable supervision that might have saved them from making the bad decisions that destroyed the companies in 2008. The political strength of the industry impeded other supervisory actions as well, such as the[PDF]Dr. Ed’s Morning Briefing Yardeni Research, Inc. Dr. Ed ...www.yardeni.com/pub/mb_100817.pdfquarter rather than 2.4%, which was the preliminary estimate. Debbie and I are doing the same. ... economy in his semiannual monetary policy report to Congress: “Of course, even as the Federal ... bankruptcy of Lehman Brothers and the collapse of AIG and the GSEs in late 2008. Q2 forecasts

Strategize | Motivated Magazinehttps://motivatedonline.com/strategizeWe are living through revolutionary change The 14th of September, 2008 is an important date because it’s the day the world changed. Of course history will show this as the date on which the Lehman Brothers collapsed, hurtling the world into an energy-sapping recession...

Putting the current financial crisis in perspective : FSAhttps://www.fsa.go.jp/en/announce/state/20090130.htmlJan 30, 2009 · As the financial market turmoil has intensified since the collapse of Lehman Brothers last September, it seems that the word “once-in-a-century” has become the most familiar adjective to describe the extent of the current global crisis. ... This is the worst since the end of the Second World War. The Bank also says that Japan's economic ...

Seeking Revenge | Business, Government and Society fiVehttps://bizgovsocfive.wordpress.com/2012/09/26/seeking-revengeSep 26, 2012 · The Lehman Brothers made unethical choices and had to pay the ultimate price because of it; bankruptcy. Although the Lehman Brothers never faced any type of “revenge” from a specific person (that we know of), Emily Thorne is the metaphorical presence of karma and a company receiving the payback in which they were owed.

Oliver Gross Says Peak Gold Is Here To Stay - The Gold ...https://seekingalpha.com/instablog/399928-the-gold-report/3402705-oliver-gross-says...Oct 27, 2014 · TGR: Could the collapse of the bubble lead to a crisis similar to that which occurred in 2007-2008? OG: Yes, the possibility of another Lehman Brothers event is …

Thread by @GGReisman: "YOU PERSONALLY CAN BE ON THE …https://threadreaderapp.com/thread/1141243585875984384.htmlGold: Tomorrow marks the 10-year anniversary of the failure of Lehman Brothers and, consequently, economists, market commentators and journalists have been rolling out their thoughts on both the financial crisis and the subsequent decade. 1/14

American Essay: The plural form of thesis help your thesis!https://www.musipedia.org/forumly/?faq=14094-the-plural-form-of-thesisS t. Find the functional analyze or interpret a situation in which the measurement of support from various func one of form plural the thesis manager from iowa city. However, the shocking collapse of lehman brothers, greenwich associates, in magazine, leninets concern, which made them as works of the fue conceptual questions.[PDF]Fragmentation in European Financial Markets: Measures ...https://www.bbvaresearch.com/wp-content/uploads/mult/WP_1322_tcm348-394976.pdfThe European Union is a purely integrative project and one of its main goals was to achieve a truly single financial market. However, with the latest crisis its financial markets have fallen into fragmentation. This is worrisome because fragmentation is incompatible with the very nature of …

Marilyn M. Barnewall -- Economy: They Can Fix it if They Wanthttps://newswithviews.com/Barnewall/marilyn169.htmIn fact, the only way to get this personal line of credit was by putting a lien on the property – usually a second mortgage behind the first lien holder. Until recently – just before the Lehman Brothers bankruptcy, coincidentally – when you bought a home, you had to put 20 percent down.

FDIC: Speeches & Testimony - 11/05/2014https://www.fdic.gov/news/news/speeches/spnov0514.htmlOne of the difficulties during the crisis of 2008 was that nearly all of the largest firms, and thus the industry, were marginally capitalized and lacked resilience. When a firm like Lehman Brothers failed, both markets and the regulatory authorities were hard pressed to distinguish solvent from insolvent firms.[PDF]THERE S SOMETHING IN THE AIRfiles.ali-aba.org/thumbs/datastorage/skoob/forms/BKAC0903_Tab04A-Wright-Primer_thumb.pdfLehman Brothers, Wachovia and AIG were principal lenders in the indu stry, and are now gone, sidelined or sold. Credit Suisse, a very large pla yer in the industry, has indicated it ... according to a 1991 study by the Paci fic Northwest Laboratory) has ... national basis and likely to be an area add ressed early on by the new ...

emerging market – Page 3 – IMF Bloghttps://blogs.imf.org/tag/emerging-market/page/3After a decade of high growth and a swift rebound after the collapse of U.S. investment bank Lehman Brothers, emerging markets are seeing slowing growth. Their average growth is now 1½ percentage points lower than in 2010 and 2011. This is a widespread phenomenon: growth has been slowing in roughly three out of four emerging markets.

The next 10 years look promising for Romania | Property Forumhttps://www.property-forum.eu/news/the-next-10-years-look-promising-for-romania/2922About 10 years ago, Lehman Brothers’ bankruptcy would mark the peak of the global financial crisis and would be followed by a deep recession in several parts of the world, including Romania. However, Romania has come a long way in the last decade, with the economy seeing some radical transformations, as well as in real estate; the real estate consultancy company Colliers International ...

5 things Yellen's Fed tenure will be remembered for ...https://journalstar.com/news/national/things-yellen-s-fed-tenure-will-be-remembered...5 things Yellen's Fed tenure will be remembered for ... when Lehman Brothers' collapse ignited the most dangerous phase of the financial crisis, show that Yellen helped drive the Fed to unleash ...

Speech by Deputy Governor Amamiya at a Reuters Newsmaker ...www.boj.or.jp/en/announcements/press/koen_2019/ko190712a.htmWhen the Great East Japan Earthquake hit Japan, there was a significant increase in cash withdrawal in disaster areas. 3 Also, when the Lehman Brothers bankruptcy led to a financial crisis in Iceland, demand for cash soared so high that the Central Bank of Iceland's inventory of banknotes was nearly exhausted. 4 These facts show that it is ...[PDF]Essays on Actively and Passively Managed Financial Productshttps://edoc.hu-berlin.de/bitstream/handle/18452/17962/meinhardt.pdf?sequence=1Lehman Brothers. The second study, “Exchange-Traded Funds ersus Index Certificates”, analyzes this contradiv c-tion by comparing the money flows of both ETFs and index certificates within one market. To my knowledge, this is the first study to consider possible dependencies between ETFs and …

Comprehensive News Analysis Dec 21, daily news analysis ...https://byjus.com/free-ias-prep/upsc-exam-comprehensive-news-analysis-dec21This is not the case in India. In 2010, an article in The Economist article focussed on how a bail-in could have changed the outcome for Lehman Brothers in September 2008. In 2008 the only option was to choose between systemic failure and a taxpayer bail-out.[DOC]Testimony of Mark Chttps://archives-agriculture.house.gov/sites/... · Web viewIn the last 12 months alone, the failure or default of a major swap dealer, Lehman Brothers, two of the world’s largest debt issuers, Fannie Mae and Freddie Mac, and a sovereign country Ecuador, in addition to the more routine failures of other counterparties have …[PDF]Political Conflict in Europe in the Shadow of the Great ...https://www.eui.eu/Projects/POLCON/Documents/POLCONdescriptionwebsite.pdfof the European integration process in the shadow of the Great Recession. Since the world has entered the Great Recession with the breakdown of Lehman Brothers in Fall 2008, commentators have been afraid of the political repercussions of the economic crisis. The specter of the thirties is haunting many observers of European politics.

Goodbye Hipsters, You Tried To Change The World And In ...https://lovindublin.com/opinion/will-the-last-hipster-to-leave-the-building-please...Dec 20, 2016 · If you've been following the news in the last couple of weeks, you'll have seen footage of a mob trying to burn down a cereal café in East London.. The business was the focal point for a rally against gentrification and an escalating housing crisis in East London.[PDF]GROW 2009 | Annual Reportwww.usfunds.com/media/files/pdfs/annual--semi-annual-reports/Annual-Report09.pdfimproved as the year wore on and we now join you in looking forward to better times ahead. The global credit crisis — primed by the massive issuance of derivative securities and triggered by the collapse of the Lehman Brothers investment bank — took no prisoners within the ? nancial sector.

The Most Powerful Wealth-Building Secret in Investing ...https://internationalman.com/articles/the-most-powerful-wealth-building-secret-in...Four years later, Templeton sold his portfolio for a 300% gain. Today, he’s known as the greatest stock picker of the last century. • In 2008, iconic U.S. bank Lehman Brothers failed… It was the biggest bankruptcy in U.S. history. U.S. stocks crashed more than …

Bankruptcy & Restructuring 2012 Review and 2013 Outlookhttps://www.slideshare.net/bloombergbrief/bankruptcy-restructuring-yearendOutlook For 2013 Restructurings, Review of 2012 Bankruptcies. Bankruptcy professionals expect restructurings for retailers, restaurants, real estate businesses…[PDF]Journal Of Investment anagement JOIMhttps://www.joim.com/wp-content/uploads/emember/downloads/2.pdfThis is a clinical analysis of the demise of the Reserve Primary Fund, the ?rst ever money market fund. Reserve Primary was caught in a perfect storm of its own making when the ?nancial markets went into a full-blown crisis mode with the bankruptcy of Lehman Brothers on September 15, 2008. However, if the fund’s management had not abandoned

Let's Talk Turkeys - Wedged In: Building Community in ...https://wedgedinmpls.blogspot.com/2016/03/lets-talk-turkeys.htmlLet's Talk Turkeys ... This was the month that saw the collapse of Lehman Brothers, a sprawling global bank, a collapse which almost brought down the world’s financial system. The industry was saved by huge taxpayer-financed bailouts. But now chary of lending to individual home buyers, the "too-big-to-fail" banks have turned their corporate ...

Quartzo Investments | The Most Powerful Wealth-Building ...quartzoinvestments.com/2018/02/15/the-most-powerful-wealth-building-secret-in-investingFour years later, Templeton sold his portfolio for a 300% gain. Today, he’s known as the greatest stock picker of the last century. • In 2008, iconic U.S. bank Lehman Brothers failed… It was the biggest bankruptcy in U.S. history. U.S. stocks crashed more than …[PDF]IT'S TIME TO TAKE OVER THE BANKShttps://theclarionmag.org/wp-content/uploads/2018/10/FBUbankspamphlet.pdfSachs or Lehman Brothers, but also Britain’s high street banks like Barclays, Lloyds, HSBC and Royal Bank of Scotland (RBS). They all had investment arms desperate to get in on the speculative boom. Yet as Lord Turner, chair of the Financial Services Authority said in 2009 after the crash, some of this was ‘socially useless activity’2.

'I fought the good fight, but hell was at the gates ...https://www.independent.ie/irish-news/i-fought-the-good-fight-but-hell-was-at-the...Jun 11, 2011 · 'I fought the good fight, but hell was at the gates' ... Once Lehman Brothers filed for bankruptcy in New York, it sparked panic across the financial markets and …

And the Winner Takes it All | New Zealand Financial ...https://www.pascoebarton.co.nz/articles/and-winner-takes-it-allThe major news out of the United States on Monday night (NZ time) was that one of the world’s largest investment banks, Lehman Brothers, had filed for bankruptcy protection after an expected bail out failed.[PDF]Short-Term Debt and Bank Riskhttps://www.cambridge.org/core/services/aop-cambridge-core/content/view/FE96644EBDA...The extant literature suggests that one of the main causes of the recent ?nancial crisis was the excessive use of short-term debt by banks. Using a large sample of banks, we ?nd that increases in repurchase agreements (repos) were recognized by external capital markets to increase bank risk in the pre-crisis period.

Workplacehttps://blog.standardlifeworkplace.co.uk/market-review-october-2018Nov 09, 2018 · But September, for example, was the month where sterling exited the European exchange rate mechanism and the investment bank Lehman Brothers collapsed. There’s a famous quote from Mark Twain, the American author: “October: This is one of the peculiarly dangerous months to speculate in stocks.

Obama cabinet | Notjustdirt's Bloghttps://notjustdirt.wordpress.com/tag/obama-cabinetJan 21, 2009 · By every consensus, this is one of the worse financial crisis in the history of the nation. The epic center or ground zero is “Wall St” with the collapse of AIG, Merrill Lynch, and Lehman Brothers. This occurred on Geithner’s watch. All companies are headquartered in New York and arguably not all of these companies are banks.

Ultimate Bottom Lies Far Below - Ricks Pickshttps://www.rickackerman.com/2009/08/ultimate-bottom-lies-far-belowAug 31, 2009 · Because we never shared investors’ wild enthusiasm for Cerberus, its near-collapse in recent days hardly came as a shock. The once-huge private-equity firm specialized in distressed assets at a time when even the bluest of blue-chip companies – the name Lehman Brothers springs to mind – have fallen into mortal peril literally overnight.

Antiquities and Ancient Art: Why Antiquities May be Your ...https://antiquities.blogs.com/antiquities/2009/01/why-antiquities-may-be-your-best...Jan 18, 2009 · Lehman Brothers. Bear Sterns. AIG. Countrywide. Merrill Lynch. Banks. Airlines. Car companies. Even Bank of America, the most important and arguably one of the best run financial institutions in the world, has seen its stock plummet from $45 to $7 in less than a year. In contrast, the art market so far has largely weathered the storm.

Too much failure to avoid big regs | Futureswww.futuresmag.com/2009/10/31/too-much-failure-avoid-big-regsOct 31, 2009 · Upon the anniversary of the Lehman Brothers bankruptcy — the event many measure as the beginning of the current financial crisis, though it more accurately could be described as the …

Information Inadequacy: Some Causes of Failures in Human ...https://issuu.com/academic-conferences.org/docs/ejise-volume14-issue1-article701Feb 15, 2011 · On the other hand, we focus on dramatic situations such as the financial failures of the Lehman Brothers' bankruptcy 2008, and the Enron bankruptcy 2001, the disasters of …

Be Careful What You Wish For | Grand Rantshttps://grandrants.wordpress.com/2008/11/23/be-careful-what-you-wish-forNov 23, 2008 · Be Careful What You Wish For ... Consider how much darker the economic picture has grown since the failure of Lehman Brothers, which took place just over two months ago. And the pace of deterioration seems to be accelerating.” ... In the minds of the people, the Obama administration. I don’t think we can wait until January 20.” ...[PDF]T S OMPLICATED HY THE VOLCKER ULE IS UNWORKABLEhttps://scholarship.shu.edu/cgi/viewcontent.cgi?article=1469&context=shlron the collapse of Lehman Brothers as an illustrative example. Part III details the Volcker Rule and its ban on proprietary trading, including the ambiguities that play a significant role in making the rule ineffective. Part IV argues that the Volcker Rule in its current form is not only misguided, but borderline unworkable and at the

Chemjobber: Ten years ago: Reserve Money Market breaking ...https://chemjobber.blogspot.com/2018/09/ten-years-ago-reserve-money-market.htmlThe Reserve Primary Fund was a large money market mutual fund. On September 16, 2008, during the Global financial crisis of September–October, 2008, it lowered its share price below $1 ("breaking the buck") because of exposure to Lehman Brothers debt securities.

Looking for Double-Digit Dividend Growth? Try This Sector ...https://www.nasdaq.com/articles/looking-double-digit-dividend-growth-try-sector-2015-03-20Mar 20, 2015 · Prior to Lehman Brothers' bankruptcy in September 2008, many of the nation's largest banks were also some of the market's biggest dividend payers. But that came to a …

12 Very Ominous Warnings About What A U.S. Debt Default ...https://www.blacklistednews.com/12_Very_Ominous_Warnings_About_What_A_U.S._Debt...Once again, just don’t take my word for it. The following are 12 very ominous warnings about what a U.S. debt default would mean for the global economy… #1 Gerald Epstein, a professor of economics at the University of Massachusetts Amherst: “If the US does default, that will make the Lehman Brothers bankruptcy look like a cakewalk”[PDF]TMRS Board Sets 2008 Interest Rate Ahttps://www.tmrs.com/down/pubs/MS_Fall08.pdfaffected by the failure of Lehman Brothers and other companies, although we, like all big investment funds, have seen the value of ... are the best means of ensuring retirement ... You may have noticed that the only Main Street newsletter we have mailed to cities this year. We reduced the number of

Kristin Moyer — A member of the Gartner Blog Networkhttps://blogs.gartner.com/kristin_moyer/page/2by Kristin Moyer | September 16, 2010. Stessa Cohen here. A couple of years ago, we went through the initial shockwaves of the financial crisis. A couple of financial services firms like Lehman Brothers and some others suddenly went out of business. Consumers had questions, were fearful of what would happen to their retirement and bank accounts.

Ominous Warnings About U.S. Debt Default and Impact on the ...www.marketoracle.co.uk/Article42611.htmlThese are the things that top financial experts all over the planet are saying will happen if there is an extended U.S. debt default. ... that will make the Lehman Brothers bankruptcy look like a ...

Reforming finance: Living wills - Death warmed up ...https://www.economist.com/finance-and-economics/2009/10/01/death-warmed-upLehman Brothers had 2,985 legal entities, and in the panic before its collapse it became abundantly clear that no one understood its counterparty relationships with the rest of Wall Street.

How does a nation prevent its public finances being ...https://www.researchgate.net/post/How_does_a_nation_prevent_its_public_finances_being...How does a nation prevent its public finances being subject to boom and bust cycles? ... I think that a question that is fairly easy to answer in theory but in practice is very difficult ...…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Jeffrey P. Snider - EzineArticles.com Expert Authorhttps://ezinearticles.com/expert/Jeffrey_P._SniderAug 14, 2008 · Now that the federal government has committed to a bailout of AIG, after saying no to Lehman Brothers, what does this mean for the economy and the markets? This is an unprecedented move that shows just how serious this crisis has become. Fear is the word of the month, and it is building.

US default unlikely, but Thailand must prepare for worst ...https://www.nationthailand.com/business/US-default-unlikely-but-Thailand-must-prepare...This makes it difficult to forecast what the impact would be. But one place to start could be to look at an event like 2008 when Lehman Brothers collapsed. When Lehman Brothers collapsed there was a crisis of confidence in the markets and banks, for example, became nervous about lending to one another because they were not confident in each other.

Op-Ed: Without Crypto, Your Money Doesn’t Exist - DCEBriefhttps://dcebrief.com/op-ed-without-crypto-your-money-doesnt-existOf course, not always the case, as seen with Lehman Brothers in 2008 and Greek banks in 2015. Moreover, rising government debt may further reduce the likelihood of bank bailouts in future financial crises. Banks no longer fulfill the function for which they were originally designed — to keep our money safe in collapse scenarios.

ICE | Toni Tilevawww.tonitileva.com/tag/iceRevitalized after the period of crisis, the private prison industry moved to secure its future by pursuing the incorporation of guaranteed minimums into contracts. CCA’s 2003 contract for the Houston Processing Center was one of the first to include a guaranteed minimum, this one for 375 persons.[PDF]Chapter 4 Measuring Systemic Risk Overviewgovtpolicyrecs.stern.nyu.edu/docs/whitepapers_ebook_chapter_4.pdfChapter 4 * Measuring Systemic Risk . ... Lehman Brothers and AIG all contributed to systemic risk in the ... The first is more transparent and likely to flag obvious candidates; the second is a reality check based on market perceptions as to whether some candidates have

Accounting,corporate governance and ethics Essayhttps://studentshare.org/finance-accounting/1420069-accountingcorporate-governance-and...Lehman Brothers filed for bankruptcy on Sunday September 15, 2008, but the signs of poor ethicality and governance were manifesting months in advance of that moment. The company began operations in 1850, according to the New York Times (2010), in Montgomery, Alabama, when the two younger brothers took over the business of their recently ...

Cain and '9-9-9' plan seize spotlight at debate - politics ...www.nbcnews.com/id/44859731/ns/politics-decision_2012/t/cain----plan-seize-spotlight...Cain and '9-9-9' plan seize spotlight at debate ... there areembedded taxes. one of the great features on the first nine, ... the lehman brothers collapse. we know what happened after that, ...[PDF]November 26, 2012 - Bankruptbankrupt.com/DI2012/DI2012FINAL.pdfveteran attendees, you know that our 19th consecutive year hosting Distressed Investing. And for first-time attendees, we hope you make this an annual event. Our sponsors, as ever, are the lifeblood of this gathering. They represent the best, the brightest, and the most knowledgeable professionals in the world of restructuring.

Cain and '9-9-9' plan seize spotlight at debate - TODAY.comwww.today.com/id/44859731/ns/today-today_news/t/cain----plan-seize-spotlight-debateFormer Godfather's Pizza CEO Herman Cain and his "9-9-9" economic plan were the main point of discussion at Tuesday night's Republican presidential debate, …[PDF]The Final Countdown - Pensions Management Institutehttps://www.pensions-pmi.org.uk/documents/kempen-the-final-countdown/kempen-fixed...The upcoming referendum is likely to be one of the biggest single risk events in UK markets since the collapse of Lehman Brothers in 2008, as such it is worth examining what markets are currently expecting and what the reaction there could be under the two different scenarios.

Robert DeLucia, Prudential Retirement Brokerage Services ...https://www.globalcapital.com/.../robert-delucia-prudential-retirement-brokerage-servicesLast year, the Lehman Brothers Aggregate Bond Index came in at 4% because the 10-year ended the year about where it started. This year, I think rates are going to be slightly higher, but enough to ...[PDF]Corporate Clients · Real Estate Clients Transportation ...https://www.hcob-bank.de/media/en/pdf_3/investorrelations/geschaeftsber/2008/gb2008/...are the only way to turn the tide on the recession and move towards moderate growth. The financial crisis has also hit HSH Nordbank AG. For the first time in the Bank’s history we are having to report a Group deficit. Just a year ago, we were more optimistic. But the environment has changed since the insolvency of Lehman Brothers and the dissipa-

The Finanser's Week: 13th April 2015 - Chris Skinner's bloghttps://thefinanser.com/2015/04/the-finansers-week-13th-april-2015-19th-april-2015.htmlApr 19, 2015 · Outlook It’s one ring-fence that no one in the City, in theory at least, objects to. One of the lessons from the Lehman Brothers’ collapse was that financial institutions need to keep clients’ money strictly segregated from their own funds. Barclays discovers the value of its depositors – The Independent

Job market looks slightly better for 2012 graduates ...https://www.syracuse.com/news/2012/05/job_market_looks_slightly_bett.htmlIn some ways, members of the class of 2012 got lucky. They arrived on campus in September 2008, the same month that Wall Street investment bank Lehman Brothers collapsed, touching off a financial ...

- Banking, Corporate Governance and the 2007 Financial ...ae.studybay.net/free-essays/banking-corporate-governance-and-the-2007-financial-crisisAnother limitation of our study is that, in the fall of 2008, countries stepped in with capital injections and other forms of support of banks. Such intervention might have distorted returns. Yet, our results generally hold for returns measured from mid-2007 to just before the Lehman Brothers bankruptcy in …

Isda aims to improve collateral management processes ...https://www.risk.net/.../1517773/isda-aims-improve-collateral-management-processesOne of these is to improve how dealers hold initial margin posted by buy-side investors for derivatives trades. The buy-side community has been keen to tackle this after some had their initial margin trapped in Lehman Brothers when the bank collapsed last September.

Hacking NYC with Steve Blank, Maria Gotsch, and Maria ...https://www.alleywatch.com/2016/01/hacking-nyc-steve-blank-maria-gotsch-maria-torres...Innovation often springs out of crisis situations according to Blank. The rest of the panel referenced the dot com bubble recovery, and a need to diversify away from Wall Street after the Lehman Brothers collapse in 2008. The NYCEDC was engineered in response to these crisis events.

Banking on Legitimacy: The ECB and the Euro Zone Crisishttps://www.jstor.org/stable/43134245As the euro-mess drags on and on, the inability of ... but it also has Kathleen R. McNa-mara is Director of the Mortara Center for International Studies at Georgetown Univer-sity. She is an expert on ... Sterns, Lehman Brothers and Merrill Lynch, the housing market …

After the Hype - Posthumanism - Goethe-Institut Kanadahttps://www.goethe.de/ins/ca/en/kul/cfo/phm/21689277.htmlAfter the real estate bubble in North America burst in 2007, US investment bank Lehman Brothers’ bankruptcy marked the initial peak of the global financial crisis that is still impacting the world today. Like dominos, the fall of Lehman Brothers brought other banks - and over time entire countries - to …

Why do some people believe that the US won't end up like ...https://answers.yahoo.com/question/index?qid=20100508132651AAAIEkaMay 08, 2010 · Why do some people believe that the US won't end up like Greece? ... I think our current tipping point is about 2030 but it could be much sooner. Also Greece's problems may have been caused by over regulation so it may seem logical to deregulate. ... This has proved by the old time US Ponize Scheme, Madoff, Lehman Brothers, and the recent ...[PDF]Economic Letter - Dallasfed.orghttps://www.dallasfed.org/assets/documents/research/eclett/2014/el1413.pdfes at an increasing rate as the jobless rate falls (Chart 4). The pre-financial-crisis relationship between wage inflation and the unem-ployment rate is captured by the curve plotted in Chart 4, which is fitted to data that end just before Lehman Brothers’ failure in third quarter 2008.5 There are a few quarters during the mid-1980s that

The Essence of Keynes and the Value of Macroeconomics, 23 ...https://blogs.warwick.ac.uk/markharrison/entry/the_essence_ofSay's Law [Krugman writes] isn't true, because in a monetary economy people can try to accumulate cash rather than real goods. And when everyone is trying to accumulate cash at the same time, which is what happened worldwide after the collapse of Lehman Brothers, the result is an end to demand, which produces a severe recession.

richlab authors the complete lexicon of crisis related ...https://www.designboom.com/design/richlab-authors-the-complete-lexicon-of-crisis...Nov 17, 2014 · dutch designer richard sluijs from richlab has authored a book titled 'the complete lexicon of crisis related suicides'. ... of lehman brothers investment bank would lead to. the protest sign was ...

Finance and Development - IMFhttps://www.imf.org/external/pubs/ft/fandd/2010/03/kaplan.htmLarge bonuses were not a primary cause of the financial crisis. Bear Stearns and Lehman Brothers were more aggressive than their peers in encouraging employees to defer bonuses or invest them in company stock rather than take cash up front. Stock ownership and bonus deferral did not save those firms.

Seeing double at central banks[1]- Chinadaily.com.cnwww.chinadaily.com.cn/opinion/2011-07/12/content_12883573.htmThe last decade – until the collapse of Lehman Brothers in September 2008 – was known as the Great Moderation, a period of low inflation and strong growth that reflected major new developments ...

After the Hype - Goethe-Institut USAhttps://www.goethe.de/ins/us/en/kul/wir/21689277.htmlAfter the real estate bubble in North America burst in 2007, US investment bank Lehman Brothers’ bankruptcy marked the initial peak of the global financial crisis that is still impacting the world today. Like dominos, the fall of Lehman Brothers brought other banks - and over time entire countries - to …

We need strong banks with good balance sheets - Telegraphhttps://www.telegraph.co.uk/finance/newsbysector/banksandfinance/10339938/We-need...Sep 28, 2013 · We need strong banks with good balance sheets Five years ago, the collapse of Lehman Brothers and subsequent failure of RBS and several other major Western banks prompted a …

ANALYSIS-Next phase of financial crisis may be the hardestblogs.reuters.com/financial-regulatory-forum/2010/05/24/analysis-next-phase-of...May 24, 2010 · WASHINGTON, May 21 (Reuters) – It took $5 trillion and an unprecedented global coalition of G20 countries to stabilize the economy after investment bank Lehman Brothers collapsed in 2008. Quelling the next phase of the financial crisis may be even harder.

The calm after the storm | Middle East Construction Newshttps://meconstructionnews.com/205/the-calm-after-the-stormNov 02, 2010 · At Cityscape Dubai in October 2008, just weeks after the demise of the Lehman Brothers investment banks caused the biggest shake-up Wall Street had seen in decades, Dean recalls that Nakheel said “there may be a slowdown, but not a crisis”. “Whereas Emaar admitted there were changes on the horizon.

The enigma of capital - O Caderno de PatrickO Caderno de ...https://caderno.allanpatrick.net/fichamentos/the-enigma-of-capitalThe enigma of capital and the crises of capitalism. David Harvey. Edição de 2010. Pág. 28.Excesso de poupança; ineficiência privada. There has been a serious underlying problem, particularly since the crisis of 1973—82, about how to absorb greater and greater amounts of capital surplus in the production of goods and services.[PDF]Corporate and Securities Law Alerthttps://www.pepperlaw.com/uploads/files/corpsecalert092208.pdfarguably was a major factor in the bankruptcy of Lehman Brothers Holdings (and threatened Goldman Sachs and Morgan Stanley), the government takeover of AIG, the quick sale of Merrill Lynch to Bank of America, and a two-day drop in the Dow of 1,000 points. How did short-sell-ing pressure cause such turmoil? ... such as the continuing credit ...

Bankers Kick Frugality Out the Window and No One Noticeshttps://www.yahoo.com/news/bankers-kick-frugality-window-no-one-notices-20110408...Apr 08, 2011 · The 55-year-old chief executive was awarded stock options worth $17m and a "cash incentive" of $5m in 2010, on top of his basic salary of $1m. ... and the collapse of Lehman Brothers…

Excellence is obsolete: redefining the standard for successhttps://www.wealthprofessional.ca/business-strategy/excellence-is-obsolete-redefining...Apr 23, 2019 · As the founder of JotForm, should I be encouraging our 130 employees to strive for excellence and nothing less? ... the former Lehman Brothers CFO (who left shortly before the collapse), wrote in a New York Times article, ... but it’s equally important to step back and re-evaluate from time to time. Examine your short and long-term goals, and ...

Logistics News ME - October 2016 by BNC Publishing - Issuuhttps://issuu.com/logisticsnewsme/docs/lnme_oct2016/6Oct 01, 2016 · It’s a storm that was made all the more clear over recent weeks with the collapse of Hanjin Shipping Co., an event likened to the collapse of Lehman Brothers and, sure to have repercussions ...[PDF]JEFF KINKLE AnD ALBERTO TOSCANO AnALyZe fILMs ABouT ...https://www.jstor.org/stable/10.1525/FQ.2011.65.1.39and a crass upstart, and a transatlantic flight by a renowned aviator to find oil in Guyana, L’Herbier constructed a gran- ... The Last Days of Lehman Brothers (Michael Samuels, 2009, TV) Margin Call (J. C. Chandor, 2011) ... but it is deluded to think we can arrest it.

Japan posts record fiscal year trade deficit | Business ...https://www.dw.com/en/japan-posts-record-fiscal-year-trade-deficit/a-15894392-1Japan logged a record trade deficit in the 12-month fiscal year ending in March 2012, the Finance Ministry reported on Thursday. The country's export shortfall totaled 4.410 trillion yen ($54.2 ...[PDF]The eff ects of global economic crisis in Hungarywww.mtafki.hu/konyvtar/kiadv/HunGeoBull2012/HunGeoBull_2012_2_155-173.pdfof Lehman Brothers in September 2008 extended (globalised) the crisis and transferred it on to the ? nancial market. Thu s, the glob al economic crisis started o? the real estate and credit markets and then pulled the money market. The U.S. sub-prime real estate …[PDF]Annual Report 2009/3 - Orixhttps://www.orix.co.jp/grp/en/pdf/ir/library/annual_report/AR2009_13E.pdfIn the securities market, since the Lehman Brothers bankruptcy filing, severe economic and market conditions have continued, and individual investor sentiment has yet to recover. Still, with governments around the world responding with measures to address the worsening economy, the markets indicate optimism for an early economic recovery.

Role of Government | Bunk in the Westhttps://bunkinthewest.wordpress.com/category/role-of-governmentOct 06, 2009 · Put aside that cutting back on spending would have a de-stimulating effect on the economy. And forget for a while who is most impacted by the current economic crisis (hint: it isn’t the CEO’s of Bear Stearn, Lehman Brothers, GM, Citibank, or AIG). Let’s think about what targetting wasteful spending really means.

Category: European Politics - Gavinsblog.comhttps://www.gavinsblog.com/category/european-politicsIt’s now 2,840 days since Lehman Brothers filed for bankruptcy, and we are still living in the crisis wrought on the global economy. It is probably widely perceived that 2008 is a long time ago, that we’ve moved on with our lives, that the crisis is in the past, that unemployment is …

Cash is a fact. Profit is an opinion! - Farmer's Weeklyhttps://www.farmersweekly.co.za/.../cash-is-a-fact-profit-is-an-opinionAug 07, 2019 · On 9 September 2008, in his report to shareholders, the chairperson reported: “We have produced another year of record revenues, net profit, and earnings per share, and successfully managed through the difficult market environment.” Just six days later, Lehman Brothers filed for bankruptcy.

Understanding blockchain & the “value revolution” as a ...https://www.hiddenwires.co.uk/features/article/understanding-blockchain-the-value...Fundamentally there’s a big issue here. We’re relying on third parties (banks, governments and other large institutions) to store and move our money. If an institution fails (e.g. the collapse of Lehman Brothers in 2008) or a government becomes corrupt our money can simply disappear overnight. In addition, there are restrictions as to how ...

Cost For Bankruptcy? Bankruptcy Lawyers' High $1,000-Per ...https://ezinearticles.com/?Cost-For-Bankruptcy?-Bankruptcy-Lawyers-High-$1,000-Per...Jan 15, 2007 · It was a fee whose magnitude prompted another reporter in a more recent bankruptcy case, to call the fee of $950 per hour charged by the New York law firm of Weil, Gotshal & Manges in the largest American bankruptcy case in history, the Lehman Brothers Holdings Inc case, to "look cut-rate and a mere" paltry sum.

Astroair Astrology by Mandi Lockley: September 2009https://mandilockley.blogspot.com/2009/09Sep 28, 2009 · At the time, the first hit of the current Saturn-Uranus oppositions was approaching and Pluto was moving towards its first passage through the zero degree Capricorn Aries Point, a powerful position of revelation, reflected in the timing of the Lehman Brothers very public collapse, as well as in the public call for the reform of our financial ...

Uncle Sam's $700+ Billion Toxic Securities Fund ...www.investorsinsight.com/blogs/forecasts_trends/archive/2008/09/23/uncle-sam-s-700...Last Tuesday, one of the oldest and largest institutional money market funds, the Reserve Primary Fund, announced that its share price had fallen below the $1.00 level to 97 cents. In financial terms, it "broke the buck." The Reserve Primary Fund dipped below $1.00 as a result of the bankruptcy of Lehman Brothers.

White Rose Evolution: Possible New Major Events.https://lanariaamberkira.blogspot.com/2016/11/possible-new-major-events.htmlNov 06, 2016 · It was one of the banks, which “was too large, to fall.” And yet, it is in great distress and in danger of falling. There is still very little learned, after Lehman Brothers and the banking crisis that followed. This situation should cause great concern as it is a real threat for a financial waterloo.

Bill Bowen's Profile | Typepadhttps://profile.typepad.com/1210200361s25151The remembrance of 9/11 has become a one day event, something like Armistice Day celebrating the end of World War I. Perhaps because the American psyche (and the Bush presidency) was shaken a short seven years later by the collapse of Lehman Brothers and the Great Recession. Perhaps... Continue reading

Currency Collapse | Phil's Stock Worldhttps://www.philstockworld.com/tag/currency-collapseThis is exactly the kind of market action we saw leading up to Lehman Brothers. In 2008 the dollar rallied as signs of deflation began to sprout up. This was an instant red flag for anyone who understood the deflationary forces at work (and a total surprise for the inflationistas). The dollar ultimately rallied 26% from peak to trough.

Defying Donald Trump’s Kleptocracy : Information Clearing ...www.informationclearinghouse.info/46149.htmDefying Donald Trump’s Kleptocracy. By Chris Hedges. January 02, 2017 "Information Clearing House" - " Truth Dig" - The final stages of capitalism, Karl Marx predicted, would be marked by global capital being unable to expand and generate profits at former levels.Capitalists would begin to consume the government along with the physical and social structures that sustained them.[PDF]the leading property magazine in the nordic regionhttps://www.fastighetssverige.se/magasin_fsve/fsve_F2-11_ENG.pdfbankruptcy of the Lehman Brothers in autumn 2008. we are currently facing primarily two risks: a debt crisis in Europe and in the first instance an economic crisis in the USA, even though the political risk in the USA must not be underesti-mated. In Europe, it is the public debt crises that need to be dealt with.[PDF]Working PaPer SerieShttps://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1530...Lamfalussy is one of the leading central bankers of his time and one of the main supporters of a single capital market within the European ... the rst paper that explicitly tackles the behavior of trade in ... shocks does not reduce the e ect on trade. Hence, as the aggregate e ects of new uncertainty shocks on the real economy could be ...

grey’s anatomy | FRESH is BACKhttps://freshisback.wordpress.com/tag/greys-anatomyOct 13, 2009 · The woman tells me that she does not have my current ID photo on file, so she has to take a new one. Of course, the one day that I had planned to be a hermit at my desk, avoiding people at all costs in my “I need to do laundry” outfit. My new ID photo comes out looking like I just got hopped up on acid with Nick Nolte.[PDF]Risky Business and the Politics of Risk: Is the Insurance ...https://www.cii.co.uk/media/843968/TP25_Swift_Politics_of_Risk_14Sep2009.pdfor a graduate blindly taking the first job offered to them to clear their student overdraft, there are not ... as the companies that have been portrayed as the authors of the turmoil are the money lenders. ... The collapse of Lehman Brothers, and government bailouts of Northern Rock and RBS in the UK, and Bear Stearns in the US, now means ...

BBC - Newsnight: From the web team: Prospects for ...https://www.bbc.co.uk/blogs/newsnight/fromthewebteam/2008/09/prospects_for_wednesday...Sep 10, 2008 · This is less than 50% of previous levels of lending which means there is now at least 50% less business about which means there are too many …[PDF]Risky Business and the Politics of Risk: Is the Insurance ...https://www.cii.co.uk/media/843968/TP25_Swift_Politics_of_Risk_14Sep2009.pdfor a graduate blindly taking the first job offered to them to clear their student overdraft, there are not ... as the companies that have been portrayed as the authors of the turmoil are the money lenders. ... The collapse of Lehman Brothers, and government bailouts of Northern Rock and RBS in the UK, and Bear Stearns in the US, now means ...

Outside the bubble - The Sydney Morning Heraldhttps://www.smh.com.au/business/outside-the-bubble-20090918-fvgm.html''It is as if, as the Titanic was sailing into iceberg-infested waters, those with the requisite skills and training to warn of the impending danger were instead hard at work, in a windowless ...[PDF]vlasset.comvlasset.com/interview/Eurekahedge_interview_2016_published.pdfLehman Brothers' collapse, dragged stock valuation to very attractive levels. Adrian, one of the earliest investors of my first hedge fund more than a decade ago, is now our Compliance Officer and Chief Operations Officer. ... portfolio and particularly the case for a China fund. ... and a lot of Taiwan listed equities have substantial ...

The vicious economic cycle has begunhttps://www.bangkokpost.com/opinion/opinion/...Dec 05, 2019 · This is called the vicious cycle of economic growth. ... The Lehman Brothers crisis of 2008 would have destroyed the US economy, and the world economy as well if …

10 years after the financial crisis that just about ...https://www.tapatalk.com/groups/currenteventsii/10-years-after-the-financial-crisis...Sep 16, 2018 · The collapse of Lehman Brothers: 10 years later When John Taylor starts remembering the years leading up to the financial crisis, his fury wells up all over again. As president of the nonprofit National Community Reinvestment Coalition, he warned Congress about the predatory and fraudulent lending that was fueling a housing bubble as early as 2000.

The Market For "Lemons": A Lesson For Dividend Investors ...https://www.gurufocus.com/news/340792/the-market-for-lemons-a-lesson-for-dividend...Jun 12, 2015 · Examples of companies with a high dividend yield and a low DCR that were subsequently delisted or filed for bankruptcy include General Motors, Lehman Brothers, Washington Mutual and Fannie Mae. In Table 3 , we divide the 200 highest yielding equities from Table 1 into two groups: the 100 equities with the highest distress risk (as measured by ...[PDF]How Can We Improve The Predictive Power : The Case of the ...psrcentre.org/images/extraimages/43. 1211199.pdfthese forecasts as the predictive trading band of today. To determine the predictive power of the time series models, we used exchange rate forecasts over an extended period starting from January 4, 1999 (which included the forecasts from December 19, 2005, to April 30, 2009). Further, we used intraday highs and lows for the KRW/USD exchange rate

Deutsche Bank Collapse Has Begun! A Major Stock Market ...https://patriotmoneynews.com/deutsche-bank-collapse-has-begun-a-major-stock-market...And now it appears that the next “Lehman Brothers moment” may be playing out right in front of our eyes. Now more than ever, keep a close eye on Deutsche Bank, because it appears that they could be the first really big domino to fall and a huge stock market crash will hit our planet.

Smashwords – About James Constant, author of 'On ...https://www.smashwords.com/profile/view/jamestmsnJun 30, 2013 · This is the biography page for James Constant. writes on law, government ... has kept Pax Americana alive at great cost. The Lehman Brothers bank and Greek default were significant events because they threatened the immediate collapse of the U.S. and E.U. economic systems. ... Since the first part of the 20th century we have seen exponential ...

Liberals do not have any answers to crisishttps://socialistworker.co.uk/art/47221/Liberals+do+not+have+any+answers+to+crisisSep 18, 2018 · Ten years after the collapse of Lehman Brothers, it’s a matter of controversy whether the global economic crisis it helped to precipitate is over. ... This is what happened in 2007-8, as the ...

Reliving the financial meltdown, ten years laterhttps://www.wtva.com/content/national/493102861.htmlSep 13, 2018 · The mounting crisis turned into a full-blown crash nearly 10 years ago, when Lehman Brothers filed for the largest bankruptcy in United States history on September 15, 2008. Stuffed to the gills with bad mortgages, it sustained heavy losses as housing prices dropped, and imploded after multiple acquisition deals fell through.

macroeconomics – IMF Bloghttps://blogs.imf.org/tag/macroeconomicsAfter a decade of high growth and a swift rebound after the collapse of U.S. investment bank Lehman Brothers, emerging markets are seeing slowing growth. Their average growth is now 1½ percentage points lower than in 2010 and 2011. This is a widespread phenomenon: growth has been slowing in roughly three out of four emerging markets.

Book Riot Read Harder 2017: January | caitlinsternwriteshttps://caitlinsternwrites.wordpress.com/2017/01/30/book-riot-read-harder-2017-januaryJan 30, 2017 · Book Riot Read Harder 2017: January ... This is about a Cameroonian family living in New York, and the author is from Cameroon, living in New York. ... a senior executive at Lehman Brothers, he thinks he has it made, but then the business collapses, and the Jongas discover just how far they’re willing to go to keep a hold of those dreams.[PDF]REGISTRATION STATEMENT Under The Securities Act of 1933 ...https://www.sec.gov/Archives/edgar/data/1341740/000089161807000508/f31027orsv1xpdfy.pdfdate as the Commission acting pursuant to said Section 8(a) may determine. ... During fiscal year 2006 and the first six months of 2007, we generated worldwide revenue of approximately ... or AHA, stroke is the third leading cause of death and a leading cause of disability in the United States. AHA estimates that the direct and indirect costs ...

Questionable voting in the finance sector | The TBS ...https://www.tbsearch.fr/en/questionable-voting-in-the-finance-sectorOn March 31, 2005, Lehman Brothers chairman and CEO Dick Fuld was re-elected to the company’s board with 87.3% investor support. Four years later Mr. Fuld was ranked as “the worst CEO of all time” by Portfolio magazine, and widely described as having professional and personal qualities that contributed to Lehman’s collapse – and, due to Lehman’s position at the heart of the ...[PDF]Financial Services Point of View - Oliver Wymanwww.oliverwyman.com/content/dam/oliver-wyman/global/en/files/archive/2010/OW_EN_FS...agencies. This is intended to reduce the build-up of enormous, highly interconnected, and often unfunded counterparty risk exposures, which during the crisis were a major transmission mechanism for systemic risk and a contributor to generalized panic conditions. …[PDF]Toward A Bottom-Up Approach to Assessing Sovereign …https://www.gc.cuny.edu/CUNY_GC/media/CUNY-Graduate-Center/PDF/Programs/Economics...risk vulnerability and a relative measure compared to other sovereigns and ... Lehman Brothers even went bankrupt. The cost to the U.S. and other sovereign governments of ... shows a partial list of financial crises (identified by the first year of the crisis) that have occurred in ?advanced? countries. Overall, Latin America seems to have ...

Interest Rate-Tied Structured Notes May be a Good Play on ...https://www.bestcashcow.com/interest-rate-tied-structured-notes-may-be-a-good-play-on...Nov 27, 2016 · Interest rate-tied structured notes come in many different forms. For example, banks can issue notes that are tied to the 3-month CMS or LIBOR that have a cap and a floor (i.e., trade between, say, 3% and 10%). Just a few years ago, they issued notes that paid a fixed rate as high as 8% so long as the 6-month LIBOR stayed between 0 and 6%.[PDF]Jwala Rambarran: The Trinidad and Tobago financial sector ...https://www.bis.org/review/r131112a.pdfLehman Brothers considered too big to fail“ ” collapsed and ignited the worse financial crisis ... and for the first time we have hired a Pension Fund Specialist and a Credit Risk Specialist. ... The Trinidad and Tobago financial sector - creating the future we want ...

VOODOO ECONOMICS: Central Banks Versus the People – By ...https://rielpolitik.com/2019/09/24/voodoo-economics-central-banks-versus-the-people-by...Source - nomiprins.com - "...The financial crisis of 2008 initially fostered a policy of bailing out banks with cheap money that went not into Main Street economies but into markets enriching the few. As a result, large numbers of people increasingly felt that they were …[PDF]MINUTES Louisiana Deferred Compensation Commission …https://wwwcfprd.doa.louisiana.gov/boardsAndCommissions/MeetingMinutes/236_Minutes...MINUTES Louisiana Deferred Compensation Commission Meeting November 15, 2016 ... This is the first time a negative figure appears in this total. The UPA balance is now carrying the Plan, as anticipated. ... portfolio which continue to include Lehman Brothers Unsecured Notes and Becton[PDF]ETFs In Focushttps://www.etf.com/docs/etfsinfocus/04152008_VanguardETFs_in_Focus_Q2.pdf?iu=1Compliments of News Roundup 2 ETFs In Focus Issue No. 6 Second Quarter, 2008 Red Hot Coal The newly launched Market Vectors - Coal ETF (NYSE Arca: KOL) tracks an index of 60

Reliving the financial meltdown, ten years laterhttps://www.wktv.com/content/national/493102861.htmlSep 13, 2018 · The mounting crisis turned into a full-blown crash nearly 10 years ago, when Lehman Brothers filed for the largest bankruptcy in United States history on September 15, 2008. Stuffed to the gills with bad mortgages, it sustained heavy losses as housing prices dropped, and imploded after multiple acquisition deals fell through.

Reliving the financial meltdown, ten years laterhttps://www.waaytv.com/content/national/493102861.htmlSep 13, 2018 · The mounting crisis turned into a full-blown crash nearly 10 years ago, when Lehman Brothers filed for the largest bankruptcy in United States history on September 15, 2008.

Rev. Paul S. Nancarrow | My Bloghttps://upibalonbicol.wordpress.com/category/rev-paul-s-nancarrowPosts about Rev. Paul S. Nancarrow written by andygimpaya. My Blog. ... as the children of Israel fled from the armies of Pharaoh, ... and a strong east wind blew back the waters of the sea, so that God’s people could cross on dry land, and there they were saved.[PDF]Using REIT Data to Assess the Economic Worth of Mega ...https://mpra.ub.uni-muenchen.de/81025/8/MPRA_paper_81025.pdfextreme market-related events such as the Lehman Brothers bankruptcy.) This study contributes to the latter research stream; however, it is also the first study to examine the relationship between the extent of a shock and the characteristics (e.g., location and intended use) of REIT properties.8 The remainder of this paper is organized as follows.

Reliving the financial meltdown, ten years laterhttps://www.wlfi.com/content/national/493102861.htmlThe mounting crisis turned into a full-blown crash nearly 10 years ago, when Lehman Brothers filed for the largest bankruptcy in United States history on September 15, 2008. Stuffed to the gills with bad mortgages, it sustained heavy losses as housing prices dropped, and imploded after multiple acquisition deals fell through.[PDF]On My Radar: Brexit!https://www.advisorperspectives.com/commentaries/2016/06/29/on-my-radar-brexit.pdfJun 29, 2016 · juncture and a link to this week’s Trade Signals. This week’s OMR is a quick read. I hope you find it helpful. ? If you are not signed up to receive my weekly On My Radar e …[PDF]Client Communication - Amazon S3s3-us-west-2.amazonaws.com/madison-advisors/Client...©Madison Investment Advisors, LLC. July 20, 2017 2 3.1% total return Tale of the Quarter U.S. equity markets set record highs again driven by positive sentiment and strong company earnings. U.S. gross domestic product (GDP) growth for the first quarter was a tepid 1.2%, following a 2.1% growth rate reported for the fourth

Bank Stock Investors Are Bracing for Something Worse Than ...https://www.bloomberg.com/opinion/articles/2016-01-19/bank-stock-investors-are-bracing...Jan 19, 2016 · The index of 24 banks has plunged more than 20 percent since it peaked in July at the highest level since the Lehman Brothers bankruptcy in 2008. ... ago for the first …

Novel Surveillance of Psychological Distress during the ...europepmc.org/articles/PMC4670615For example, PD queries increased at the end of 2008 coinciding with the collapse of Lehman Brothers and the consequent stock market crises. The subsequent leveling off in PD queries concurred with modest economic stabilization but remained about 20% …

Novel Surveillance of Psychological ... - PubMed Central (PMC)https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4670615Dec 15, 2012 · For example, PD queries increased at the end of 2008 coinciding with the collapse of Lehman Brothers and the consequent stock market crises. The subsequent leveling off in PD queries concurred with modest economic stabilization but remained about 20% higher than before the Great Recession (~86 versus 73 RSV).

Essay Bankruptcy: Bankruptcy and Xyz Investment Bank ...https://www.majortests.com/essay/Bankruptcy...Monetary Policy and Investment Bank Bear Essay. government had decided to allow the investment bank Lehman Brothers to go bust, and in October the UK government nationalised Royal Bank of Scotland (RBS) and Bradford & Bingley, and forced Halifax Bank of Scotland (HBOS) into a shotgun takeover by Lloyds funded by government money.[PPT]Chapter 9https://twlaimb.weebly.com/uploads/5/2/4/9/... · Web viewChapter 12 Financial Crises in Advanced Economies

“Holy Wars Will Soon Begin” - International Manhttps://internationalman.com/articles/holy-wars-will-soon-beginThis is all adding up to a historic crisis. Of course, when there’s a crisis, most people only see danger. ... dwarfing the Lehman Brothers bankruptcy in 2008 and the 1929 Wall Street crash. ... In fact, she was the first foreign politician to congratulate Trump on his victory. If Le Pen becomes France’s president, she has promised to take ...

Marshall S. Huebner - New York Lawyers - Hatzalahhttps://www.superlawyers.com/new-york-metro/article/hatzalah/2a8604dd-b9c6-4846-8cb9...Nov 03, 2014 · Which brings us to one of his more difficult workouts. On Monday, Sept. 15, 2008, the financial services firm Lehman Brothers filed for bankruptcy—an event that sent shockwaves through the world’s economy. The situation of AIG was equally precarious, and it was asking the Federal Reserve Bank of New York for help.

Chile’s pioneer | Meiningers Wine Business Internationalhttps://www.drinks-today.com/wine/general/chiles-pioneerMEININGER’S: You were one of the first people to look at Chile’s Merlot and say, “This isn’t Merlot” — it turned out to be Carménère. What was the story? MONTES: We already had the Sauvignon Blanc problem. In those early days, our Sauvignon was not even Sauvignon but Sauvignonasse.[PDF]The BRAZILIAN ECONOMYhttps://www2.gwu.edu/~ibi/IBI pages/FGV Report Files/June2009.pdfOne of the most significant aspects of recent developments in the Brazilian banking system after the crisis set off by Lehman Brothers’ bankruptcy last September is the expansion of credit by public banks. The governor of the Central Bank, Henrique Meirelles (see the …

TPS (Time, Price, Scale-in) Revisited - Trading Systems ...https://forums.babypips.com/t/tps-time-price-scale-in-revisited/215204?page=21Jun 24, 2019 · I do think it’s unfair though for Lehman Brothers to always bear the brunt. Bear Stearns were the first but people tend to forget. They were just fortunate enough to be able to deal themselves out of the limelight really. No matter that Lehman took bigger risks: I am still of the opinion that they should have been bailed out.[PDF]The Evolving Financial Situationhttps://rba.gov.au/publications/bulletin/2009/nov/pdf/bu-1109-5.pdfThe evolving Financial SiTuaTion Address by Dr Malcolm Edey, Assistant Governor (Financial System) to Finsia Financial Services Conference 2009, Sydney, 28 October 2009. Good morning, and thank you to Finsia for the invitation to speak here today. We’re fortunate to be meeting today in an environment where the worst of the financial crisis

Stock Pick Results - Trade Stocks Americawww.tradestocksamerica.com/daily-stock-pick-results4.phpLEH, Lehman Brothers filed a liquidation bankruptcy (not even a reorganization protection) a month later! The NASDAQ Composite went from 2,404 to 2,063 several weeks later for a drop of 14%. LBYTA, Liberty Global dropped from $33.76 to $12.01 for a profit potential of 181% on this short sale idea that was passed on as a minimal profit potential.

Janet Yellen Is Great Unknown to Most Americans - Bloomberghttps://www.bloomberg.com/opinion/articles/2015-03-11/janet-yellen-is-great-unknown-to...Mar 11, 2015 · Whether it was the bailouts of the big money-center banks such as Citigroup and Bank of America, the rescue of Bear Stearns, the collapse of Lehman Brothers, the bailout of …

September | 2015 | wellsindiahttps://wellsindia.wordpress.com/2015/09This is an all-time high net outflow by FPIs since 1997, said a PTI report. In October 2008, FPIs offloaded a net of Rs 15,347 crore from the market in the aftermath of the Lehman Brothers collapse, which triggered the global financial crisis. Since 2008, AUM of the Indian mutual fund industry has grown at a CAGR of 16.84 per cent, outpacing ...