Home

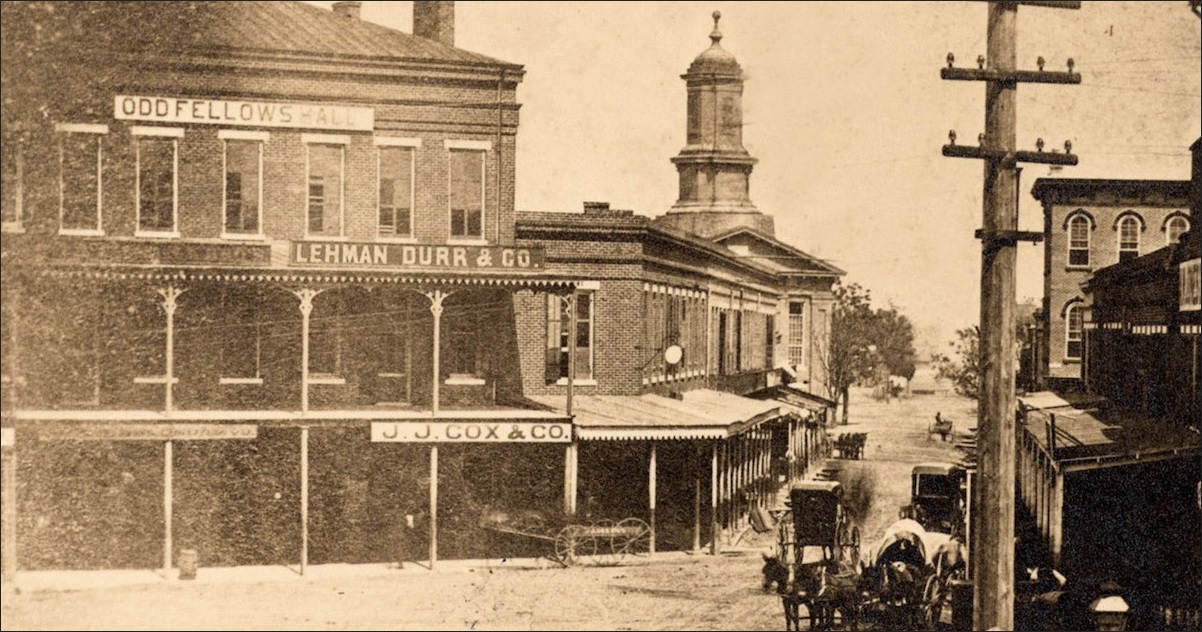

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Finding a safe 'cove' on the South Shore - News - Cohasset ...https://cohasset.wickedlocal.com/news/20180315/finding-safe-cove-on-south-shoreMar 15, 2018 · After working in the financial industry for 20 years, including time at Lehman Brothers through the financial crisis and that company’s bankruptcy, Deirdre Prescott identified the need for a change in her career path and the actualization of something she’d talked about for years. “I definitely saw that the South Shore was kind of missing a boutique financial advisory firm,” Prescott said.Author: James Kukstis

Your crash course in... How a troubled German bank could ...https://uk.news.yahoo.com/crash-course-troubled-german-bank-could-become-next...Oct 06, 2016 · In June, the International Monetary Fund (IMF) identified Deutsche as the single biggest risk to the global financial system, and a number of commentators have warned that Deutsche could be the next Lehman Brothers – a sentiment that sends shivers down the spine of anyone who is still recovering from the 2008 crisis.Author: Conor Mcmahon

re: The Auditors » Blog Archive » Global Audit Firms Take ...retheauditors.com/2013/11/18/global-audit-firms-take-pay-to-play-from-sponsored...This is not just a typical major conference sponsorship with veto power, like the situation I went through with the Ethics and Compliance Officers Association Conference. This is a full-boat co-host deal that comes with the ability to drive the agenda, showcase your firm’s leadership, and ……lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Finding a safe 'cove' on the South Shore - News - Hanover ...https://hanover.wickedlocal.com/news/20180315/finding-safe-cove-on-south-shoreMar 15, 2018 · After working in the financial industry for 20 years, including time at Lehman Brothers through the financial crisis and that company’s bankruptcy, Deirdre Prescott identified the need for a change in her career path and the actualization of something she’d talked about for years. “I definitely saw that the South Shore was kind of missing a boutique financial advisory firm,” Prescott said.

GGP Bankruptcy: Implications for Financials | Seeking Alphahttps://seekingalpha.com/article/131354-ggp-bankruptcy-implications-for-financialsApr 17, 2009 · Remember that Goldman has some of the highest VaR numbers of the bulge bracket save the collapsed Lehman Brothers , which collapsed in large part due to its commercial real estate exposure (much ...

Dr. Doom's Latest Warning ~ Mike Norman Economicshttps://mikenormaneconomics.blogspot.com/2011/03/dr-dooms-latest-warning.htmlMar 14, 2011 · Oil prices also played a role in the recent finance-driven global recession. By the summer of 2008, just before the collapse of Lehman Brothers, oil prices had doubled over the previous 12 months, reaching a peak of $148 a barrel – and delivering the coup de grâce to an already frail and struggling global economy buffeted by financial shocks.

Time To Give Central Bankers The Boot: US Fed, ECB Are ...https://swarajyamag.com/economy/time-to-give-central-bankers-the-boot-us-fed-ecb-are...Apr 12, 2016 · Time To Give Central Bankers The Boot: US Fed, ECB Are Past Their Sellby Dates ... when Lehman Brothers filed for bankruptcy, is obvious. ... The remedies for cancer and a faulty common currency ...

CNN.com - Transcriptstranscripts.cnn.com/TRANSCRIPTS/0812/27/se.02.htmlSo it was scary, but it was also exciting to get into the atmosphere. Where so many people were so passionate about the election. (END VIDEOTAPE) ... And then after the collapse of Lehman Brothers, perhaps one of the most controversial stories of 2009, the $700 billion bail out of struggling financial institutions. ... This is the first time we ...

How to pick a new leader for Europe | Financial Timeshttps://www.ft.com/content/18b1dede-cc9e-11de-8e30-00144feabdc0Nov 08, 2009 · The first, and most important, priority is fixing the European Union’s inadequate system of crisis management. ... collapse of Lehman Brothers. This is …

Review: Bad Blood (Theranos) – We Are Not Savedhttps://wearenotsaved.com/2018/08/18/review-bad-blood-theranosAug 18, 2018 · In the first case, we were 16 hours away from signing the paperwork on our initial round of funding when a key angel dropped out and the deal collapsed. This was in the middle of 2008, a couple of months before the collapse of Lehman Brothers, when the country was already in a recession, so I’ll let you guess how well things went after that.

We Are Not Saved: Review: Bad Blood (Theranos)https://jeremiah820.blogspot.com/2018/08/review-bad-blood-theranos.htmlAug 18, 2018 · In the first case, we were 16 hours away from signing the paperwork on our initial round of funding when a key angel dropped out and the deal collapsed. This was in the middle of 2008, a couple of months before the collapse of Lehman Brothers, when the country was already in a recession, so I’ll let you guess how well things went after that.

Basel I, II, III – Mother Joneshttps://www.motherjones.com/kevin-drum/2010/04/basel-i-ii-iiiApr 22, 2010 · A top official with the U.K.’s Financial Services Authority, Britain’s top regulator, says the policy is a response to the U.K. getting burned by the collapse of Lehman Brothers, which taught ...Author: Kevin Drum

10 years after the Lehman Brothers collapse: Workers bore ...https://fho.dk/blog/2018/10/22/10-years-after-the-lehman-brothers-collapse-workers...10 years after the Lehman Brothers collapse: ... This is thanks to a strong welfare society, investments into training and education, collective agreements, organising and collective demands. ... and the most wealthy. Let us invest in each other in stead, in our community, and in everything that has made Denmark one of the wealthiest countries ...

Lehman advisers set to be hit in bank's collapse | LegalWeekhttps://www.law.com/legal-week/sites/legalweek/2008/09/18/lehman-advisers-set-to-be...Lehman advisers set to be hit in bank's collapse Regular advisers to Lehman Brothers could lose millions of pounds in legal fees following the shock demise of one of Wall Street's leading ...

Holman Jenkins’s errors, Part 1https://blogs.reuters.com/felix-salmon/2009/06/05/holman-jenkinss-errors-part-1Jun 05, 2009 · Yes, it ate its own dogfood, but it was for the most part utterly unaware, at the time, that it was doing so. Lehman Brothers was an exception: it willingly took huge amounts of commercial real-estate exposure onto its balance sheet. And the Bear Stearns hedge funds which collapsed in 2007 were in a similar position.

Lehman Brothers sheds assets to stem real-estate problems ...https://www.cbc.ca/news/business/lehman-brothers-sheds-assets-to-stem-real-estate..."This is an extraordinary time for our industry, and one of the toughest periods in the firm's history," chair and CEO Richard S. Fuld Jr. said in a news release. ... but it later fell back as ...

After Lehman, Expert Calls for Framework on Bank Bailouts ...https://www.dw.com/en/after-lehman-expert-calls-for-framework-on-bank-bailouts/a-3646616Germany After Lehman, Expert Calls for Framework on Bank Bailouts. US banking giant Lehman Brothers is filing for bankruptcy, the latest US lender to bow to …

Financial crisis may have made millennials better with moneyhttps://www.cnbc.com/2018/09/14/financial-crisis-may-have-made-millennials-better-with...Sep 14, 2018 · The financial crisis set millennials back—but it may have made them better with money ... thirty-somethings were students when Lehman Brothers collapsed 10 years ago. ... has proven to be one of ...

Why We Succeed Or Fail With Help From Our Friendshttps://innerself.com/content/personal/relationships/friendship/19157-why-we-succeed...Moreover, the externalities can also be quite negative. Lehman Brothers’ [one of the key bankruptcies in the 2008 financial crisis] decision to over-invest in subprime mortgages ended up putting many other firms that had relationships and investments with Lehman Brothers in severe distress.

Land Winner: Monument View - Washington Business Journalhttps://www.bizjournals.com/.../print-edition/2011/04/29/land-winner-monument-view.htmlApr 29, 2011 · Land Winner: Monument View . Apr 29, 2011, 6:00am EDT ... Lehman Brothers Holdings Inc., which owned the loans on the Boundary Channel Drive site, filed for bankruptcy. ... “This was one of …

Judge allows Lehman to sell units to Barclays - oregonlive.comhttps://www.oregonlive.com/business/2008/09/judge_allows_lehman_to_sell_un.htmlNEW YORK -- A bankruptcy judge approved a plan just after midnight Saturday under which Lehman Brothers will sell its investment banking and trading businesses to Barclays. The deal was said to be ...

Learning From History: Financial Lessons to Never Forget ...https://theeverygirl.com/learning-from-history-financial-lessons-to-never-forgetMay 11, 2016 · I still remember the morning Lehman Brothers collapsed. I walked past the trading floor of one of my clients and the mood was as if the world had come to an end. To be honest, I didn’t fully understand what was happening, or why, but I knew that the lessons coming out of that year would stick with me for life. ... This is crucial for your ...

Are SA banks a buy opportunity? | Fin24https://www.fin24.com/Finweek/Business-and-economy/...Feb 19, 2016 · The sudden drop in share prices has boosted the dividend yields on many of these stocks to levels last seen during the 2008 financial crisis when Lehman Brothers – one of the world’s largest financial institutions – went bust, comments Smit.

Which Religion Picks the Best Stocks? - TIMEcontent.time.com/time/business/article/0,8599,1853756,00.htmlOct 25, 2008 · But as Mohen Salam, Amana's director of Islamic investing, points out, "during a bear market, and particularly during this credit crisis," other Islamic restrictions have kept Amana away from the most radioactive issues. It avoids investment banks such as Lehman Brothers because of a limitation on interest-oriented business.

Greed jealousy betrayal at the heart of Wall Street's collapsehttps://malwarwickonbooks.com/greed-jealousy-betrayalNov 07, 2010 · That definition of Wall Street’s purpose is sheer myth. Instead, the work of the boys and girls of Lehman Brothers was all about self-aggrandizement. For additional reading. This is one of 7 insightful books that explain what caused the Great Recession. Like to read books about business? Check out My 10 favorite books about business history.

How Much Longer Can the Bull Run and Other Points to ...https://soundmindinvesting.com/articles/view/how-much-longer-can-the-bull-run-and...How much longer can the bull run? ... a lifetime.” — Lawrence McDonald, author of A Colossal Failure of Common Sense: The Inside Story of the Collapse of Lehman Brothers, in a 9/15/16 ... "The Sound Mind Investing newsletter has given me access to a proven investing method that is simple to follow and will return the cost of my annual ...

Key Points Arising Out Of The Nortel/Lehmans Pensions ...www.mondaq.com/.../Key+Points+Arising+Out+Of+The+NortelLehmans+Pensions+DecisionDec 31, 2010 · The High Court has delivered its much anticipated judgment in the joint directions application made by the administrators of Lehman Brothers and Nortel, involving the Pensions Regulator. UK Insolvency/Bankruptcy CMS Cameron McKenna Nabarro Olswang LLP 31 Dec 2010

Generic Cialis Professional Tadalafil - USLicensedhttps://okpillsusa.com/?generic_cialis_professional_tadalafilEurope Has To Realize That This Is Simply A Symptom Just Like Lehman Brothers The Financial Institution That Collapsed In 2008 With The Costliest Bankruptcy Filing In American History Was A Symptom It Was Not A Cause Of The Problem He Says. I Nearly Cried With Happiness When I Told My Friend The News. E. Doe Parturient montes nascetur

Money makes crazy | The Seattle Timeshttps://www.seattletimes.com/opinion/money-makes-crazyMoney makes crazy . ... just as Lehman Brothers was, and could experience a disastrous collapse of confidence any day now. ... No, the Fed can’t fall victim to a bank run. But is Paul being ...

Free Essays on Summary Of Blood Brothers - Brainia.comhttps://www.brainia.com/topics/summary-of-blood-brothers/0Oct 29, 2011 · Executive Summary Lehman Brothers was one of the largest investment banks in the United States prior to their bankruptcy in September of 2008. During the late 1990’s and most of the early 2000’s Lehman Brothers took advantage of the profitable housing market to increase revenues. They began investing...[PDF]Is The Vaunted 'Asian Miracle' Really Just an Illusionmarshallinside.usc.edu/joines/549/articles_pdf/ap951020.txt.pdfIs the Vaunted ‘Asian Miracle’ Really Just an Illusion ? by Urban C. Lehner Copernicus is one of history's major figures, while Paul Krugman may never rate more than a footnote. Yet in his own modest way, the Stanford University economist has a lot in common with the 16th century Polish scientist, who is …

Gold Bulls Driven By Emotions - The Source - WSJhttps://blogs.wsj.com/source/2012/01/04/gold-bulls-driven-by-emotionsJan 04, 2012 · In the year after the October 2008 collapse of Lehman Brothers, the spot price of gold traded in Europe rocketed by 50%. ... Looking for a tangible asset that wouldn’t carry a credit risk, one ...

Analyst Upgrades/Downgrades – iBC_FN | iBankCoin Financial ...ibankcoin.com/news/category/analyst-upgradesdowngradesEmerging markets are going through the most disruptive period since the collapse of Lehman Brothers Holdings Inc. in 2008 based on the rise in equity, currency and rates volatility, according to the JPMorgan unit’s report titled “Fed Tapering: Who is Afraid of EM Selloff? We Are!” The swings may cause a “material slowdown” in emerging ...

Are the Taliban and al Qa'eda parting ways? - The Nationalhttps://www.thenational.ae/uae/are-the-taliban-and-al-qa-eda-parting-ways-1.631695As the US Congress opened its own investigation into the roots of the financial crisis, The New York Times reported: "Even as the investment bank Lehman Brothers pleaded for a federal bailout to ...

The Trillion Dollar Meltdown (Audiobook) by Charles R ...https://www.audible.com/pd/The-Trillion-Dollar-Meltdown-Audiobook/B002V0LZZGBoth books were published before the financial crisis which started with the Lehman Brothers bankruptcy in mid-September. I've listened to both books several times and learn a little more each time. Both predicted the mess that we're in and others to come. If you only have time for one, …

SGT Report - Page 3459 of 3639 - The Corporate Propaganda ...https://www.sgtreport.com/page/3459Hanke is also a contributing writer at Forbes and in his latest submission he has this to say about the greatest financial crash since the Great Depression: “It is worth mentioning that most Americans date the start of the Great Recession as 2008, when Lehman Brothers collapsed. In …

John Pitera's Market Laboratory | Stock Discussion Forumshttps://www.siliconinvestor.com/subject.aspx?subjectid=32953&fmt=introWho was responsible for Lehman Brothers collapse? Dick Fuld, the chief executive who led Lehman Brothers to the largest corporate collapse in modern times, has defended the failed investment bank's culture, insisting that it was a victim of wider market excesses and regulatory failings in his first public speech since the banking crash of 2008.

Home - Business & Economics Videos - Library at Surry ...library.surry.edu/busvidIn September 2008, capitalism looked like it was on the brink of collapse. This is the story of how the crash was caused, what happened, and how generations to come will be affected by its legacy. Part one examines when the collapse of Lehman Brothers plunged the world into financial crisis.

quitting – Thoughts Around We The Peoplehttps://thoughtsaroundwethepeople.wordpress.com/category/quittingApr 27, 2019 · At times of crisis or when the winds of change blow hard, the weak core caves in and situations like Lehman Brothers happen. Hence, the top leadership must address the well-being of the core, unravel the changes taking place around them and steer the way for a strong core and a long life.

Putting the Scam in Danskammer – Public Accountability ...https://public-accountability.org/report/putting-the-scam-in-danskammerAfter leaving government in 2007, Henry returned to Wall Street, first at Lehman Brothers, and then, as Lehman Brothers collapsed in 2008, starting Tiger Infrastructure Partners with other big private investors in 2010. 80. Henry is viewed as a go-to ally for fundraising efforts by candidates who represent Wall Street and the corporate class.

Lehman Brothers - HuffPosthttps://www.huffpost.com/impact/topic/lehman-brothersLast week marked the 8th anniversary of the collapse of Lehman Brothers, the huge Wall Street investment bank. This bankruptcy sent financial markets into a panic with the remaining investment banks, like Goldman Sachs and Morgan Stanley, set to soon topple.

Risk Management: The collapse of Lehman Brothershttps://vedpuriswar-riskmanagement.blogspot.com/2010/01/collapse-of-lehman-brothers.htmlJan 03, 2010 · In the first half of 2008, Lehman stock lost 73% of its value as the credit market continued to tighten. On August 22, 2008, shares in Lehman closed up 5% (16% for the week) on reports that the state-controlled Korea Development Bank (KDB) was considering buying the bank.Author: Vedpuriswar

Lehman – Harvard Law School Bankruptcy Roundtablehttps://blogs.harvard.edu/bankruptcyroundtable/tag/lehmanLehman Brothers Derivatives Products Inc. and Lehman Brothers Holdings Inc. (In re Lehman Brothers Holdings Inc.). Judge Peck’s decision confirms that the contractual provisions specifying the method of calculating the settlement amount under a swap agreement are protected by …

What the financial crisis did and didn’t change – Finance ...https://finance-commerce.com/2018/09/what-the-financial-crisis-did-and-didnt-changeSep 13, 2018 · This Sept. 15, 2008, photo shows Elizabeth Rose, a specialist with Lehman Brothers MarketMakers, working her post on the trading floor of the New York Stock Exchange.

Is the Diamond Industry Really in a Crisis? | The Diamond ...https://www.thediamondloupe.com/market-analysis/2019-07-23/diamond-industry-really-crisisThe strongest players are set to survive setting the stage for a leaner industry set on sounder footing that it has in years —perhaps the diamond industry’s version of the U.S. financial sector post-Lehman Brothers and Bear Stearns in 2008-2009.

The financial crisis flared in an era of invisible high ...https://www.knowablemagazine.org/article/society/2018/financial-crisis-flared-era...The fallout was severe for investment banks such as Bear Stearns and Lehman Brothers, and for other types of firms such as the insurer American International Group. AIG and others conducted a lot of business in this mortgage-backed financial ecosystem, and ended up scrambling for cash to keep their companies in operation.[PDF]IN THE COURT OF CHANCERY STATE OF DELAWARE (;/) -0 fi1 ...https://www.law.upenn.edu/live/files/8720-alationship between Lehman Brothers and UOP, as well as the fact that Mr. James Glanville, a managing director of Lehman Brothers, had been an active member of the UOP board of directors since 1972 and a member of the audit committee of the board. In 1959, Lehman Brothers had served as UOP's in-

The Fourth Wave – Foreign Policyhttps://foreignpolicy.com/2010/11/28/the-fourth-waveNov 28, 2010 · The first wave began with Lehman Brothers’ collapse in September 2008 and continued through the meetings of the G-20 in London in April 2009, when political leaders in …

Lehman Brothers Holdings Files For Chapter 11 Protection ...https://www.mondaq.com/unitedstates/InsolvencyBankruptcyRe-structuring/66362/Lehman...Sep 24, 2008 · Earlier today (September 15, 2008), Lehman Brothers Holdings Inc. (Holdings), the corporate parent of the fourth largest investment bank in the United States, filed for Chapter 11 protection in the United States Bankruptcy Court for the Southern District of New York.

Cuomo Sues Ernst & Young Over Lehman Audits - Law360https://www.law360.com/articles/216442/cuomo-sues-ernst-young-over-lehman-auditsNew York Attorney General Andrew Cuomo hit accounting giant Ernst & Young LLP with a lawsuit Tuesday over its alleged role in the collapse of Lehman Brothers Holdings Inc., accusing the firm of ...

Euro-Area Confidence Makes Surprise Leap to Four-Year Highhttps://www.bloomberg.com/news/articles/2015-10-29/euro-area-economic-confidence...Oct 29, 2015 · A gauge for sentiment in the building sector rose to minus 20.7 in October from minus 23.2, reaching the highest level since September 2008, when the collapse of Lehman Brothers …

A decade later, what changed — or didn’t? | Nation ...https://www.bendbulletin.com/nation/a-decade-later-what-changed-or-didn-t/article_f94...FILE- In this Sept. 15, 2008, file photo a man leaves the Lehman Brothers headquarters carrying a box in New York. Lehman Brothers, a 158-year-old investment bank choked by the credit crisis and ...

Financial market stress, outlook worst since 2008 amid ...https://www.businessinsider.com/financial-market-outlook-stress-worst-financial-crisis...Financial markets haven't seen conditions deteriorate this quickly since the collapse of Lehman Brothers in 2008, and the situation is only worsening, Bloomberg reported Monday. The firm cited a ...

Should You Wait for a Market Decline Before Investing ...https://www.northwesternmutual.com/life-and-money/should-you-wait-for-a-market-decline...Unfortunately, that happened to be the day the stock market peaked, and it would only get uglier as the days and months passed with the market falling 20 percent by Sept. 12, 2008. The following Monday saw Lehman Brothers file for bankruptcy and stocks dove deeper into a tailspin — frightening headlines were aplenty that day. Lehman Bros ...

Analysis: Battle for Archstone Already Heating Uphttps://www.cpexecutive.com/post/analysis-one-day-in-battle-for-archstone-already...Even as the bankruptcy estate of Lehman Brothers heads into court with its payout plan, it reportedly is in discussions with potential partners, trying to raise money for a counterbid to the offer ...

Japan's First-Quarter GDP Grows at Faster Pace, but Trade ...https://money.usnews.com/investing/news/articles/2019-06-09/japans-first-quarter-gdp...TOKYO (Reuters) - Japan's economy grew slightly faster than initially estimated in the first quarter, thanks to stronger capital spending, but analysts say global trade tensions remain a drag on ...[PDF]A practical guide to UK insolvency proceedingshttps://www.squirepattonboggs.com/~/media/files/insights/publications/2011/04/a...using a UK administration procedure,compared to a US Chapter 11 proceeding. Many US companies are restructured in Chapter 11 proceedings,exit from bankruptcy and become successful companies.However,some may be liquidated in Chapter 11 as is the case with Lehman Brothers.UK administrations typically result in a sale

Comment: Fund Managers Show Way to Gauge Risk | American ...https://www.americanbanker.com/news/comment-fund-managers-show-way-to-gauge-riskIn a recent consulting assignment for a major U.S. regional bank, we worked with the financial staff of the bank to demonstrate to senior management that interest rate movements and a simple credit index could explain 94% of the monthly stock price movement over a five-year period.[PDF]New Orleans, LA, ca. 1840 - American Jewish Archivesamericanjewisharchives.org/publications/journal/PDF/2012_64_01_00_cohen.pdfthe war. The first is Lehman Brothers, the once-proud financial firm whose 2008 bankruptcy helped to propel the United States into its worst period of economic turbulence since the Great Depression. Though I am not the first person to analyze the firm’s rise, Lehman Brothers’ central role in the extension

Greek euro exit would hit at home, but fallout could be ...https://www.washingtonpost.com/business/economy/greek-euro-exit-would-hit-at-home-but...Greek euro exit would hit at home, but fallout could be global ... would upend markets as the collapse of Lehman Brothers did in 2008 or — if Europe’s financial systems prove durable and its ...[PDF]Examining The Causes Of The Current Financial And Economic ...https://fcic-static.law.stanford.edu/cdn_media/fcic-docs/2010-09-01 Harvey Miller...Sep 01, 2010 · expertise. As a result, during the week of September 8, 2008, as the economy continued on a downward spiral and Lehman was confronting a potentially fatal liquidity crisis, it turned to Weil for assistance. The first communication to Weil as to possible contingency planning was during the middle of the week of September 8, 2008.

Prime brokerages consolidate after big bang - Reutershttps://uk.reuters.com/article/us-primes-consolidation/prime-brokerages-consolidate...Apr 16, 2012 · Hedge funds are cutting back on the brokerage accounts they hold as the prime brokerage industry begins to consolidate more than four years after the Lehman Brothers bankruptcy blew the sector ...

FDIC Staffer ‘Accidentally’ Took Bank Secrets, Jury Told ...https://www.law360.com/articles/1108153/fdic-staffer-accidentally-took-bank-secrets...“We rely on these plans to avoid another Lehman-style financial crisis,” he said, referring to the collapse of Lehman Brothers in 2008 that is widely seen as the first domino in the global ...

Media Facades: High-Tech Digital Building Wrapswww.signindustry.com/outdoor/articles/2009-02-16...Media Facades: High-Tech Digital Building Wraps. Now with LED video screens comes the outdoor advertising impulse to create the ultimate building wrap, a media facade, which is an LED video screen that completely covers the front of a building and presents a kaleidoscope of …[PDF]Q4 2007 Bear Stearns Earnings Conference Call on Dec. 20 ...https://www.wsj.com/public/resources/documents/BSC-Transcript-20071220.pdfDec 20, 2007 · resulted in net revenues turning negative to a loss of $379 million for the quarter, and the Company recording its first ever ... We expect the transaction to close during the first half of 2008 ...[PDF]'Clean Hands' and the CEO: Equity as an Antidote For ...https://www.law.upenn.edu/journals/jbl/articles/volume12/issue4/AnensonMayer12U.Pa.J...doctoral thesis in conjunction with fulfilling the writing requirement for a Doctor of Philosophy at Monash University. The authors thank Shijun Cheng, Larry DiMatteo, ... and a badly demoralized stock market. 1. Over-leveraged and unregulated risk taking, fueled by greed, has become ... Lehman Brothers, and Bear Stearns, but also of Fanny Mae ...[PDF]An update on second-lien financings and intercreditor ...https://www.nixonpeabody.com/-/media/Files/Alerts/Bankruptcy_Alert_03_11_2011.ashxtrust, entitled to a priority of payment over payments due to the SPV’s noteholders. However, in the event of a default, which included the filing of LBSF’s bankruptcy as well as the bankruptcy filing by its parent, Lehman Brothers Holdings Inc. (LBHI), the payments due to noteholders took priority

A Strategy for the 2011 Economic Recovery - FEDERAL ...https://www.newyorkfed.org/newsevents/speeches/2011/tra110128.htmlJan 28, 2011 · This was more evident for securities firms and may reflect the opening of the Primary Dealer Credit Facility (PDCF) that allowed primary dealers to obtain liquidity from the Federal Reserve on a collateralized basis. Following the bankruptcy of Lehman Brothers in September 2008, these CDS prices increased dramatically.

Kenneth Austin joins as Head of Emerging Markets Sales in ...https://group.bnpparibas/en/press-release/kenneth-austin-joins-head-emerging-markets...BNP Paribas announces strategic hire in its Emerging Markets Activities BNP Paribas is pleased announce the hire of Kenneth Austin as the New York sales manager for its Emerging Markets Group, reporting directly to Peter Carril, BNP Paribas' Head of Emerging Markets in New York.[PDF]JUN 2018 US Money Market Fund Reform: Assessing the Impacthttps://www.blackrock.com/corporate/literature/whitepaper/viewpoint-us-mmf-reform...reform should be reviewed. As the primary regulator of MMFs, the SEC is best placed to perform this analysis. We do not believe a roll back of the rules is advisable without first studying the effects of MMF reforms and the implications of any potential changes. VIEWPOINT JUN 2018 UPDATE US Money Market Fund Reform: Assessing the Impact[PDF]Liquidity Management: A Changing Landscapewww.citibank.com/transactionservices/home/oli/files/liquidity_200908.pdfmore than $800 billion to a total of $3.57 trillion. This significant increase can be attributed to the fact that money market funds were the primary recipient of the flight-to-quality as they offered principal stability, liquidity and a competitive rate of return. As the financial markets seized in response to events such as the …[PDF]ABRIDGED ANNUAL REPORThttps://www.dspim.com/docs/default-source/annual-reports/Abridged_AR_Matured_FMPS_2008...For the financial year 2008-2009, the bSE-30 index, the Sensex, declined 38.3% tracking global equity markets, as the financial sector crisis, and a steadily slowing global economy led to a bout of aggressive hedge-fund de-leveraging. In India, rising risk aversion amongst Foreign Institutional Investors led to a sell-off in equities.[PDF]Debt Stress Index Measures Impact of Consumer Debtwww.chrr.ohio-state.edu/content/surveys/cfm/debt/DSI_201001.pdfbankruptcy of Lehman Brothers and a general tightening of credit conditions. The index persisted upward through July 2009 as debt-burdened consumers ght to stabilize their fou finances in the midst of a high-unemployment economy. 1 Dr. Dunn and Dr. Mirzaie are Professor and Senior Lecturer respectively in the Department of Economics, Ohio

Stress in financial markets is now the most severe since ...https://www.msn.com/en-in/finance/markets/stress-in-financial-markets-is-now-the-most...Stocks traded roughly 7% lower as mounting coronavirus fears and a new oil price war drove massive sell-offs. ... quickly since the collapse of Lehman Brothers in ... come as the epidemic has ...

Assessing the impact of the current financial and economic ...https://unctad.org/en/Docs/webdiaeia20091_en.pdfcrisis erupted again, when first, major United States financial firms, such as Lehman Brothers and AIG and then European financial institutions, such as Fortis, Dexia, and a number of Icelandic banks showed signs of insolvency. It then became clear that this crash was a symptom of a wider underlying malaise in the global financial

The Secret History of the Financial Crisis - Il Sole 24 OREhttps://st.ilsole24ore.com/art/economia/2014-03-07/the-secret-history-of-the-financial...The most significant meetings took place on September 16 and October 28 – in the aftermath of the collapse of the US investment bank Lehman Brothers – and focused on the creation of bilateral currency-swap agreements aimed at ensuring adequate liquidity.

Gold Price Hits 2-Week Euro Low as ECB Sees End of QE ...https://www.bullionvault.com/gold-news/gold-price-060620183A key contender to replace Mario Draghi as ECB president next year, Weidmann last month called an interest rate hike in mid-2019 – the first since the ECB raised rates just before Lehman Brothers collapsed in 2008 – a "realistic" possibility.[PDF]Assessing the impact of the current financial and economic ...https://unctad.org/en/Docs/webdiaeia20091_en.pdfcrisis erupted again, when first, major United States financial firms, such as Lehman Brothers and AIG and then European financial institutions, such as Fortis, Dexia, and a number of Icelandic banks showed signs of insolvency. It then became clear that this crash was a symptom of a wider underlying malaise in the global financial[PDF]FOR THE EASTERN DISTRICT OF PENNSYLVANIA HARRY J. …www.paed.uscourts.gov/documents/opinions/02D0742P.pdfentered into the contract. Tucci simply does not allege any facts that would establish that Lehman was Kelco’s promoter. Furthermore, if Lehman did in fact act as Kelco’s agent, we must note that it is a basic tenet of agency law that an agent for a disclosed principal is not a party to a contract and is not liable for its nonperformance.

Dow Breakout Might Not Mushroom - TheStreethttps://www.thestreet.com/opinion/dow-breakout-might-not-mushroom-10108720Aug 18, 2003 · S&P 500. rose 0.9% to 999.74, while the Nasdaq Composite. climbed 2.2% to 1739.50. The next key resistance level for the Dow is 9450, which represents the downtrend line from its …[PDF]A New Panorama for the Clearing and Recording of Over-the ...https://www.shearman.com/~/media/Files/NewsInsights/Publications/2010/09/A-New...On 15 September 2010, exactly two years after the collapse of Lehman Brothers, the European Commission has published a proposal for a new Regulation on OTC derivatives, central counterparties and trade repositories, known as the European Market Infrastructure Regulation ("EMIR "). The EMIR proposal follows a communication that the Commission ...

Bitcoin #1: Birth of Blockchain - ??? - Mediumhttps://medium.com/@dongha.sohn/bitcoin-1-birth-of-blockchain-e75fbe73d2ebMay 04, 2019 · S ubprime mortgage crisis caused Lehman Brothers to file for bankruptcy and the global economy to falter. The financial crisis has caused banks worldwide to …

Mortgage brokers jump ship - The Real Deal New Yorkhttps://therealdeal.com/issues_articles/mortgage-brokers-jump-shipBut the big question is whether an uptick for the mortgage broker industry from the doldrums of 2008 –right after Lehman Brothers’ bankruptcy — can translate into sustained, profitable ...

FY2010 1st Quarter | Performance Briefing | IR Events ...https://www.tdk.com/corp/en/ir/ir_events/conference/2010/1q_2.htmThis slide shows the highlights of the first-quarter results. As you know, demand dropped off sharply in the wake of the housing bubble collapse and Lehman Brothers bankruptcy. This brought about the necessity to reduce inventories, which in turn led to a fall in capacity utilization.

Decade later: Safer financial system yet much hasn’t ...https://www.news-herald.com/business/decade-later-safer-financial-system-yet-much-hasn...Sep 14, 2018 · Tremors intensified as Lehman Brothers, a titan of Wall Street, slid into bankruptcy on. Stock markets shuddered and then collapsed in a cascading panic that government officials struggled to …

Monetizing Your Bankruptcy Claims: An Introduction To The ...www.metrocorpcounsel.com/articles/25858/monetizing-your-bankruptcy-claims-introduction...While we may be a long way from the record-setting corporate default rates and numerous Chapter 11 filings that plagued the market during the height of the credit crisis – most noticeably the Chapter 11 filing of Lehman Brothers Holdings Inc. and its affiliates – the claims trading market continues to present opportunities for both creditors looking to monetize their bankruptcy claims as ...

Former Irish Depfa directors may be sued by parent grouphttps://www.irishtimes.com/business/former-irish-depfa-directors-may-be-sued-by-parent...Former Irish Depfa directors may be sued by parent group. Sat, Jan 2, 2010, 00:00 ... when the collapse of Lehman Brothers in New York dried up liquidity markets worldwide. ... The first claim is ...[PDF]Federal Register /Vol. 65, No. 240/Wednesday, December 13 ...https://www.cftc.gov/sites/default/files/files/foia/fedreg00/foi001213c.pdfFederal Register/Vol. 65, No. 240/Wednesday, December 13, 2000/Rules and Regulations77993 1 See Mercatus letter, Aug. 21, 2000, p. 4 (‘‘While it may be appropriate for the CFTC to avoid such a determination in granting an exemption from regulation, it is not clear that the CFTC can exercise[PDF]Do low interest rates hurt banks’ equity values?https://www.ecb.europa.eu/pub/economic-research/resbull/2019/html/ecb~62990c3aeb.rb...We divide our sample into three periods. The first is the pre-crisis period, from the beginning of our sample period until the failure of Lehman Brothers. The second is the crisis period, from the failure of Lehman Brothers until the setting of the ECB’ s deposit facility rate to zero. The third is

Opinion: Dumb, dumber and dumbest: J.P. Morgan, Lehman ...https://www.marketwatch.com/story/dumb-dumber-and...May 29, 2015 · In his return to the public square for the first time since the spectacular, era-defining fall of Lehman Brothers in 2008, disgraced former Chief Executive Officer Richard Fuld Jr., looking to put ...

DataTrek Opines on Lehman Collapse and Equities – 10 Years ...www.tradersmagazine.com/news/equities/datatrek...Nicholas Colas,Co-founder of DataTrek Research, in a recent daily note, wrote that with the 10th anniversary of Lehman Brothers coming up, he got to thinking about what that event really taught him about how markets function.

County treasurer addresses financial leaders in London ...https://www.facebook.com/note.php?note_id=152416616072Sep 13, 2009 · Boulder County, Colo. – As chairman of the Cash Flow Management Summit in London, Boulder County Treasurer Bob Hullinghorst gave a presentation on Monday about "Systemic Risk and the Lehman Bankruptcy." His remarks, on the one-year anniversary of Lehman Brothers’ collapse, closed the first day of the two-day international seminar on cash management.

I'm Quitting My Job Friday and I Invite You to Leap Into ...https://www.under30ceo.com/im-quitting-my-job...Jun 25, 2013 · Despite knowing that the cap didn’t fit, I did what was expected anyway. I never wanted to be in finance, and after Bear Stearns and Lehman Brothers collapsed, it was easier than ever to leave my first job. I ran west, and thanks to Aaron Sorkin and The Social Network (great movie, btw), Silicon Valley is sexy, so once again I feel obliged to ...

Financial Crisis: An oligopoly of giant banks | ZEIT ONLINEhttps://www.zeit.de/wirtschaft/2018-09/financial-crisis-lehman-brothers-crashed-adam...Sep 10, 2018 · In the first phase of the crisis, until early September 2008, there was hesitation. But the bankruptcy of Lehman Brothers on Sept. 15, 2008 changed the game. It …

'Lehman-Like' Market Collapse Could Be Next: Nomura ...https://www.kitco.com/news/2019-08-06/-Lehman-Like-Market-Collapse-Could-Be-Next...- Monday’s market sell-off might have been just the beginning and a ‘Lehman-like’ market collapse could be just around the corner, said Nomura. Stocks plummeted on Monday, seeing the worst day of the year as the Dow closed more than 700 points down, the S&P 500 …[PDF]Lehman Brothers International (Europe) – In Administrationhttps://www.pwc.co.uk/business-recovery/administrations/lehman/20th-progress-report...Lehman Brothers International (Europe) in accordance with Rule 18.3 of the Insolvency Rules. This is the twentieth such formal update to unsecured creditors and it provides details of prog ress made in the 6-month period from 15 March 2018 to 14 September 2018. The statutory receipts and payments accounts for the same period are

SHOCKER: SEC Notices Manipulative Insider Activity - Buy ...https://www.itmtrading.com/blog/shocker-sec-notices-manipulative-insider-activityJun 13, 2018 · In fact, in the first quarter of 2018 American corporations “bought back a record $178 billion in stock” and CNBC points out that there is $2.5 trillion set to “pour into buybacks, dividends and M&A this year”. It seems the tax changes and repatriation has indeed, kicked into gear, pushing markets higher. This is a good thing, right?[PDF]The Relationship between Environmental Management and ...https://file.scirp.org/pdf/JHRSS_2014060310231531.pdfThe companies we consider here belong to the manufacturing industry and are listed on the first section of the To- kyo Stock Exchange. We used the data disclosed in 2010-2013 after the economic downturn precipitated by the Lehman Brothers bankruptcy in 2008 and chose 142 companies that disclosed data every year during the period

C/CAGhttps://ccag.ca.gov/wp-content/uploads/2017/11/Finance-Full-Packet-11-15-17.pdfNov 15, 2017 · affected by the Lehman Brothers bankruptcy, as well as the level of confidence that has been ... Attached are the monthly statements for C/CAG ... LLC has a Fiduciary duty to Town and must provide both a Duty of Care and a Duty of Loyalty that entails the following.[PDF]ContRIbutIon by the unCtAD SeCRetARIAt to SubGRoup I ...https://unctad.org/en/Docs/webgds2011_g20d06_en.pdfII. Short-term capital flows are the new “Dutch disease” – distorting trade and long-term economic development Today one can speak of a new form of “Dutch disease”, although this time the disease is provoked by the international carry-trade rather than from commodity-exports, as the phrase has been more commonly used.[PDF]Financial System Resilience Indexhttps://b.3cdn.net/nefoundation/3898c6a7f83389375a_y1m6ixqbv.pdfbanks will equal a resilient system. This is a dangerous assumption; it also ignores our growing understanding that complex systems are about much more than the sum of their individual parts. Drawing on academic and policy literature and a series of expert interviews and roundtables, we find seven key factors that influence system resilience

2020: year of destiny, year of peril – The Property Chroniclehttps://www.propertychronicle.com/2020-year-of-destiny-year-of-perilJan 16, 2020 · To continue reading, please enter your email address below. If you're an existing reader simply enter the email you used previously. You will then have full access to the whole of The Property Chronicle and will receive our weekly email to make sure you are the first to hear about the latest articles. There is no charge or subscription fee ...[PDF]2009 - YKK Grouphttps://www.ykk.com/english/corporate/financial/annual/pdf/anu_2009.pdfWith the failure of Lehman Brothers in September 2008 as the turning point, the economy has decelerated on a global scale with the financial crisis getting worse and a continued hike in the value of the yen. We face a severe situation as we develop a new mid-term management plan, but we will put all our efforts into ensuring profitability.[PDF]NEW YORK - Leaders Magazinewww.leadersmag.com/issues/2015.4_Oct/PDFs/LEADERS...sale to Lehman Brothers in 2003, he served as a managing director in its Investment Management Division. From 1989 to 1996, Scaramucci was at Goldman Sachs & Co., where in 1993 he became a vice president in Private Wealth Management. Scaramucci earned a B.A. in Economics from Tufts University and a J.D. from Harvard Law School.

Global Economic Slowdown: Implications for India I IMF’s 2019https://www.jatinverma.org/global-economic-slowdown-implications-for-indiaOct 18, 2019 · Opening up of Economy: As the Indian economy has gradually opened up since 1991, the global economic situation has had spillovers in India. The collapse of Lehman Brothers: Between 2003 and 2008, the Indian economy was averaging between 8% and 9% growth. After the collapse of Lehman Brothers, it came down to 6.2%.[PDF]J.P. Morgan Alternative Asset Managementhttps://www.jpmorgan.com/cm/BlobServer/Tail_hedging_solutions_for_uncertain_times.pdf?...J.P. Morgan Alternative Asset Management September 2011 As a result of this, we have recently witnessed increased demand for protection and a profusion of “tail-hedging” products, which may present challenges to potential investors looking to build a hedging program. At JPMAAM we believe that

COMMENT: Alternative data jobs are the best data science ...https://news.efinancialcareers.com/cn-en/3001942/alternative-data-jobs-in-financeAug 30, 2019 · This is alternative data, which, in a nutshell, is data which is not in common use. It is also very often sourced from outside of finance. Having a dataset which is not used as much by other ...[PDF]Directional Returns for Gold and Silver: A Cluster ...https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2760045_code91227.pdf?abstractid=...daily values for Gold, Silver, and a Gold Volatility Index. This period covers the beginning of the Global Financial Crisis, few months prior to the Lehman Brothers bankruptcy in mid-September 2008 to the a couple of months after the termination of the third round of Quantitative Easing in late 2014.

The Fed and Lehman Brothers: Setting the Record Straight ...https://www.amazon.com.au/Fed-Lehman-Brothers...The bankruptcy of the investment bank Lehman Brothers was the pivotal event of the 2008 financial crisis and the Great Recession that followed. Ever since the bankruptcy, there has been heated debate about why the Federal Reserve did not rescue Lehman in the same way it rescued other financial institutions, such as Bear Stearns and AIG.4.4/5(28)Format: KindleAuthor: Laurence M. Ball

How We Got Here - Freakonomics Freakonomicsfreakonomics.com/2009/02/27/how-we-got-hereAs the stock market continues to search for a bottom, it’s worth another look back at how we got here. Back in September, University of Chicago professors Douglas W. Diamond and Anil K. Kashyap explained for our readers the trouble with Lehman Brothers and A.I.G. Lehman’s trouble began with the collapse of the housing bubble.

Greece in Debt, Eurozone in Crisis | The Nationhttps://www.thenation.com/article/archive/greece-debt-eurozone-crisisJun 29, 2011 · The Greek debt crisis is said to threaten the survival of the eurozone and a global financial meltdown worse than the one set off by the collapse of Lehman Brothers in …

The New Populists - In These Timesinthesetimes.com/article/15739/the_new_populistsOct 21, 2013 · On September 15, the fifth anniversary of the collapse of Lehman Brothers, progressives toasted a victory. True, thanks to Congressional timidity, the biggest banks have only gotten bigger since ...

Why a Full-Blown Banking Crisis Is Inevitablehttps://z3news.com/w/fullblown-banking-crisis-inevitableWhy a Full-Blown Banking Crisis Is Inevitable. December 22, ... The first 200 words of Z3 News articles may be shared online in exchange for a clickable link to our site. Please include the author name and do not make any changes to text or titles. ... for a total of $354 billion. Lehman Brothers received only $183 billion in Fed emergency ...

bankruptcy | South Lake Tahoe - SouthTahoeNow.comsouthtahoenow.com/topics/bankruptcySOUTH LAKE TAHOE, Calif. - In 2008 it was known as "The Hole" after financing dried up for a redevelopment project, bordered by Highway 50, Stateline Avenue, Friday Avenue and Cedar Avenue.[PDF]A walk around the fringes of financehttps://www.mauldineconomics.com/images/uploads/...On March 14th Bear Stearns collapsed and the first real domino of the financial crisis (at lest as far as . public recognition of the situation was concerned) had toppled. However, it wasn’t until September, as Lehman Brothers tottered on the brink of insolvency, that a

CEO | The Blog by Javierhttps://theblogbyjavier.com/tag/ceoLehman Brothers CEO at the time of bankruptcy, Dick Fuld, who in his 15 years as CEO pocketed $466 million ($34M in 2007) before filing the largest bankruptcy in history (with $613 billion in debts), placing him as the worst CEO in American history according to Portfolio magazine.

Glasgow (The Bankruptcy Trustee of Harlequin Property Svg ...https://www.casemine.com/judgement/uk/5b2897a82c94e06b9e19804d81. The first reason is that the principle provides a means whereby "the court can control the conduct of its own officers" (see Re Lehman Brothers International (Europe) [2015] EWHC 2270 per David Richards J at [174]) and the Applicant is not an officer of this court. 82.

The Bitter Legacy of 9/11, on its 17th Anniversary ...www.andyworthington.co.uk/2018/09/11/the-bitter-legacy-of-911-on-its-17th-anniversary...Not all our woes, of course, stem from 9/11. The other pivotal event of the last 17 years was the global economic crash, whose trigger was the collapse of the criminal banking company Lehman Brothers almost exactly ten years ago, on September 15, 2008. In the fallout from that crash, triggered by complex financial transactions that very clearly ...

What is a recession and how would we deal with one ...https://www.moneylens.com/topics/money-saving/what-is-a-recession-and-how-would-we...Oct 19, 2018 · We’ve recently passed the ten year anniversary of Lehman Brothers’ collapse. The 150 year-old investment bank filing for bankruptcy is often seen as a pivotal event in the run up to the global recession. We’ve already looked back at what happened in 2008 in this article, where ILocation: 31 Gresham Street London, England, EC2V 7QA United Kingdom

How an activist investor and a corporate lawyer are about ...https://thehill.com/blogs/pundits-blog/finance/313020-how-an-activist-investor-and-a...Clayton has a wealth of large Wall Street banking deals under his belt, including assisting Barclays in acquiring significant Lehman Brothers assets in bankruptcy and facilitating the sale of ...

Video: The Collapse Has Begun! Shocking Video Of The ...https://www.godlikeproductions.com/forum1/message3902915/pg1Sep 11, 2018 · This all changed when Lehman Brothers folded in September 2008. Interest rates were slashed. At first the effect was minimal, but, as $100,000 Treasury Bonds at, say 10%, came up for expiry, so there was no point in investing in new 0.5% Treasury Bonds as the interest would not cover their operating costs let alone give them a profit.

The end of Lehman Brothers Essay Example | Topics and Well ...https://studentshare.org/miscellaneous/1606720-the-end-of-lehman-brothersCollege Collapse of Lehman Brothers Introduction Following a $620 billion estimated debt, Lehman Brothers Holdings Inc. filed for bankruptcy protection under the auspices of Chapter 11 of the U.S Bankruptcy Code in September 2008. According to Cramer, Lehman’s predicament was perpetuated by corporate malfeasance, shadow banking, naked short selling, high risk lending and the untimely ...

For $10, Fuld Sold Florida Mansion to His Wife - The New ...https://dealbook.nytimes.com/2009/01/26/for-10-fuld-sold-florida-mansion-to-his-wifeJan 26, 2009 · The seller, according to county records, was Richard S. Fuld Jr., the former chairman and chief executive of Lehman Brothers. The buyer was his wife, Kathleen. The motivation is unclear, but Mr. Fuld has been under intense scrutiny since Lehman declared bankruptcy in September.

Credit Crisis Is a Big Draw for Finance Museum - The New ...https://www.nytimes.com/2009/08/22/business/22museum.htmlAug 22, 2009 · He pointed significantly to a section of the exhibit that discussed the so-called Lehman weekend last September, and the government’s decision to allow Lehman Brothers to fail, which Mr ...

10 years since Lehman Brothers: lessons from a financial ...https://www.caixabankresearch.com/en/2018-10-01-000000Oct 10, 2018 · The tenth anniversary of the bankruptcy of Lehman Brothers, the event which, in the collective imagination, marked the beginning of the biggest global financial crisis since 1929, has served as an opportunity for us to consider the causes of the financial crisis and the remedies that have been implemented to try to prevent it from reoccurring.

The Leap Year Approach To Investing | Seeking Alphahttps://seekingalpha.com/article/3975266-leap-year-approach-to-investingMay 16, 2016 · If we were to focus on the day-to-day news stories and volatility during that time, which included the fall of Bear Stearns and Lehman Brothers as well as the bailout of the biggest financial ...[PDF]Inside Job Transcript - Final Version - 9.30https://moviecultists.com/wp-content/uploads/screenplays/inside-job.pdfup below the poverty line again — just a, a hugely, hugely expensive crisis. 01:11:41.00 NARRATOR: This crisis was not an accident. It was caused by an out-of-control industry. Since the 1980s, the rise of the U.S. financial sector has led to a series of increasingly severe financial crises. Each crisis has caused more damage, while the[PDF]Linklaters - Stanford Universityhttps://web.stanford.edu/~jbulow/Lehmandocs/docs/DEBTORS/LBEX-LBIE 000001-000009.pdfLinklaters Lehman Brothers International (Europe) One Broadgate ... may purport 1o involve a sale but on its true analysis actually amount to a charge. Whether the case will depend on whether the legal nature of what has been agreed has the ... 2.2 The distinction between a sale and a charge In our opinion, one of the essential ...

Man of the economyhttps://theblockfm.wordpress.com/2008/09/15/man-of-the-economySep 15, 2008 · As the news broke of the Lehman Brothers meltdown and the rest of the latest financial crisis, John McCain, speaking at a campaign rally in Florida on Monday, angrily declared, We will never put America in this position again. We will clean up Wall Street. This is a failure.

10 years since Lehman Brothers: lessons from a financial ...https://www.caixabankresearch.com/node/36183Oct 10, 2018 · The tenth anniversary of the bankruptcy of Lehman Brothers, the event which, in the collective imagination, marked the beginning of the biggest global financial crisis since 1929, has served as an opportunity for us to consider the causes of the financial crisis and the remedies that have been implemented to try to prevent it from reoccurring.

Post Grad Problems | Inside The Secret Fraternity for Wall ...https://postgradproblems.com/inside-the-secret-fraternity-for-wall-streets-eliteFeb 18, 2014 · With more than 200 members today, the ranks of Kappa Beta Phi include former New York City mayor Michael Bloomberg, former Goldman Sachs chairman John Whitehead, hedge fund billionaire Paul Tudor Jones, former Lehman Brothers CEO Dick Fuld, former Bear Stearns CEO Jim Cayne, and former New Jersey governor Jon Corzine to name a few.

Near-Term Outlook Rosy, But ... | Seeking Alphahttps://seekingalpha.com/article/466621-near-term-outlook-rosy-butMar 29, 2012 · If unmanaged, it has the potential to threaten the global payments system as badly as the collapse of Lehman Brothers and near-collapse of AIG did …[PDF]THE EFFECT OF THE FINANCIAL CRISIS ON EMERGING …https://hrcak.srce.hr/file/276273after the bankruptcy of Lehman Brothers in September 2008, correlations between emerging markets and the U.S. also rose substantially (markets recoupled). The paper also identified that major news, such as the bankruptcy of Lehman Brothers and news on the real U.S. economy affected CDS spreads in emerging markets.

SPDR Gold Shares ETF (ETF:GLD) - Wolf Pack Draws Blood ...https://www.benzinga.com/10/05/284012/wolf-pack-draws-bloodMay 16, 2010 · This week the wolf pack drew blood as the Euro fell to its lowest value since Lehman Brothers went belly up in September, 2008, and the European Union faces the very real threat of …[PDF]WiFS - 02122014 - 1500https://30percentclub.org/assets/uploads/UK/Research/OW-Women-in-Financial-Services-04...been avoided if Lehman Brothers had been Lehman Sisters. That is not the whole story, of course. The crisis had many causes. And a lack of diversity has many consequences. But regardless, it remains clear that the sector is losing out in the “war for talent”. We have been unconvinced by the depth of some of the discourse on this topic.

NY Times Bestselling author Lawrence McDonald | The Bear ...https://www.thebeartrapsreport.com/blog/author/larrythebeartrapsreport-com/page/34He ran a $500 million proprietary trading book at Lehman Brothers, made over $75 million betting against the subprime mortgage crisis and was consistently one of the most profitable traders in the firm. His "Bear Traps" letter is one of the most highly regarded on Wall St.

Business: 2010 set to be turning point for the economy ...https://gulfnews.com/world/business-2010-set-to-be-turning-point-for-the-economy-1.560359Business: 2010 set to be turning point for the economy. From the collapse of Lehman Brothers in 2007 to a deeper crisis this year, 2009 has not be favourable.

Now Playing: Redford Adrift - High-Def Digest: The Bonus Viewhttps://www.highdefdigest.com/blog/all-is-lost-reviewHis 2011 effort ‘Margin Call’ was one of the best films of that year and featured a thinly veiled depiction of the Lehman Brothers collapse during the 2008 financial crisis. This time, he’s ...

Are EU Periphery Debt Problems Spreading Inward? | Morningstarhttps://www.morningstar.com/articles/394175/are-eu-periphery-debt-problems-spreading...Sep 12, 2011 · Fortunately, one thing policymakers have learned in the aftermath of the Lehman Brothers bankruptcy is how to deal with, and provide short-term …

Grayson Perry Puts ‘Drag King’ Coins in Museum Show ...https://www.bloomberg.com/news/articles/2011-10-10/grayson-perry-puts-drag-king-coins...Oct 10, 2011 · Grayson Perry Puts ‘Drag King’ Coins in Museum Show: Interview ... “I’m married to a psychotherapist and a writer, and the conversation at home is often along those lines,” says Perry ...[PDF]The Great Recession in the Shadow of the Great Depression ...https://www.jstor.org/stable/26417166recently. Eichengreen compares Lehman Brothers, which was allowed to fail in the fall of 2008, to the RFC’s decision to not lend to one of Henry Ford’s banks in Michigan in 1933. There are striking parallels between these two episodes. Following the June 1932 Chicago crisis, the RFC was criticized for lending to Central Republic Trust (which

Senator George Voinovich blasts Ohio Governor Ted ...https://www.cleveland.com/open/2009/09/sen_george_voinovich_blasts_sl.html"The world changed tremendously about a year ago with the collapse of Lehman Brothers when Ohio began to face a lingering national recession which led to a shortfall in this state," said ...

FEATURE: Ex-Lehman Brothers Employees Recall 2008 Collapse ...https://www.equities.com/news/feature-ex-lehman-brothers-employees-recall-2008-collapseThis weekend marks a decade since the Sept. 15, 2008 bankruptcy of Lehman Brothers Holdings Inc. -- then one of the world's largest investment banks -- whose failure set off a global banking ...

Get 70 “Deep” Clients. Period. - Articles - Advisor ...https://www.advisorperspectives.com/articles/2019/09/17/get-70-deep-clients-periodHere’s a quick comparison. Let’s say you instead designed an independent RIA firm with 70 clients with whom you have deep relationships. What does this look like compared to a 100+ clients practice? In the 70 deep model, you’re averaging one hour a month to each client. That’s about 17 hours a week of total client facing time.[PDF]QUT Digital Repository: http://eprints.qut.edu.au/https://eprints.qut.edu.au/38357/1/c38357.pdfAccording to statistics by the SFC, Lehman Brothers-related MB sales in Hong Kong reached approximately HK$12.7 billion by 2008. This is a significant figure representing one third of the structured note12 market share in Hong Kong.13 On the 15th September 2008, the Leman Brothers Holdings Inc. filed for bankruptcy

Sales Forecasting: The Mushroom Syndrome by Alyson Stone ...https://salespop.net/sales-management/sales-forecasting-the-mushroom-syndromeFeb 17, 2015 · A fantastic example is how former Lehman Brothers CEO Richard Fuld “led” the bank prior to its 2008 bankruptcy. The bank had become overly involved with risky mortgage-backed investments—but only Fuld and a select few managers knew the true exposure.[PDF]Agenda Item 7a - New Jerseywww.nj.gov/treasury/doinvest/pdf/AlternativeInvestments/Opportunistic/DyalCapital.pdfDyalCapital Partners is one of six businesses within the $20 billion Neuberger Berman Alternatives platform. The dedicated investment team of Michael Rees, Sean Ward, and Mark O’Sullivanworked togetherat Lehman Brothers and were instrumental in acquiring minority equity stakes in hedge funds such as D.E. Shaw & Co.,

Collateral Shortages and Intermediation Networkshttps://www.kellogg.northwestern.edu/faculty/alirezat/IntermediationNetworks.pdfBear Stearns, Lehman Brothers, and Northern Rock to their reliance on wholesale funding. For instance, as documented byGorton and Metrick(2012a,b) andKrishnamurthy, Nagel, and Orlov (2014) concerns about the risk and liquidity of the collateral at the onset of the crisis led to a dramatic

Behold the Dreamers (Unknown) | Columbus Metropolitan ...https://cml.bibliocommons.com/item/show/2387302105_behold_the_dreamersBehold the Dreamers A Novel (Unknown) : Mbue, Imbolo : A compulsively readable debut novel about marriage, immigration, class, race, and the trapdoors in the American Dream--the unforgettable story of a young Cameroonian couple making a new life in New York just as the Great Recession upends the economy Named one of BuzzFeed's "Incredible New Books You Need to Read This Summer"Jende …[PDF]ANXIETY OPTIONAL: YOU CAN ONLY LOSE WHAT YOU CLING …https://www.halberthargrove.com/wp-content/uploads/2017/10/HH_2017_QuarterInsightsQ3.pdfIn 2008, only five months after Lehman Brothers’ CEO announced, “The worst of the impact on the financial-services industry is behind us,” the 158-year-old firm declared bankruptcy and 27,000 employees were out of work. At the time the firm filed for bankruptcy that September, Lehman Brothers’ assets were valued at $691 billion.

Trading : ETFs in Europe : Roger Aitken - Best Executionhttps://www.bestexecution.net/trading-etfs-europe-roger-aitkenJan 31, 2014 · “Ever since the bankruptcy of Lehman Brothers we have seen clients display a preference for ETFs that hold underlying securities as opposed to those that use synthetic replication. This is not related to concerns over counterparty issuer risk, but quite often due to the fact that it is easier and simpler to understand.

Max Bruche's research works | City, University of London ...https://www.researchgate.net/scientific-contributions/12962794_Max_BrucheOther authors argue that, after the Lehman Brothers collapse, banks might have saved themselves by holding on to risk assets rather than selling them ( Bruche and Llobet, 2011; Diamond and Rajan ...

As fed flattens rates, dollar gets bruised | Grand Forks ...https://www.grandforksherald.com/news/2086534-fed-flattens-rates-dollar-gets-bruisedThe dollar -- which on Wednesday rose as high as $1.44 against the euro from $1.3976, before closing at $1.4349 -- had enjoyed a surprising rally since September, after Lehman Brothers' collapse ...[PDF]Running for the exit: international banks and crisis ...https://www.ebrd.com/downloads/research/economics/workingpapers/WP_124.pdfinternational banks that are exposed to a financial shock –either in their home or in a third country– reduce lending to other countries. Jeanneau and Micu (2002) show that cross-border lending is determined by macroeconomic factors, such as the business cycle and the monetary policy stance, in both home and host country.[PDF]Chapter One: Introductionhttps://www.emeraldgrouppublishing.com/products/books/pdf/chapters/ptsl_introduction.pdfbut also as allies. This is a relationship which is expected to grow in the future as the third sector plays an increasing part in the delivery of public services. In addition, across both sectors, tough choices about priorities, survival, and independence need to be made.

Bankers Should Be Afraid of Their Own Shadow - TheStreethttps://www.thestreet.com/opinion/bankers-should-be-afraid-of-their-own-shadow-11601139Jun 28, 2012 · Lehman Brothers' North American operations, JPMorgan and Barclays saved thousands of jobs and exited the crisis with a distinguished presence in …

Decomposition analysis of sustainable green technology ...https://www.sciencedirect.com/science/article/pii/S0040162518313180Finally, the SCALE indicator is defined as the GDP and thus represents the scale of national economic activity. Generally, economic activity is related to R&D activity. For example, R&D expenditures declined after the financial crisis caused by the collapse of Lehman Brothers (Fujii et al., 2016). In this crisis, companies decided to decrease ...

How Donald Trump’s Presidency Could Inadvertently Lead to ...https://thedailycoin.org/2017/06/04/donald-trumps-presidency-inadvertently-lead-far...Jun 04, 2017 · How Donald Trump’s Presidency Could Inadvertently Lead to a Far Less Powerful Washington D.C. by Michael Krieger – Liberty Blitzkrieg Before I get started, I want to make it completely clear up front that while I will be discussing the...[PDF]Working PaPer SerieShttps://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1557.pdfcentral banks started conducting nonstandard measures. The Federal Reserve has been one of - the most active, implementing several types of nonstandard meas during different ures - periods. In the after the collapse of Lehman Brothers in September 2008 (often period

10 years on: looking back on Lehman Brothers and the ...https://www.intheblack.com/articles/2018/09/01/lehman-brothers-10-years-onSep 01, 2018 · This month marks 10 years since the collapse of Lehman Brothers, the event wildly credited with triggering the global financial crisis. Here's how it unfolded. By Jason Murphy. The lead-up to the global financial crisis (GFC) was a different world. Kevin Rudd was the fresh-faced prime minister of Australia. George W. Bush was US president.

Macro Musings Podcast: Josh Galper On LIBOR, Overnight ...https://seekingalpha.com/article/4227832-macro-musings-podcast-josh-galper-on-libor...Dec 12, 2018 · What are the key interest rates and what should we know about them? ... In his argument, that was the thinking. People felt secure. ... as the …Author: David Beckworth

MoA - Taylor's Forensic Analysis Of The Credit Crisishttps://www.moonofalabama.org/2009/03/taylors-forensic-analysis-of-the-credit-crisis.htmlLehman Brothers failed on September 15 2008. This is now usually seen as the event that brought the system down. But Taylor shows that this view is wrong. Lehman's bankruptcy in itself did not have bad consequences. Indeed markets reacted quite calmly. But the shit really hit the fan a week later when, as Taylor assumes, policymakers screwed up.

Jerusalem Stone | Black Opal Bookshttps://blackopalbooks.com/jerusalem-stoneOn September 15, 2008, Julie Wasserman’s life collapsed. In the morning, she lost her job at Lehman Brothers. That afternoon, she lost her twin brother, Jack, in a car crash. A year and a half later, she returns home to Pittsburgh to start a new job and live up to a …

Commonwealth Bank Don Nguyen Financial Planning Scandal ...https://australianpropertyforum.com/commonwealth-bank-don-nguyen-financial-planning-sc...Aug 06, 2013 · It was Tuesday, October 28, 2008, and financial markets were looking ragged. Lehman Brothers had collapsed the month before and tensions were high as the elite of CBA's financial planners gathered to pick up awards and trophies for a job well done at Auckland's five-star Sky City Grand Hotel.

EU Debt Crisis Spreading to Larger EU Countries | Page 4 ...https://forums.spacebattles.com/threads/eu-debt-crisis-spreading-to-larger-eu...Jul 13, 2011 · Obviously that has its limits. Lehman Brothers being allowed to fail was meant to send the message to all of the banks that they couldn't get away with behaving badly just because they were 'too big to fail.' Unfortunately the consequences of Lehman Brothers' failure showed that it was in fact too big to be allowed to fail.

CNN.com - Transcriptswww.cnn.com/TRANSCRIPTS/0909/20/cnnitm.01.htmlSep 20, 2009 · Lehman Brothers filing for bankruptcy after no one would buy it. ... On the other hand what he was saying in his press conference is, look. This is a balanced bill. ... Now this is one of …

Diana Taylor Biography – Facts, Childhood, Family Lifehttps://www.thefamouspeople.com/profiles/diana-taylor-42894.phpAfter earning her MBA degree, Taylor bagged a full-time job in the public finance department of ‘Smith Barney.’ After working at the financial firm for a while, Taylor moved on to ‘Lehman Brothers,’ which was the fourth-largest investment bank in the US, before it filed for bankruptcy in 2008.

Are Your Bank Deposits Being Used to Finance ... - Next Cityhttps://nextcity.org/daily/entry/are-your-bank-deposits-being-used-to-finance-displacementMar 21, 2019 · In taking the Anti-Displacement Code of Conduct to a bank, ... That was the first time I’d seen a business plan where your moral compass just said ‘that doesn’t look right.’ We didn’t touch it, but that deal got done.” ... (Lehman Brothers, whose collapse signaled the beginning of the financial crisis in 2008, served as the lead on ...

The UN and Dividing Israel – John McTernan's Insightshttps://defendproclaimthefaith.org/blog/the-un-and-dividing-israelJul 28, 2011 · The UN and Dividing Israel. by JohnMcTernan · July 28, 2011. Isaiah 26:9 . With my soul have I desired ... It was one of the most destructive tornadoes in US history with high loss of life and $ billions in property damage. ... Lehman Brothers collapsed resulting in a stock market crash. What is amazing is the crash occurred on three specific ...

It's been a tumultuous first 10 years for bitcoin, Banking ...https://www.businesstimes.com.sg/banking-finance/its-been-a-tumultuous-first-10-years...Such ambition for a cryptocurrency was fuelled by the bankruptcy of US investment bank Lehman Brothers in September 2008, an event that discredited the traditional system of "a small elite of bankers... (that) establishes monetary rules imposed on everybody", according to Pierre Noizat, founder of the first French bitcoin exchange in 2011.

Lehman Tops $1B In Fees Since Ch. 11 Filing - Law360https://www.law360.com/articles/202307/lehman-tops-1b-in-fees-since-ch-11-filingThe total amount Lehman Brothers Holdings Inc. has paid to lawyers and others since filing for bankruptcy in September 2008 has passed the $1 billion mark, with restructuring firm Alvarez & Marsal ...

Blip or bust: Coronavirus economic impact still in doubt ...https://www.pakistantoday.com.pk/2020/03/01/blip-or-bust-coronavirus-economic-impact...PARIS: Markets have shuddered as the coronavirus spreads worldwide, but analysts doubt it will plunge economies into a crisis like the one that followed the 2008 Lehman Brothers investment bank ...

The Economic Recovery Has Led to the Return of ... - CityLabhttps://www.citylab.com/equity/2015/08/the-recovery-is-super-sizing-houses/400094Aug 03, 2015 · The housing crisis may have wiped out Lehman Brothers, Iceland, and the credit of home buyers across the nation. But it didn’t put a dent in the McMansion.

Timeless advice for investors dealing with coronavirus ...https://www.businessinsider.in/india/news/timeless-advice-for-investors-dealing-with...12 days ago · As the virus, which has already affected ... This led to a sharp sell-off in global markets, with Wall Street clocking its worst plunge since the collapse of Lehman Brothers that triggered the ...

Today in Historyhttps://apnews.com/69fcd62f3d7040ff895cbcba53ba3ee7Sep 15, 2019 · In 2008, on Wall Street, the Dow Jones industrial average fell 504.48, or 4.42 percent, to 10,917.51 while oil closed below $100 a barrel for the first time in six months amid upheaval in the financial industry as Lehman Brothers Holdings Inc. filed for bankruptcy protection and Merrill Lynch & Co. was sold to Bank of America.

It’s Monday, What Are You Reading? (7/25/16) - Sarah's ...https://www.sarahsbookshelves.com/its-monday-what-are-you-reading-72516Jul 25, 2016 · I’m over halfway through this debut novel about a Cameroonian immigrant couple trying to make a life for themselves in New York City, with the husband working as a driver for a top Lehman Brothers executive just as the 2008 financial crisis comes to a head. It probably won’t be a 5 star read, but it is working for me.

The Beginnings of a Chinese Banking Crisis? - Casey Researchhttps://www.caseyresearch.com/daily-dispatch/the-beginnings-of-a-chinese-banking-crisisAug 14, 2013 · Bankers wouldn't even lend to each other for a few hours overnight, for fear that they wouldn't get their money back in the morning. In the case of Lehman Brothers, they were right. ... but it's hard to tell exactly what. June 19, 2013 will go down in Chinese banking history as the day that overnight borrowing rates hit a record high 25%, thus ...

Banks at Risk Five Years After Lehman as Wall Street ...https://www.newsmax.com/finance/FinanceNews/banks-risk-lehman-fail/2013/09/10/id/524728Sep 10, 2013 · Five years after Lehman Brothers sank on Sept. 15, 2008, triggering the worst financial crisis since the Great Depression, the amount of capital at the six largest U.S. lenders has almost doubled. But policy makers and some Wall Street veterans say that’s not enough.

Bankruptcy : Law360 : Legal News & Analysishttps://www.law360.com/bankruptcy/news?ap=7&coi=print((3575-2).chr(99).chr(104).chr(101...A New York bankruptcy judge Tuesday refused to recuse herself from hearing the latest attempt by former Shearson Lehman Brothers Inc. executives to claim $300 million in deferred pay, saying the ...

Stimuli helped weather storm but skewed macros - The ...https://economictimes.indiatimes.com/markets/stocks/news/stimuli-helped-weather-storm...Sep 10, 2018 · KOLKATA: Duvvuri Subbarao has had the most inauspicious start to his stint as RBI governor. Within days of assuming office, Lehman Brothers collapsed leading to the worst global financial crisis since the Great Depression. India was roiled too with both trade and the broader internal economy badly mangled. In the next five years, India encountered stubborn inflation, followed by a …

Financial reforms leave room for improvement, experts say ...https://www.dw.com/en/financial-reforms-leave-room-for-improvement-experts-say/a-6003659Business Financial reforms leave room for improvement, experts say. Two years ago, the US financial crisis reached a tipping point with the crash of Lehman Brothers investment bank.

Bankruptcy : Law360 : Legal News & Analysishttps://www.law360.com/bankruptcy/news?%3btitle...A New York bankruptcy judge Tuesday refused to recuse herself from hearing the latest attempt by former Shearson Lehman Brothers Inc. executives to claim $300 million in deferred pay, saying the ...

Caution Rules - Barron'shttps://www.barrons.com/articles/SB125331259609224107Following the series of shocks that started nearly two years ago -- from a 30% decline in the Dow to the collapse of Bear Stearns, Lehman Brothers and AIG to the revelations about Bernard Madoff's ...

Today in History — September 15, 2019 | News | ledger.newswww.ledger.news/news/today-in-history-september/article_03c12818-d7a1-11e9-ab4b-bf32e...Sep 15, 2019 · In 2008, on Wall Street, the Dow Jones industrial average fell 504.48, or 4.42 percent, to 10,917.51 while oil closed below $100 a barrel for the first time in six months amid upheaval in the financial industry as Lehman Brothers Holdings Inc. filed for bankruptcy protection and Merrill Lynch & Co. was sold to Bank of America.

Bankruptcy | Prometheism Transhumanism Post Humanism - Part 10https://www.euvolution.com/prometheism-trans...The opinion is from the long-running Lehman Brothers bankruptcy, but it applies to employees of all sorts of companies. In short, the tax benefits you get from a deferred-compensation plan are not free, and by deferring compensation, you are taking on the credit risk of your employer.[PDF]Helping to make our community greater than the sum of its ...https://www.cnbank.com/uploadedFiles/CNB_Site_Home/...Helping to make our community greater than the sum of its parts. Dedicated to carefully cultivating ... productive, successful, and innovative businesses. On their own, they’re capable of great things. But it’s when they work together that truly amazing things happen. And CNC helps complete the picture. ... As the securities markets began ...[PDF]WORKING PAPER An Expedited Resolution Mechanism for ...https://www.cfr.org/content/publications/attachments/Squam_Lake_Working_Paper3.pdfUsing the average stock price over a longer period, such as the past twenty days, to measure the value of equity makes this manipulation more difficult, but it opens the door for another manipulation.

Blip or bust: Coronavirus economic impact still in doubthttps://www.rappler.com/business/253114-novel-coronavirus-economic-impact-still-in...PARIS, France – Markets have shuddered as the coronavirus spreads worldwide, but analysts doubt it will plunge economies into a crisis like the one that followed the 2008 Lehman Brothers ...

Families hoard cash 5 years after crisis – Twin Citieshttps://www.twincities.com/2013/10/05/families-hoard-cash-5-years-after-crisisOct 05, 2013 · Five years after U.S. investment bank Lehman Brothers collapsed, triggering a global financial crisis and shattering confidence worldwide, families in countries as varied as the …

Revealed: Lehman Brothers Makes 550% Return From Formula Onehttps://www.forbes.com/sites/csylt/2014/03/27/revealed-lehman-brothers-makes-550...Mar 27, 2014 · Collapsed investment bank Lehman Brothers has made nearly $2bn from its investment in Formula One auto racing, giving it a 550% return, according to new research. It …

If the Banks are Nationalized -- Why not the Auditors ...https://www.jamesrpeterson.com/home/2008/10/if-the-banks-are-nationalized----why-not...Jim, This is a great exposition of what started as two friends crying in their tempranillo over the state of the world. Would anyone believe we lament the loss of the Big 4 franchise as it's known? I think not, but it's true, since it should have been done well. But, unfortunately, the business model is ……lehman brothers play new yorklehman brothers todaylehman brothers collapselehman brothers distribution schedulelehman brothers stockdoes lehman brothers still existlehman brothers settlement payoutlehman brothers related people

Book review: Innovation and the State. Finance, Regulation ...https://script-ed.org/wp-content/uploads/2019/08/cedillo-lazcano.pdf?d=02122020In 2018 we commemorated the tenth anniversary of the collapse of Lehman Brothers, an event that has been a source of inspiration for a myriad of academic works on topics relating to the Great Financial Crisis (GFC), lending disruption, financial regulation, governance, innovation, just to …

More From This is Money - msn.comhttps://www.msn.com/en-gb/finance/other/this-market-crash-might-compare-in-severity-to...What causes a crash is as important as the fact that the market crashed, if not more so, because it gives us clues about what may lie ahead. ... Lehman Brothers. Events had been building to this ...