Home

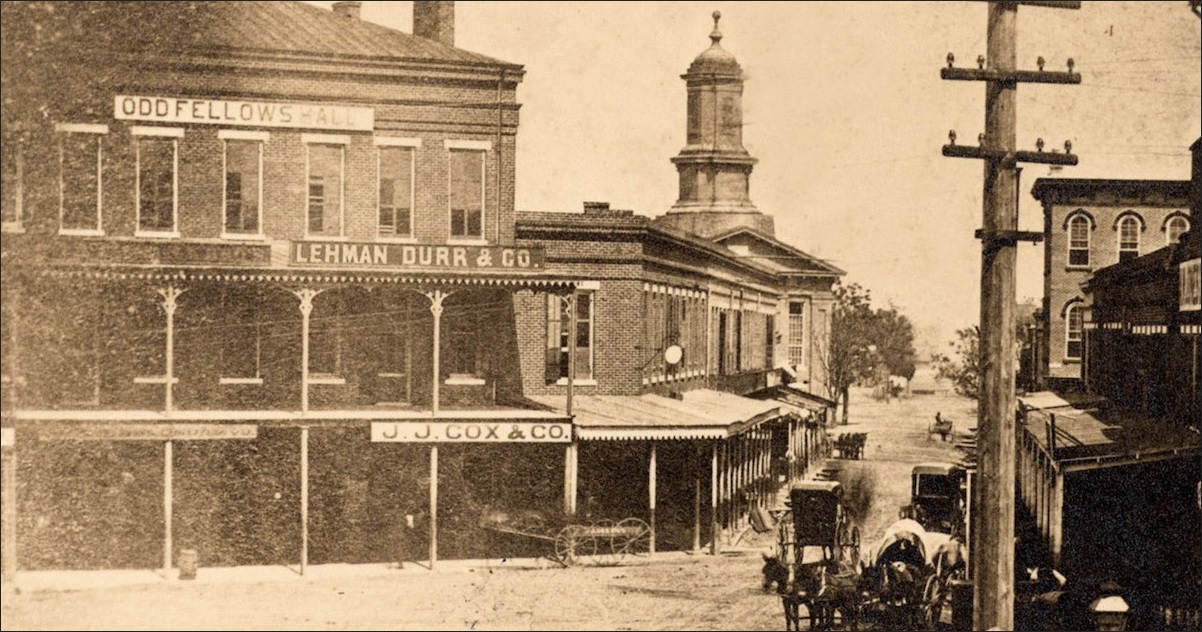

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

SEP US presidential candidate addresses London meeting ...https://www.wsws.org/en/articles/2012/09/lond-s07.htmlThe last time White had addressed an audience in London was in October 2008, just a month after the collapse of the Lehman Brothers investment firm and a month before the election of Barack Obama.

(PDF) Structural Models and the Credit Crisishttps://www.researchgate.net/publication/251259408...We implement the model for the case of Lehman Brothers in the midst of the 2008 Financial Crisis and are able to predict higher default probabilities in March of 2008, well before Lehman's ...

Who am I - 250 words essay - PHDessay.comhttps://phdessay.com/who-am-i-250-words-essayThe caused and effects of Lehman Brothers bankruptcy. ? Lehman Brothers was founded in 1850 and it is a diversified investment bank provided financial services for �[PDF]Banking as a Virtuous Practice - Amazon S3https://s3-eu-central-1.amazonaws.com/viisi/app/...In September 2008 the financial world was shaken to its core by the bankruptcy of Lehman Brothers, a large international investment bank. Signs of turmoil in the financial markets had started to show more than a year earlier caused by decreasing housing prices, deteriorating

Investors need to brave 'ghosts of 2008' and keep cash ...https://markets.businessinsider.com/news/stocks/...Mar 15, 2020 � Rich Steinberg was at his son's baseball game the Friday before Lehman Brothers filed for bankruptcy in September 2008. The other attending parents �

Subprime crisis to hit charities - SMH.com.auhttps://www.smh.com.au/business/subprime-crisis-to...Lehman Brothers denies the claims Wingecarribee Council has made in its statement of claim filed with the Federal Court." Save Log in , register or subscribe to save articles for later.

G20 Summit and XI Jinping Speech Analysis - Communal Newshttps://communalnews.com/g20-summit-and-xi-jinping-speech-analysisFurthermore, the global economy has fallen into decline. This scenario is much worst in comparison to the 2008 crisis. The financial crisis stretched over more than a year, whilst causing the collapse of Lehman Brothers in September 2008 and the government bailout of the Wall Street.[PDF]Bayesian Forecasting for Financial Risk Management, Pre ...https://ses.library.usyd.edu.au/bitstream/2123/8156/1/OMWP_2011_03.pdfFannie Mae and Freddie Mac, Lehman Brothers ling for bankruptcy after being denied support by the Federal Reserve Bank. However, the "credit-crunch" became apparent in January, 2008 and it has been suggested the whole GFC was pre-empted by house prices falling in June, 2007. In late

December | 2015 | grow. learn. connect.https://jmrlblog.com/2015/12Gray Mountain by John Grisham � Losing her job at New York City�s largest law firm in the weeks after the collapse of Lehman Brothers, Samantha becomes an unpaid intern in a small Appalachian community where she stumbles upon dangerous secrets.

Trying to fill 6,000 jobs, Microsoft pitches $10,000 H-1B ...https://www.computerworld.com/article/2491730/...In April of 2008, still months before the collapse of Lehman Brothers in September that year, the U.S. exhausted the visas within one week. But after the recession, demand slowed. But after the ...

Top 7 risks to global economy | All media content | DW ...https://www.dw.com/en/top-7-risks-to-global-economy/g-45839006Some tend to ignore the lessons from the collapse of Lehman Brothers some 10 years ago. 6.Hard Brexit Time's running out, but there is still no agreed plan as to the modalities of Britain's exit ...

Why Christine Lagarde wants gender quotas in business � Quartzhttps://qz.com/1493144/why-christine-lagarde-wants-gender-quotas-in-businessDec 12, 2018 � Referencing her famous past remark that the 2008 financial crisis would have looked different if Lehman Brothers had been �Lehman Sisters,� the �[PDF]Policy Report Annual Report on Major State Investment ...https://www.lbb.state.tx.us/Documents/Publications...fiscal year 2003. The Lehman Brothers Aggregate Bond Index returned 6.8 percent compared to 3.7 percent for the The fiscal year 2004 Annual Report on Major State Investment Funds presents the performance for Texas� major investment funds. Included in the report are the risk-adjusted returns for the funds as well as other performance

Transcripts reveal struggle to revive economy in 2008https://www.usatoday.com/story/money/2014/02/21/...Feb 21, 2014 � Lehman Brothers wound up filing for bankruptcy, Bear Stearns was acquired by JP Morgan Chase, Merrill Lynch was acquired by Bank of America, while lenders Fannie Mae and Freddie Mac were put under ...

G-7 Vows Growth Efforts As Japan�s Abe Warns Of Global Crisishttps://www.ibtimes.com/g-7-vows-growth-efforts...Japanese Prime Minister Shinzo Abe, talking up what he calls parallels to the global financial crisis that followed the 2008 Lehman Brothers bankruptcy, said the G-7 "shares a strong sense of ...[PDF]Fool proof plans - PwChttps://www.pwc.com/la/en/publications/assets/12th_annual_global_ceo_survey.pdfgrowing and a new set of countries emerging to challenge the group of eight industrialised nations (see figure 0.2, opposite). Added to these challenges are the scarcity of key skills, climate change, the depletion of natural resources and the potential for over-regulation by government. Introduction The government�s purpose should be to

Don't write off structured products | Analysis � Gulf Newshttps://gulfnews.com/business/analysis/don39t...Around 10 years ago, structured products found their way into the portfolio of numerous affluent investors. In the aftermath of the Lehman Brothers bankruptcy, these products were often portrayed ...

OUR SOLUTIONS | What Is Interrobanghttps://www.whatisinterrobang.org/our-solutionsThe suppression of data that led to Thalidomide scandal, the Ford Pinto disaster, the Lehman Brothers collapse, and the Rwandan, Yugoslavian and Nazi Germany genocides are just some of the corporate and social case studies where good people went with the flow, following unethical decisions.

Neil Desena, Larry Thompson Highlight 2017 Markets Choice ...https://markets.businessinsider.com/news/stocks/...Apr 20, 2017 � Larry Thompson, Vice Chairman of DTCC and a 36-year veteran whose influence helped stabilize markets through 9/11 and the Lehman Brothers bankruptcy, won Lifetime Achievement.

Fear in money market sector easing after intervention ...https://www.catholic.org/news/business/story.php?id=30472Crane says at least 20 parent companies of money market funds have pumped billions of dollars of cash into their funds. They had to after the subprime crisis began to explode, because almost overnight, money market funds couldn't sell securities tied to such troubled investment banks as Lehman Brothers �

A unique model in Europe � European CEOhttps://www.europeanceo.com/finance/a-unique-model-in-europeMar 15, 2010 � Since September 15, 2008 and the bankruptcy of the US bank Lehman Brothers, all the traditional landmarks for investors have disappeared. The role of each of our private bankers is all the more important since the client is looking for a new landmark in the current environment.

CleanTuesday : Association pour la promotion des cleantech ...https://cleantuesdayparis.fr/home/?page=4&em_x=22Special 10 ans - Special 10 years. Exactly 10 years ago, on September 17, 2008, 2 days after the bankruptcy of Lehman Brothers, a group of entrepreneurs, experts in energy and sustainable development, actors of the Emerging Open Innovation created the Non Profit Organisation Cleantuesday in the "Digital Canteen", pioneering place of innovation in Paris in the 2000s.[PDF]Reporterpremiacap.com/publications/MFA_Reporter_0304.pdfSandy Fleischman, Lehman Brothers; Kenneth Grant, EXIS Capital Management; Kenneth Raisler, Sullivan & Cromwell The first panel discussed the role of prime brokers, auditors and pricing services in continued on page 2 The panelists asserted that hedge fund man-agers should clearly establish consistent, reproducible, simple, transparent and verifi-

Conspiracy Against Lehman Brothers? | A Colossal Failure ...https://lawrencegmcdonald.wordpress.com/2009/05/02/lehman-brothers-collapsMay 02, 2009 � Letting Lehman Brothers collapse was a huge mistake, according to many people who worked on Wall Street during the economic crisis of 2008. They think it was a conspiracy between Hank Paulson, Geithner, Bernanke and the chiefs at Bank of America and JP Morgan. But this isn't really true. It wasn't a conspiracy to let�

Lehman Brothers Creditors To Enjoy $1.5B Payout From Sale ...https://www.sportsbusinessdaily.com/Global/Issues/...Sep 26, 2017 � Creditors of Lehman Brothers "are on track for a turbocharged windfall" after the collapsed bank announced it is selling its stake in NASDAQ-listed Formula 1, giving it a payout of $1.5B from a $300M investment, according to Christian Sylt for the London GUARDIAN.

Managing the bankruptcy of Lehman Brothers | International ...https://www.internationaltaxreview.com/article/b1f...Aug 31, 2000 � For a business as large and as complex as Lehman Brothers, the process was and continues to be nothing short of traumatic. Working through the tax implications is a significant part of the work. Bankruptcy is a trying time for any company.

Lehman RMBS Settlement Likely to Spur Additional Claims ...https://www.financialserviceswatchblog.com/2018/03/...Mar 19, 2018 � On March 8, the Bankruptcy Court for the Southern District of New York concluded a lengthy �claims estimation� trial to determine the appropriate final settlement price for a resolution of lawsuits filed on behalf of investors in residential mortgage-backed securities (RMBS) created by Lehman Brothers Holdings prior to its bankruptcy in September 2008.

Lehman Brothers, Citigroup settle $2 billion financial ...https://www.livemint.com/Industry/SUL81t4jYtXH6...New York: Citigroup Inc. and the wreckage of Lehman Brothers Holdings Inc. have resolved a fight over $2.1 billion that dates to the financial crisis, while quietly burying a key question about ...

Affiniti parent KCOM latest to reveal Lehman Brother's hithttps://www.computerweekly.com/microscope/news/...Sep 26, 2008 � The fall-out from the collapse of Lehman Brothers continues to ripple across the channel with Affiniti and Kingston Communications parent KCOM warning it �

"Long-term U.S. Cross-border Security Flows with Developed ...https://digitalcommons.georgiasouthern.edu/honors-theses/88We find evidence for a flight-to-safety with the start of the global financial crisis, with a significant, but short lived interruption due to the bankruptcy of Lehman Brothers. Further, the bankruptcy of Lehman Brothers has caused an abrupt drop in holdings of U.S. and �[PDF]Bankruptcy Lehman Brothers Treasury Co. B.V.https://www.finanzaonline.com/forum/attachments/...Feb 27, 2013 � 310000132/9687515_1 Bankruptcy Lehman Brothers Treasury Co. B.V. 27 February 2013 Lists of Provisionally Admitted Claimsand provisionally disputed Claims, Lists of �

Minimal in Milan: Matter Matters at The Flat - Massimo ...https://www.yatzer.com/matter-matters-milanApr 28, 2017 � His most impressive piece, �Dataflags� (2014), visually documents Lehman Brothers' collapse by tracking its daily share price for ten years up until its bankruptcy, transforming the data into a visual graph screen-printed onto a 2.4 by 1.4 meter sheet of Somerset paper. Hanging from the gallery ceiling like a dystopic flag of corporate ...

Lehman Brothers Collapse Blames Executives | Wall Street ...https://www.badcreditloancenter.com/report-on...The report on the collapse of Lehman Brothers has come out and it has blamed the company�s executives, its auditors and its rivals of wrong doing. The 158 year old Wall Street bank went bankrupt in 2008, triggering a huge financial crisis.

The Lehman Brothers' Bankruptcy.docx - Surname1 Name ...https://www.coursehero.com/file/69206182/The...Surname1 Name: Course Instructor: Course Title: Date: The Lingering Impact of Lehman Brothers' Bankruptcy When cross-examination is screened through the matter that has led to the menacing concussion, different instances have been portrayed in this case. Equity reception industrial firms from the Lehman Brothers', were adversely affected. Other services deliverance which includes analysis ...

Hong Kong lawmakers vote for Lehman Brothers probe - The ...https://economictimes.indiatimes.com/news/...Nov 13, 2008 � An investigation will be launched in Hong Kong into the sale of financial products linked to collapsed U.S. investment bank Lehman Brothers after lawmakers voted overwhelmingly for a probe.

Credit Contagion Channels: Market Microstructure Evidence ...https://onlinelibrary.wiley.com/doi/full/10.1111/j.1755-053X.2012.01194.xImmediately after Lehman Brothers� bankruptcy, many firms disclosed their financial exposure (or lack thereof) to Lehman. This offers a clean setting to test two credit contagion channels through which a financial firm's bankruptcy can affect other firms��counterparty risk� and �

BBC - Essex - Credit crunch - Essex counts cost of Lehman ...www.bbc.co.uk/essex/content/articles/2008/09/17/lehmans_feature.shtmlSep 17, 2008 � People in Essex who worked for Lehman Brothers have been left counting the cost of the bank's collapse. For Shirley Carter from Hutton, who worked as �

Lehman Brothers Structured Note Investors Should Take Actionhttps://www.dkrpa.com/blog/lehman-brothers...Investors in Lehman Brothers structured notes recently received a notice concerning potential distributions from the Lehman Brothers bankruptcy. These investors include those who bought so-called �100% Principal Protection� Notes. Investors must vote on the distribution plan by November 4, 2011.

Softbank's Masayoshi Son Is Holding $80B Cash From Asset ...https://www.ibtimes.com/softbanks-masayoshi-son...Softbank's Masayoshi Son Is Holding $80B Cash From Asset Sales For A 'Worst Case Scenario' By Vaibhavi Khanwalkar @vaiitoh ... similar to the 2008 Lehman Brothers crisis.

Deutsche Bank share prices: Drop sparks fears ... - The Sunhttps://www.thesun.co.uk/news/1890689/dramatic...Oct 01, 2016 � Shares crashed to their lowest level since the 1980's yesterday - amid fears the German bank could collapse like Lehman Brothers and crash the �

Rodge Cohen Recalls the Collapse of Lehman Brothers in ...https://www.sullcrom.com/News-Cohen-Collapse...Sep 15, 2010 � In �Remembering Lehman Brothers,� Mr. Cohen recalled the moment he learned Lehman would not survive. �I felt I had failed because we had been trying so hard for a period of months to save Lehman,� he said. �There was also a deep concern about an impending catastrophe.

Lehman Brothers sues JPMorgan for billions over collapse ...https://www.jurist.org/news/2010/05/lehman...[JURIST] Lehman Brothers Holdings [corporate website] on Wednesday filed suit [complaint, PDF] against JPMorgan Chase & Co. [corporate website] for allegedly "siphoning" off billions of dollars in "critically-needed" assets days before the investment bank filed for a record-breaking bankruptcy. JPMorgan was Lehman's main short-term lender before its collapse and acted acted as a middleman ...

Bankruptcy fees - Boom, bust, bonanza | Finance ...https://www.economist.com/.../09/10/boom-bust-bonanzaSep 10, 2009 � None is doing better than Weil, Gotshal & Manges, the lead law firm in the clean-up at Lehman Brothers. It has requested more than $100m of fees in �

EconPapers: Analysis of the Lehman Brothers collapse and ...https://econpapers.repec.org/RePEc:eee:phsmap:v:474:y:2017:i:c:p:162-171Analysis of the Lehman Brothers collapse and the Flash Crash event by applying wavelets methodologies. Maria P. Beccar-Varela, Maria C. Mariani, Osei K. Tweneboah and Ionut Florescu. Physica A: Statistical Mechanics and its Applications, 2017, vol. 474, issue C, 162-171

Lehman Brothers Bankruptcy Filing | Delaware Corporate ...https://www.delawarelitigation.com/.../lehman-brothers-bankruptcy-filingSep 15, 2008 � Steve Jakubowksi�s Bankruptcy Litigation Blog here, has a characteristically erudite analysis about the Lehman Brothers bankruptcy filing today, with links to actual documents filed in the case. I have to believe that part of the case will eventually involve claims against the officers and directors for their role in this "epic mess".

lehman brothers collapse Archives - NOBSUhttps://nobsu.com/tag/lehman-brothers-collapse*XRP* IS BEING PURPOSEFULLY HELD BACK, THERE IS A $200 BILLION MOTIVE BEHIND THIS! Election Bombing Run December 28th to Jan 2nd.- Is the Big Reveal Coming This Week?

Accounting Troubles at Lehman Brothers (#101 ...https://www.accountingtools.com/podcast-blog/2019/...Nov 23, 2019 � In this podcast episode, we cover the underlying accounting issues that contributed to the collapse of Lehman Brothers. Key points made are: Lehman improperly accounted for repurchase agreements, recording sales of the securities held as collateral, without any offsetting repurchase liability.Normally, these agreements are legitimately used as window dressing at month-end to make �

David S. Siegel - Ajamie LLPhttps://www.ajamie.com/lawyers/david-s-siegelSuccessfully litigated and settled for seven-figures an unliquidated and unsecured general creditor litigation claim in the New York Lehman Brothers bankruptcy proceeding. Member of the legal team that recovered a $70 million settlement from Securities America, Inc., the broker-dealer subsidiary of Ameriprise Financial, Inc., for investors who ...

Lehman Brothers� bankruptcy will weaken commercial ...https://www.cmdgroup.com/market-intelligence/...Contractors and developers should expect a few days to a few weeks of financial chaos with volatile credit rates and delayed access to credit from the bankruptcy over the weekend of the Lehman Brothers investment bank. Then the consequences for construction will be somewhat lower short term credit rates as the FRB adds liquidity to minimize additional bank failure but somewhat higher long term ...

EXCLUSIVE: Five Reasons Why Optimism for a US Recovery is ...https://www.thegatewaypundit.com/2020/05/exclusive...May 12, 2020 � Third, in 2008 �evil� bankers were blamed for the financial crisis and they had to be punished. Hence Lehman Brothers was not bailed out, which created a panic on Wall Street. Today, corporations are not in the firing line and governments have responded by helping firms to deal with their short-term cash flow shortages.[PDF]BEFORE THE GUAM PUBLIC UTILITIES COMMISSION IN THE �https://www.guampuc.com/dockets/puc20130403114725.pdf$13.7 Million of the Bond Reserve Fund in exchange for a one-time payment to 1 GPA Petition for Contract Review Approval of the Buyout of the Lehman Brothers Investment Contract, GPA Docket 12-02, filed March 9, 2012. 2 Response of Georgetown Consulting Group, Inc. to Guam Power Authority�s Petition to Approve Buyout of

Lehman Brothers Treasury trustees publish 13th bankruptcy ...https://www.cliffordchance.com/briefings/2012/10/...Visit our resource centre giving you access to our toolkits, publications, alerters and crossborder guides all in one place. Global M&A Toolkit; Financial Markets

Why did Lehman Brothers declare bankruptcy and Bear ...https://brainly.com/question/16308777Answer: Basically when Lehman Brothers went bankrupt, nobody thought that things were going to get so bad so quickly. If you analyze Lehman Brothers vs Bear Sterns, Lehman had better collateral that could have been used to secure a loan from the Fed, but �

Banking union: reducing the risk of a new financial crisis ...https://www.europarl.europa.eu/news/en/headlines/economy/20190404STO35072Lehman Brothers: 10 years after Reducing risks Another two reports by German S&D member Peter Simon stress that the completion of the banking union is necessary to create cross-border markets where customers can benefit from the positive effects of an integrated European banking system.[PDF](ORDER LIST: 546 U.S.) MONDAY, FEBRUARY 27, 2006 ...https://www.supremecourt.gov/orders/courtorders/022706pzor.pdfMONDAY, FEBRUARY 27, 2006 CERTIORARI -- SUMMARY DISPOSITIONS 05-535 HIGGINS, EVER V. TYSON FOODS, INC. The petition for a writ of certiorari is granted. The judgment is vacated and the case is remanded to the United States Court of Appeals for the Eleventh Circuit for further consideration in light of Ash v. Tyson Foods, Inc., 546 U.S. ___ (2006).

Causes of Lehman brothers� collapse | BluPapershttps://blupapers.com/file/causes-of-lehman-brothers-collapse-paperThis research paper extensively discusses the causes of collapse of Lehman brothers. This research paper in finding and discussing the causes of collapse of the bank will highly contribute in saving other banks or similar institutions from falling victim of the same. Additionally, it will play a major role in educating investors on the way to follow when investing in such banks.

Global Financial Development Report 2019/2020: Bank ...https://elibrary.worldbank.org/doi/book/10.1596/978-1-4648-1447-1Dec 05, 2019 � Over a decade has passed since the collapse of the U.S. investment bank, Lehman Brothers, marked the onset of the largest global economic crisis since the Great Depression. The crisis revealed major shortcomings in market discipline, regulation and supervision, and reopened important policy debates on financial regulation.

The Week at Ropes & Gray: Lessons from the Lehman Brothers ...https://www.ropesgray.com/en/newsroom/news/2018/09/...Weekly highlights of what�s happening at Ropes & Gray: Sept. 15 marked the 10th anniversary of the Lehman Brothers bankruptcy. A recent article in The Deal titled �The Great Rollback� looked back at the status of rules and laws written in the aftermath of the financial crisis, particularly the Dodd-Frank Act, to get a sense of how prepared Washington is for a future credit crunch.

Lehman bankruptcy will hit IIM placementshttps://www.rediff.com/money/2008/sep/16lehman.htmSep 16, 2008 � With America's fourth largest investment bank Lehman Brothers filing for bankruptcy protection and Merrill Lynch being bought over by the Bank of �

finance - Collapse of Lehman Brothers: What did they have ...https://economics.stackexchange.com/questions/...Tour Start here for a quick overview of the site ... Collapse of Lehman Brothers: What did they have in their books? Ask Question Asked 2 years ago. Active 1 year, 7 months ago. Viewed 61 times 2 $\begingroup$ What kind of products did Lehman Brothers �

Obama touts U.S. economy on 5th anniversary of Lehman ...https://www.ctvnews.ca/business/obama-touts-u-s...Sep 16, 2013 � In this Sept. 15, 2008 file photo, Lehman Brothers world headquarters is shown in New York, the day the 158-year-old investment bank, choked by the credit crisis and falling real estate values ...

The Federal Reserve�s Commercial Paper Funding Facility ...https://www.newyorkfed.org/research/staff_reports/sr423.htmlThe Federal Reserve created the Commercial Paper Funding Facility (CPFF) in the midst of severe disruptions in money markets following the bankruptcy of Lehman Brothers on September 15, 2008. The CPFF finances the purchase of highly rated unsecured and asset-backed commercial paper from eligible issuers via primary dealers. The CPFF was a liquidity backstop to U.S. issuers of commercial paper ...

Japan economic package to deal with epidemic to top 30 ...https://english.kyodonews.net/news/2020/03/6cb737...Mar 06, 2020 � The spending by the government for the planned stimulus is likely to surpass 15 trillion yen, the sum the government spent in an economic package in the wake of the global financial crisis sparked by the 2008 failure of Lehman Brothers Holdings Inc. The new package could involve providing cash and gift certificates to the public, as well as ...

Lehman Brothers administrators sell mortgage business to ...https://www.telegraph.co.uk/finance/newsbysector/...Lehman Brothers, the biggest banking casualty of the financial crisis, continues to be picked apart after administrators sold its UK mortgage business to private equity firms Blackstone and TPG.

Elizabeth Warren Takes a Victory Lap - The Daily Beasthttps://www.thedailybeast.com/elizabeth-warren-takes-a-victory-lapJul 11, 2017 � Despite the tough new stance of the SEC, Warren isn�t satisfied with what has been accomplished in the five years since the collapse of Lehman Brothers triggered the financial crisis.

Lehman Brothers1 | Lehman Brothers | Repurchase Agreementhttps://www.scribd.com/presentation/329191412/Lehman-Brothers1Lehman Brothers: Crisis in Corporate Governance. Agenda: About Lehman Brothers Subprime Mortgages Repo Market Business Model of Lehman Brothers The thing which went wrong The last days of Lehman Brothers. About Lehman Brothers : 1850 2008 Global financial services firm 4th largest Investment bank in U.S. Core Business: Investment banking, equity and fixed-income sales, research �

Comments on Lehman Brothers - Begbies Traynorhttps://www.begbies-traynorgroup.com/news/...Nick Hood, Head of the International Practice of Begbies Traynor, the insolvency and business turnaround specialist, said: �Nobody can predict how far the financial contagion from the collapse of Lehman Brothers will spread, but the credit crunch has reached the bleakest point to date.

How To Protect Your Financial Futurehttps://simplyhomeimprovement.com/how-to-protect-your-financial-futureI know I am. Lehman Brothers, the biggest Stock Brokerage company in the country, has submitted for bankruptcy just and are requesting federal government help in bailing them out also. How can you prepare for your retirement? Who is it possible to count on to save lots of your money for you until you are 65 years old? The answer is you.

Top IT woman at JP Morgan to deliver leadership keynote ...https://www.computerworld.com/article/3416970India Gary-Martin, global chief operating officer (COO) of investment banking technology and operations at JP Morgan, has signed on to deliver the keynote at the inaugural everywoman in Technology ...�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

e governance business News and Updates from The Economic Timeshttps://economictimes.indiatimes.com/topic/e-governance-business/newsMar 07, 2020 � �I see a replay of 2008 (Lehman Brothers crisis) scenario. We are seeing a very choppy business environment. It�s the time when grain gets separated from the chaff. In the end we will know who was swimming without shorts,� said Deep Kalra, chairman, Makemytrip.com.

Full Version Economics Rules: The Rights and Wrongs of the ...https://www.dailymotion.com/video/x7rl9t7Feb 06, 2020 � Beyond the science, economics requires the craft to apply suitable models to the context. The 2008 collapse of Lehman Brothers challenged many economists' deepest assumptions about free markets. Rodrik reveals that economists' model toolkit is much richer than these free-market models.

TEPAV | The Policy Response in Emerging Market Economies ...https://www.tepav.org.tr/en/haberler/s/3781This study aims at analyzing the problems faced by the emerging-market economies in the G20�Argentina, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, and Turkey (the EMEs in short) �and their economic policy response after the collapse of Lehman Brothers during the 2008 global crisis.

London investment banker denies 'jogger rage' | The Week UKhttps://www.theweek.co.uk/87693/police-arrest-man-in-jogger-rage-caseAug 11, 2017 � Eric Bellquist, the financier arrested after a woman was shoved in front of a double-decker bus on a London bridge, says he was in the US when the jogging assault occurred.[PDF]METROPOLITAN BANK AND TRUST COMPANY AND �https://www.metrobank.com.ph/images/SEC 17Q and 17A Reports/17Q/For the Quarter Ended...Attached are the following: ... * There is no participant of PCD who is a beneficial owner of more than ... These came as a result of the declaration of bankruptcy filed by Lehman Brothers Holdings, Inc., a surety under the loan agreements. The rehabilitation plans were duly approved by the

Food Standards | Outside the marginalshttps://outsidethemarginals.wordpress.com/category/policy-issues/environment/food...Dec 31, 2020 � Posts about Food Standards written by outsidethemarginals. Five years after Lehman, all tickety-boo? Robert Peston on his BBC blog (9 September 2013) poses the above question.At the end of this week, on 15 September, it will be the fifth anniversary of the collapse of the US investment bank Lehman Brothers. �

RBS has just hired a UBS MD as its new head of APAC ...https://news.efinancialcareers.com/sg-en/310998/thomas-siegmund-rbs-natwest-marketsMar 19, 2018 � His move follows that of Jae Jun Lee, Standard Chartered�s former head of structured and illiquid credit sales for Hong Kong and Korea, who is now a ��lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

UPDATE 1-EU watchdog says pricing at derivatives reporting ...https://www.kitco.com/news/2018-01-11/UPDATE-1-EU...Where Are the Stops - Jim Wyckoff; Forex Charts - Jim Wyckoff ... is scrutinised by regulators to see who is behind each trade and whether risks are building up in the system. The aim is to apply lessons from the financial crisis when Lehman Brothers collapsed and it took time to find out who was exposed to the bank's derivatives trades ...

Financial Crisis Hits U.S. Economy Hardhttps://www.infoplease.com/current-events/year-in-review/news-nation-1Over the course of just days, the once venerable Lehman Brothers filed for bankruptcy, Bank of America acquired Merrill Lynch, and the Fed agreed to a $85 billion rescue of insurance giant American International Group. In addition, JP Morgan Chase bought the majority of Washington Mutual almost immediately after the government seized the company.

Readiness & Recovery - Evercorehttps://www.evercorewealthandtrust.com/readiness-recoveryApr 21, 2017 � So too were many of those who bet the farm on Internet stocks in the late 1990s or in collateralized mortgage obligations in the run up to the collapse of Lehman Brothers in 2008. Time will tell how some of today�s high-wire strategies pan out, including stretching for yield by extending credit qualities or maturities, and buying high ...

�How Good We Can Be�, by Will Hutton | Financial Timeshttps://www.ft.com/content/2d31b890-a63a-11e4-abe9-00144feab7deThe smoking ruins of financial capitalism have brought forth any number of books that could bear the subtitle: �How the collapse of Lehman Brothers proved me right�.[PDF]The Future of Construction Machinery Manufacturershttps://newsroom.porsche.com/dam/jcr:0a82c747-7e78...performance since the fall of Lehman Brothers back in 2008. A weak third quarter will likely be followed by a rebound at the end of 2020. So the construction industry is expected to once again face high demand and high utilization for the post-COVID-19 era. The order books have been full for years, and customers are used to long project-lead times.

Federal Investigators Punt On Goldman Sachs Prosecutions ...https://www.huffpost.com/entry/investigation-goldman-sachs_n_1765368Aug 10, 2012 � In May, the SEC dropped its probe of Lehman Brothers, even though an independent examiner appointed by the bankruptcy court of the defunct bank concluded that there were "actionable claims" against senior Lehman officers for using an accounting tool known as Repo 105 to book billions of dollars in phony sales to disguise the true extent of the ...[PDF]The Future of Construction Machinery Manufacturershttps://newsroom.porsche.com/dam/jcr:0a82c747-7e78...performance since the fall of Lehman Brothers back in 2008. A weak third quarter will likely be followed by a rebound at the end of 2020. So the construction industry is expected to once again face high demand and high utilization for the post-COVID-19 era. The order books have been full for years, and customers are used to long project-lead times.

Covid-19 Sector Reviews: Financials | Keelan Cooperhttps://www.stockopedia.com/content/covid-19-sector-reviews-financials-636613During the credit crisis of 2008-2009, the Financial sector was inevitably one of the worst affected. After the demise of Lehman Brothers and the daunting prospect of a collapse of the entire financial system, new banking and financial institution regulations were put �

Reaching Across the Waters : Facing the Risks of ...https://openknowledge.worldbank.org/handle/10986/13077Over a decade has passed since the collapse of the U.S. investment bank Lehman Brothers marked the onset of the largest global economic crisis since the Great Depression. The crisis revealed major shortcomings in market discipline, regulation, and supervision, and reopened important policy debates on financial regulation.

About US VetWealth | New Military & Veteran Financial Guideshttps://usvetwealth.com/about-us-vetwealthIt seemed like an amazing opportunity and a way to truly give back by serving others. But I was wrong. My last day in uniform was on September 10th, 2008. Lehman Brothers collapsed on the 15th. SHIT. HIT. THE. FAN. Whoops.

Values | ....@ the intersection of learning & performancehttps://attheintersectionblog.com/category/culture/valuesApr 19, 2020 � Three Ivy League attorneys working for a large and prestigious law firm in Manhattan are called to a partner�s office and told they no longer have a job. Lehman Brothers and Bear Stearns collapsed and the economy has begun its rapid descent into the Great Recession. Everyone is scared, and everything is chaotic. (more�)

Average Age of Cars And Loan Tenure Period In ... - Motormehttps://www.motorme.my/average-age-of-cars-in-malaysiaJul 24, 2012 � CBT wants to know how old is your car. Over in the US, the new car sales never quite recovered from the effects of the 2009 credit crisis following the collapse of Lehman Brothers. Americans are keeping their cars longer than ever, 11.1 years for passenger cars and 10.4 years for light trucks and SUVs.

�Mumbai must increase its green cover� - The Hinduhttps://www.thehindu.com/news/cities/mumbai/mumbai...Aug 20, 2019 � In 2008, the Lehman Brothers collapse happened in the U.S., and the entire economy was tumbling down. At that time, I was told I could lead Welspun India, the group�s textile business.[PDF]The Centre for Economic Justice THE UK IN THE GLOBAL �https://www.ippr.org/files/2019-05/uk-in-the-global-economy.pdf10�15 years, and a decade on from the collapse of Lehman Brothers there are good reasons to prepare for instability and a potential recession: � Global slowdown : The global economy is reaching the late stage of the financial cycle.

Are storytelling techniques the new social lubricant?https://www.anecdote.com/2015/08/storytelling...Dealing with stress and burnout. In our region of the world, we are all looking for strength and identity too. For seven consecutive years of economic stagnation � the economic activity in Europe did not increase since the collapse of Lehman Brothers in 2008 � have led to uncertainty for a huge numbers of people.

(PDF) L'ancrage de l'Europe centrale et orientale � l ...https://www.researchgate.net/publication/315217400... � Translate this pageHowever, the growing financial integration at the end of 2008 seems rather to be the result of the propagation of the shock induced by the bankruptcy of Lehman Brothers. exchange rate risk premium ...

Shipping industry braced for storm to blow long and hard ...https://www.telegraph.co.uk/finance/newsbysector/...Nov 14, 2015 � Shipping industry braced for storm to blow long and hard ... Events triggered by Lehman Brothers� collapse changed that. ... the giants are the ones still �

Gold Price Falls and Peter Schiff Blames �Clueless� Investorshttps://beincrypto.com/gold-price-falls-and-peter-schiff-blames-clueless-investorsMar 16, 2020 � BlockTower Capital CIO Ari Paul was quick to challenge Schiff, reminding him about the 2008 market meltdown in which the price of gold plummeted from $1,000 an ounce to $775 � incidentally in response to the infamous Lehman Brothers bankruptcy on Wall Street. [Gold Republic] As fate would have it, some are comparing today�s gloomy sentiment ...[PDF]PENSION BOARD NOVEMBER 9, 2005www.norwalkct.org/ArchiveCenter/ViewFile/Item/1538securities, and they are limited to investment grade. Their benchmark is the Lehman Brothers aggregate index. Capstone has a preference for corporates because of the higher yields and treasuries. They do buy mortgages. In the last year and a half, they have taken the portfolio shorter than the benchmark. Performance reports show that the three and

How To Get Ready If There Is An Economic Recession In 2017https://innerself.com/content/social/economy/14463...It could be a sudden trigger like the collapse of Lehman Brothers in late 2008 or just a general loss of confidence. Economic theories, such as works by economist Hyman Minsky , explain that the longer an expansion continues, the more likely a recession becomes.

Who DIDN'T See 2008 Coming?! - Luxury Gold Barshttps://luxurygoldbars.com/who-didnt-see-2008-comingSep 29, 2018 � It�s fair to say �no one saw the financial crisis coming�, if by that you mean that no one specifically said �In September 2008, Lehman Brothers will go bust�. But I don�t think that�s what Her Majesty meant when she asked the question.[PDF]COURSE SYLLABUS - University of Southern Californiahttps://msbfile03.usc.edu/digitalmeasures/mische/schteach/559-96-Syll-F18-1.pdfanalysis and formulation of recommendations for a company that is in distress. Prior 559 classes have distinguished their work by accurately forecasting the demise of companies such as, Lehman Brothers, General Motors, Enron, WorldCom, Chrysler, Borders Books, Sears and Yahoo, years before their actual failures, acquisitions, or restructurings ...

Innocent Bystanders : How Foreign Uncertainty Shocks Harm ...https://openknowledge.worldbank.org/handle/10986/12063?show=fullThe failure of trade economists to anticipate the extreme drop in trade post Lehman Brothers bankruptcy suggests that the behavior of trade in exceptional circumstances may still be poorly understood. This paper explores whether uncertainty shocks have explanatory power for movements in trade.

Why Do A Lot Of People Dislike Huawei Productshttps://prijom.com/posts/why-do-a-lot-of-people-dislike-huawei-products.phpSame with Samsung, they all learned from hired engineers from Japanese corporation when things went sour during Asian financial crunch of 1998 or thereeabouts along the Lehman brothers fiasco that regrettably the likes of Sony,Panasonic,Sanyo,Sharp etc h.had to release those much valuable and knowledgeful engineers then hired by Samsung.�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Keynesian Economics Leads to Big Failures | Let's Get Ethicalhttps://bizgovsoc9.wordpress.com/2013/10/04/keynesian-economics-leads-to-big-failuresOct 04, 2013 � I would like to approach the question of if too big to fail still exists. With financial institutions ever so tied in with the national economy, one must first ask how this happened. To accurately answer to big to fail, one must first understand the origin of �[PDF]metrobank.com.phhttps://metrobank.com.ph/images/Disclosures/2012/September14 - Amended Quarterly Report...Lehman Brothers Holdings, Inc. in connection with a combined P2.4 billion loan exposure. These came as a result of the declaration of bankruptcy filed by Lehman Brothers Holdings, Inc., a surety under the loan agreements. The rehabilitation plans were duly approved by the Rehabilitation Court (RC).

Trillium CEO on ESG Investing, Tesla Sustainability ...https://www.bloomberg.com/news/videos/2019-05-16/trillium-ceo-patsky-on-esg-investing...May 16, 2019 � 00:00 carol: they goes all the way back to your early days at lehman brothers. what is it you saw that he knew we had to start incorporating esg factors into investing? >> it �[PDF]Cross-Border Banking on the Two Sides of the Atlantic ...https://www.frbatlanta.org/-/media/Documents/research/publications/wp/2015/11.pdfto solvency issues diverged after the failure of Lehman Brothers Holdings Inc. in September 2008. Why was the response to the crisis so different in the EU compared to the US? One important difference between the two is that the US entered the crisis with a banking system that

Inside the World�s Most Elite (and Secret) Traders� Club ...https://elitetrader.com/et/threads/inside-the-worlds-most-elite-and-secret-traders...May 10, 2018 � Imagine you enter an ISDA agreement with Lehman Brothers just before the 2008 financial crisis and yet us individual investors would not have the means to demand for them to put up more collaterals or high quality collaterals for the agreement because they were the "BIG Banks" and we are the individual traders who are just "privileged" to trade ...

Morgan & Goldman To Merge With Banks?, T-Bills Rally To 0% ...https://thebasispoint.com/morgan-goldman-to-merge-with-banks-t-bills-rally-to-0-yieldSep 18, 2008 � Investors stockpiled money on concern more financial institutions would fail after the bankruptcy of Lehman Brothers and the problems with AIG. The cost to hedge against losses on U.S. government debt climbed to a record yesterday. What are we up to today? Mortgage prices are worse by .250, and the 10-yr Treasury is up to 3.45%.

M&A bankers' dreams revealed: A survey | Ansaradahttps://www.ansarada.com/blog/bankers-dreams-ansarada-surveyOne says, perhaps in jest, they would be a dolphin trainer. Another a Formula One motor racing driver. Racing cars for a living may be the ultimate fantasy but the best M&A market since the collapse of Lehman Brothers is giving many M&A bankers the ride of their lives.

A model for testing green consumer behaviour: the ...https://www.ladissertation.com/Archives-du-BAC/BAC-Anglais-LV1/A-model-for-testing...Our reason of survey is to find that one link which needs to be corrected or to aim for to bring the change, various studies like behavioural observations, field survey gives us the result of having a strong connection between the attitude and the behaviour of the consumer when it comes to a green buy .Their level of knowledge, Demographics even age and gender has different impact on their ...�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Barack Hussein Hoover? - WNDhttps://www.wnd.com/2011/04/289861Apr 22, 2011 � Is the world headed for a debt crisis to dwarf the one that befell us in 2008, when Treasury Secretary Hank Paulson stood aside and let Lehman Brothers �[PDF]Central Bank Functions and the Unconventional Operations ...epub.lib.aalto.fi/fi/ethesis/pdf/14769/hse_ethesis_14769.pdfCentral bank functions and the unconventional operations and their effectiveness during the financial crisis in 2007-2012. A literature review . ... After the collapse of Lehman Brothers the interbank lending became ... Next symptom was the frozen of the interbank lending, which eventually led to a worldwide

Mark Wadsworth: Can Someone Tell Me the Truth About This?https://markwadsworth.blogspot.com/2019/07/can-someone-tell-me-truth-about-this.htmlJul 12, 2019 � It's just land owner propaganda. From the point of view of a tenant, rent and rates are the same thing. The rules is, rates are set at about 50% of the rental value net of the rates, i.e. for every �1 rents tenant should be paying about 50p in rates. So claiming that rates are too high is the same as saying rents are too high. 12 July 2019 at ...[PDF]Cross-border banking on the two sides of the Atlantic ...https://www.bde.es/f/webbde/SES/Secciones/Publicaciones/PublicacionesSeriadas/Document...solvency issues diverged after the failure of Lehman Brothers Holdings Inc. in September 2008. Why was the response to the crisis so different in the EU compared to the US? One important difference between the two is that the US entered the crisis with a banking system that was

Lindsay's Lobes: March 2010https://lindsaylobe.blogspot.com/2010/03It need not come as a surprise the recent revelations in creative accounting emanating from the US Bankruptcy Court about the non-disclosure in Lehman Brothers accounts of about $50 billion in obligations to repurchase securities sold in exchange for temporary funding lasting only a few days.

Management Studies: Investments in a Bearish Markethttps://mbagyanpot.blogspot.com/2011/08/investments-in-bearish-market.htmlThis was the time when the market crashed , Lehman Brothers collapsed and I saw my portfolio in red. But I still felt that the companies that I invested in was good and I bought a few more shares hoping that if it goes up my losses will average out. In investment term we can say I was following a contrary strategy.

A Debt Crisis is ComingGains Pains & Capitalhttps://gainspainscapital.com/2015/10/29/the-six-year-grand-delusion-is-endingOct 29, 2015 � We are heading for a crisis that will be exponentially worse than 2008. The global Central Banks have literally bet the financial system that their theories will work. They haven�t. All they�ve done is set the stage for an even worse crisis in which entire countries will go bankrupt. The situation is clear: the 2008 Crisis was the warm up.�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

What's Bernanke hiding? - Robert J. Samuelsonwww.jewishworldreview.com/1215/samuelson121815.php3Dec 18, 2015 � What's Bernanke hiding? By Robert J. Samuelson ... it gives new credibility to his claim that the Fed couldn't have prevented Lehman Brothers' bankruptcy in September 2008. ... It was the �[PDF]The value of sustainability ratings - Fair Impactwww.fairimpact.nl/esg/wp-content/uploads/12182012-The-value-of-sustainability-ratings...Lehman Brothers (2008) Governance and Accounting What happened? Bankruptcy due to over-exposure to sub-prime mortgages What was the GMI Ratings ESG rating? D What drove the rating? � Exceptionally weak & ineffective board � Accounting & disclosure issues � Consistently poor pay/performance link ESG Rating Scores A 96-100 B 76-95 C 26-75

The rise of Nio; Goldman Sachs' future; Lehman Brothers ...https://www.kimt.com/content/national/493227861.htmlLehman anniversary: Saturday marks the 10th anniversary of the collapse of Lehman Brothers. The investment bank's demise set off a chain reaction of bank failures that required unprecedented US federal action, and led to a global financial meltdown.

JP Morgan and Citigroup contributed to Lehman's collapse ...https://www.telegraph.co.uk/finance/financetopics/...Jan 30, 2021 � JP Morgan Chase and Citigroup helped cause the illiquidity that led to the collapse of Lehman Brothers, the bankrupt bank�s examiner said today in a report filed in Manhattan federal court.

Answered: After Lehman Brothers filed for� | bartlebyhttps://www.bartleby.com/questions-and-answers/...Solution for After Lehman Brothers filed for bankruptcy in September 2008, the FED doubled its balance sheet from $1 trillion to $2 trillion over the next two�[PDF]2007 Lehman Brothers CEO Conferencehttps://www.snl.com/IRW/file/4010705/Index?KeyFile=15000784776 Elements of Forward Growth > Highly visible growth in International Markets � 2007 � 2008 growth �75% and 50% � Two thirds of upside is renewals at current market rates > Visible growth in Alaskan Drilling and Construction on smaller base � Two new heli-rigs and potential for more new pad rigs � New 15,000 ft. coiled tubing/STEM drilling rig > 81 new rigs in U.S. lower 48 with ...[PDF]In re Lehman Brothers Inc. - Epiq 11https://portal-redirect.epiq11.com/LBI/document/...In re Lehman Brothers Inc. A Securities Investor Protection Act (SIPA) Liquidation James W. Giddens, Trustee August 5 and 7, 2009 Confidential �Not for Distribution The numbers and figures contained herein are approximations and remain subject to revision.

FDIC: Press Releases - PR-184-2010 8/10/2010https://www.fdic.gov/news/press-releases/2010/pr10184.htmlThe absence of such authority exacerbated the recent financial crisis, when such firms as AIG, Lehman Brothers, and Bear Stearns became insolvent. The establishment of a new division dedicated to depositor and consumer protection will provide increased visibility to the FDIC's compliance examination and enforcement program.

'Lehman Sisters' could have averted financial collapse ...https://www.foxnews.com/politics/lehman-sisters...May 16, 2018 � In 2010, Lagarde wrote in The New York Times: "In response to a journalist who asked me a few months ago about women�s strength in times of crisis, I smiled and said that if Lehman Brothers �[PDF]WEIL, GOTSHAL & MANGES LLP 767 Fifth Avenue UNITED �https://www.creditslips.org/files/lehman_brothers_holdings_inc._26516.pdfLEHMAN BROTHERS HOLDINGS INC. AND ITS AFFILIATED DEBTORS PLEASE TAKE NOTICE that all conditions precedent to the Effective Date 1 of the Modified Third Amended Joint Chapter 11 Plan of Lehman Brothers Holdings Inc. and Its Affiliated Debtors , dated December 5, 2011 [ECF No. 22973], have been satisfied, and the

The State of the News Media 2009 | The Pew Charitable Trustshttps://www.pewtrusts.org/en/research-and-analysis/...Mar 16, 2009 � The report's detailed Year in the News�a comprehensive analysis of some 70,000 stories from all the main media sectors�finds that the media to a significant degree did not see the economic collapse coming. The month before the collapse of Lehman Brothers, for instance, the economy was at its lowest point as a story all year, and the story ...

Lehman Brothers Sues Intel Over $1B in Seized Collateral ...https://www.foxbusiness.com/features/lehman...May 02, 2013 � Under the swap agreement, executed days before Lehman filed for bankruptcy in 2008, Intel gave $1 billion to a derivatives unit of Lehman Brothers in exchange for 50.5 million Intel shares, to �

The Last Days of Lehman Brothers (2009) - Changes � The ...https://www.themoviedb.org/movie/59027-the-last...Translate this pageThe heads of Wall Street's biggest investment banks were summoned to an evening meeting by the US Treasury Secretary, Hank Paulson, to discuss the plight of another - Lehman Brothers. After six months' turmoil in the world's financial markets, Lehman Brothers was on life support and the government was about to pull the plug. Lehman CEO, Dick Fuld, recently sidelined in a boardroom coup, spends ...

Research | Gianluca Rinaldihttps://scholar.harvard.edu/rinaldi/publicationsTo link the model to historical crashes, I consider two strategies associated with the Black Monday crash in 1987 and the Lehman Brothers bankruptcy in 2008. Hedged put options selling suffered severe losses around Black Monday, while arbitraging the difference in implied credit risk between the corporate bond and CDS markets was similarly ...

Center Reports - Seton Hall Universityhttps://law.shu.edu/policy-research/reports.cfmLEHMAN BROTHERS: A LICENSE TO FAIL WITH OTHER PEOPLE'S MONEY (12/08/11) Read Press Release, Seton Hall Law Report Shows Lehman Brothers Bankruptcy Court Examination Amounts to a License to Fail with Other People's Money. THE UNTESTABLE DRUNK DRIVING TEST (04/29/10)

Lehman Brothers Fraud Lawsuit Filed by California Public ...https://www.lawyersandsettlements.com/legal-news/...When Lehman Brothers filed for Chapter 11 bankruptcy protection on September 15, 2008, it represented the largest bankruptcy in US history, according to MarketWatch.

Lehman Brothers Schedules Bankruptcy Court Hearinghttps://www.nysun.com/business/lehman-brothers...Sep 16, 2008 � Lehman Brothers has scheduled a hearing in its bankruptcy case that could lead to a judge's approval of an asset sale. The investment bank, which filed the biggest American bankruptcy case today, has on its agenda for the meeting this afternoon a �

John Lewis as a model - The feeling is mutual | Britain ...https://www.economist.com/britain/2012/01/21/the-feeling-is-mutualJan 21, 2012 � It does not prevent bad decisions: having a quarter of shares in employees' hands did not save Lehman Brothers from bankruptcy. And the benefits for staff are questionable.

Lehman Brothers Bankruptcy Reminds Us of Trucking Hard Timeshttps://www.avatarfleet.com/blog/myth-theres-always-driver-shortageSep 16, 2013 � Scores of news stories this week, including this compilation in the Huffington Post, remind us that five years ago, the bankruptcy of Lehman Brothers sent the US and world economy into a tailspin.How soon we forget. We�re reminded of that truism as we read oodles of stories about the driver shortage. There are normally comments that �there has always been a driver shortage� or �there ...

The rise of Nio; Goldman Sachs' future; Lehman Brothers ...https://www.wtva.com/content/national/493227861.htmlLehman anniversary: Saturday marks the 10th anniversary of the collapse of Lehman Brothers. The investment bank's demise set off a chain reaction of bank failures that required unprecedented US federal action, and led to a global financial meltdown.

CEO face shape linked to company performance � Association ...https://www.psychologicalscience.org/news/ceo-face...Aug 30, 2011 � Corporate leaders with faces that were wide relative to their length � such as Herb Kelleher, the former CEO of Southwest Airlines � tended to lead better-performing companies than CEOs with narrower faces, such as Dick Fuld, the long-faced final CEO of Lehman Brothers�

The 'Warren Buffett of bonds' is stepping back from ...https://markets.businessinsider.com/news/stocks/...Dec 08, 2020 � Moreover, Fuss warned leveraged buyouts were a bubble a year before Lehman Brothers collapsed, Bloomberg said. He was also a calming influence during the 2008 financial crisis, urging traders to ...

�Vincent Reinhart on Bear Stearns, Lehman Brothers, and ...https://www.aier.org/article/vincent-reinhart-on...May 12, 2011 � �Vincent Reinhart of the American Enterprise Institute talks with EconTalk host Russ Roberts about the government interventions and non-interventions into financial markets in 2008. Conventional wisdom holds that the failure to intervene in the collapse of Lehman Brothers �

Lehman Brothers collapse: Barclays Ex-CEO Bob Diamond ...https://economictimes.indiatimes.com/news/...Sep 12, 2018 � �We have a recipe for issues, and how we manage through that is the single biggest impact of the financial crisis today,� he said. Diamond, who led Barclays� purchase of parts of bankrupt Lehman 10 years ago, was ousted as CEO of Britain�s second biggest bank in 2012 amid the fallout from the Libor-rigging scandal that enveloped several institutions. Today he is the CEO and founding ...

????? ?????? - ???????https://www.marefa.org/?????_??????Translate this pageThe Lehman Brothers Treasure Trove � slideshow by Life magazine; What did the Lehman Brothers implosion look like to a techie?, The Register; BBC: The Love of Money, The Bank That Bust the World; Bloomberg: Lehman Files Biggest Bankruptcy Case as Suitors Balk; Lehman Brothers Records at Baker Library Historical Collections, Harvard Business ...

Mandarin Gardens en bloc bid grinds to a halt, after ...https://www.channelnewsasia.com/news/business/...Mar 25, 2019 � Mandarin Gardens en bloc bid grinds to a halt, after failing to get 80% approval from owners. ... the worldwide financial crisis was triggered by the collapse of the Lehman Brothers.

RMJ Custom Benefit Solutions - Robin Yenk | RMJ Custom ...https://rmjcbs.ebadvisor.comLike so many affected by the 2008 Financial crisis, Robin departed from Lehman Brothers after her 25-year career in Corporate Finance came to a sudden end. Following her transition from Lehman, Robin took on a personal goal of helping businesses in need of benefits find the right options.

Geithner, Bernanke, And Fuld Testify At House ... - Zimbiohttps://www.zimbio.com/photos/Thomas+Cruikshank/...Thomas Cruikshank Photos - Thomas Cruikshank, former member of the Board of Directors and chair of Lehman Brothers' Audit Committee, testifies before the House Financial Services Committee about ...

Wall Street Bull Artist Sues Author Of Lehman Brothers Bookhttps://www.businessinsider.com/wall-street-bull...The guy who made the iconic Wall Street bull is suing the publisher and authors of a new book about the collapse of Lehman Brothers because they put a picture of the bull on the cover. That's right.

Boortz compares President Obama to a child molester ...https://archive.thinkprogress.org/boortz-compares...Today, on the one-year anniversary of the collapse of Lehman Brothers, President Obama will speak on Wall Street to �try to breathe new life into efforts to overhaul the financial regulatory system.�Hate radio host Neal Boortz used his Twitter account this morning to compare the President�s visit to Wall Street to �sending a child molester to speak to a kindergarten class�:

The Conflict Between Global Companies and Local Laws - The ...https://dealbook.nytimes.com/2011/10/26/the...Oct 26, 2011 � The regulator sought to issue just such an order to Nortel Networks, which is in bankruptcy proceedings in Canada and the United States, and Lehman Brothers, which � well, you know. Lehman has a shortfall �125 million, or nearly $200 million, but Nortel�s British operations have an eye-popping shortfall of �2.1 billion, or nearly $3.4 ...

10 Yrs After 2008 Crash, We're Making Same Mistakes ...https://www.realclearpolitics.com/2018/09/07/10...Sep 07, 2018 � The world economy ground to a halt in the days following Lehman Brothers' bankruptcy in September, 2008. Most of the lessons learned in the �

Causes and Effects of the Lehman Brothers Bankruptcy ...https://core.ac.uk/display/100613333I argue that the demise of Lehman Brothers is the result of its very aggressive leverage policy in the context of a major financial crisis. The roots of this crisis have to be found in bad regulation, lack of transparency, and market complacency brought about by several years of positive returns.

Tim Geithner would have backed a Barclays bid for Lehman ...https://www.hitc.com/en-gb/2014/05/13/tim-geithner...It will never been known what might have happened if Lehman Brothers had not collapsed in 2008, unleashing a wave of panic on the financial markets that led to the bailout of banks around the world.

Binance US, Genesis, & Abra Suspends XRP Support; Bittrex ...https://bitcoinexchangeguide.com/binance-us...�While not a bankruptcy, XRP is effectively the third-largest collapse of all-time behind Lehman Brothers and Washington Mutual,� he added. Coinbase Under Hot Water Too. A class-action lawsuit has been filed against US-based crypto exchange Coinbase alleging that it �

Lehman Brothers' collapse was orderly, but its effects ...https://www.axios.com/lehman-brothers-collapse...The chart of the last five years of the Lehman Brothers' share price shows a company going to zero in pretty much the most orderly way you could imagine. It doesn't suddenly plunge at the end; rather, the decline begins in mid-January 2007, a full 20 months before catastrophe strikes.

Lehman Brothers Really Takes the Cake ~ don't panichttps://chrisgrundemann.com/index.php/2008/lehman...Sep 17, 2008 � The Lehman Brothers bankruptcy is on a scale never before seen. Look over this list of the top 10 bankruptcy filings by US corporations, based on pre-bankruptcy assets (data is from BankruptcyData.com via a CNBC slide show). 10) United Airlines Pre-Bankruptcy Assets: $25.2 billion Date Filed: Dec. 9, 2002. 9) Pacific Gas and Electric

Still Litigating the 2007-08 Financial Crisis: The Claims ...https://www.jdsupra.com/legalnews/still-litigating-the-2007-08-financial-11985Dec 17, 2020 � Lehman Brothers Holdings Inc. (LBHI) lawsuits: LBHI has in the last few years resolved more than 100 contractual indemnification/breach of representation and warranty cases that it filed in the ...

The rise of Nio; Goldman Sachs' future; Lehman Brothers ...https://www.kq2.com/content/national/493227861.htmlSep 14, 2018 � Lehman anniversary: Saturday marks the 10th anniversary of the collapse of Lehman Brothers. The investment bank's demise set off a chain reaction of bank failures that required unprecedented US federal action, and led to a global financial meltdown.

Adam Tooze: The 2008 Global Crisis: Approaches to a Future ...https://vimeo.com/260532462The year 2008 will forever be associated with the collapse of Lehman Brothers, the subprime mortgage crisis, the Great Recession, and the election of Barack Obama. But taking an overly America-centric view of this time drastically reduces its global financial, economic, political, and geopolitical ramifications.

Fed�s Balance Sheet Grows by $2.4 Trillion ... - SGT Reporthttps://www.sgtreport.com/2020/04/feds-balance...Following three rounds of Quantitative Easing (QE) after the financial crisis on Wall Street in 2008, the Fed�s balance sheet peaked at $4.5 trillion in 2015. On the day that Lehman Brothers collapsed into bankruptcy on September 15, 2008, the Fed�s balance sheet stood at just $995 billion.

International financial crises and the ASEAN economies ...https://www.eastasiaforum.org/2011/12/14/...Dec 14, 2011 � Triggered by different factors, the world has observed two similar crises within the last decade; the burst of the dotcom bubble in the early 2000s and the beginning phase of the global financial crisis through 2007 and 2008, which culminated in the bankruptcy of Lehman Brothers and the freezing up of global finance.

Mother - 9Finance - Business News, Finance, Shares & Investinghttps://finance.nine.com.au/motherThe disgraced chief of Lehman Brothers is aware of his unpopular status in the US following his company's 2008 collapse, but says his elderly mother remains on his side.

Treasury proposes to guarantee money market funds in ...https://www.investmentnews.com/treasury-proposes...Mar 18, 2020 � Money market mutual funds became a crucial weak spot during the finial crisis when losses from the collapse of investment bank Lehman Brothers caused the �

If it'd been Lehman Sisters rather than Lehman Brothers ...https://www.smh.com.au/business/the-economy/had-it...Sep 06, 2018 � Ten years after the collapse of Lehman Brothers sparked the global financial crisis, the financial system still isn't �safe enough� says International Monetary Fund managing director Christine ...

Uncontrolled Risk: Lessons of Lehman Brothers and How ...https://www.mhprofessional.com/9780071638296-usa...How Excessive Risk Destroyed Lehman and Nearly Brought Down the Financial Industry �Uncontrolled Risk will ruffle feathers�and for good reason�as voters and legislators learn the diffi cult lessons of Lehman�s collapse and demand that we never forget them.�Dr. David C. Shimko, Board of Trustees, Global Association of Risk Professionals �Uncontrolled Risk is a drama as gripping as ...

Lehman Brothers Hopes to Sell Two Portfolios of Reverse ...https://reversemortgagedaily.com/2011/06/14/lehman...Jun 14, 2011 � In a potential deal valued at upwards of $43 million, MetLife Bank is making a play for reverse mortgage assets owned by the former Lehman Brothers empire. Bankruptcy court documents in the Southern District of New York outline a deal proposed by Lehman Brothers Holdings Inc. to sell two loan portfolios owned by the former [�]

financial crisis | The Epoch Timeshttps://www.theepochtimes.com/t-financial-crisisNov 29, 2020 � Recovery From Financial Crisis Limps On 10 Years After Lehman Brothers Bankruptcy Sept. 15, 2018, marks the 10-year anniversary of the bankruptcy of U.S. investment bank Lehman Brothers�the one ...

Stories by Emily Stewart : Contentlyhttps://emilystewart2.contently.comOn December 14, 2006, Lehman Brothers and Bear Stearns reported huge earnings, helping push major US indexes toward record numbers. Fewer than two years later, both investment banks collapsed and their stocks became virtually worthless.

The GCI Podcast � A podcast on Anchorhttps://anchor.fm/the-gci-podcastNov 21, 2020 � Tune in to hear what the impressive Katherine Waldock, who focuses on bankruptcy research, has to say and be sure to stay for her experiences at Lehman Brothers in 2008! 37:44 November 21, 2020

MYOB: An Australian Co-investment - HarbourVesthttps://www.harbourvest.com/case-study/myobHarbourVest�s Global Private Markets Platform Value Add. Deep Sector Expertise � HarbourVest�s long-standing tech expertise and due diligence enabled it to support the investment thesis and participate in the take-private offer, which was submitted just weeks after Lehman Brothers filed for bankruptcy in the fall of 2008; Large, Knowledgeable Global Investor � HarbourVest had the ...

Lehman Brothers Structured Notes UBS Claims Following ...https://www.youhavealawyer.com/blog/2011/11/04/lehman-notes-ubs-claimsNov 04, 2011 � Lehman Brothers, once the fourth largest investment bank on Wall Street, filed for bankruptcy on September 15, 2008. During the months leading up to the company�s fall, UBS and other brokers continued to recommend the bank�s financial instruments, even though they knew or should have known that Lehman Brothers was in a weak financial ...

Lehman diaries: the MD in equity research - Financial Newshttps://www.fnlondon.com/articles/lehman-brothers...Lehman diaries: the MD in equity research 'It is difficult to underestimate the cult of personality that existed around Dick Fuld' It was kind of weird, to be honest. It is difficult to underestimate the cult of personality that existed around Dick Fuld. ... How to become a millionaire and retire by 35, according to a 23-year-old banker

President LIU Deshu meets Lehman Brothers� Guests_About Us ...www.sinochem.com/en/s/1719-5697-19953.htmlPresident LIU Deshu meets Lehman Brothers� Guests Date: 2008-07-09 Source: June 13, Liu Deshu, President and CEO of Sinochem received the guests from Lehman Brothers headed by Richard Fuld, Chairman and CEO of the renowned Wall Street investment bank. Mr. Chen Guogang, CFO of Sinochem was also present.

Australia cops UN investor slap on climate policy as ...https://www.smh.com.au/environment/climate-change/...Jan 31, 2018 � "This, however, is a kind of a nightmare scenario for financial regulators, because they figure out a financial crisis scenario and they fear something like a fossil-fuelled Lehman Brothers �

Critics, fans weigh in on Obama's economic reforms | Newsdayhttps://www.newsday.com/business/obama-wall-street...Critics, fans weigh in on Obama's economic reforms President Barack Obama delivers a major speech on the financial crisis, on the anniversary of Lehman Brothers' collapse. (Sept. 14, 2009) Credit ...

The Impact of Universal Coverage Schemes in the Developing ...https://openknowledge.worldbank.org/handle/10986/13302Over a decade has passed since the collapse of the U.S. investment bank Lehman Brothers marked the onset of the largest global economic crisis since the Great Depression. The crisis revealed major shortcomings in market discipline, regulation, and supervision, and reopened important policy debates on financial regulation.

Hong Kong hedge fund Double Haven hires Wells Fargo's Greg ...https://www.scmp.com/business/banking-finance/...Sep 10, 2013 � Hedge funds have been under pressure from institutional investors to separate investment and operational staff to improve risk management after Lehman Brothers' collapse in 2008 and revelation of ...

Wealth Disparity By Race: After 2008 Financial Crisis ...https://www.ibtimes.com/wealth-disparity-race-after-2008-financial-crisis-black...In the near-decade since Lehman Brothers collapsed, signaling the start of a downward economic spiral, the balances of minority 401(k) accounts have dropped while white future retirees have seen ...

Inside Lehman Brothers 2018 1080p BluRay x264-BRMP | Leakerhttps://leaker.tv/movies/inside-lehman-brothers-2018-1080p-bluray-x264-brmpNov 24, 2019 � Messy mortgages taken out by Lehman Brothers caused a real estate crisis in America ten years ago. This led to a global financial crisis. Ten years later, the French journalist Jennifer Deschamps looks back on the bankruptcy of Lehman Brothers.

NIO Stock Price On The Move | Investors Alleyhttps://www.investorsalley.com/nio-stock-price-on-the-move-article-cooperHe was among the few analysts to spot the financial crisis of 2008, the top of subprime and Alt-A, the death of Lehman Brothers, Bear Stearns, and New Century Financial, and even the Dow�s collapse to 6,500, as well as its recovery. He even called for gold to rally well above $1.500 when it �

Lessons from Lehman Brothers | Financial Timeshttps://www.ft.com/video/8abcf93a-f6a7-31b1-8f07-5b8936f91faaLessons from Lehman Brothers Jennifer Hughes considers the institution's legacy and how the continuing ramifications of its collapse will affect financial services companies well into the future

White House touts progress since collapse of Lehman Brothershttps://thehill.com/policy/finance/217684-white...The White House is hoping to use the sixth anniversary of the Lehman Brothers collapse to refocus attention on the economy ahead of the midterm elections, highlighting signs of recovery in a blog ...

Euromoney The race to sell Lehman Brothers before it fell ...https://www.euromoney.com/article/b132293zqlcd45/...Oct 30, 2008 � Japanese press report Nomura is considering a stake in Lehman Brothers. MUFG denies it is considering a stake: 7 : LB announces Jeremy Isaacs, CEO Europe and Asia, is leaving the company : 9 : Collapse of talks with Korea Development Bank, after which LB shares fall by 30%: 10 : LB reports $3.9 billion loss for third quarter of 2008: 11 : LB ...

Baltic Dry Watchers Can Relax - The Source - WSJhttps://blogs.wsj.com/source/2010/11/16/baltic-dry-watchers-can-relaxNov 16, 2010 � The financial crisis made many notorious: Dick Fuld of Lehman Brothers springs to mind all too quickly, as does fraudster extraordinaire Bernie Madoff. But it wasn�t just the personalities.�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

It's no big deal, you only owe $123,636 - WNDhttps://www.wnd.com/2010/06/164713Jun 09, 2010 � But it gets even better. ... spending to save the economy from utter collapse after the Lehman Brothers Crisis of September 2008. ... put the clamps on all lending which led to a �

Right medicine turkey hikes interest rates combat ...https://russellinvestments.com/us/blog/right-medicine-turkey-hikes-interest-rates...On the latest edition of Market Week in Review, Senior Investment Strategist Paul Eitelman and Consulting Director Sophie Antal Gilbert discussed the market impact of trade developments between the U.S. and China, steep interest-rate increases in Turkey, and the state of the U.S. banking sector 10 years after the collapse of Lehman Brothers.

Stuck in safety first | Features | IPEhttps://www.ipe.com/stuck-in-safety-first-/29684.articleOther than remaining in safety first, a shift to riot point is the most likely move in the map based on prior history. It is too early to say how the bankruptcy of Lehman Brothers will affect investor behaviour, but it is unlikely to inspire a bounce in risky assets.

Viagra Pill Photos - USLicensedhttps://www.okpillsusa.com/?viagra.pill.photosEurope Has To Realize That This Is Simply A Symptom Just Like Lehman Brothers The Financial Institution That Collapsed In 2008 With The Costliest Bankruptcy Filing In American History Was A Symptom It Was Not A Cause Of The Problem He Says.

Private pensions have become a piggy bank for spendthrift ...https://www.cityam.com/private-pensions-have-become-piggy-bank-spendthrift-statesSep 10, 2013 � FIVE years after the collapse of Lehman Brothers, and the fallout from the financial crisis is far from over. Across Europe, private pensions have become a targets for politicians seeking to ...

Joshua M Brown, Author at The Reformed Broker - Page 1093 ...https://thereformedbroker.com/author/joshua-m-brown/page/1093One Year After Lehman: We Don't Love These Bros. No one misses Lehman Brothers. Yeah, I said it. On September 15th 2008, the investment bank filed for bankruptcy after 6 months of protestations by Dick Fuld, Erin Callan and the rest of the brain trust that all was well at �

The World Economy�s Demolition Derby of Competing and ...https://iweworkfutures.org/2012/01/22/the-world-economys-demolition-derby-of-competing...The Lehman Brothers collapse triggered just such an explosion � Since a complex network comprises linkages between many sub-networks, individual inefficiencies or weaknesses can have an impact on the viability of the whole.� ... This is not the case for competition in the world economy. ... The Transition To A Clean And Sustainable World ...

Hugo Dixonblogs.reuters.com/hugo-dixon/page/27Nov 22, 2010 � Rahm Emanuel, President Barack Obama�s former chief of staff, popularized the motto that one shouldn�t waste a good crisis. But there is a severe risk that precisely what the world has been doing by being excessively soft in bailing out banks and countries since Lehman Brothers �

Despite Gloomy Eurozone Issues, U.K. Housing Market ...https://www.worldpropertyjournal.com/international-markets/residential-real-estate...Oct 06, 2011 � However, this figure masks a significant difference between homes in the North and South of England. For example, house prices in London have risen by 2.5% over the year compared to a fall of -5.2% in the North West. Taken together, this means that the national average is being heavily supported by the desirability of homes in the capital.

Commentary: How we got into this money mess - CNN.comwww.cnn.com/2008/POLITICS/09/17/beck.wallstreetSep 17, 2008 � More than 150 years later, after surviving the Great Depression, Black Monday, the savings and loan crisis and the dot-com bust, Lehman Brothers filed for bankruptcy protection.

Real Estate | Nah, Nope, Not Quitehttps://nahnopenotquite.wordpress.com/category/real-estateAnd in each case, that fear became self-fulfilling, as banks that couldn�t roll over their debt did, in fact, become unable to pay. This is precisely what drove Lehman Brothers into bankruptcy on September 15, causing all sources of funding to the U.S. financial sector to dry up overnight.

new appreciation - German translation � Lingueehttps://www.linguee.com/english-german/translation/new+appreciation.htmlThe turning point came with the collapse of the US investment bank Lehman Brothers, which caused the speculative bubble that had formed on the commodity futures exchanges to burst suddenly: The euphoria felt by farmers about the new appreciation expressed in the form of higher grain prices was - after years of feeling unimportant - only short-lived but understandable and deflated.

FOXTOBERFEST Of Stupid: Gretchen Carlson (4) vs. Laura ...https://thedailybanter.com/2014/10/14/foxtoberfest-stupid-gretchen-carlson-4-vs-laura...Nov 09, 2018 � This is the classic Alinsky-ite tactic he always employs." ... but it's certainly not the worst -- which was a very real possibility after Lehman Brothers' bankruptcy threatened to send us into a ...

Infosys cuts revenue guidance on US woeshttps://www.livemint.com/Companies/hH25T0IxE2NryZh7vp7fqM/Infosys-cuts-revenue...Oct 11, 2008 � Infosys expects customers in the US to move more work offshore to low-cost locations such as India, but the financial crisis that has felled Bear Stearns Companies Inc. and Lehman Brothers ...

Why Women Make Great LeadersAuthentic Leadership Internationalhttps://www.boldermoves.com/women-leadersMar 11, 2015 � In August 2014, former Citigroup CFO Sallie Krawcheck suggested in an interview that the 2008 financial crisis might have turned out differently if it were the �Lehman Siblings� instead of the �Lehman Brothers�. As she pointed out, many people claimed that the crisis wouldn�t have happened if it were the �Lehman Sisters� instead.

Guest Post: Where Is The Inflation Today? | Zero Hedgehttps://www.zerohedge.com/news/2014-01-16/guest-post-where-inflation-todaySubmitted by Hunter Lewis via The Circle Bastiat Mises Economics blog,. People often ask today: if the Fed has created so much new money, why hasn�t it produced more inflation? When the Fed creates masses of new money, it initially flows to Wall Street, which profits from it in a variety of imaginative ways, but from there its path is unpredictable.�lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

chiragchadha9 | WHOSE BLOG IS LIT ANYWAY?https://whoseblogislitanyway.wordpress.com/author/chiragchadha9Jan 19, 2013 � How would you explain the collapse of Lehman Brothers to a ten year old? Let�s say your friend buy 10 snickers bars from the store for $1 each, and sell them at school for $1.50. He then has 15 dollars, but he could probably sell 100 a day, so 10 friends loan him $10 each, so �[PDF]ANNUAL REPORThttps://www.caixaenginyers.com/documents/1109332/125896954/Annualreport2018.pdfof one of the events with the greatest impact on the financial sector and which was, in large part, the catalyst for its transformation: the collapse of Lehman Brothers. During these ten years, the sector has had to overcome several challenges as a result of the regulatory efforts of �

Global financial meltdown coming? Clear signs that the ...https://www.sott.net/article/303547-Global-financial-meltdown-coming-Clear-signs-that...This is something that I have warned would happen over and over again. In fact, I have written about it so much that my regular readers are probably sick of hearing about it. ... At this point, Glencore is probably the most likely candidate to be "the next Lehman Brothers". And it isn't just Glencore that is in trouble. ... Bernanke was the one ...