Home

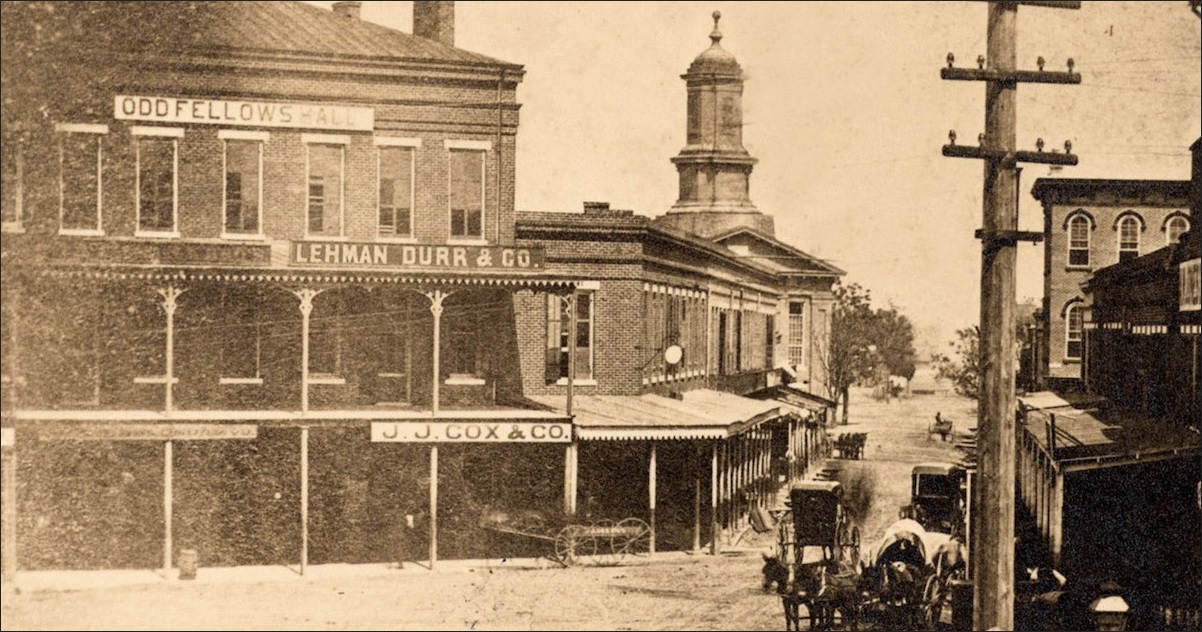

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Fate of firms taken over by Erinaceous: To ... - Buildinghttps://www.building.co.uk/focus/fate-of-firms-taken-over-by-erinaceous-to-fight...The commercial property consultancy, formerly Dunlop Haywards, has had a rough ride. Ian McGarry, its former head of valuations, was being investigated for fraud just as Erinaceous was crumbling, leading in February 2009 to a court ordering the then-collapsed Dunlop Haywards to pay �21m in damages to Cheshire Building Society.[PDF]�The Great Depression and the Great Recession: What Have ...https://rbidocs.rbi.org.in/rdocs/Speeches/PDFs/SPRBL090412.pdfteacher and a widely respected policy thinker. His pioneering work, centred around ... When Lehman Brothers collapsed in September 2008 and the global financial sector seemed to be hurtling towards a collapse, one of the biggest fears was whether we were heading for Great Depression - II. In the event, we stopped just short of that. ...

Securities Arbitration and Litigation: June 2009https://securitiesarbitration.blogspot.com/2009/06Jun 29, 2009 � Last Sept. 10, as the stock market started heading south, he checked with his broker, who he said assured him that he wasn�t exposed. Two days later, he learned about Lehman Brothers was facing bankruptcy. �Boy, I�m glad I�m not tied up with Lehman Brothers,� Rufo said he told to himself.[PDF]WestminsterResearch http://www.westminster.ac.uk ...https://westminsterresearch.westminster.ac.uk/download...events, such as the �Dot-Com� crash in 2000, September 11 attacks in 2001, the collapse of Lehman Brothers in 2008, the Greek Government Debt crisis in 2010, the Oil price Slump in 2014, the collapse of the Ruble in 2014, and Brexit in 2016. Reciprocal influences also

Currency Balloons | Thundering Heardhttps://thundering-heard.com/2014/10/07/currency-balloonsOct 07, 2014 � This has contributed to an impatience that robs perspective and often leads people to feeling left out of the latest price trend craze. Most people have at least a dim recollection of the the collapse of Lehman Brothers that is the poster child for the 2008 portion of the financial crisis.

Europe backs down in bid to tackle mega-bankshttps://uk.news.yahoo.com/europe-backs-down-bid...By John O'Donnell BRUSSELS (Reuters) - Europe will unveil a blueprint to challenge the power of big banks on Wednesday but critics believe it will change little as it does not strictly separate multi-billion-euro market bets from savers' money. After the collapse of Wall Street's Lehman Brothers

TTC News Archives-Trans Texas Corridor: Phil Gramm and his ...https://corridornews.blogspot.com/2008/09/phil-gramm-and-his-pack-of-whiners.htmlSep 18, 2008 � On Monday, McCain issued a tough-talk statement that he was "glad" that the feds "have said no to using taxpayer money to bail out Lehman Brothers, a position I have spoken about throughout this campaign." On Tuesday, the government did the daddy of all bailouts. It took over AIG, fearing its bankruptcy could set off a cataclysmic chain of events.

Justice Bao Konghttps://baokong.blogspot.comOct 17, 2008 � The salesperson cannot entirely be blamed too. He is also working for a living, and he has revenue targets set by his bank and he will be fired if he does not meet his targets. If the salesperson tells the whole truth to the customer, he will lose the sale and face the possibility of being fired.�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Financial Crisis � Patrick J. Buchanan � Official Websitehttps://buchanan.org/blog/Topics/financial-crisisApr 22, 2011 � Is the world headed for a debt crisis to dwarf the one that befell us in 2008, when Treasury Secretary Hank Paulson stood aside and let Lehman Brothers crash? No one knows for certain. As Yogi Berra said, �it�s tough to make predictions, especially about the future.� ... General Motors was to the nation. It was the largest and most ...

IMT 56 Strategic Management M2_Sample.docx | Profit ...https://www.scribd.com/document/249128045/IMT-56...Answer: The bankruptcy of Lehman Brothers was a result of the investment banks exposure to the 2007-2010 financial crisis. In fact, the demise of the investment bank would come to symbolize the crisis. Therefore, in order to understand the Lehman Brothers bankruptcy, a consummate understanding

Auto loan ABS delinquencies rise - Risk.nethttps://www.risk.net/.../structured-products/1504115/auto-loan-abs-delinquencies-riseAs was the case with subprime mortgages, auto loans originated in 2006 have underperformed earlier vintages. According to research from Lehman Brothers, 4.5% of prime loans are delinquent by 30 days+, rising to 12% for subprime loans. However, investors can take comfort in fundamental differences between the assets.[PDF]Europe finds its bouncehttps://www.treasurers.org/ACTmedia/Nov09TTDOTY14-16.pdfpriced the week before the collapse of Lehman Brothers. A rare BBB corporate issue in 2008, the bond may have enjoyed good fortune in its timing, but it still took advantage of a window of opportunity. The bond was used to refinance a $1.5bn acquisition term loan due 2010. Other winners last year included German-based healthcare

?????????????????????(5????) - �https://ejje.weblio.jp/sentence/content/???/5Translate this pageI expect that further debates and work will be done to prepare for a G-8 summit next month and a G-20 summit in September - ... such as the APEC Finance Ministers� meeting and the G-20 meeting. ... The global financial sector had been in turmoil since the Lehman Brothers collapse sent shockwaves around the world in September 2008.

Could the Fed Have Saved Lehman? - The Big Picturehttps://ritholtz.com/2016/07/fed-saved-lehmanJul 27, 2016 � Let�s dispose of the first issue: That the Fed could have rescued Lehman Brothers, since a collapse would be an existential threat to the banking and financial systems, and withholding a bailout was likely to precipitate a much greater crisis. That�s not my belief, but it was the argument for a bailout in 2008, and ever since.

Room for some more - Insurance Linkedhttps://insurancelinked.com/room-for-some-moreRoom for some more. Posted on Jan 6th, ... catastrophe bond market saw $7.1 billion of new issuance taking the total amount of outstanding bonds to over $20bn for the first time. But a larger and more important change is the increasing breadth of the market. ... not least after the collapse of Lehman Brothers in 2008 led to several cat bonds ...[PDF]Treasurer John Chiang Sanctions Wells Fargo Bank for ...https://www.treasurer.ca.gov/news/releases/2016/20160928.pdfSep 28, 2016 � As the state�s banker, the Treasurer oversees nearly $2 trillion in annual banking transactions, manages a $75 billion investment pool, and is the nation�s largest issuer of municipal debt. His office historically relies on financial institutions , such as Wells Fargo, to serve as partners to meet the state�s investment and borrowing needs.

Nationalists � modernsocialworkerhttps://modernsocialworker.wordpress.com/tag/nationalistsNov 07, 2015 � Tag: Nationalists United States of Fear. ... Following on the heels of the collapse of Lehman Brothers and the housing crisis that we are all familiar with (some more intimately than others) began the worst global economic disaster since the market went belly up in 1929. ... As the economic crisis deepens in many parts of the world, other ...

Thursday newspaper round-up: Brexit, RBS, Sports Direct ...https://www.sharecast.com/news/press-round-up-short-premium/thursday-newspaper-round...Britain�s leader during the period when the collapse of the US investment bank Lehman Brothers put every major bank at risk, said that after a decade of stagnation the global economy was now ...

Poll backs Government's stimulus planhttps://www.smh.com.au/national/poll-backs-governments-stimulus-plan-20090913-fm73.htmlTomorrow is the first anniversary of the collapse of US investment bank Lehman Brothers, which sparked the financial crisis. The poll found Coalition voters were the most likely to want the ...

#include file="issue.txt" --> Businesswww.pattayamail.com/847/business.shtmlIn his presentation, Sam explained how the markets had collapsed and what to do in the future. ... The first was from John Sheehan who resigned from Lehman Brothers a month before it went under as ...

FEARLESS PREDICTIONS REAL PSYCHICS: December 2015https://fearlessprediction.blogspot.com/2015/12Dec 28, 2015 � What I sense is that the third global financial crisis will indeed happen in 2016, as already being cautioned by financial experts. This will be comparable to that which hit the U.S. and the rest of the world in 2008 which resulted in the closure of the global financial services firm Lehman Brothers and plunged all leading economies into financial recession.

Climate | The Scientific Leader Bloghttps://scientificleader.wordpress.com/tag/climateJan 04, 2009 � If the poster child for the first era was Ken Lay of Enron , then perhaps the second should be Dick Fuld of Lehman Brothers. In Fuld�s case, did his inappropriate disrespect for uncertainty and his ability to know everything cause him to approve the taking on a fatal level of risk tolerance?

Myron Gushlak: April 2009https://myrongushlak.blogspot.com/2009/04Apr 09, 2009 � Whatever it is or will be called, the first decade of the twenty-first century ended prematurely this past autumn with the fall of Lehman Brothers and the threat posed by AIG�s possible collapse. Perhaps it will be known as the Decade of the Scam. Not all the scams that have been discovered have had the enormity of the Bernard Madoff Ponzi ...

The latest libor news for investment advisers and wealth ...https://www.investmentweek.co.uk/tag/libor/page/4Four years after Lehman Brothers suffered the largest bankruptcy in US history, a former vice president at the investment bank has warned the financial system is on a �collision course' for another 2008-style event. Investment; 17 September 2012

Salviamo l'Europa dall'austerit� | Andrea Terzi | sconto 15%https://www.unilibro.it/libro/terzi-andrea/salvia...Translate this pageBut the first real crisis-launched in 2008 by the collapse of Lehman Brothers-the great and ambitious design proved woefully inadequate. The European currency has since repeatedly risked ending up on the rocks, swept away by a storm which was born, Yes, overseas, but that in Europe has found a structure too weak to bear the brunt.Price: �8,50Availability: In stock

Auditors on the Firing Line | Lehman Brothers | Audithttps://www.scribd.com/document/246944934/Auditors-on-the-Firing-LineAuditors on the Firing Line. E&Y served as Lehmans independent audit firm from 1994 through 2008. For the 2007 audit, the final audit of the company prior to its collapse, Lehman paid E&Y approximately $29.5 million. That figure included the fee for the 2007 audit, fees for tax services provided to the company, and miscellaneous fees. William Schlich served as the engagement audit partner for ...

RBI cuts rates, banks say they�ll follow | VRIDHI Money ...https://vridhi.co.in/2009/01/03/rbi-cuts-rates-banks-say-theyll-followThis is the fourth round of rate cuts announced by the central bank since the global credit crisis intensified in September following the collapse of US financial institutions led by Lehman Brothers. Since October, CRR and the repo rate have been lowered 350 basis points each.

FED cut rates 50 basis pointswww.thetreeofliberty.com/vb/showthread.php?246178-FED-cut-rates-50-basis-pointsMar 03, 2020 � If your first visit, ... The last time the FED did a similar emergency cut was right after Lehman Brothers went bankrupt the first big fallout of the banking crisis which began the last recession. The time before that the FED did an emergency cut was in 2001 [you know that reason.] ... "You think a wall as solid as the earth separates ...

The Gated Globe_????https://wenku.baidu.com/view/5a906ca6910ef12d2af9e76e.htmlTranslate this pageThe Gated Globe_??_????_???? 89???|16???. The Gated Globe_??_????_?????World economy The gated globe The forward march of �[PPT]On Global Currencies Jeffrey Frankel, Harpel Professor ...https://sites.hks.harvard.edu/fs/jfrankel/Global... � Web viewThe $ appreciated after Lehman Brothers� bankruptcy, & US T bill interest rates fell. Clearly in 2008 the world still viewed the US Treasury market as a safe haven and the US $ as the premier international currency. Is the $�s unique role an eternal god-given constant?

Video for your eBay listings in less than 5 minutes - Tamebayhttps://tamebay.com/2008/09/4102.htmlSep 12, 2008 � I think a great idea with videos on ebay for items, but it would be time consuming though. Will video really make a difference and play a major part in �[PDF]ILX AR 09 draft5 - Progilityhttps://www.progility.com/pdf/ILX_Annual_Review_2009.pdfin the first half, but fell by 37% in the second half of the year, following the collapse of Lehman Brothers and the resulting global banking crisis. Despite maintaining excellent relationships with core clients and generating a number of new business streams, in particular from overseas collaborations, full year revenues were 11% down over

ROYALMAILCHAT � View topic - Royal Mail in threat to axe ...https://www.royalmailchat.co.uk/community/viewtopic.php?t=16710Jun 07, 2009 � There are now 292 pension funds poised to fall into the lifeboat fund. These include schemes run by Woolworths and Lehman Brothers and a giant fund run by Nortel, the collapsed telecoms firm. Pension experts insist that the protection fund would be bust if it was judged on the same measures as private pension providers.

Dividend Warrior: August 2012https://dividendsrichwarrior.blogspot.com/2012/08Aug 21, 2012 � At that time, I shared their concerns and fears. Therefore, I was so glad that I was safe and sound when the sub-prime crisis hit the world in 2008 year end. I was having my popcorn and watching the carnage from the sideline as Lehman Brothers collapsed and AIG was on the verge of collapsing too. Banks were receiving bailouts.

Things Blight and Beautiful: March 2013https://smadanpersonal.blogspot.com/2013/03The financial crisis of 2008 had complex roots including policy failures by the Fed's Alan Greenspan and Clinton's Secretary of Treasury Robert Rubin's earlier deregulation leading to risky bank behavior. But there was an execution aspect as well, like allowing Lehman Brothers to collapse like it did leading to a �

Free Money Day: Sharing is Common Cents, by Donnie ...www.dailygood.org/story/313/free-money-day-sharing-is-common-cents-donnie-maclurcan...Home > News > Free Money Day: Sharing is Common Cents. ... purposefully coinciding with the anniversary of the 2008 bankruptcy filing by Lehman Brothers. One of the world�s largest investment banks at that time, Lehman Brothers� collapse triggered a series of events which contributed to global financial mayhem, the repercussions of which ...

Libor dollar rates drop amid stepped-up bank rescues ...www.gata.org/node/6772Oct 13, 2008 � "This is because bank solvency risk should decline as the government offers protection." ... Markets Frozen . Credit markets remained frozen last week even as policy makers jointly cut interest rates for the first time since 2001 and continued to inject cash into the banking system.[PDF]Annual report 2018 - Pareto Asset Managementhttps://paretoam.com/globalassets/rapporter-og-dokumenter/annual-reports/pareto_asset...US economy as well as the US stock market. By the end of August, close to ten years after the Lehman Brothers bankruptcy sent the world�s markets spinning, we were able to note that the return over these ten years had been more than satisfactory � even though this period started just before the historic fall in the autumn of 2008.

Markets - How rate rises impact stocks - Wealth management ...https://www.schroders.com/en/ch/wealth-management/insights/wirtschaft/how-markets...The case for a further improvement in earnings may therefore not be as strong as in previous hiking cycles, especially with an increase in wages still expected to come through. ... back into panic later in the year when there was a big spike in volatility in the aftermath of the bankruptcy of Lehman Brothers. ... outweighed by a ...

Credit Rating | I paid WHAT?https://ipaidwhat.wordpress.com/tag/credit-ratingThis has been a hell of a week. Thursday saw the biggest decline in global and US stocks since Lehman Brothers collapsed in 2008. Friday night (conveniently after the markets closed) S&P reported they downgraded US credit from AAA to AA+ for the first time in US history.[PDF]B-Lot Company Limited - FISCOwww.fisco.co.jp/uploads/b-lot20170404_e.pdfwill pay a dividend for the first time B-Lot Company Limited <3452> (hereafter, also �the Company�) is an emerging company that provides one-stop ... ever time for a real estate company founded after the bankruptcy of Lehman Brothers, of six years and two months.[PDF]The European Consulting 10 - Consultancy.nlhttps://www.consultancy.nl/media/European Consulting M&A Report 2010-970.pdfThe European Consulting M&A Report 2010 03 This is the fourth year we have published the only publicly available information on the European Consulting M&A market,which covers companies providing consultancy/advisory services,including strategic, management,operations,marketing,engineering consultants and accounting and law firms.Our report shows

zum Teil noch - English translation � Lingueehttps://www.linguee.com/german-english/translation/zum+teil+noch.htmlthe turning point came with the collapse of the us investment bank Lehman Brothers, which caused the speculative bubble that had formed on the commodity futures exchanges to burst suddenly: the euphoria felt by farmers about the new appreciation expressed in the form of higher grain prices was - after years of feeling unimportant - only short-lived but understandable and deflated. in the light ...[PDF]

Tips of RUDRA-"The distroyer and maker"https://tipsofrudra.blogspot.comEpic, which also happens to be the first entirely Indian made web browser, is based on the Mozilla platform and comes with quite a bunch of India centric features. We did take it for a short spin and we came out quite happy with it. Before we look at the details, let's look at details about Hidden Reflex, the company behind the browser.[PDF]core.ac.ukhttps://core.ac.uk/download/pdf/93359621.pdfinsolvency of Lehman Brothers in September 2008, the discourse about the GFC and its causes and consequences dominated the political agenda and has become a major topic in the mass media discourse. After Lehman one could get the impression that the crisis marks a critical historical

credule: vignettes/credule.Rmd - rdrr.iohttps://rdrr.io/cran/credule/f/vignettes/credule.Rmdthe probability of a default occurring within the time interval [t,t+dt) conditional on surviving to time t, is proportional to some time dependent function $\lambda(t)$, known as the hazard rate, and the length of the time interval dt. We make the simplifying assumption that the hazard rate process is deterministic.[PDF]WWWBRAGGINANCIALCOM INETMENT MANAGEMENT �https://braggfinancial.com/marketreports/WithCicero.pdfindex is down 3.3% for the first three quarters of the year. The performance disparity between ... collapse of Lehman Brothers, now 10 years in the past, seems like but a distant memory. Bull markets don�t, however, die ... (softening auto sales and a sluggish housing market in parts of the country).

Consumers face challenging times as access to credit ...https://pwc.blogs.com/press_room/2008/12/consumers-face-challenging-times-as-access-to...2. The first PwC Credit Confidence survey was carried out in cooperation with YouGov. 3,958 UK consumers were contacted on 5 September to assess attitudes to credit market conditions. Following the collapse of Lehman Brothers and spreading banking sector crisis a follow-up survey was done on 20 and 21 September.

Archive < News < XML to PDF, PostScript, AFP, Print - RenderXnew.renderx.com/news/news_archive.htmlThe history of news items and press releases from RenderX - the leader in XSL-FO software tools that transforms XML to PDF, PostScript, SVG, AFP, print.[PDF]ECONOMIC POLICY II ECONOMICS 2289G-001 Department of ...https://economics.uwo.ca/undergraduate/undergraduate_docs/winter18_docs/2289G001COJan...This is an essay course dealing with issues in contemporary macroeconomic policy. Chapters fro m ... The first chapter of the following book is also required reading: Laidler, ... - Collapse of Lehman Brothers and beginning of stock market crash, Fall 2008

Consumption Junctionhttps://kh-on-econ.blogspot.comSep 15, 2008 � So Lehman Brothers has been forced into bankruptcy, with Henry Paulsen having declined any government bailout whatsoever. As a result, Merrill Lynch sought refuge in Bank of America, making BOA the largest bank in the world (meaning my depressingly small checking account is safe for now, thank you very much.)

NEW JERSEY | American Dream@Meadowlands (Xanadu) - Page 12 ...forum.skyscraperpage.com/showthread.php?p=8206295Apr 02, 2019 � First conceived as Xanadu in 2003, the project stalled during the financial crisis after financing dried up following the Lehman Brothers collapse. Now, 16 years and three developers later, the long-time eyesore along the New Jersey Turnpike is hoping to turn its fate around.

Research & Investment � Pelias' viewshttps://pelias01.wordpress.com/2016/03/10/research-investment-6When there is no sudden shock, like Lehman Brothers� collapse or LTCM, the market can remain undecided for a considerable time before rolling over into a hard down-trend. The monthly chart of the S&P 500 is flying on one engine. Currently testing resistance at 2000, a peak at this level would strengthen the warning of a bear market.

The Financial Collapse Of Greece: The Canary In The Coal ...https://theeconomiccollapseblog.com/archives/the-financial-collapse-of-greece-the...Jun 20, 2011 � It is important to keep in mind that just the first Greek bailout that we are talking about. ... almost a quarter of the population now live below the poverty line, unemployment is at a record 16% and, as the economy contracts for a third year, economists estimate that about 100,000 businesses have closed. ... When Lehman Brothers ...

25 | September | 2012 | Justice Leaguehttps://justiceleaguetaskforce.wordpress.com/2012/09/25Sep 25, 2012 � Of the many debts that John Suckow would like to unwind from Lehman Brothers Holdings, the first might be shame. Stigma, baggage, jokes about zombie banks back from the dead�Suckow would like to jettison all that, just as Lehman is liquidating what remains of its assets, four years after the bank�s failure sent the financial crisis into overdrive.

Sole Piccata & Win the Cookbook! � The Feisty Foodiefeistyfoodie.com/2008/07/28/sole-piccata-win-the-cookbookCooking for one � and a small budget � led me to pick up 4 ounces of grey sole at Whole Foods. At $15.99/lb. I told the guy I only wanted a few pieces, let�s say two, and he said �This is only 4 ounces, is that enough?� and I said yes. I kind of regretted it once I was eating, since it was really yummy, but it was definitely enough ...[PDF]DETERMINANTS OF RISK PREMIUMS ON CORPORATE BONDS �https://gupea.ub.gu.se/bitstream/2077/37028/1/gupea_2077_37028_1.pdfWhen Lehman Brothers, the fourth largest investment bank in the US, declared bankruptcy in September 2008, the recession was a fact. As an effect of the economic crisis in 2008/2009 the companies in Sweden have increasingly begun to use bonds as an alternative source of funding. This is partly because many of the

bust - FC2??https://video.fc2.com/search/video/?keyword=bustTranslate this pageIn September 2008, the collapse of Lehman Brothers tipped the world into recession. A cast of contributors including national leaders, finance ministers and CEOs describe the tense negotiations in New York and London as the investment institution headed towards bankruptcy.

????:America�s bail-out plan???????_???? - ? �m.kekenet.com/kouyi/52192.shtmlTranslate this pageFor over a year, since August 2007, central bankers, principally Mr Bernanke, have been trying to make this toxic debt liquid. But by September 17th, following the bankruptcy of Lehman Brothers and the nationalisation of American International Group earlier that week, the problem started to become one of the system�s solvency too.

[2008.9.27]???????: ????????? � The Economist �blog.ecocn.org/archives/356/comment-page-1Translate this pageFor over a year, since August 2007, central bankers, principally Mr Bernanke, have been trying to make this toxic debt liquid. But by September 17th, following the bankruptcy of Lehman Brothers and the nationalisation of American International Group earlier that week, the problem started to become one of the system�s solvency too.

Has us bank ever filed bankruptcybote.downloadrain.com/BmxaQ70This is a list of banks in the. IndyMac Bank was also a large bank that was changed into a bridge bank by the FDIC, after its failure, until . Dec 27, 2008. Lehman Brothers went bankrupt.. By the end of February, all was quiet save for global banks routinely updating queasy investors over the.

If We Could See The Crisis Coming, Why Couldn�t Anybody ...https://libertyguys.wordpress.com/2008/09/15/if-we-could-see-the-mortgage-crisis...Sep 15, 2008 � OOOH, This Is BAD (7/2/2004); ... Favored financial industries will be the first to be nationalized and more will be added as the trickle-down effects are felt and Washington drives off the precipice into a command economy. Reply.[PDF]United States Senatehttps://www.agriculture.senate.gov/download/testimony/thompson-testimony-7-17-12&...Jul 17, 2012 � DTCC also provides services for a significant portion of the global over-the-counter (�OTC�) derivatives market. ... the right policy, and I am happy to report to you the ... CDS market following the collapse of Lehman Brothers, DTCC began public aggregate reporting of the CDS open position inventory. Today, this reporting includes ...[PDF]Get Political Allies to Save a Losing Case;https://bettermarkets.com/sites/default/files/Financial Reform Newsletter 4-27-2017.pdfdesignated five nonbanks in more than six years. (One of the five has been de-designated because it eliminated the systemic risk that it posed to the U.S. financial system.) Given the numerous nonbanks that had to be bailed out by the government and taxpayers in 2008-2009, a very restrained record. In fact, one could make a good case that

Floods in Germany: No impact on ECB policyhttps://www.uk.daiwacm.com/ficc-research/recent-blogs/posts/2013/06/1/floods-in...Only in the aftermath of the collapse of Lehman Brothers in the autumn of 2008 the headline index fell more sharply (by 5.5pts). And although sentiment rebounded strongly in the following month as the damage proved smaller than initially feared, the sharp collapse in confidence temporarily raised uncertainty over the short-term economic outlook.

Market Profile (MP) levels/targets for DAX DOW NQ - Page ...https://www.forexfactory.com/showthread.php?t=617762&page=327Sep 07, 2018 � As long as the DOW remains above the 26K we could see a little recovery. ... I won't have to remind you that 10 Years ago the financial crisis started with the colapse of Lehman Brothers. ... A few days ago one of the biggest Dutch banks got a penalty by the Dutch goverment (+/- 1 Bilijon US$)because they were helping laundering money. Biggest ...

Have investors grown too comfortable with North Korea? By ...https://uk.investing.com/news/stock-market-news/have-investors-grown-too-comfortable...Have investors grown too comfortable with North Korea? ... the collapse of Lehman Brothers and Greece's 2015 debt default all pushed the MSCI World Index (MIWO00000PUS) lower than any of North Korea's nuclear tests. 2) VOLATILITY. A similar pattern plays out in the VIX index , also known as the market's "fear gauge": for the first three nuclear ...

Eckington DC Livinghttps://eckingtondc.blogspot.comYou know, you meet a lot of people who can't stop bitching about DC. But I've LOVED DC since landing here more than ten years ago. So gonna be a (mostly) happy and positive blog about living in my new neighborhood, Eckington, and in Washington, D.C.[PDF]For personal use onlywww.asx.com.au/asxpdf/20130409/pdf/42f4ryzc20jtf6.pdfApr 09, 2013 � As the holder of a granted Financial and Technical Assistance Agreement (the Columbio FTAA), SMI acts ... Since the collapse of Lehman Brothers in 2008, the overwhelming majority of global copper development ... This is to be commended, and when carried through, will bring great benefit to �

Do You Really Want to Learn Investing from These Guys?https://ca.finance.yahoo.com/news/really-want-learn-investing-guys-190000163.htmlJan 29, 2014 � (See "Case Study: The Collapse of Lehman Brothers.") It�s a stretch to think taxpayers wanted to take the TARP risk in the first place and it was a coin-toss as to whether they�d profit. Even five years later, there�s little love lost between the public and the industry that brought us �[PDF]UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF �https://impaneled.files.wordpress.com/2012/09/g-m-reply-lead-counsel-mem.pdfUNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK DAVID CASPER, Individually And On Behalf ... In an effort to unseat the Blanck Investor Group as the most adequate plaintiff, movant ... This is basically the same language about �affiliated firms� found in �[PDF]Gertrude Tumpel-Gugerell: The new financial architecture ...https://www.bis.org/review/r090522e.pdfGertrude Tumpel-Gugerell: The new financial architecture and the role of Europe ... The aftermath of the Lehman Brothers� collapse saw this financial crisis spreading across the globe. In November last year, therefore, the Heads of State or ... April 2009, for a preliminary analysis of the effect of the financial crisis on financial integration.[PDF]Daniel Mminele: The importance and development of sound ...https://www.bis.org/review/r120911c.pdfthe first forum that focusses specifically on the South African financial community. I should ... many, for a number of reasons, not least of which relates to the economics. It is true that ... that a relatively expensive payment instrument and much more vulnerable to fraud.

High hopes for property sector as Burj Khalifa opens ...https://www.business-live.co.uk/economic-development/high-hopes-property-sector-burj...Jan 16, 2010 � The collapse of Lehman Brothers, credit crunch and recession saw an almost perfectly correlated meltdown for the major asset classes of equities, fixed interest and commercial property for a �

German economy grows by 0.1% | IOL Business Reporthttps://www.iol.co.za/business-report/international/german-economy-grows-by-01-1129432Sep 01, 2011 � German economy grows by 0.1%. ... German business morale fell at its fastest rate since the aftermath of the Lehman Brothers collapse in late 2008, a �

Crisis adviser one of seven insider arrestshttps://www.theaustralian.com.au/business/crisis-adviser-one-of-seven-insider-arrests/...Mr Dodgson was one of six people to be arrested on Tuesday in Britain's biggest insider dealing case. He joined Deutsche 15 months ago, having previously worked for Lehman Brothers �

Paradigm shift - News | Khaleej Timeshttps://www.khaleejtimes.com/editorials-columns/paradigm-shiftThis is not the first time Gulf Arab investors have emerged as Citi's knight on horseback as a financial neutron bomb gutted its balance sheet. ... ADIA is unquestionably one of the crown jewels ...[PDF]CFOs in China +18https://app1.hkicpa.org.hk/APLUS/0905/CFOs.pdfthey were unable to repay debts as the markets turned sour, but Haitian was an exception. �I foresaw this problem and advised the company to hold on to all its cash and put any expansion plan on hold after the collapse of Lehman Brothers. �The company currently holds nearly one �

Economy | Mcauleysworld's Weblog | Page 7https://mcauleysworld.wordpress.com/tag/economy/page/7The recent �take over� of Fannie Mae and Freddie Mac and today�s sale of Merrril Lynch and the potential bankruptcy of Lehman Brothers is directly related to the number of failing �NINJA or LIAR LOANS� used to back mortgages in an over hyped Housing Market.

City Spy: Keeping mum over Hedgestock re-run | London ...https://www.standard.co.uk/business/cityspy/city-spy-keeping-mum-over-hedgestock-re...If the event is re-run, let�s hope it isn�t a bad omen. Hedgestock 2006 came just over two years before the collapse of Lehman Brothers, which was, incidentally, one of the sponsors. Ah. happy ...

Musings of a Money Manager to the Megarich: December 2011https://voiceofthemarkets.blogspot.com/2011/12If we look at the attached chart, we see that Gold has been consistently rising since 2001, when it touched USD 280 levels. We can also see a downward blip in Sept 2008 when the world's financial system was almost about to collapse and only Lehman Brothers went bankrupt but various other 'insolvent' banks of the USA were allowed to continue at the cost of the American taxpayer and the �[PDF]Winter Investmenthttps://pearsonwm.co.uk/wp-content/uploads/2020/01/Pearson-Wealth-Management-review...The first graph shows the total return for the last six months whereas the second graph illustrates the �month by month� performance (all data powered by FE). 6 month performance The graphs below show how the Pearson portfolios within the six Pearson risk categories have performed over the longer term. The first graph shows the total

Households Own 42 Percent of MMFs Says Fed Z1; NY Fed on ...https://cranedata.com/archives/all-articles/5082It says, "One of the lessons from the recent financial crisis is the need for securities dealers to have durable sources of funding. As evidenced by the demise of Bear Stearns and Lehman Brothers, during times of stress, cash lenders may pull away from firms or funding markets more broadly. Lengthening the tenor of secured funding is one way ...

Gruppo pubblico Press For Truth | Facebookhttps://it-it.facebook.com/groups/173759511199Translate this pageAs we are dealing with a global everything bubble, it's of no surprise that one of the biggest banks in the world (at least formerly) is facing one crisis after another. In fact, Deutsche Bank is likely going to be Lehman Brothers 2.0 and may very well be the domino to cause the global collapse. John breaks down the latest on Deutsche Bank.

trotz der hohen Anforderungen - Englisch-�bersetzung ...https://www.linguee.de/deutsch-englisch/...Translate this pageDespite the very pragmatic approach taken by the government and the highly active Fed, distrust among banks after the bankruptcy of Lehman Brothers heightened to an extent that many banks were no longer able to refinance on the money market at all, i.e., other banks simply did not lend money to them or only at very high premiums.

Banks only winners in Babcock crash - InvestSMARThttps://www.investsmart.com.au/investment-news/banks-only-winners-in-babcock-crash/7292Sep 21, 2009 � Banks only winners in Babcock crash ... And such was the speed and impact of the GFC on the company that both Jim Babcock and Phil Green were gone from their executive jobs even before the seminal collapse of Lehman Brothers in September. ... But it won't be at the same high price, in percentage terms at least, as that paid by the group's ...

Marc Pado Comments: UPS Delivers Six-Day Streak To Wall ...https://www.cantor.com/2010/04/16/marc-pado-comments-ups-delivers-six-day-streak-to...Apr 16, 2010 � It�s not great growth, but it is definitely not what people were thinking was going to happen just two months ago.� Buoyed by that economic optimism, the Dow ended at its highest close since Sept. 19, 2008, or four days after the bankruptcy of Lehman Brothers that rocked Wall Street.

Financial meltdown deepens - marxist.comhttps://www.marxist.com/financial-meltdown-deepens.htmAs I write, financial markets in Wall Street, New York, the City of London and all over are in turmoil. In just 24 hours, two out of the four largest investment banks in the US have disappeared. Lehman Brothers, around for 158 years, has declared bankruptcy and 25,000 employees around the �

Five years on The failure of free market finance | ICAEW ...https://economia.icaew.com/features/september-2013/five-years-on-the-failure-of-free...Sep 05, 2013 � Five years on: the failure of free-market finance. Five years after the collapse of the US investment bank Lehman Brothers, the world has still not addressed the fundamental cause of the subsequent financial crisis � an excess of debt.

Kingsport Times-News: Dow hits record, erasing Great ...https://www.timesnews.net/News/2013/03/05/Dow-hits...Mar 05, 2013 � It was just a trickle, but it may have helped stocks surge. In January, the Dow rose 5.8 percent, and the S&P 500 rose 5 percent. It was the best start to a year for the Dow since 1994.[PDF]Managing Economic Crisis in East Asiahttps://muse.jhu.edu/chapter/625025the bankruptcy of Lehman Brothers, which, in Mundell�s opinion, was caused by the 25 per cent fall of the U.S. dollar against gold and the euro in the third quarter of 2008. The third crisis, characterized by the contraction of the real economy, and also caused by the strong dollar, occurred at the same time as the �

Central Bank Challenges after the Financial Crisiswww.sciedu.ca/journal/index.php/mos/article/download/3910/2859maximum of transparency, but it is unlikely to perform better than a central bank�s carefully judgment of inflation, ... what was the financial crisis. The essential conditions behind the crisis were: 1) The underestimation of risk related ... (such as Lehman Brothers), increased uncertainty spread with two[PDF]

US Federal Reserve Vice Chairman Stanley Fischer - At "The ...www.mondovisione.com/media-and-resources/news/us...US Federal Reserve Vice Chairman Stanley Fischer - At "The Lender Of Last Resort: An International Perspective," A Conference Sponsored By The Committee On Capital Markets Regulation, Washington, D.C. - February 10, 2016 - The Lender Of Last Resort Function In The United States[PDF]2013-09-04 - The failure of free-market financehttps://www.economics.utoronto.ca/gindart/2013-09-04 - The failure of free-market...Sep 04, 2013 � The failure of free-market finance By Adair Turner September 4, 2013 � Project Syndicate Five years after the collapse of the US investment bank Lehman Brothers, the world has still not addressed the fundamental cause of the subsequent financial crisis � an excess of debt. And that is why economic recovery ... As long as the debt was in the ...

innescata - Traduzione in inglese � Dizionario Lingueehttps://www.linguee.it/italiano-inglese/traduzione/innescata.htmlTranslate this pageThe acute loss of confidence following the collapse of Lehman Brothers led to a sharp rise in risk premia, pushing up the threemonth Libor to 3.13%. ... But it was in New York that he met a lot of ... who at the time could count on a certain number of places where one could play, plus (some) sympathetic press, and a fringe section of the ...

it's a journey: May 2009https://yeongboon.blogspot.com/2009/05The good time came to a stop by end of the year 2006 when the housing prices started to come down, people who bought houses found out there are no more buyers for the houses so they just defaulted on the loan and said F**K IT! The Bank try to lelong out those houses but could not find buyer. Citibank, Bank of America all reported huge loses.[PDF]Proletarian No 8 / Spring 2012 1 Proletarianwww.pcint.org/40_pdf/07_TP-pdf/Proletarian_08-w.pdfLehman Brothers. Nouriel Roubini, the famous money expert nicknamed �Dr. Doom� a reputation gained by his 2006 forecast of the imminent occurrence of a severe economic crisis in the United States, gloomily declared to reporters of the Wall Street Journal, the organ of the financial community: �Marx said it right. At some point capital-

Reflecting on 2-Year Anniversary of Reserve Primary ...https://cranedata.com/archives/all-articles/3043Crane Data wrote ( incorrectly, it turns out) early Monday, in "Fed Moves, Limited Exposure Should Shield Money Mkts From Lehman," " The bankruptcy filing of Lehman Brothers has led to a downgrade of the company' s short- term debt by Moody' s from P- 1 to Not Prime.

Uncategorized - Lynne McTaggartlynnemctaggart.com/category/uncategorizedThis is a question I�ve been wrestling with ever since the financial crisis of 2008. Back then, after Lehman Brothers collapsed and Morgan Stanley threatened to follow suit, a Wall Street broker told reporters, �The world as we know it is going down,�. And when American auto giants General Motors filed for bankruptcy, Michael Moore ...

Financial Freedom Restored: 2015https://financialfreedomrestored.blogspot.com/2015In a report sent to clients on Sunday, Bank of America Corp. strategists totted up the results of 606 global interest-rate cuts since the collapse of Lehman Brothers Holdings Inc. and the $12.4 trillion of central bank asset purchases following the rescue of Bear Stearns Cos.

Value Investment - Musicwhiz's Journey: January 2010https://sgmusicwhiz.blogspot.com/2010/01Jan 31, 2010 � Note that my first true bear market, and it happens to be one of the worst in the last 70 years. In fact, this period of time would now go down in history as �The Great Recession�, characterized by the collapse of large investment banks such as Bear Stearnes and Lehman Brothers and the near-failure of the global financial system ...

Insiders' Gameinsidersgame.com/?p=1846Nor were the companies expected to announce their quarterly earnings any time soon. But, as Paulson acknowledges in his memoir, the urgency was driven by his deadline for a government takeover days before Lehman Brothers released its third quarter earnings, on September 10, 2008.[DOC]A Corpus approach to figurative expressions of fear in ...ucrel.lancs.ac.uk/publications/CL2009/459_FullPaper.doc � Web viewA Corpus approach to figurative expressions of fear in business reports. Janet Ho. The Hong Kong Polytechnic University. [email protected]. Introduction. 1.1 Global financial crisis 2008. In the global financial crisis 2008, there was a dramatic downturn and tumult in the stock markets, as well as mass job cuts in various sectors worldwide.

The US-Turkey standoff in context: Global capitalism and ...links.org.au/united-states-turkey-global-capitalism-crisis-hegemonyAs the tenth anniversary of the collapse of Lehman Brothers approaches, it seems that none of the underlying contradictions of the capitalist world economy have been resolved. ... One of the most striking features of the US economy has become the rise of the rentier and the money capitalist. ... in his seminal work, The Global Gamble, noted ...

shipping | Clarksons Research | Page 26https://clarksonsresearch.wordpress.com/category/shipping/page/26Aug 29, 2014 � After five and a half years of painful downturn, in Q3 2014 (to 22 Aug), the average was $10,900/day, just 5% different. ... Although the Lehman Brothers collapse in September 2008 triggered the meltdown in rates, the seeds of the crash were sown exactly seven years ago on 10th August 2007. ... Off To A Good Start.

Current Thoughtshttps://impossibledeeds.blogspot.comNov 09, 2008 � Internally, the collapse of Lehman Brothers has marked the worst financial situation in recent history, and America is halfway on its path to a full-blown recession. Let's hope that Obama truly wants to rise above partisan politics as he says and not worry about reelection so that he can completely devote himself to the issues at hand.

Financial Freedom Restoredhttps://financialfreedomrestored.blogspot.comIn a report sent to clients on Sunday, Bank of America Corp. strategists totted up the results of 606 global interest-rate cuts since the collapse of Lehman Brothers Holdings Inc. and the $12.4 trillion of central bank asset purchases following the rescue of Bear Stearns Cos.

Physician Investors | Evidence-Based Investing in Practicehttps://physicianinvestors.wordpress.comThis is because the risk of a recurrent credit crisis are currently far more severe than most investors anticipate, and because the long-term benefits for value investors of achieving even modestly positive performance during a market downturn can be surprisingly extreme. ... and as the collapse of Lehman Brothers just 3 years ago has shown ...

Tim Geithner | Deus Lo Vulthttps://deuslovult.wordpress.com/tag/tim-geithnerGoing with this job, he became the vice chairman and a permanent member of the Federal Open Market Committee (FOMC), the group responsible for formulating the US� monetary policy. He was a factor in bailing out the collapsed companies Bear Sterns and AIG, and also a factor in not Lehman Brothers.

??????:2017??????4????_?????_???https://www.hujiang.com/c/liujimoniti/p1171862Translate this pageAll but two pieces sold, fetching more than ?70m, a record for a sale by a single artist. It was a last victory. As the auctioneer called out bids, in New York one of the oldest banks on Wall Street, Lehman Brothers, filed for bankruptcy, triggering the most severe financial crisis since the 1920s.

???????????????????????(224????) �https://ejje.weblio.jp/sentence/content/?????/224Translate this pageTwo years ago, the Lehman Brothers shockwave triggered the Global Financial Crisis. It even affected the real economy, and countries across the world increased public spending- the situation we are in today. We are currently in a state of global financial turbulence.

De Larosiere shows how it could work | IOL Business Reporthttps://www.iol.co.za/business-report/international/de-larosiere-shows-how-it-could...Apr 21, 2014 � De Larosiere shows how it could work. ... He dipped a croissant in his coffee as he talked to Reuters. ... leading to the collapse of Lehman Brothers �[PDF]Technische Universit�at Mu�nchen Zentrum Mathematikhttps://mediatum.ub.tum.de/doc/1079307/1079307.pdfThe failure of the former investment bank Lehman Brothers in September 2008 and the ... This is one of the ... dual approach in his proof. In Embrechts and Puccetti (2006) the authors focused on a related problem. They considered for all s ? Rk the functions m

On the cent: real wolf of Wall Street hungry for 2008 ...https://thevegasnewsjournal.com/finance/on-the-cent-real-wolf-of-wall-street-hungry...One of Asia�s richest businessman yesterday vowed to use his personal fortune to bring the US bankers responsible for the 2008 financial crash to justice. ... a decade on from the collapse of Lehman Brothers and the beginning of the credit crisis, the billionaire tycoon promised to widen his net and bring multi-million-dollar actions against ...

On the cent: real wolf of Wall Street hungry for 2008 ...https://allindiabulletin.com/business/on-the-cent-real-wolf-of-wall-street-hungry-for...One of Asia�s richest businessman yesterday vowed to use his personal fortune to bring the US bankers responsible for the 2008 financial crash to justice. ... a decade on from the collapse of Lehman Brothers and the beginning of the credit crisis, the billionaire tycoon promised to widen his net and bring multi-million-dollar actions against ...

Who�s afraid of Basel 3? Not crisis-hardened PH bankers ...https://business.inquirer.net/246Mar 16, 2011 � MANILA, Philippines�The global economic turmoil that led to the collapse of Lehman Brothers in September 2008 and the near bankruptcy of several large financial establishments in �

A history of forward planning - Cyprus Mailcyprus-mail.com/2017/10/08/history-forward-planningThe sector survived the 1974 Turkish invasion, the devastation inflicted on the global shipping industry by the collapse of Lehman Brothers in 2008, and emerged from Cyprus� bailout in 2013 ...

Pressure on Reserve Bank for more rate cutshttps://www.theaustralian.com.au/business/financial-services/pressure-on-reserve-bank...Pressure on Reserve Bank for more rate cuts ... Unlike after the collapse of Lehman Brothers in 2008 when the Australian dollar fell sharply, Mr Jarman said: "You're probably not going to get that ...

social media. consumers | Digital 3000https://digital3000.wordpress.com/category/social-media-consumersThe first big finding: �In the wake of a recession that saw large, global companies such as Lehman Brothers, General Motors, and AIG collapse, trust in business imploded. � The public has lost confidence. The report shows that � people now trust one another more than they do established institutions.� This is huge.

Investment banks had their worst start to the year since 2009https://uk.finance.yahoo.com/news/investment-banks-had-worst-start-105100331.htmlApr 04, 2016 � Investment banks collected $16.2 billion (�11.3 billion) in fee revenue, according to Thomson Reuters, which marks the worst start to the year since 2009 � a point at which the industry was in turmoil following the collapse of Lehman Brothers in 2008. Here's how it looks on the chart:

Toronto CFAs gather, partake in divination | Wealth ...https://www.wealthprofessional.ca/news/industry-news/toronto-cfas-gather-partake-in...That is, the bearish talk that has become so common since the "week after Lehman Brothers collapsed" in the Great Recession doesn�t get the big story (commenting on the psychology of current market commentators he noted, that "you sound cooler when you�re bearish�but that this misses what other smart people are saying�� So true).

How does Corporate Governance Affect the Stability of ...https://wenku.baidu.com/view/134f7b633169a4517723a35d.htmlTranslate this pageThe 2008 financial crisis has caused more than 400 banks to fail in the US, and some giant international banks were involved as well. For example, Lehman Brothers Holdings Inc. collapsed when the crisis happened, and AIG, Fannie and Freddie were taken over by the US government after the crisis.

Gray Mountain | LiVe YoUr DrEaM...https://sayedkhadri.wordpress.com/2014/12/05/gray-mountainDec 05, 2014 � Let�s get to the point straight away � this story revolves around Samantha Kofer, a third year associate at prestigious law firm but when Lehman Brothers collapses and US is hit with major recession in 2008 � she gets downsized, furloughed, escorted out of the building. Her firm gives her an option of keeping health insurance for a year if she take a Pro-Bono work and only option she ...

Crypto Investing in the 2020shttps://www.fxstreet.com/cryptocurrencies/news/crypto-investing-in-the-2020s-201910161624Lehman Brothers failed, triggering a chain reaction of even greater failures in the banking system. ... That was the dream. But it has not been the reality. ... Bitcoin was the first successful ...[PDF]BOARD INDEPENDENCE AND CORPORATE FRAUDerf.org.eg/wp-content/uploads/2014/08/620.pdfbankruptcy of the company, but it also caused the disappearance of one of the biggest consulting firms: Arthur Anderson. The negative consequence of fraud in accounting numbers was not limited to developed markets, but touched emerging markets like Tunisia, where there was the bankruptcy of

Wendell Tucker Saves The Worldhttps://yourewelcomeworld.blogspot.comLehman Brothers Global Investment Bank has begun proceedings to file for Chapter 11 Bankruptcy. Perennial Wall Street powerhouse Merril Lynch has been bought out by Bank of America for a mere $29 per share or around $40 billion. Earlier this year we saw the fall of Bear Stearns, which was bought by J.P. Morgan Chase.

The Glenn Beck Program Podcasts | All & Latest Episodeshttps://www.owltail.com/podcast/29430-the-glenn-beck-program/episodesIt's not going to be the Democratic party of Bill Clinton or even Barack Obama. It will be the Democratic party of Bernie Sanders.Sovereign Debt Crisis and Dollar CrisisWe're going back to the anniversary of the Financial Crisis and the collapse of Lehman Brothers, and the next crisis, which will be a sovereign debt crisis and a dollar crisis.

Their Debts - The Economic Collapsehttps://theeconomiccollapseblog.com/archives/tag/their-debtsApr 29, 2013 � As mentioned earlier, a massive problem for the financial system of Europe, because nearly all of the major European banks are leveraged to the hilt and they are massively exposed to government debt. If you don�t think that a problem, just remember what happened back in 2008. Back then, Lehman Brothers was leveraged 31 to 1.

IT Capital News: May 2012https://itcapnews.blogspot.com/2012/05May 30, 2012 � Six years later Lehman Brothers collapsed and Citigroup and General Motors turned to the government for salvation. Meanwhile, SOEs were growing in emerging markets, challenging the idea that public companies are the biggest fishes in the sea. Private-equity firms flourished in the West, challenging the idea that public companies are the best ...

Connecticut Bankruptcy Court | Essential Credit Repair ...https://franziskadxbx81h67.wordpress.comLehman Brothers Holdings Inc., with assets of $639 billion, filed the biggest bankruptcy in U.S. history. The the biggest U.S. bank failure, Seattle-based Washington Mutual Inc. File Bankruptcy collapsed in September with $307 billion in assets. Searching for a Low Cost Bankruptcy Lawyer lawyer in the Philippines is simple. You can just open ...

Tradenext Limited Bloghttps://tradenext-blog.blogspot.comThe Euro seems to be pushing the boundaries as the Greek dilemma seems to be taking charge after the biggest global recession in history is still haunting us. The 2008 crisis which was steered by the collapse of banking giants Bear Stearns and Lehman Brothers hasn�t let go of its troubles.

Daily Links Archives: September, 2012 - Crane Datahttps://cranedata.com/archives/daily-links/2012/9Starting in 2008, after the collapse of Lehman Brothers hit investor confidence, the government began guaranteeing an unlimited amount of non- interest- bearing deposits at banks. But that program, now called the Dodd- Frank Deposit Insurance Provision, is set to expire at the end of the year.

Taibbi � Public Intelligence Bloghttps://phibetaiota.net/tag/taibbiNobody goes to jail. This is the mantra of the financial-crisis era, one that saw virtually every major bank and financial company on Wall Street embroiled in obscene criminal scandals that impoverished millions and collectively destroyed hundreds of billions, in fact, trillions of dollars of the world�s wealth � and nobody went to jail.[PDF]Interpreting recent movements in sterlinghttps://core.ac.uk/download/pdf/6296816.pdfoccurred in the final few months of 2008, as the financial crisis intensified substantially following the bankruptcy of Lehman Brothers in September 2008. In fact, the 20% �ERI depreciation in 2008 Q4 was the sharpest quarterly fall in sterling since the end of the Bretton Woods system of fixed exchange rates in the early 1970s (Chart 3). But ...

Business Times - The Sunday Timeswww.sundaytimes.lk/100110/BusinessTimes/bt29.htmlHowever, there are times when diversification seems to come unstuck. The global meltdown after the collapse of Lehman Brothers in 2008 was a classic example. Every asset class was equally battered. A closer inspection reveals that the benefits of diversification remained intact, and it was the individual portfolio mix that actually failed ...

Getting Through a Volatile Market - SlideSharehttps://www.slideshare.net/JLinneman/marketvolatilityseminarApr 07, 2009 � Lehman Brothers High Yield Bond Index covers the universe of fixed rate, non-investment grade debt. The Index includes both corporate and noncorporate sectors. Lehman Brothers Aggregate Bone Index is composed of corporate, U.S. Government, mortgage-backed and Yankee bonds with an average maturity of approximately 10 years.[PDF]Interpreting recent movements in sterlinghttps://core.ac.uk/download/pdf/6296816.pdfoccurred in the final few months of 2008, as the financial crisis intensified substantially following the bankruptcy of Lehman Brothers in September 2008. In fact, the 20% �ERI depreciation in 2008 Q4 was the sharpest quarterly fall in sterling since the end of the Bretton Woods system of fixed exchange rates in the early 1970s (Chart 3). But ...[PDF]Tarisa Watanagase: The road ahead for central banks ...https://www.bis.org/review/r100721a.pdfdrastic increases in oil prices. Two months after my talk, starting with the fall of Lehman Brothers, the world went into the deepest recession never seen since the Great Depression. Thailand was not spared, as the Thai economy last year experienced negative growth for the first time since the 1997 crisis.[PDF]Erik Corsman, Master's thesis Finallup.lub.lu.se/student-papers/record/7860390/file/7860395.pdfcrisis entered a new phase as the investment bank Lehmann brothers entered bankruptcy on September the 15 as a result of having held large positions in subprime-linked securities. This event was followed by the collapse of the insurance firm AIG the day after and this was the beginning of a serve economic crisis

China Nowhttps://www.garyascott.com/2009/09/18/7262.htmlA large drop in the Chinese stock market, a falling US dollar and good Chinese equity news should get us looking at China and the yuan. Last week, on the anniversary of the bankruptcy of Lehman Brothers, Ben Bernanke said that the US recession is probably over but the economy will remain weak for some �[PDF]RESIDENTIAL RESEARCH PRIME CENTRAL LONDON SALES �www.cimbpreferred.com/articles/promotions/overseasmortgagefinancing/researchreport/...annual growth in prime central London eased to 1% in February after prices fell -0.1% from the previous month. The half-year decline of -0.6% is the lowest rate since June 2009, as the market found its feet following the collapse of Lehman Brothers. The 1% annual increase is skewed by the relatively stronger performance of eastern

???? ? ?????????????? ?????????? (21 - 25 ??????? 2011 ...https://ime.bg/bg/articles/novo-v-ikonomieskata-biblioteka-21-25-noemvri-2011-As the title of the opening chapter puts it, financial crisis is a "hardy perennial", and there has been no shortage of material for the purposes of updating. The new edition incorporates events such as the collapse of Lehman Brothers and the Bernie Madoff fraud into �

Peace Corps Online: 2009.03.04: March 4, 2009: Headlines ...peacecorpsonline.org/messages/messages/467/3213910.htmlAccording to Kevin Jones, the creator of the conference and a principal in Good Capital, an investment firm focusing on social business, two-thirds of the participants signed up after the collapse of Lehman Brothers, which he called a sign that people are flocking to what he calls a "new asset class." ... Ms. Bretos said that a business was the ...

??????????????????????? - Weblio?? �https://ejje.weblio.jp/sentence/content/?????Translate this pageThis was the first attempt of the survey toaddress the U.S. market conditions, ... In relation to the bankruptcy of Lehman Brothers and the government bailout of AIG, ... the surrounding environment has changed considerably � true not only for the financial sector but for the entire economy.

approach in direction - Deutsch-�bersetzung � Linguee ...https://www.linguee.de/englisch-deutsch/...Translate this pageSince the credit freeze brought the global financial system to the brink of collapse in the aftermath of the failure of Lehman Brothers on 15 September 2008, governments of the G20 have been [...] seeking to mo v e in t h e direction o f a co mm o n approach t o f inancial regulation.

Sandy Weill U-turn fuels big bank breakup fire � Breakingviewshttps://www.breakingviews.com/.../sandy-weill-u-turn-fuels-big-bank-breakup-fireJul 25, 2012 � In his interview on CNBC, Weill complained that the combination of the Dodd-Frank Act�s tangle of regulation and populist outrage at big banks has hobbled the industry. His suggestion: hive off investment banking. This is rich coming from the man who hung a portrait with the words �The Shatterer of Glass-Steagall� in his office.[PDF]The Master�s idea: Revitalising uncertaintyhttps://www.s-e-i.ch/archive/Masteridea.pdfstatistics and econometrics, uncertainty can be understood as the ratio of ... ity distribution function for a set of events. In his Treatise on Probability, ... uncertainty �[PDF]Day banking world stood stillshellnews.net/images/8SEPT2009DAILYMAIL.pdfAs the anniversary of the climax of the banking crisis approaches, the Daily Mail today launches a series of investigations into events that brought the global financial system to the brink of disaster. Here, BEN LAURANCE examines the collapse of an Amer ican banking icon UNTIL that very weekend, it seemed Lehman Brothers could still be saved.

The Golden Truth: A Smoking Gun Emerges in Lehmangatehttps://truthingold.blogspot.com/2010/03/smoking-gun-emerges-in-lehmangate.htmlMar 06, 2010 � "A Lehman Brothers whistleblower warned his bosses that accounting gimmicks the bank used before its collapse may have been illegal, his lawyer said Friday." Here's the Yahoo News link: LINK Lee wrote in his letter that "I believe the manner in which the firm is reporting these assets is potentially misleading to the public and various ...

Fortis � Infinite Unknownhttps://infiniteunknown.net/tag/fortisFortis is the largest European firm so far caught up in the global financial crisis that drove Lehman Brothers Holdings Inc. into bankruptcy two weeks ago and prompted U.S. President George W. Bush to seek a $700 billion bank rescue package.

Commentary Archives - Accredited Investorshttps://www.accredited.com/coined/tag/commentaryThis weekend marks the tenth anniversary of the collapse of the Lehman Brothers investment bank, and with it the rapid descent into the global financial crisis. For many investors, it feels like only yesterday � and that fact may have implications for the next downturn, whenever it may come.

BBC Two England - 14 January 2009 - BBC Genomehttps://genome.ch.bbc.co.uk/schedules/bbctwo/near/2009-01-14Jan 14, 2009 � Tracing the rise and fall of Northern Rock and Lehman Brothers, the Today presenter tries to get to the bottom of why the UK experienced its first run on a high street bank since the mid-19th century and what prompted a giant of Wall Street to collapse in the biggest bankruptcy in history. ... This is a historical record of the planned output ...[PDF]Lancaster University Management School: Author Accepted ...www.research.lancs.ac.uk/portal/services/downloadRegister/245500703/Gabbioneta_et_a_SI...This is an �accepted manuscript� as required by HEFCE�s Open Access policy for REF2021. ... to as the �Panama Papers� � provide evidence that a number of law firms, tax advisors, and ... law to provide a favourable assessment of the Lehman Brothers� plans to remove liabilities from

Unrepentant Fuld blames Washington for Lehman collapse and ...www.ftchinese.com/story/001062274/ce � Translate this pageDick Fuld, the chief executive who presided over the implosion of Lehman Brothers, used his first voluntary public appearance since its collapse in 2008 to blame the US government for fuelling the financial crisis and ordering the closure of his investment bank.

firm steps - Deutsch-�bersetzung � Linguee W�rterbuchhttps://www.linguee.de/englisch-deutsch/uebersetzung/firm+steps.htmlTranslate this pageAsean will not take firm steps to deal with the junta for fear of trade fallouts as well as the fear of the organization falling apart at the seams. burma-report.de. ... This is a new [...] Africa that has taken firm steps to give concrete ... at last following the bankruptcy of Lehman Brothers. kof.ch. kof.ch. Ebenso schnell und entschlossen ...

Latest Hedge Fund Composite shows assets class offers ...https://www.fanews.co.za/article/investments/8/general/1133/latest-hedge-fund...Nov 17, 2009 � Latest Hedge Fund Composite shows assets class offers stability . ... compared with 8.21% for the All Bond Index and a massive 20.90% for the JSE All Share Index. Cash predictably offered the most stable returns over the period. ... �While the JSE is now trading above levels seen just prior to the collapse of Lehman Brothers, the future ...

Relevant Science: The Forever Slump - NYTimes.comhttps://relevantscience.blogspot.com/2014/08/the-forever-slump-nytimescom.htmlAug 14, 2014 � "It�s hard to believe, but almost six years have passed since the fall of Lehman Brothers ushered in the worst economic crisis since the 1930s. Many people, myself included, would like to move on to other subjects. But we can�t, because the crisis is by no means over.

Lisa's Investment Talk: ?????:???? ?????8.72?https://investtalk-lisa.blogspot.com/2015/09/872.htmlTranslate this pageon.cc???? ?on.cc????? ????,?????????,?????????????,?????8.72?,???????(25?)?3.38?,????5.34?;?1??????7??�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

The Maple Three: June 2010https://themaplethree.blogspot.com/2010/06The acronym PIGS make it seem that Europe's debt crisis is a result of government spending. This is simply not true. Prior to the Lehman Brothers bankruptcy Portugal, Ireland, and Spain, had debt levels that were either comparable to Canada's or lower. Moreover, none of these countries were running huge deficits prior to the crash.

Failure of corporate governance � intention or negligence_????https://wenku.baidu.com/view/e936677676c66137ef06193b.htmlTranslate this pageLehman Brothers The collapse of Lehman Brothers [9] seen by a lot of people, a corporate governance failure, not a failure of financial markets, in September 2008, was the biggest bankruptcy in the corporative history of the USA, and the event that conduced to the largest and worst financial crises of �

Interview with IMF Head Dominique Strauss-Kahn: 'It Is ...https://www.spiegel.de/international/world/... � Translate this pageThis is why we need to restrain our greed with better regulation." ... Was the downfall of Lehman Brothers necessary as an educational measure? ... the IMF was the first institution among all the ...

David L Riddick � The Aged P � Page 2 � Biased BBChttps://biasedbbc.org/blog/author/david-l-riddick-the-aged-p/page/2Excuse me? If that was the case why was it that the only time that the McCain ticket led Obama in the polls was in the first half of September after Palin joined it? After September 15th, of course, the ticket was dead in the water � not because of Palin but due to McCain�s deer-in-the-headlights reaction to the Lehman Brothers collapse.

Lehman bros bankruptcy settlement" Keyword Found Websites ...https://www.keyword-suggest-tool.com/search/lehman...En.wikipedia.org The bankruptcy of Lehman Brothers on September 15, 2008 was the climax of the subprime mortgage crisis.After the financial services firm was notified of a pending credit downgrade due to its heavy position in subprime mortgages, the Federal Reserve summoned several banks to negotiate financing for its reorganization. These ...

dEMOCRAT ceo'S ON wALL STREET? Will they ... - Yahoo Answershttps://answers.yahoo.com/question/index?qid=20080923045800AAqOqmkSep 23, 2008 � Jamie Dimon J.P. Morgan Chase & Co. Lloyd Blankfein Goldman, Sachs & Co. John Mack Morgan Stanley Vikram Pandit Citigroup Inc. Richard Fuld Lehman Brothers Inc.

MinitheShyGal | the shy gal finally speaks uphttps://minitheshygal.wordpress.comMay 03, 2018 � In 2008, the investment bank Lehman Brothers filed for the largest bankruptcy in American history. It took just hours for the catastrophic effects of the company�s failure to become apparent to ordinary people all across the world. Jende Jonga and his wife, Continue reading ?

Lehman collapse timeline" Keyword Found Websites Listing ...https://www.keyword-suggest-tool.com/search/lehman+collapse+timelineLehman Brothers declares bankruptcy - HISTORY History.com At the time of its collapse, Lehman Brothers was the country�s fourth-largest investment bank, with some 25,000 employees worldwide�but it began as a humble dry goods store founded by German ...

January 14, 2011 � Indyfromaz's Blog: The Thoughts of An ...https://indyfromaz.wordpress.com/2011/01/14Jan 14, 2011 � The prospect of oil breaking $100 a barrel, last touched in October 2008 after Lehman Brothers collapsed, has raised alarm bells about the impact of fuel costs on the economic recovery. Obama almost secretly �allowed� some oil companies to start drilling again 6 �

Finlaw Consulting ABIL is no longer ABLE - Aug 2014 ...https://www.finlaw.co.za/abil-longer-able-aug-2014Perhaps the BIG news in the local market over the past quarter was the collapse of African Bank Investments Limited [ABIL]. Parallels were quickly drawn by the fearful to the collapse of Northern Rock [2007] and Lehman Brothers [2008] which triggered the Global Financial Crisis and a record share market plummet not seen since the 1920�s.

vJ~ - Southeastern Homepageshomepages.se.edu/cvonbergen/files/2013/01/Why-Women-Make-Less-s-Than-Men.pdfStreet. What I found intriguing-and hypocritical-was the initial reac tion when men like Dick Fuld of Lehman Brothers and Jimmy Cayne of Bear Stearns drove their respective banks into the ground in 2008. The coverage focused on management mistakes and market forces seemingly beyond their control. It did not, at first, say that these were men who[PDF]Glossary on the alternative investment fund managers directivehttps://www.europarl.europa.eu/pdfs/news/expert/2010/11/background/20100923BKG83508/...As the name implies, hedge funds were initially designed with the aim of hedging (protecting ... techniques and a wide range of other investment methods with the aim of increasing the return ... This is a fund that invests specialised investors' money directly in private companies.[PDF]A study undertaken on behalf of Interpharma The Importance ...https://www.interpharma.ch/sites/default/files/polynomics-2011_bedeutung-der-pharma...presents a very different picture. 2003 was the only year when the number of persons employed was below the prior year�s level. This difference in development as regards job development is also reflected in the annual growth trend. Since 1990, 3.2% additional jobs were created in �

Bad Financial Moon Rising by William White - Project Syndicatehttps://www.project-syndicate.org/commentary/global-economy-weak-fundamentals-by...Oct 03, 2018 � A decade after the collapse of Lehman Brothers, global debt levels are higher than in 2008, lending has moved into the opaque realm of asset management and private equity, and the dollar is surging. Given the proliferating risks, another financial crisis and downturn could be in store.�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

BBC News - City Diaries: 24 Decembernews.bbc.co.uk/2/hi/business/8429303.stmDec 24, 2009 � City Diaries: 24 December ... Justifications given for not preventing Lehman Brothers going to the wall turned out to be flawed as ripples on a pond are sometimes difficult to predict and symbolic and psychological damage was not properly taken into account. ... It was the phrase "we say this from a position of strength". Obviously, the ...[PDF]Glossary on the alternative investment fund managers directivehttps://www.europarl.europa.eu/pdfs/news/expert/2010/11/background/20100923BKG83508/...As the name implies, hedge funds were initially designed with the aim of hedging (protecting ... techniques and a wide range of other investment methods with the aim of increasing the return ... This is a fund that invests specialised investors' money directly in private companies.[DOC]Diamond and Kashyap on the Recent Financial Upheavalspeople.exeter.ac.uk/gdmyles/Teaching/IAPM/FinancialCrisis.doc � Web viewOn Monday, the largest bankruptcy filing in U.S. history was made by Lehman Brothers. Lehman had over $600 billion in assets and 25,000 employees. (The largest previous filing was WorldCom, whose assets just prior to bankruptcy were just over $100 billion.) On Tuesday, the Federal Reserve made a . �[PDF]A study undertaken on behalf of Interpharma The Importance ...https://www.interpharma.ch/sites/default/files/polynomics-2011_bedeutung-der-pharma...presents a very different picture. 2003 was the only year when the number of persons employed was below the prior year�s level. This difference in development as regards job development is also reflected in the annual growth trend. Since 1990, 3.2% additional jobs were created in �

Pink picks | FT Alphavillehttps://ftalphaville.ft.com/2010/10/15/371351/pink-picks-616In the financial earthquake that followed the collapse of Lehman Brothers in 2008, bankers were gripped by one question: who would be the next to go? Back in 2008, the answer seemed clear to many ...

www.albany.eduhttps://www.albany.edu/honorscollege/files/Karasaridis_Thesis_Final_Version.docxEvidence of this can be seen in the failure of major investment bank Lehman Brothers, whose dealings were part of the economic collapse in 2008. After news revealed that Lehman Brothers was in talks with a South Korean firm over buying a stake in their company, shares of the bank plummeted 45% (Agence France-Presse, 2008).

Fundamentals could resurface after wrenching sell-offhttps://ca.finance.yahoo.com/news/fundamentals-could-resurface-wrenching-sell-off...Jan 16, 2016 � It is only the fourth day since the end of 2008 that the number is above 900. It also was the seventh day in a row of more than 500 NYSE stocks at their lowest in at least a year, a streak not seen since October 2008 -the month following the bankruptcy of Lehman Brothers. Major indexes fell Friday for a third consecutive week.

Greek Debt Crisis Won�t Spawn Second Global Financial ...www.marketoracle.co.uk/Article19007.htmlJust as Lehman Brothers Holdings Inc. (OTC: LEHMQ) executives kept voting themselves giant bonuses as the company was tottering into bankruptcy, so, too, do Greek-public-sector workers go on ...

Insurance & Reinsurance Industry Group: Corporate ...https://www.mayerbrown.com/-/media/files/perspectives-events/publications/2009/08/...balance sheets have been hit hard and a number of businesses have raised capital, often by way of a rights issue, in order to strengthen balance sheets. Most, if not all, businesses have taken steps to reduce their cost base, and this has seen an increase in the outsourcing of back-office and ��lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Jeffrey Flew Tutor Interview - Cafetalkhttps://cafetalk.com/page/interview/tutor/one/?code=jeffrey-flew&lang=enI was working for the Investment bank Lehman Brothers when it famously went bankrupt in 2008 triggering the global financial crisis. I left Japan in 2013 and after travelling for a while I met a wonderful girl in Cebu City Philippines who would later become my wife.[PDF]Temi di discussionehttps://www.bancaditalia.it/pubblicazioni/temi-discussione/2019/2019-1217/en_Tema_1217...crisis, which intensi ed right after Lehman Brothers� default and was followed by a large contraction of world trade between late 2008 and early 2009. The second shock is the sovereign debt crisis in the euro area, which led to a steep rise in risk premium in Italy, Spain and other countries.[PDF]THE ALUMASC GROUP PLC � FULL YEAR RESULTS �www.alumasc.co.uk/wp-content/uploads/2016/08/Handout-2014.pdfTHE ALUMASC GROUP PLC � FULL YEAR RESULTS ANNOUNCEMENT Alumasc (ALU.L), the premium building and engineering products group, announces results for the year ended 30 ... This is a welcome development as the Board refreshes its ... moved to Lehman Brothers in its Investment Banking group in 1987 and later became a Partner at PwC, where he led ...

Europe drifting to an inevitable, disastrous crisishttps://www.dnaindia.com/business/report-europe-drifting-to-an-inevitable-disastrous...Jun 29, 2011 � Europe drifting to an inevitable, disastrous crisis - Rather than amputating a gangrenous limb, leaders of the continent risk poisoning the entire body fatally. The rescue plan is coming apart.[PDF]The Financial Meltdownhttps://cs.uwaterloo.ca/~paforsyt/protter.pdfin liquidity. The government of FDR helped to solve this problem, and a key component of the solution was the Glass-Steagall act of 1933. Glass-Steagall ... polluting the air and water is at a competitive disadvantage to a company that does ... 5 Richard Fuld Jr. of the now bankrupt Lehman Brothers �earned� $54 million in 2006 SMF ...

Escaping from a Combination of Liquidity Trap and Credit ...https://core.ac.uk/download/pdf/6563311.pdfFrom the collapse of Lehman Brothers on September 15 to the announcement of the recapitalization of European banks on October 13 and US banks on October 14, stock prices were falling by several percent per day. Currently, it seems that this downward trend has come to a halt.�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Western force - The Australianhttps://www.theaustralian.com.au/business/the-deal-magazine/western-force/news-story/...IT was in October 2008, in the chaos after the collapse of Lehman Brothers, that Jon Sutton took a career-changing call on his mobile phone while he watched his son play in the national under-16 ...

Bears are circling bulls in the China shophttps://www.theaustralian.com.au/business/business-spectator/news-story/bears-are...In 2008 -- and after the collapse of Lehman Brothers -- commercial banks, having lost confidence in the solvency of other banks (and therefore that other bank�s capacity to pay back their short ...[PDF]38th ECONOMICS CONFERENCE 2010 � Stefan Gerlachhttps://www.oenb.at/dam/jcr:a4e85fc0-047a-4276-b799-5bf466beefa2/vowitag_2010_gerlach...5 Another factor contributing to this decline in long interest rates was the fall in real interest rates (see Gerlach et al. 2009). Bernanke (2005) suggests that this decline was largely due to global imbalances. 6 See OECD (2009). 7 These frameworks are more flexible since they do not express the inflation objective as a point but as a range and