Home

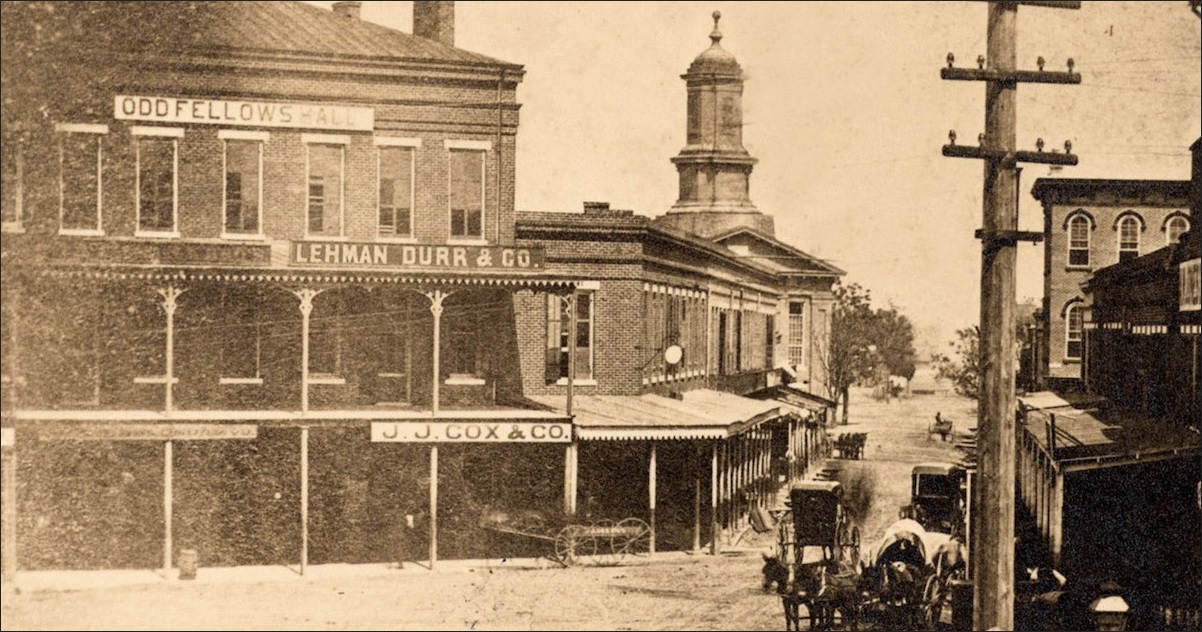

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

When did the meltdown really begin? | Economic Policy ...https://www.epi.org/blog/lehman-brothers-collapse-anniversarySep 16, 2011 · Yesterday marked three years since Lehman Brothers filed for bankruptcy – the high-water mark of the financial crisis. Over the next six months, the stock market declined by nearly 40 percent and the economy lost 4.2 million jobs – a pace of …

10 years after the financial crisis, is the housing market ...https://www.home-mortgage-tampa.com/2018/10/05/10-years-after-the-financial-crisis-is...Oct 05, 2018 · In 2018 it will be exactly 10 years since the bankruptcy of Lehman Brothers, which sparked the outbreak of the largest post-war global financial and economic crisis, which was the aftermath of a bubble burst on the US real estate market. On the occasion of the round anniversary of this event, the subject of the likelihood of repeating the history of the previous decade is gaining momentum.

Lehman executives may face criminal charges - The Nationalhttps://www.thenational.ae/business/lehman-executives-may-face-criminal-charges-1.536558Former executives at Lehman Brothers may face criminal charges after a report by a court-appointed examiner on the collapse of the Wall Street investment bank.

This Was The Worst Week For The Stock Market Since The ...www.renegadetribune.com/this-was-the-worst-week-for-the-stock-market-since-the...This Was The Worst Week For The Stock Market Since The Financial Crisis Of 2008 ... the kind of thing that I am talking about. ... The rest were in the aftermath of the collapse of Lehman Brothers in October and November 2008. And it isn’t just stocks that are getting hammered.

Monitor Financial Crisis – Andes Wealth Technologieshttps://andeswealth.com/2019/08/monitor-financial-crisisOn 2018/09/15, Lehman Brothers filed for bankruptcy. It was the largest bankruptcy in history and a pivotal point during the 2008 financial crisis. What would it look like using our Real-time Risk Monitor?

List of Largest Companies in Chapter 11 Bankruptcy ...https://www.bids4bonds.com/2019/07/list-of-largest-chapter-11-bankruptcies.htmlLehman Brothers Holding, Inc. ( September 2008 )-$691 Billion.Lehman Brothers was founded 150 years ago and became the largest American corporate banruptcy. Barclays bought Lehman's business for $1.75 billion, and Nomura purchased its Asia assets.

This Was The Worst Week For The Stock Market Since The ...https://freeworldeconomicreport.com/this-was-the-worst-week-for-the-stock-market-since...Dec 22, 2018 · This Was The Worst Week For The Stock Market Since The Financial Crisis Of 2008. ... the kind of thing that I am talking about. ... and then again during the following session. The rest were in the aftermath of the collapse of Lehman Brothers in October and November 2008. And it isn’t just stocks that are getting hammered. In fact, ...

The reality of why Goodell's job is safe: League ... - reddithttps://www.reddit.com/r/nfl/comments/79gemi/the_reality_of_why_goodells_job_is_safe...Yeah the issue I have with this argument. Lehman Brothers had its most profitable quarter and year in history weeks before it filed for bankruptcy. People look at past performance to evaluate Goddell when they should be assessing the potential future of the NFL due to …

Strickland blasts GOP “monkey business” opponenthttps://www.peoplesworld.org/article/ted-strickland-blasts-gop-monkey-business-opponentAug 31, 2010 · But not because of policies in Columbus, Ohio. ... The collapse of Lehman Brothers was a key part of this, Strickland charged. “It was the …

Investors: Keep an eye on the market bubble - New York Posthttps://nypost.com/2009/09/15/investors-keep-an-eye-on-the-market-bubbleSep 15, 2009 · NEWSPAPERS are busy this week commemorating the one-year anniversary of the collapse of Lehman Brothers as if that was the World Series …

Reading - Emily C. Marshallhttps://sites.google.com/site/emilycorinnemarshall/home/courses/the-great-recession/...“Lessons to Be Learned One Year After Lehman Brothers Collapse Roiled the World ... “Hank Paulson: This is What it Was Like to Face the Financial Crisis.” ... Peter and James B. Stewart. 9/29/14."Revisiting the Lehman Brothers Bailout That Never Was." The New York Times. ...

Epidemic Quotes - Page 6 - BrainyQuotehttps://www.brainyquote.com/topics/epidemic-quotes_6The assumption that Washington could and would resolve Lehman Brothers without a bankruptcy, as it had Bear Stearns, was the single biggest mistake in the series of mistakes in 2007 and 2008 that led to the financial panic and the ensuing epidemic of job losses.

Ten Years After – 3rd Qtr 2018https://www.noesis-capital.com/ten-years-after-3rd-qtr-2018Oct 24, 2018 · Dear Client: Ten Years After. While the heading may remind some of a popular British rock band, others will recall that September marked the 10th anniversary of the fall of Lehman Brothers when the global financial system came close to cessation in the early days of the financial crisis.

The hazard in moral hazard - The Economisthttps://www.economist.com/free-exchange/2008/10/13/the-hazard-in-moral-hazardMr Setser goes on to explain how the proximate cause of this intense phase of the crisis was the Lehman Brothers failure, which was a huge miscalculation on the part of Treasury secretary Hank ...

This Was The Worst Week For The Stock Market Since The ...https://www.blacklistednews.com/article/69902/this-was-the-worst-week-for-the-stock...This Was The Worst Week For The Stock Market Since The Financial Crisis Of 2008. Published: December 22, 2018 ... the kind of thing that I am talking about. ... and then again during the following session. The rest were in the aftermath of the collapse of Lehman Brothers in October and November 2008. And it isn’t just stocks that are ...

So What Blows Up Next? Investor Psychology Shifts To The ...https://thedailycoin.org/2018/03/31/so-what-blows-up-next-investor-psychology-shifts...The leading U.S. investment bank Lehman Brothers filed for bankruptcy and brokerage Merrill Lynch was the subject of a $50 billion buyout by Bank of America. The fate of other big name financial institutions remained in doubt and stock prices plunged in Asia, Europe and the United States.

UK QE has failed, says quantitative easing inventor - BBC Newshttps://www.bbc.com/news/business-24614016Oct 22, 2013 · When the UK embarked on quantitative easing (QE) in March 2009, in the aftermath of the Lehman Brothers collapse, the Bank of England was expected to administer a …

Top quotes by Richard Grassohttps://www.quotemaster.org/author/Richard+GrassoWhat the American people don't understand is how Merrill Lynch or AIG or Lehman Brothers can reward people, and the entity fails. ... This is done through transparency, high quality financial reports, and a standardized economic market. This is not just for China, but also for the world market as a whole.…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Ben Bernanke in Denver: What it was like living 'Too Big ...https://www.bizjournals.com/denver/blog/finance_etc/2014/11/gallery-ben-bernanke-in...Lehman Brothers filed for Chapter 11 bankruptcy protection in the wee hours of Sept. 15, 2008, after it had lost most of its clients, cited hundreds of billions of debt and saw huge losses in its ...

Lehman Brothers invested in IT despite credit crunch ...https://www.computerworld.com/article/2532955/lehman-brothers-invested-in-it-despite...Lehman Brothers Holdings Inc. was boosting its investment in IT even as it headed toward bankruptcy. In the quarter ended Aug. 31, the New York-based company spent $309 million on technology and ...

Lehman Brothers was Boosting IT Investment Despite Credit ...https://www.cio.com/article/2433665/lehman-brothers-was-boosting-it-investment-despite...Lehman Brothers Holdings Inc. was boosting its investment in IT even as it headed toward bankruptcy. In the quarter ended Aug. 31, the New York-based company spent $309 million on technology and ...

Lehman Brothers invested in IT despite credit crunch ...https://www.networkworld.com/article/2275976/lehman-brothers-invested-in-it-despite...Lehman Brothers was increasing its investment in IT even as it headed into bankruptcy. In the last quarter, ending 31 August 2008, it spent $309 million on technology and communications, up from ...[PDF]

From Labor Shortage to Labor Surplus: The Changing Labor ...https://files.eric.ed.gov/fulltext/EJ903450.pdfAs the nation caught its first terrifying insight into the catastrophe of the global financial crisis following the collapse of Lehman Brothers, the size and pace of domestic job losses exploded in a way that was consistent with the worst fears of economic deflation. In September and October combined, the nation lost 700,000 jobs.

Obamanomics: 'What's In It For Me' Thinking 'Not Good For ...https://www.newsbusters.org/.../12/07/obamanomics-whats-it-me-thinking-not-good-anybodyDec 07, 2008 · As the president-elect was pointing fingers at greed, looking out for number one, and Lehman Brothers, why didn't Brokaw bring up Obama's own connections to the two companies at the heart of this financial crisis?

Nigeria: CBN Will Rid Banks of Criminals - Sanusi ...https://allafrica.com/stories/200911090008.html"I have learnt some lessons from the collapse of Lehman Brothers. The first lesson is that, you should never let a big bank fail. The US had the option of spending $700 billion to save Lehman ...

Goldman Sachs: The Vampire Squid’s Alum Control Two Fed ...https://wallstreetonparade.com/2020/01/goldman-sachs-the-vampire-squids-alum-control...Jan 23, 2020 · Representatives from banks like Lehman Brothers, Citigroup, Bear Stearns and Merrill Lynch sat on key committees of the Group and helped to formulate the “Guiding Principles” for Wall Street. Lehman Brothers filed bankruptcy on September 15, 2008 – just five weeks after a report from the group on managing risk was released. One day before ...

What are the recent developments in global financial markets?www.yourarticlelibrary.com/investment/what-are-the-recent-developments-in-global...Recent Developments in Global Financial Markets are: Global financial markets witnessed turbulent conditions during 2007-08 as the crisis in the US sub-prime mortgage market deepened and spilled over to markets for other assets.[PDF]Lehman Brothers UK Holdings Limited – in Administrationhttps://www.pwc.co.uk/assets/pdf/lbukh-1st-progress-report.pdfLehman Brothers UK Holdings Limited – in Administration ... Administration and these are the main proceedings. PricewaterhouseCoopers LLP 6 ... on 7 January 2009. This Statement was filed at Companies House on 16 January 2009 and a copy is attached to this report at Appendix A. In preparing the Statement, the directors made

Investing in compliance when a recession is lurking ...https://www.compliance-wise.com/investing-in-compliance-when-a-recession-is-lurkingIt began in 2007 with a crisis in the subprime mortgage market in the US and developed into a full-blown international banking crisis with the collapse of the investment bank Lehman Brothers. The crisis was nonetheless followed by a global economic downturn, the Great Recession.

CNNMoney.com Pre-Market Report - Oct. 7, 2008https://money.cnn.com/2008/10/07/markets/stockswatch/index.htmOct 07, 2008 · The first, on Monday, grilled Richard Fuld, chief executive of the bankrupt bank Lehman Brothers, over why his company failed. On Oct. 16, the House …

wk 6 post.docx - Discuss what monetary policy is Discuss ...https://www.coursehero.com/file/36424525/wk-6-postdocxThe discount rate is where the commercial banks and other institutions are able to borrow capital from the central bank and a discounted rate. Reserve requirements are the portions of deposits that banks must maintain either in their vaults or on deposit at a Federal Reserve Bank. ... Lehman Brothers failure as a series of actions were taken in ...[PDF]The impact of market structure and the business cycle on ...https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2804923_code851390.pdf?abstractid=...context, both prior to and during the crisis. This study consists of three parts and a summary. The first part is a broad literature review concerning the relationship between bank profit, market structure, and the degree of competition. The second part describes the structural and[PDF]Chapter 2 Structure and change of Japan’s trade and ...https://www.meti.go.jp/english/report/downloadfiles/2012WhitePaper/2-1.pdfturned into deficit in the Trade Statistics for the first time since 1980 (in 31 years), ... the failure of Lehman Brothers and fell into deficit in 2011. ... “Exports” and “imports” are the amount of goods trade since the expression in Japan’s long-term statistical series is used with no change.

Pharma M&A: Diverse and Accelerating | Pharmaceutical ...www.pharmexec.com/pharma-ma-diverse-and-acceleratingSep 18, 2014 · Young & Partners compiles and analyzes pharma M&A activity every quarter, as well as the pipeline of deals that are an indication of the M&A outlook. In the first half of 2014, 25 deals worth $21.3 billion were completed versus 42 deals worth $39.9 billion that were completed during all of 2013.[PDF]Teaching as a Second Career - ERIChttps://files.eric.ed.gov/fulltext/ED536867.pdfTeaching as a Second Career p. iv on teachers. The support of Lehman Brothers for the companion study conducted by Public Agenda has also greatly benefited Woodrow Wilson’s work on these issues, and thanks are due to Richard S. Fuld, Jr., the chairman and chief executive officer of Lehman Brothers …

The Prepayment Paradox | Derivatives Risk Management ...https://fincad.com/blog/prepayment-paradoxIt’s hard to believe that we are now a decade on from the nadir of the financial crisis and the collapse of Lehman Brothers. A big difference between now and then is the extent to which the terms ‘ABS’ and ‘MBS’ have entered the common parlance and consciousness. Both, with some justification, have been cited as being central antagonists for their role in bringing the world to the ...

The Regulation of the Global Financial System - Jvnto - Mediumhttps://medium.com/jvnto/stay-savvy-understand-global-financial-regulation-in-5-steps...Mar 29, 2014 · Six years after Lehman Brothers ruptured, much has been written about the global financial crisis’s causes and consequences, but little has been penned on the key issue of …

Arrested For Selling Viagra - TrustedPharmhttps://trustpillsusa.com/?arrested,for,selling,viagraThe Developers Should Hide Status Bar When It Is Essential To Do This.Europe Has To Realize That This Is Simply A Symptom Just Like Lehman Brothers The Financial Institution That Collapsed In 2008 With The Costliest Bankruptcy Filing In American History Was A Symptom It Was Not A Cause Of The Problem He Says.Rehab For Oxycontin Contains Of ...

Catalog | Voices Bookshttps://voicesbooks.com/?page_id=85The High Price I Had To Pay: Sentenced To 12 1/2 Years For Victimizing Lehman Brothers Bank The High Price I Had To Pay is a captivating real-life story written by author Jamila T. Davis, who is currently serving a 12 1/2 year prison sentence. Before Lehman’s collapse, Davis was accused of being the 25 year old mastermind who defrauded the ...

Revenue per employee up at IT cos | Gadgets Nowhttps://www.gadgetsnow.com/jobs/Revenue-per...Jul 12, 2010 · Revenue per employee up at IT cos ... after dropping to a low of $41,499 during the first quarter. ... Bhadada said companies began to get fixated on non-linear initiatives since mid-2008 after the collapse of Lehman Brothers when business groaned due to projects getting shelved or delayed.

Mnuchin said to be top Treasury pick among Trump’s ...https://www.bostonglobe.com/business/2016/11/14/...Nov 14, 2016 · The bank collapsed that July, just months before Lehman Brothers Holdings Inc.’s failure set off a global emergency. At one of the murkiest moments …

With Menaker & Herrmann Affiliation, Offit Kurman Expands ...https://www.offitkurman.com/publication/with...His recent significant matters include a $17 million international arbitration for an Italian avionics firm and a $1.3 billion litigation incident to the Lehman Brothers bankruptcy. In his antitrust practice, he has co-authored an amicus curiae brief at the U.S. Supreme Court, and counseled clients on vertical distribution agreements and ...

A Sample Of Warren Buffett's Largest Profits - Benzingahttps://www.benzinga.com/news/14/09/4811238/a...Following the collapse of Lehman Brothers in 2008, Goldman Sachs (NYSE: GS) needed a boost. Warren Buffett answered Goldman Sachs’ call and acquired 13.1 million shares in the troubled financial ...

How to Get a Big Pay Raise Without the Briefcase Techniquehttps://barbarafriedbergpersonalfinance.com/how...Let’s rewind back to fall of 2008. I was out of IT work for three years by then. I took sabbatical to manage a portfolio of hotels that I owned back then. Lehman Brothers collapsed the day I sold one of my hotels. I planned on building a new one, but we were in the midst of one of …

RECENT PROGRAMS : WealthTrackhttps://wealthtrack.com/category/recent-programs/page/87Lehman Brothers filed for bankruptcy in September 2008, tipping the world into a systemic financial meltdown which we have been recovering from ever since. It’s helpful to step back every once and while and see how far we have come since the market lows of March 2009, when the S&P closed under 700.

Christine Daley, Lehman’s Star Distressed Debt Analyst ...https://www.bnnbloomberg.ca/christine-daley-lehman...In his 2010 book “A Colossal Failure of Common Sense: The Inside Story of the Collapse of Lehman Brothers,” he recalled the time that Daley sensed financial problems at the electricity company Calpine and proposed a massive short position that “took a lot of guts.” Her recommendation would end up making over $190 million for Lehman.

Fairy Tale of High-End New York Real Estatehttps://www.courthousenews.com/fairy-tale-of-high-end-new-york-real-estateAug 21, 2012 · “In the fifteen month interval between the contract signing and the scheduled closing, Lehman Brothers collapsed and the United States tumbled into a recession,” U.S. District Judge William Pauley III summarized in his 23-page order.

The Debt Financing Landscape - 2 Key Developments ...https://www.acc.com/education-events/2020/debt...Feb 26, 2020 · As a member of the trial team in the Lehman Brothers RMBS bankruptcy dispute, he helped obtain a $2.4 billion verdict for investors. He also represented PetSmart in a covenants dispute with lenders regarding $8 billion in debt obligations. In his past pro bono work, he has represented indigent parties in appellate, housing, and family law matters.

Season 09 : WealthTrackhttps://wealthtrack.com/category/season-09/page/9Lehman Brothers filed for bankruptcy in September 2008, tipping the world into a systemic financial meltdown which we have been recovering from ever since. It’s helpful to step back every once and while and see how far we have come since the market lows of March 2009, when the S&P closed under 700.

Feature Film, Drama (Sorted by IMDb Rating Descending)https://www.imdb.com/search/title/?title_type=...The story of Lehman Brothers, from their beginnings as cotton brokers before the Civil War to the company's involvement in the financial crisis of 2008. ... Liyan is one of the leaders of the Church of Almighty God. One time, on her way to a meeting, she was captured by the Chinese Communist Party's police and endured extremely brutal torture

How Jason Njoku Beat The Odds To Create iROKOtv, 'Africa’s ...https://legacy.travelnoire.com/jason-njoku-create-irokotv-africa-netflix“It was largely acknowledged that I was an absolute, complete failure,” Njoku stated to Fast Company.. After being forced to move back into his mother’s apartment following the collapse of Lehman Brothers, he noticed a change in how his mother consumed television …

econ 201 exam 2 Flashcards | Quizlethttps://quizlet.com/386711824/econ-201-exam-2-flash-cardsWhich of the following is NOT one of the main features designed to protect depositors and the economy against bank runs? ... and Leroy deposits the $1,000 check he received as a graduation gift in his checking account. The bank does NOT want to hold excess reserves. ... The primary reason for Lehman Brothers' bankruptcy in September 2008 was ...

U.K. Awaits EU Short-Selling Ruling Ahead of Banker-Pay ...https://www.bloomberg.com/news/articles/2014-01-21/...Jan 21, 2014 · Lehman Brothers. ESMA is one of three EU-level agencies set up to coordinate oversight of securities markets, banks and insurers in the wake of the collapse of Lehman Brothers …

Jeb Bush, shifting focus, quits firm that has profited ...https://www.latimes.com/nation/la-na-jeb-bush-money-20141225-story.htmlDec 25, 2014 · That same year, Bush also was hired as an advisor to Lehman Brothers, the New York investment bank and financial services firm. When Lehman collapsed in bankruptcy in …

Wilmington Trust Adds Corporate Trust Professional ...https://www.businesswire.com/news/home/...Mar 30, 2010 · Wilmington Trust currently serves on the unsecured creditors’ committees in many high-profile bankruptcy cases, including those of General Motors Corporation and Lehman Brothers …[PDF]UvA-DARE (Digital Academic Repository) Exploration of a ...https://pure.uva.nl/ws/files/1636943/112505_05.pdfU.S. example is Lehman Brothers, which is the largest bankruptcy in history to date. Although management in its annual statement confirmed to comply with the Sarbanes Oxley Act, the bank could not prevent bankruptcy. One of the books on Lehman Brothers (A Colossal Failure of Common Sense) describes an arrogant,

Stocks advance ahead of Fed interest rate decision ...https://www.silive.com/news/2008/12/stocks_advance_ahead_of_fed_in.htmlAgainst the fear that has gripped Wall Street since the mid-September bankruptcy of Lehman Brothers Holdings Inc. and the subsequent freezing of the credit markets most economists are anticipating ...

The Last Days of Lehman Brothers - New Statesmanhttps://www.newstatesman.com/television/2009/09/lehman-brothers-days-fuldSep 10, 2009 · One week, two programmes about the collapse of Lehman Brothers. The first was a drama entitled The Last Days of Lehman Brothers (9 September, 9pm), in which James Bolam played Ken Lewis, the chief executive of Bank of America, who comes, I believe, from Mississippi. Naturally, our Jimmy played him with a Geordie accent, which was distracting.But I digress. The second (10 …

Dodd calls for Lehman Brothers investigation - Mar. 19, 2010https://money.cnn.com/2010/03/19/news/economy/...Mar 19, 2010 · A year and a half after Lehman Brothers' collapse, Senate Banking Committee Chairman Chris Dodd (D-Conn.) is calling for a federal investigation of the "Lehman situation."

Ten years on from Lehman, why has nothing… | Green Economy ...https://www.greeneconomycoalition.org/news...A lot can change in ten years. Back at the start of 2008, the first iPhone had only just been released, Nickelback were still topping the charts, and Barrack Obama was just an obscure Senator from Illinois. And Lehman Brothers was the forth-largest investment …

News Summary - The New York Timeshttps://www.nytimes.com/2006/08/22/nyregion/news-summary.htmlAug 22, 2006 · C1 Equity Firm Adds Adviser Felix G. Rohatyn, the investment banker who helped New York City avert bankruptcy in the 1970's, is joining Lehman Brothers as an adviser to its chairman.

Large-Cap, Industrials Lead As US Deal Flow Ticks Up In Q3 ...https://www.law360.com/articles/383716/large-cap-industrials-lead-as-us-deal-flow...U.S. private equity deal flow is coming off its second-strongest quarter since the collapse of Lehman Brothers, buoyed by a surge in larger deals and continuing appetite in the industrial and ...

Billionaires Go Trophy Hunting: The Biggest Real Estate ...https://observer.com/2012/12/billionaires-go...Rumor has it that just months after the Lehman Brothers collapse, the ex-vice chair of Morgan Stanley, Bruce Fiedorek, was quietly shopping his apartment around for $45 million, but no one was buying.

The largest bankruptcies in US history - Credit Writedownshttps://creditwritedowns.com/2008/09/chart-of-day-largest-bankruptcies-in-us.htmlSep 18, 2008 · The bankruptcy of Lehman Brothers, with assets of over $600 billion is the largest in U.S. history. Wikipedia has catalogued the list of the largest U.S. bankruptcies of all time. (Hat tip: Börsennotizbuch) Drum roll, please.

Weekly Stock Market Commentary 6 15 2009 - The Money Alertwww.themoneyalert.com/weekly-stock-market-commentary-6-15-2009Jun 15, 2009 · It was the first decline in charitable giving since 1987 and only the second since Giving USA began tracking donations in 1956. High Hopes – Consumer confidence hit its highest reading since September 2008, when the Lehman Brothers failure started the financial crisis felt ‘round the world.

Amazon.com: Lessons from the Financial Crisis ...https://www.amazon.com/Lessons-Financial-Crisis-Arthur-Berd/dp/1906348472Dec 22, 2010 · Prior to joining CFM, Arthur was the Head of Quantitative Market Strategies at BlueMountain Capital Management, a leading credit hedge fund in New York. Prior to that, he was a Senior Vice President at Lehman Brothers where he was responsible for a variety of quantitative credit models and strategies across corporate bonds and credit ...Format: Paperback

Why It's Time to Rethink Sales Altogether | Irishttps://www.iris.xyz/sell/social-selling/why-its-time-to-rethink-sales-altogetherThe collapse of Lehman Brothers is an example that springs to mind, or the recent Libor rigging. The overall effect in my view is that this will give the client a much, much better buying experience. Therefore, they will be more loyal, and more likely to take cross-sell and up-sell opportunities.[PDF]THE ART OF STORY FUNDING - L'Officiel Fundlofficielfund.com/officielfund_files/LOFFICIEL_FUND.pdfTHE ART OF STORY FUNDING Jalou Media Group and GEM present : L’OFFICIEL FUND, a US $50 million ... Lehman Brothers from 1988 to 1993. Mr. Brown attended UCLA. He is the chairman of L’Officiel USA. ... She was the first to meet with Armani and Versace in Italy, and Donna

Is Anyone Paying Professors to Lie?https://www.freerepublic.com/focus/f-bloggers/3770830/posts?page=2The Enron Corporation "the Crooked E" , the corrupt firm whose failure should have disproved the myth "too big to fail", but didn't? At the time it was the seventh largest corporation. It's bankruptcy was the largest in history until Lehman Brothers failed. Incidentally, Lehman Brothers was also involved in …

Demand for gold at an all-time high - Telegraph.co.ukhttps://www.telegraph.co.uk/finance/personal...Nov 19, 2008 · Demand for gold at an all-time high . ... bar and coin buying and France became a net investor in gold for the first time since the early 1980s. ... the collapse of Lehman Brothers and a …

43 Profitable Analytics and Data Mining Business Ideas ...https://www.starterstory.com/analytics-and-data-mining-business-ideasThe year was 2008, the beginning of the financial crisis. I remember being sent to UBS headquarters in Weehawken, NJ for training in the same week that Bear Stearns and Lehman Brothers were on the verge of bankruptcy. It wasn’t a good sign. They ended up laying off all the young advisors and towards the end of 2009, I was unemployed and jobless.

Requiem for a Dream - STRAY REFLECTIONShttps://stray-reflections.com/article/34/Requiem_for_a_DreamMar 31, 2020 · As a pre-emptive move to protect the US economy, the Fed pushed through an emergency rate cut on March 3, the first since the collapse of Lehman Brothers in October 2008. Stocks rallied for about 15 minutes and then the selloff intensified. The 10-year Treasury yield dipped below 1 percent for the first time.

European securitisation: Making a comeback? | White & Case LLPhttps://www.whitecase.com/publications/insight/european-securitisation-making-comebackMay 19, 2016 · Although the dust may have settled on the financial crisis of 2008, the finger of blame remains squarely pointed at securitisation. In the aftermath of the demise of Lehman Brothers, one of the disgraced bank's former senior executives admitted that Lehman was addicted to securitisation like "financial heroin". €213.7 billion

Lehman collapse shapes Bank of England's trading test for ...https://finance.yahoo.com/news/lehman-collapse-shapes-bank-englands-125218272.htmlMay 26, 2015 · Britain's top banks will be tested this year for their ability to cope with the type of market mayhem that followed the collapse of U.S. bank Lehman Brothers in …

Lehman announces exit from bankruptcy - The Hindu BusinessLinehttps://www.thehindubusinessline.com/economy/lehman-announces-exit-from-bankruptcy/...Nearly three-and-a-half years after it went belly-up in September 2008, the once-powerful investment bank Lehman Brothers has announced its exit from bankruptcy. A Wall Street behemoth at that time, L

Toward a Stronger Financial Market Infrastructure for ...https://www.bankofcanada.ca/2013/03/toward-stronger-financial-marketFor example, the Lehman Brothers default, one of the most memorable and dramatic of the recent crisis, would have been even worse if the London Clearing House, which is the CCP for a large portion of OTC interest rate derivatives, had not managed the default as well as it did.

Pound LIVE: Sterling steady but Carillion collapse ...https://www.express.co.uk/finance/city/904744/Pound-sterling-live-updates-pound-to...Jan 15, 2018 · Pound LIVE: Sterling steady but Carillion collapse described as 'Lehman Brothers moment' THE POUND has yet to respond as after the collapse …

4 lessons learned from Lehman Brothers’ collapse: 10 years ...https://www.eteaket.co.uk/4-lessons-learned-from-lehman-brothers-collapseSep 15, 2018 · I’m hoping that whether the UK is wallowing in misery or celebrating our success over the next 10 years (or somewhere in-between), there will still be a demand for a proper cup of tea and a slice of cake. The future is very uncertain but then that’s life isn’t it? The only thing certain is change.

A Black Monday For the Record Books — Steemkrhttps://steemkr.com/hive-167922/@shanghaipreneur/a-black-monday-for-the-record-booksAs he says, Cheadle "puts the Brother in Lehman Brothers" in this fictional retell of how the biggest single day market collapse (in terms of percentage points, at least) transpired. We still don't know what exactly happened on that Black Monday, October 19, 1987, when the shit hit the fan for a …

Global Gold | Morningstarhttps://www.morningstar.com/articles/869562Jun 14, 2018 · What's changed, though, is the pace at which information flows--which only exacerbates knee-jerk responses to events such as the collapse of Lehman Brothers, where "everyone collectively did …

Barclays caught up in US debt inquiry | This is Moneyhttps://www.thisismoney.co.uk/money/markets/article-1692801/Barclays-caught-up-in-US...After buying the US wing of collapsed US bank Lehman Brothers, Barclays accounted for some of £1.7bn of the total. Share or comment on this article: Barclays caught up in US debt inquiry

Global Competitiveness Report 2015-2016 - Reports - World ...https://reports.weforum.org/global-competitiveness-report-2015-2016/the-global...The collapse of Lehman Brothers in 2008 triggered a crisis of historical proportions, sending the global economy into freefall. ... global growth is projected at 3.3 percent, its lowest rate since 2009—the trough of the crisis—and one of the lowest since 2000. 7 Unemployment, especially among youth, ... This is true for both advanced ...

The Death of Mainstream Media - The Daily Coinhttps://thedailycoin.org/2016/09/14/the-death-of-mainstream-media-2Sep 14, 2016 · The Death of Mainstream Media. ... Yes it’s true Congress doesn’t get anything done on behalf of the people, but no accident. The government doesn’t work for the people. ... The sad truth is the publication has been living on borrowed time and a borrowed reputation for a long time. Long on prestige, it remains very short on ...[PDF]The Impacts of Negative Interest Rates on the Eurozone …https://ir.lib.uwo.ca/cgi/viewcontent.cgi?article=1025&context=undergradawards_2017In 2008, the world experienced its biggest financial crisis since the Great Depression. Also known as the subprime mortgage crisis, this recession was caused by the burst of the housing bubble, causing major firms such as Lehman Brothers Holding Inc. and Bear Stearns Companies Inc. to declare bankruptcy.

Does The History of The DMV's New Listings Predict The ...https://dc.curbed.com/2012/8/29/10334578/does-the-history-of-the-dmvs-new-listings...Aug 29, 2012 · - The Bush II-Obama transition was in the middle (34.4%). The credit crunch rapidly accelerated with the collapse of Lehman Brothers in the fall and a …

Daily Bankruptcy News - bkinformation.comhttps://bkinformation.com/News/PriorEditions/2018/September/9-14-2018_Mobile.cfmSep 14, 2018 · Sen. Elizabeth Warren sees new dangers lurking 10 years after collapse of Lehman Brothers (DBN) Lehman Brothers: the bankruptcy of a bank and a system (DBN) Hughes Hubbard’s Lehman Team Marks 10th Anniversary (DBN) I worked at Lehman Brothers during its final days. This is what the global financial crash looked like from the inside (DBN)

College Students Drop Dreams Amid Wall Street Woes - ABC Newshttps://abcnews.go.com/Business/story?id=5868400&page=1Sep 23, 2008 · But many have seen their plans dashed in the last two weeks as the 158-year-old investment banking giant Lehman Brothers filed for bankruptcy …

Four-Star Corton Serves Sublime Cotton Candy Sushi: Dine ...https://www.bloomberg.com/news/articles/2013-05-15/four-star-corton-serves-sublime...May 15, 2013 · Four-Star Corton Serves Sublime Cotton Candy Sushi: Dine ... It opened less than a month after Lehman Brothers collapsed in 2008. As the …

Walberg - The Bankers 9/11https://rense.com/general83/bankers.htmCEO salaries have skyrocketed in the past two decades; for instance, Lehman Brothers' Richard Fuld received $466 million from 1993-2008 and a whopping $62 million "golden parachute" exit pay on resigning last month, as his firm chalked up a $6 billion loss and declared bankruptcy.

True Risk Management - brightscope.comhttps://www.brightscope.com/financial-planning/advice/article/5201/True-Risk-ManagementThis is particularly the case when a specific outlook is adopted and a portfolio is managed accordingly. We have seen many famous cases of overconfidence leading to disastrous financial results. Surely, the people running Bear Stearns and Lehman Brothers thought their firms were not at risk of collapse.

Empty Mansions (eBook) in 2019 | Books, Ebooks, Mansionshttps://www.pinterest.com/pin/779545016731139410This book has one of the most beautiful endings I've ever read. ... Gray Mountain by John Grisham. Losing her job at New York City's largest law firm in the weeks after the collapse of Lehman Brothers, Samantha becomes an unpaid intern in a small Appalachian community, where she stumbles upon dangerous secrets. ... To Die For: A Novel of Anne ...

Mergers & Acquisitions: Energy Sector on the Cusp of Recoveryhttps://www.ivyexec.com/career-advice/2017/mergers-acquisitions-energy-sector-recoveryMr. Watson joined Lehman Brothers in 1997 and joined Barclays in 2008. ... From 2010 – 2014, Jeff served as the CFO and EVP of Devon Energy Corporation, one of the largest US-based oil and natural gas producers. Jeff joined Devon in 1997 and was involved in $35B worth of acquisitions and $23B worth of divestitures. ... This is the right place ...[PDF]Growing philanthropy advice - Boncertohttps://boncerto.com/assets/files/Philanthropy-Advice.pdfBONCERTO White Paper Growing philanthropy advice In 2008, over 60% of banks were planning to expand their philanthropy offering.(11) The global ?nancial crisis which started with the collapse of Lehman Brothers on 15th September 2008 has changed the …

Banks, fraud and Caribbean exposure | Business | Jamaica ...jamaica-gleaner.com/gleaner/20120701/business/business73.htmlAs being written, the story is still unfolding. ... Of these so far only Barclays has admitted that its traders and bankers did so and a fine of US$453m has been levied on it by UK and the US regulators. ... it largely avoided exposure to the collapse of Lehman Brothers and other US financial institutions, did not buy mortgage-backed ...

Jim Rickards: The Chinese Credit Bubble - Crusoe Researchcrusoeresearch.com/article/jim-rickards-chinese-credit-bubbleJan 31, 2017 · The banks finance their lending with customer deposits or sales of wealth management products (WMPs, something like the CDOs that brought down Lehman Brothers). WMP’s have been described by the former Chairman of the Bank of China as the greatest Ponzi scheme in history. Banks rely on sales of new WMPs to redeem the old ones at maturity.[PDF]G! SE e FOR ENERGY A FUTURE SEhttps://www.dora.dmu.ac.uk/bitstream/handle/2086/5664/Energise Complete 10thDec08.pdf...Completed in the weeks that saw the collapse of Lehman Brothers and the climax of the US Presidential campaign, this ... problem of individual consumption more than one of supply . This is a concept that must be understood if a rational politics of ... focus is on humanity’s need for a lot more energy, and a lot more innovation in energy supply.[PDF]Gordian group Sept 2009https://gordiangroup.com/wp-content/uploads/2015/11/Gordian-Group-Financier-Worldwide...Lehman Brothers, Chrysler, and GM. Lending virtually disappeared in the second half of 2008 and first quarter of 2009, resulting in a broad range of companies facing liquidity crises and the inability to refinance their debts or meet working capital needs. The lack of credit in turn resulted in a rash of bankruptcy liquidations and a con-

IMF Warns of Rising Instability in the Global Financial Systemhttps://www.dailyfx.com/forex/market_alert/2018/10/10/IMF-Warns-of-Rising-Instability...It is known to be one of the world's 'safe-haven' currencies. ... This is echoing into Asia with widening CDS spreads ... Following the 10-year anniversary of the collapse of Lehman Brothers, IMF ...

Goldman: Still Greedy, No Longer Patient - The New York Timeshttps://opinionator.blogs.nytimes.com/2010/04/29/goldman-still-greedy-no-longer-patientApr 29, 2010 · And the essence of how Goldman has changed.” The battle between bankers and traders is as old as Wall Street itself. In “Greed and Glory on Wall Street,” the writer Ken Auletta famously described the near-collapse of Lehman Brothers in the early 1980s because of a similar feud.

nicklausgreens.com - Part 47https://www.nicklausgreens.com/page/47Lehman Brothers was one of the most aggressive commercial lenders employing this approach, and they also filed for bankruptcy due to this as properly as other questionable economic practices. There’s a worldwide list and a U.S. list. Apple, Salesforce, Facebook, Google, Amazon, Microsoft, Uber, Unilever, and Coca-Cola and Oracle appear on ...

Most Defining Banking Trends: 2017 - Apogaeishttps://www.apogaeis.com/blog/most-defining-banking-trends-2017Most Defining Banking Trends: 2017. ... Remember the tragic collapse of Lehman Brothers? That may be one of the most unfortunate thing happened to banking & financial industry in last decade & the effects were shown for years. It took around 5 years for banking industry to come into shape. ... The key to a bank’s success depends on the ...

Search Results - NetGalleyhttps://www.netgalley.com/catalog/recentlyAdded?sort=b.publicAt&direction=desc&page=1&...This is the remarkable memoir of Michael Ainslie, a man who has always embraced the adventures and misadventures of business and life. In A Nose for Trouble , he describes his personal experience with several high profile events, including the 2008 bankruptcy filing of Lehman Brothers: He was one of ten people in the Lehman boardroom on the ...

The Bank That Lived a Little: Barclays in the Age of the ...https://www.foyles.co.uk/witem/business/the-bank-that-lived-a-little,philip-augar...This is an extraordinary corporate thriller, which among much else describes how Barclays came to buy Lehman Brothers for a bargain price in 2008, why it was so keen to avoid taking government funding during the financial crisis, and the price shareholders have paid for a …

Why Gold is a buy again! - Voice Of The Marketshttps://voiceofthemarkets.com/why-gold-is-a-buy-againIf we look at the attached chart, we see that Gold has been consistently rising since 2001, when it touched USD 280 levels. We can also see a downward blip in Sept 2008 when the world’s financial system was almost about to collapse and only Lehman Brothers went bankrupt but various other ‘insolvent’ banks of the USA were allowed to continue at the cost of the American taxpayer and the ...

Solved: Background: Goldman: Still Greedy, No Longer Patie ...https://www.chegg.com/homework-help/questions-and-answers/background-goldman-still...And the essence of how Goldman has changed.” The battle between bankers and traders is as old as Wall Street itself. In “Greed and Glory on Wall Street,” the writer Ken Auletta famously described the near-collapse of Lehman Brothers in the early 1980s because of a similar feud.

The Financial Coach - Managing people & their emotions ...https://www.thefinancialcoach.co.zaWe have seen it before with the collapse of Lehman Brothers where employees had their entire life savings invested in just one share and we will see it again in the future. If there is a financial planning lesson here it is this: diversification is essential to a successful long-term investment strategy.

Business Debt Delinquencies Are Now Higher Than When ...https://www.alt-market.com/articles/2901-business-debt-delinquencies-are-now-higher...Just imagine what it would mean for your family if your debt was growing 50 times faster than your bank account. Needless to say, an extremely troubling development… Well, American companies may just have a mountain’s worth of problems, according to a new report from Andrew Chang and David Tesher of S&P Global Ratings.

Lehman Brothers - latest news, breaking stories and ...https://www.independent.co.uk/topic/lehman-brothersLehman Brothers. Americas. ... The super rich were the first to bail when Lehman Brothers collapsed. Business News. ... New City jobs treble, but it's still a long way from boom.

The jobless recovery is a myth - Nov. 6, 2009https://money.cnn.com/2009/11/06/news/economy/...Nov 06, 2009 · Because output fell so sharply following the oil shock and Lehman Brothers collapse of 2008, some pundits are banking on a sharp rebound. But job and wage growth have been weak for a …

Eurozone crisis to trigger another Lehman moment?https://economictimes.indiatimes.com/blogs/our...Sep 29, 2011 · Lehman Brothers was an investment bank, not a commercial bank with retail deposits. Those at the helm of affairs in the US judged that it did not fall in the category of ‘too big to fail’. They were proved disastrously wrong. Lehman may not have been a commercial bank but it was connected with commercial banks through derivative transactions.

Families hoard cash 5 years after crisis | Nation/World ...https://www.southbendtribune.com/news/nation/...NEW YORK - Five years after U.S. investment bank Lehman Brothers collapsed, triggering a global financial crisis and shattering confidence worldwide, families in major countries around the world ...[PDF]The global economic crisis, its impact on exporters and ...www.philexport.ph/barterfli-philexport-file...due to its exposure to the bankrupt Lehman Brothers. But it assured its depositors it remains in the pink of health. True to their vaunted liquidity, the biggest local banks, Metrobank, Banco de Oro, and Bank of the Philippine Islands, are now the most serious contenders in acquiring Philamlife, the crown jewel of troubled AIG of the

This crisis will show us who the leaders truly are | The ...https://www.spectator.com.au/2020/03/this-crisis...Mar 27, 2020 · Working for a company that is collapsing is about as tough an experience as there is in professional life; working in a financial system tinkering on collapse even more so. In the weeks after Lehman Brothers filed for bankruptcy, my colleagues and I existed in a surreal state.

A Wild Weekend Ten Years Ago, and Lessons for Today ...https://www.cfrti.com/blog/2018/9/12/a-wild...Sep 12, 2018 · First, BankAmerica was buying Merrill Lynch – perhaps the stodgiest of the stodgy brokerage firms, which was created the same year the first community foundation was launched in Cleveland in 1914. But more ominously, Lehman Brothers, a fixture on Wall Street for more than 150 years, filed for bankruptcy. Stock prices swooned.

The Financial Cure Made the Disease Worse - The Patriot Posthttps://patriotpost.us/articles/29758-the...Oct 07, 2014 · In fact, the legislation merely institutionalized the symptoms of the crisis. The main reason it hasn’t worked – and never will work – is because the government itself was behind the economic meltdown that wrecked Lehman Brothers and placed many other large financial institutions in the loving arms of Big Brother in Washington.

The US is having a bank-shaped recovery | Financial Timeshttps://www.ft.com/content/26173096-7fe8-47e4-abeb...The US is having a bank-shaped recovery. ... then I argued that the “bank” shape was oddly relevant since the need to “fix” finance after the collapse of Lehman Brothers would cause an ...

Owen Jones: The Coalition has failed. There is an ...https://www.independent.co.uk/voices/commentators/...Apr 27, 2012 · It is worse than the last double-dip recession, in the mid-1970s, because the fall in growth since Lehman Brothers collapsed is much greater. It is worse than the 1930s, because the recovery to a ...

Sharan Burrow: G20 must continue stimulus and corporate ...https://www.actu.org.au/actu-media/speeches-and...What has changed in the 12 months since the collapse of the US investment bank Lehman Brothers? A lot, and not much. Certainly, there have been major changes for millions of working people across the globe who are the victims of a global financial collapse they did not cause.

A decade of U.S. economic sluggishness may have just ...https://www.metro.us/a-decade-of-u-s-economic...Oct 05, 2018 · By Howard Schneider WASHINGTON (Reuters) – For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy ...

A decade of U.S. economic sluggishness may have just ...https://www.srnnews.com/a-decade-of-u-s-economic...By Howard Schneider. WASHINGTON (Reuters) – For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about the health of the labor market to tepid economic growth and the moribund rate of interest paid on U.S. Treasury bonds.

A decade of U.S. economic sluggishness may have just ...https://kvoa.com/news/2018/10/06/a-decade-of-u-s...Oct 06, 2018 · WASHINGTON (Reuters) – For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to …

A decade of U.S. economic sluggishness may have just ...freeworldeconomicreport.com/a-decade-of-u-s...Oct 05, 2018 · WASHINGTON (Reuters) – For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about the health of the labor market to tepid economic growth and the moribund rate of interest paid on U.S. Treasury bonds.

Analysis: A decade of U.S. sluggishness may ... - Zee Businesshttps://www.zeebiz.com/agencies/analysis-a-decade...For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about the health of the labor market to tepid economic growth and the moribund rate of interest paid on U.S. Treasury bonds.In a heartbeat, that seemed to change this week, adding facts on the ground to Federal Reserve ...

A decade of U.S. economic sluggishness may have just ...https://jimbakkershow.morningsidechurchinc.com/...For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about the health of the labor market to tepid economic growth and the moribund rate of interest paid on U.S. Treasury bonds.

A Decade of US Economic Sluggishness May Have Just Snapped ...https://www.theepochtimes.com/a-decade-of-us...Oct 07, 2018 · WASHINGTON—For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about ...

Ameriprise Economist Russell Price: Job Market 'Best in a ...https://www.newsmax.com/finance/streettalk/job...For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about the health of the labor market to tepid economic growth and the moribund rate of interest paid on U.S. Treasury bonds.

US Economy 2018: A Decade Of Economic Sluggishness May ...https://www.ibtimes.com/us-economy-2018-decade...For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about the health of the

A decade of U.S. economic sluggishness may have just ...https://globalrubbermarkets.com/138288/a-decade-of...By Howard Schneider. WASHINGTON (Reuters) – For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about the health of the labor market to tepid economic growth and the moribund rate of interest paid on U.S. Treasury bonds.. In a heartbeat, that seemed to change this week ...[PDF]Bayesian Correlation Estimationhttps://web.ma.utexas.edu/users/pmueller/pap/LLM03.pdfinclude Citi-Bank, Lehman Brothers, Merrill Lynch and Bank of America. The stock in the middle is Enron; see Table 1 for their empirical correlations. Insert Table 1 Here. The grouped variable model introduced in x2:4 and which classi es stocks into groups based on the correlations within and between each group o ers a natural method for ...

euro: Why Greece election is important for the world ...https://economictimes.indiatimes.com/news/international/Why-Greece-election-is...Jun 18, 2012 · If the new government decides to tear up the bail-out package, the common currency will be history. Financial markets will seize up as it did after Lehman Brothers collapse in 2008. Central banks left a lot weaker after the 2008 crisis will attempt to save the system, but the outcome is anyone’s guess. Who are the dramatis personae?[PDF]On My Radar: Nitroglycerin on a Bumpy Roadhttps://www.advisorperspectives.com/commentaries/...Mar 13, 2017 · On My Radar: Nitroglycerin on a Bumpy Road March 13, 2017 by Steve Blumenthal ... But the bank says to itself, “she probably won’t need this buck for a while, so I’ll lend it to Joe who wants to start a pizza store.” Joe borrows the buck and pays for flour, pepperoni and a pizza oven from Sally’s Pizza ... Its assets are the one buck ...

The great crash - The meaning of Lehman (take 4) | Free ...https://www.economist.com/free-exchange/2013/09/16/...Sep 16, 2013 · The great crash The meaning of Lehman (take 4) ... Of course the signal fact about the bankruptcy of Lehman Brothers and the financial and political chaos that followed was that it …

A decade of U.S. sluggishness may have just snapped back ...https://www.insider.com/r-a-decade-of-us...WASHINGTON (Reuters) - For a solid decade after the collapse of Lehman Brothers touched off a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about the health of the labor market to tepid economic growth and the moribund rate of interest paid on U.S. Treasury bonds.

Gold, fine wine, art or under the bed: what's the safest ...https://www.theguardian.com/business/2011/jul/25/safe-havens-investors-cashJul 25, 2011 · UK shareholders have received their largest dividend payouts since the collapse of Lehman Brothers in 2008, with companies returning £19.1bn …

David Stevenson: Beware of the sting in the fat tail ...https://www.ft.com/content/20a109e4-9171-11dd-b5cd-0000779fd18cWhat do Bradford & Bingley, AIG, Wachovia and Lehman Brothers all have in common – apart from the small matter of their role in the global financial crisis? The answer is that their fates ...

A decade of U.S. economic sluggishness ... - The Japan Timeshttps://www.japantimes.co.jp/news/2018/10/06/...Oct 06, 2018 · WASHINGTON – For a solid decade after the collapse of Lehman Brothers ushered in a global financial crisis, there was good reason to think the U.S. economy remained broken, from skepticism about ...

The reasons that induced Lehman Brothers to collapsehttps://testmyprep.com/subject/finance-1/the-reasons-that-induced-lehman-brothers-toPerhaps most significant, however, was the time of deregulation that preceded the crisis. Arguably, the period of deregulation began through the Reagan Time. Reaganomics, the lassiez faireeconomic guidelines advocated by the ex - president, may have served as the starting place for the deregulatory climate that ensued for the next two decades.

Lehman and hedging with non collateralized derivative ...https://www.curezone.org/forums/fm.asp?i=1260729This week's bankruptcy of Lehman Brothers and bailout of the insurer AIG may have proved both men right, while testing the limits of the $62 trillion market for such financial derivatives. The rising costs of a company's credit-default swaps tend to correlate with a slump in its stock price, and the case with Lehman was no different.

Program of Seminars – IMF Bloghttps://blogs.imf.org/tag/program-of-seminarsAfter a decade of high growth and a swift rebound after the collapse of U.S. investment bank Lehman Brothers, emerging markets are seeing slowing growth. Their average growth is now 1½ percentage points lower than in 2010 and 2011. This is a widespread phenomenon: growth has been slowing in roughly three out of four emerging markets.

American Economic Associationhttps://www.aeaweb.org/research/should-we-worry-banks-grow-more-connectedThis could potentially put pressure on other banks and institutions just as the failure of AIG and Lehman Brothers did in the summer and fall of 2008. In the intervening time, financial markets have gotten used to living with the idea of “ systemic risk ” and the threat of a financial crisis that can spread between banks like a contagious ...

Physical Gold In Vault Is “True Hedge of Last Resort ...news.goldseek.com/GoldSeek/1504702295.php– Physical gold is “the true currency of the last resort” – Goldman Sachs ... Using a gold futures contract as the basis of the hedge makes the implicit assumption that market liquidity will not be a problem in the realization of a geopolitical event. ... The liquidity event that was the collapse of Lehman Brothers.…lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Basel 3 Technology Solutions 2012 - Chartis Researchhttps://www.chartis-research.com/regulatory-compliance-and-reporting/regulatory...The financial crisis of 2008 was the largest global economic crisis since the Great Depression. It brought down major institutions such as Lehman Brothers and Bear Stearns, led to a rush to bail out many other banks, and revealed a plethora of flaws in the financial system.

Is It Time to be Concerned? - Physical Gold In Vault Is ...https://thedailycoin.org/2017/09/06/time-concerned-physical-gold-vault-true-hedge-last...Sep 06, 2017 · Their logic for this? The liquidity event that was the collapse of Lehman Brothers. The importance of liquidity was tested during the collapse of Lehman Brothers in September 2008. Gold prices declined sharply as both traded volumes and open interest on the exchange plunged.

Greek Crisis Unlikely To Set Off A Chain Reaction Of ...https://www.nuwireinvestor.com/greek-crisis-unlikely-to-set-off-a-chain-reaction-ofApr 29, 2010 · Just as Lehman Brothers Holdings Inc. (OTC: LEHMQ) executives kept voting themselves giant bonuses as the company was tottering into bankruptcy, so, too, do Greek-public-sector workers go on strike after strike to protect their right to retire with a full pension more than a decade earlier than ordinary German workers. ... This is the paradox ...

10 Years of US Financial Crisis | Financial Tribunehttps://financialtribune.com/articles/world-economy/89803/10-years-of-us-financial-crisisThe bankruptcy of investment bank Lehman Brothers on September 15, 2008, is considered the seminal moment in the global financial crisis. But an event two months earlier deserves mention.

Physical Gold In Vault Is "True Hedge of Last Resort ...https://www.zerohedge.com/.../physical-gold-vault-true-hedge-last-resort-goldman-sachs- Physical gold is "the true currency of the last resort" - Goldman Sachs - "Gold is a good hedge against geopolitical risks when the event leads to a debasement of the dollar" - Trump and Washington risk bigger driver of gold than risks such as North Korea - Recent events such as N. Korea only explain fraction of 2017 gold price rally[PDF]Central Bank of oman - GulfBasehttps://www.gulfbase.com/ScheduleReports/ad4b9247_CBO Financial Stability Report...The bankruptcy of Lehman Brothers on Monday, September 15, 2008, was the game-changer. It occurred to the surprise of many even while inflation was benign and estimated output gaps were small reflecting a seemingly calm macroeconomic surface. That gave rise to a sensible[PDF]The Variable-Rate Demand Note: A Primerwww.citibank.com/transactionservices/home/oli/files/global_capital_management.pdfthe Municipal Bond Women’s Club of New York, was the chair of the Southern Municipal Analysts Society and a member of the board of governors of the National Federation of Municipal Analysts. Past performance is no guarantee of future results.

The Impact of the Crisis on the Indian Economyhttps://www.jstor.org/stable/40278668The Impact of the Crisis on the Indian Economy T T RAM MOHAN The effects of the global financial crisis have been more severe than initially forecast. The turning point was the decision in September 2008 to let Lehman Brothers fail, an event that had a series of ruinous cascading effects. Given the depth of the crisis in the United States and[PDF]

Lehman Europe creditors in line for extra $8 billion paydayhttps://uk.finance.yahoo.com/news/lehman-europe-creditors-line-extra-000307043.htmlMar 05, 2014 · The collapse of U.S. investment bank Lehman Brothers in September 2008 plunged the global financial system into chaos and its European arm, based in London, was the largest and most complex part of the group because it was a hub for trading and investments spanning asset classes and dozens of countries.

A Bankruptcy Prediction Method Based on Cash flow Using ...https://www.researchgate.net/publication/4262647_A_Bankruptcy_Prediction_Method_Based...The defining moment of this crisis was the failure of Lehman Brothers, which precipitated the October 2008 crash and the Asian Correction (March 2009). Had the Federal Reserve seen these crashes ...

Measuring volatility linkage, clustering and sensitivity ...https://www.researchgate.net/publication/336003424_Measuring_volatility_linkage...The collapse of Lehman Brothers bank in United States in 2008 was the most significant shock transmitted to CEECs stock markets. The empirical results also suggest that the transmission of other ...

A letter written to Anigone from Ismene trying to talk her ...https://www.studymode.com/essays/a-Letter-Written-To-Anigone-From-64966981.htmlMar 14, 2004 · ? Lessons from Lehman Brothers: Will We Ever Learn? MGT 521 September 9, 2013 Introduction Lehman Brothers financial services filed bankruptcy on September 15, 2008, in the New York Southern District U.S. Bankruptcy Court. Resulting in an immediate 500 point drop in the Dow Jones (Did Ernst & Young Really Assist Financial Fraud? 2011).

Lehman client funds ruled safe | Financial Timeshttps://www.ft.com/content/6781fe58-be67-11de-b4ab-00144feab49aOct 22, 2009 · Hedge funds that have more than $3bn tied up in the European arm of Lehman Brothers, the collapsed investment bank, have won a crucial court ruling that …

The crisis virus hits Germany as factory ... - This is Moneyhttps://www.thisismoney.co.uk/money/news/article-2057810/The-crisis-virus-hits-Germany...Nov 05, 2011 · The purchasing managers’ index across the 17-country eurozone yesterday revealed the biggest monthly drop in business activity since the downfall of Lehman Brothers in 2008.

Sep 5, 2011 Job Killer in Chief Peter Schiff 321gold ...www.321gold.com/editorials/schiff/schiff090511.htmlJob Killer in Chief. Peter Schiff Posted Sep 5, 2011. This morning many on Wall Street were stunned by the big fat zero put up by the August jobs report, the worst showing in 11 months.[PDF]Aufheben Return of the crisis part 1 - Libcom.orglibcom.org/files/Crisis_I_final.pdfReturn of the crisis part 1 Introduction On September 12th 2008, before the assembled grand financiers of Wall Street, Hank Paulson, flanked by his team from the US Treasury, announced his determination that there would be no government money to bail out Lehman Brothers, the fourth biggest investment bank in the world,

How & When Will The Next Financial Crisis Happen? 26 ...https://www.zerohedge.com/news/2018-11-01/how-when-will-next-financial-crisis-happen...Via FocusEconomics.com, It is often stated that there is a major financial crisis every 10 years or so. Having said that, it’s been a little over a decade since the Lehman Brothers collapse sparked the last global financial crisis (GFC) and with global economic growth starting to show signs of petering out, some in the media and elsewhere in the public eye are forecasting another global ...

G.M. Speeds Hat in Hand to Treasury - The New York Timeshttps://dealbook.nytimes.com/2008/10/28/gm-speeds-hat-in-hand-to-treasuryOct 28, 2008 · General Motors and Chrysler want the government to help finance a merger they hope will revive their fortunes.. The automakers are working hard to stoke fears that letting either fail, and G.M. in particular, would unleash an economic catastrophe like what erupted from the collapse of Lehman Brothers, Andrew Ross Sorkin writes in his latest DealBook column.

Deal Me Out - The Bafflerhttps://thebaffler.com/salvos/deal-me-outAnother is JPMorgan Chase CEO Jamie Dimon, who is hailed for not losing as much money as everyone else. The closest thing the book has to a villain is the comically inept former Lehman Brothers’ head Dick Fuld, and even he gets a dollop of sympathy: “He had known for years that Lehman Brothers’ day of reckoning could come,” and so on.

LINDSEY WILLIAMS ~ The Derivatives Market is about to ...https://financearmageddon.blogspot.com/2013/06/lindsey-williams-derivatives-market-is.htmlLindsey Williams received two emails recently from his elite warning about a Lehman Brothers like Crash happening in China that could mean global collapse. Email #1: 'A large Chinese bank just last night ran out of liquidity and was bailed out by the government. Furthermore: "The seven-day repo rate, the benchmark rate for funding costs between banks, surged to 12.33% Thursday afternoon from ...

Mega Conference 2018x6fx5lk.attendify.ioJohn Adams is vice president of mergers and acquisitions with Sheshunoff & Co. Investment Banking. He joined the company 13 years ago, prior to which he served four years with Lehman Brothers in New York. Early in his career, he worked on a year-long project in Asia to restructure the banking sector after the Asian currency crisis of 1997.

Timelines :: The United States - Rapture Readyhttps://www.raptureready.com/timelines-the-united-statesLehman Brothers declares bankruptcy, the largest ever in the United States. Investor concerns turn next to American International Group Inc., a giant insurance company, after a plunge in that company’s stock and downgrades to its debt by credit ratings agencies who say the slumping housing market could further undermine its finances.

Black Monday? | NewsCut | Minnesota Public Radio Newshttps://blogs.mprnews.org/newscut/2008/09/black_mondaySep 15, 2008 · Lehman Brothers is expected to file for bankruptcy, ... then where it should focus. 1:07 p.m. ... The first public break-out in the public attention was last year and lead to a rapid drop ...

9 facts about Greece and the eurozone crisis - Voxhttps://www.vox.com/2015/2/25/18094224/eurozone-crisisJul 06, 2015 · It was the severity of the recession that created the debt problem and not the other way around. ... Then the collapse of Lehman Brothers caused a collapse of enthusiasm. ... Even as …Author: Matthew Yglesias

From ABCL to Lehman Brothers, six companies that simply ...https://economictimes.indiatimes.com/magazines/...Aug 10, 2016 · A hundred years later in 2009, as one of the world’s largest automobile manufacturing companies, it filed for bankruptcy. With the help of US Treasury and a government-led sale of the manufacturer and some of its subsidiaries, the company was restructured to form the General Motors Company, which has been reporting annual profits since 2010.

NYC Office Rents Post First Gain Since Lehman Collapse ...https://www.bloomberg.com/news/articles/2011-01-11/...Jan 11, 2011 · The increase was the first since the third quarter of 2008, when the bankruptcy of Lehman Brothers Holdings Inc. heralded a freeze in leasing. …

Gray Mountain (Audiobook CD) | Hennepin County Library ...https://hclib.bibliocommons.com/item/show/5152826109_gray_mountainGray Mountain (Audiobook CD) : Grisham, John : Samantha Kofer was a third-year associate at Scully & Pershing, New York City's largest law firm. Two weeks after Lehman Brothers collapsed, she lost her job, her security, and her future. A week later she was working as an unpaid intern in a legal aid clinic deep in small-town Appalachia. There, for the first time in her career, she was ...

Gray Mountain (Audiobook CD) | The Indianapolis Public ...https://indypl.bibliocommons.com/item/show/780713165_gray_mountainGray Mountain (Audiobook CD) : Grisham, John : Samantha Kofer was a third-year associate at Scully & Pershing, New York City's largest law firm. Two weeks after Lehman Brothers collapsed, she lost her job, her security, and her future. A week later she was working as an unpaid intern in a legal aid clinic deep in small-town Appalachia. There, for the first time in her career, she was ...

What a Difference a Decade Makes… | LawVision - JDSuprahttps://www.jdsupra.com/legalnews/what-a-difference-a-decade-makes-17532Between that day and the collapse of Lehman Brothers 13 months later, the world was clearly on a major slide toward and ultimately into, crisis. We all remember how that played out.

D Subbarao says 2008 financial crisis impacted emerging ...https://www.cnbctv18.com/finance/d-subbarao-says...The first thing was to ring-fence the two subsidiaries of Lehman Brothers in India. I think Lehman Brothers had non-bank finance company and a primary dealership. The first thing we did was to issue a statement ring-fencing them, so that no money would go out from them.

Now that the Fed has raised rates ... hopefully this ends wellhttps://www.usatoday.com/story/money/2015/12/19/...Dec 19, 2015 · The federal funds rate, the rate at which banks lend excess reserves to each other on an overnight basis, has been at or near zero essentially since Lehman Brothers declared bankruptcy in ...

The Lehman Brothers Bankruptcy Essay -- Business ...https://www.123helpme.com/lehman-brothers-bankruptcy-preview.asp?id=224849The Collapse Of Lehman Brothers Holdings Inc. Essay - 1. Introduction 158-years-old institution, the Lehman Brothers Holdings, Inc., Sought chapter 11 protections on September 15, 2008, indicating the largest bankruptcy filed in the U.S. history.

lehman brothers collapse ssrn.pdf - Pursuing a High Risk ...https://www.coursehero.com/file/26032011/lehman-brothers-collapse-ssrnpdfOct 24, 2017 · The significance of it is demonstrated in Appendix 1 which shows respondent answers to a survey of the U.S Securities and Financial Markets Association (2008). Over 60% of respondents viewed the collapse of Lehman Brothers as the event that had th e most significant impact on the financial

What the Pros Say: Investing Tips after Lehman Fallhttps://www.cnbc.com/id/26715549The financial sector took another hit after Lehman Brothers filed for bankruptcy protection on Sunday and Wall Street scrambled to shore up the system.

Causes of economic crisis - Answershttps://www.answers.com/Q/Causes_of_economic_crisisThe collapse of Lehman Brothers, a large global bank, in September 2008 almost brought down the worldâ??s financial system. The years before the collapse, a flood of irresponsible mortgage ...[PDF]The Failure of Lehman Brothers Holding Inc.https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2277574_code1383938.pdf?abstractid=...spectacular collapse of one of “the too big to fail” institutions: Lehman Brothers. It is to be noted that since the early 1970s, the new international system that replaced the Bretton Woods system is more volatile and prone to a crisis (Swedberg, 2009). Thus, is the failure of Lehman ... The Failure of Lehman Brothers Holding Inc. 5 Source ...Author: Kokou OhoukohPublish Year: 2012

The 2008 Financial Crisis Essay - 1326 Words | Bartlebyhttps://www.bartleby.com/essay/The-2008-Financial-Crisis-PKK4WGZTJintroduction The 2008 financial crisis led to a sharp increase in mortgage foreclosures primarily subprime leading to a collapse in several mortgage lenders. Recurrent foreclosures and the harms of subprime mortgages were caused by loose lending practices, housing bubble, low interest rates and extreme risk taking (Zandi, 2008).[PDF]High Performance Business in China: Pioneering the Future ...https://www.accenture.com/t20150527t211713__w__/cn-zh/_acnmedia/accenture/conversion...High Performance Business in China: Pioneering the Future amidst Financial Crisis. Table of Contents ... to become one of the world's leading powers. This change amounts to a ... collapse of Lehman Brothers. It was the worst financial nightmare since the Great Depression. The crisis rapidly

What are the major contribution of entrepreneurs for today ...https://www.answers.com/Q/What_are_the_major_contribution_of_entrepreneurs_for_today...Aug 23, 2014 · What are the major contribution of entrepreneurs for today economic recession? ... One of biggest problems was the Lehman Brothers bankruptcy which started the recession. ... It began due to a ...

For the Term of your natural life – Adelaide Financial Advicewww.adelaidefinancialadvice.com/for-the-term-of-your-natural-lifeOn 15 September 2008, Lehman Brothers, one of the oldest and largest investment banks in the United States, collapsed and filed for bankruptcy as a direct result of its investment in highly complex, derivative assets. This was the symbolic epicentre of the GFC and was followed by years of dislocation in markets and economies across the world.

BIS Issues An Alert: Tightening "Paradoxically" Leading To ...https://www.zerohedge.com/news/2017-12-04/bis-warns-frothy-valuations-and-how-central...The BIS was one of the few organisations to warn during 2006 and 2007 about the unstable levels of bank lending on risky assets such as the US subprime mortgages that eventually led to the Lehman Brothers crash and the financial crisis.

What is a film that was directly influenced by an ...https://www.enotes.com/homework-help/what-film-that-was-directly-influenced-by-an-407202One of my favorite movies is Margin Call. It was supposedly based on the real-life events behind the Lehman Brothers collapse and portrayed quite realistically that people in power didn't always ...

Coronavirus: FTSE 100 suffers worst week since 2008 ...https://www.msn.com/en-gb/finance/other/coronavirus-ftse-100-suffers-worst-week-since...The FTSE 100 has suffered its worst week since the 2008 financial crisis as new cases of coronavirus pummelled global stock markets. London’s blue-chip index had fallen a collective 11.1 per ...[PDF]Constellation Investment Ltd. (the “Issuer”) Structured ...https://www.ocbcwhhk.com/webpages/en-us/notice/LehmanBrothersPDFFiles/Constellation...redemption amount was the substantial notional loss on the reference obligation of Lehman Brothers Holdings Inc. resulting from the substantial drop in the price of such reference obligation. The bankruptcy of Lehman Brothers Holdings Inc. has caused the reference obligations to trade at …

The World a Decade After Crisis - Assured Asset Managementhttps://assuredam.com/2018/10/how-is-the-world-a-decade-after-crisis-who-are-the...On September 15, 2008, Lehman Brothers, the fourth largest investment bank in the United States, declared bankruptcy in the 158th year since its incorporation. The instantly escalated subprime mortgage storm drew urgent attention to the most serious financial crisis since the Great Depression.

BIS Issues Alert: Tightening “Paradoxically” Leading To ...https://riggedgame.blog/2017/12/04/bis-issues-alert-tightening-paradoxically-leading...Dec 04, 2017 · The BIS was one of the few organisations to warn during 2006 and 2007 about the unstable levels of bank lending on risky assets such as the US subprime mortgages that eventually led to the Lehman Brothers crash and the financial crisis.

Analysis: China as lender of last resort...more than just ...https://www.reuters.com/article/us-banks-china-overseas-lending/analysis-china-as...Jan 19, 2012 · Chinese banks started building out their U.S. and European loan presence in 2008 after the collapse of Lehman Brothers, with China Construction Bank, China Merchants Bank and ICBC setting up New ...

How Long Can USA Maintain their Dominance of The World ...https://studentshare.org/business/1391658-how-long-can-usa-maintain-their-dominance-of-theThe study also suggests ways to improve the situation. There is also a mention of the recent shut down and take-over of Lehman Brothers and also the problems faced by AIG to borrow money, which have only made the whole crisis worse than before. One of the most important responsibilities of...

Deutsche Bank in Free-Fall Collapse! Controlled Demolition ...beforeitsnews.com/banksters/2016/09/deutsche-bank-in-free-fall-collapse-german...Deutsche Bank in Free-Fall Collapse! Controlled Demolition in Progress! German Government Non-responsive! Friday, September 30, 2016 3:46 ... That month and a half period saw the market crash repeatedly until the Congress agreed to fund the first major bank bailout of its kind. ... Is Glencore Being Set Up As The Next Lehman Brothers ...

Q2 2018 Market Commentary | Gratus Capitalhttps://gratuscapital.com/2018/08/01/q2-2018-market-outlookAug 01, 2018 · We asked Gratus Capital Director of Investments Todd Jones to weigh in on the current financial environment and critical market trends for our Q3 Market Update. September would mark the 10-year anniversary of the Lehman Brothers collapse. In the article, the author identified four “big risks,” described below with my comments.

Banking On Failure: Junk Banks - BIZCATALYST 360°https://www.bizcatalyst360.com/bannking-on-failure-junk-banksEditor’s Note: This is the next in a Continuing Series of Articles by Joe, as excerpted from his Book; “Banking on Failure” co-authored by Laurel, Credit Suisse, Royal Bank of Scotland, Australia, Lehman Brothers, Goldman Sachs, Bankruptcy of Lehman Brothers, Corporation, Bloomberg L.P., Bloomberg News, Basel III, Ameriprise Financial, A Colossal Failure of Common Sense, Application ...

SPECIAL REPORT Evaluating the Housing Market Since the ...https://www.corelogic.com/downloadable-docs/corelogic-peak-totrough-final-030118.pdf?...Lehman Brothers files for Chapter 11 bankruptcy protection, the largest bankruptcy case in U.S. history. Barack Obama is ... 10 percent, reaching double digits for the first time since September 1982, and American households lost over $16 trillion in net worth.2 After a …[PDF]Lazy Man's Guide to the Last 150 Years in Americaannavonreitz.com/lazymansguide.pdfLazy Man's Guide to the Last 150 Years in America By Anna Von Reitz Lazy Man's Guide to the Last 150 Years in America 1861 -- a bogus mercenary "conflict" begins on …

Finance oligarchy captures US government; US government ...https://blogs.ubc.ca/ross/2009/03/if-theyre-saying-this-stuff-in-the-msn-you-know-were...And in each case, that fear became self-fulfilling, as banks that couldn’t roll over their debt did, in fact, become unable to pay. This is precisely what drove Lehman Brothers into bankruptcy on September 15, causing all sources of funding to the U.S. financial sector to dry up overnight.

Since Lehman Brothers' collapse, it's been an upside-down ...https://www.investmentnews.com/since-lehman...Apr 23, 2014 · When Lehman Brothers Holdings Inc. went bankrupt and American International Group Inc. was taken over by the U.S. government in the fall of …bing.com/imagesSee allSee all images

JPMorgan Pays $20M Slap on Wrist Over Lehmanhttps://www.newser.com/story/143355/jpmorgan-pays...Apr 04, 2012 · Federal regulators have filed their first action related to the momentous, crisis-sparking collapse of Lehman Brothers, but it won't amount to much. The …Author: Kevin Spak

What’s changed since the 2008 financial crisis in four ...https://medium.com/mckinsey-global-institute/whats...Sep 10, 2018 · This month will mark the 10-year anniversary of Lehman Brothers’ collapse. In many ways, the global financial system is better off as a result of …