Home

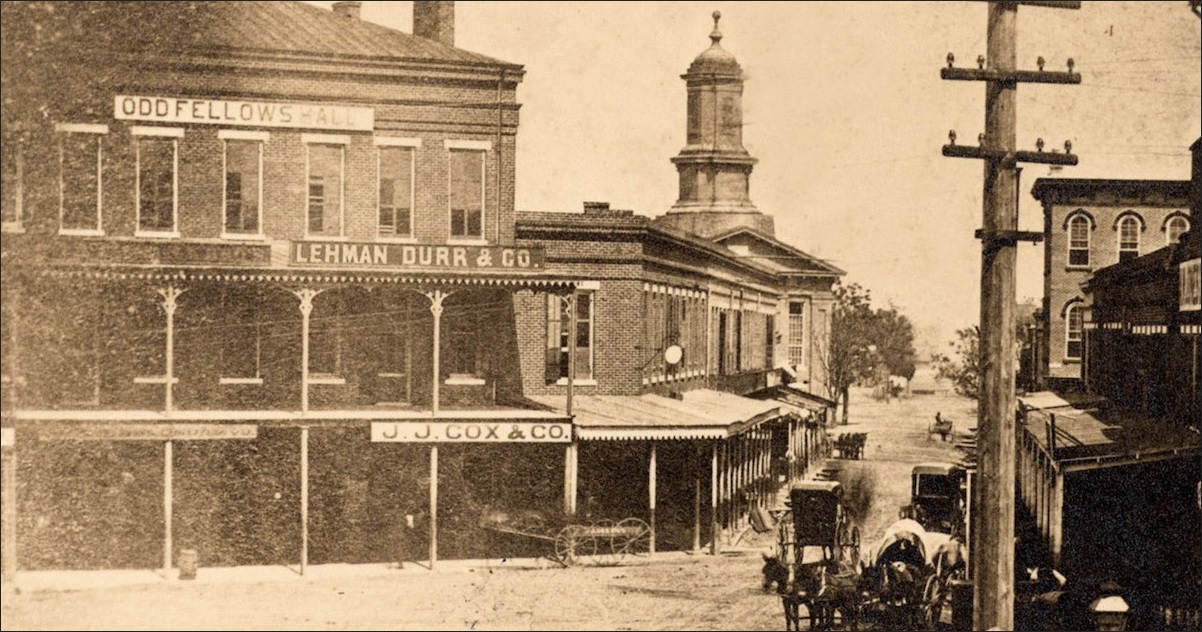

The Lehman Durr & Co. offices in Montgomery, Alabama, 1874 Columbia University Library

Over 305,000 Results

Tag: Greece - Page 7 – The Burning Platformhttps://www.theburningplatform.com/tag/greece/page/7The Federal Reserve balance sheet is leveraged 55 to 1, meaning a 2% loss would wipe out their capital. Lehman Brothers and Bear Stearns were leveraged 30 to 1 when they went belly up. During the recent financial crisis the Federal Reserve secretly loaned $16 trillion to the biggest banks in the world, including $4 trillion to foreign banks.

Illuminati News | The Whataheal Timeshttps://thewhatahealtimes.wordpress.com/category/illuminati-newsSep 27, 2009 · In the video below, ITV, Brown speaks to union workers from Liverpool, was important as its answer to the economic crisis, making a great drama of the crisis, which began with the collapse of Lehman Brothers, and now ended, could have been worse than the great depression of 1929, and as the way he handled the crisis saved the country.

Clients don’t blame Agile – The Denver Posthttps://www.denverpost.com/2009/02/03/clients-dont-blame-agileFeb 03, 2009 · “The collapse of Lehman Brothers led to a series of events that forced a number of hedge funds to stop disbursement,” Tancredo said. “When that happened, a …

The Fifth Estate - Curio.cahttps://curio.ca/en/show/the-fifth-estate-1391/2010When Lehman Brothers collapsed in September 2008, heralding the onset of a recession, the focus was on the greed and vanity of the Americans who ran the doomed investment giant. But The Fifth Estate has uncovered the Canadian connection to that collapse. His name: Brian Chisick.

Knight Rout Shows Why Banks Shouldn’t Split, Hintz Sayshttps://www.bloomberg.com/news/articles/2012-08-05/...Aug 05, 2012 · Goldman Sachs Group Inc., which converted to a bank in 2008 a week after the collapse of competitor Lehman Brothers Holdings Inc., agreed Aug. 1 …

40 Years In The Desert: Thanks Elizabethhttps://40yrs.blogspot.com/2016/04/thanks-elizabeth.htmlApr 14, 2016 · Warren told Yellen that at the time of its collapse in 2008, Lehman Brothers had $639 billion in assets and 209 subsidiaries and it took three years to unwind the bank in bankruptcy. Warren singled out JPMorgan Chase for comparison, saying that …

banking - When Lehman Brothers collapsed, what happened to ...https://history.stackexchange.com/questions/51227/...Ultimately, Lehman Brothers customers appears to have got all their money back. According to a press release by the SIPC, In total, customers have received more than $106 billion, fully satisfying the 111,000 customer claims. Secured, priority, and administrative creditors have …

Econ 310 Chapter 12 Flashcards | Quizlethttps://quizlet.com/349370487/econ-310-chapter-12-flash-cardsWhy was the decision by the Fed to orchestrate the purchase of Bear Stearns so controversial? (Check all that apply. ) A. Because the Fed intervened by brokering a guaranteed deal with Lehman Brothers. B. Because, according to some economists, the action increased moral hazard in the financial system. C.…lehman brothers stock chart 2008lehman brothers bankruptcy websitelehman brothers share pricelehman brothers stock 2019lehman brothers stock graphbankruptcy of lehman brothersfemale lehman brothers related peoplelehman brothers history

Lehman Brothers and Repo 105 | Harvard Business Publishing ...https://hbsp.harvard.edu/product/112050-PDF-ENGOct 13, 2011 · The collapse of Lehman Brothers in 2008 was the largest bankruptcy in US history. The case examines the economics of the off-balance sheet transactions Lehman undertook prior to the collapse, and highlights the corporate governance challenges in situations where firms face capital market pressure and market downturns. In particular, the case examines the financial accounting, …

Barclays Pulls Out of Lehman Brothers Deal | Fox Newshttps://www.foxnews.com/story/barclays-pulls-out-of-lehman-brothers-dealSep 14, 2008 · But there were signs that Lehman Brothers Holdings Inc. might be edging closer to a bankruptcy filing, with several reports that it has hired Weil, …

Principal Protected Notes and the Lehman Brothers Debacle ...https://www.investorlawyers.net/blog/principal...Oct 24, 2011 · When Lehman Brothers filed for bankruptcy, the principal on the PPNs — for which Lehman was the borrower — became unprotected and investors were left with unexpected losses. According to claimants in the case, they were led to believe that as long as they held them to maturity, their PPNs were 100 percent principal protected.

Lehman led trading in bankruptcy claims in 2009 | Reutershttps://www.reuters.com/article/us-claimstrading...Feb 18, 2010 · Creditors of bankrupt Lehman Brothers Holdings Inc traded some $4.4 billion of claims in 2009, leading an increasingly active market for creditors last year, according to a study on Wednesday.

BBC NEWS | Entertainment | BBC to make Lehman Brothers dramanews.bbc.co.uk/2/hi/entertainment/8209901.stmAug 19, 2009 · The Last Days of Lehman Brothers will follow chief executive Dick Fuld as he attempts to strike a last-ditch rescue deal for the bank. The hour-long drama will be screened on BBC Two this autumn. Lehman's collapse last September helped trigger the world's worst recession since World War II.

DTCC Successfully Closes out Lehman Brothers Bankruptcy ...https://www.businesswire.com/news/home/...Oct 30, 2008 · DTCC Successfully Closes out Lehman Brothers Bankruptcy ... This was the largest close ... These exercises involve simulating the steps DTCC would have to take to respond to a …

Lehman Brothers CEO Dick Fuld Working At Penny Stock Firm ...https://www.businessinsider.com/dick-fuld-now...Former Lehman Brothers CEO Dick Fuld is apparently working at a small ... during 2006 to total out to a $221,000 net loss. ... record of buying or selling securities where Legend was the counter ...

(Solved) - True or false? a. The financial crisis was ...https://www.transtutors.com/questions/true-or...Aug 27, 2019 · The crisis could have been much more serious if the government had not stepped in to rescue Merrill Lynch and Lehman Brothers. e. The crisis in the eurozone finally ended when other eurozone countries and the IMF provided a massive bailout package to …

Wall Street tumbled after the collapsed of Lehman Brothers ...https://www.groundreport.com/wall-street-tumbled-after-the-collapsed-of-lehman...Sep 15, 2008 · It was a trading session on 16 September 2008. Dow Jones Industrial Average Index, DJI was seen deeply in red along side with its comtemporary like Nasdaq, S&P 500 and so on. Global markets were thrown in a state of panic as DJI was seen dropped by …

Lehman Brothers and Repo 105 | The Case Centre, for educatorswww.thecasecentre.org/educators/products/view?id=105822The collapse of Lehman Brothers in 2008 was the largest bankruptcy in US history. The case examines the economics of the off-balance sheet transactions Lehman undertook prior to the collapse, and By continuing to use our site you consent to the use of cookies as ...

Lehman Maneuver Raises Accounting Question - WSJhttps://www.wsj.com/articles/SB10001424052748703447104575118070388102914A key question has emerged from the report of the Lehman Brothers Holdings bankruptcy examiner: Was the investment bank playing by the accounting rules when it shifted $50 billion in assets off ...

Who Has Two Thumbs And Is Wrong About The Financial Crisis ...https://www.huffpost.com/entry/paul-krugman-is...Lehman Brothers had a peak market cap of $60 billion just 18 months before it collapsed. When it failed, it was the fourth-largest U.S. investment bank, and with $600 billion in assets became the largest bankruptcy in the country’s history.

A Step Ahead of Crisis | The Actuary Magazinehttps://theactuarymagazine.org/a-step-ahead-of-crisisWhile more than 10 years have passed since the Sept. 15, 2008, collapse of Lehman Brothers and the last full-blown international banking crisis, the qualitative and quantitative risks affecting our industry and the way we work have never been greater.

CIBC sued by Lehman in CDO dispute | Investment Executivehttps://www.investmentexecutive.com/news/industry...Sep 15, 2010 · Lehman Brothers Special Financing, the plaintiff, contends it was deprived of more than US$3 billion from collateralized debt obligation deals, or CDOs, because it was switched to junior from senior payment priority after Lehman declared bankruptcy two years ago.

The Fed started raising interest rates so much that by ...https://www.coursehero.com/file/p122brlv/The-Fed-started-raising-interest-rates-so...In September 2008 Lehman Brothers was forced to file bankruptcy (Ibid). There was no one single cause of the Lehman Brothers failure; instead a number of factors contributed to the collapse. However there can be little question that the single biggest cause of the mortgage meltdown was the single biggest factor; much of the fault with the ...

The Dow Falls as Markets Try to Figure Out What Really Mattershttps://www.barrons.com/articles/the-dow-jones-industrial-average-falls-for-week...U.S. money markets went crazy and forced the Fed to intervene, setting off comparisons to the collapse of Lehman Brothers in 2008. And yet a Montana junket was the ultimate determinant of whether ...

Federal Tax Update – June 2019 - AAA-CPAhttps://www.attorney-cpa.com/articles/federal-tax-update-june-2019Flume, 123 AFTR2d 2019-2211, a Texas Federal District Court found a failure to file FBAR returns to be willful, the Court noting the individual’s disingenuous testimony including setting forth that his reason for opening a Swiss bank account was the collapse of Lehman Brothers in the United States when it did not actually fold until three ...

Bond investors headed for a doozie of a hangover: Mark ...https://www.investmentnews.com/bond-investors...Sep 08, 2010 · Next week, it will be the two-year anniversary of the collapse of Lehman Brothers Holdings Inc. Sadly, the bond market suggests the investment community has …

Carlyle attempts largest post-Lehman buyout in Europe ...https://www.fnlondon.com/articles/carlyle-attempts-largest-post-lehman-buyout-in...Apr 29, 2009 · Carlyle attempts largest post-Lehman buyout in Europe. By. Toby Lewis. Wednesday April 29, 2009 9:08 pm. A Carlyle Group joint venture has tabled the largest bid for a European public company since US bank Lehman Brothers collapsed, suggesting private equity firms are regaining confidence financing will be available for deals. ...

The Financial Crisis: What Went Wrong? - Arizona Real ...https://arizonarealestatenotebook.com/the-financial-crisis-what-went-wrongOct 02, 2008 · But why did Lehman Brothers and AIG go under? After all, they don’t make mortgage loans. I turn next to how the problem spread. Assume that A borrows from B to buy a home, giving a mortgage on the home to secure her debt. B then borrows from C, using A’s mortgage as security. C in turn borrows from D, using B’s obligation as security. And ...

S.E.C. Is Said To Investigate Amazon Chief - The New York ...https://www.nytimes.com/2001/03/09/business/sec-is...Mar 09, 2001 · The closing price of $15.81 on Feb. 6 is the highest level at which the stock has traded for a month. And yesterday's closing price of $11.69 is 20 …[PDF]FOR PUBLICATION UNITED STATES BANKRUPTCY COURT …www.nysb.uscourts.gov/sites/default/files/opinions/171441_12862_opinion.pdffor publication united states bankruptcy court southern district of new york in re lehman brothers inc., debtor. chapter 11 case no. 08-01420 (scc) post-trial memorandum decision granting in part and denying in part trustee’s amended objection to the general creditor proofs of claim filed by certain former employees of lehman brothers inc.

Teenomics: Why the US Fed’s Interest Rate Decision Is a ...https://www.thequint.com/voices/opinion/teenomics...Dec 11, 2015 · It was the Lehman Brothers that led it all – a bankruptcy that spiralled into a GFC (an acronym TV talking heads love to refer to for the Global Financial Crisis).

Behind the scenes of a collapse | Financial Timeshttps://www.ft.com/content/64f96d5c-9301-11dd-98b5-0000779fd18cLehman Brothers tried to cultivate a longer list of takeover suitors than its eventual collapse into bankruptcy might suggest, the Financial Times has learnt. But that only twists the knife deeper ...[PDF]Petitioner Respondents. - SCOTUSbloghttps://www.scotusblog.com/wp-content/uploads/2017/03/16-373-pet-merits-brief.pdfMar 16, 2017 · At the turn of the century, Lehman Brothers was the fourthlargest investment bank in the United - States. Between July 2007 and January 2008, Lehman raised over $31 billion from investors through debt offerings. Petitioner CalPERS, the largest nation’s

German morale dips. - Free Online Libraryhttps://www.thefreelibrary.com/German+morale+dips.-a0266037324Sep 01, 2011 · The last time the index fell so sharply was in November 2008, just after the collapse of Lehman Brothers when the German economy was in its deepest post-war recession. It was the lowest reading for the index since June of last year.

Another economic catastrophe? » Albuquerque Journalhttps://www.abqjournal.com/1153229/another-economic-catastrophe.htmlWhat I missed was the sense that grown-ups, even if imperfect ones, had once been in charge. ... They released a joint statement shortly after Lehman Brothers collapsed, about the need “to rise ...

SDNY Bankruptcy Court interprets section 546(e)’s safe ...https://www.lexology.com/library/detail.aspx?g=789...May 03, 2012 · The Relationship Between JPMorgan and Lehman Brothers. JPMorgan was the principal clearing bank for Lehman Brothers Inc. (“LBI”), and performed clearing activities for LBI pursuant to a ...

(Solved) - Make a list of state and local politicians who ...https://www.transtutors.com/questions/make-a-list...The Unexpected Failure of Lehman Brothers. The failure of Lehman Brothers bank on September 15,... The failure of Lehman Brothers bank on September 15, 2008, created the largest bankruptcy in U.S. history and the global financial crisis that followed.

Prison Planet.com » The U.S. Path to Collapse - infowarshttps://www.prisonplanet.com/the-u-s-path-to-collapse.htmlSep 02, 2010 · They are trying to figure out why Lehman Brothers was allowed to collapse, with the belief that the failure of Lehman Brothers caused the financial crisis of 2008. The truth is, the failure of Lehman Brothers was a result of the crisis and allowing them to fail was the only correct decision the government made during the crisis.

2008 Financial Crisis Timeline - Softschools.comhttps://softschools.com/timelines/2008_financial_crisis_timeline/423Lehman Brothers Filed for Bankruptcy Also on September 15, 2008, Lehman Brothers investment firm filed for bankruptcy protections. The company was failing, but bankruptcy laws provided the ability to stay in business. September 16, 2008: Government Bailout of American International Group

What is qualitative easing? - Qualitative Easingqualitativeeasing.weebly.com/what-is-qualitative-easing.htmlThis was the strategy of the FED before the Lehman Brothers collapse in September 2008. When the purchase of low quality assets is not sterilized, there is quantitative and qualitative easing at the same time. This has been the strategy of the ECB during the financial crisis and the FED after Lehman.

UPDATE 1-Japan households' confidence slumps to decade low ...https://in.reuters.com/article/japan-economy-boj-sentiment-idINL4N2HD1BBIt was the worst reading since June 2009, when the global financial crisis, triggered by the collapse of Lehman Brothers, jolted markets and dealt a severe blow to Japan’s economy.

The Dynamic Nature of Market Values - Deepstashhttps://deepstash.com/idea/54990/the-dynamic-nature-of-market-valuesThis was the worst economic disaster since the Stock Market Crash of 1929. It started with a subprime mortgage lending crisis in 2007. Then it moved into a global banking crisis with the failure of investment bank Lehman Brothers in September 2008.

The man who saw tomorrow- Business Newshttps://www.businesstoday.in/magazine/cover-story/...Kanubhai S. Patel realised the true magnitude of the global financial crisis, when, a week after Lehman Brothers fell, his company, Voltamp Transformers, decided to ask each of its existing ...

A reminder: Credit unions didn't cause the financial ...https://www.cuinsight.com/a-reminder-credit-unions...Oct 03, 2013 · There was the conservatorship of Fannie Mae and Freddie Mac; the bankruptcy of Lehman Brothers; the failure and near-nationalization of …

Album Review: Maximo Park - Too Much Information ...https://drownedinsound.com/releases/18058/reviews/4147373Where the credit crunch was clearly sparked by the collapse of Lehman Brothers, I’m not sure than any single, totemic event sparked the commercial cataclysm that befell UK indie rock around the same time – perhaps it was the Pigeon Detectives having two top 5 albums on the trot, conceivably it in fact was the collapse of Lehman Brothers again, probably it was something more prosaic to do ...

The Phones Don’t Work, But At Least The ATMs Do | Andrew ...https://andrewtobias.com/the-phones-dont-work-but-at-least-the-atms-doOct 12, 2010 · At the time of the meltdown after Lehman Brothers’ collapse, many of the redwoods and sequoias in the economic forest were shown to have dry rot and would have caused a lot of damage if they fell. But the overall ecology of the economy was strong, and would have recovered a lot quicker and in a more healthy manner if we had allowed Citi, AIG ...[PDF]The Bankruptcy Strategist - Schulte Roth & Zabelhttps://www.srz.com/images/content/1/4/v2/146998/The-Bankruptcy-Strategiest...court was “the preferable venue in which to handle mass tort actions involving claims against an insolvent debtor,” underscor-ing the need “for a centralized proceeding. … ” Id. at 641. 3. Lehman confirms that a bankruptcy court, in a core pro-ceeding at least, must analyze each dispute on a case-by-case basis as to whether arbitration

Markets not stimulated by bailout plan – The Denver Posthttps://www.denverpost.com/2009/02/10/markets-not-stimulated-by-bailout-planFeb 10, 2009 · The plan is aimed at restoring proper functioning to credit markets, which seized up over worries about bad debt after the September bankruptcy of Lehman Brothers Holdings Inc.

Inflation Alert: The U.S. Path to Collapsehttps://www.prnewswire.com/news-releases/inflation...The truth is, the failure of Lehman Brothers was a result of the crisis and allowing them to fail was the only correct decision the government made during the crisis.

American Dream Bond Sale Staves Off Court Challenge | Bond ...https://www.bondbuyer.com/news/american-dream-bond...Sep 29, 2016 · Construction of the American Dream development was first halted in 2009 after a subsidiary of Lehman Brothers missed loan payments following a bankruptcy filing when Xanadu was the …

Stocks fall as Germany cools hopes for debt deal ...https://www.csmonitor.com/Business/Latest-News...Oct 17, 2011 · That could lead to a freeze in lending between banks and escalate into another financial crisis similar to the one that occurred in 2008 after the collapse of Lehman Brothers.

A Casualty of the Financial Crisis: Sports Sponsorships - TIMEcontent.time.com/time/business/article/0,8599,1841701,00.htmlSep 17, 2008 · Citigroup stumped up some $400 million to tag its name to a new stadium that baseball team the New York Mets will play in from next year. And British lender Barclays — who backed out of talks over a possible takeover of troubled Lehman Brothers last weekend — lavished a similar sum for the naming rights to the New Jersey Nets' planned ...

Is Gold a Better Hedge than Oil? | Seeking Alphahttps://seekingalpha.com/article/129714-is-gold-a-better-hedge-than-oilApr 06, 2009 · Slackening demand certainly contributed to oil's downtrend, but the fire sale of assets in the wake of the Lehman Brothers collapse, led by hedge fund selling, really pitched oil prices into the ...

Junior Bankruptcy Judge is Assigned Lehman Casehttps://www.abajournal.com/news/article/junior...The second-most junior bankruptcy judge in Manhattan will be handling the Lehman Brothers bankruptcy, but that doesn’t mean he can’t handle the job, says a lawyer who will be appearing before him.

Election 2016: John Kasich talks Wall Street, time at Lehmanhttps://www.springfieldnewssun.com/news/state...Sep 23, 2016 · Kasich worked in a Columbus office of Lehman Brothers, whose filing for Chapter 11 bankruptcy protection on Sept. 15, 2008, caused the Dow Jones to …

LeRoy Kim Wiki, Age, Lindsey Boylan Husband, Family ...https://primalinformation.com/leroy-kim-wikiDec 14, 2020 · Prior to joining Allen & Company, he worked as an Analyst at Lehman Brothers from 1993 – 1995. He served on the Board of Directors of thingDaemon from May 2009 – Jun 2018 and Venture For America from Jun 2011 – Jan 2015, according to his LinkedIn profile. He was the President of the Board of Directors of The Door – A Center for ...…lehman brothers stock chart 2008lehman brothers bankruptcy websitelehman brothers share pricelehman brothers stock 2019lehman brothers stock graphbankruptcy of lehman brothersfemale lehman brothers related peoplelehman brothers history

Bernanke, Paulson and Geithner say they bailed out Wall ...https://www.hitc.com/en-gb/2018/09/13/bernanke...Paramount among those failures was the inability to save Lehman Brothers, whose collapse Sept. 15, 2008, intensified a crisis that began six months earlier with the failure and bailout of Bear ...

NYC’s $olution - New York Posthttps://nypost.com/2012/09/13/nycs-olutionSep 13, 2012 · The speech came on the fourth anniversary of Lehman Brothers’ collapse, which marked the low point in the national recession. “Four years ago, New York City was the …

Ghost of Lehman Still Haunts Neuberger - The New York Timeshttps://dealbook.nytimes.com/2011/07/18/ghost-of-lehman-still-haunts-neubergerJul 18, 2011 · When Lehman Brothers collapsed in September 2008, the asset manager that it owned, Neuberger Berman, was successfully spun out. Neuberger, however, has not managed to completely shake its connection to Lehman. Last week, a three-member arbitration panel ordered the New York firm to pay more than $5 million to four former clients who bought structured products from Neuberger.

Erin Callan, Lehman Brothers' Former CFO Feels Guilty, But ...https://www.huffpost.com/entry/erin-callan-lehman-brothers_b_2854965May 11, 2013 · Callan was chief financial officer at Lehman Brothers when the firm collapsed in 2008 and set off a global economic crisis. That's not the root of Callan's guilt, however. In a Sunday New York Times op-ed that many are calling sad, poignant and gutsy , Callan writes that she regrets placing her job above her personal life .

Lehman facing at least 16,000 claims at deadline -- Daily ...https://prev.dailyherald.com/story/?id=323411Sep 23, 2009 · Lehman Brothers Holdings Inc. creditors including UBS AG, the New York Giants and Abu Dhabi Investment Authority filed more than 16,000 claims against the collapsed bank before today's 5 p.m. court-imposed deadline.

Dick Fuld’s New Job - The Daily Beasthttps://www.thedailybeast.com/dick-fulds-new-jobApr 25, 2017 · Cosmic justice would seem to require that former Lehman Brothers CEO Dick Fuld spend the rest of eternity scrubbing floors, but alas, he is now working for the hedge fund Matrix Advisors.

MF Global Chapter 11: One Complicated Bankruptcyhttps://www.valuewalk.com/2012/12/mf-global...In October this year, MF Global dislodged Lehman Brothers Holdings Inc. (PINK:LEHMQ) from the top spot of most actively traded bankruptcy claims. There were 565 reported trades of MF Global Holdings Ltd (PINK:MFGLQ) claims totaling $1.64 billion.

UDocs FILMhttps://courses.udocsfilm.com/collections?category=lawyersINSIDE LEHMAN BROTHERS. This course’s overall objective is the promotion of professionalism – i.e., professional ethics, encompassing the personal and corporate standards of behavior expected by legal and business professionals. (LSO Accredited for 2 hrs Professionalism)[PDF]UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT …portal-redirect.epiq11.com/LBI/document/GetDocument.aspx?DocumentId=2500589united states bankruptcy court southern district of new york in re lehman brothers inc., debtor. case no. 08-01420 (scc) sipa order pursuant to sections 105(a), 502(a), 502(c) and 726 of the bankruptcy code and bankruptcy rule 3009 (i) establishing a final reserve for secured, administrative and priority claims, (ii)

In fiery speech, Warren calls for limiting size of banks ...https://www.bostonglobe.com/news/politics/2013/09/12/elizabeth-warren-says-pick...Sep 12, 2013 · In fiery speech, Warren calls for limiting size of banks ... Law School marking five years since the collapse of Lehman Brothers to renew her call to reinstate the Glass-Steagall Act, aimed at ...

Who's Not on the Clinton Foundation Donor List? — ProPublicahttps://www.propublica.org/article/whos-not-on-the...There's also money from businesses at the center of the ongoing financial crisis, like Citigroup's Citi Foundation ($1 million to $5 million), AIG ($500,000 to $1 million), Lehman Brothers ...

Billionaire Schwarzman Grants Elite Scholarships to Study ...https://www.newsmax.com/Finance/StreetTalk/Schwarz...Jan 11, 2016 · China’s government bought a $3 billion non-voting stake in Blackstone in 2007, before the financial crisis swept across the globe and led to the bankruptcy of Schwarzman’s former employer, Lehman Brothers Holdings Inc. He founded Blackstone in 1985 with former U.S. Secretary of Commerce Peter G. Peterson, who oversees a foundation to ...

Obama: Hope Gives Way To Fear - RedStatehttps://redstate.com/diary/blackhedd/2009/02/09/...Feb 09, 2009 · They chose to allow Lehman Brothers to go bankrupt with no intervention. Two things happened immediately: the volte-face caused market participants to permanently lose their confidence about what the authorities would do in any given situation; and the bankruptcy unleashed a chain of disruptions that, after thirteen months of contained crisis ...

Lehman’s Chaotic Bankruptcy Destroyed Billions - Memphis ...https://www.memphisdailynews.com/news/2008/dec/30/...Dec 30, 2008 · As much as $75 billion of Lehman Brothers Holdings Inc. value was destroyed by the unplanned and chaotic form of the firm’s bankruptcy filing in …

“Gold is NOT money!.. But, can we have yours to pay our ...https://www.aier.org/article/gold-is-not-money-but...Nov 06, 2011 · When the collapse of Lehman Brothers in 2008 unleashed a financial crisis, the G-20 in 2009 approved a $250 billion SDR allocation to help backstop efforts to fight the spread of the crisis. The European Central Bank has been buying euro-zone bonds in an effort to keep borrowing costs of weakened members from exploding.

Bond Insurer Assured Guaranty Defends Against Attack by ...https://www.insurancejournal.com/news/international/2018/04/24/487181.htmApr 24, 2018 · Einhorn often unveils short bets where he thinks the stock price will fall and surged to fame 10 years ago with a call against Lehman Brothers only months before the bank collapsed.

Black Swan Event: Can This Economic Crisis be Worse than ...www.mybudget360.com/black-swan-event-can-this...Take a look at the fall of Lehman Brothers for example. During the Great Depression, thousands of banks failed but many were lightly connected. Now with the failure of Washington Mutual one big bank failure is the equivalent of hundreds of smaller banks. Watch …

Danvers Bancorp cranks up loan spigots as larger rivals ...https://www.bizjournals.com/boston/stories/2010/02/22/story9.htmlFeb 22, 2010 · About eight months before Lehman Brothers collapsed in the fall of 2008, Danvers Bancorp Inc. reeled in about $175 million in capital from its conversion to a …

Made in Germany | World Financial Crisis: Is there Hope ...https://www.youtube.com/watch?v=q-3BOE0cQnwSep 25, 2008 · The past turbulent week saw the collapse of Lehman Brothers and the 85 billion dollar rescue of US insurer AIG. Crises are popping up all over on world finance markets. It …

Finance world from recession to powerhouses - IMDbhttps://www.imdb.com/list/ls049979549Lehman Brothers (3) Lie (3) Loan (3) ... Based on the true story of Jordan Belfort, from his rise to a wealthy stock-broker living the high life to his fall involving crime, ... An investigation of the 2008 banking crisis: what went wrong, who is to blame, and how long it will take to repair the damage. Director: ...

J-GoodTech Aster Co., Ltd. |Company Profilehttps://jgoodtech.jp/en/web/page/corp/-/info/JC0000000005194/outline/engPage for the corporate outline of Aster Co., Ltd.. J-GoodTech is the business matching website to connect Japanese small and medium enterprises with the world's companies. The Lehman Brothers bankruptcy in 2008 provided an opportunity for establishing our company. Our predecessor, a manufacturer of machine parts, closed its factory due to a drastic decrease in orders, and planned to …

Note To Chuck Todd: Kasich Is A Churchgoing Anglicanplunderbund.com/2015/05/31/note-to-chuck-todd...May 31, 2015 · If you, as I did, quickly recalled that sector as Lehman Brothers, the Wall Street global investments firm, that gave up its ghosts in 2008 and declared bankruptcy , and Fox News, where Kasich was a regular contributor, I’m now waiting for him to tell all of us what he learned.

Prof. Edward Pekarek talks to Law360 about the collapse of ...newswire.blogs.pace.edu/2011/...talks...of-mf-globalNov 03, 2011 · In Law360 article this week, experts assert that while MF Global Holdings Ltd.’s high-profile bankruptcy filing Monday might be reminiscent of the 2008 collapse of Lehman Brothers, the “Lehman Brothers Holdings Inc. case could provide a roadmap that will streamline MF Global’s restructuring.”. According to the article: “MF Global filed for bankruptcy after revealing it had lost ...

Masters In Business: BAML's Michelle Meyerhttps://www.valuewalk.com/2015/03/masters-in-business-bamls-michelle-meyerWe also chatted about more personal issues: What it was like being at Lehman Brothers in the midst of the financial crisis and the firm’s bankruptcy. We also discuss the challenges facing women in what has been a male dominated profession, and what a day in the life is like at a big firm for an economist.[PDF]Nationwide Mutual Funds Annual Reportglobaldocuments.morningstar.com/documentlibrary/...Lehman Brothers (LB) U.S. Aggregate Index: An unmanaged, average score of three risk factors for measuring growth stocks market value-weighted index of investment-grade, ?xed-rate (constitutes about 33% of the S&P 500 Index’s total market cap);

Why financial stocks haven’t fallen muchblogs.reuters.com/felix-salmon/2010/10/15/why...Oct 15, 2010 · Bank stocks didn’t do so well this week, what with foreclosuregate coming to a boil. But they didn’t do all that badly, either, as a group: the XLF financial sector ETF ended the week down a pretty modest 2.45% from where it started.. You might remember the XLF fund from a famous column by Evan Newmark two years ago, a few weeks after Lehman Brothers declared bankruptcy and the …

S&P slams Brexit, drops UK bond rating two notcheshttps://hotair.com/archives/ed-morrissey/2016/06/...Jun 27, 2016 · Previously, S&P asserted that the Brexit vote created the biggest daily loss in equity markets in history — outstripping the collapse of Lehman Brothers in 2008: If that’s the case — and if that’s unrecoverable, which it probably isn’t — then it justifies some rethinking of credit ratings, to be sure.

A little bit of realism | The Indian Expresshttps://indianexpress.com/article/opinion/...Sep 06, 2016 · In 2008, as Lehman Brothers collapsed, and the global financial crisis loomed, the G20 played a key role in averting a calamity. The members no longer have a common cause. There has been little progress on agreed ends — witness the fate of last year’s G20 summit agreement for cooperation against terrorism.

South County appraiser gets 3 years for mortgage scheme ...https://www.ocregister.com/2010/01/29/south-county...Jan 29, 2010 · Lehman Brothers Bank alone was deceived into funding more than 80 such inflated loans from 2000 into 2003, resulting in tens of millions of dollars in losses, Mrozek said.[PDF]Econ 353: Financial Institutionshttps://econ.duke.edu/sites/econ.duke.edu/files/course-attachments/ECON353_15F...The subprime crisis, Bear Stearns and Lehman Brothers Mid-term Exam Part IV: Central banks and economic policy – Chapters 11-14, 16-17 Ball Revisiting money supply, interest rates and economic growth Monetary policy and the FOMC The European Monetary Union and the euro Inflation and deflation

What Makes for a Good Collateral Asset? | Nasdaqhttps://www.nasdaq.com/articles/what-makes-for-a...Jan 06, 2021 · In the case of Lehman Brothers, a large U.S. financial institution that filed for bankruptcy, transferring certain client assets became difficult in part due to a lack of easily accessible records ...

District Court Vacates Decision in Lehman Brothers ...https://www.arentfox.com/perspectives/alerts/...On March 31, 2014, the United States District Court for the Southern District of New York issued a decision in In re Lehman Brothers Holdings Inc., et al., vacating the Bankruptcy Court’s decision allowing the payment of individual committee members’ professional fee expenses, and remanding to the Bankruptcy Court to determine whether such ...

What is the role of cash in an investment portfolio ...https://www.sharesight.com/blog/what-is-the-role...In the six months following the collapse of Lehman Brothers in September 2008, the S&P 500 fell 46%, from 1,233.81 to 666.79. For older investors allocating most or all of their portfolio in stocks, the crash would’ve been devastating.

Rs 1 crore a day is not far away for PE-backed Indiamart ...https://www.business-standard.com/article/...It was then that Indiamart shifted focus to the domestic SME segment. The business picked up well and Agarwal was soon in talks with investors such as Intel Capital and Bennett, Coleman and Co. Then, Lehman Brothers happened, sending valuations for a toss. "The day the money finally came in, the Sensex was at its lowest," he recalls.[PDF]GENERAL APTITUDE Q. No. 1 - 5 Carry One Mark Each 1. The ...https://gateforum.com/wp-content/uploads/2020/04/ECGUQPWVL_20.pdfApr 27, 2020 · banking crisis in 2008 with the collapse of Lehman Brothers in 2008. The sub-prime lending refers to the provision of loans to those borrowers who may have difficulties in repaying loans, and it arises because of excess liquidity following the East Asian crisis.[PDF]ING VUL-CV A FLEXIBLE PREMIUM VARIABLE UNIVERSAL LIFE ...https://www.sec.gov/Archives/edgar/data/917677/...Fund. For a more complete description of these funds' investments, risks, costs and expenses, please see the prospectus for each fund. Your policy's prospectus and the fund prospectuses can be requested by calling our Customer Service Center toll-free at 1-877-253-5050.

A man speaks on the phone outside of the ... - Getty Imageshttps://www.gettyimages.com/detail/news-photo/man...The September 15th 2008 collapse of the investment bank Lehman Brothers officially marked the beginning of the global meltdown which resulted in billions in financial losses around the world. Millions of people lost their jobs, homes and savings in what was one of the worst recessions in U.S. history.

Mark Alan Abrams Archives - California Real Estate Fraud ...https://www.californiarealestatefraudreport.com/archives/tag/mark-alan-abramsSep 15, 2011 · One of the remaining defendants in the Beverly Hills mortgage fraud story that dates back 10 years and costs Lehman Brothers Bank tens of millions of dollars has been sentenced to prison.. U.S. District Judge Dean D. Pregerson sentenced Richard A. Maize, 53, a former Beverly Hills mortgage banker, to 18 months in prison. Maize pleaded guilty to conspiracy to commit bank fraud, loan fraud …[PDF]GENERAL APTITUDE Q. No. 1 - 5 Carry One Mark Each 1. The ...https://gateforum.com/wp-content/uploads/2020/04/ECGUQPWVL_20.pdfApr 27, 2020 · banking crisis in 2008 with the collapse of Lehman Brothers in 2008. The sub-prime lending refers to the provision of loans to those borrowers who may have difficulties in repaying loans, and it arises because of excess liquidity following the East Asian crisis.

Centralised Clearing May Not Be a Panacea for Counterparty ...https://www.cfainstitute.org/en/research/financial...In contrast, a buyer who had purchased a similar CDS via a CCP was unaffected by Lehman Brothers’ bankruptcy. Centralised clearing alters the constitution of the bilateral element by removing the credit exposure of buyers and sellers to one another and replacing it with a credit exposure to the CCP.

A man sits on steps along Wall Street on ... - Getty Imageshttps://www.gettyimages.com/detail/news-photo/man...The September 15th 2008 collapse of the investment bank Lehman Brothers officially marked the beginning of the global meltdown which resulted in billions in financial losses around the world. Millions of people lost their jobs, homes and savings in what was one of the worst recessions in U.S. history.

April 2020 – The FinReg Bloghttps://sites.law.duke.edu/thefinregblog/2020/04Apr 29, 2020 · Courtesy of Chris Smith and Sangita Gazi A decade after Lehman Brothers collapsed, the Federal Reserve Bank of St. Louis reviewed the economics literature and concluded that “one of the main reasons why the subsequent recession was ‘great’ was due to high levels of leverage and debt.” On the eve of the 2008 financial crisis, […]

Finance company - CEOpedia | Management onlinehttps://ceopedia.org/index.php/Finance_companyThe global crisis can be started by bankruptcy of one of the financial institution, like it happened from 2008 by information about bankruptcy of Lehman Brothers bank. Lehman brothers bank was an American bank, one of the biggest investment banks in the world, founded in 1850 by Henry, Emanuel and Mayer Lehman.

Corzine’s MF Global files for bankruptcyhttps://nypost.com/2011/10/31/corzines-mf-global-files-for-bankruptcyOct 31, 2011 · The bankruptcy ended one of the most harrowing weekends on Wall Street since Lehman Brothers on Sept. 15, 2008 imploded on worries that it was choking on toxic mortgage debt.

Bond Vigilantes Set Sights on Sovereign Debt | Nasdaqhttps://www.nasdaq.com/articles/bond-vigilantes...Feb 25, 2010 · The collapse of Lehman Brothers ( LEHMQ.PK) triggered one of the biggest corporate debt defaults in history, and also ignited the biggest stock market meltdown in …

Monument To Wall Street Glory Becomes Just Another ...https://www.investors.com/news/monument-to-wall...But the grand ambitions began to unravel after the 2008 financial crisis that pushed Wall Street to the brink of failure and sunk one of its biggest players, Lehman Brothers Holdings. Bondholder ...

Why should you care about yield curves? by Les Nemethy and ...https://europhoenix.com/blog/why-should-you-care...By the time Lehman Brothers filed for bankruptcy on September 15, 2008, the US bond yield curve was even less inverted (Figure 4). In the same way that an electrocardiogram doesn’t reveal continuous problems leading up to a heart attack, but may very well reveal some temporary negative patterns in the preceding weeks or months, so too with ...

Another banking crisis begins? - MINING.COMhttps://www.mining.com/web/another-banking-crisis-beginsOct 04, 2016 · Do you remember Lehman Brothers? On June 11, 2008, after moves to shore up the balance sheet and increase capital, Lehman CEO Dick Fuld assured us that “the worst is behind us.”

Lehman Brothers and Bear Stearns employed 40,000 people ...https://www.linkedin.com/pulse/lehman-brothers...About 150 of the Bear Stearns and Lehman Brothers crisis alumni classify the U.S. Federal Reserve system — its board of governors or one of its 12 banks — as their current employer.

Best Banks In Client Trust Ratings: Here Are The Top 3 ...https://www.investors.com/news/best-banks-client-trust-ratings-here-are-top-3Sure, the bankruptcy of Lehman Brothers in 2008 absorbed some of the hit, and later Wells Fargo took much of the brunt when it was fined $3 billion for its role in a fake-account scandal.

A Colossal Failure of Common Sense Books, Book Price ...www.bookfinder4u.com/search/A_Colossal_Failure_of_Common_Sense.htmlA Colossal Failure of Common Sense: The Incredible Inside Story of the Collapse of Lehman Brothers: The Inside Story of the Collapse of Lehman Brothers by Larry S. McDonald One of the world's biggest and most successful ban ISBN: 0091936152 | ISBN-13: 9780091936150 More Details Similar Books

How shipping has changed since Lehman Brothers collapsed ...https://splash247.com/how-shipping-has-changed...Lehman Brothers world headquarters is shown Monday, Sept. 15, 2008 in New York. Lehman Brothers, burdened by $60 billion in soured real-estate holdings, filed a …

The bank merger rumor mill is heating up - Sep. 17, 2008https://money.cnn.com/2008/09/17/news/companies/merger_rumors/index.htmSep 17, 2008 · NEW YORK (CNNMoney.com) -- Wall Street isn't finished yet. In a two-day span, Lehman Brothers (LEH, Fortune 500) filed for bankruptcy, Bank of America (BAC, Fortune 500) snapped up Merrill Lynch ...

Dodd-Frank News Center: Bankruptcyhttps://financialreform.wolterskluwerlb.com/bankruptcyRep. Spencer Bachus, R-Ala., has sent a letter to Financial Services Committee Chairman Barney Frank, D-Mass., calling for an investigatory hearing to be held on the bankruptcy of Lehman Brothers, whose collapse contributed to the financial crisis in the fall of 2008. As Ranking Member on the Committee, Bachus called for the hearing on new ...

Is a U.S. Default Inevitable? | RealClearPoliticshttps://www.realclearpolitics.com/articles/2010/01/...Jan 16, 2010 · Backing up Blankfein's plea of ignorance and incomprehension is this: The crisis killed Lehman Brothers and would have killed every one of them …

Credit Default Swaps, Part One: Origins and Implementationshttps://seekingalpha.com/article/100714-credit-default-swaps-part-one-origins-and...Oct 20, 2008 · You (Bond Guru Inc.) were long a Lehman Brothers’ CDS, and were probably paying a healthy quarterly premium to the seller (Default Newbie Inc.) of the CDS. When Lehman filed for bankruptcy, this ...

Is a U.S. Default Inevitable? by Pat Buchananhttps://townhall.com/columnists/patbuchanan/2010/...Jan 15, 2010 · Backing up Blankfein's plea of ignorance and incomprehension is this: The crisis killed Lehman Brothers and would have killed every one of them …[PDF]Q1 Legg Mason Partners Social Awareness Fundglobaldocuments.morningstar.com/documentlibrary/...5 The Lehman Brothers U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage and asset-backed issues, rated investment …

alerts & publications - O'Melveny & Myershttps://www.omm.com/resources/alerts-and-publications/alerts/energy-practice...Dec 06, 2017 · At the height of the financial crisis, Chrysler, General Motors, and Lehman Brothers were just some of the big-name companies to utilize section 363(f) to facilitate quick sales in order to preserve value and shed unwanted liabilities.

How the right asset mix can lower your risk | Vanguardhttps://investor.vanguard.com/college-savings-plans/what-is-asset-mixFor U.S. bond market returns, we use the S&P High Grade Corporate Index from 1926 through 1968, the Citigroup High Grade Index from 1969 through 1972, the Lehman Brothers U.S. Long Credit AA Index from 1973 through 1975, the Barclays U.S. Aggregate Bond Index from 1976 through 2009, and the Spliced Barclays U.S. Aggregate Float Adjusted Bond ...[PDF]Betterment’s Consumer Financial Perspectives Report: 10 ...https://www.betterment.com/uploads/2018/09/...Consumer Financial Perspectives Report 10 Years After the Crash 8 Roughly half (47%) of survey participants were investing in 2008. People who had money in the market when Lehman Brothers collapsed felt the pain: 93% of investors said they were affected by the crisis, and 80% said they lost money in the market.

Bankruptcy Information | Banks Want Out of Tough ...https://bankruptcylawnetwork.com/banks-want-out-of-tough-accounting-rulesAnd there are strong hints in the Lehman Brothers’ bankruptcy that accountants are still letting some banks be very generous in their valuation of collateral. So apparently the banking industry thinks that having less clarity, more guesswork in their book-keeping, and perhaps a set of rose-tinted glasses, will be a good thing for the American ...

IT Diwali Celebrations | Bangalore Software Hub | Infosys ...https://www.oneindia.com/2009/10/17/recovering...Oct 17, 2009 · Bangalore, Oct 17: In contrast to the dull 2008 Diwali following the collapse of the Lehman Brothers leading to one of the world's worst economic crisis, Indian IT is all set for a bright 2009 Diwali.[PDF]IN THE COURT OF CHANCERY OF THE STATE OF DELAWAREonline.wsj.com/public/resources/documents/delmonte.pdfunderstood that it was one of Del Monte’s principal investment banks. Del Monte’s stable businesses throw off large amounts of cash, a critical attribute for debt-fueled LBOs. In fiscal 2010, for example, Del Monte generated $3.7 billion in net sales and $250 million in …

Willkie Farr Adds 2 More Restructuring Pros - Law360https://www.law360.com/articles/173601/willkie-farr-adds-2-more-restructuring-prosShe recently handled complex international bankruptcy and jurisdictional issues in connection with the Lehman Brothers Holdings Inc. Chapter 11 proceeding. Chapter 11 proceeding.

Prison Planet.com » Is a U.S. Default Inevitable? - infowarshttps://www.prisonplanet.com/is-a-u-s-default-inevitable.htmlBacking up Blankfein’s plea of ignorance and incomprehension is this: The crisis killed Lehman Brothers and would have killed every one of them had not the Treasury and Fed, neither of which saw it coming, either, intervened with hundreds of billions in bailout cash.

African writer's American Dream comes true - Breitbarthttps://www.breitbart.com/news/african-writers-american-dream-comes-trueSep 12, 2016 · Mbue’s tale of a migrant from her oceanside hometown of Limbe who lands a job as a chauffeur for a Lehman Brothers executive — just before the bank’s collapse triggered a global financial crisis — is a bittersweet tale of great expectations slowly shattered. – Folly of the 1 percent –

Should the CEO of Lehman been hung drawn and quartered ...https://au.answers.yahoo.com/question/index?qid=20081007041337AAWe6YHOct 07, 2008 · Seems that bastard who ran Lehman Brothers which was a major catalyst in the Wall St collapse has pocketed half a billion dollars while losing shareholders over 100 billion dollars.

Is a U.S. Default Inevitable? | Human Eventshttps://humanevents.com/2010/01/15/is-a-us-default-inevitableJan 15, 2010 · Backing up Blankfein’s plea of ignorance and incomprehension is this: The crisis killed Lehman Brothers and would have killed every one of them had not the Treasury and Fed, neither of which saw it coming, either, intervened with hundreds of billions in bailout cash.

Mr. David M. Guess - Irvine, CA Attorney | Lawyers.comhttps://www.lawyers.com/irvine/california/david-m-guess-14540857-a-- Represented a hedge fund with a partial beneficial interest in over $1.6 billion in note and guaranty claims in the bankruptcy case of Lehman Brothers -- Represented 420-bed acute care hospital debtor in appeals from its chapter 11 plan confirmation order, and represented purchaser of assets of aerospace and defense company debtor in appeal ...

Lehman Brothers workers share memories 10 years after the ...https://www.reuters.com/article/us-lehman-reunion-idUSKCN1M12Q6Ex-employees of Lehman Brothers Holdings Inc met at Irish pubs near their former office in Midtown Manhattan on Thursday night to reminisce 10 years after the bank's collapse, in gatherings with ...

Lehman Brothers collapse stuns global markets - CNN.comhttps://www.cnn.com/2008/BUSINESS/09/15/lehman...Sep 15, 2008 · The leading U.S. investment bank Lehman Brothers filed for bankruptcy and brokerage Merrill Lynch was the subject of a $50 billion buyout by Bank of America.

Case Summary : Lehman Brother Holdings, Inc. Essay | Bartlebyhttps://www.bartleby.com/essay/Case-Summary-Lehman...Lehman Brothers Holdings, Inc. (Case 1.2) Case Summary When Lehman Brothers filed for bankruptcy in September 2008 it was the largest corporate filing in our country’s history. Lehman Brothers Holdings Inc. declared $639 billion in assets and $613 billion in debt (Florescu, 2017).

Lehman's $350M Broken-Lease Settlement Gets Judge's Nod ...https://www.law360.com/articles/585690/lehman-s...A New York bankruptcy judge has approved bankrupt Lehman Brothers Holdings Inc.'s plan to settle for $350 million an originally $4.47 billion claim for breaking a lease for pricey London real ...Author: Cara Salvatore

Court approves Lehman plan to exit bankruptcy | Reutershttps://www.reuters.com/article/us-lehman/court-approves-lehman-plan-to-exit...Dec 06, 2011 · Lehman Brothers Holdings Corp, now just the odds and ends of the global financial behemoth that collapsed in September 2008, received court approval on …

Lehman report casts auditors in poor light | Financial Timeshttps://www.ft.com/content/e062fdda-2f97-11df-9153-00144feabdc0Claims about Ernst & Young’s part in the collapse of Lehman Brothers look set to open a wider debate on what has until now been one of the least dissected aspects of the financial crisis – the ...

What could trigger new global crisis like Lehman collapse ...https://www.investmentwatchblog.com/what-could...The collapse of banking giant Lehman Brothers was the catalyst for a financial crisis in 2008. What could cause a new great recession a decade later? The Boom Bust show investigates.

Lehman Brothers Press Releasehttps://www.pressreleasepoint.com/lehman-brothers-0Avis Budget Group: 03/12/2018 - 02:24 : The Troubled Legacy Of Dodd-Frank. It has been almost ten years since the financial crisis of 2008, which threw the financial system into turmoil with the collapse of Lehman Brothers.[PDF]The Future of Foreclosure Law in the Wake of the Great ...scholarship.law.nd.edu/cgi/viewcontent.cgi?article=...shook when it was announced that Lehman Brothers, one of the nation’s premier financial institutions, had failed. 3 For many people, this was the * Clinical Professor at Notre Dame Law School.

The worst financial crashes in history - DISCUSS | BLOG | CUblogs.coventry.ac.uk/discover/the-worst-financial-crashes-in-historyThis was the worst financial crisis since The Great Depression and for most of us (who aren’t approaching 100) it’s the one we will remember most clearly. This crash was triggered by the collapse of the housing market in the US and then the collapse of Lehman Brothers, one of the biggest US investment banks.

discussion 8.docx - In 2008 Indymac and Lehman Bros caused ...https://www.coursehero.com/file/76113842/discussion-8docxLehman Bros Bank located in New York and was the fourth largest investment bank. There were several factors for Lehman Bros Bank contributing to its collapse, many experts seem to agree that it was in large part due to a lack of trust, over-leveraging, poor long-term investments, and shaky funding.[PDF]Global Financial Transactions and Jurisdictional ...elibrary.law.psu.edu/cgi/viewcontent.cgi?article=1176&context=psilrfiling for bankruptcy by Lehman Brothers Holdings International, Inc., the parent company, and Lehman Brothers Special Financing, the subsidiary, and, on occasion, the issue has been whether the borrower for bankruptcy purposes was the corporate group, the parent company or the

Lehman Brothers workers share memories 10 years after the ...https://uk.reuters.com/article/uk-lehman-reunion-idUKKCN1M12PZEx-employees of Lehman Brothers Holdings Inc met at Irish pubs near their former office in Midtown Manhattan on Thursday night to reminisce 10 years after the bank's collapse, in gatherings with ...

Bankruptcy | The 3 Largest Bankruptcies in U.S. History ...https://www.dsouzalegalgroup.com/the-3-largest-bankruptcies-in-u-s-historyAug 24, 2018 · The final dagger for Washington Mutual was the loss of customer deposits. When Lehman Brothers went down, people everywhere started pulling all of their money out of investments and banks. Prior to declaring bankruptcy, Washington Mutual had $329.7 billion in assets. 1 – Lehman Brothers. You may be familiar with the term “subprime mortgage”.

Available to Registered users only - Global Risk Regulatorhttps://www.globalriskregulator.com/Subjects/...Jan 14, 2019 · One of the great lessons of the collapse of Lehman Brothers was the lack of data surrounding its operations and relationships with counter-parties. Since then there has been an intense focus on data quality with considerable progress made. By Charlie Browne, head of market data and risk at GoldenSource.

Lots of noise from Warren but little delivery - The Boston ...https://www.bostonglobe.com/opinion/2013/07/20/the...Jul 20, 2013 · Goldman Sachs, which notoriously bet both sides of the market downturn, wasn’t a bank, and nor was Lehman Brothers, the investment firm whose bankruptcy triggered the economic crash in …

Why Incentive Program Design Really Mattershttps://www.creativegroupinc.com/2017/08/22/why...Aug 22, 2017 · Compensation Example #2 – Lehman Brothers. Do you remember Lehman Brothers? At the beginning of 2008 they had about $680 billion in assets. By the end of 2008, they were essentially gone. In the eyes of some, the collapse of Lehman Brothers was the canary in the coal mine of the Great Recession.

Lehman Brothers, Merrill Lynch Gobbled by Marketwww.findingdulcinea.com/news/.../Lehman-Brothers...Sep 15, 2008 · The beginning of the end for Lehman and Merrill, as has been the case with much of the financial industry, was the sub-prime crisis. Merrill Lynch replaced CEO Stan O’Neal last October after the bank posted third-quarter 2007 losses of $2.3 billion and $8.4 billion in debts incurred by failed credit and mortgage-related investments—its worst-ever showing in the bank’s then 92-year history.

5 tech trends every bank should be prepared for in 2021 ...https://www.dialabank.com/news/5-tech-trends-every...Jan 28, 2021 · A similar crisis occurred in 2008 with the Lehman Brothers crisis. The global disruption caused by the pandemic can be seen in a similar sense. Back in 2008, this crisis had led to a change in the economic regime and has forced the authorities to make any changes. The same can be …[PDF]1-Toxic currency options in Poland as a consequence of the ...www.davidpublisher.com/Public/uploads/Contribute/56d7f85e1a461.pdfCONSEQUENCE OF THE 2008 FINANCIAL CRISIS 564 That tendency held on for a fairly long time, which prompted businesses to take short positions on currency. The Lehman Brothers collapse dragged down the Polish currency and implied volatility shoot up …

How Did TXU Go Bankrupt? - Choose Energyhttps://www.chooseenergy.com/blog/energy-news/how...But speculation for a year or more that this would happen is only part of the story. The intricate structure of debt, holding companies and leverage seems to be exceeded only by the strange and complex deals that brought down Lehman Brothers and caused financial panic 5 years ago this week.

Top 5 Worst Accounting Scams In US Historyblog.accountingprincipals.com/top-5-worst-accounting-scams-historyLehman Brothers The investment bank with $600 billion in assets borrowed significant amounts to fund investments in the years leading up to its bankruptcy. A significant portion of this investment was in housing-related assets.

P1.T1.20.14. Learning from financial disasters (first of ...https://www.bionicturtle.com/forum/threads/p1-t1-20-14-learning-from-financial...Apr 08, 2020 · Three famous financial disasters are Continental Illinois (whose failure in 1984 was the largest bank failure in US history prior the global financial crisis), Lehman Brothers (who was the fourth-largest U.S. investment bank before filing for bankruptcy in 2008), and Northern Rock (who was a fast-growing British mortgage bank, who in 2008 was ...[PDF]Never Again,' Again: A Functional Examination of the ...https://repository.law.umich.edu/cgi/viewcontent.cgi?article=1076&context=mlrmanaged banks could fail due to a lack of liquid assets. The financial crisis of 2007-2008 revealed the extent to which the U.S. financial system is ex-posed to the risk of a system-wide failure from insufficient liquidity. Financial regulators from economies around the world have responded to

Catherine Rampell: Trump’s economic team needs to grow up ...https://www.sltrib.com/opinion/commentary/2018/03/...Mar 27, 2018 · They released a joint statement shortly after Lehman Brothers collapsed, about the need “to rise above politics for the good of the country.” Imagine such a thing.

Why Zero Wall Street CEOs Are in Jail - POGO.orghttps://www.pogo.org/analysis/2013/09/why-zero-wall-street-ceos-are-in-jailThe Wall Street Journal made a startling point in its Wonkblog yesterday: five years after Lehman Brothers fell and the U.S. economy collapsed in on itself, not a single Wall Street C.E.O. is in jail. In fact, none of them have even faced criminal charges. Those men in charge, whose shady practices landed the United States’ economy in the worst shape it’s been in in decades, include ...

Nomura Analyst Predicts Possible Lehman Brothers Type ...https://www.bankingexchange.com/big-data/item/7973...The 2008 crisis came in a similar time of year, with a drop of market value that was more than 1/3 of the market. While the market was the shakiest since the Great Depression at the time, it bounced back with one of the strongest decade in stock market history, and notably strong overall stability for America’s banking industry.

Banks Could Still Blow Up The World | HuffPosthttps://www.huffpost.com/entry/banks-derivatives_n_4638942Jan 25, 2014 · Banks Could Still Blow Up The World. ... during the Lehman Brothers meltdown when banks suddenly realized they didn't understand just how exposed they were to huge losses on derivatives trades with Lehman and others. That led to a panic that caused global financial markets to basically shut down for a little while, in what was the worst crisis ...

The Wild Beasts of Chinese Real Estate Are Growing Up ...https://www.bloomberg.com/opinion/articles/2019-04...Apr 02, 2019 · There was the 4 trillion yuan stimulus after the collapse of Lehman Brothers, the local government financing vehicles in the summer of 2012, and the People’s Bank of …[PDF]Beyond Dodd-Frank: Pinning Down the Octozilla of Too-Big ...https://ir.stthomas.edu/cgi/viewcontent.cgi?article=1061&context=ocbeblpub1 In 2010, Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act1 (Dodd- Frank). According to its preamble, Dodd-Frank was supposed “to end ‘too big to fail.’” 2 “Too big to fail” (TBTF) had played a devastating role in the 2008 Financial Crisis in the United States.3 In order to address the problem of TBTF, Dodd-Frank employs a number of approaches.4 ...

Who Cares About Syria? The Fed Is Buying Fewer Bonds ...https://blogs.wsj.com/moneybeat/2013/09/04/who...Sep 04, 2013 · These will rally in tandem at times of global market stress--as they did after the collapse of Lehman Brothers, during the worst moments of the euro crisis and even after Standard & Poor's ...

Investors face U.S. default risk with no Plan B - The ...https://www.theglobeandmail.com/report-on-business/international-business/investors...Jul 25, 2011 · Fund managers are reluctant to seek insurance for a low probability or 'tail risk' event ... even after suffering huge losses following the collapse of Lehman Brothers in 2008. This was the tail ...

The travel entrepreneur who beat the market downturn not ...https://www.business-standard.com/article/...Dec 16, 2020 · Twelve years years ago, just when he started work on the company, the 2008 Lehman Brothers crisis hit. That led to at least one investor pulling out the term sheet. Now, in the pandemic year, travel is one of the most, if not the most, affected business industries and Ixigo is in a tough spot.

Money safety in bank crisis - CNN Businesshttps://money.cnn.com/2008/09/15/pf/saving/toptipsSep 15, 2008 · Lehman Brothers filed for Chapter 11 bankruptcy protection and Bank of America is buying Merrill Lynch. With the changing banking landscape, here's what …

Goldman Sachs Downgrades Global Stocks as Rally Stallshttps://www.cnbc.com/id/100451957Feb 12, 2013 · World stock markets have rallied to levels not seen since the collapse of Lehman Brothers in January, but the bull market has screeched to a halt and now one of …

Marc E. Hirschfield — RCCB Lawwww.rccblaw.com/marc-e-hirschfield-bioI was appointed by the United States Bankruptcy Court for the Southern District of New York to be on the Mediation Panel for indemnification claims asserted by Lehman Brothers. An international bank as secured creditor in a Chapter 11 case pending in Delaware and with respect to a …

Lehman Brothers Archives - Your Moneyhttps://www.yourmoney.com/tag/lehman-brothersToday marks the seventh anniversary of the Lehman Brothers bank collapse. Graham Spooner, ... 0. Jan 09, 2014. Regulators look to draw up list of ‘too big to fail’ asset managers. ... These are the words in a series of adverts which... 0. Sep 13, 2013 ...

BBC - Todaynews.bbc.co.uk/today/hi/today/newsid_7615000/7615947.stmSep 15, 2008 · One of the biggest investment banks in the US, Lehman Brothers, has filed for bankruptcy protection. Ten other international banks are to create a pool of nearly $70bn to try to minimise further turmoil in markets. And Vince Cable, Liberal Democrat treasury spokesman, explains Nick Clegg's plans for cutting taxes.

The Worst Investment Opportunity We Have Ever Seen - ValueWalkhttps://www.valuewalk.com/2020/08/spruce-worst-investment-opportunityThe Enron And Lehman Brothers Scandal. I witnessed the Enron (NYSE: ENE) scandal firsthand at the epicenter and watched bankers in the thick of the mess incapable of spotting red flags, and the ultimate fraud, that was being perpetuated right in front of their faces before it collapsed. Perhaps they took comfort in the charismatic CEO Ken Lay and his assurances:

Bankruptcy court hears that Och-Ziff had information on ...https://www.fnlondon.com/articles/och-ziff-lehman-shorting-20100813Aug 13, 2010 · Lehman Brothers Holdings says Och-Ziff Capital Management, one of the world's biggest hedge funds, has information about efforts to "short and distort" the investment bank's stock before its collapse in September 2008.

Fed’s Balance Sheet Grows by $2.4 Trillion in One Year to ...https://wallstreetonparade.com/2020/04/feds...Apr 16, 2020 · Following three rounds of Quantitative Easing (QE) after the financial crisis on Wall Street in 2008, the Fed’s balance sheet peaked at $4.5 trillion in 2015. On the day that Lehman Brothers collapsed into bankruptcy on September 15, 2008, the Fed’s balance sheet stood at just $995 billion.

WAPPP Wire: Corporate Boardrooms: Where are the Women?https://wapppwire.blogspot.com/2014/09/corporate...Op-Ed By Amanda Clayton, WAPPP Fellow, Postdoctoral Fellow, Free University of Berlin During the global financial crisis, several public figures asked: would we be here if Lehman Brothers had been Lehman Sisters? This question resurfaced in late 2013 when Twitter went public with an all-male corporate board The New York Times columnist Nicholas Kristof to wryly point out if Twitter added …

To bankruptcy and back- Business Newshttps://www.businesstoday.in/magazine/trends/to...Here are the five biggest. Lehman Brothers Pre-bankruptcy assets: $691 billion The bank filed for bankruptcy under Chapter 11 on September 15, 2008 but changed the filing to Chapter 7 bankruptcy ...

CFPB defends its toughness; Freedom Mortgage's rapid rise ...https://www.americanbanker.com/morning-scan/cfpb...Looking back: Ten years “after presiding over the collapse of Lehman Brothers,” which the Wall Street Journal calls “the biggest casualty of the worst financial crisis since the Great Depression,” former CEO Dick Fuld “is still working on the second act of a Wall Street career that many predicted had also expired in September 2008.”

Monument to Wall Street Glory Becomes Just Another ...https://www.bloomberg.com/news/articles/2017-04-19/...Apr 19, 2017 · But the grand ambitions began to unravel after the 2008 financial crisis that pushed Wall Street to the brink of failure and sunk one of its biggest players, Lehman Brothers Holdings Inc ...

Did Howard Marks Lose Money on $75MM Malibu Sale? Plus 4 ...https://la.curbed.com/2013/1/30/10279144/did...Jan 30, 2013 · Real estate investor C. Frederick Wehba started building the joint in 2006 as his family's supposed dream house, before Lehman Brothers collapsed and …

Top Tips About VMware 5V0-32.19 Exam Preparation 2021 ...https://www.guest-articles.com/education/top-tips...This interdisciplinary occupation is starting to become precisely appropriate right soon after the new actual estate collapse a result 5V0-32.19 test of shady house loans and also the subsequent slide of suppliers like AIG, Lehman Brothers and what appears like fifty % of Wall Avenue.

Subprime Litigation Targets: Rating Agencies, Auditing ...https://www.dandodiary.com/2008/12/articles/sub...Lehman Excavation: The November 30, 2008 issue of New York Magazine has a cover article entitled "Burning Down His House" about the fall of Lehman Brothers and the role of Lehman CEO Richard Fuld in the firm’s collapse. The article raises the question whether Fuld is a dupe or a victim; the article says:

October 3, 2016 - Why Deutsche Bank Isn't Lehman | T ...https://www.tjacksonco.com/blog/october-3-2016-why-deutsche-bank-isnt-lehmanOct 03, 2016 · A similar loss of confidence in Lehman Brothers in 2008 caused counterparties (major clients) to ask the cash-strapped firm for their money back, triggering its collapse and the beginning of the financial crisis. However, Deutsche Bank is not Lehman, and the world is …

The Outsider: Xavier Rolet - TIMEcontent.time.com/time/magazine/article/0,9171,1988858,00.htmlMay 24, 2010 · "These are turbulent times," says Rolet, 50, who learned all about dislocation during the collapse of Lehman Brothers. "We are moving in directions that are hard to forecast." (See pictures of the global financial crisis.) Rolet sees the world moving to a system of just a handful of dominant, pan-global exchanges.

Domestic Debt Before & After the Great Recession - Real ...https://realestateinvestingtoday.com/domestic-debt...Nov 01, 2018 · A recent report from the Federal Reserve Bank of St. Louis notes that September marked the 10th anniversary of the collapse of Lehman Brothers, marking the critical stage of the financial crisis. They say that many economists argue that one of the main reasons why the subsequent recession was “great” was due to high levels of leverage and debt, particularly in the financial and household ...

The Conservatives must mean business | Conservative Homehttps://www.conservativehome.com/thetorydiary/2013/...For the central question for Labour since the collapse of Lehman Brothers has been not so much about ideology as practice : namely, how does the Party pay for its client group – the public ...

Opinion: Studies Show TARP Worked, But We Should Never Do ...https://www.benzinga.com/government/19/03/13302061/...By John Sedunov, Allen Berger, and Raluca Roman.. Amid the throes of the financial crisis exacerbated by the collapse of Lehman Brothers, Congress passed the Emergency Economic Stabilization Act ...

Trusting Brands in an Era of Mistrusthttps://littlebuddhaagency.com/blog/trusting-brands-in-an-era-of-mistrustThe economic crisis that began in 2008 with subprime mortgages and the Lehman Brothers’ bankruptcy led to a significant alteration in society’s values. The sudden change from a situation of comfort to one of crisis led to millions of people losing their jobs. People’s expectations changed and there was growing uncertainty as regards the ...

The Harvard Law School Forum on Corporate Governance ...https://corpgov.law.harvard.edu/2016/08/page/8Recent examples include the bankruptcy of Lehman Brothers in 2008, JP Morgan’s trader (the “London Whale”) who built a large short position in credit default swaps that led to trading losses exceeding $6 billion within weeks, and the sudden departure of co-founder Bill Gross from Pimco in September 2014 which caused unprecedented large ...

Deutsche Bank Trader Fired Over Rate-Rigging Loses $53 Millionhttps://www.fa-mag.com/news/deutsche-bank-trader...That paid off after the collapse of Lehman Brothers Holdings Inc. in September 2008, when banks became unwilling to lend to each other for all but the shortest periods, they said. First « 1 2 3 ...

House of Trelawney by Hannah Rothschild — Books & Companyhttps://www.booksandcompany.dk/book-of-the-week/...Sep 28, 2020 · The story begins in 2008 just before the collapse of Lehman Brothers, and Kitto has taken some financial risky positions in the hope of making some much needed money. His sister, Blaze, who didn’t inherit the estate, but rather saw herself banished due to a centuries old rule, is living as a fund manager in London and is one of the few to ...

WHAT IS IN STORE FOR THE MARKETS IN Q4? - SuisseRock ...https://suisserock.com/market-update-q4Sep 29, 2017 · WHAT IS IN STORE FOR THE MARKETS AS WE CLOSE IN ON Q4? For those of us old enough to remember the Financial crash of 2008, this month brings us a very important 9-year anniversary On September 15 th 2008 Lehman Brothers filed for section 11 bankruptcy protection with $639Bn in assets, and $619 in debt. The stock immediately plunged 93% from its previous close on …

A financial crisis foreshadowed | London Business Schoolhttps://www.london.edu/think/a-financial-crisis...One is a systemic banking crisis, which is what happened in 2008. It started with Lehman Brothers and spread rapidly, to economies both large and small. As a result Iceland lost a whopping 40% of GDP. The second is an exchange rate crash. That didn’t quite happen to …

The Fed Is Doomed to Failhttps://www.smarteranalyst.com/bloggers-corner/the-fed-is-doomed-to-failWe also alerted our readers about the dollars crisis of 2004-2005, the meltdown in the private-equity markets in 2007, the collapse of Lehman Brothers in 2008, and we’ve been sounding the alarm ...

Should you buy DBS Group Holdings Ltd (SGX: D05) now ...yourwealthdojo.com/should-you-buy-dbs-group-holdings-ltd-sgx-d05-nowMay 16, 2020 · Following the collapse of the Lehman Brothers, about 10,000 retail investors in Singapore lost all or a large part of their investments total-ling over S$500 million in structured investment products linked to the American investment bank. They were mis-sold these relatively high-risk products to investors, many of whom were the elderly and ...

Lehman Brothers | Bank REO Real Estatewww.bankreorealestate.com/tag/lehman-brothersMar 24, 2010 · Huffington Post – As Lehman Brothers careened toward bankruptcy in 2008, the New York Federal Reserve Bank came to its rescue, sopping up junk loans that the investment bank couldn’t sell in the market, according to a report from court-appointed examiner Anton R. Valukas.

U.K. audit watchdog closes Lehman probe against E&Y - The ...https://www.theglobeandmail.com/report-on-business/international-business/european...Jun 22, 2012 · U.K. audit watchdog closes Lehman probe against E&Y ... 2010 to focus on E&Y's audit of the European operations of Lehman Brothers which collapsed in September 2008 and led to a …

Civil Fraud – CBS New Yorkhttps://newyork.cbslocal.com/tag/civil-fraudErnst & Young May Be Charged In Lehman CollapseAccounting firm Ernst & Young LLC may face civil fraud charges in New York for its alleged role in the demise of Lehman Brothers, according to a ...

AIG Bailout Rushed Without Complete Documentation, Fed ...https://www.insurancejournal.com/news/national/2014/10/02/342554.htmBaxter said today that the New York Fed needed to calm anxiety in the markets linked to the bankruptcy of Lehman Brothers Holdings Inc. and the near bankruptcy of several other financial institutions.

Alex Rampell on Twitter: "Lehman Brothers filed for the ...https://twitter.com/arampell/status/1173376332853432321Sep 15, 2019 · Lehman Brothers filed for the largest ever bankruptcy 11 years ago, on September 15, 2008. ... This is a good example: https: ... If you give $100,000 M1 cash to a small bank and deposit in savings or a CD, they will send it to the US Treasury and get a M2 receipt from the Treasury to keep or trade with bigger banks. ...

Hire, Train, Retain - BCCJ Acumenhttps://bccjacumen.com/hire-train-retainFortunately, the firm began diversifying before the Lehman Shock. “The year 2007 was a boom one here in Japan on the back of the growth in the banking sector, but that all changed with the crisis triggered by the collapse of Lehman Brothers”, said King, 41, who is originally from Newquay in Cornwall.

Lehman Brothers - Term Paperhttps://www.termpaperwarehouse.com/essay-on/Lehman-Brothers/87677Lehman Brothers profoundly invested in pension plans such as the New York State Teacher Retirement Plan and the California Public retirement System, traded at a high over $ 65 per share. Lehman Brothers Bankruptcy, after a year they have had their biggest profit.

Lehman Brothers - Term Paperhttps://www.termpaperwarehouse.com/essay-on/Lehman-Brothers/456461A quick peak to Lehman Brothers’ history will help the reader to understand how, starting from very humble origins, Lehman Brothers became one of the top investment financial institutions in the US before its collapse. The financial crisis of 2008, also called the subprime crisis was …

After 12 years at the helm, two bank CEOs ponder ... - CNBChttps://www.cnbc.com/2018/01/09/after-12-years-at-the-helm-two-bank-ceos-ponder-the...He managed this feat even as the crisis claimed the stand-alone futures of other pure investment banks such as Lehman Brothers (which went bust), Merrill Lynch (which was acquired by Bank Of ...

9 Major Achievements of Barack Obama, 44th U.S. President ...https://www.worldhistoryedu.com/barack-obama-accomplishmentsJan 13, 2020 · The crisis called on every bit of strength of the President Obama. Mind you, the president took office just as the crisis had fully engulfed the country. Businesses across the country were folding up on a daily basis. A month prior to his election, Lehman Brothers, a titan in the investment banking sector, folded up.[PDF]IN THE COURT OF APPEALS OF TENNESSEE AT KNOXVILLE …www.tsc.state.tn.us/sites/default/files/webbcorrected.pdfMr. Conaty went on to explain that because February 14th was the final day of the initial public offering for the Bonds, in his view it was a true statement that Ms. Webb had one day to get the bonds at the offered price. Later in the day on February 14th, Ms. Webb decided to …

(Solved) - Risk management negligence within the financial ...https://www.transtutors.com/questions/risk-management-negligence-within-the-financial...1 Answer to Risk management negligence within the financial services industry contributed to one of the most significant economic crisis in the recent history of the U.S. During this time, Lehman Brothers, a global financial services company, filed for bankruptcy protection. This created the largest bankruptcy...

Lehman Brothers’ Collapse a Decade Ago Offers a Key Lesson ...https://grow.acorns.com/lehman-brothers-collapse-offers-lesson-for-investorsSep 11, 2018 · Before the longest running bull market in U.S. history got started, one of the country’s longest-running banks collapsed. Lehman Brothers’ bankruptcy, declared on September 15, 2008, was the largest ever and marked a major plot point in the financial crisis and the Great Recession. Ten years later, Americans continue to harbor a distrust of Wall Street and big banks.Author: Stacy Rapacon

"Lessons from Lehman Brothers: Will We Ever Learn?" Essay ...https://www.studymode.com/essays/Lessons-From...Oct 24, 2013 · The collapse of Lehman Brothers was the results of ethical failures which were rooted in its corporate culture. Lehman Brothers ’ risk-oriented culture encouraged unethical decision for financial gain, therefore the risk-taking ideal and the overlook of questionable behaviors.

PoM-Case05-Lessons from Lehman Brothers.docx - Principles ...https://www.coursehero.com/file/78111809/PoM...Principles of Management-Case04 Lessons from Lehman Brothers: Will We Ever Learn? On September 15, 2008, financial services firm Lehman Brothers filed for bankruptcy with the U.S. Bankruptcy Court in the Southern District of New York.95 That action—the largest Chapter 11 filing in financial history—unleashed a “crisis of confidence that threw financial markets worldwide into turmoil ...

Lehman shock News and Updates from The Economic Times - …https://economictimes.indiatimes.com/topic/Lehman-shock/news/9Feb 27, 2014 · Lessons from bad old days may pull Japan out of recession. The shock of the collapse of America's Lehman Brothers' investment bank last September sent waves across the world and helped to sink the lives of ordinary Japanese like Satoru Todo.

Swig warns of bankruptcy if Square Mile moves on judgment ...https://therealdeal.com/2009/09/22/swig-warns-of...Sep 22, 2009 · As previously reported by The Real Deal, he faces litigation on a $5 million credit line from Citibank, a $4.75 million note from Signature Bank and a $50 million judgment from Lehman Brothers for ...

Risk aversion highest since Lehman brothers collapse ...https://www.business-standard.com/article/markets/...Jan 21, 2013 · Risk aversion among Indian stock market investors at present is the highest since the US investment bank Lehman Brothers collapsed in September 2008, strategists at Credit Suisse said. Factors like a worsening debt crisis in the euro zone, fears of a double-dip recession in the US and a high rate of inflation, in addition to the high interest ...

Dodd-Frank's four years through troubled waters | Al ...america.aljazeera.com/watch/shows/real-money-with...Jul 23, 2014 · When Lehman Brothers collapsed in 2008, it set off a series of financial and political events that have had significant ripple effects to this day. One of the consequences was the passage in 2010 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, otherwise known simply as “Dodd-Frank,” which was meant to reign-in the reckless ...